VISA: Quality, Growth And a Compounding Machine

Visa, who hasn't heard of the name or hasn't seen a card with the name 'Visa' on it? In the market, a duopoly exists; there's Visa and Mastercard. Today, we will be delving deep into Visa: its business model, moat, risks and opportunities, valuation, and more.

On March 19, 2008, this giant debuted on the New York Stock Exchange for a mere $16.09. Currently, Visa is priced at $290.37, and it seems like there's no limit for Visa. From $14.524 billion in revenue to $33.325 billion LTM in revenue in ten years, with high margins and high capital efficiency, this giant should not be underestimated for what it is.

But what goes on behind the big screens of this payment giant? What lies ahead for Visa, and what can we, as shareholders, expect from this payment giant? Is there more opportunity, too much risk, or can we expect stagnant results?

In this article, I'll be diving deep into the world of Visa. Join me.

Visa Overview

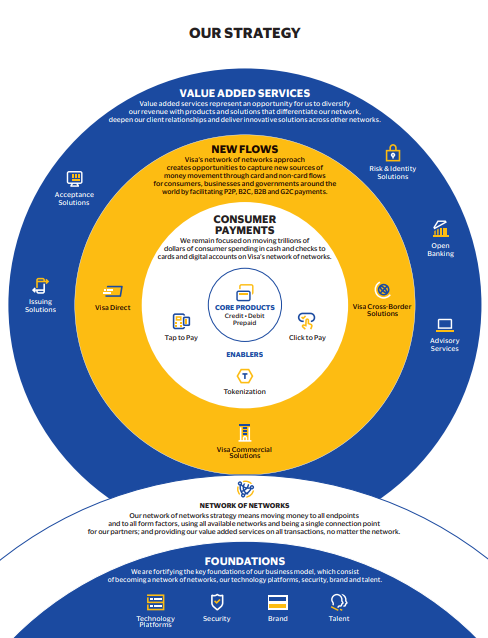

From the infographic taken from their annual report, we see a well-diversified portfolio of services Visa offers.

With the core of business being:

Credit- and debitcards and prepaid card (the card we ALL know an maybe even have, I know I do)

A solid services surrounding their core business is:

Click to Pay (Click to Pay provides a simplified and more consistent cardholder checkout experience online by removing time-consuming key entry of personal information and enabling consumer and transaction data to be passed securely between payments network participants)

Tap to Pay (this is paying with your phone or tap your card onto the terminal to pay for your services or goods)

Tokenization (Visa Token Service (VTS) brings trust to digital commerce innovation. As consumers increasingly rely on digital transactions, VTS is designed to enhance the digital ecosystem through improved authorization, reduced fraud and improved consumer experience)

Revenue Drivers and Cost Drivers

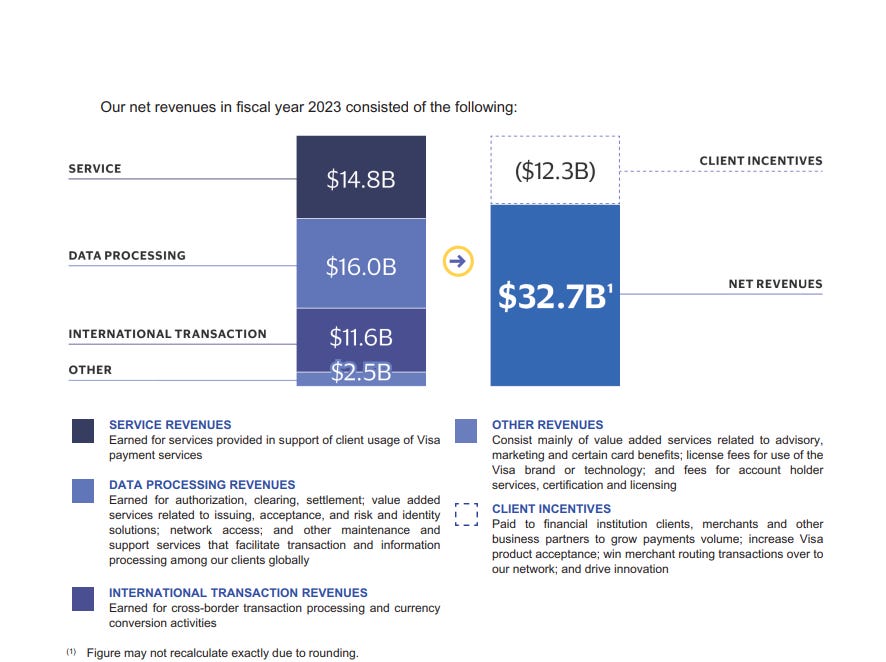

We can see that the following segments are key driver for their revenue, let look at them over a longer period to get a more clear picture.

Service Revenues

Earned for services provided in support of client usage of Visa

payment services

Data Processing Revenues

Earned for authorization, clearing, settlement; value addedservices related to issuing, acceptance, and risk and identity

solutions; network access; and other maintenance and

support services that facilitate transaction and information

processing among our clients globally

International Transaction Revenues

Earned for cross-border transaction processing and currencyconversion activities

Other Revenues

Consist mainly of value added services related to advisory,marketing and certain card benefits; license fees for use of the

Visa brand or technology; and fees for account holder

services, certification and licensing

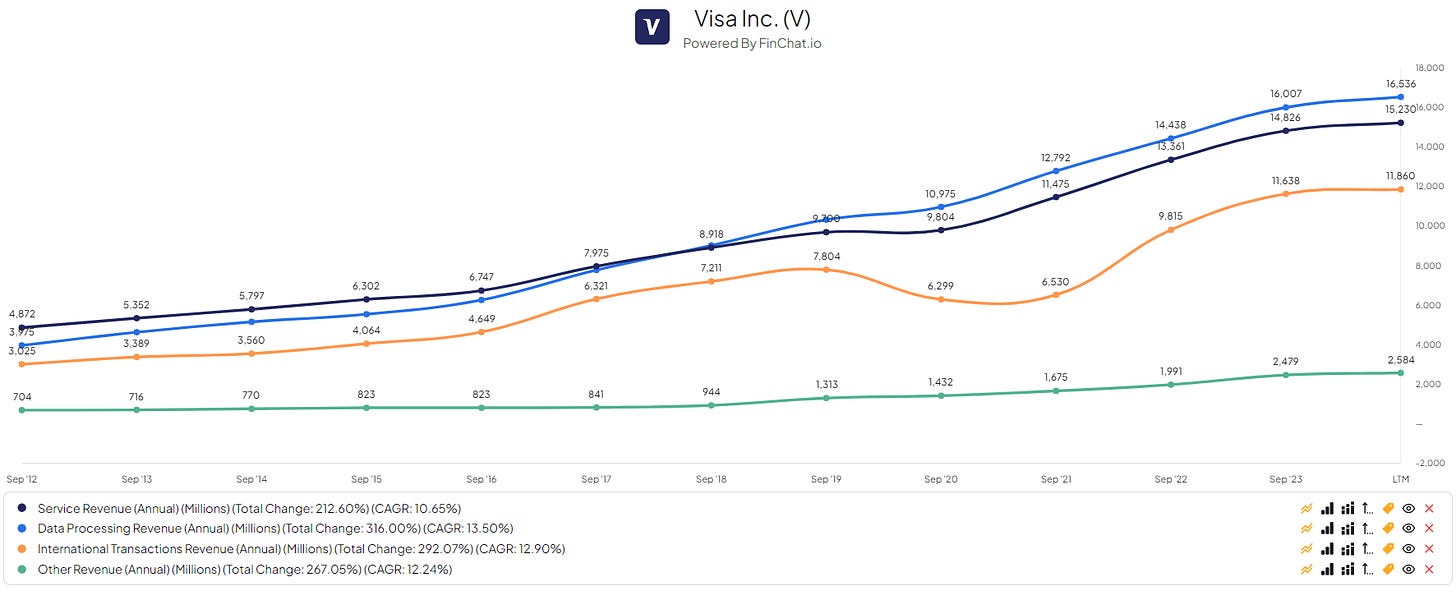

Above, you see a chart from Finchat.io—highly recommended app/website—depicting these processes/services over multiple years.

Service Revenue has a CAGR of 10.56%.

Data Processing has a CAGR of 13.50%.

International Transactions has a CAGR of 12.90%.

Other Revenue has a CAGR of 12.24%.

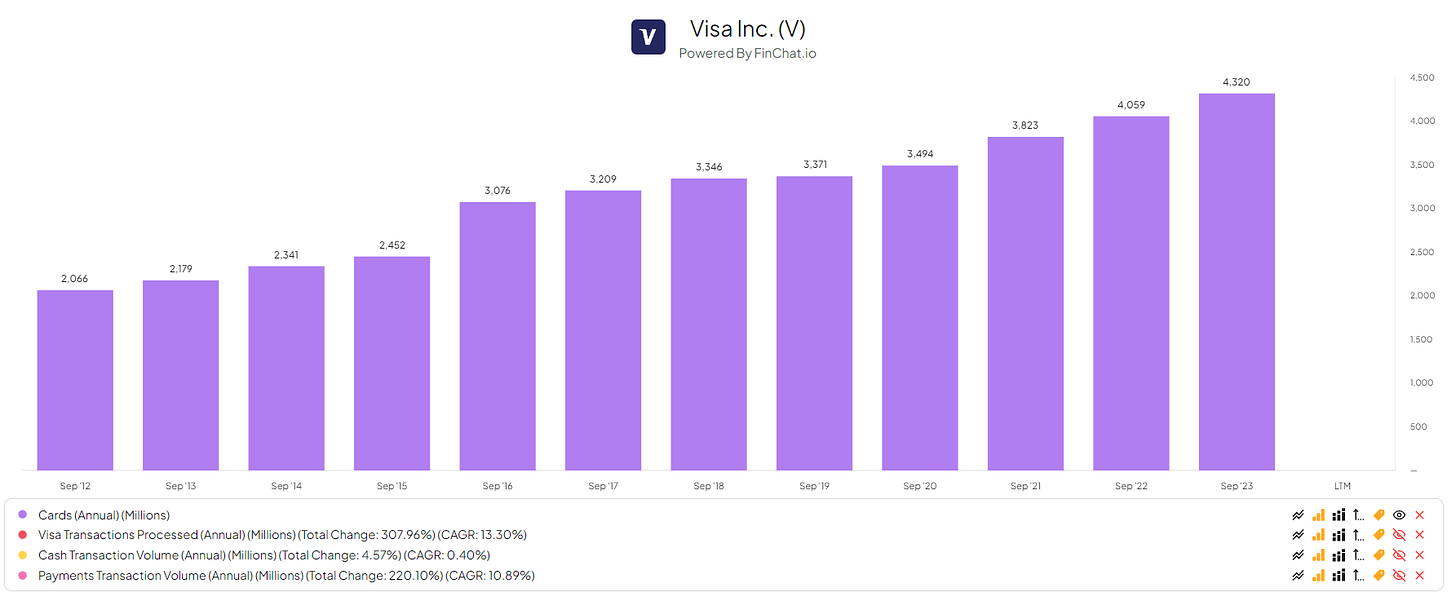

There’s no denying that Visa has great returns on its services—as shown above—and we could see this continue. In the current world, more people are using credit, debit, or prepaid cards, increasing Visa's market share. Below, I’ll post the increase Visa sees in its cards. Having more cards out there means there will inevitably be more spending by consumers and merchants, further increasing their revenues.

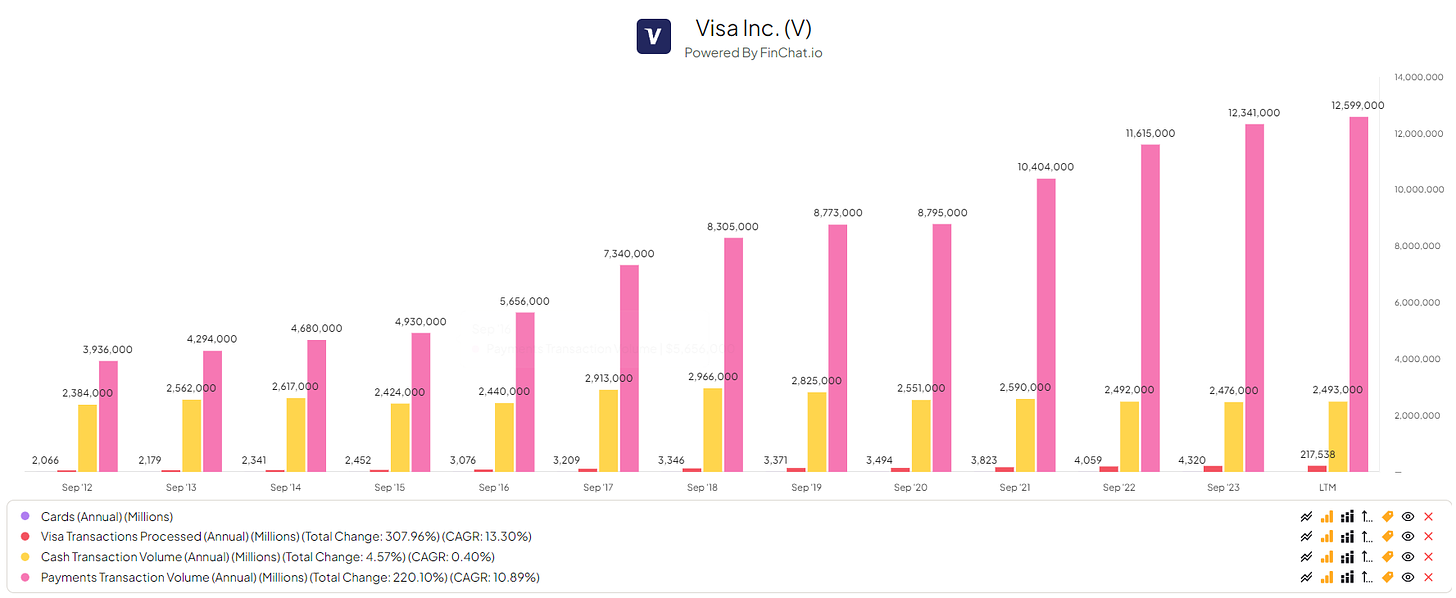

As shown in the graph from Finchat, we observe stable growth in all sectors regarding cards and transactions. We witness a small dip in cash transactions and payment transactions in 2020; this occurred during the peak of the pandemic, explaining the dip. Everybody around the world experienced a dip during the pandemic, so this is not an issue we should expect to recur anytime soon.

Here’s a clearer view of the cards being distributed:

Overall, what we see is an increase in consumer and merchant spending, more cards being deployed, and more transactions being made. All of this will result in an above modest— in my opinion—return for Visa. Their product keeps getting pushed to the masses, and the results are visible.

Of course, there are costs bound to all the services and more that Visa provides, let’s talk about their costs in comparison to their revenue!

Costs of Business

The wonderful part about Visa and its business is that there’s no need to massively increase their costs to drive more revenue. Due to the nature of their services, the total expenses for them can increase a tad bit but drive huge returns back to them.

Here, we see their total revenue compared to their total expenses.

Something wonderful I love to see is that their total spending compared to their revenue is a mere average of 20% to 25% of net revenue. To put it simply, for every $10 Visa makes, Visa puts in a total of a 'whopping' $2.50, if we account for the high end being 25%. Compared to their 'rival' Mastercard, they come out even. In the future, I would love to see Visa keep up these metrics to really boost shareholder—and of course—company returns.

Let’s talk about the sector, digital payments, for a short bit! What does the future of payment look like and is Visa positioned well?

Digital Payments Sector

We’re in a peak of digital evolution. Every person on this planet, every company on this planet, every state, every goverment and many more and going digital. For some this is going to be, lets say, a pain in the ass. For some, this will be the next step they need, like Visa.

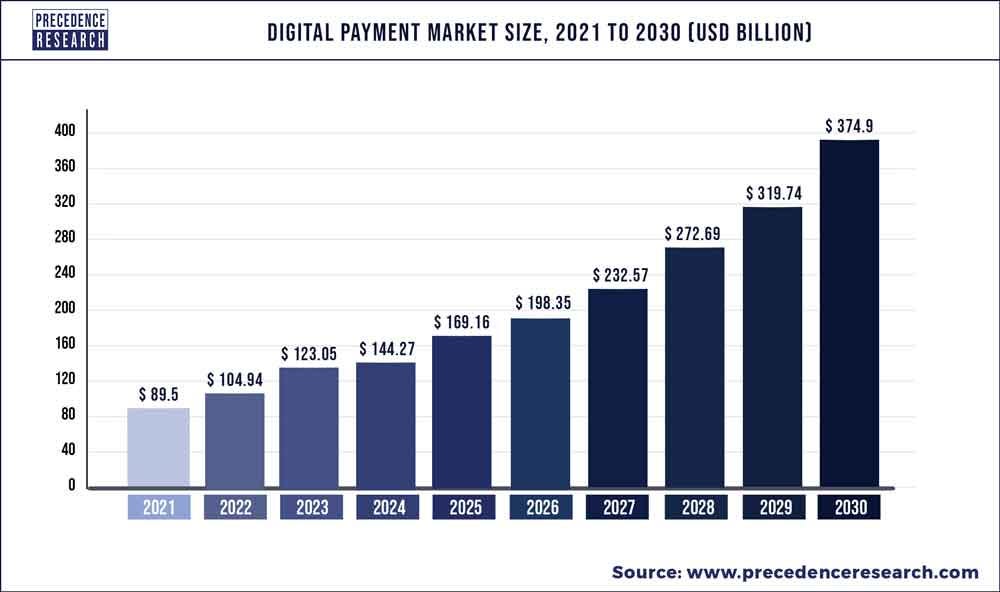

The global digital payment market size was accounted for USD 104.94 billion in 2022 and is expected to hit around USD 374.9 billion by 2030, poised to grow at a compound annual growth rate (CAGR) of 17.25% from 2022 to 2030.

As shown above, the digital payment market size from 2021 to 2030 will substantially grow. This means we’re going to be moving more and more toward a digital manner. This indicates that Visa, being a digital payment processor and more, can really benefit from this new rush of digitalization. Already well-positioned in a duopoly with Mastercard, my opinion is that they will continue to dominate the markets. Of course, there are other players like Adyen, Block, PayPal, and many more. I think they—and we—have come to the conclusion that disrupting the two giants—Mastercard and Visa—is nearly impossible. With the empire that they’ve built and streamlined consumer and merchant possibilities, I see no threat to either Visa or Mastercard. Perhaps, we see Adyen or PayPal standing close by, but they will never become a real threat.

With their ever-increasing (loyal) merchant and customer bases, they are positioned extremely well.

So, if Visa is postioned this well, are there even any risks? Yes! Let’s talk about the risks Visa may face.

Risks of Business

Regulations

Visa is postioned in a pretty regulated place. The payment sector comes with a ton of regulation. With the EU being very persistant in inforcing strict rulings, huge fines and continued monotoring, Visa could face regulation issues outside the USA. Also in the USA there might be regulation issues, but the EU is know for being more strict in their rulings and fining those who are to blame.

The impact of these regulations on Visa, their clients, and other third parties could limit their ability to enforce their payments system rules; require them to adopt new rules or change existing rules; affect their existing contractual arrangements; increase their compliance costs; and require them to make their technology or intellectual property available to third parties, including competitors, in an undesirable manner.

International Transactions

Governments in a number of jurisdictions shield domestic payments providers, including card networks, brands, and processors, from international competition by imposing market access barriers and preferential domestic regulations. To varying degrees, these policies and regulations affect the terms of competition in the marketplace and impair the ability of international payments networks to compete. Public authorities may also impose regulatory requirements that favor domestic providers or mandate that domestic payments or data processing be performed entirely within that country, which could prevent them from managing the end-to-end processing of certain transactions.

Privacy Regulations

Our business relies on the movement of data across national borders. Legal requirements relating to the collection, storage, handling, use, disclosure, transfer and security of personal data continue to evolve, and we they subject to an increasing number of privacy and data protection requirements around the world. For example, their ongoing efforts to comply with complex U.S. state privacy and data protection regulations, and emerging international privacy and data protection laws, may increase the complexity of their compliance operations, entail substantial expenses, divert resources from other initiatives and projects, and limit the services they are able to offer. Additionally, privacy laws in other regions, such as China’s Personal Information Protection Law and India’s Personal Data Protection Act, have extraterritorial application and include restrictions on processing sensitive data, extensive notification requirements, and substantial compliance and audit obligations.

So, there are definitly some risksfactors we need to keep an eye out for when it comes to Visa.

Now, let the fun begin!

Metrics of Visa

Visa is a compounding mean machine. With incredable metrics, margins, moat and much more. This is clearly visable in their performance and (financial) statements, lets go over them.

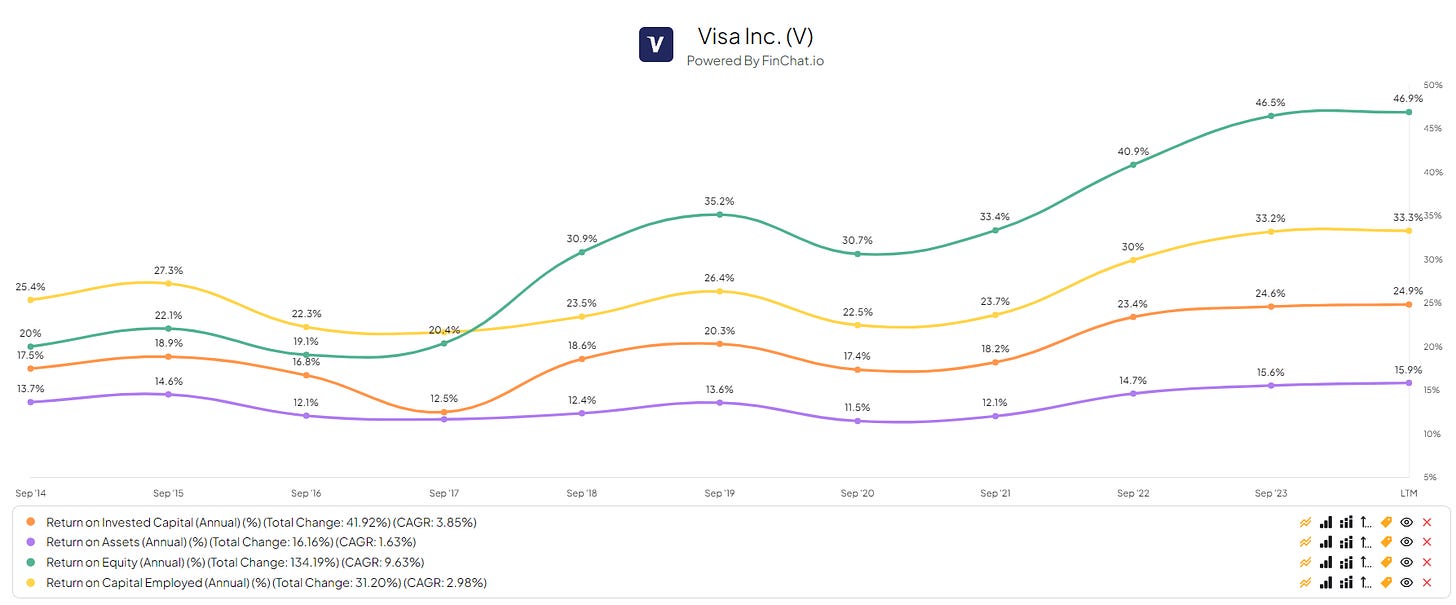

I mean, look at this! These are the results of a compounding mean machine at its finest. Visa demonstrates through these metrics—ROIC, ROA, ROE, and ROCE—that they know where to invest their money and yield the highest returns. Despite operating in a highly competitive sector, they manage to achieve wonderful returns.

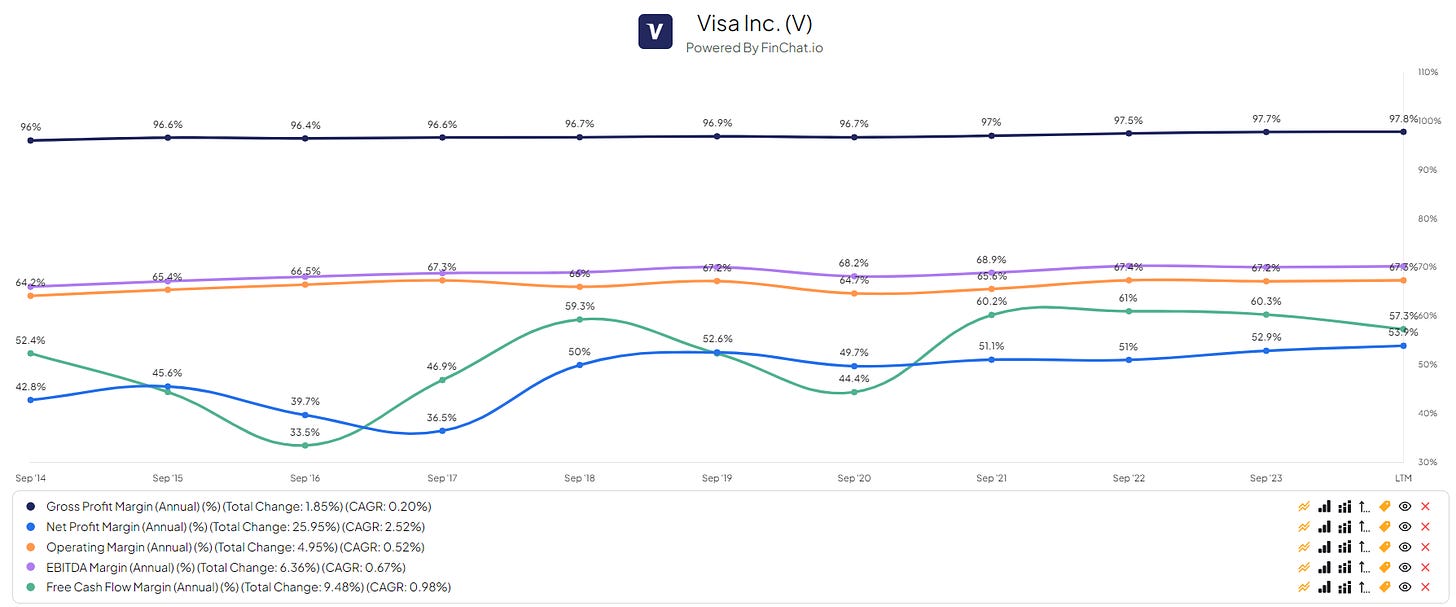

Their wonderful margins follow the line. We see stable margins and could expect these types of margins to hold. With limited competition—due to the duopoly—they have no need to lower their margins to attract more merchants or customers. Also, Visa being barricaded against any disruptor, also that accounts for them to be able to sustain these types of margins.

Overall, Visa has a good track record of being very capital efficient and having sustainable and above modest margins, with room to keep growing on these metrics.

Shareholder Value and Returns

Visa knows its shareholders and what they want to see. Visa offers great shareholder returns, lets take a look.

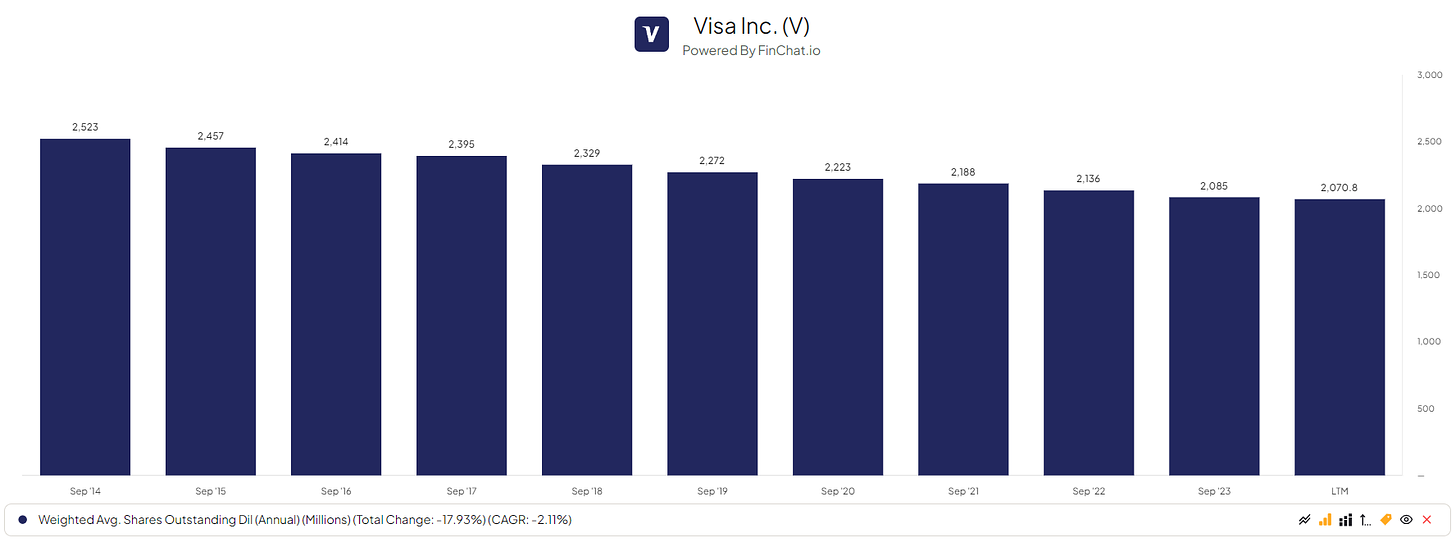

Share repurchase

Common stock repurchases. In October 2022, our board of directors authorized a $12.0 billion share repurchase program. During fiscal 2023, we repurchased 55 million shares of our class A common stock in the open market for $12.2 billion. As of September 30, 2023, our share repurchase program had remaining authorized funds of $5.0 billion. In October 2023, our board of directors authorized a new $25.0 billion share repurchase program, providing multi-year flexibility.

As shown above, from their annual statement, Visa buys back their shares, limiting the outstanding shares as seen below in the graph. Fewer shares out there mean more per share you own!

Lovely to see, right?

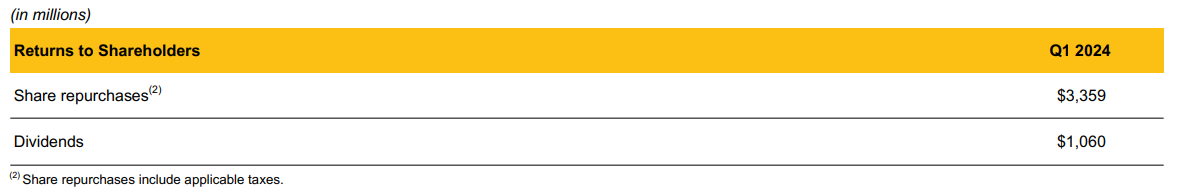

Also, in their most recent filings of Q1 '24, we see yet another repurchase back!

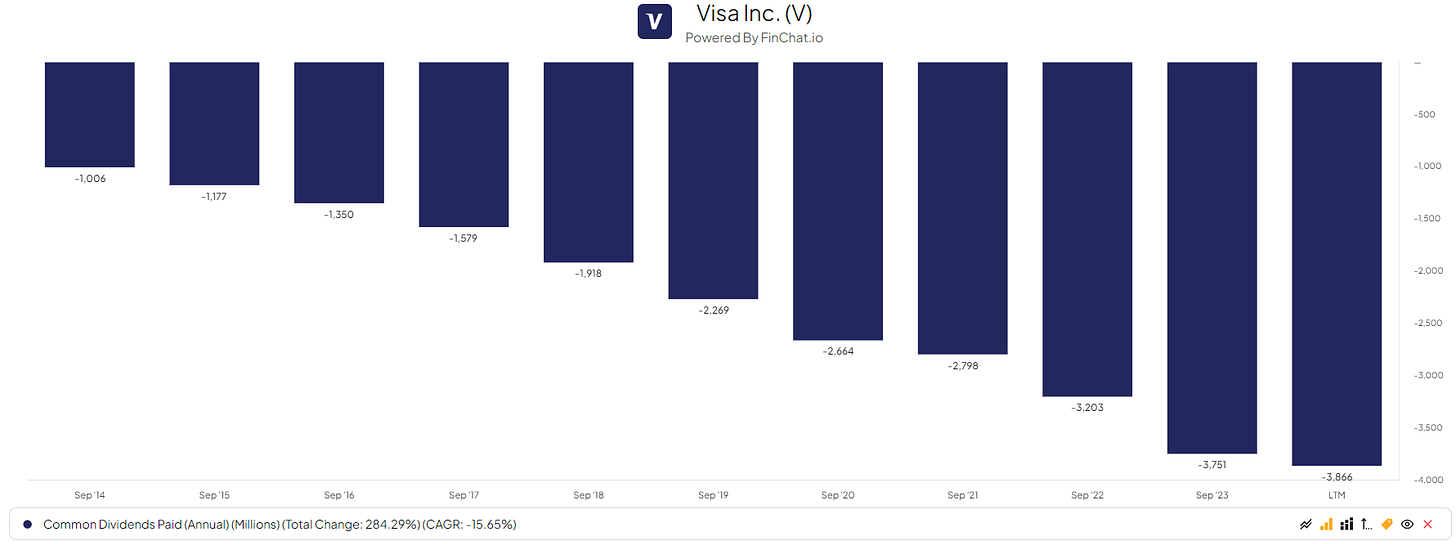

Dividend(s)

Visa gives even more by paying a quartarly dividend.

0.78% yield

22.09 payout ratio

Visa shows us shareholders that they are determined to return value to their shareholders, value to their customers, their merchants, and the company itself.

With this story, you can see why Visa is a favorite of many (super) investors.

Valuation

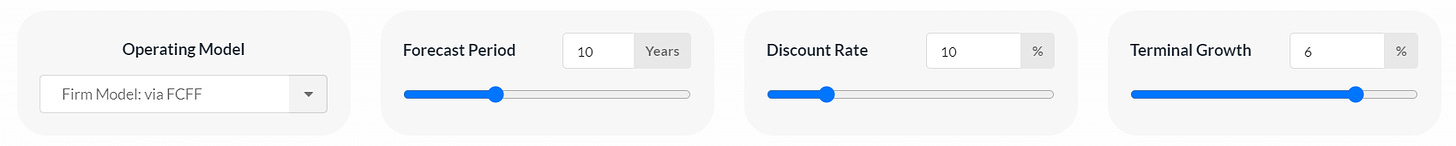

Filling out the DCF with metrics I find reasonable, we arrive at a price of $316.94.

Analysts median price is estimated to be $305.00

Average = $310.97

(NOTE: These are longer period estimates, not short term)

Conclusion

I’m a fan of Visa and will definitely be looking into scaling into a position. This is not because of fair value, DCF, or analysts' 'predictions' that Visa will perform above modestly, but because I genuinely feel my investment thesis fits the company. With great results, wonderful metrics, good management, and a lovely duopoly, I think Visa has a lot more potential.

Visa is a company that offers value and quality to its shareholders, something I love. We see that they keep increasing their dominance and not lose sight of shareholders.

Although the price is currently a little on the higher side for my taste, this should not stop me from becoming a shareholder of this giant. If we look at the past, we see that 'good timing' was never the case with Visa. I am personally going to DCA my way into the stock when I have the capital for it AND when I have fulfilled my wishes of other stocks I eagerly want in my portfolio.

End Note Author

Thank you for reading this! I put a lot of time and effort into doing my research, putting it into words, and becoming a better author over time. Please keep in mind that I’m new to writing, and some errors may occur in my layout. I apologize for any mistakes. I am working on getting better every day. I would love to receive feedback from all of you to help me improve and deliver more and better content.

Thank you!

Yours sincerely,

Yorrin

Disclaimer(s)

I, Yorrin, am not a licensed financial advisor, and the information provided in my publications is for educational purposes only. Any views or opinions expressed are solely my own and do not constitute financial advice.

Readers and viewers are advised to conduct their own research and due diligence before making any investment decisions. The stocks or financial instruments discussed in my publications may involve risks, and past performance is not indicative of future results.

Investing in financial markets carries inherent risks, including the potential loss of principal. It is important to understand that all investments involve risks, and individuals should carefully consider their risk tolerance and financial situation before making any investment decisions.

I do not guarantee the accuracy, completeness, or reliability of any information provided in my publications. I shall not be held responsible for any errors, omissions, or inaccuracies in the content, nor for any actions taken by readers or viewers based on the information provided.

By accessing and reading my publications, readers and viewers acknowledge that they have read, understood, and agreed to this disclaimer. They further understand that they are solely responsible for any investment decisions they make based on the information provided.

If you have any questions or concerns regarding the content of my publications, please consult with a qualified financial advisor or investment professional.