🏆 Ten Stocks to Own for the Rest of Your Life

We all want those companies that just win, win and win. Here's a list of ten winners!

Investing is all about having a handful of wonderful companies you can own forever and expect the above-modest results.

Today, we are answering that one question of every investor, ‘what stocks should I own forever?’

10 Stocks to Own For the Rest of Your Life

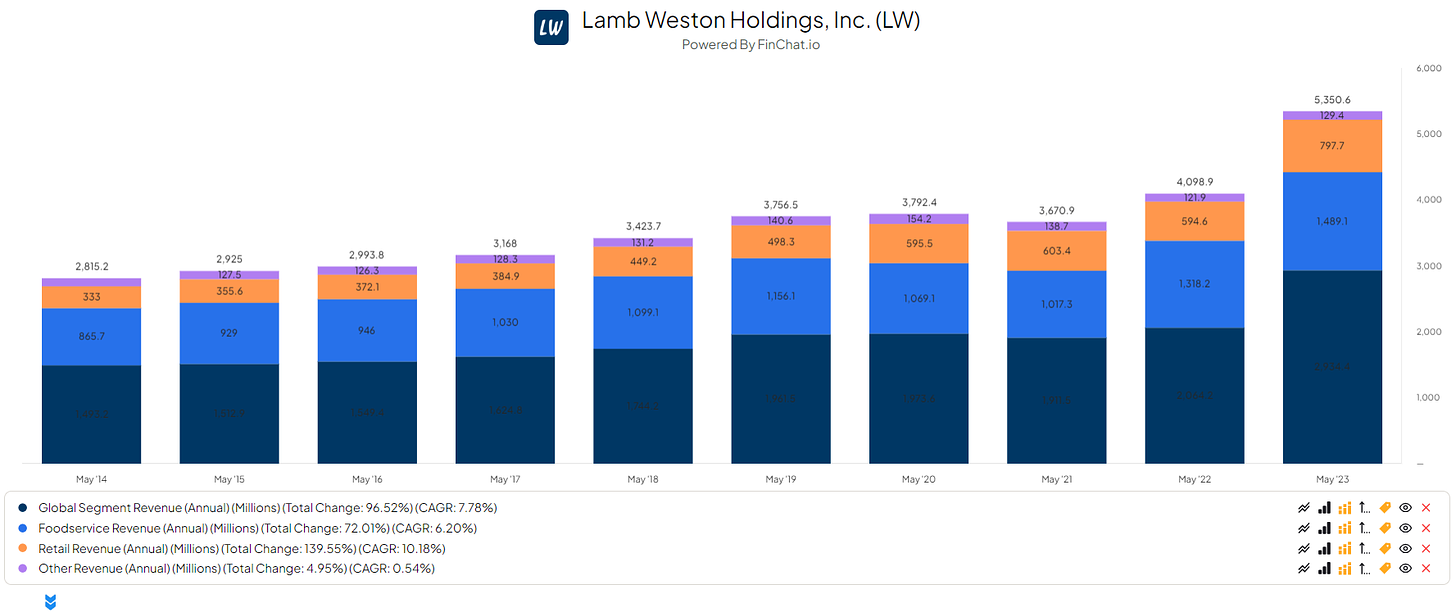

10. Lamb Weston ($LW)

Lamb Weston is a global leader when it comes to frozen potato products. They've been in the game since 1950, and their innovations have shaped the French fry industry. Think of those delicious crinkle-cut or curly fries you love. Lamb Weston might be the mastermind behind them! They offer various frozen potato products beyond fries, catering to restaurants, and food service operations worldwide.

Source: Finchat

Will Lamb Weston be relevant in the next 30–50 years?

Growing global demand

Shifting food trends and convenience

Innovation beyond the potato

Lamb Weston is for a good reason the leader in the frozen food sector. They’re performing strategic acquisitions, leverage their margins well, offer to both individuals and companies, and focus on higher margin operations.

This goes beyond the potato.

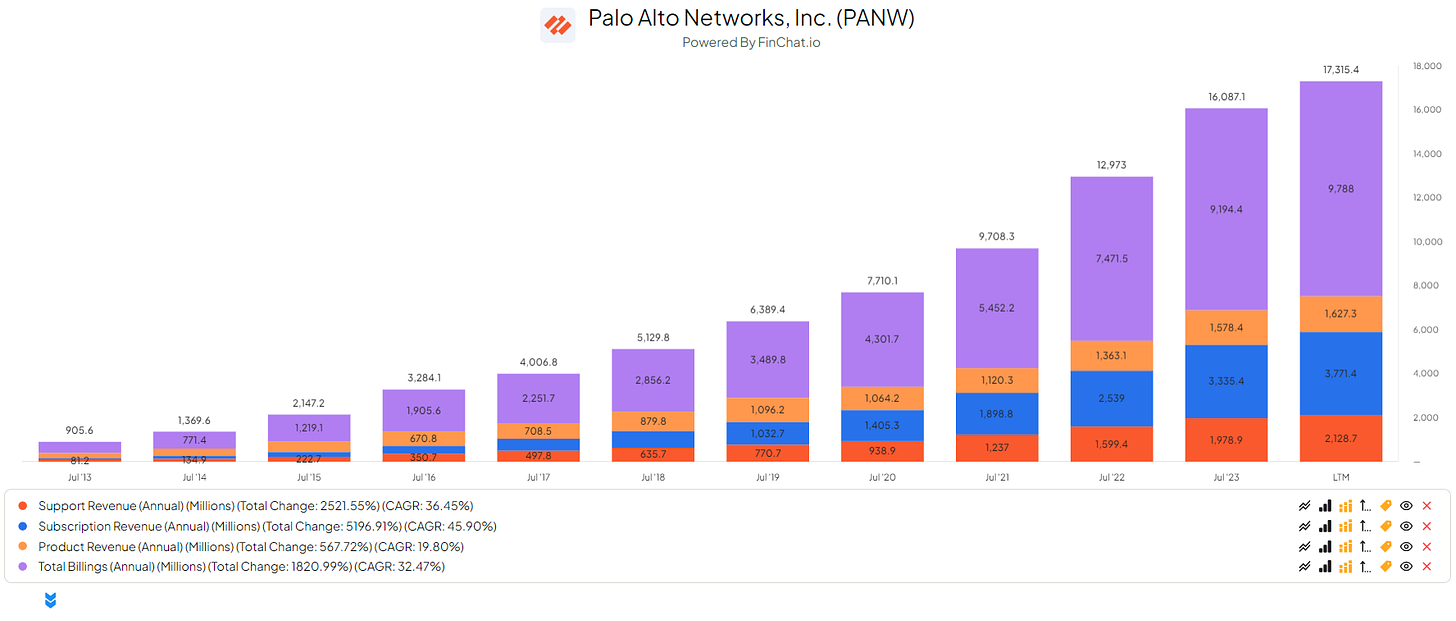

9. Palo Alto Networks ($PANW)

Palo Alto Networks, a cybersecurity leader headquartered in Santa Clara, California, safeguards organizations worldwide. Their core offering is a security platform that combines advanced firewalls with cloud-based tools for comprehensive protection.

Source: Finchat

Will Palo Alto Networks be relevant in the next 30–50 years?

Increasing online threats from foreign and domestic threats.

Fully digital is the new norm

Security, privacy, and protection are in high demand because we have started living more digitally.

Never before in time, we’ve become more reliable on the internet, the safety of the internet, our apps, our accounts, and so much more. Almost everything about us is linked to apps or profiles on the internet. With this comes a higher risk of breaches or threats. Palo Alto Networks provides the safety we’re looking for.

Imagine your bank account being hacked, or your digital ID being hacked and stolen. This would ruin a person’s life.

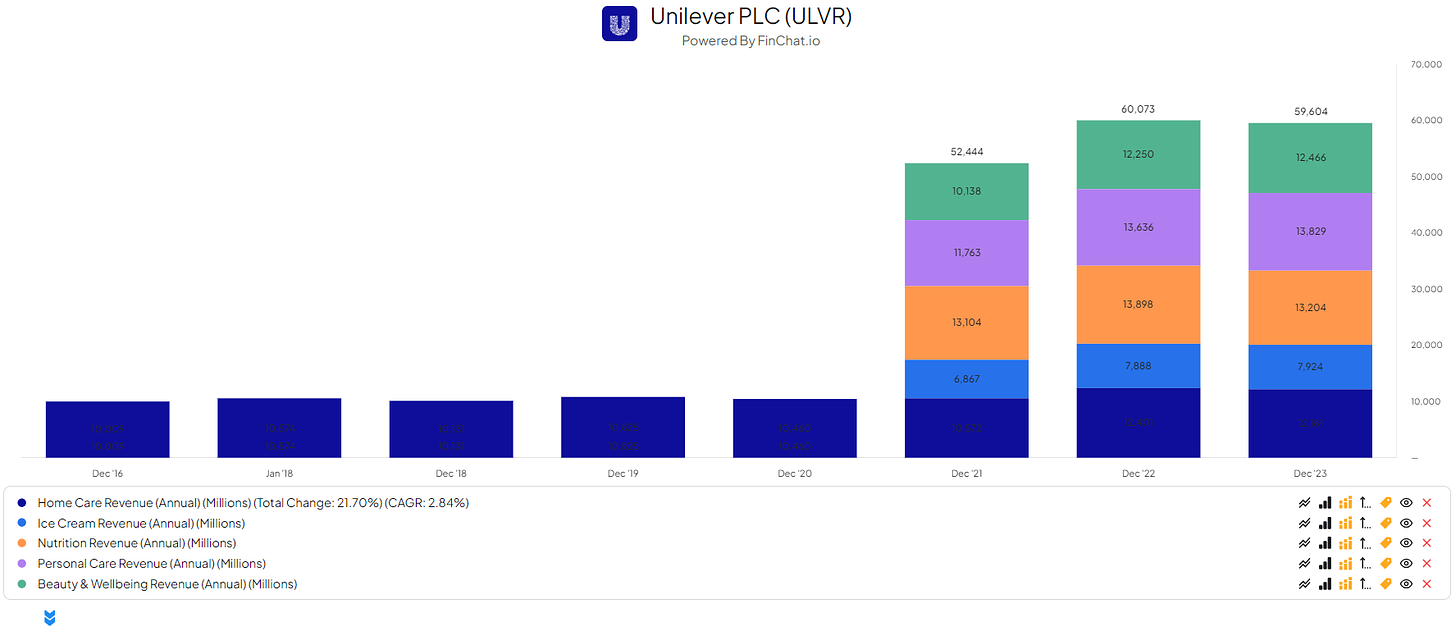

8. Unilever ($UL)

Unilever, a British consumer goods giant founded in 1929, is a household name in over 190 countries. Formed by the merger of Lever Brothers and Margarine Unie, they offer a vast range of everyday products from food and beverages to cleaning agents and personal care items.

Source: Finchat

Will Unilever be relevant in the next 30–50 years?

Demand for consumer goods will increase, it’s a basic necessity

Disposable income increases, consumers will spend more on consumer goods

Worldwide known name, doing strategic acquisitions

Next time you’re in the supermarket, check the label on the back of a product. There’s a high probability that you’ll see the logo of Unilever. Due to their strategic acquisitions, branding, and products, they are on all shelves across the whole world. Even in the most rural parts of the world, Unilever has its products. Being it due to delivering to third parties, their product is out there.

With strong pricing power, MOAT, acquisitions, and much more, Unilever is a cash-generating machine.

7. Dino Polska ($DNP)

Dino Polska, a rapidly growing Polish grocery store chain founded in 1999, has become a national staple. With over 2,406 stores as of January 2024, they focus on serving medium-sized towns and city outskirts across Poland.

Source: Finchat

Will Dino Polska be relevant in the next 30–50 years?

Growing demand for convenience

Room for further expansion

Focus on underserved markets

Dino Polska is not your average supermarket. With their strategic placement in rural areas, investing ALL their FCF back into the business, expanding stores on an annual basis, offering a wide range of products, and capabilities to expand into other countries.

They're solely operating in Poland as of writing this article, giving them enough room for expansion. Besides that fact, their margins, and revenue are absolutely nuts compared to any other supermarket. They create above-modest returns for their shareholders by re-investing their FCF back into the business.

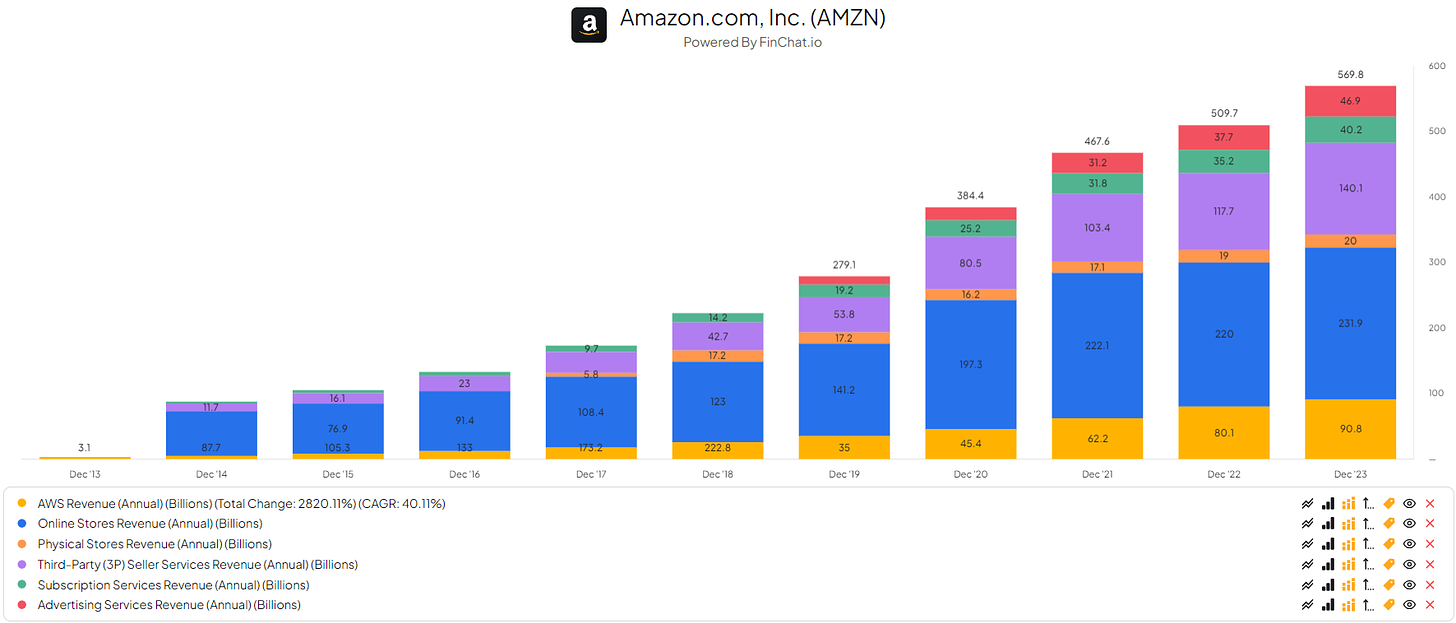

6. Amazon ($AMZN)

Jeff Bezos created a monster in 1994. Amazon started selling books and quickly became the giant it is today, selling almost everything to everyone over the world.

From AWS to consumer goods, Amazon does it all. Amazon quickly took its shares in the industry and grew to one of the magnificent seven. With a current market cap of $1,910.15B and a total revenue of $574.8B, this monster is here to stay.

Amazon played in the demand for cloud services with their AWS, currently generating $90.8B with their cloud service AWS.

Source: Finchat

Will Amazon be relevant in the next 30–50 years?

Consumer spending will increase in the coming years. Even during recessions, consumers keep spending.

Demand for more cloud and more powerful cloud will grow

Streaming and advertising have shown to be a steadily growing business

Amazon has subscriptions, owns Twitch (streaming site), has a cloud service, sells all sorts of items, and has physical stores to drive even more traffic.

This giant is a name we will not see replaced or leave anytime soon. Their multi-billion dollar business is here to stay.

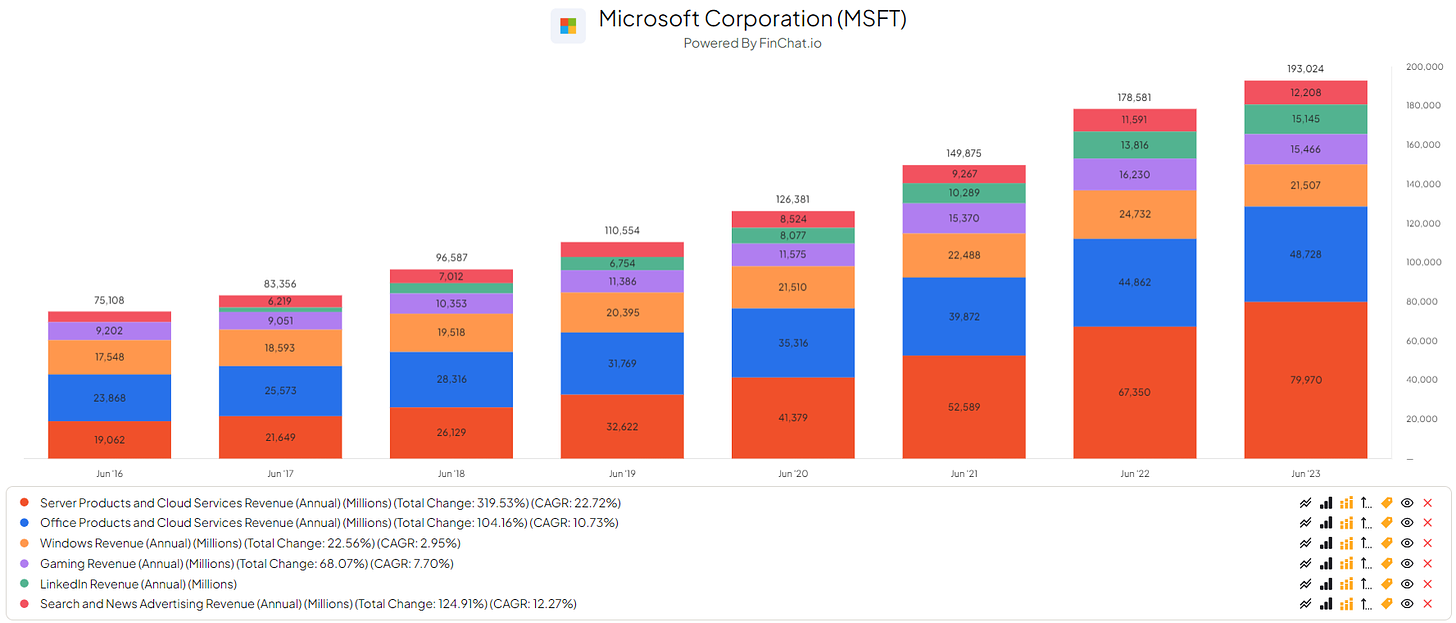

5. Microsoft ($MSFT)

Microsoft is one of the magnificent seven on the stock market.

This company should not be mistaken for anything. Their products, cloud services, apps, consoles, games, and much more dominate the world. Everybody around the world has at least one app or service that is owned by Microsoft.

With a market cap of $3,073.53B and an enterprise value of $3,103.9B, this is one of the most important players in the game and industry.

Source: Finchat

Will Microsoft be relevant in the next 30–50 years?

Cloud, gaming, and search keeps growing, giving Microsoft more playground

Strong brand recognition and established ecosystem

Convergence of technologies

Microsoft has proven time over time to be a consistent and reliable company, bringing modest returns to its shareholders. The company operates in many sectors, doing strategic acquisitions, and expanding operations, making it a player poised for the future.

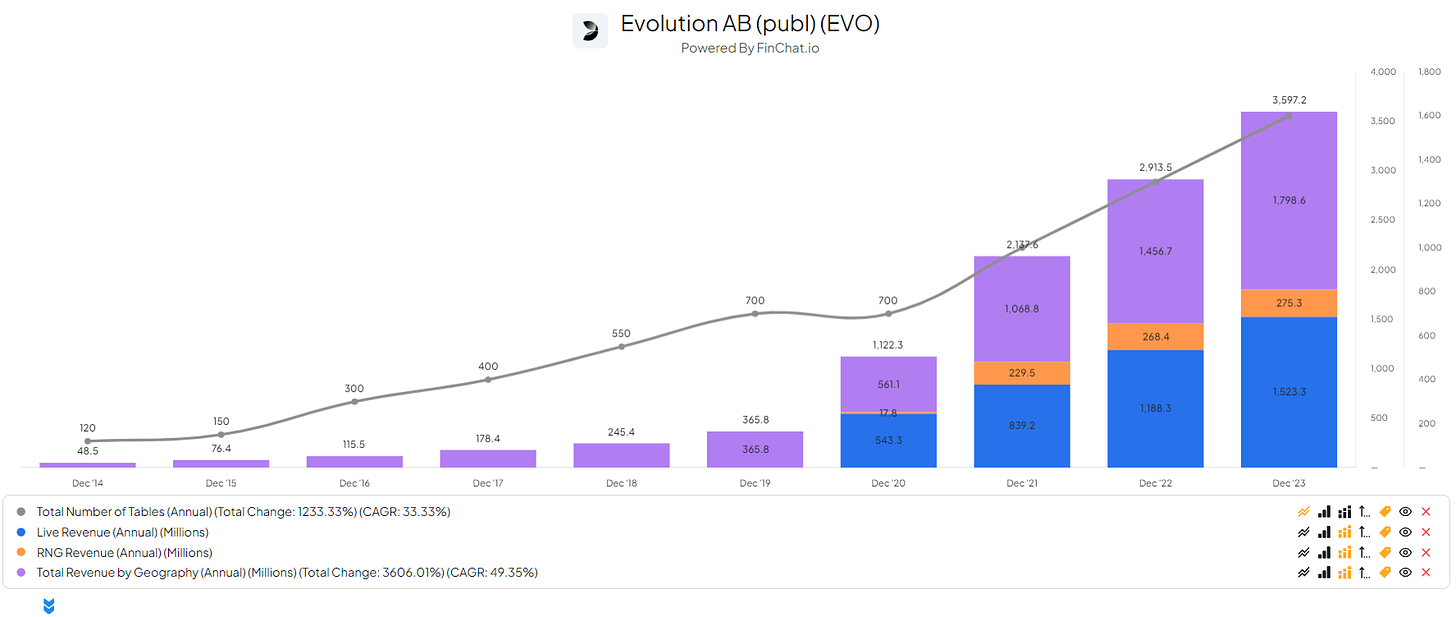

4. Evolution AB ($EVO)

Evolution AB is a Swedish company leading the way in online casino technology. Founded in 2006, they develop, produce, and license live dealer casino games for online gambling operators around the world. Imagine the thrill of live blackjack or roulette, but from the comfort of your home – that's Evolution's expertise.

Source: Finchat

Will Evolution AB be relevant in the next 30–50 years?

Growth of online gambling

Integration with emerging technologies

Diversification beyond traditional games

Evolution has placed itself as number one in the (online) gambling scene. Evolution is active in most parts of the world, generating an above modest return on their products/services.

With their growing tables, growing licenses, and growing interest in their product. Evolution is poised for success in the long term.

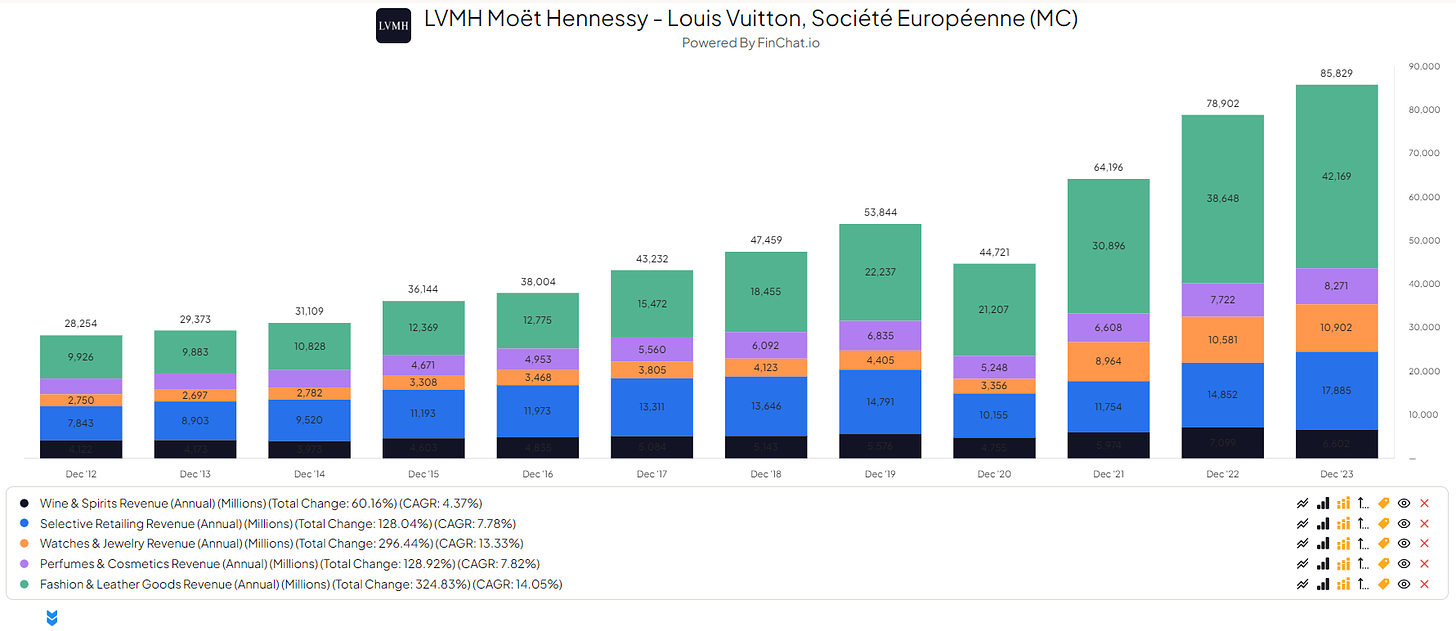

3. LVMH ($MC)

Louis Vuitton Moët Hennessy is the number one in luxury goods.

LVMH controls around 60 subsidiaries that manage 75 luxury brands. In addition to Louis Vuitton and Moët Hennessy, LVMH's portfolio includes Tiffany & Co., Christian Dior, Fendi, Givenchy, Marc Jacobs, Stella McCartney, Loewe, Loro Piana, Kenzo, Celine, Sephora, Princess Yachts, TAG Heuer, and Bulgari.

Currently, LVMH has 6,000+ stores, operating worldwide.

Source: Finchat

Will LVMH be relevant in the next 30–50 years?

Luxury is a never-dying sector

Strong brand portfolio and expertise

Increasing disposable income, creating more middle to higher-class households.

Luxury is something humankind will always find attractive. Luxury gives people the feeling of wealth, a higher status, and social approval. These things are a lot of people's driving factors, and those people will spend a lot of money to achieve this feeling.

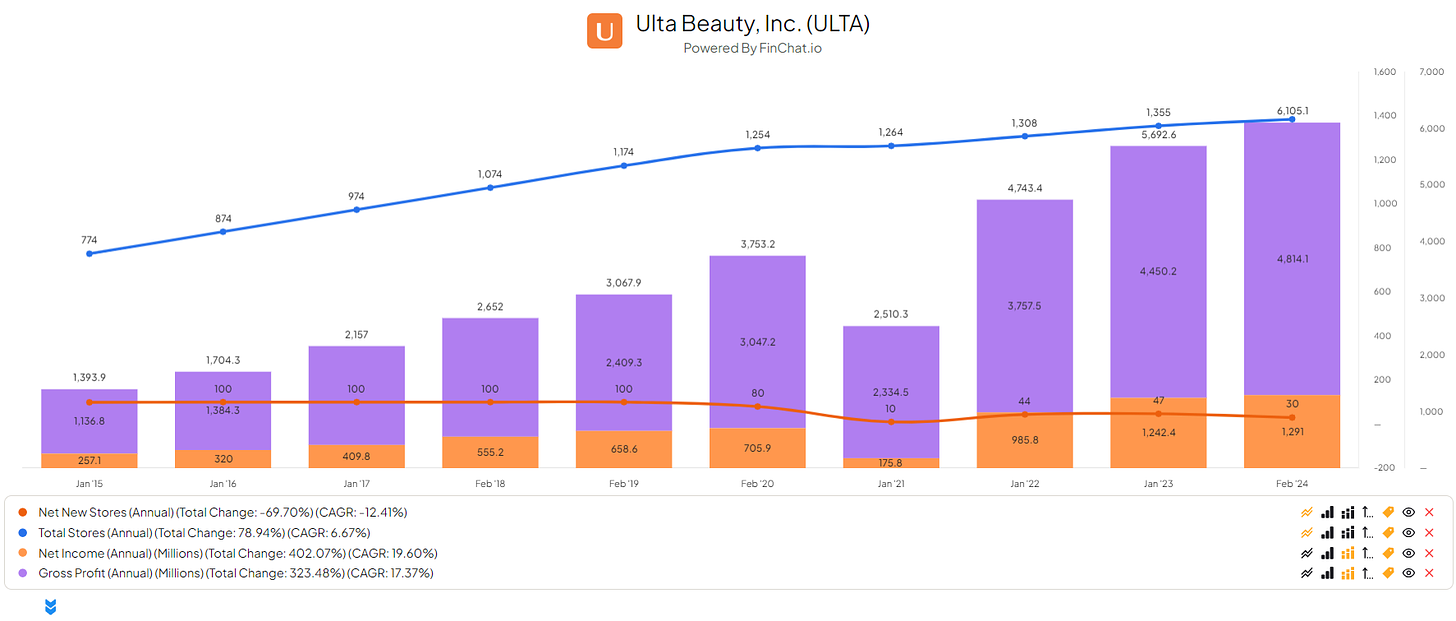

2. ULTA Beauty ($ULTA)

Ulta Beauty, Inc. operates as a specialty beauty retailer in the United States. The company offers branded and private label beauty products, including cosmetics, fragrance, haircare, skincare, bath and body products, professional hair products, and salon styling tools through its Ulta Beauty stores, shop-in-shops, Ulta.com website, and its mobile applications. It also offers beauty services, including hair, makeup, brow, and skin services at its stores.

Source: Finchat

Will ULTA Beauty be relevant in the next 30–50 years?

Evolving Beauty Definitions

The universal human desire for self-expression and confidence

The Rise of Bespoke Beauty

We can all agree that people all over the world spend and will keep spending, a good amount of capital to make themselves representable to others. Might it be for work, a business trip, a vacation, a date, a day out, or heading to the in-laws?

Everybody wants to look good, ULTA just offers that! Products to make you look good.

The human desire to impress others, and yourself, is something that will never stop.

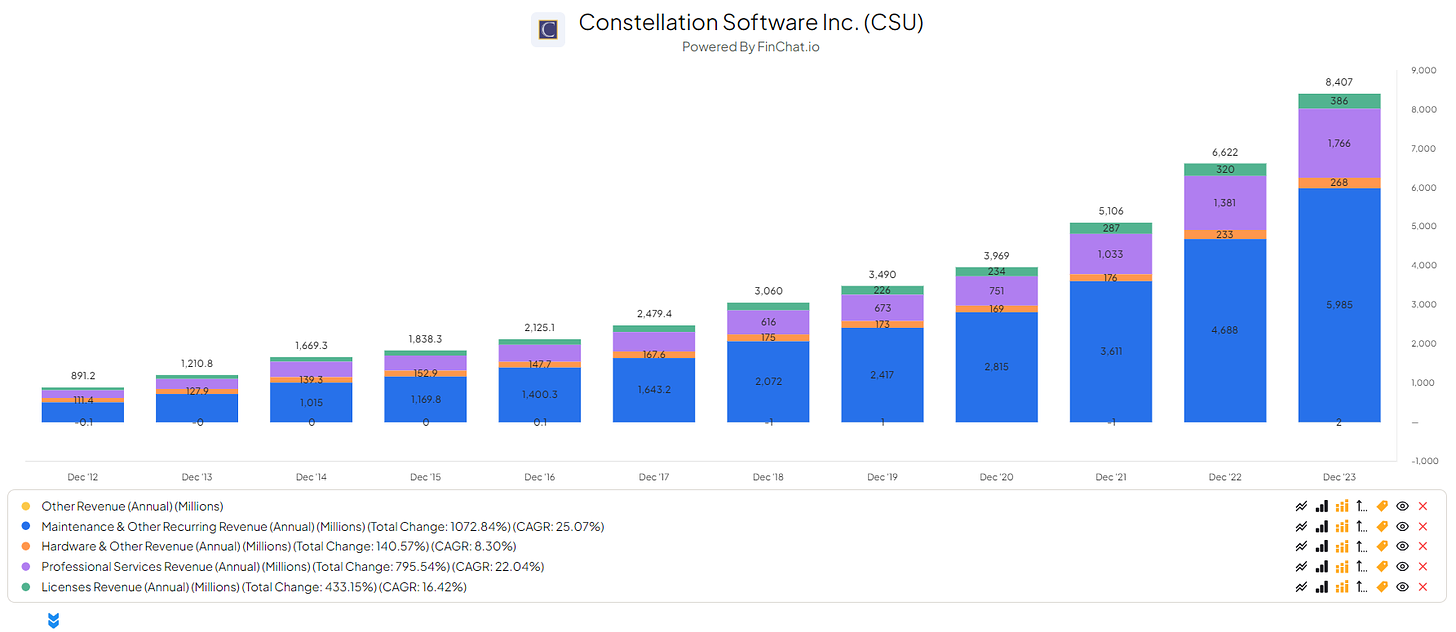

1. Constellation Software ($CSU)

Constellation Software is a Canadian-based serial acquirer mean machine! Their mission is to acquire, manage, and build market-leading software businesses that develop specialized, mission-critical software solutions to address the specific needs of their particular industries.

Source: Finchat

Will Constellation Software be relevant in the next 30–50 years?

Growing Need for Integration and Interoperability

Evolving Business Landscape

Rise of Distributed Systems

In the ever-evolving world, where more and more are going digital, the need for different kinds of software in different types of sectors keeps growing. Constellation is poised to play into this trend.