Hello friend! 👋

My name is Yorrin, also known as ‘‘Fluentinvalue’’.

I am pleased to have you back here for another investment case. This time, we are discussing Adobe.

In case you have missed previous articles, click on the link below:

If you’re currently not yet following me, consider doing so. I provide FREE content to help and inform you in your investment journey. From beginner to advanced, all info will be helpful. :-)

Adobe is a name everybody knows (in the design industry) all over the world.

From the 2nd of January till today, Adobe has been one of the best performers in the stock market.

37.320% total return from day one, adding up to a CAGR of a whopping 18.82%.

These results are results some companies can only dream of.

Let us chat about Adobe!

Adobe - General information

Company name: Adobe Inc.

Ticker: ADBE

Stock price: $469.39

Market cap: $210.29B

Revenue: $19.94B

Industry: Software

If you’re into these kinds of investment theses, consider checking out the following Visa, Duolingo, and Starbucks. These are available for FREE on my Substack page.

Step-by-step

(To get a better understanding of the business, I recommend doing the following too for yourself the next time you’re eager to invest in a business. This method has helped me pick quality companies, and understand their business, and know when to get it & when to get out)

In analyzing a stock, I follow the following steps:

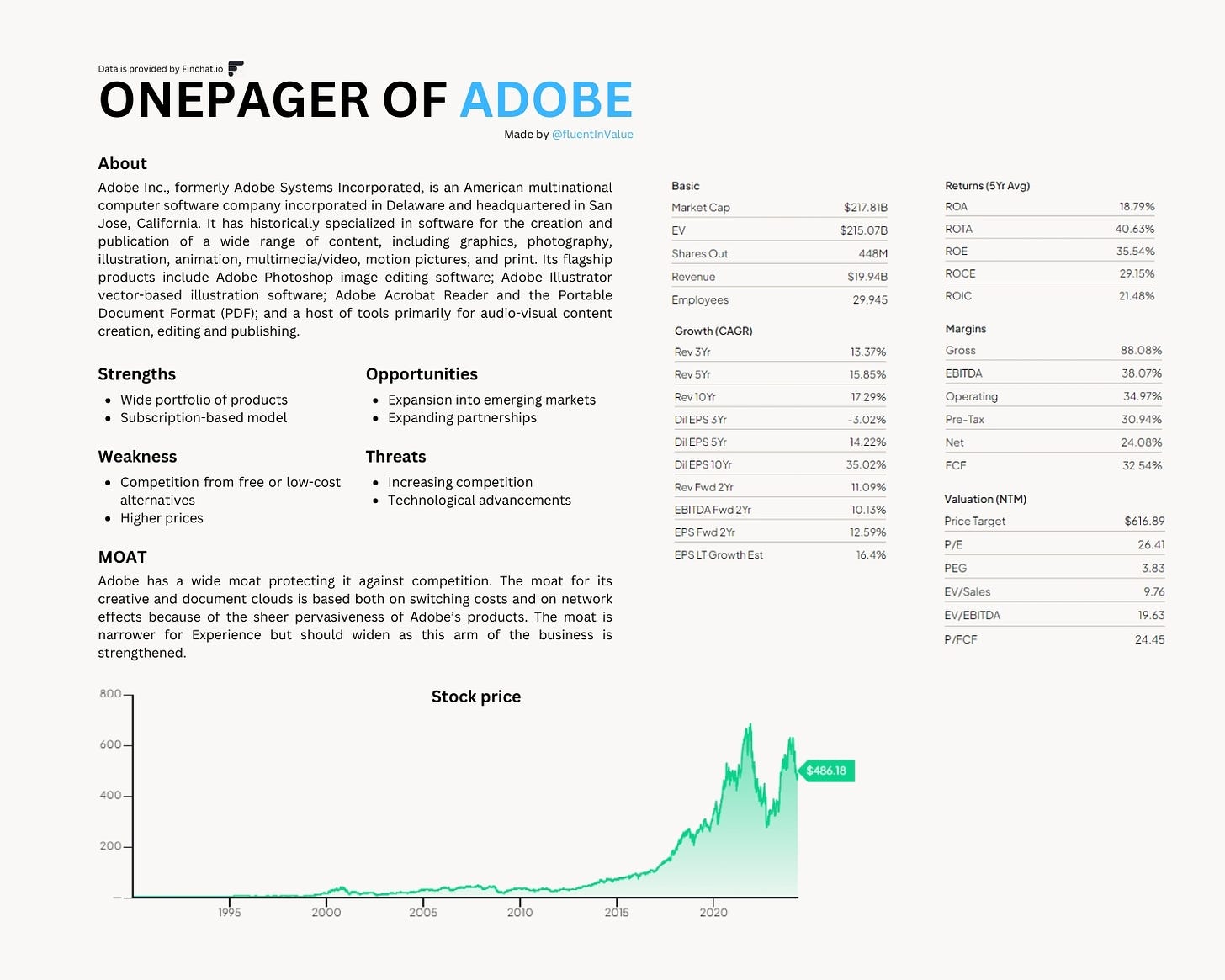

Adobe One Pager

1. Do I understand Adobe?

As someone who has studied graphic design, I am familiar with Adobe and their products. While in school, I used the following programs that Adobe offers:

Photoshop

Illustrator

InDesign

Audition

After Effects

Premiere Pro

These tools were being used daily for me, more than 6+ hours a day. So, the products Adobe offers are familiar to me. I know why their products are there, how they function, what issues they resolve, and how practical these programs are.

Also, with internships, I found real-life examples of how professionals and bigger companies used these programs & how reliant some of the companies were on these programs. Without these programs, these companies would be out of business.

Now, let us chat about the business a bit more and if I understand the business. We have concluded that the programs are familiar to me, but is the business itself?

Adobe offers technologies that help bring the ideas of creators to life. By arming creators with the right tools, Adobe brings art to life. Adobe is, as we all know, a SaaS business (Software as a Service). Adobe currently offers 100+ solutions for artists of all sizes and shapes. From video production to art creation, voice production, web production, and much more.

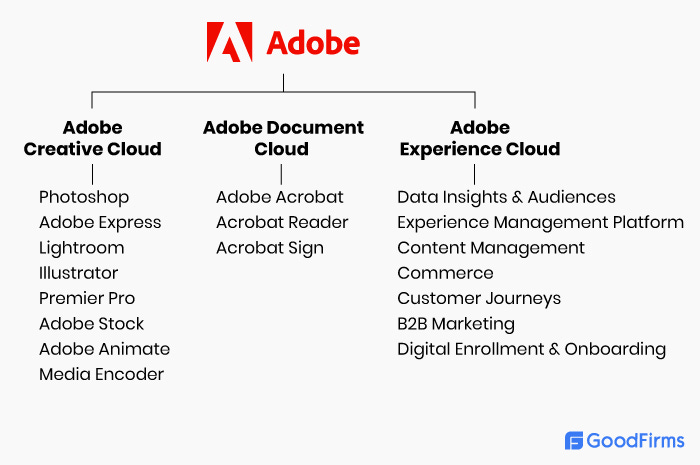

Adobe is active in the following segments:

Creative Cloud

Adobe Creative Cloud is a set of applications and services from Adobe that gives subscribers access to a collection of software used for graphic design, video editing, web development, and photography, along with a set of mobile applications and also some optional cloud services. In Creative Cloud, a monthly or annual subscription service is delivered over the Internet.Document Cloud

Adobe Document Cloud is a digital service from Adobe used to store PDF files in the cloud and to access them remotely. The service supports integration with Adobe tools to fill and sign forms electronically. Adobe Scan can take pictures of documents, convert them to PDFs, and upload them to and store them in the cloud.Experience Cloud

Adobe Experience Cloud is a suite that provides analytics, social, advertising, media optimization, targeting, web experience management, journey orchestration, and content management services, hosted on Microsoft Azure.

As of now, +- 94% of Adobe their revenue comes from subscriptions to these services!

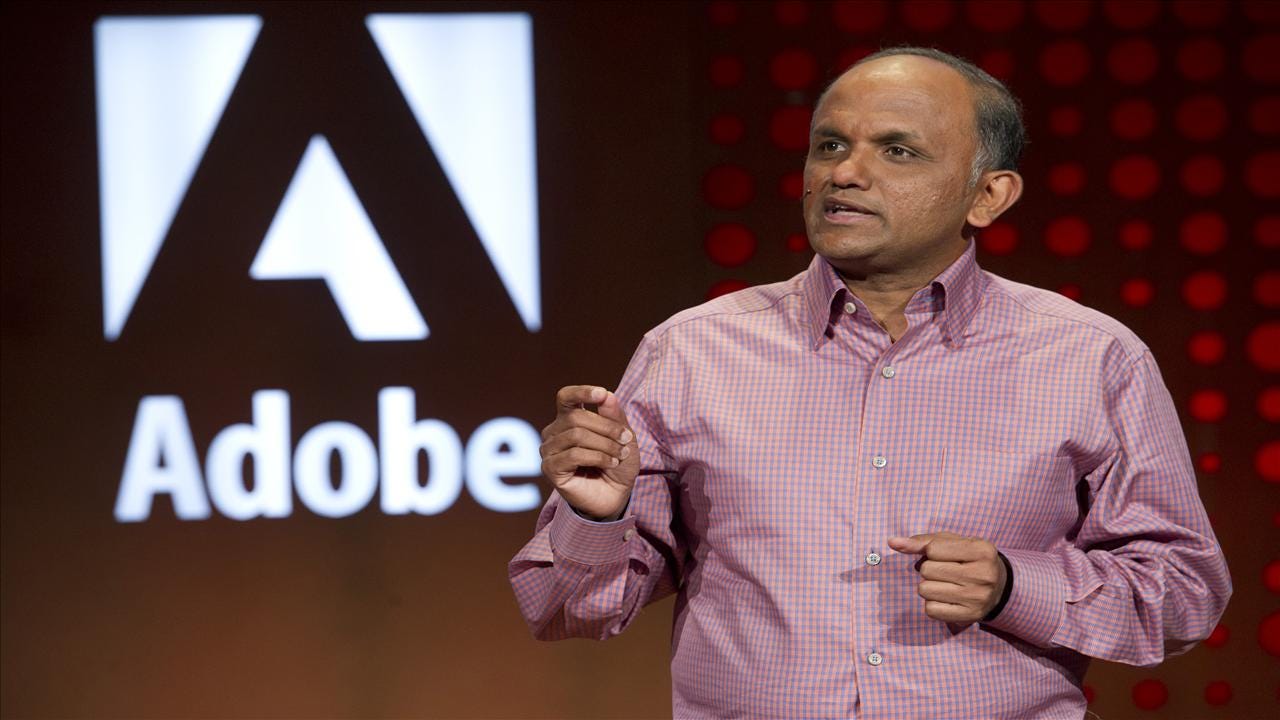

2. Management

The current CEO Shantanu Narayen, started with Pictra Inc. Pictra Inc. was one of the first companies that revolved around digital photos and the sharing of via the internet. Before Pictra Inc. Shantanu Narayen was the head of desktop and collaboration products with Silicon Graphics. Also, Shantanu Narayen has different functions over at Apple one time!

Shantanu Narayen joined the Adobe team back in 1998, the year I was born! Shantanu Narayen joined as senior vice president of worldwide product development. In 2005, 7 years later, Shantanu Narayen was appointed to be the new COO. Not much later, in 2007, Shantanu Narayen was selected to be the CEO after Bruce Chizen stepped down.

As CEO, Shantanu Narayen transformed the company, moving its creative and digital document software franchises, which included the likes of Photoshop, Premiere Pro, and others, from desktop to cloud.

Shantanu Narayen is a real mega-entrepreneur and has a solid feeling about how to manage and run Adobe.

Management/insiders currently hold 0.21% of all outstanding shares.

3. Competitive & sustainable advantage

So, does Adobe have a sustainable and competitive advantage? Yes!

Adobe has created tools that all creators need for their day-to-day business. Currently out there, no good or cheaper alternative offers the same wide range of capabilities that Adobe and its products offer.

In every industry, over the world, people rely on the tools provided by Adobe. From filmmakers, voice actors, the movie business, the design industry, the fashion industry, and so many more industries, they all have one thing in common and that is the use of Adobe and its software.

The crazy part is once you get a feeling with Adobe and its software, and learn to create in the programs, you become reliant on their software. Due to the extreme variety of options, that I have experienced, nobody wants to turn to another program.

I have noticed, while in college, that once I started my projects in one of the programs, I really could not change provider or program, for the sole reason that others do not provide what Adobe provides. A wide range of capabilities and ease of use!

Do we see this advantage back in their margins or results? We do.

My opinion is that when a company has a sustainable advantage, you can see this in its margins. Companies do not need to adjust or lower margins to keep up with their peers.

Gross Profit Margin; %40+? Check, Adobe has 88% ✅

Operating Margin; %20+? Check, Adobe has 29% ✅

Free Cash Flow Margin %5+? Check, Adobe has 38% ✅

As shown above, Adobe profits from a perfect gross margin. Its other margins are also extremely good! We see that Adobe does not need to lower margins to keep its customers or attract new ones. Why? Because they have a solid MOAT and pricing power.

Due to their MOAT, pricing power, and sustainable advantage, Adobe can go on with this course till the very end. I deem it very unlikely that there will come a new peer that will drop Adobe from its throne.

4. Is the business in an attractive industry? Peers?

Yes, Adobe is in a very attractive market!

Adobe is positioned in an extremely evolving market. Customers demand more, coming out with new ideas, wanting new ideas to realize their arts and crafts, and more.

Adobe keeps up with the demand with solid innovations. Adobe uses AI in a lot of programs, who knew? I use Photoshop and love the ‘‘new’’ edition that lets you auto-fill your selected area to your liking, just by simply typing a prompt and AI will generate your image.

There was a huge scare in the rise of AI and the relevancy of Adobe. If AI can make art via prompt, why need Adobe? Well, AI can only do so much and is, and will stay, very limited. Thus, making AI less ‘‘useful’’ in the creation and production world. Adobe perfectly uses AI to its advantage to optimize workflow and products by incorporating AI.

Besides graphic design, Adobe implements AI in ALL their products in one way or another, good call from Adobe. Play in on the hype & improve products and services.

Read more about their Firefly AI over here: Adobe Firefly

Adobe operates in:

Creative Cloud

Peers: None? Yes, none! This is something only Adobe does, on a larger scale.Document Cloud

Peers: DocuSign, Zoho Docs, Box, Foxit Software, Nitro…Experience Cloud

Peers: Salesforce, Oracle CX, Hubspot, IBM Watson…

Should we have any concerns about these peers? No, otherwise we would have seen some switch by now. ;-)

5. Risks

Usually, I can give almost all companies a good list of low risks, a list of medium risks, and a couple of high risks. But, Adobe treats me differently. Why? Not because there are none, but Adobe has shown to conquer challenges like no other.

Adobe Experience;

The competition is huge and the competitions have billions to spend to make sure its products/services are the ones that are going to be used by the consumer. Microsoft, Salesforce, Oracle, and many more are serious players who are known to innovate rapidly. If Adobe starts lagging, a downhill slope might form and cause side effects for its business.Regulatory risks;

I name these with almost every company, but especially tech companies. Tech is being cracked down by law- and rule-makers. Due to the sensitivity of privacy and integrity, Adobe is sensitive to some harsh regulations, that impact their business.Disruption;

Adobe has no worries as of now for any disruption, but nothing is a given. Due to rapidly increasing technology, disruption is not something we should ignore. There will be a day when someone else meets consumers’ demand better or for a better price, damaging Adobe and its business.

So, yes, some risks come with Adobe. But, am I worried about these risks? Not as of yet!

Adobe has shown to be resilient in all types of market environments, including possible disruption and changing/growing customer demand. Shantanu Narayen, the CEO of Adobe, has shown us time and time again that he knows what way to steer Adobe. But, as usual, do always keep the risks in mind when you’re investing.

6. Balance sheet

Ah, the part (most) investors love, the balance sheet! The balance sheet is the soul of the company. If there are any underlying issues with interests, debts, or any other part, we can spot it right here. But, this is also the place to be to spot opportunities!

So, let us dive into the balance sheet!

Quick ratio: 1.0 or higher? No. ❌

Current ratio: 1.0 or higher? Yes! ✅

Cash Ratio: 1.0 or higher? No. ❌

Debt ratio: 0.5 or lower? Yes! ✅

The fact the quick ratio and cash ratio are not met is not a make-or-break situation.

Goodwill / Assets: 20% or lower? No. ❌

The Goodwill to Assets % is too high in my opinion. Although, historically, it is on the lower side, this should be below 20%.

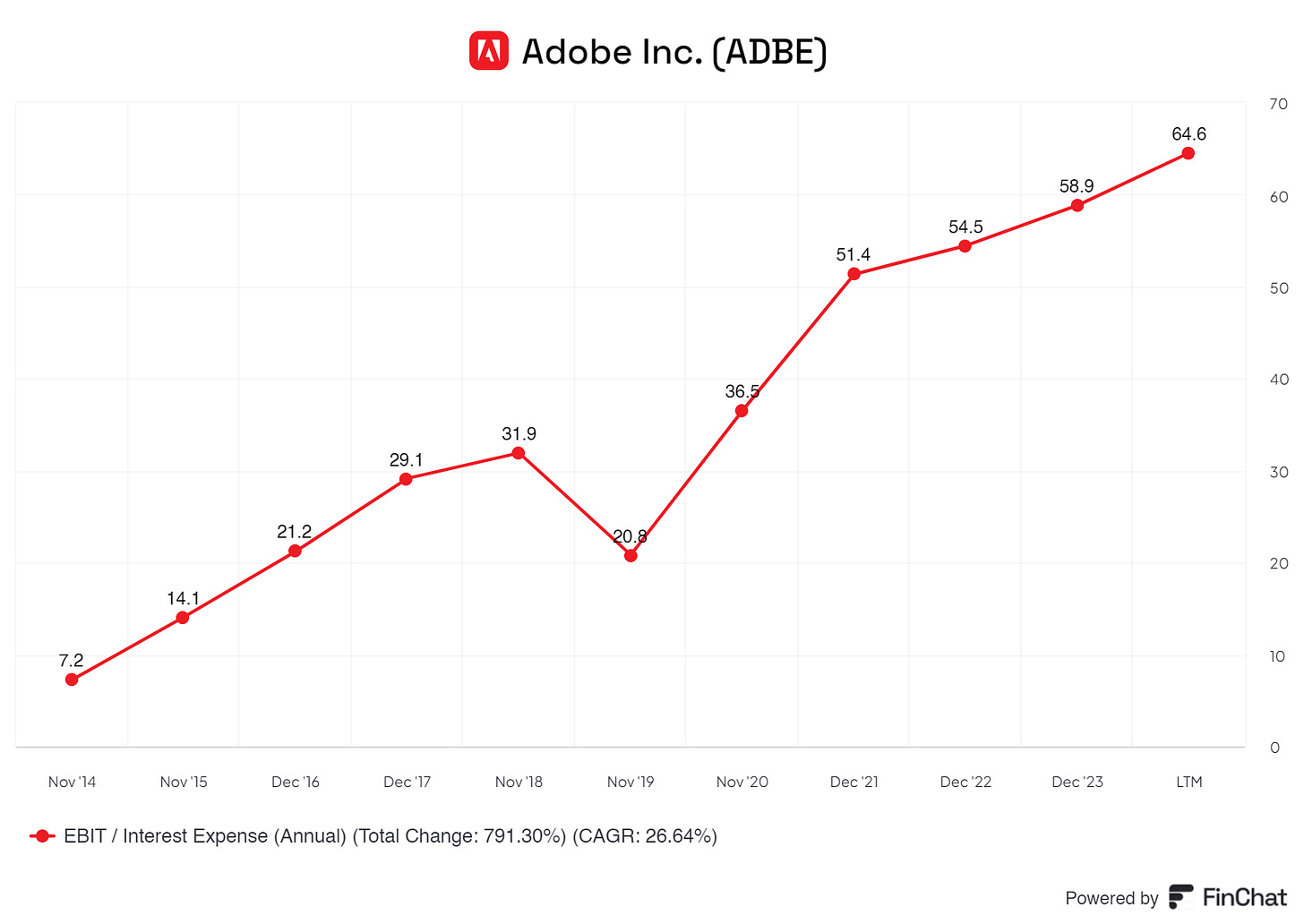

EBIT / Interest Expense: 10x or higher? Yes! ✅

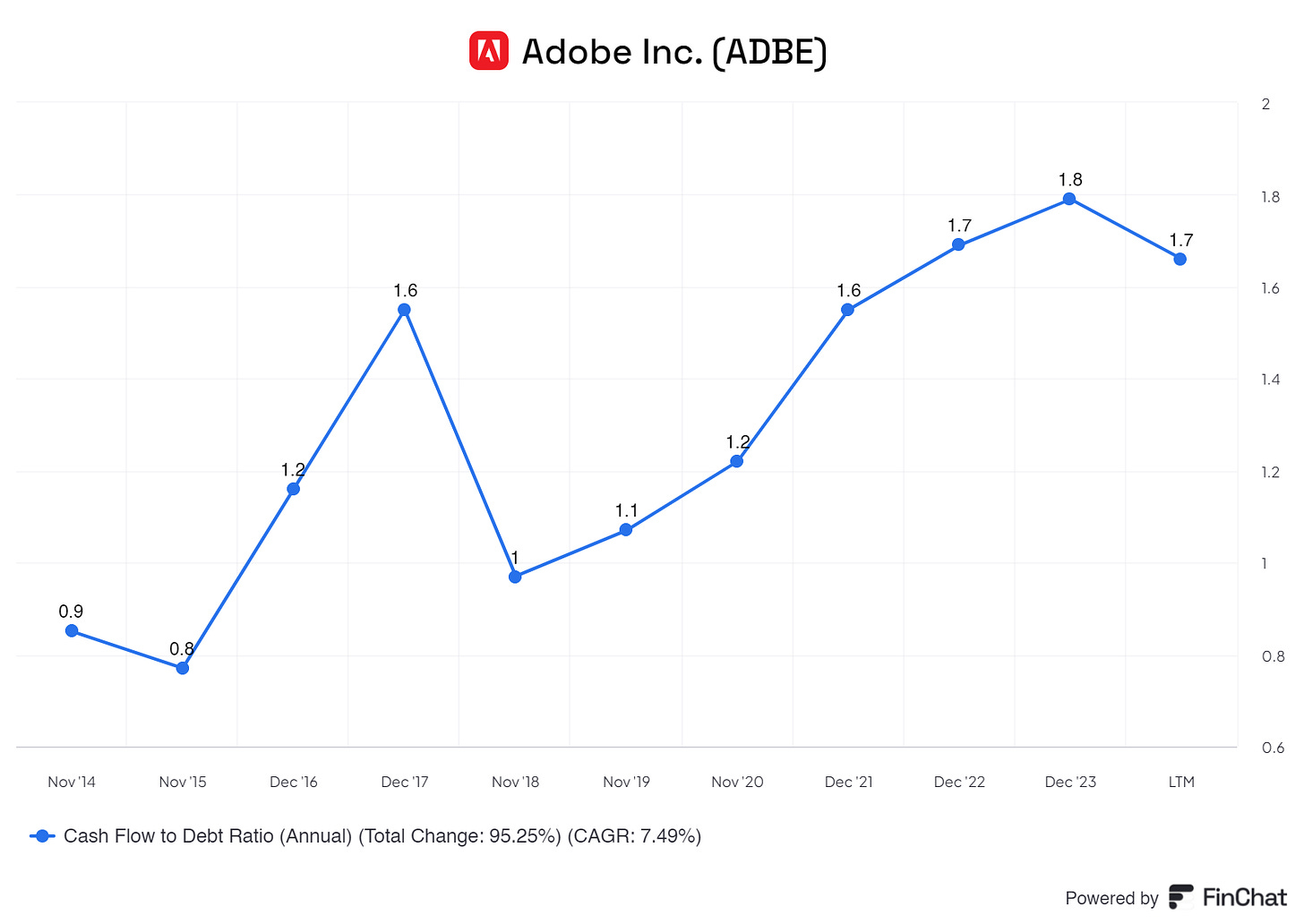

Cash Flow / Debt Ratio: 0.25 or higher? Yes! ✅

7. Capital intensity & allocation

Something I like about Adobe is that their business is not reliant on heavy capital expenditures. Which, in return, gives Adobe more cash to play with and invest wisely.

Let us take a quick look at capital expenses!

So, solely looking at their CAPEX does not tell us much, but, let us add their total revenue and gross profit into the picture!

Now we get a more clear picture!

In my investing world, I would love to see that a company its capex-to-revenue & capex-to-gross profit are as low as possible. The highest I allow for sales is 5% and for the gross profit, I want to see 25% or lower.

Adobe its CAPEX/Total Revenue is 1.48% and its CAPEX/Gross Profit is 1.69%. So, Adobe has an extremely low capital-heavy business. To add to this we could even check their CAPEX/Net income.

Adobe its CAPEX/Net revenue is 6.17%!

Quick Summary:

CAPEX/REVUE: below 5%? Yes! ✅

CAPEX/Gross Profit: below 25%? Yes! ✅

CAPEX/ Net Income: Below 50%? Yes! ✅

Adobe operates at a wonderful pace and does not need to invest heavily in capital expenditures, which is good!

Now, for the following, their capital allocation!

Adobe is showing that YoY is improving its capital allocation.

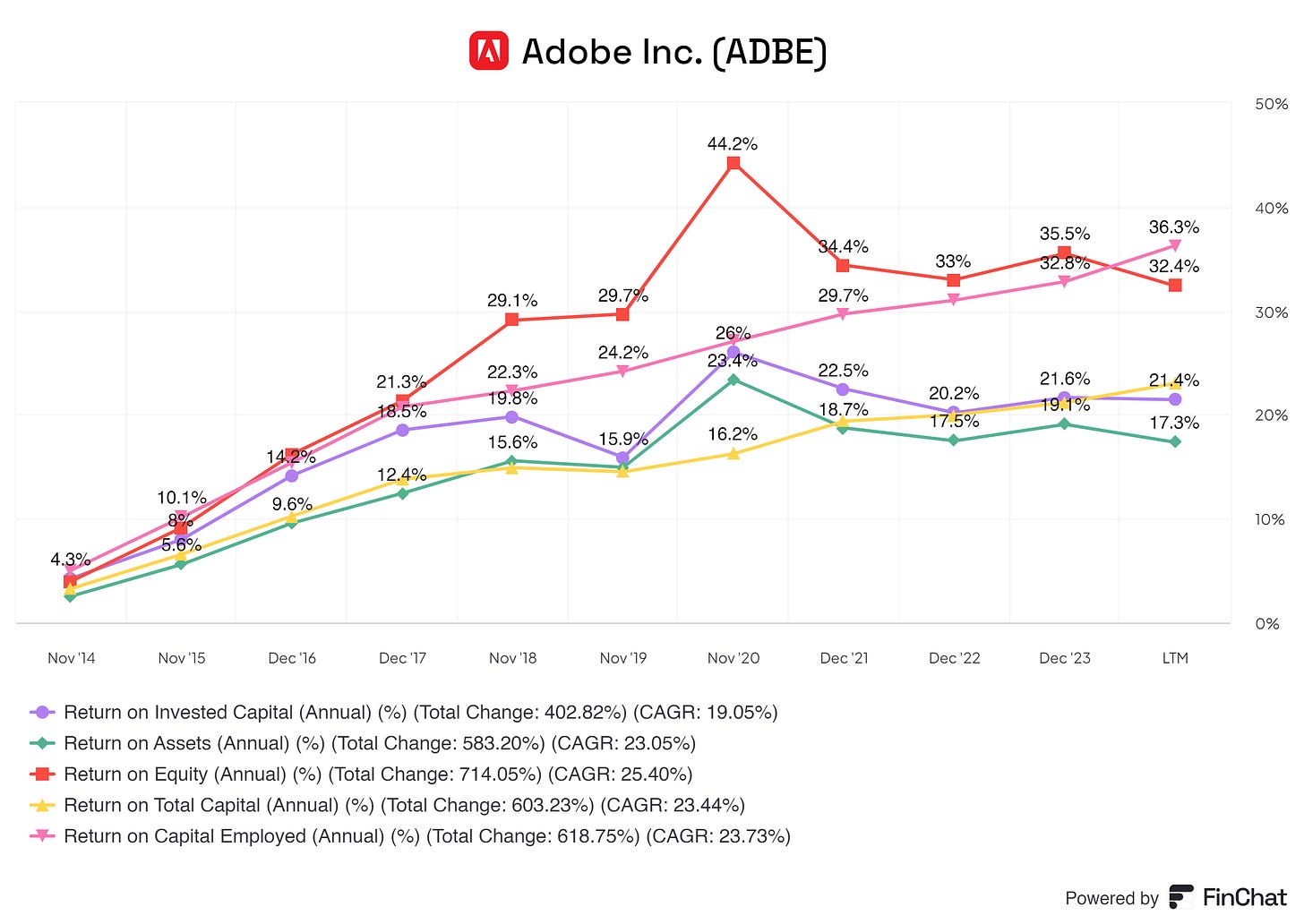

So, to check how capable management is and how well they allocate their capital, I always check the ROIC, ROA, ROE, ROTC, and ROCE. These factors tell me a lot about how management is handling its assets, shareholder equity, and financed assets.

Adobe is showing a pitch-perfect example of putting money where it’s working for you. YoY Adobe is generating more % returns on its investments, equity, shareholders equity, and financed assets. Adobe does not need debt to finance operations, pulling its ROE up a good portion. Also, from their ROCE I can paint a clear picture that shareholders equity is being put to work and, in return, is creating wonderful returns.

What I see here is that Adobe and its management are wonderful at putting hard-earned money to work!

8. Profitability

So, as you might have read already, Adobe is handling its money well, limiting debt, providing quality to its customers & shareholders, and generating solid revenue.

So, Adobe is profitable for sure! Let us dive a little into their profitability.

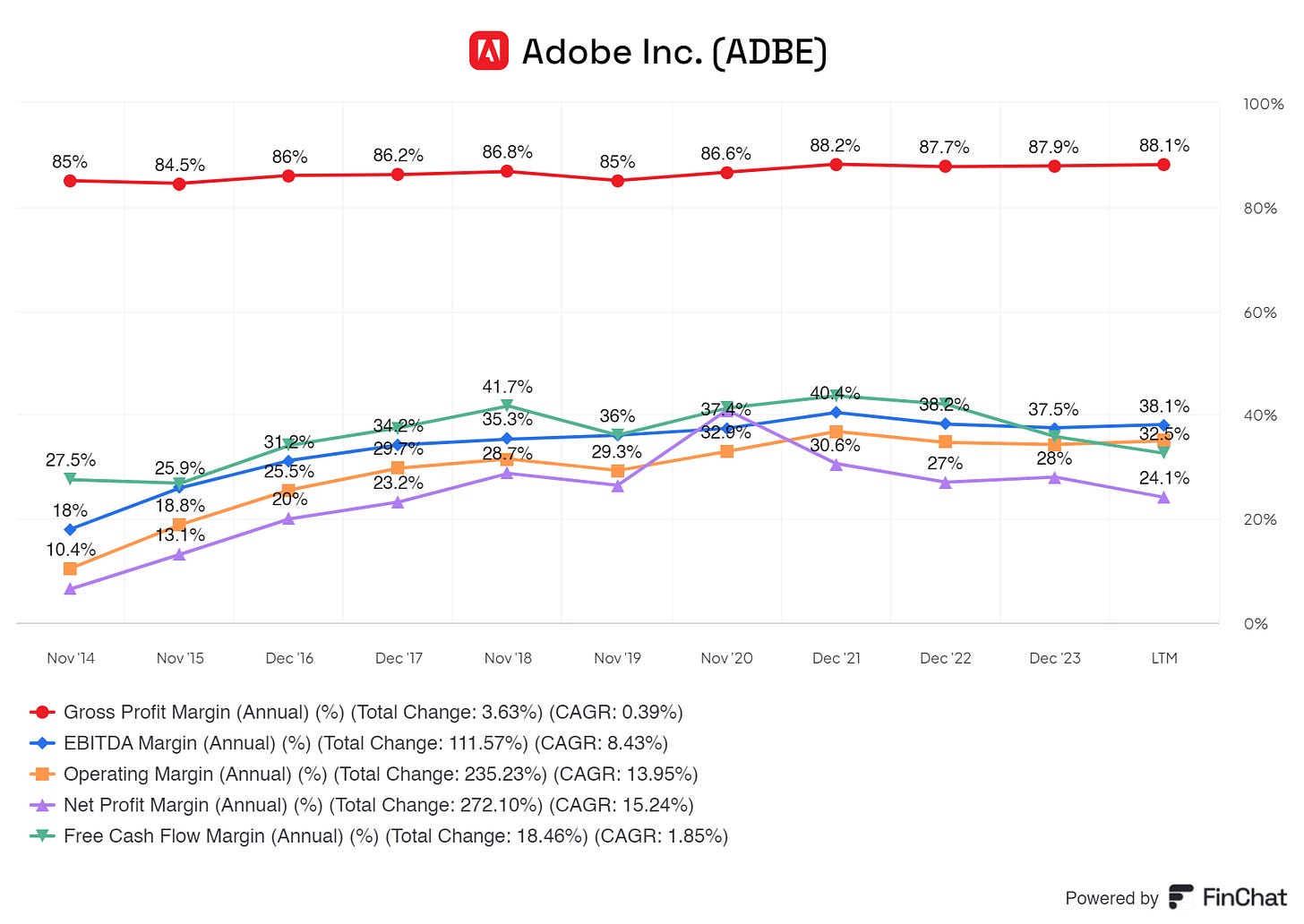

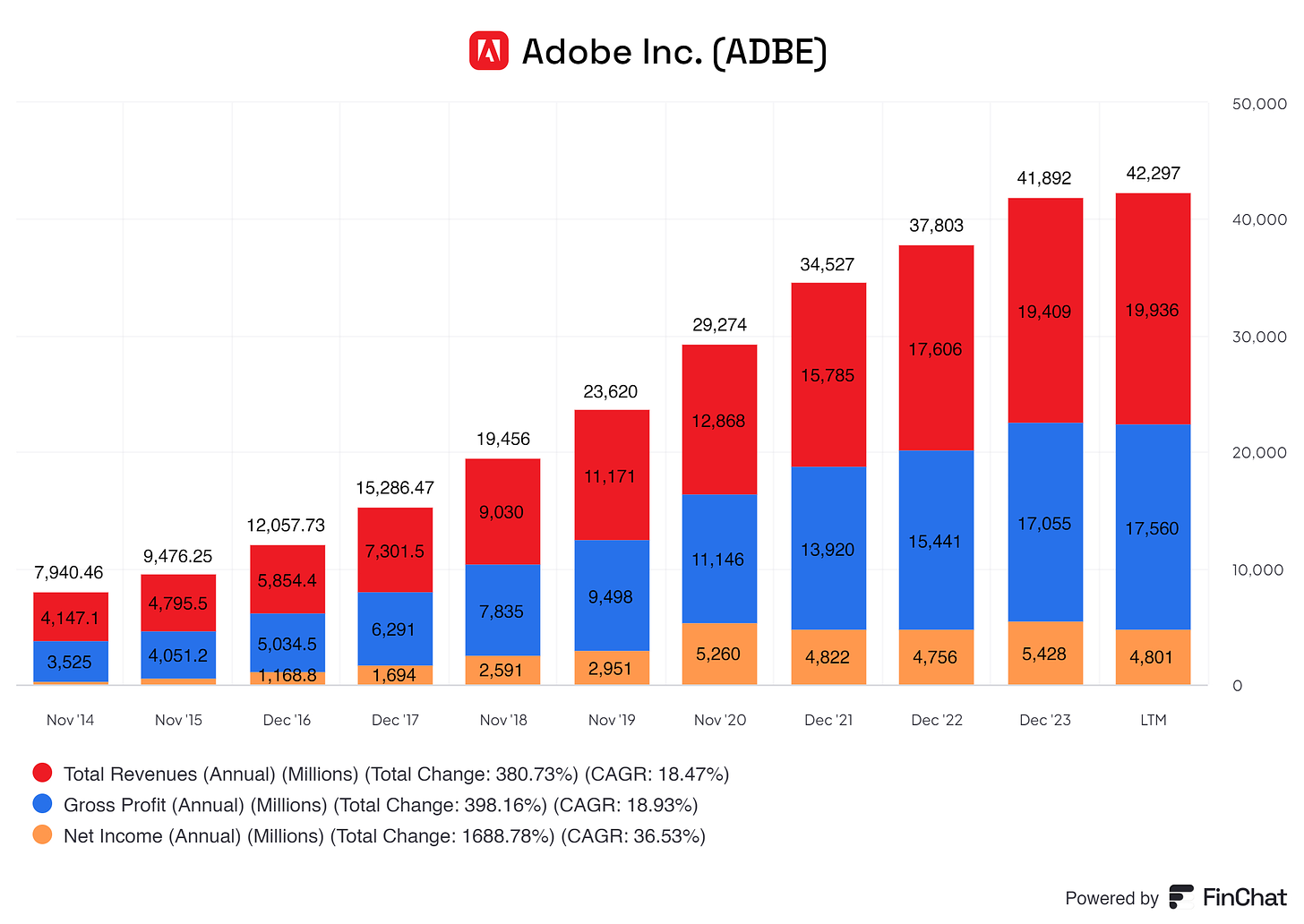

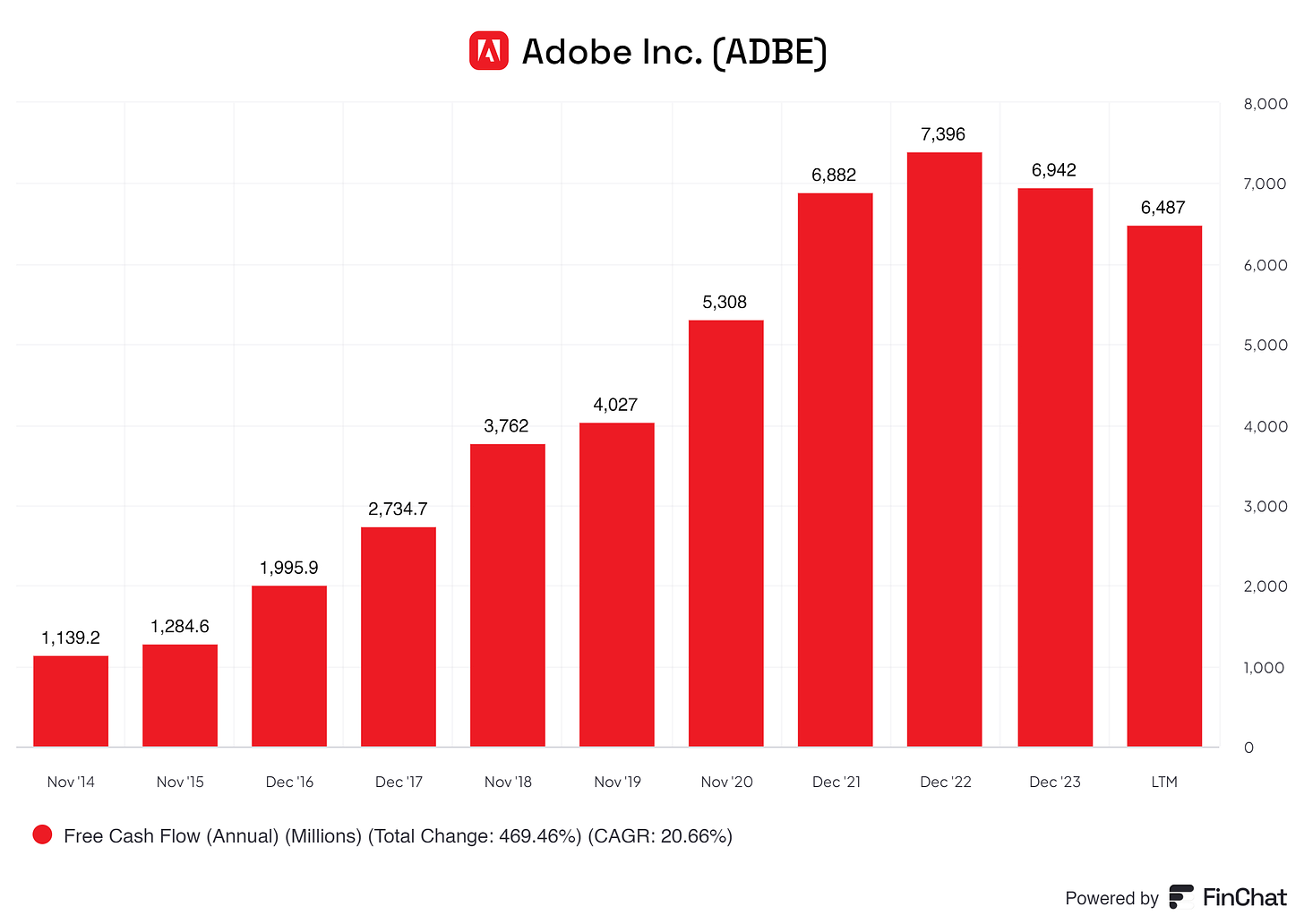

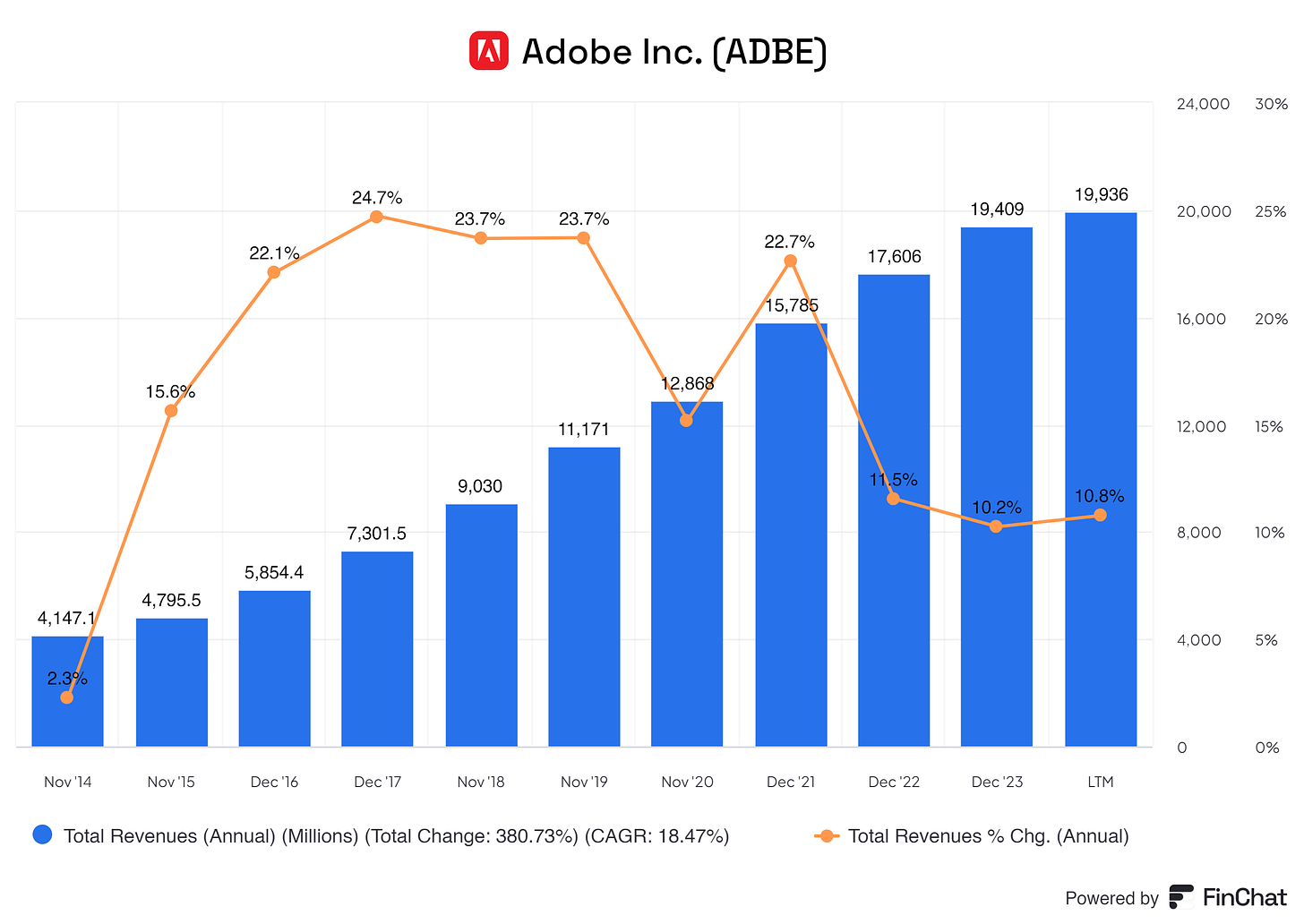

Adobe is creating wonderful revenues YoY, having a CAGR of a staggering 18.47% since November 2014. LTM Adobe has a Gross Profit Margin of an insane 88.1%! This kind of margin is what most companies can only dream about. Of course, Adobe is in the software industry, therefore having the space to have these wonderful margins.

Adobe has an LTM net profit margin of 24.1% which is also very, very good! This shows us that for every $10.000 Adobe makes, they gross $7.761,61 and they net about $2.410. These types of margins allow Adobe to pocket a big chunk of its revenue, which is good for us investors!

In pocketing a big chunk of its revenue, Adobe can have a higher FCF margin. This means Adobe can use this FCF to reinvest in the business, pay off debt, pay dividends, or create any other type of shareholder returns, which Adobe is doing.

(Adobe does not pay dividends)

Here are the FCF margins of Adobe:

2014: 27.5%

2015: 26.8%

2016: 34.1%

2017: 37.5%

2018: 41.7%

2019: 36%

2020: 41.2%

2021: 43.6%

2022: 42%

2023: 35.8%

LTM: 32.5%

Adobe has a solid flow of FCF. This gives Adobe the space to invest in new projects, pay off their debt, and perform other value and quality-increasing projects in the future.

Adobe, in my eyes, is a FCF king!

9. Historical and future growth

Let us dive into the past growth of Adobe and see if past growth is achievable in the future or what growth we might expect from Adobe. Growth is a driving factor for us investors. We want companies to keep growing or find new ways to achieve growth.

From 2014 up to 2019 we see that Adobe is growing at fast rates, averaging 18.68%, this number is brought down by the slow growth in 2014 of 2.3%. If we remove this, we get a staggering 21.96%. These returns are, of course, due to the growing phase of Adobe. During this time Adobe was at its peak of building the empire it currently is. So, to think we can keep this average up is nuts.

From 2022 up to now we are averaging a modest 7.5%, which is more reasonable to expect also going on from here. Something we should realize is that Adobe is maturing year by year. So, we can not expect Adobe to grow 20% consistently. Can it happen? Yes, but not consistently.

For Adobe, their past growth was something in line with what we shareholders love to see in this sector. Adobe is a market leader, low on peers, and has strong pricing power & MOAT. If Adobe grew at slower rates I would be worried.

Now, for the future.

Adobe has a strong position and with the current CEO, who drives Adobe, I have high expectations, and I think everybody does. For the coming years, I would love to see a 7% growth YoY for at least the next 5 years. After this period Adobe is maturing once again. This can cause us to lower or maintain the growth expectations.

With my 7% growth rate, this is how the coming year would look like with total revenue:

2025: 21,341.52 million

2026: 22,826.28 million

2027: 24,397.75 million

2028: 26,159.12 million

2029: 28,029.59 million

2030: 30,018.56 million

With a gross margin of 85% and a net margin of 20%, its gross and net would look something like this:

(These margins are the ones me that are sustainable for Adobe and keep in thought the possible reduction in margins)

For 2025:

Gross Income = 21,341.52 million * 85% = 18,140.79 million

Net Income = 21,341.52 million * 20% = 4,268.30 million

For 2026:

Gross Income = 22,826.28 million * 85% = 19,402.34 million

Net Income = 22,826.28 million * 20% = 4,565.26 million

For 2027:

Gross Income = 24,397.75 million * 85% = 20,738.09 million

Net Income = 24,397.75 million * 20% = 4,879.55 million

For 2028:

Gross Income = 26,159.12 million * 85% = 22,235.25 million

Net Income = 26,159.12 million * 20% = 5,231.82 million

For 2029:

Gross Income = 28,029.59 million * 85% = 23,825.15 million

Net Income = 28,029.59 million * 20% = 5,605.92 million

For 2030:

Gross Income = 30,018.56 million * 85% = 25,515.78 million

Net Income = 30,018.56 million * 20% = 6,003.71 million

This seems like realistic returns Adobe might get with the perimeters I set that seem sustainable and reasonable for the future.

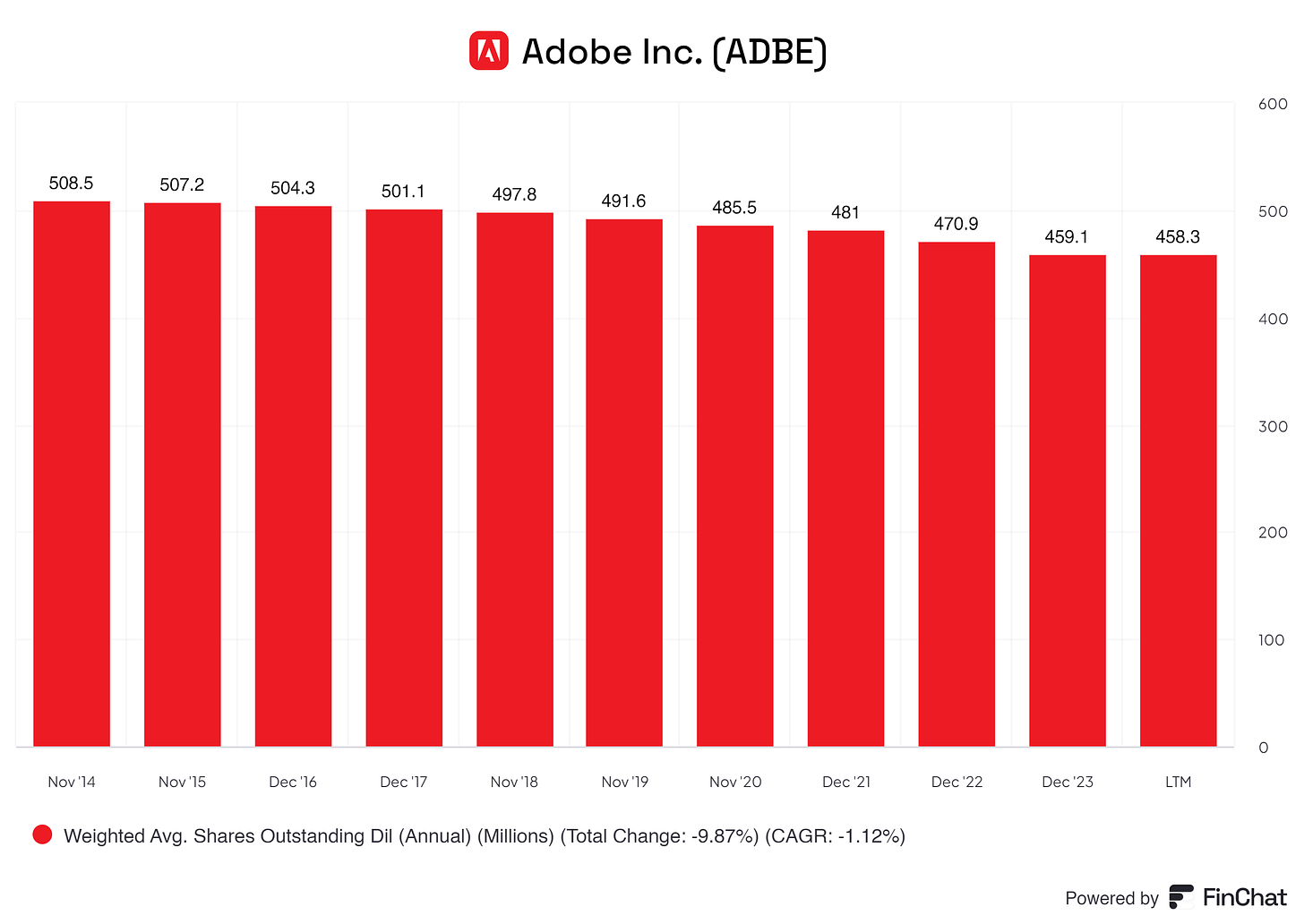

10. Value creation

Does Adobe create value for its shareholders? YES!

Adobe is YoY buying back its shares, I love to see this. This means the EPS increases, controls Adobe its ownership, and signals consistence confidence in its operations. Adobe does not spend all its capital on buybacks, Adobe is still investing in other ways to create shareholder return. These share buybacks are little extras that Adobe is giving us, I love it.

Adobe is an avid deliverer of stocks to the insiders. If Adobe was not buying back its shares, this sight would have been a tad bit more troubling to me, but, Adobe buys back shares and distributes shares over insiders, I do not mind in this case. I see this as giving more insiders a share of Adobe, boosting the employee’s benefits. If Adobe performs well, insiders benefit and the willingness to keep improving grows.

Dividends are something Adobe does not do, which I am happy about. I see that management is very capable of putting capital to work. I rather have management keep doing so instead of giving cash to its shareholders.

Adobe is giving back to its people and shareholders!

11. Outlook

The future looks good for Adobe. I believe Adobe is here to stay because it has the best tools that every creator needs, even though they can be expensive. It's not easy to switch from Adobe because its tools are better than what others offer.

But, when it comes to Adobe Experience, things are tough. Adobe has to work hard to stay ahead of other big companies. These companies have a lot of money to spend to make sure people use their products. Adobe needs to keep up to avoid losing customers or market share. My only worry is that Adobe might fall behind if they don't keep customers interested or keep making their platform better.

For document solutions, I don't see Adobe struggling as much. They have good products that beat their competition. But there's a risk with Document and Experience because customers can easily switch to other providers. It's harder to switch from Adobe Creative Cloud because it has a lot of options that other products don't have.

12. Valuation

Adobe currently is priced at $486.18, is this reasonable?

A forward P/E of 27.5x and an EPS of $21.15 translates to a price target of $581, which suggests an upside of about 17% from current levels.

Analysts value Adobe at 616.86.

Average = $598.91

So, Adobe is currently a good catch. Although it seems pricey, the possible returns seem attractive.

End note

Thank you for reading this investment case on Adobe!

With every investment case as of yet I am trying to improve my writing and how I communicate my findings with you all. Because I started not too long ago, some posts might change in layout or other aspects before I find the layout that suits my wishes the best, sorry in advance.

As of now, thank you so much for your time! I hope you found some valuable information in this investment case.

Disclaimer

I, Yorrin, am not a licensed financial advisor, and the information provided in my publications is for educational purposes only. Any views or opinions expressed are solely my own and do not constitute financial advice.

Readers and viewers are advised to conduct their own research and due diligence before making any investment decisions. The stocks or financial instruments discussed in my publications may involve risks, and past performance is not indicative of future results.

Investing in financial markets carries inherent risks, including the potential loss of principal. It is important to understand that all investments involve risks, and individuals should carefully consider their risk tolerance and financial situation before making any investment decisions.

I do not guarantee the accuracy, completeness, or reliability of any information provided in my publications. I shall not be held responsible for any errors, omissions, or inaccuracies in the content, nor for any actions taken by readers or viewers based on the information provided.

By accessing and reading my publications, readers and viewers acknowledge that they have read, understood, and agreed to this disclaimer. They further understand that they are solely responsible for any investment decisions they make based on the information provided.

If you have any questions or concerns regarding the content of my publications, please consult with a qualified financial advisor or investment professional.