Starbucks Stir-Up: Brewing Success, One Sip at a Time!

You’re walking in a city or local place in your hometown or even somewhere abroad, and you’re greeted by this big, friendly and inviting green logo, it’s a Starbucks shop. You walk past the shop and smell coffee being brewed by one of the many baristas.

Who hasn’t seen the shops from the outside or inside, nobody? Starbucks is everywhere and besides coffee they offer a relaxing spot to drink your coffee and get some work done, work and coffee is for the most people a wonderful experience.

Today, we dribble our toes in the business of the coffee giant Starbucks!

Currently, Starbucks has a market cap of $96.15 billion dollars, revenue of $36.69 billion dollars and a whopping 381,000 employers. This coffee giant can not be mistaken for a nobody.

But, is there a future for their ‘‘simple’’ coffee business? Let’s chat about it!

What is Starbucks?

Starbucks Corporation is an American multinational chain of coffeehouses and roastery reserves headquartered in Seattle, Washington. It was founded in 1971, and is currently the world's largest coffeehouse chain.

As of today, the company had 38,587 stores in 80 countries, 15,000+ of which were located in the United States. Of Starbucks' U.S.-based stores, over 9,150 are company-operated, while the remainder are licensed.

The rise of the second wave of coffee culture is generally attributed to Starbucks, which introduced a wider variety of coffee experiences. Starbucks serves hot and cold drinks, whole-bean coffee, micro-ground instant coffee, espresso, café latte, full and loose-leaf teas, juices, Frappuccino beverages, pastries, and snacks. Some offerings are seasonal or specific to the locality of the store. Depending on the country, most locations provide free Wi-Fi Internet access.

Starbucks its Core Business

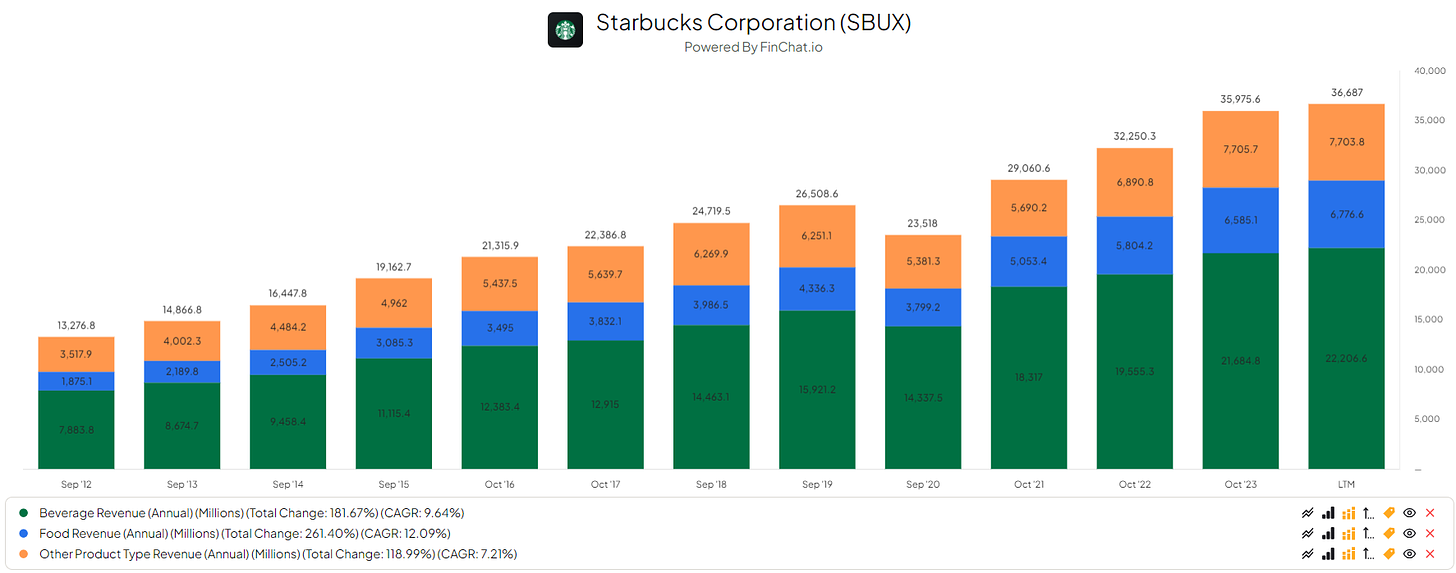

Starbucks as three types of streams of income.

Beverage Revenue

Food Revenue

Other Product Type Revenue (packaged and single-serve coffees and teas, plus royalty and licensing revenues, beverage-related ingredients, serve ware, and ready-to-drink beverages, among other items)

In their beverage, food and other sector we’re seeing overall good growth. The company is matured yet a lot of growth is still very visible. The company is expanding its business to mainland China, which should accelerate growth even more. Starbucks is also expanding in Europe, Asia, and America.

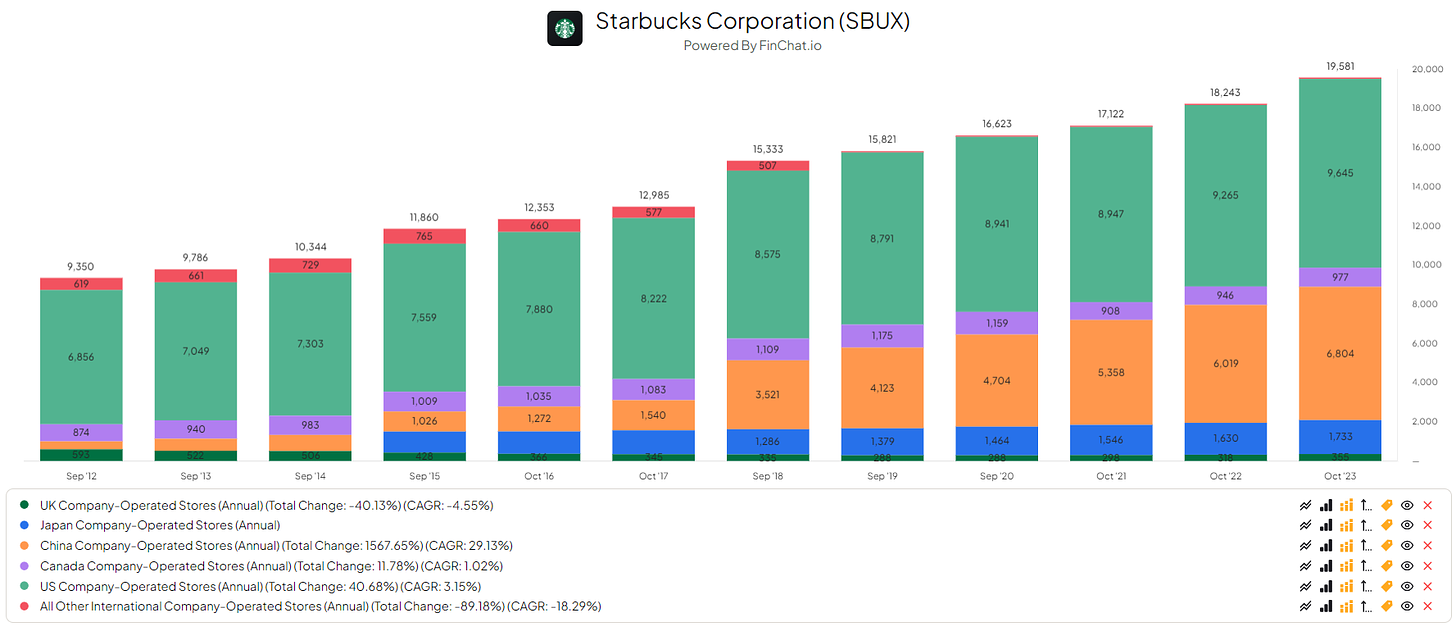

Their overall majority comes from China and the USA, with the most of their stores being in those locations. This means that Starbucks still has a lot of growth potential in other regions.

I personally do hope to see more growth in other regions besides the USA and Chine. Of course, I do want to see growth in all regions, but as of now their focus lies on the USA and China. I understand that those regions, the USA, and China, is where the big money lies for them, and I’m happy they focus on that. But, in the future, I would like to see more expansion and traffic from the EU too.

As of now, Starbucks is modestly divers in their exposure over the world.

Company-operated & Licensed

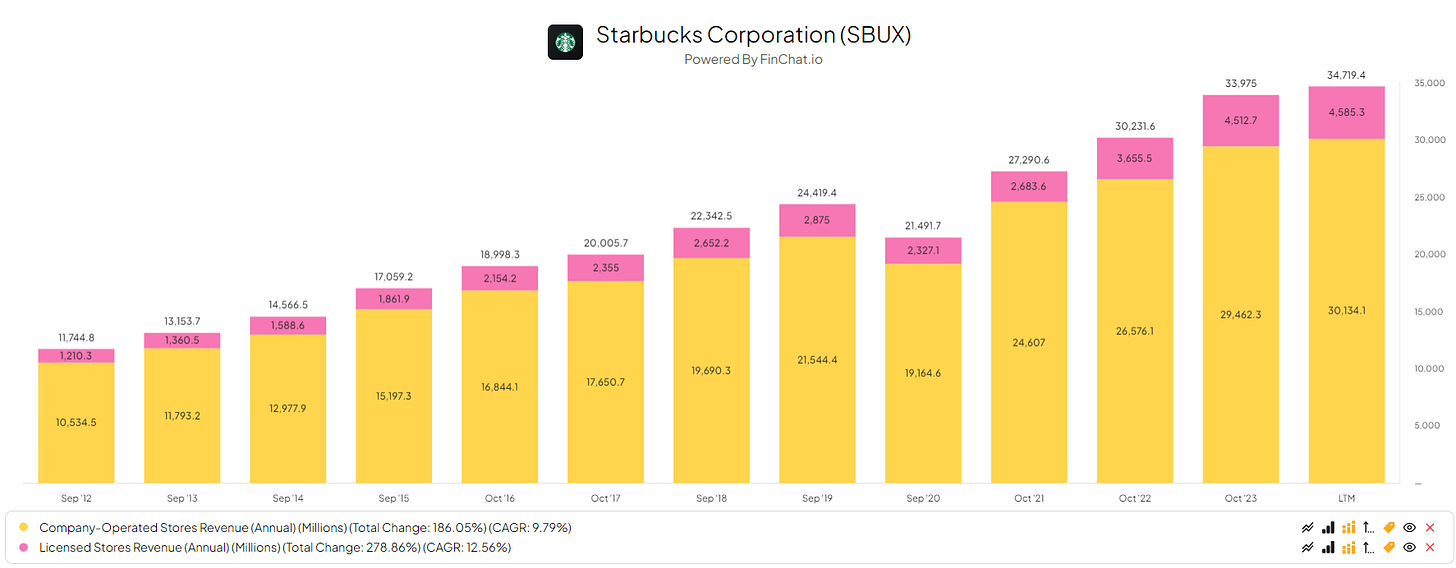

Starbucks operates in company-operated stores and licensed stores. They have almost the exact same model as McDonald’s. The licensed stores pay their ‘‘fee’’ for using the Starbucks logo, products, services, and goods. Starbucks uses the licensed stores for better amplification of brand, revenue, and profits. Their main focus lies on company-operated stores so that they have tight control over their product development, branding, distribution, and customer experience.

Starbucks follows a chain business model strategy, where most of its revenue comes from its owned stores.

As shown above, their majority of revenue comes from company-operated stores.

In my eyes, this is a good thing! Create more value via the licensed stores, create more traffic and more volume but keep your focus on the company-operated stores. This way you give less out of hand and keep control of the majority.

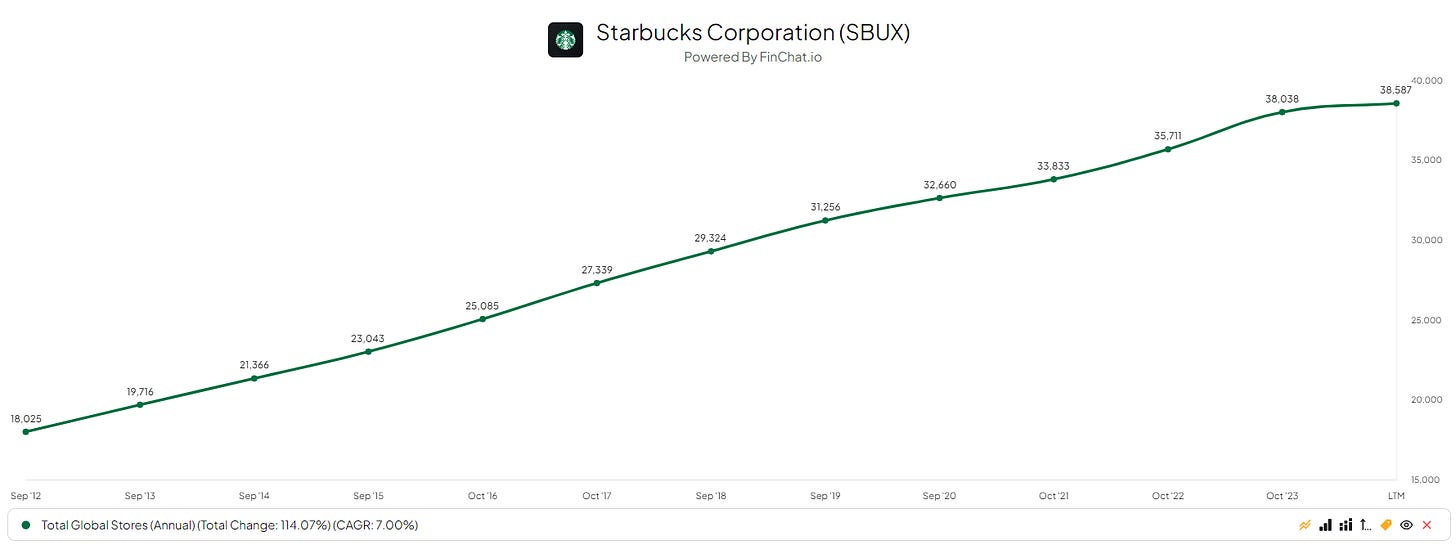

Overall we’re seeing growth in stores and this is a wonderful sight to see. To put it simple, the more, the merrier! More stores mean their exposure is bigger and revenue is greater.

Something I love seeing is that even during a pandemic, Starbucks manages to open up more stores. Other stores were closing down, moving somewhere else or selling other sections of their stores, usually in expensive areas like crowded cities and parts, where Starbucks opened up their stores. During the pandemic of about three years, their total stores grew with an average of 7.66%, 3% the first year, 10% the second and 10% the last year.

(In my opinion, the pandemic lasted from 2019 up to 2022. To this day, people agree and disagree with me on this, haha)

So, overall we’re seeing growth in revenue, company-operated revenue being the leader, and Starbucks is pushing out their product in all regions. They’re well-placed and positioned for more growth in all regions. As of now, they’re execution their core-business to perfection.

Revenue and Costs

Although we’ve spoken about their revenue a little bit, let’s talk about their revenue and costs.

Starbucks is a capital intense company. That means they need a lot of capital to produce more capital. For their coffee’s they need all the items to make it and hand it over to their customer, even doing customer requests like a pumpkin spice latte and many more.

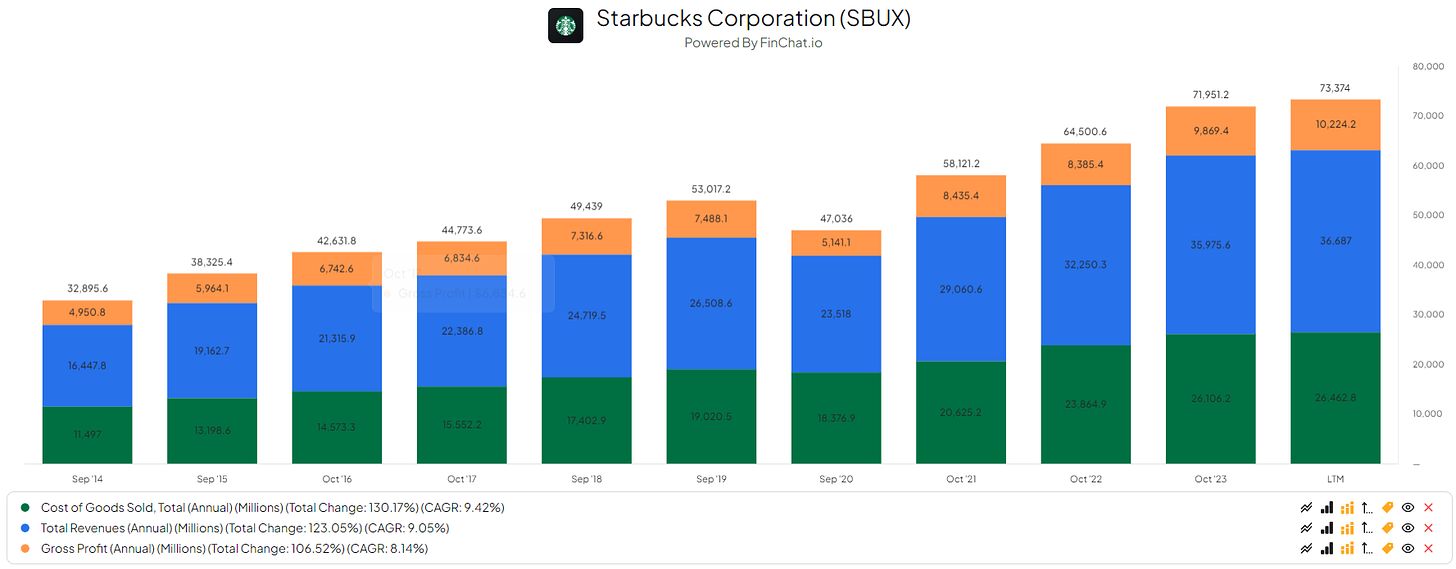

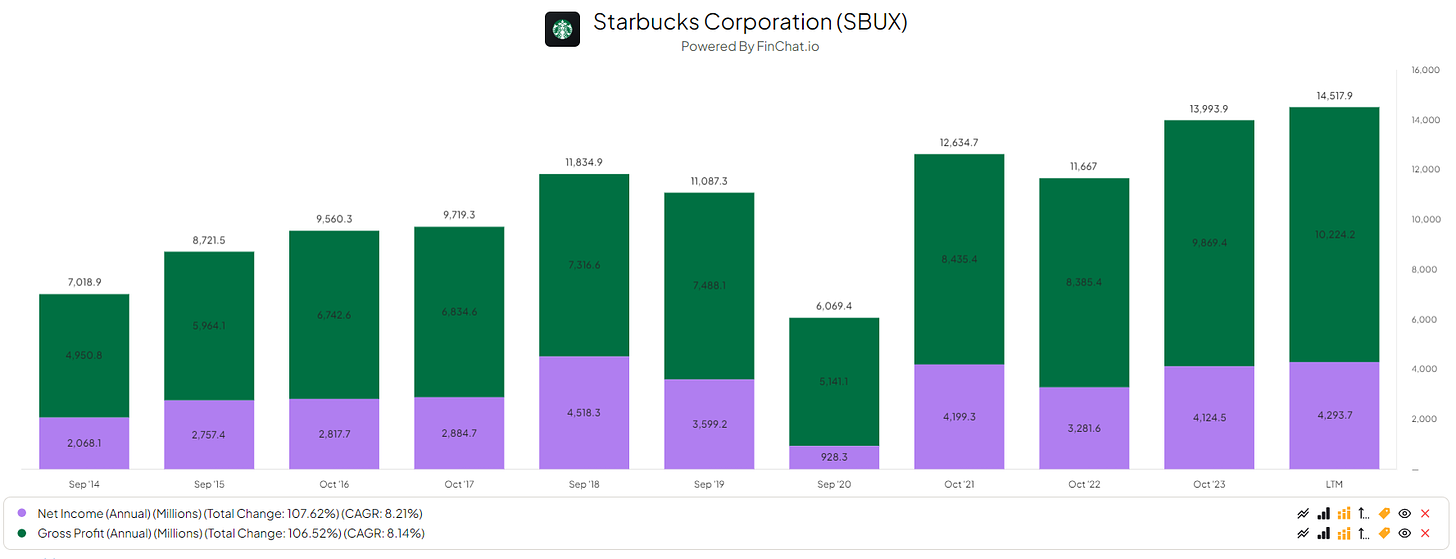

Their COGS compared to their total revenue shows that Starbucks need a lot of capital. In October ‘23 their COGS accounted for 72.13%. What’s left-over is their gross profit. Of course, from their gross profit they still need to pay taxes, SGA, OPEX and other expenses.

Starbucks currently nets about 42% from their gross profits.

Starbucks is a strong, profitable company, although it being a capital intense one.

The Coffee Sector

It sounds lovely and all, but, is there actually a future for outdoors and indoors coffee? Let’s find out!

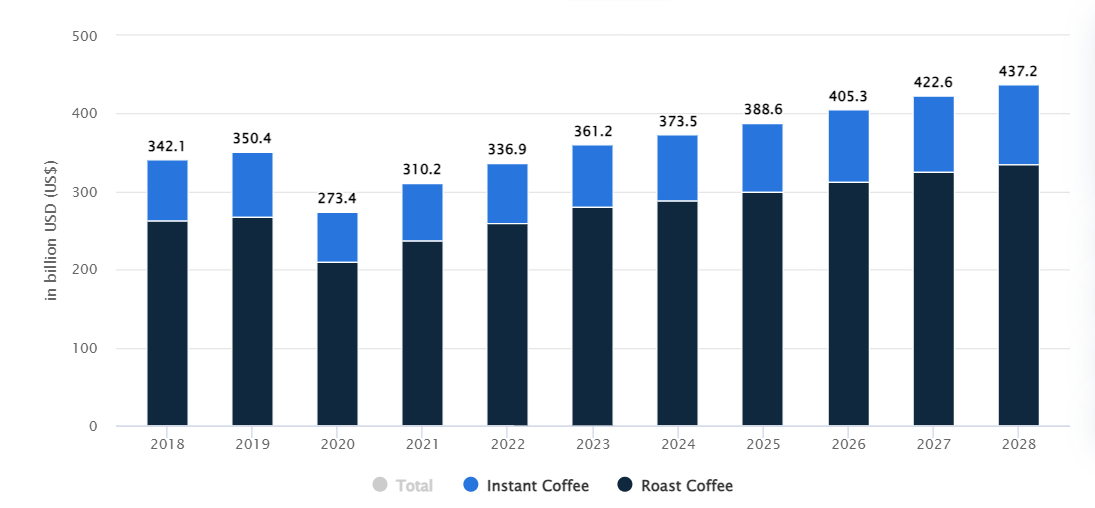

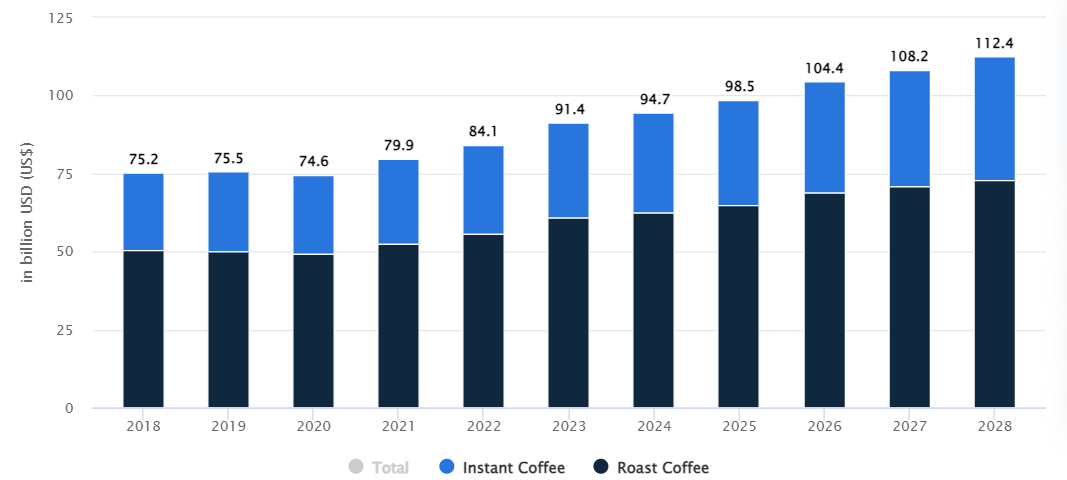

Show above is the estimates, in billions, for the expected revenue of outdoors coffee spending. We’re seeing overall a lovely growth! This means that we can expect overall growth in the outdoor coffee spending.

With outdoor, I mean people spending money at coffee shops.

Also, at home coffee making is expected to grow in the coming years, this is a good sign! You can buy Starbucks coffee beans and brew it at the comfort of your own home. This means that in the whole coffee sector, Starbucks is capable to capitalize on the rising trend in outdoor spending but also indoor spending, making coffee’s at home.

Starbucks offers instant coffee and roast coffee products from outdoors and indoors. This means even if outdoors or indoors would drop, Starbucks can still capitalize on the other side.

Do I think that we’ll see a change in spending on coffee’s? No, not really.

There are three drivers I see that can keep this rise going for a longer period of time.

Disposable income: As economies grow and the standards of living improve, people often have more disposable income to spend on non-essential items like luxury coffee’s. This increased affluence enable consumers to indulge in premium coffee experiences, such as those offered by Starbucks, without significantly impacting their budget. As more and more people join the middle and upper-middle classes globally, the demand for upscale coffee appearances is likely to increase.

Shift Towards Experiential Consumption: There's a noticeable shift in consumer preferences towards spending on experiences rather than material possessions. Luxury coffee outlets like Starbucks provide not just a beverage but an entire experience - from the ambiance of the café to the quality of the service and the customization options available. People are willing to pay a premium for these experiences, seeking moments of relaxation, socialization, or productivity that accompany their coffee consumption. As this trend continues, the demand for luxury coffee brands is likely to grow.

Cultural Shift Towards Premiumization: There's a growing cultural emphasis on quality and premiumization in consumer goods, including coffee. Consumers are increasingly discerning about the origin, quality, and preparation of their coffee, leading to a greater willingness to pay for premium offerings. Starbucks and similar luxury coffee brands capitalize on this trend by offering a range of specialty coffees, artisanal blends, and limited edition brews that cater to the sophisticated palate of modern coffee enthusiasts. As the appreciation for high-quality coffee grows, so does the market for luxury coffee experiences.

The Risks of Coffee

Besides the fact you can burn your mouth drinking a coffee that’s too hot, there’s more risk. No worries, risks with investing, not drinking your pumpkin spice latte. ;-)

Third-party providers

Starbucks its global business strategy, including their plans for new stores, branded products and other initiatives, relies significantly on a variety of business partners, including licensee and joint venture relationships, third-party manufacturers, distributors and retailers, particularly for their entire global Channel Development business. Licensees, retailers and food service operators are often authorized to their logos and provide branded food, beverage and other products directly to customers. They believe their customers expect the same quality of service regardless of whether they visit a licensed or company-operated store, so they provide training and support to, and monitor the operations of, certain of these licensees and other business partners. However, the product quality and service they deliver may still be diminished by any number of factors beyond their control, including financial constraints or solvency, adherence to sanitation protocols and guidance, labor shortages and other factors. They do not have direct control over their business partners and may not have visibility into their practices.

highly dependent on the financial performance of their North America operating segment.

Their financial performance is highly dependent on their North America operating segment, which comprised approximately 74% of consolidated total net revenues in fiscal year 2023. If the North America operating segment revenue trends slow or decline, especially in their U.S. market, their other segments may be unable to make up any significant shortfall and their business and financial results could be adversely affected. And because the North America segment is relatively mature and produces the large majority of their operating cash flows, such a slowdown or decline could result in reduced cash flows for funding the expansion of our international businesses and other initiatives and for returning cash to shareholders.

There are more ‘‘risks’’ that come with investing in Starbucks. But these two are my personaly main two ‘‘concerns’’. They rely heavily on their third-party businesses and the Noth America region. Any disruption in one of the two, or both, can create a serious impact on Starbucks and its operations.

Am I currenly worried? No, not really. I do hope to see that Starbucks puts focus on expanding more and grows in company-operated stores. This will resolve the main ‘‘issues’’ that I have with Starbucks.

Lets Talk Metrics!

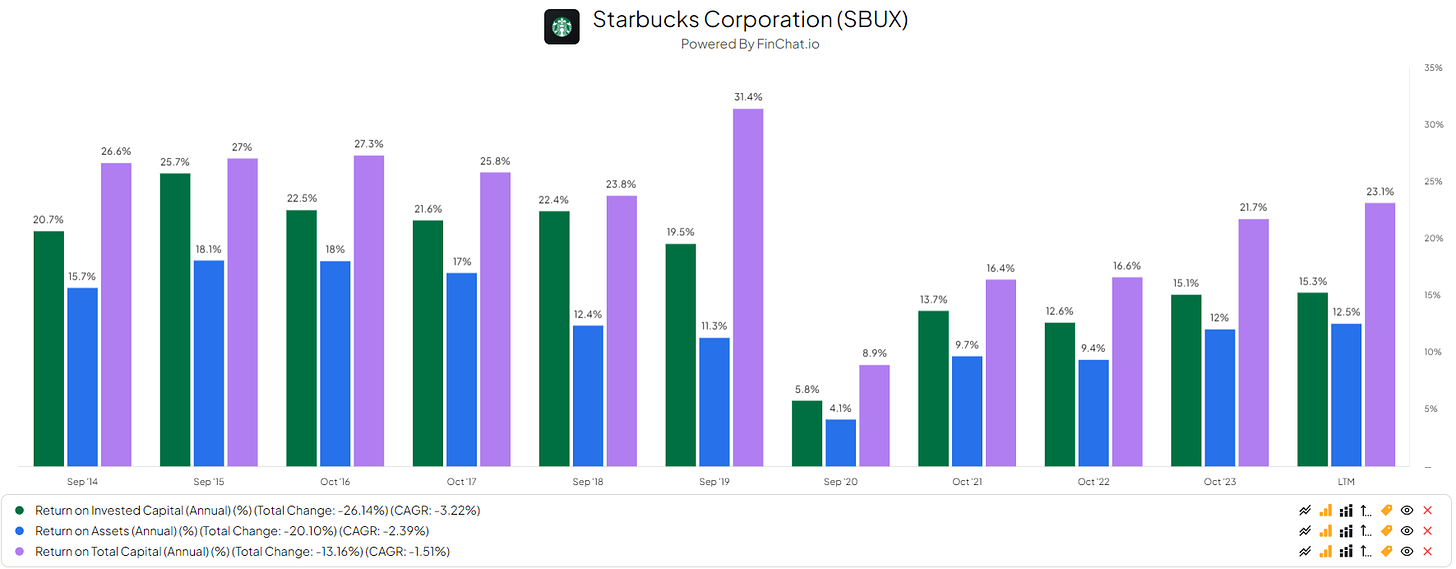

Starbucks was very efficient with its capital and the allocation of capital before the pandemic, as shown in the graph above. Of course, during and after the pandemic Starbucks is still showing signs that improvement is needed. But, if I look before the pandemic, I see no issue in rebounding back to its original metrics. As of now, their ROIC is improving and coming back, rather quickly, to the levels it used to be. for their ROA and ROTC we’re seeing a slow recovery.

I’m not worried about this, at all.

I believe that Starbucks will recover, or come close to, the levels it used to operate on. With the expected growth, and ever expanding strategy, Starbucks will be able to perform like it used to. As of now, I am excited to see their strategy roll-out and play out.

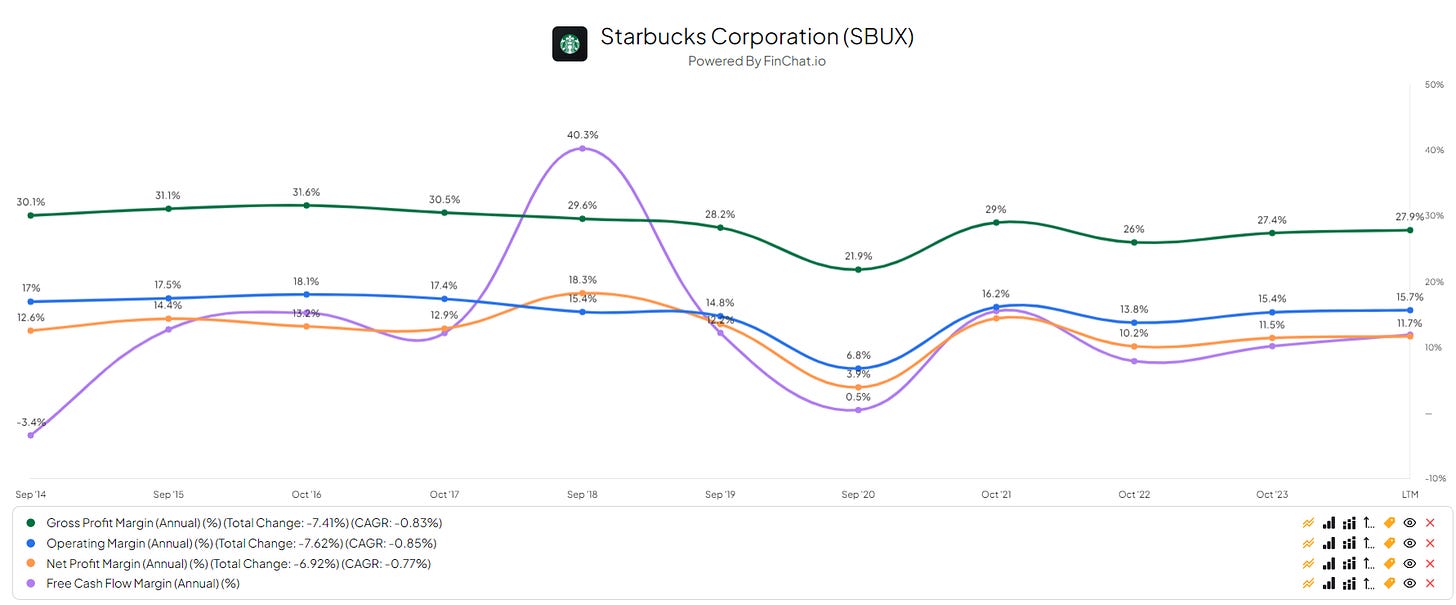

Margins

Starbucks has modest and stable margins, something I love to see. Even being capital intense, they offer a solid product that gives them a solid margin.

Does the Coffee Create Shareholder Returns?

Of course, one of the crucial parts we’re all curious about. Is Starbucks actually creating shareholders return. Yes, they definitly are!

Starbucks is expanding operations globally, as we’ve talked about in this deep dive. With their expanding operations we can expect more cash to be generated. Starbucks already pays a dividend and buys back their own shares. So, even with just share buybacks and dividend, Starbucks already creates a solid return for the shareholders.

Currently Starbucks has a payout ratio of 60.1% and a dividend yield of 2.5%. Both the yield and payout ratio is gradually increasing. This means that the dividend investor can expext dividends and every so growing dividends.

Starbucks also buys back their own shares, as shown below.

As many of you know, I love seeing this.

Starbucks buying their shares is a sign of strenght, trust, and dedication to their shareholders.

Why is this good to see? This means Starbucks is ‘‘removing’’ outstanding shares, creating more value for the shares that you currently own. This increases the earnings per share.

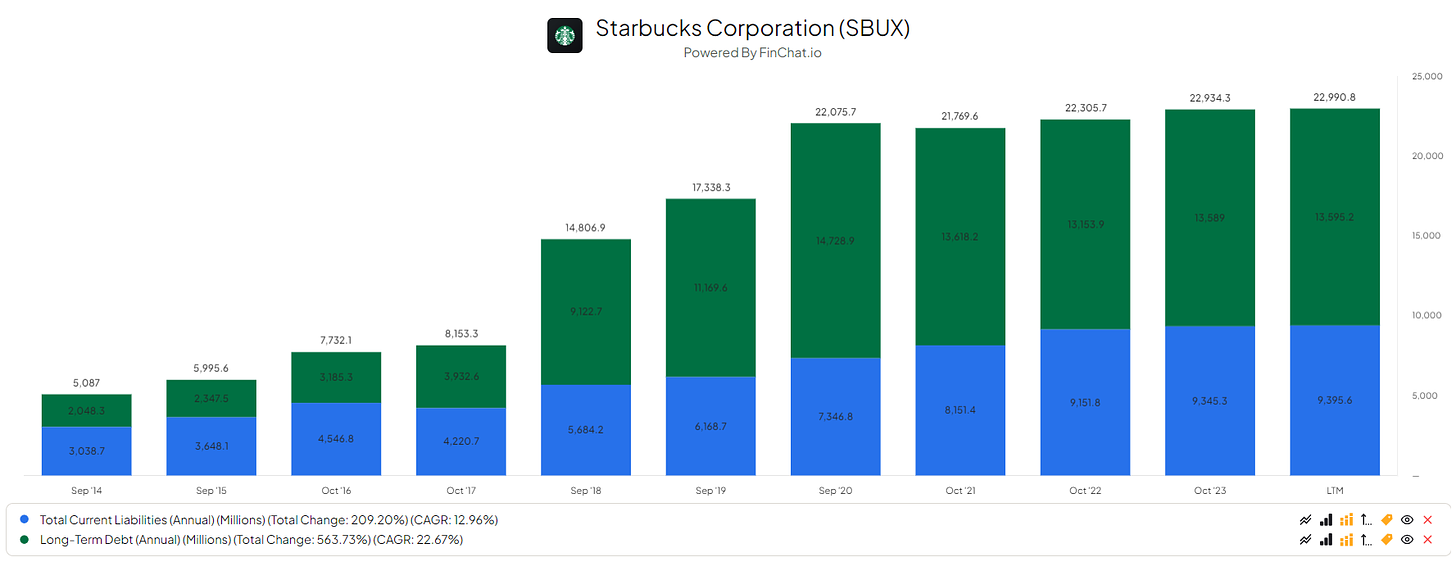

Starbucks is also not taking on much more debt, this is good!

When Starbucks was growing, they took on debts at a quick pace. As of today, their debt levels are stable and according to their IR releases, they intend to pay-off debts more and more, creating more value for us shareholders.

Valuation Time!

My fair value comes to $148 dollars per share, base-case. With analysist their estimates being $105.58 dollars per share, we average on $126.79 dollars per share.

I personally think that the analysts are pessimistic on Starbucks due to their slow progression since the pandemic.

Conclusion

Starbucks is an overall wonderful company with a bright future ahead. In the short term, over the next 12 months, I believe we could see some bearish sentiment overall. Starbucks is facing pressure because investors perceive its growth as too slow for their liking. However, in the long term, I am confident that Starbucks will benefit from its wide moat in the sector.

Starbucks will remain a prominent name in its industry, with disruption seeming unlikely. We are currently witnessing growth, and I hope it continues.

The current trading levels of Starbucks do not seem 'fair' to me. The market is expecting too much from a company that is maturing and stabilizing.

Starbucks will continue to profit from its brand and product, following demand closely.

With management, I have full confidence that they will rebound to pre-pandemic levels.

End Note Author

Thank you for reading this! I put a lot of time and effort into doing my research, putting it into words, and becoming a better author over time. Please keep in mind that I’m new to writing, and some errors may occur in my layout. I apologize for any mistakes. I am working on getting better every day. I would love to receive feedback from all of you to help me improve and deliver more and better content.

Thank you!

Yours sincerely,

Yorrin

Disclaimer(s)

I, Yorrin, am not a licensed financial advisor, and the information provided in my publications is for educational purposes only. Any views or opinions expressed are solely my own and do not constitute financial advice.

Readers and viewers are advised to conduct their own research and due diligence before making any investment decisions. The stocks or financial instruments discussed in my publications may involve risks, and past performance is not indicative of future results.

Investing in financial markets carries inherent risks, including the potential loss of principal. It is important to understand that all investments involve risks, and individuals should carefully consider their risk tolerance and financial situation before making any investment decisions.

I do not guarantee the accuracy, completeness, or reliability of any information provided in my publications. I shall not be held responsible for any errors, omissions, or inaccuracies in the content, nor for any actions taken by readers or viewers based on the information provided.

By accessing and reading my publications, readers and viewers acknowledge that they have read, understood, and agreed to this disclaimer. They further understand that they are solely responsible for any investment decisions they make based on the information provided.

If you have any questions or concerns regarding the content of my publications, please consult with a qualified financial advisor or investment professional.