Duolingo, Unlocking the World of Language

Duolingo, an app many of us have seen, heard, or even used, teaches language in a fun and catchy manner. With engaging games, prizes, tutorials, videos, animations, and much more, Duolingo knows how to attract and retain users.

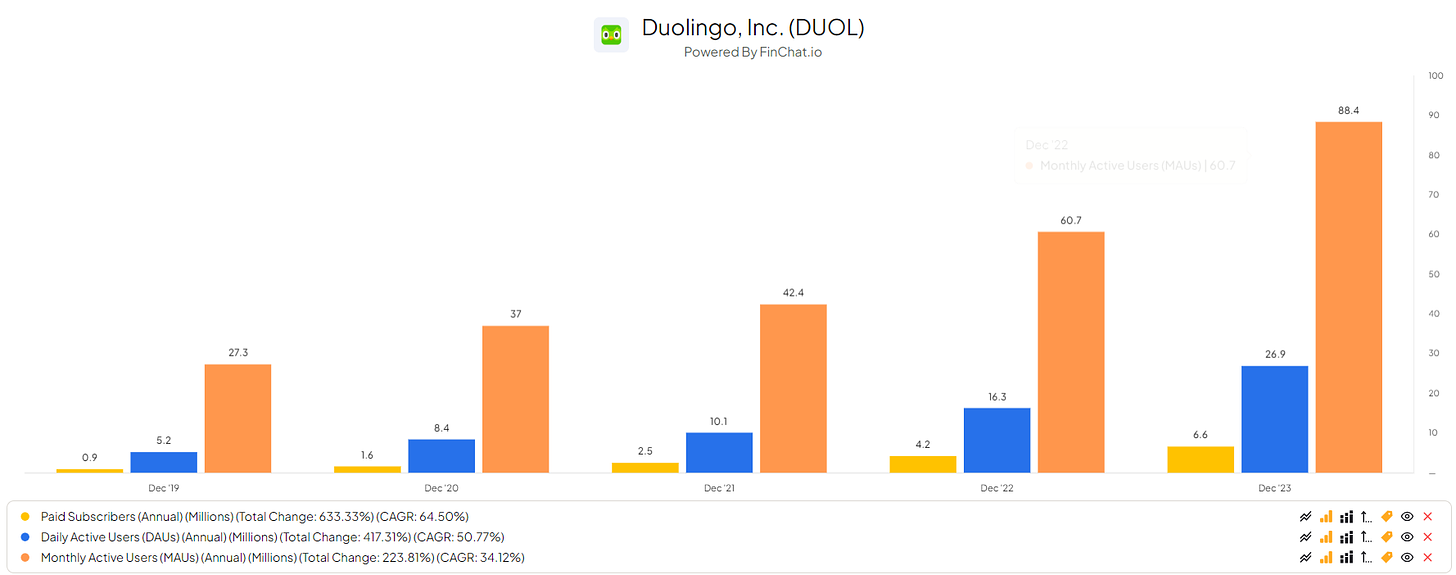

With a current market cap of $9,542.02M, Duolingo is a prominent player. On a monthly basis, Duolingo has 88.4 million users, and on a daily basis, it reaches 26.9 million players. To put this in perspective, The Netherlands—my country—has a total of ~18 million residents(!). This means more than my country on a daily basis is active on Duolingo; that’s insane. With this, logically, revenue comes in with a YoY growth of 43.7%; wow.

But beneath the fun green owl, is there actually a company worth investing in? Is Duolingo future-proof, capable of sustained growth, generating solid revenues, retaining subscribers, and maintaining good margins? Let’s find out!

Today, we will dive into the owl world of Duolingo.

In case you’ve missed it, check out my previous posts here:

Duolingo Overview

Duolingo stands as the premier mobile learning platform worldwide. Its flagship application has naturally evolved into the most favored method for learning languages globally, securing its position as the top-grossing app in the Education category on both Google Play and the Apple App Store. Rooted in technology, Duolingo steadfastly dedicates itself to delivering a captivating, enjoyable, and fruitful learning journey for its users. Simultaneously, the company remains steadfast in its mission to create the finest education accessible to all, ensuring universal availability.

The core business of Duolingo is pretty straightforward: attract users to the platform, encourage them to sign up and subscribe, and retain them on the app. As a personal user of the app—for learning German, as my partner's parents are German—I've experienced Duolingo at its finest and feel well-placed to undertake a deep dive on the platform.

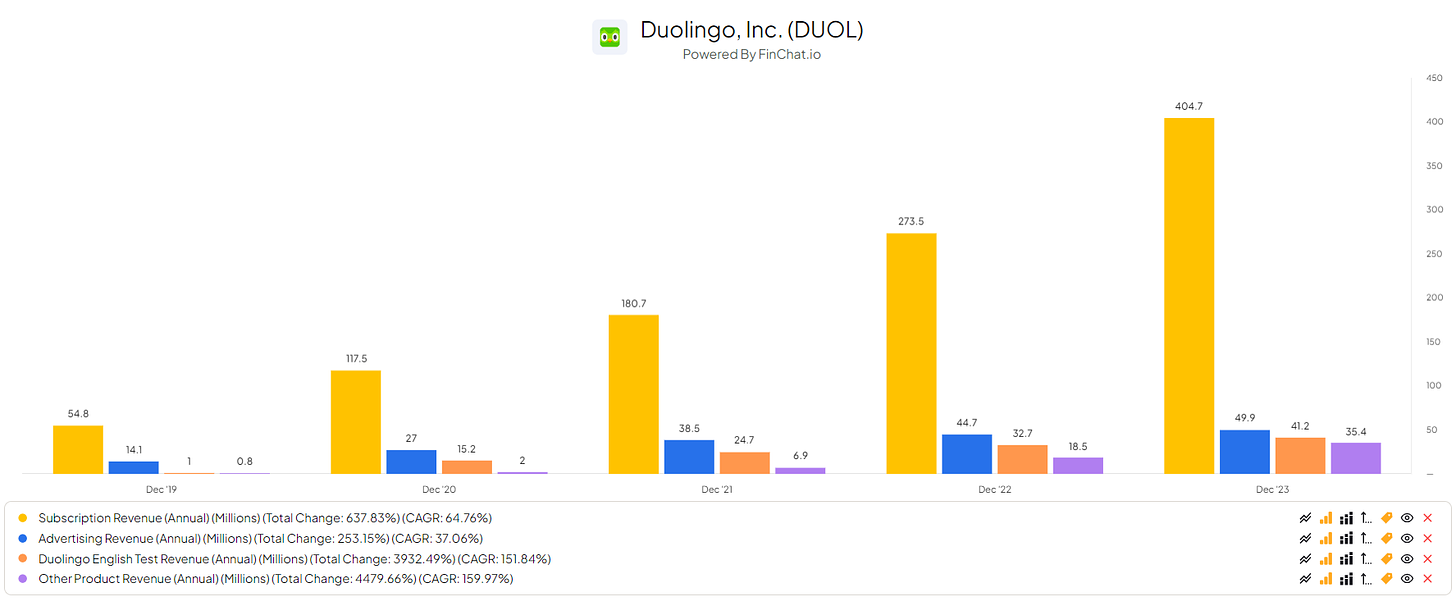

The main sources of revenue for Duolingo are as follows:

Subscription Revenue

Advertising Revenue

Duolingo English Test Revenue

Other Product Revenue

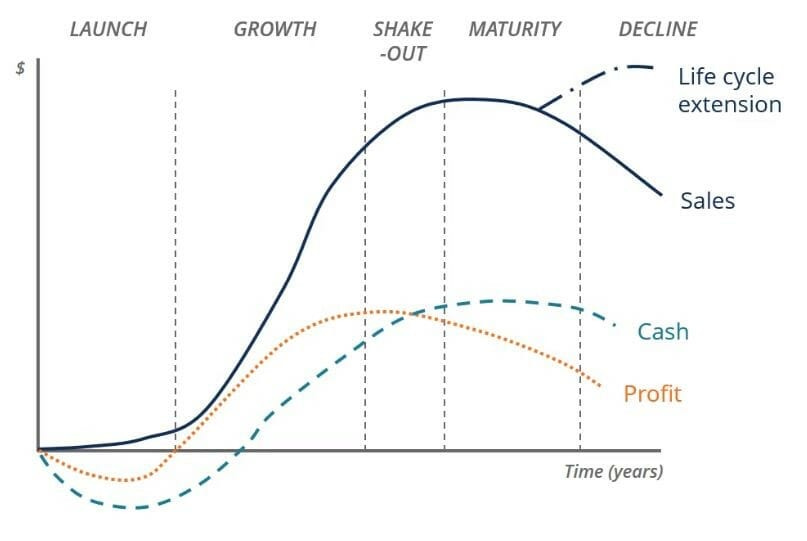

Across all revenue streams, we are witnessing significant growth for Duolingo. This is attributed to the company being in the growth stage of its lifecycle. Companies progress through multiple stages during their lifespan, with growth being an earlier phase. Refer to the graph below for visual representation.

The number of years a company remains in the launch, growth, shake-out, maturity, or decline phase depends largely on the sector it operates in, how management navigates its current phase, and whether consumers demand—or do not demand—a particular product or service.

Duolingo finds itself situated in an intensely competitive landscape. Its core business lacks the creation of a strong competitive advantage (MOAT) for the company. Being a language app, the concept can be easily replicated without much resistance. In contrast, companies like Hérmes or Diageo boast uniquely crafted or time-intensive production processes. For instance, in the case of Diageo, their rums and whiskeys undergo years of aging, giving Diageo an edge over competitors attempting to enter their market.

Revenue and Cost Drivers

Lets talk some numbers! The story is clear yet the numbers need some loving too, haha.

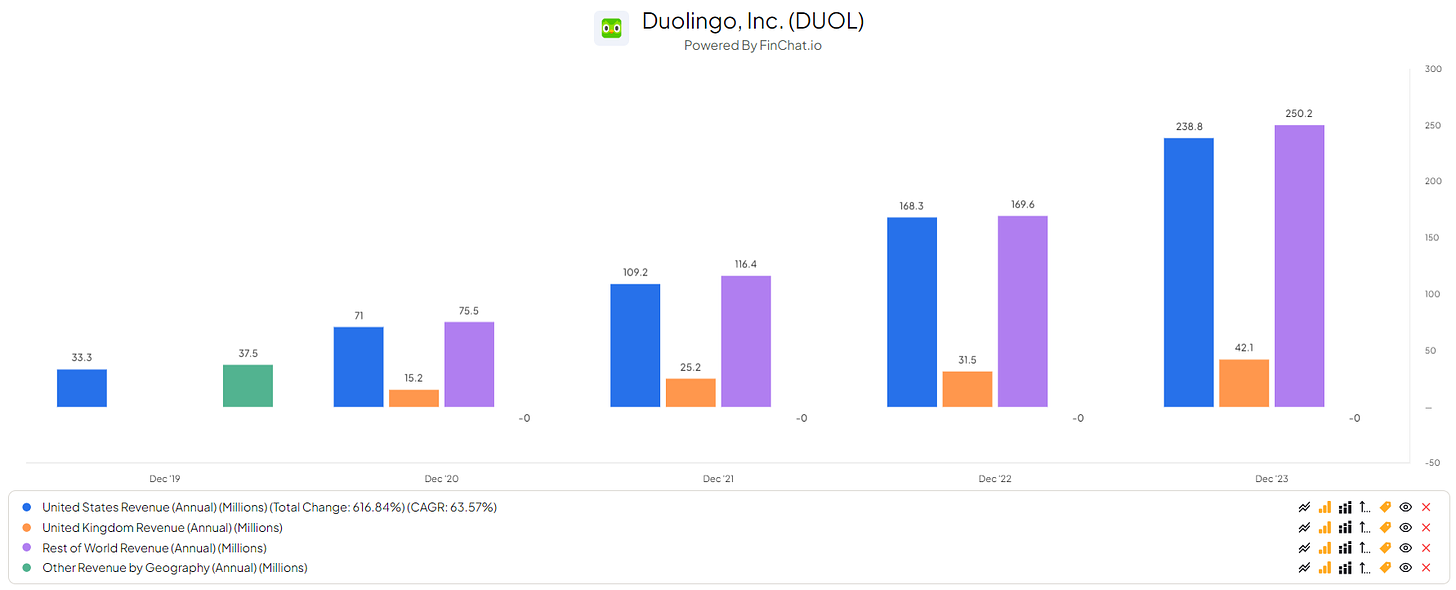

Here we observe the growth rates of different countries. The USA is experiencing an average growth rate of 65.72% per year, the UK is growing at an average of 41.30% per year, and the rest of the world is seeing an average growth of 49.17% per year. These are indeed impressive numbers to witness, indicating substantial growth across the board for Duolingo.

During Duolingo's growth phase, it is crucial to witness strong growth geographically. For a tech company, demonstrating robust growth figures across various regions signifies its strength during this phase. Investors prioritize growth over net revenue, as significant growth typically leads to eventual profitability through expense reduction.

But is this growth to be expected for the coming years? In my opinion, yes!

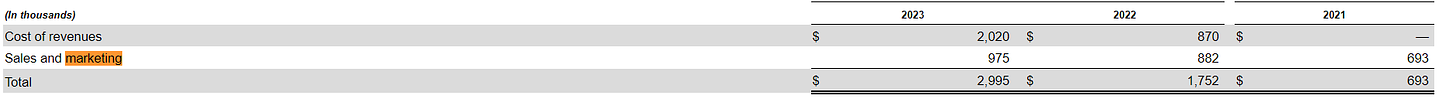

Duolingo is heavily marketing their service, as shown below.

‘‘For almost a decade, Duolingo’s learner community has grown organically through word-of-mouth virality. In recent years, we have made investments in marketing to supplement our organic model and amplify the voices of our existing users. Key elements of our sales and marketing strategy include:

•Brand campaigns. Our brand marketing increases awareness of Duolingo through online and offline campaigns that drive press, social sharing, and more word-of-mouth virality. Investments in our brand enable us to drive long-term growth by attracting new learners to our platform and keeping existing learners engaged. We leverage our iconic brand on social media platforms to drive organic new user growth and engagement with entertaining content, instead of promotional content, that takes advantage of viral trends and Duolingo memes created by our community.

•Owned media marketing. Our owned media marketing engages our learner community, creating millions of brand advocates who drive word-of-mouth virality by sharing their love of Duolingo within their networks. We send our learners personalized emails and push notifications that provide progress reports, lesson reminders, and sometimes a simple message of positivity to encourage them to remain engaged.

•Paid acquisition. We complement and accelerate our organic user growth with strategic and targeted paid user acquisition. Our performance marketing strategy is focused on targeting high quality user segments around the world that are more likely to retain well as users and/or subscribe.

•Geographic expansion. In markets where our organic awareness is relatively low and the opportunity for growth is strong, we hire experienced local marketing managers and engage in.’’

‘‘Our brand became more iconic. Our social-first marketing strategy, discussed in last quarter’s letter, earned nearly 3 billion social media impressions in 2023 (+170% YoY). The iconic Duolingo “ding” appeared in “Barbie”, the highest-grossing movie of the year. We also won our first Cannes Gold Lion award for our 2022 HBO “House of the Dragon” campaign.’’

‘‘For the year ended December 31, 2023 and 2022, our Sales and marketing expenses were $75.8 million and $67.0 million, respectively. Evolving consumer behavior can affect the availability of profitable marketing opportunities. For example, as consumers communicate less via email and more via text messaging, messaging apps and other virtual means, the reach of email campaigns designed to attract new and repeat users (and keep current users) for our products is adversely impacted.’’

Source: SEC Filings & Shareholder letters

We see that Duolingo is pushing their service/product to the masses with lightning speed. They’re heavily investing in their marketing and making sure everybody knows their name.

Because Duolingo is in its growth phase, I do not mind seeing them invest large sums into marketing. This will accelerate their growth and make their current growth sustainable for the time being.

So, yes. I do see Duolingo growing at the current rates Duolingo is growing.

Their marketing pays off!

As shown above, Duolingo is managing to grow at substantial rates. With their subscription being their core business and main focus, we see solid growth, something we expect with the investment Duolingo is making. Their advertising and test revenue is also climbing at respective rates. Although my main focus lays on their subscription revenue.

This revenue comes from users, duh.

In the graph above, we can clearly see that the monthly and daily user numbers are growing rather quickly. This growth stems from their excellent marketing efforts, of course, but it also speaks to the quality of the product. If users didn’t like the product, we would observe a high number of users one month followed by a drop-off. However, we consistently see increases, attributed to their marketing, followed by sustained growth, indicating user satisfaction with the product.

I love seeing this! It demonstrates that Duolingo is very capable of both acquiring and retaining users, something many companies struggle with.

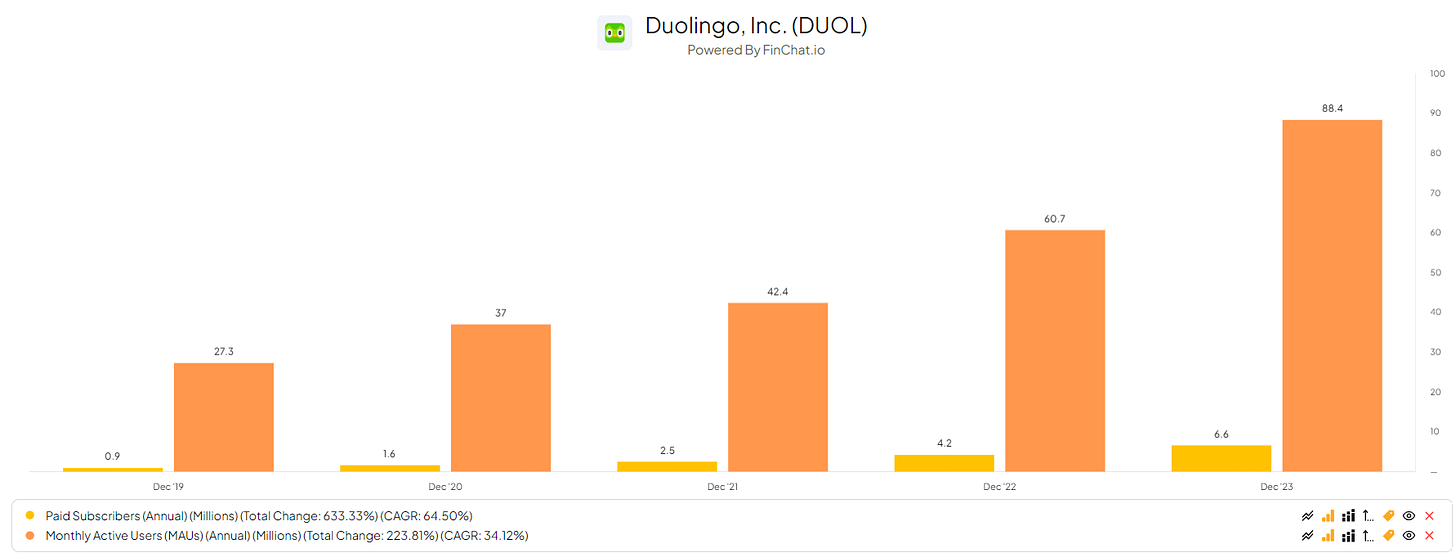

In the graph above, we observe monthly active users and paid subscriptions. What I would like to see is a solid increase in their annual conversion rate.

In 2019, the conversion rate was 3.30%.

In 2020, it rose to 4.32%.

In 2021, it further increased to 5.90%.

By 2022, the conversion rate reached 6.92%.

And in 2023, it climbed to 7.47%.

What we're witnessing here is a robust growth in conversions! This indicates that Duolingo effectively promotes its subscription offerings to users, resulting in a higher conversion rate. This suggests that Duolingo efficiently targets or reminds its users to upgrade their plans to enjoy more benefits.

Ideally, I would love to see an average conversion rate of 15% or higher. With the current improvements, existing rates, good execution, and solid marketing, I believe Duolingo is well-positioned to achieve this rate.

Cost of Business

Duolingo incurs costs like any other business worldwide. However, Duolingo enjoys several advantages. Unlike many other companies, Duolingo does not face heavy expenses related to product development, product updates, procurement of materials, and various other factors.

Now, let's examine their costs.

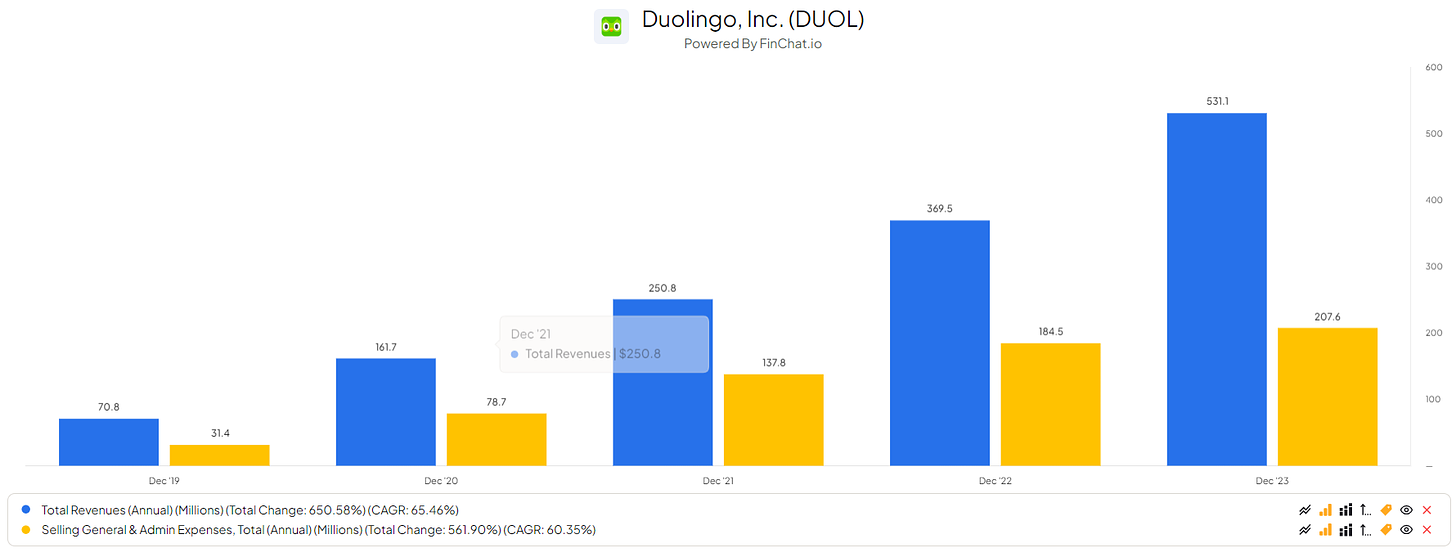

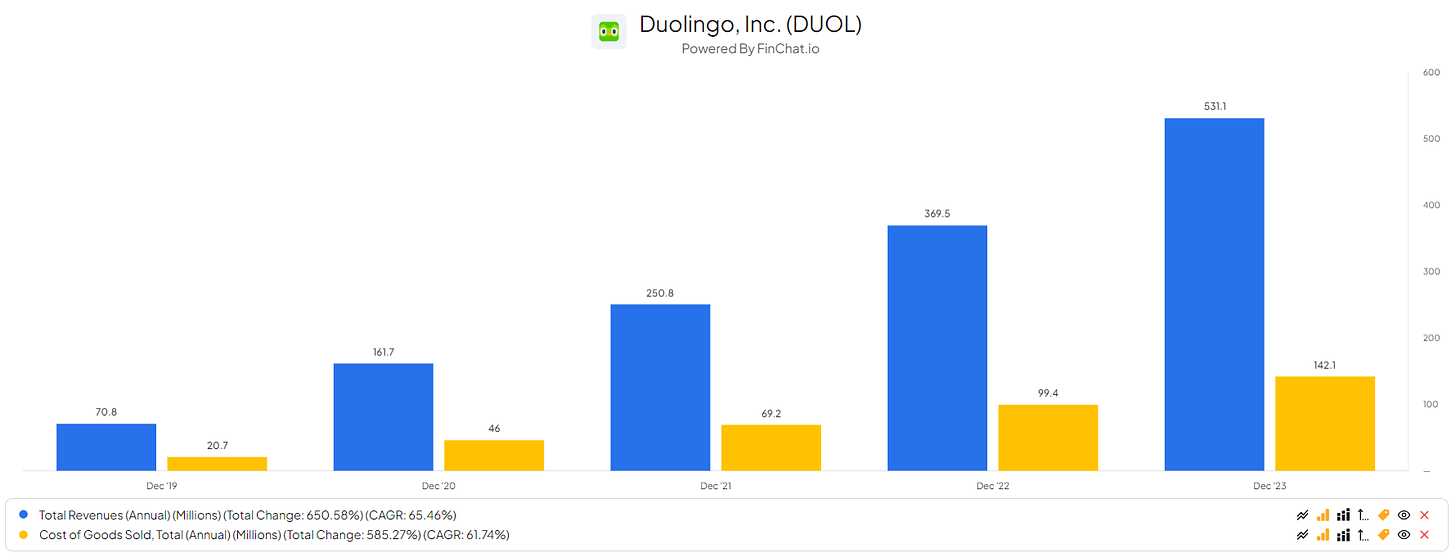

As depicted in the graph, we observe that Duolingo's SG&A costs are increasing gradually, while their total revenue is experiencing rapid growth. Duolingo operates as a low-cost business model. Unlike many other sectors or industries, Duolingo can swiftly scale its revenue at a lower cost.

Also, their Cost of Goods Sold (COGS) compared to their revenue presents a priceless picture. Due to their minimal reliance on capital for product improvement, distribution, and scaling, Duolingo can maintain their COGS at a low volume while boosting revenue.

Duolingo profits from operating in a high margin & low capital intense product. They can put their money where it should be, in R&D and Marketing to keep growing their market share, add more languages, add more users and capture more language curious customers, and of course keep them.

The Market

Indeed, there is a growing market for Duolingo to operate in.

The world is becoming more interconnected than ever before. It's becoming increasingly easy to cross borders, relocate to other countries, establish friendships globally, travel, and immerse oneself in different cultures. With this effortless connectivity across the globe, the demand for learning other languages is on the rise.

People are seeking more connections, and oftentimes, the only hurdle they face is the language barrier. With many individuals migrating to new countries, Duolingo plays a pivotal role in providing the solution to this persistent barrier: language learning.

5.1 million immigrants entered the EU from non-EU countries in 2022, an increase of around 117% (2.7 million) compared with 2021.

-European Commission

And there’s more!

1.5 million people previously residing in one EU Member State migrated to another Member State in 2022, an increase of around 7% compared with 2021.

-European Commision

This trend indicates that people worldwide are increasingly considering living outside their home countries, which is good news for Duolingo!

I anticipate this trend to persist for an extended period. As people around the globe become more interconnected, forging relationships with individuals from different regions, and as economies expand and improve, the allure of residing elsewhere grows stronger.

Furthermore, this trend isn't limited to migration; it also extends to travel. People often travel to new destinations and express a keen interest in learning the local language.

Risks(!)

Faling to keep existing users or add new users

The size of their user base and their users level of engagement and paid conversion are critical to their success. Their financial performance has been and will continue to be significantly determined by their success in adding, keeping and engaging users of their products and converting them into paying subscribers who remain continuing paying subscribers.

They expect that the size of their user base will fluctuate or decline in one or more markets from time to time. If people do not perceive their products to be useful, effective, reliable, and/or trustworthy, they may not be able to attract or keep users or otherwise maintain or increase the frequency and duration of their engagement or the percentage of users that are converted into or remain paying subscribers.

Discruption

The online language learning industry is highly competitive, with a consistent stream of new products and entrants. As a result, new products, entrants and business models are likely to continue to emerge, both in the U.S. and abroad. It is possible that a new product could gain rapid scale at the expense of existing brands through harnessing a new technology (such as generative AI), or a new or existing distribution channel, creating a new or different approach to connecting people or some other means. They compete for learners’ time, attention, and share of wallet not only with other online and app-based language learning platforms, but also with offline forms of language learning. Because of the extensibility of the Duolingo platform beyond language learning, they also compete with language learning assessment providers and literacy platforms and may compete with other kinds of online learning platforms in the future.

Google Play & Apple Store

Duolingo heavily relies on mobile app stores for product distribution and payment collection. Maintaining a positive relationship with these platform providers is crucial. Any changes in their terms and conditions or pricing could pose significant challenges for Duolingo.

With this reliance, if one of the providers alleges that Duolingo violated their terms and conditions, it could result in Duolingo being removed from the platform, leading to a substantial loss of market share. The barrier to entry into the app market would then increase significantly.

Yes, there are certainly some risk factors associated with Duolingo. However, are these risks something to worry about? In my opinion, no. Unless Duolingo experiences a security breach, violates terms and conditions, or faces regulatory issues, I don't foresee any direct issues stemming from their current risks.

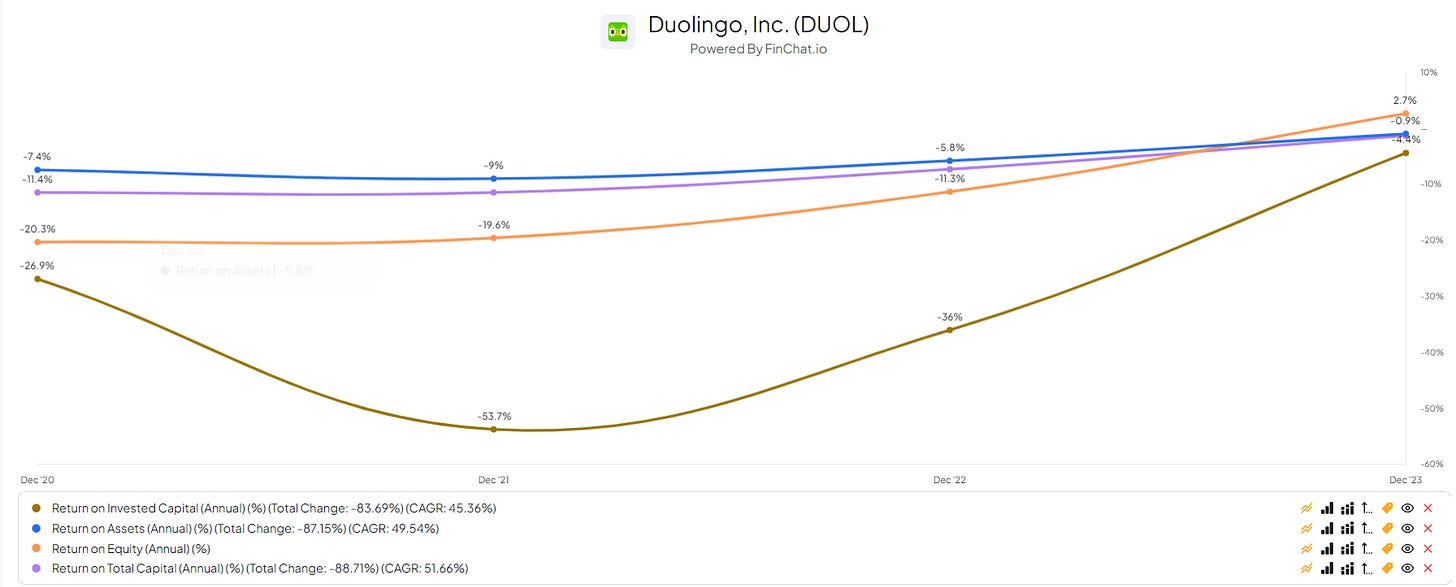

Metrics

Currently, Duolingo doesn't boast favorable metrics. Apart from 2023, Duolingo has not achieved profitability. Consequently, their capital efficiency remains in the negative. However, there are signs of improvement in Duolingo's metrics. The company is making strides across all factors, suggesting that the metrics will likely become more favorable in the near future.

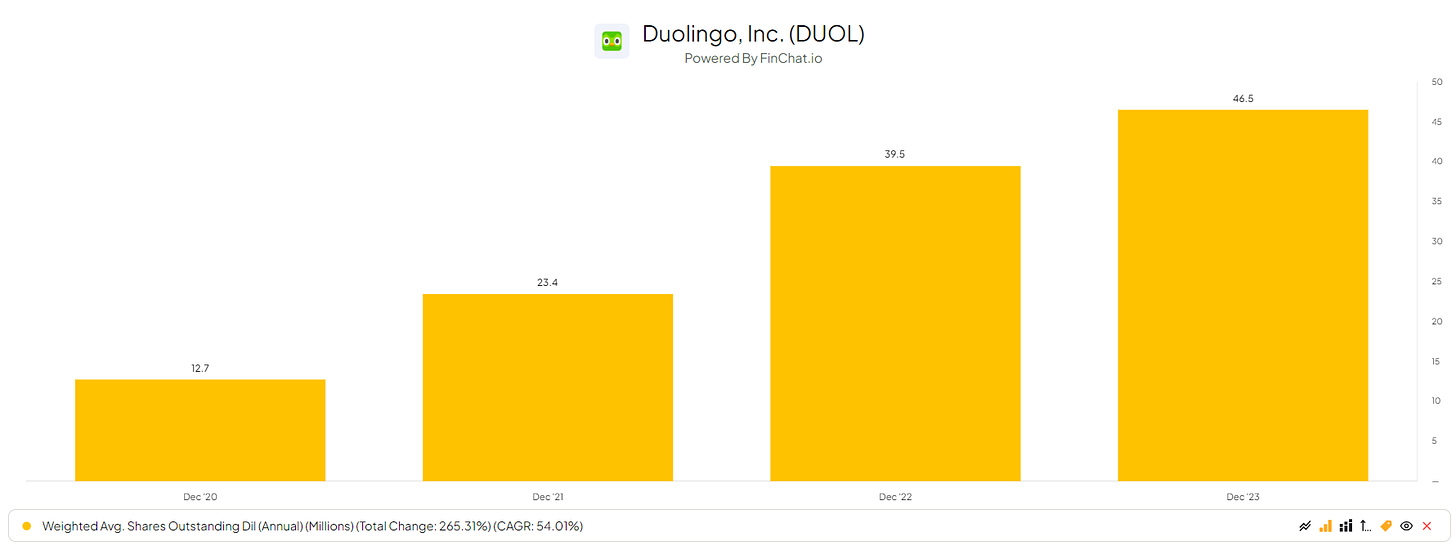

Shareholder Returns

Duolingo is increasing the issuance of shares, which can dilute the ownership of long-term shareholders. This practice can potentially decrease the value of existing shares. Share repurchases, on the other hand, are typically seen as a favorable strategy as they reduce the number of outstanding shares, thereby increasing the value of each share.

In the next five years, I hope to see Duolingo maintain or even decrease its shares outstanding through buyback programs, thus creating more value for shareholders.

The fact that Duolingo doesn't offer dividends is actually positive in this context. Instead of distributing profits to shareholders, they reinvest the money back into the business for further growth. This strategy aligns with the growth-oriented nature of tech companies, where reinvesting capital into product development, marketing, and user acquisition can lead to significant value creation.

Indeed, paying dividends in the early stages might indicate that a company lacks growth opportunities or is unable to reinvest its profits effectively to expand its business and market share. Therefore, I agree that it's preferable for early-stage tech companies like Duolingo to focus on reinvestment rather than paying dividends.

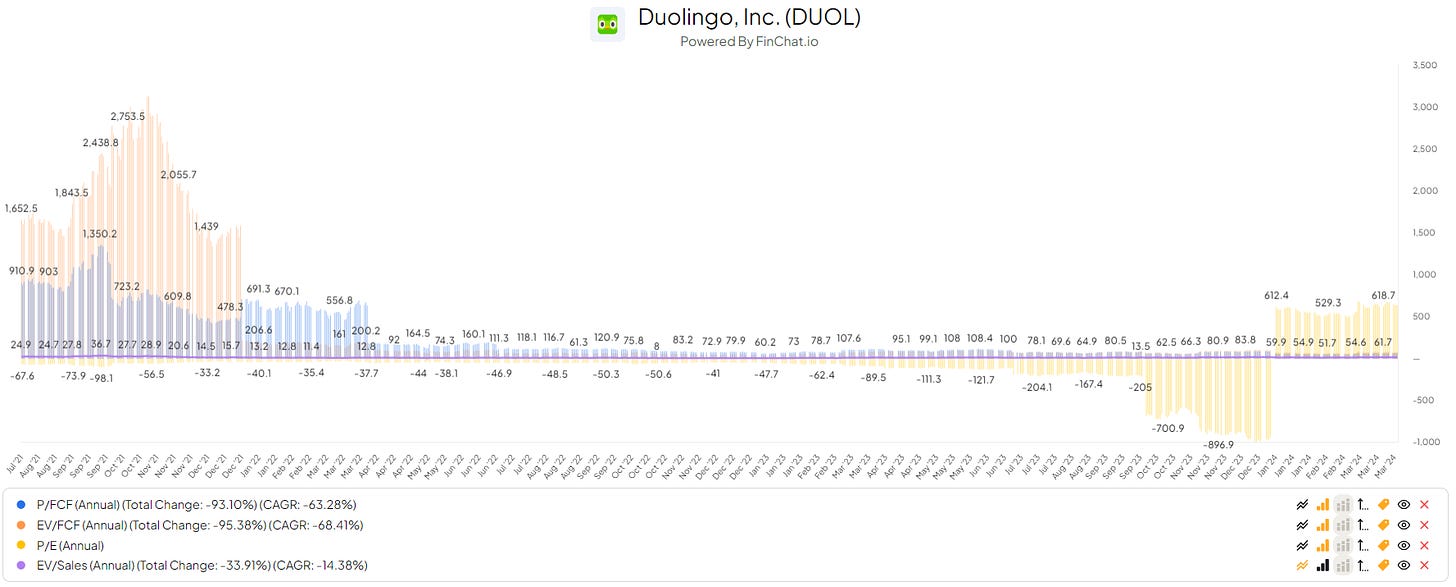

Valuation

Assessing Duolingo's valuation is challenging, particularly because it's in its growth phase where traditional valuation methods like Discounted Cash Flow (DCF) analysis may not yield accurate results.

Analysts have set their targets at $254.55, indicating their bullish outlook on the company.

Considering Duolingo's growth phase and potential, my fair value estimate comes in at around $228.

When averaging my estimate with analysts' targets, the result is approximately $241.28.

This suggests that Duolingo is currently trading below the average valuation of both my estimate and analysts' targets, indicating potential undervaluation. However, it's essential to acknowledge the inherent uncertainties in valuing companies in their growth phase.

Conclusion

Duolingo is, in my opinion, a wonderful company. Its management shows determination to reach its goals and seems very competent.

They allocate their money as they should, in marketing and making sure their current user base is growing and, of course, converting into paying subscribers. They seem to have found a recipe that works for them and should continue at this pace. This will result in more shareholder returns in the future.

The risks, in my opinion, are minimal. For the 'big' risks, there are solutions that Duolingo can uphold to ensure minimal risk. The providers, Apple Store and Google Play, are of some concern. They hold a lot of power on how many potential users might see, or not see, their product. This can result in users not signing up.

With the current view and my outlook on Duolingo, I do see more potential. Duolingo, in my opinion, is pretty pricey.

But the future looks promising for them, and I truly believe they will continue to grow. With a positive outlook on the market environment and positioning, Duolingo will be a solid investment for the years to come.

However, keep an eye out for disruptors though ;) AI can be unpredictable.

Disclaimer(s)

I, Yorrin, am not a licensed financial advisor, and the information provided in my publications is for educational purposes only. Any views or opinions expressed are solely my own and do not constitute financial advice.

Readers and viewers are advised to conduct their own research and due diligence before making any investment decisions. The stocks or financial instruments discussed in my publications may involve risks, and past performance is not indicative of future results.

Investing in financial markets carries inherent risks, including the potential loss of principal. It is important to understand that all investments involve risks, and individuals should carefully consider their risk tolerance and financial situation before making any investment decisions.

I do not guarantee the accuracy, completeness, or reliability of any information provided in my publications. I shall not be held responsible for any errors, omissions, or inaccuracies in the content, nor for any actions taken by readers or viewers based on the information provided.

By accessing and reading my publications, readers and viewers acknowledge that they have read, understood, and agreed to this disclaimer. They further understand that they are solely responsible for any investment decisions they make based on the information provided.

If you have any questions or concerns regarding the content of my publications, please consult with a qualified financial advisor or investment professional.