Hello friend! 👋

My name is Yorrin, also known as ‘‘Fluentinvalue’’.

I am pleased to have you back here for another investment case. This time, we are discussing Adobe.

In case you have missed previous articles, click on the link below:

If you’re currently not yet following me, consider doing so. I provide FREE content to help and inform you in your investment journey. From beginner to advanced, all info will be helpful. :-)

Zoetis, this name is well-known all over the world, especially in the USA. Zoetis operates in the livestock and pets sector, providing the medicinal needs for our loved companions.

As of 2024, 66% of U.S. households (86.9 million homes) own a pet. That's up from 56% in 1988.

If your beloved companion ever had issues with its joints or other medical attention, there is a high probability that you have used a product of Zoetis.

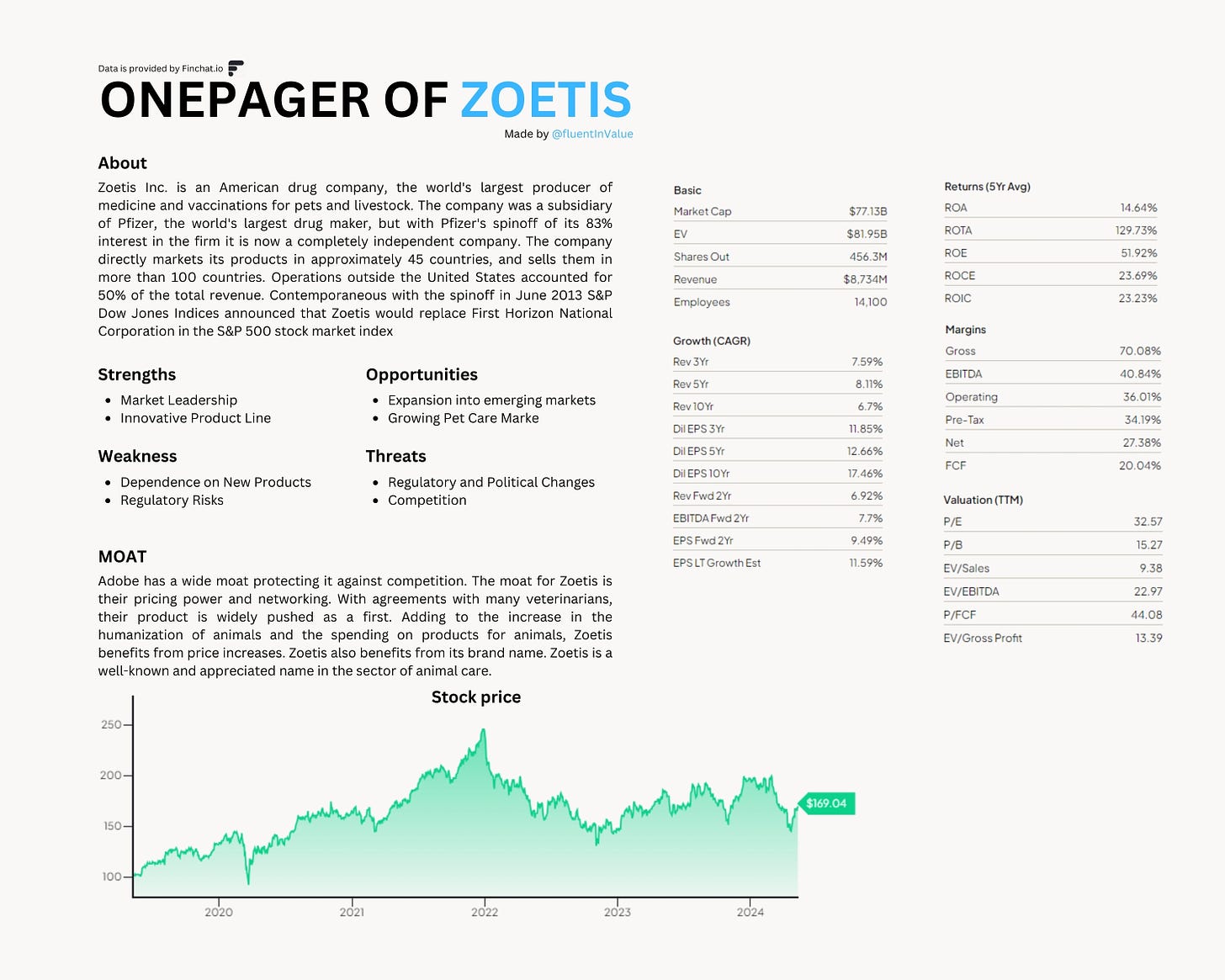

Zoetis is a giant! Currently, Zoetis has a market cap of a staggering $76.62B, a whopping annual revenue of $8,734M, with an additional 14,100 employees.

Let us chat more about Zoetis.

Zoetis - General information

Company name: Zoetis Inc.

Ticker: ZTS

Stock price: $167.91

Market cap: $76.62B

Revenue: $8,734M

Industry: Health Technology

If you’re into these kinds of investment theses, consider checking out the following Visa, Duolingo, and Adobe. These are available for FREE on my Substack page.

Zoetis One Pager

Step-by-step

To get a better understanding of the business, I recommend doing the following also for yourself the next time you’re eager to invest in a business. This method has helped me pick quality companies, understand their business, and know when to get it & when to get out)

In analyzing a stock, I follow the following steps:

1. Do I know Zoetis?

In short, yes I do. Let us dive a little into Zoetis!

Zoetis aims to help pet owners and veterinarians improve the quality of life of their livestock and pets. Zoetis discovers, develops, manufactures, and commercializes vaccines, medicines, diagnostics, and other technologies for companion animals and livestock.

Adobe is active in the following segments:

Livestock

The Pet Care section of Zoetis focuses on the health and well-being of pets like dogs, cats, and horses. They develop and sell a wide range of products, including vaccines, medications for preventing parasites, and treatments for common ailments like arthritis and allergies. This section is all about helping pet owners and veterinarians keep pets healthy and happy.Companion Animal

The Livestock section deals with animals that are raised for food, such as cattle, pigs, poultry, and fish. Zoetis provides a variety of products to help farmers and ranchers manage the health of their herds and flocks. This includes vaccines, medicines to treat and prevent diseases, and products to enhance the growth and overall productivity of these animals. The goal is to ensure that livestock are healthy, which in turn helps to produce safe and quality meat, milk, and eggs for consumers.Contract Manufacturing & Human Health

In this section, Zoetis offers contract manufacturing services, which means they produce pharmaceutical and biotechnology products for other companies. This can include anything from small molecule drugs to biologics (like vaccines and antibodies), and these services are provided to both animal health and human health industries. So, besides focusing on animal health, this part of Zoetis also helps in the manufacturing of products aimed at improving human health.

2. Management

Let us chat about the CEO, the power woman, Kristin Peck.

Kristin Peck has an impressive CV of work. Starting in 1999 up to 2004 Kristin Peck was principal at The Boston Consulting Group. After this endeavor, Kristin Peck joined Pfizer in 2004 up until 2012 as Executive Vice President of Worldwide Business Development and Innovation. So here already we see Kristin working in the medical field.

After Pfizer Kristin joined the board members of Thomson Reuters in 2016 and was part of the board up until 2020. After this endeavor, Kristin Peck joined as president of HealthforAnimal in 2022 up until 2024. As of now, we see that Kristin Peck has a solid background in the medical field.

in 2021 Kristin Peck joined as a Board Member for Catalyst Inc. (Catalyst Inc. is a global nonprofit organization, that helps build workplaces that work for women with preeminent thought leadership and actionable solutions). Also, in 2021 Kristin Peck joined as a Board Member of BlackRock, a Member Board of Trustees of Mayo Clinic, and a Board Member of the Columbia Business School.

Kristin Peck has an impressive record in the medical field and as a board member is a prestigious company.

In 2012 Kristin Peck joined Zoetis as Executive Vice President and Group President, of U.S. Operations, Business Development and Strategy and grew into the CEO in 2020.

Listening to Kristin Peck, the CEO, I hear a powerful woman at the wheel of Zoetis. Kristin Peck knows the business well, what are some points to tackle, Kristin is transparent, and open in her communication. With Kristin Peck at the wheel, Zoetis is poised for a bright future.

Individual Insider ownership: 0.0745%

3. Competitive & sustainable advantage (MOAT)

Does Zoetis have a MOAT, a competitive and sustainable advantage over its competitors? Zoetis, in my personal opinion, has a wide MOAT. I believe this MOAT is sustainable, let us dive more into Zoetis its competitive and sustainable advantage(s).

Let us start with the sector Zoetis operates.

Zoetis helps with livestock and pets, with the ever-increasing humanization of pets and livestock (97% of pet owners consider their pets to be a part of their family), there is increasingly more spending on their beloved companions. As mentioned in the intro, in 2024 66% of U.S. households own one or more pets. This is an increase of 56% in 1998. With loneliness increasing worldwide, the demand for a companion rises. This rise in pets and livestock benefits Zoetis. With more pets in U.S. and worldwide households, the demand for good treatments rises too.

People spend a lot of money on their pets. In economic downturns, we see that people cut costs on all parts of their budget except one, their companion. There is even a slight increase in the spending on toys, vaccines, and medication for their companions in economic downturns. This shows us that households put their companion its needs above their own. This statistic is one where Zoetis benefits, even if there is no economic downturn. People will spend money on their companions no matter what.

This allows Zoetis to perform in a competitive market, everybody wants a piece of this profitable and sustainable cake

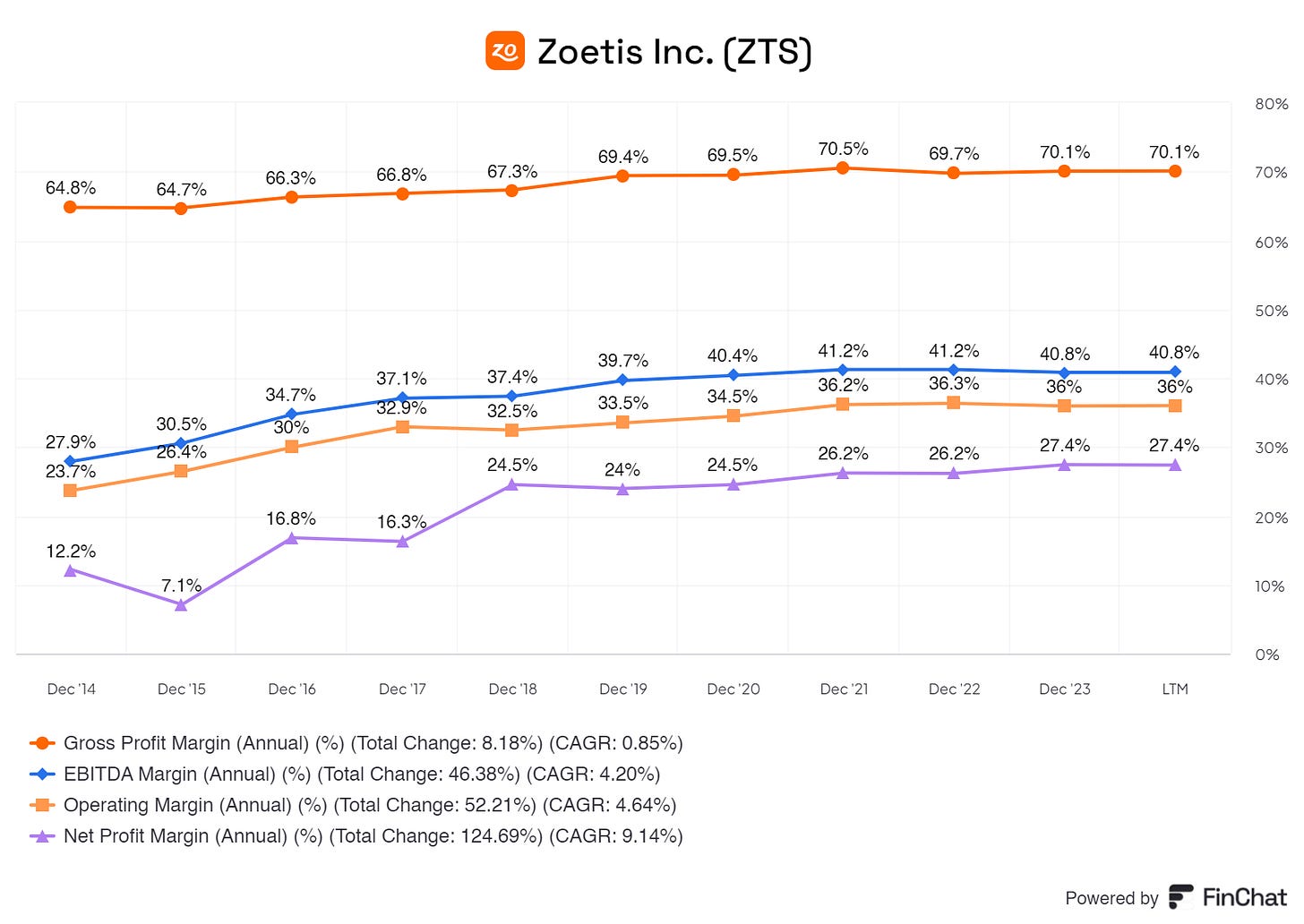

Zoetis can improve and as of lately keep their high gross profit margins. If a company has a sustainable competitive advantage this usually reflects in its margins. If margins can be maintained at higher levels or even improved, the business has a competitive advantage.

We see Zoetis improving and maintaining its high gross margins. With Zoetis’ EBITDA and operating margin, we saw growth in the past and Zoetis is currently maintaining its margins. Zoetis is to this day on the road to improving its net margins.

In my eyes, we can see from the margins that Zoetis has a wide MOAT working in its favor. Zoetis does not need to lower its margins to compete with its peers/competitors.

Gross Profit Margin: %40 or more? Yes! ✅

4. Is the business in an attractive industry? What do its peers look like?

Yes, yes, yes, and one more yes!

Zoetis is in the pet and livestock industry. This is a fast-growing market and, as I said earlier, with the humanization of their companions the spending grows alongside the market.

We are taking more pets, seeing them as family, and spending more and more on our companions. Expected that in the next 10 years, 80% of the households in the U.S. will have one or more pets. This increase means there will be an increase in medicine and vaccines for our loyal companions.

How do its peers look like, should we be worried?

Elanco Animal Health Incorporated

Elanco is a direct competitor but we should not be worried. Elanco is lagging in the market, even losing market share. In the last three years, we saw a consecutive decline in its revenue in its pets division. Also in their cattle, poultry, swine, and aqua sector, we do not see any growth.Merck & Co., Inc.

Merck & Co has an animal decision which is striving! LTM its decision accounts for 9% of its total revenue. (Pharma, animal, and others). Merck its core is the pharma sector, but it will not drop its animal side. With its high R&D investments, they are something we need to keep an eye out for.Vetoquinol

This France business is also all about the health and care of our pets. Its presence is not as big as Zoetis, but still a competitor. With a lot of customers in countries like The Netherlands, Belgium, Germany, France, Bulgaria, and more they, if executed well, have a lot of potential to penetrate the EU market.Boehringer Ingelheim Ceva Santé Animale

These two private businesses are also all about the care of our pets. These two are located in Germany and France. These two are also growing if I believe the information I find online. These are in the range of Vetoquinol, so small compared to Zoetis. But, also for these two giants, the EU is a profitable and growing market to operate in.

Most of Zoetis its competitors are operating in the EU where Zoetis is not ‘‘that active’’. Zoetis, with its capital, can try to take the EU share, but the regulations and laws might make it harder. As of now, Zoetis is the leader in its segments.

As of now, I am not worried about competition. Zoetis is positioned well, investing modest amounts in R&D, and keeps innovating to provide new vaccines and medication to stay ahead of the game.

5. Risks

I will be honest, Zoetis does carry some risks. I tend to avoid companies that operate in the medical field for good reasons, its risks. Medicine for either humans or animals comes with a ton of risks, let us chat about it.

Laws and regulations

The medicine world is monitored tightly by a lot of regulators like the: FDA, USDA, and EPA. If you can not get approval from these regulators, you need to re-invest money to improve your product and apply again. This process can take heaps of time and can make entry of a new drug or vaccine tough.Competition/disruption

It sounds extreme when I say this, but there needs to be a competitor- big or small- to find a new drug that is more cost-efficient and better at treating issues with either animals or livestock and Zoetis will be impacted. The medicine/vaccine industry is competitive and the peers/competitors are heavily investing in finding a new drug or medicine that wipes all others out. I avoid healthcare and medicine for a solid reason, a new drug is around the corner. It would be wonderful if Zoetis found a new drug or vaccine, but there’s an almost level playing field where competitors are competing.Pfizer

Under the Patent and Know-How Licence Agreement Pfizer licenses certain use of intellectual property. Pfizer has to some extent control and owns complete patents on products. Pfizer can terminate this at its own will and timing, making Zoetis almost lose all its value. Zoetis is reliable on Pfizer for a chunk due to it being a spin-off from Pfizer. Pfizer can also choose to not commercialize a product, impacting Zoetis.Supply chain issues

Zoetis relies on a lot of distributors for their needs to create new medicines and vaccines for animals and livestock. If these companies fall into any disruption in their supply chain, Zoetis will be negatively affected.

These are my main concerns with Zoetis. Although the supply chain not being my biggest worry, Zoetis is still reliant on its distributors. My biggest concerns are laws & regulations, lawsuits, and Zoetis its dependence on Pfizer with its licensing.

Zoetis recently already faced a lawsuit about its dog pain medicine. The court ruled in Zoetis' favor, but this indicates that lawsuits are something you need to be ‘‘comfortable’’ with when it comes to medicine and vaccines.

6. Balance sheet

Zoetis its balance sheet looks modest.

If we compare Zoetis its total assets to liabilities, we get a solid 1.5 rating. This means that Zoetis does have the assets to more than 100% cover its liabilities. In their liabilities, I do not see anything that is worrying to me. Zoetis currently has a cash and equivalents position of $1,975M, this covers its total current liabilities of $1,909M.

Low accounts payable and short-term borrowings which I so no issue with. Zoetis is liquid enough to cover its indebtedness.

Zoetis currently has a debt-to-equity ratio of 1.3 which is reasonable to me. This means Zoetis has $1.77 debt for every dollar in equity.

Zoetis has a current ratio of 2.4. This means that Zoetis can meet short-term obligations with current assets.

Zoetis its debt-to-fcf is 1.4. This means its debt can be paid off with 1.4 years of free cash flow (FCF).

Zoetis its interest cover is 24. So, Zoetis its ebit+ interest income / interest expenses we reach an interest cover of 24. I am to have it above 5, so as of now, Zoetis has ratios I would deem good for a potential investment.

If we take a look at their assets I see a steady asset portfolio. Account payable is steady, not growing at fast rates. This indicates that products being delivered get paid fast enough so it doesn’t come up on their assets on Accounts Payable. A high Accounts Payable means that more products are being delivered but with extended payment terms, which I am not a fan of.

Zoetis does have a high goodwill ratio. Currently, Zoetis has a goodwill ratio of 19.2% compared to its assets. Although the ratio is below my preferred 20% maximum, Zoetis pays a lot of premiums as shown by the high Goodwill-to-asset ratio.

Zoetis has solid assets and debt, manageable debt too. The only ‘‘concern’’ to me is the high premiums Zoetis pays, as shown in its Goodwill-to-assets ratio.

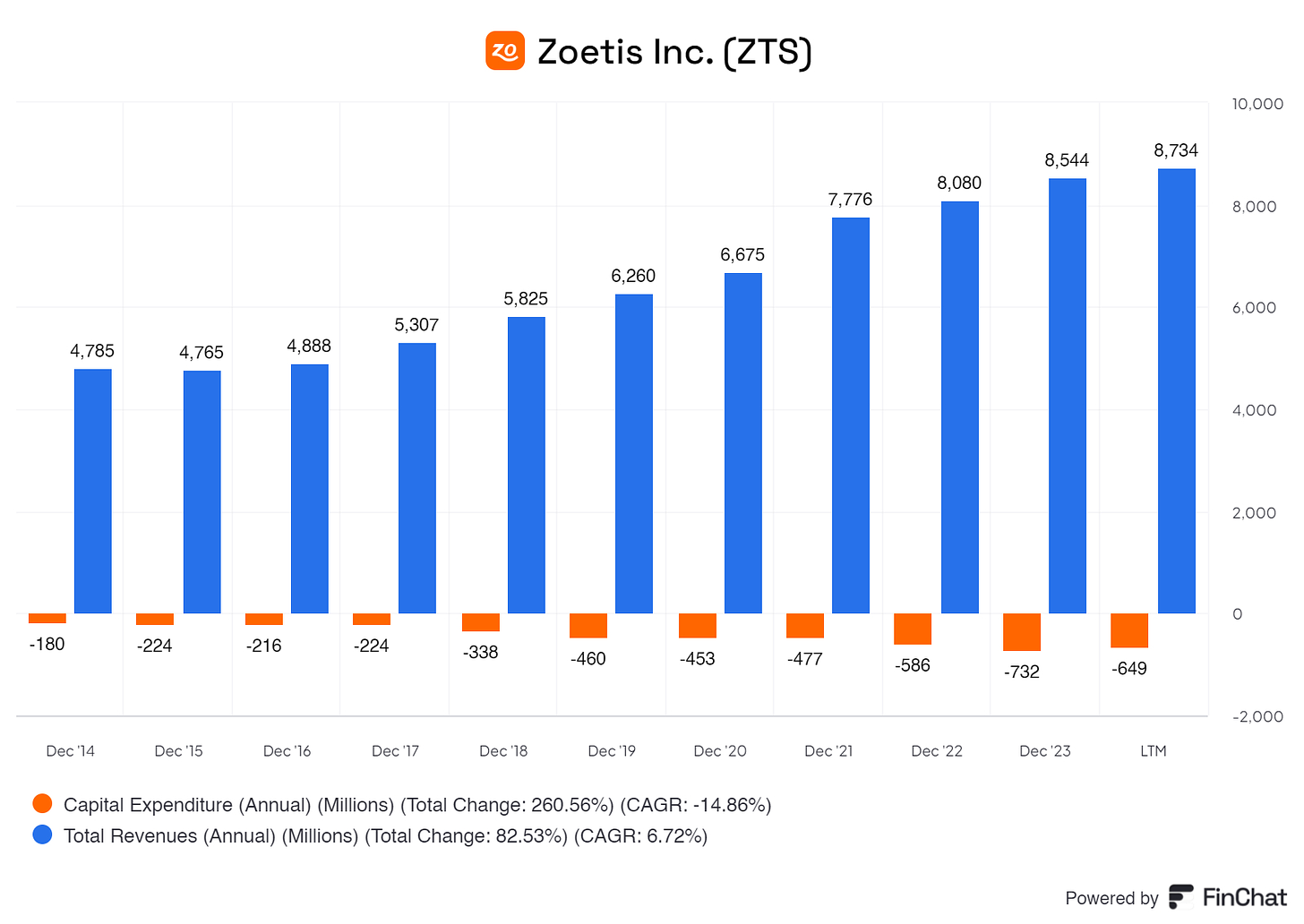

7. Capital intensity & allocation

We can see that Zoetis needs more capital expenditures over the years, which is of course not something crazy. Down below the trend of CAPEX-to-revenue %.

2014: 3.76%

2015: 4.70%

2016: 4.42%

2017: 4.22%

2018: 5.80%

2019: 7.35%

2020: 6.79%

2021: 6.13%

2022: 7.25%

2023: 8.57%

LTM: 7.43%

So, there is an increase in capital expenditures to its revenue. I am not too worried about this trend. I prefer low capex, of course, but an increase in capex is something almost impossible. The key here is to see if Zoetis can find a comfortable % of capex-to-revenue and does not keep growing in its capex-to-revenue.

In an ideal situation, I would love to see capex-to-revenue be below 5%.

CAPEX/Revenue: <5%? No. ❌ (7.43%)

CAPEX/OCF: <25%? No. ❌ (27.05%)

Now, the capital allocation!

Capital Allocation

As the leader in animal health, we understand our customers' needs. Our innovation continues to be our differentiator, and we'll continue to lead the way by investing in areas of unmet need to advance care for animals. The strength of the human-animal bond and the growing demand for a secure and sustainable food supply reinforce the essential nature of the animal health industry and our innovative portfolio. We will continue to deliver strong growth in 2024, while investing for the future.

- Source: Q1 Earnings Filings

Zoetis's every release talks about its willingness to invest more and more into R&D, which is crucial, but also in all other aspects of its business.

But, is Zoetis investing its money properly?

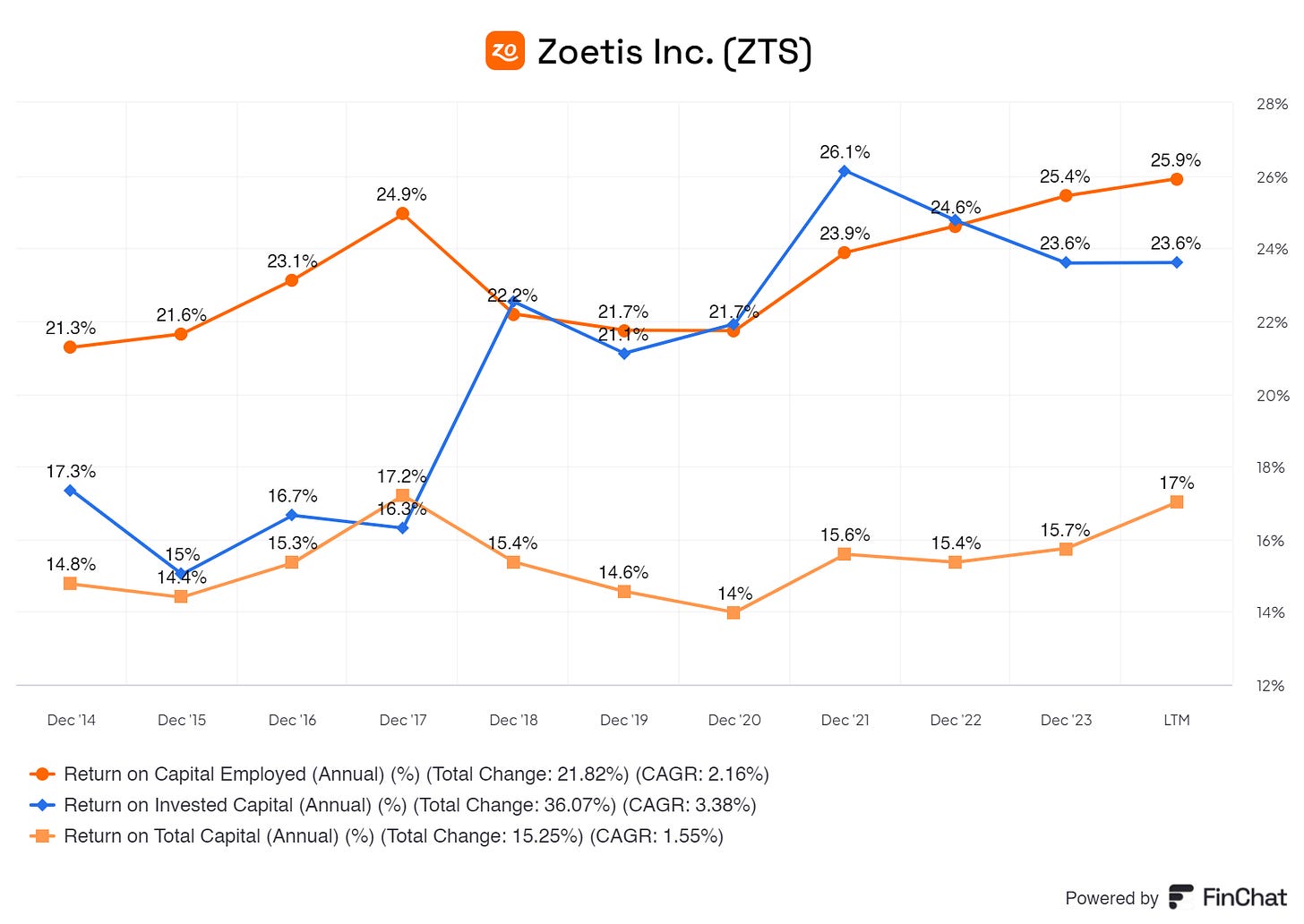

The most crucial metric for me is ROIC (Return on Invested Capital).

Zoetis shows that it is improving its ROIC, meaning that management is getting more capable of deploying capital for profitable projects. These profitable projects in return create more shareholder value, we love that.

With its total equity investing, ROCE, and ROTC, we see that management is also on the improving side, ROTC is lagging.

If management is capable of showing me consistent ROIC at these levels, we have a deal!

ROIC: >15%? Yes ✅

8. Profitability

Zoetis is very profitable!

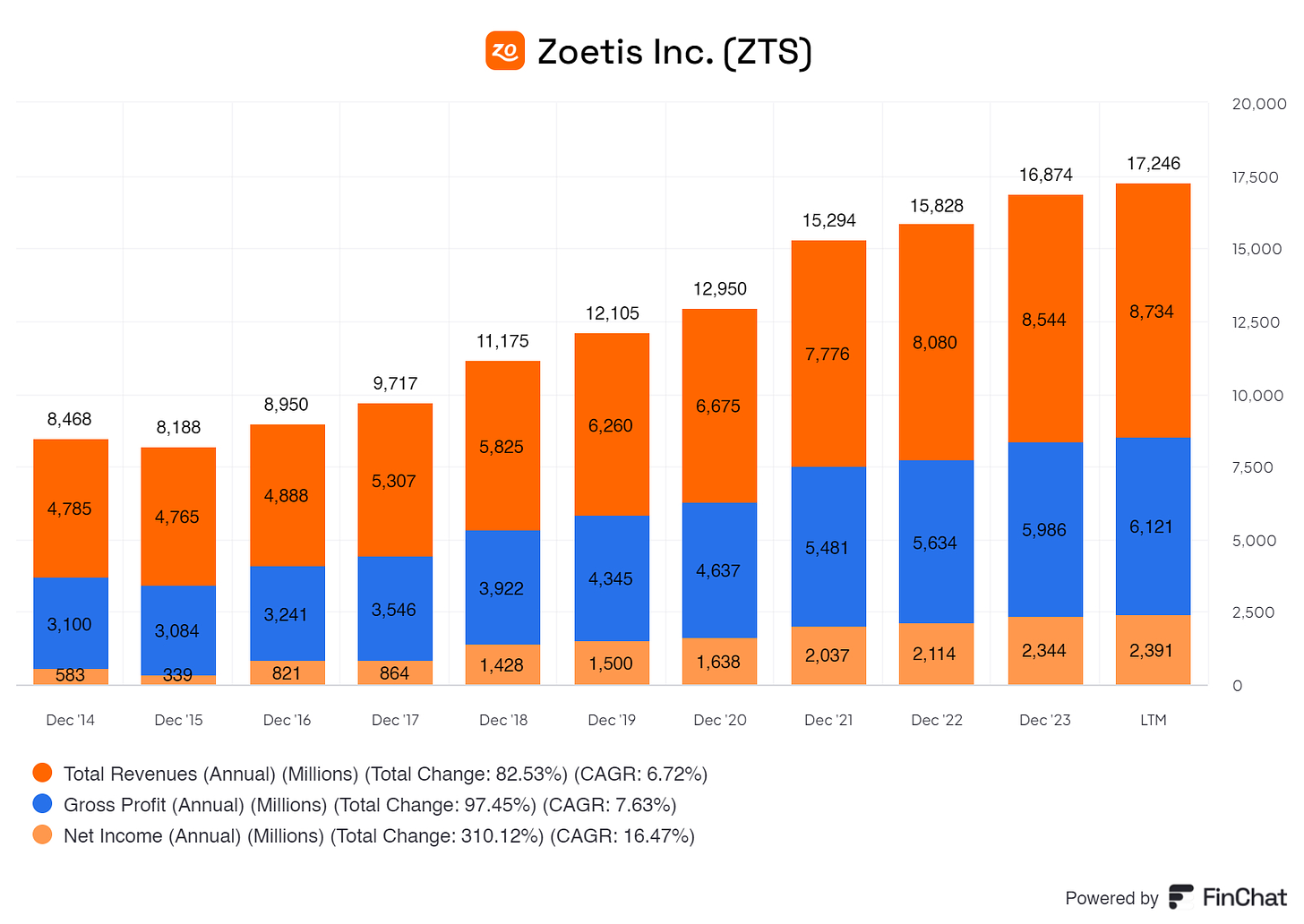

Zoetis currently has a Total Revenue CAGR of 6.72%, a Gross Profit CAGR of 7.63%, and a Net CAGR of 16.47%

Zoetis is profitable and the profitability is growing.

Zoetis is a leader but operates in a very competitive industry. Although being in a competitive industry, Zoetis grows revenue and profitability at a steady rate. Being a spin-off from Pfizer Zoetis has something going for them.

There is consistent growth in its revenue and what Zoetis is netting at the end.

This profitability is sustainable. I do not see any issues with growing at this rate for the years to come.

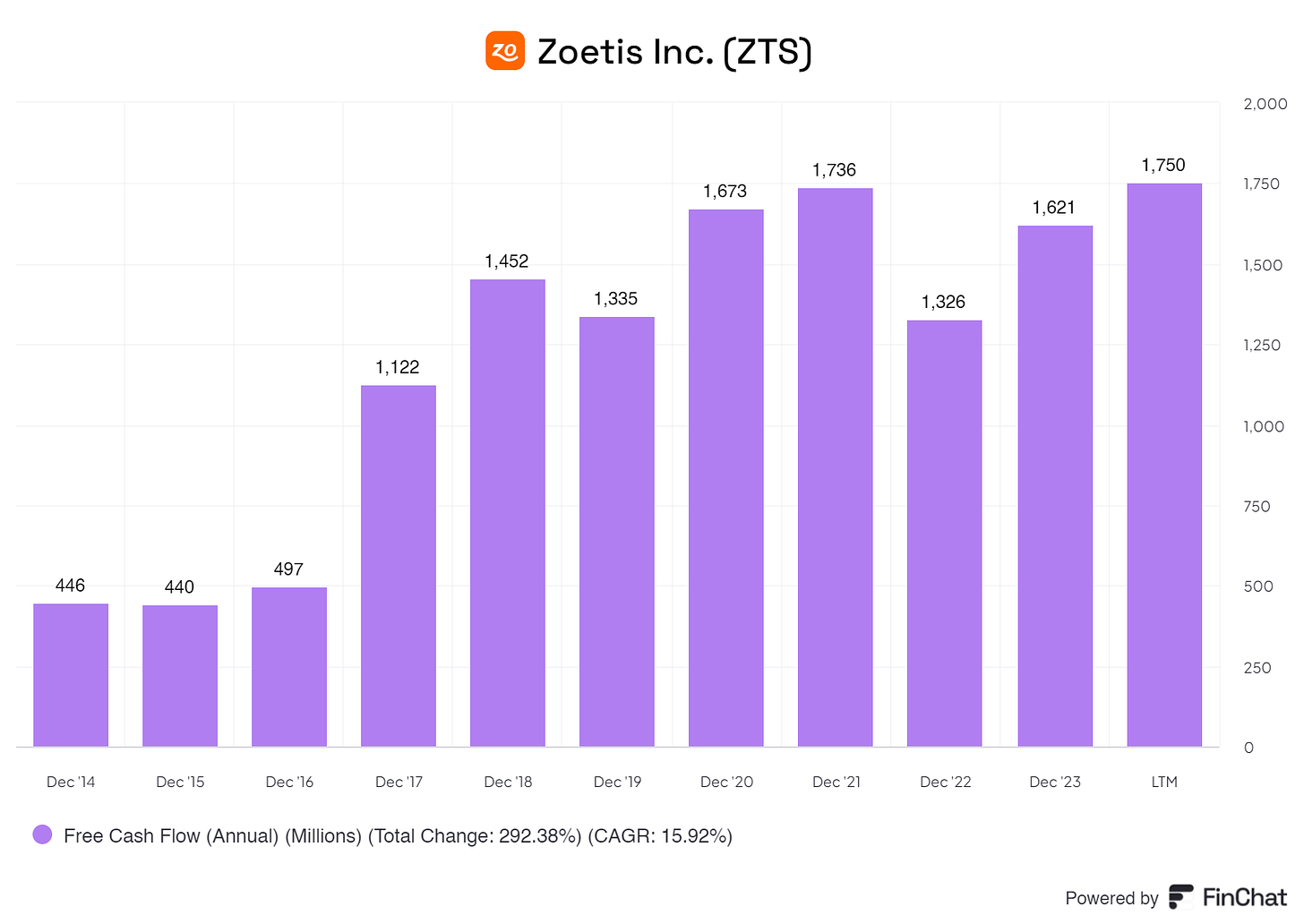

The only issue for me is that Zoetis has an FCF yield of 2.1%. This lower valuation might indicate that it is less efficient in creating and generating cash flows

Zoetis does not have much free cash flow available to invest in new projects, pay off debts, or perform other value and quality-increasing projects.

9. Historical and future growth

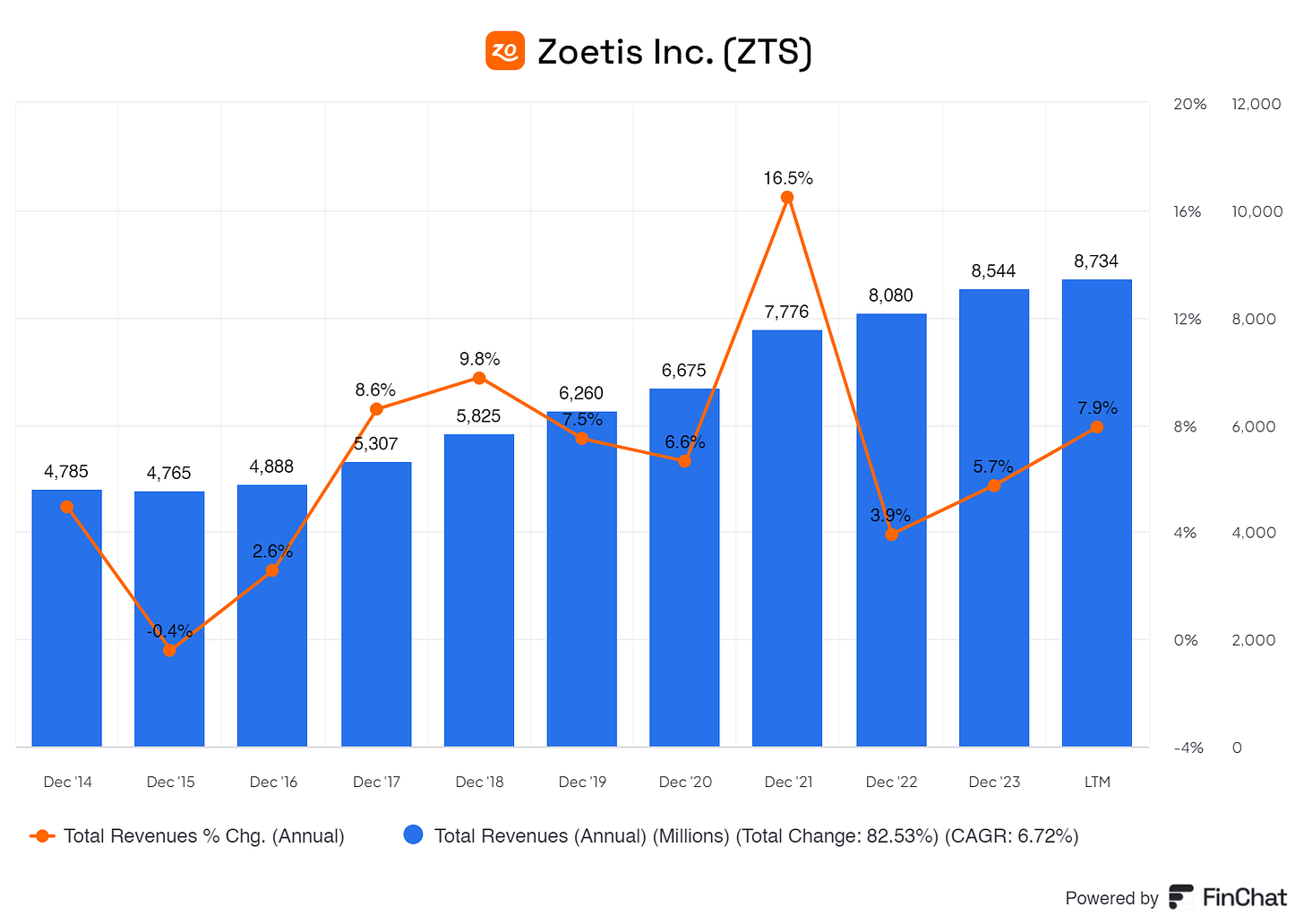

Is Zoetis its historical growth something we can continue to see in the future? Let us dive into it

Zoetis is not growing at above-average rates Zoetis has been growing at a modest rate ever since 2014. With the historical growth rate, I do not see any issues growing at the current rate Zoetis is growing.

With increasing capital efficiency from its management, I can see Zoetis growing at these consistent rates. Management is becoming more capable of investing in more profitable endeavors, promoting overall growth. With increasing investments in R&D, Zoetis is placing itself at the top for new medicine and vaccines, boosting revenue.

The current rates are rates that Zoetis is capable of sustaining or even outperforming if Zoetis keeps investing its capital at the right places, remember the compounding effect. ;-)

10. Value creation

Is Zoetis creating value for its shareholders?

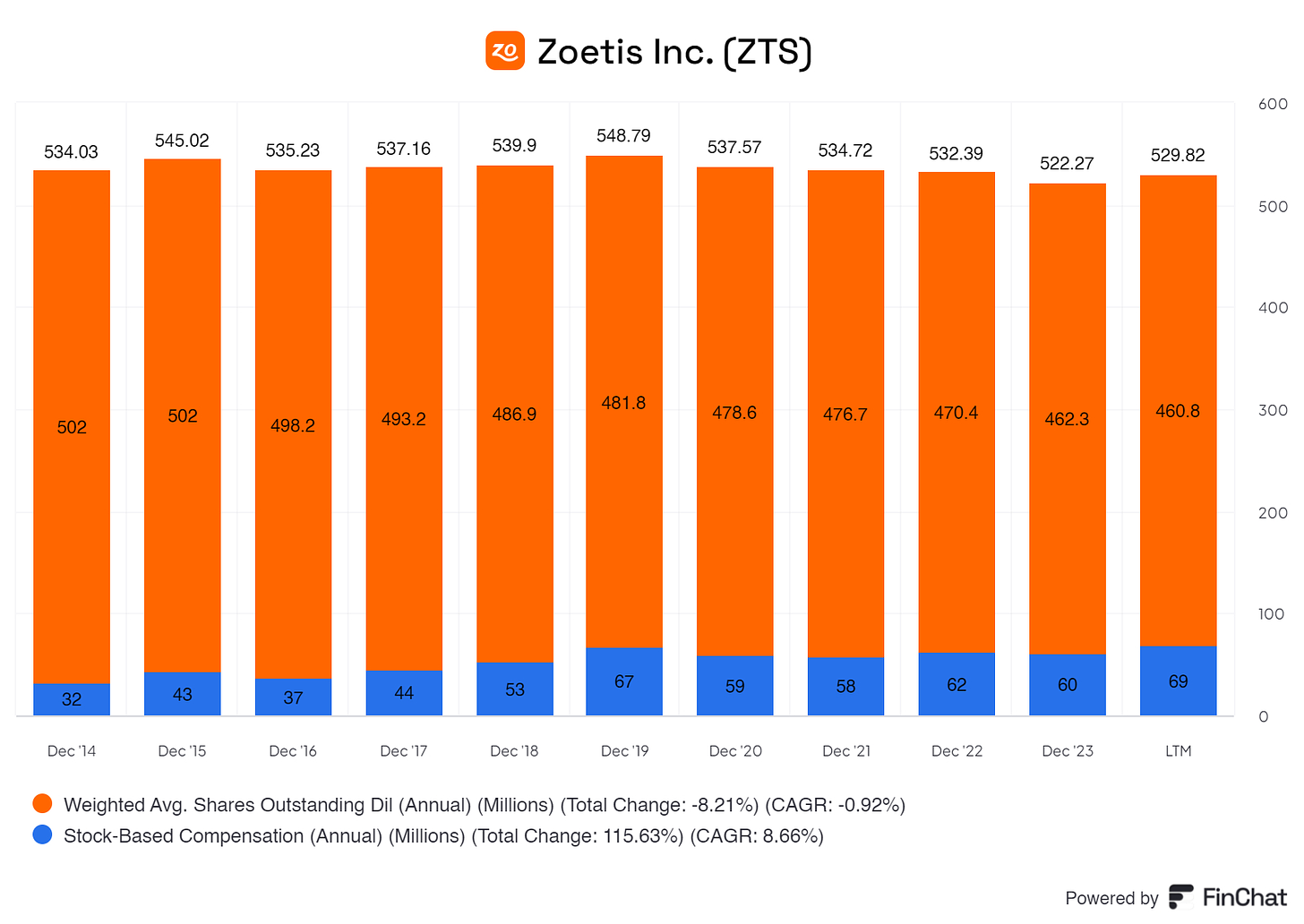

Something I am a big fan of is share buybacks, Zoetis performs share buybacks. We see a consistent decrease in available shares. This means more earnings per share and overall more value per share.

Zoetis does not have a YoY increasing SBC which is lovely to see! SBC is something I am somewhat not a fan of.

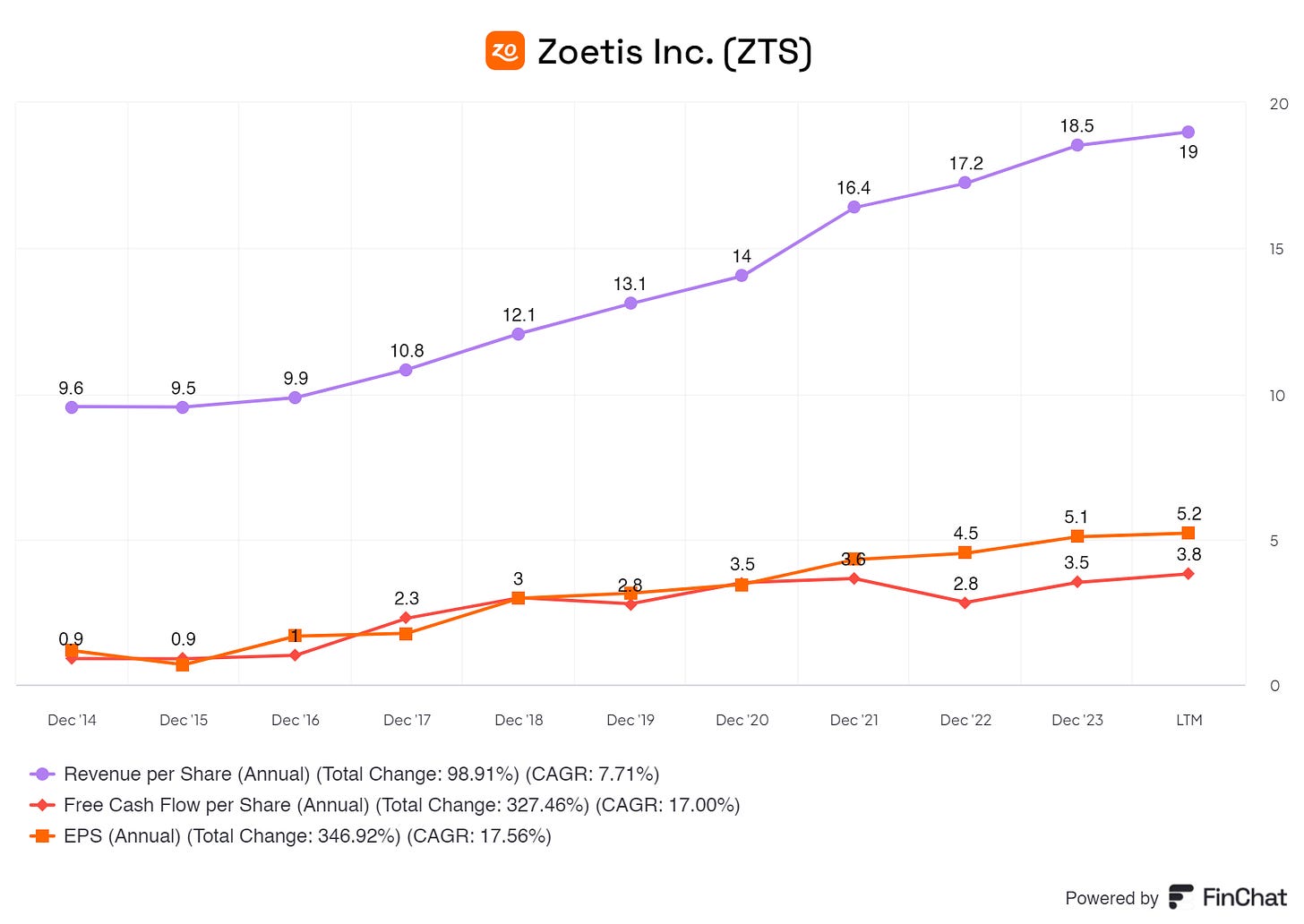

As shown above, Zoetis is giving us shareholders more per share. EPS, FCF per share, and Revenue per share are gradually increasing YoY, more value to us shareholders.

Are there more like dividends? Yes!

Zoetis does pay a dividend, to my surprise. Is this sustainable for dividend investors? I would not bet on it. The yield is low but goes with a solid payout. I would personally see Zoetis stop dividends and spend it on projects, R&D, and other investments, personally preference though. ;-)

Yield 1.03%

Payout 29.94%

DPS $1.56

11. Outlook

Zoetis is positioned well for the humanization of pets and livestock.

In the U.S., and worldwide, people are taking more and more pets into their homes, and loneliness is one of the many driving factors. Alongside this growth in pets, there will be an increase in demand for good care, medicine, vaccines, and more for the pets of people. With a bright outlook, Zoetis is capable of capitalizing on this trend.

In the care of our pets and livestock, we never skip out. As I mentioned earlier, we will not decrease our spending even in economic downturns. People keep spending on medicine, toys, pet sitters, and needs for our livestock and pets.

12. Valuation

Is Zoetis at these levels investable? Let us chat about it.

With my DCF model (10-year period, 7% discount rate, and 3% terminal growth) I come out to a value of $152.77. Currently, Zoetis trades at $167.91, which leaves almost no room for my safety margin.

EV/FCF is 44.3 for Zoetis, EV/Sales 9.3, and EV/EBIT is 25.9. Zoetis is on the expensive side.

Of course, if Zoetis keeps growing the share price will, hopefully, follow the growth. But, as of now, I deem Zoetis expensive.

Does this impact a possible investment? No. I think Zoetis is a great company and growth will be there for Zoetis. I avoid the sector because it is not the risk I like to take. Do your research and find out for yourself if this is an investment you are comfortable with.

End note

Thank you for reading this investment case on Zoetis!

With every investment case as of yet I am trying to improve my writing and how I communicate my findings with you all. Because I started not too long ago, some posts might change in layout or other aspects before I find the layout that suits my wishes the best, sorry in advance.

As of now, thank you so much for your time! I hope you found some valuable information in this investment case.

Disclaimer

By reading my posts, being subscribed, following me, and visiting my Substack you agree to my disclaimer. You can read the disclaimer here.