Franchise & Company-operated, What's the Difference and Benefits?

Is there a benefit to having franchises, does it create value for the company?

Welcome back, my friend, to another article! I am thrilled to have you here. 👋🏻

Today, we will be discussing whether franchising is beneficial or detrimental to a company's value.

Some examples are McDonalds, Starbucks, Dunkin’ Donuts, Pizza Hut, Burger King, Cruise Planners, and Anytime Fitness. There are more franchises out there, this is just to name a few.

source: pillowpartners

What is a Franchise?

A franchise is whereby the owner licenses its operations with its products, branding, knowledge, and software- in exchange for a franchise fee.

So, as an example:

You want to have a burger restaurant. But, you want to gain access immediately to a solid customer base, software, systems, and branding. In this case, you could contact Burger King or McDonald’s and ask to be part of their franchise system. The franchisor will evaluate if you’re adequate for their system. Once you have passed their evaluation, you will gain access.

You will receive their systems and everything that is required to start selling the product that is provided. Improvements or new products are allowed. For instance, in Japan, there are vastly different products over the different franchises across the whole country. The locals have different needs when it comes to their desired food, and McDonald's allows for new ideas to be implemented.

Franchise Benefits to Franchisors

A franchise is a solid way for brand owners to expand their businesses globally or domestically without carrying too much risk associated with expanding into new locations where the brand owner might not be too familiar with the unknown market, dynamics, regulations, and law.

The brand owner needs to establish the system itself, provide guidelines for the brand, and build a way to manage such an expansion while ensuring the brand his standards are kept. Once the foundation is laid down, this process can be easily replicated in other regions, allowing for more expansion and creating more value and returns for the brand owner.

The franchise pays a royalty fee to the brand owner that can range from 4% of their total sales up to 14% of their total sales. This brings a solid revenue stream to the brand owner, without putting in too much effort. Once ruling and the systems are set, this system is practically a copy-and-paste story, creating more businesses and more additional revenue streams.

Company-operated

Company-operated models are the ‘‘normal’’ way of operating your business.

This means that the company directly owns and operates its locations or units. The company is responsible for all aspects of the business, including setting up the locations, hiring, and managing employees, managing finances, marketing, and making strategic decisions. In this case, there is no independent business owner, the franchisees, involved. The location is owned and controlled by the company itself.

Company-operated have direct control over aspects of their business. This allows the company to ensure consistency across the whole store and maintain high standards.

McDonald’s and its Franchising

source: finchat

As demonstrated, McDonald's predominantly operates under the franchise model, with an impressive 94.87% of its total 41,822 stores being franchised. The remainder are company-operated. This extensive franchising strategy ensures shareholders that McDonald's products are accessible worldwide. What's more, the company can expand globally with minimal effort on its part.

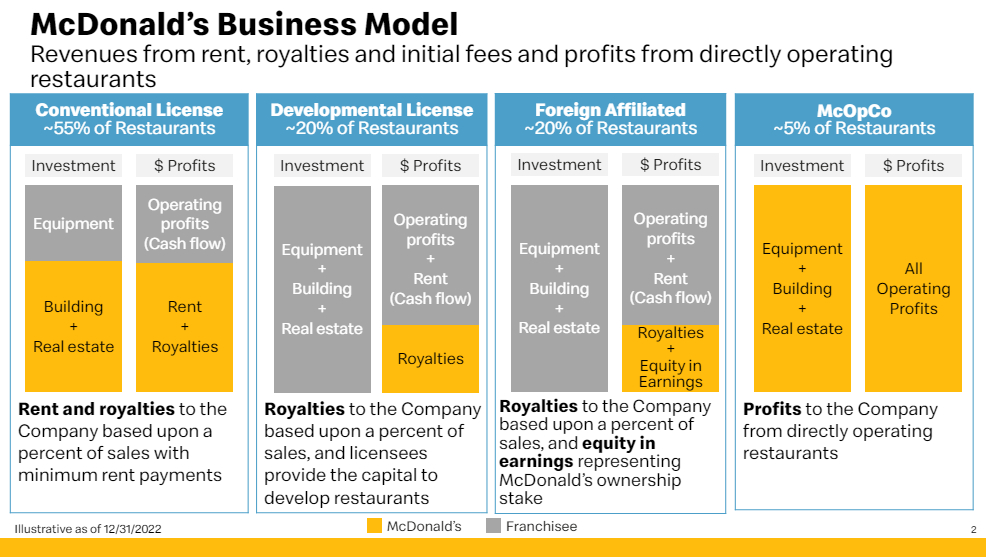

source: McDonald's Fact Sheet

As indicated, McDonald's earns substantial royalty fees from its franchises. Moreover, the company is acquiring real estate at an unprecedented rate. Many argue that McDonald's is not merely a burger chain but rather a real estate powerhouse, a sentiment I wholeheartedly agree with. McDonald's locations are strategically positioned in prime locations across regions and countries.

So, does this all bring in a good return for McDonald's? YES!

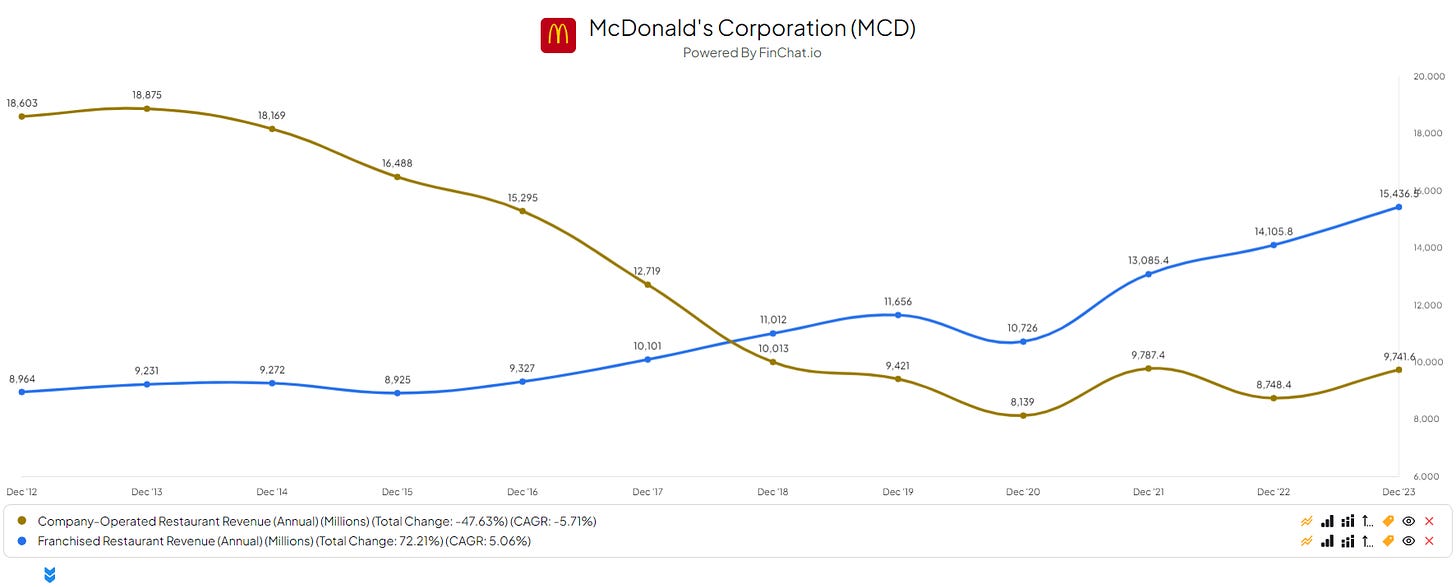

source: finchat

As you can see as clear as day, the franchises are bringing in more revenue compared to its company-operated stores since 2018. Of course, knowing the franchises account for 94.87% as of today, we would hope to see this being reflected in their revenue.

Let’s take a quick peek over at Starbucks.

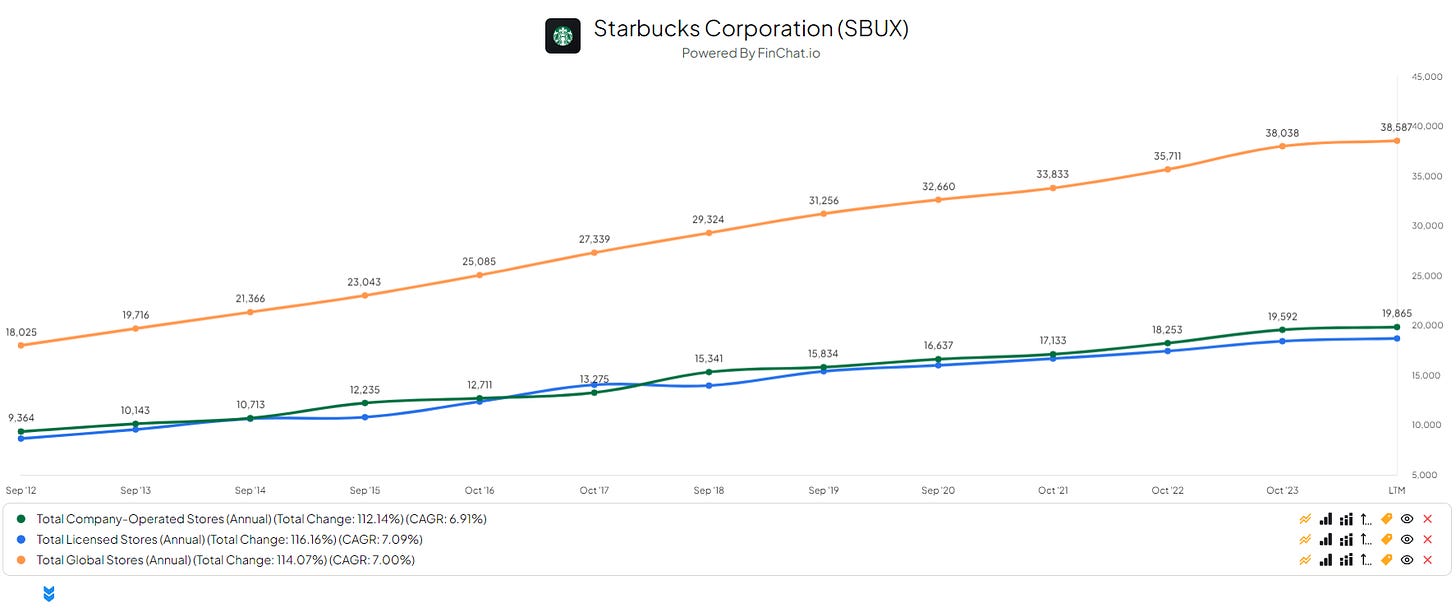

source: finchat

We see that their company-operated and licensed stores are almost equal. The licensed stores account for roughly 48.53%. The remainder is company-operated stores.

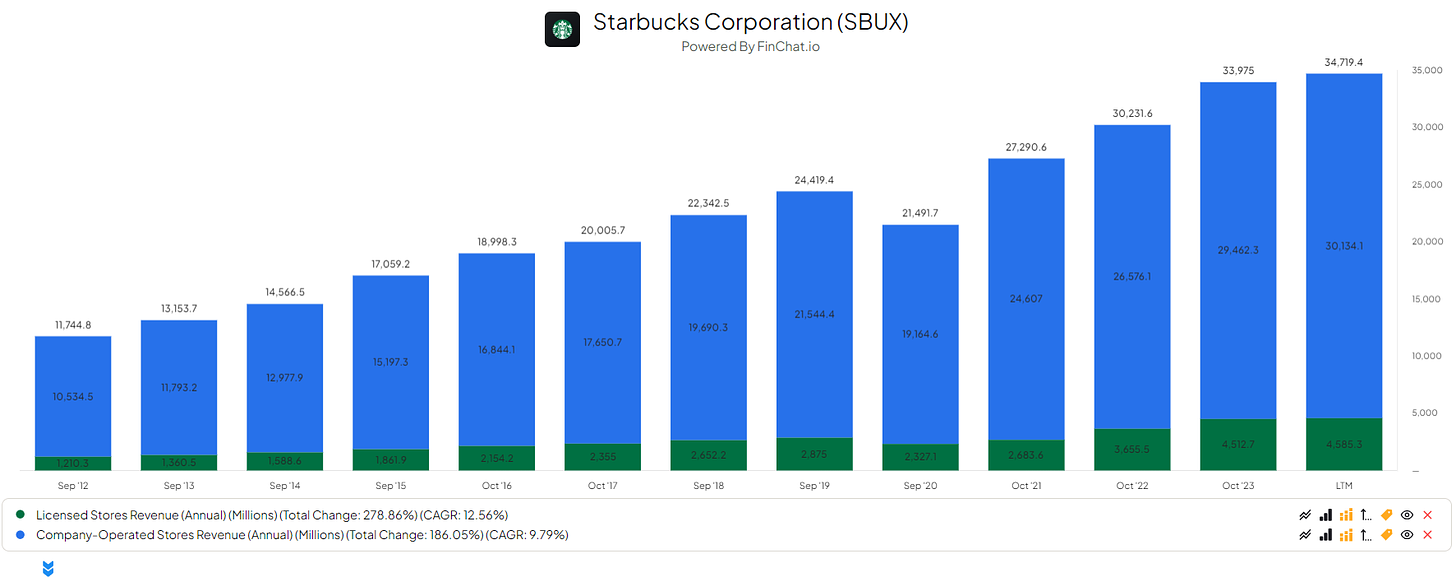

source: finchat

The revenue dynamics between McDonald's and Starbucks showcase a significant contrast. For Starbucks, approximately 12% of its total sales come from licensed stores, a figure markedly different from McDonald's. This discrepancy in revenue distribution reflects the diverse business models and fee structures employed by each company. McDonald's typically charges a 5% fee on total sales from its franchises, while Starbucks imposes a 6% royalty on all sales. While seemingly minor, this 1% variance can translate into substantial royalties over time, impacting profitability at the end of each reporting period.

Furthermore, Starbucks requires a considerable upfront capital investment from franchisees before they can benefit from royalty earnings. In contrast, McDonald's assumes much of the capital-intensive aspects of business development, making it more accessible for prospective franchisees.

Delving deeper into the intricacies of these differing models could warrant an entire article, as the nuances are reflected in the respective companies' balance sheets.

Risks of Franchising

When considering franchising, it's crucial to address certain risks that come with this business model.

Firstly, there's the issue of dependency. Franchisees heavily rely on the franchisor for support, branding, and established business processes. Any mismanagement or downfall on the franchisor's part can directly impact the franchisee's operations and success.

Moreover, brand reputation is a significant concern. Negative publicity or scandals involving either the franchisor or individual franchisees can tarnish the brand's reputation, affecting the entire network. Many customers are unaware of whether a store is company-operated or franchised, and they associate any issues with the brand as a whole rather than individual locations.

Addressing these risks requires proactive management strategies and clear communication between franchisors and franchisees to maintain brand integrity and mitigate potential damage to the network.

So, is Franchising beneficial?

Yes, franchising is very beneficial.

Expanding your brand through franchising can indeed lead to significant benefits with relatively little effort. By collecting hefty royalties, you establish a reliable revenue stream that can be reinvested into expanding your franchise network or returned to shareholders through share buybacks or dividends.

However, it's essential to acknowledge the risks involved in franchising. To mitigate these risks, companies must ensure that their guidelines and regulations are strictly adhered to across the entire franchise network. This involves thorough and frequent training of staff and management to uphold company standards and policies.

Regarding dependency on franchising, opinions vary among investors. While some appreciate the stability it offers, others prefer a more rigorous approach, such as the Starbucks model, which imposes stricter entry barriers to maintain quality standards among franchises.

Nevertheless, the revenue generated from franchising is undeniably attractive to investors. When executed effectively, this model can lead to substantial returns for shareholders by expanding market share, enhancing brand recognition, and growing the customer base. Investing in a company with a successful franchising model can indeed contribute to a flourishing portfolio.

Thank you for reading! If you have any questions, ask them in the chat.

For now, I wholeheartedly thank you for taking the time to read my article and I truly hope to see you in the next one.

Disclaimer: FluentinValue, also known as Yorrin, is not a financial advisor. Nothing produced by Fluentinvalue should be construed as investment advice. Do your own research. :-)