Hello, friends! 👋

I'm excited to welcome you back to another insightful analysis. Today, we're analyzing Salesforce, a go-to in CRM software.

If you missed my previous articles, you can catch up on them here:

If you haven't already, consider following me for more FREE content to enhance your investment journey. Whether you're a beginner or an advanced investor, you'll find valuable insights to help you make informed decisions. 😊

Table of contents

Corporate Analysis

1.1 Business Overview

1.2 Revenue BreakdownExecutive Leadership

2.1 CEO Experience

2.2 Employee Satisfaction Ratings

2.3 CEO Value CreationCompetitive and Sustainable Advantages (MOAT)

Industry Analysis

4.1 Current Industry Landscape and Growth Prospects

4.2 Competitive LandscapeRisk Assessment

Financial Stability

6.1 Asset Evaluation

6.2 Liability AssessmentCapital Structure

7.1 Expense Analysis

7.2 Capital Efficiency ReviewProfitability Assessment

8.1 Profitability, Sustainability, and Margins

8.2 Cash Flow AnalysisGrowth Analysis

9.1 Historical Growth Trends

9.2 Future Growth ProjectionsValue Proposition

10.1 Dividend Analysis

10.2 Share Repurchase Programs

10.3 Debt Reduction StrategiesFuture Outlook

Quality Rating

SWOT Analysis

Valuation Assessment

Conclusion

1. Corporate Analysis

1.1 Business Overview

Salesforce, Inc., provides customer relationship management technology that connects companies and customers worldwide. Its Customer 360 platform empowers its customers to work together to deliver connected experiences for their customers.

The company's service offerings include Sales to store data, monitor leads and progress, forecast opportunities, gain insights through analytics and relationship intelligence, and deliver quotes, contracts, and invoices; and Service that enables companies to deliver trusted and highly personalized customer service and support at scale. Its service offerings also comprise a flexible platform that enables companies of various sizes, locations, and industries to build business apps to bring them closer to their customers with drag-and-drop tools; an online learning platform that allows anyone to learn in-demand Salesforce skills; and Slack, a system of engagement.

In addition, the company's service offerings include a Marketing offering that enables companies to plan, personalize, and optimize one-to-one customer marketing journeys and Commerce offerings, which empower brands to unify the customer experience across mobile, web, social, and store commerce points. Further, its service offerings comprise Tableau, an end-to-end analytics solution serving various enterprise use cases, and MuleSoft, an integration offering allowing customers to unlock data across their enterprise.

The company offers its service offerings to customers in financial services, healthcare and life sciences, manufacturing, and other industries. It also offers professional services and in-person and online courses to certify its customers and partners in architecting, administering, deploying, and developing its service offerings.

The company provides its services through direct sales, consulting firms, systems integrators, and other partners. Salesforce, Inc. was incorporated in 1999 and is headquartered in San Francisco, California.

1.2 Revenue Breakdown

Salesforce’s main revenue drivers are as follows:

Sales Revenue:

Description: Revenue from Salesforce’s Sales Cloud, which provides tools for sales automation, pipeline management, lead tracking, and forecasting.

Products: Sales Cloud.

Service Revenue:

Description: Revenue from Salesforce’s Service Cloud, offering solutions for customer support, service management, and field service operations.

Products: Service Cloud, Field Service Lightning.

Platform & Other Revenue:

Description: Revenue generated from Salesforce’s platform services, including custom app development, integration, and other miscellaneous services.

Products: Salesforce Platform, AppExchange.

Integration and Analytics Revenue:

Description: Revenue from tools that help integrate Salesforce with other systems and provide advanced analytics capabilities.

Products: MuleSoft (integration), Tableau (analytics), Salesforce Einstein (AI).

Marketing & Commerce Revenue:

Description: Revenue from solutions that enable businesses to manage their marketing campaigns, customer journeys, and e-commerce operations.

Products: Marketing Cloud, Commerce Cloud.

Professional Services & Other Revenue:

Description: Revenue from consulting, implementation, training services, and other miscellaneous sources.

Products: Salesforce Professional Services, training programs, and other related services.

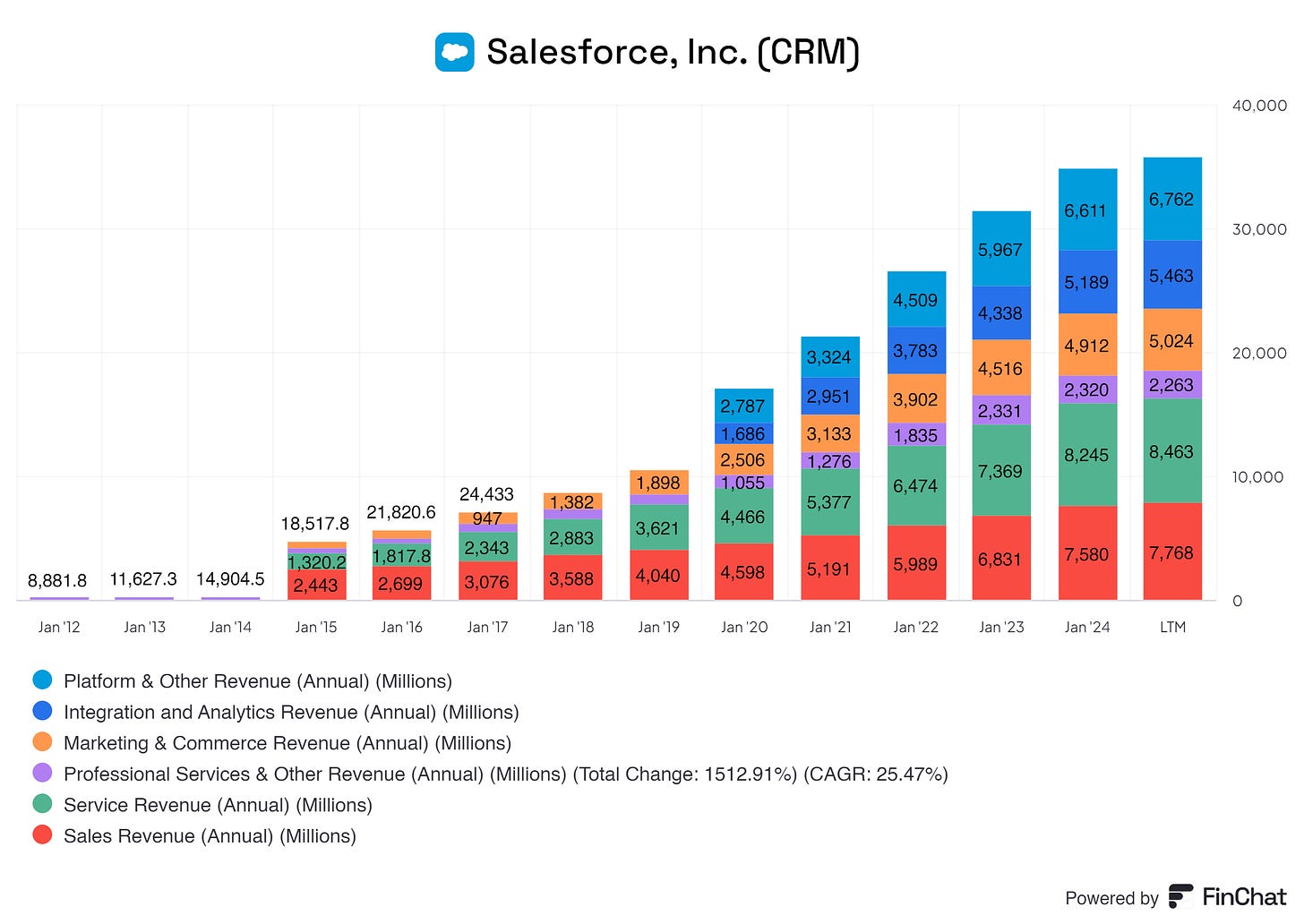

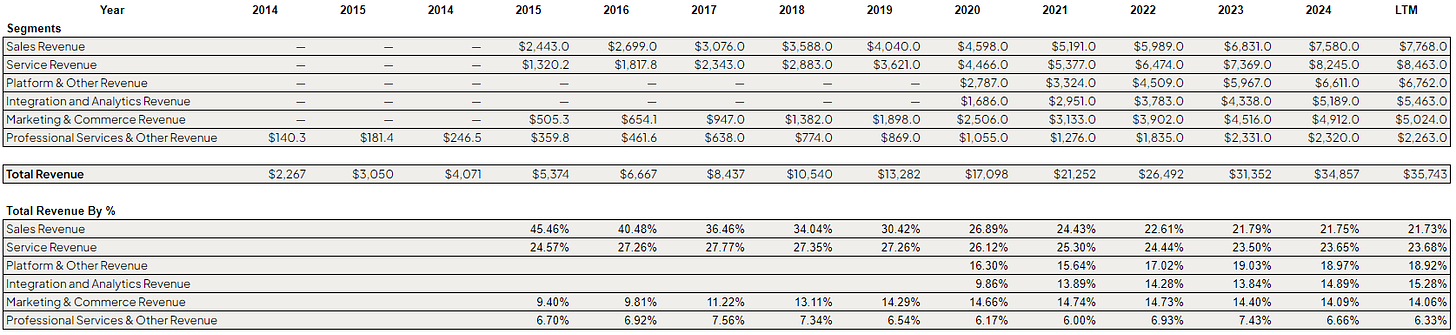

Salesforce had a total revenue of 34,857M as of January 2024.

7,580M came from its Sales, accounting for 21.75% of the Total Revenue.

8,245M came from its Service, accounting for 23.65% of the Total Revenue

6,611M came from its Platform & Other, accounting for 18.97% of the Total Revenue

5,189M came from Integration and Analytics, accounting for 14.89% of the Total Revenue.

4,912M came from Marketing & Commerce, accounting for 14.09% of the Total Revenue

2,320M came from Professional Services & Other, accounting for 6.66% of the Total Revenue

Salesforce is showing well-diversified streams of revenue income. This diversification gives Salesforce room to play. If one of the six comes under fire, there are enough other segments for Salesforce to fall back onto and do damage control. A business that has no reliance on one segment usually is more robust. Of course, over-diversification is an issue as soon as management loses either control or vision in one or more of the segments it operates in. In the case of Salesforce, there’s excellent growth all over its segments, indicating that management can uphold and maintain these.

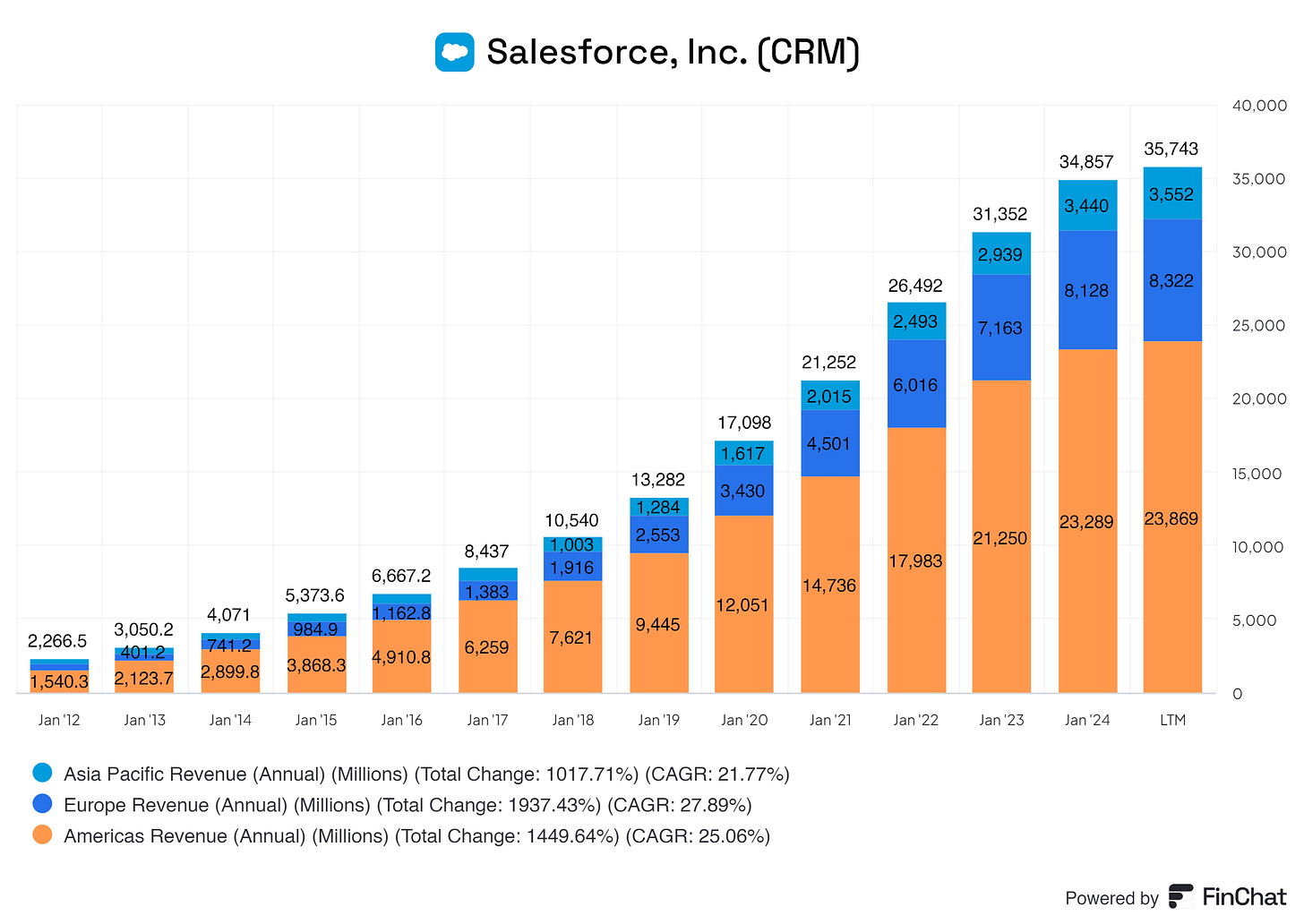

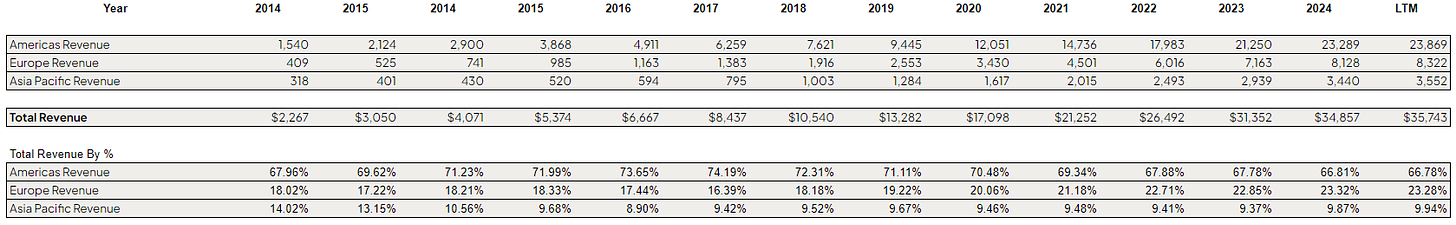

Now, let’s see how Salesforce is diversified globally by geography.

Salesforce has a heavy American customer base (U.S.A. & Canada). In 2023, 66.81% of its Total Revenue came from this region. Europe in 2023 accounted for 23.32% of its Total Revenue, and Asia accounted for 9.87% of its Total Revenue in 2023.

What we do see is that Salesforce is starting to penetrate other markets as well. Ideally, we would like more exposure to countries besides the American segment in which Salesforce operates. This would allow for a larger safety net for Salesforce in worst-case scenarios. Of course, Salesforce is an American business so that we can expect high exposure in its country of origin. This type of exposure acts as a double-edged sword.

2. Executive Leadership

2.1 CEO Experience

As of March 1999, Marc Benioff is the Chair, Chief Executive Officer, Founder of Salesforce and a cloud computing pioneer. Under Benioff's leadership, Salesforce has become the #1 global customer relationship management (CRM) software provider. Benioff was named “Innovator of the Decade” by Forbes and is recognized as one of the World’s 25 Greatest Leaders by Fortune and one of the 10 Best-Performing CEOs by Harvard Business Review. For his leadership on equality, Benioff has been honored by GLAAD, the Billie Jean King Leadership Initiative, and Variety Magazine with its EmPOWerment Award. He is a World Economic Forum (WEF) Board of Trustees member. He is the inaugural Chair of WEF's Forum Center for the Fourth Industrial Revolution in San Francisco. Benioff received a B.S. in Business Administration from the University of Southern California, where he is on its Board of Trustees.

Now, let's go over to Marc Benioff's earlier career.

Marc Benioff started his career as an intern at Apple Computer in May 1984. He worked on the Macintosh 68000 Development System until August 1984, when he wrote the example assembly language programs.

Following his internship at Apple, Marc Benioff joined Oracle Corporation in May 1986. He worked at Oracle for 13 years, serving as Senior Vice President from May 1986 to June 1999.

Benioff's extensive experience and innovative vision have significantly shaped his career and the success of Salesforce.

Marc Benioff owns roughly 22,269,457 shares of Salesforce Inc (CRM), accounting for roughly 2.25% of the total outstanding shares. This is worth roughly over $5.5 Billion.

2.2 Employee Satisfaction Ratings

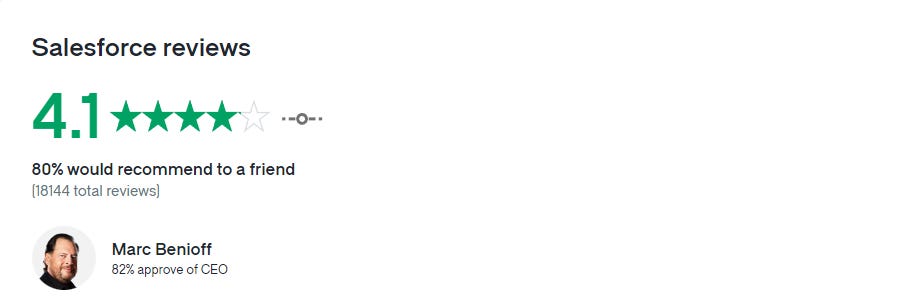

The overall rating for Marc Benioff is good!

These scores are crucial for investors. They tell us the story behind the business's fundamentals and explain why Salesforce is thriving today.

Employees seem to be extremely satisfied with all aspects of the business. This creates a pleasant work environment, shows dedication from employees, shows that employees are paid accordingly for their hard work, and shows that employees stick around longer, giving Salesforce the building blocks to start dominating the market.

A business can dominate its peers when its employees are happy and involved in the mission of the business.

2.3 CEO Value Creation

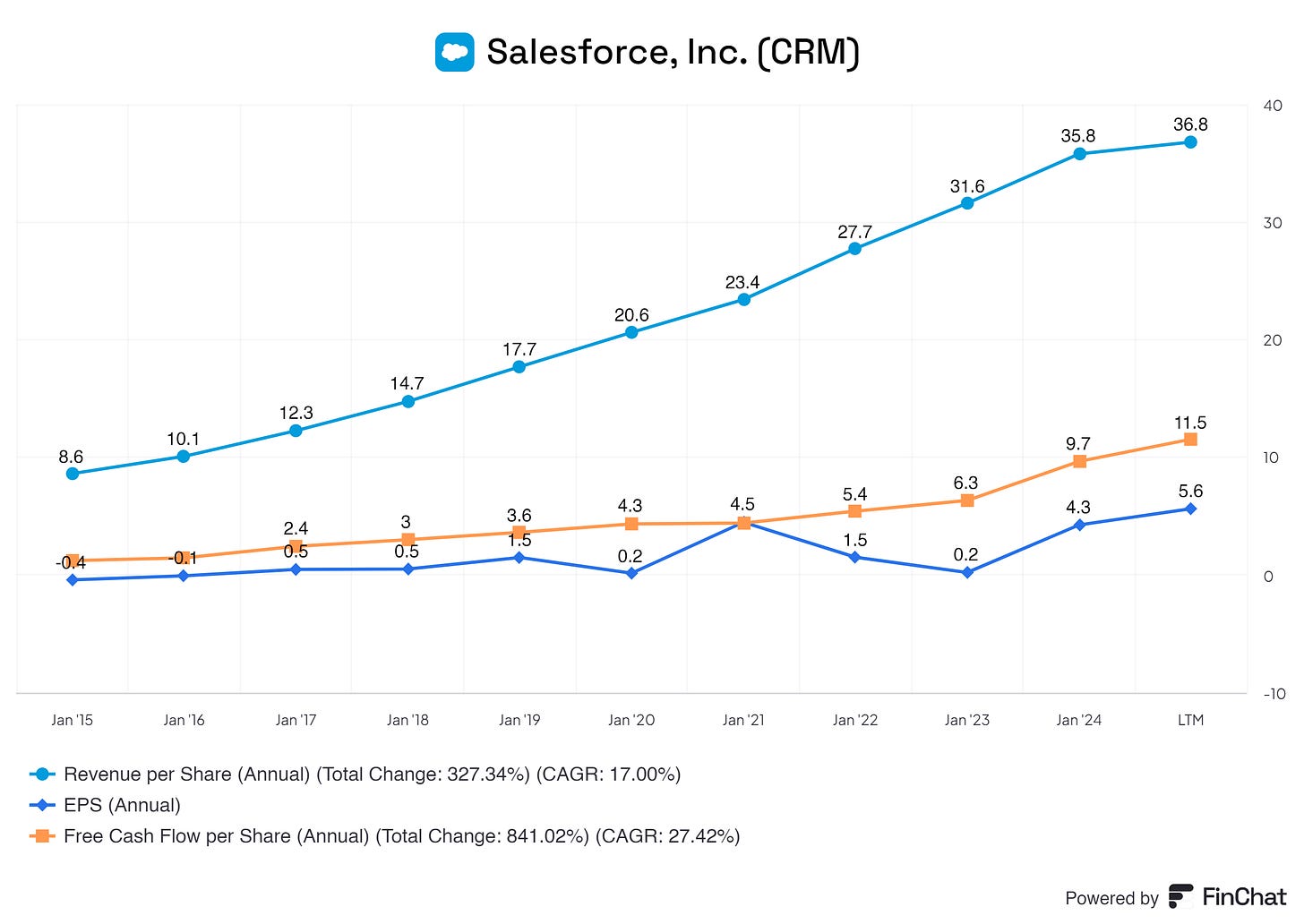

Does Marc Benioff create value for its shareholders?

That’s a big fat YES!

3. Competitive and Sustainable Advantage (MOAT)

So, a MOAT can be in either one or more of the following forms:

Brand Power

Patents

Scale and Cost Advantages

Switching Costs

Network Effect

Attracting Talent (I consider this a MOAT, others don’t. Decide for yourself)

Brand Power

Salesforce is widely recognized as a customer relationship management (CRM) software leader. Its strong brand reputation is built on reliability, innovation, and comprehensive customer service. The company’s name is synonymous with cloud-based CRM solutions, making it a preferred choice for businesses globally.

Patents

Salesforce holds numerous patents related to its innovative cloud computing and CRM technologies. These patents protect its intellectual property and ensure a competitive edge by preventing competitors from easily replicating its solutions.

Scale and Cost Advantages

Salesforce’s extensive scale allows it to operate with significant cost advantages. The company’s vast infrastructure, global presence, and large customer base enable it to spread costs over more users, resulting in lower costs per user. This scale also allows for significant investment in research and development, further solidifying its market position.

Switching Costs

Salesforce's deeply integrated and customizable CRM solutions create high customer switching costs. Once a business has adopted Salesforce and tailored it to its needs, switching to another provider would require significant time, effort, and financial resources, leading to a strong customer retention rate.

Network Effect

Salesforce benefits from a robust network effect. As more businesses use Salesforce, the value of its ecosystem increases. This includes a vast network of third-party developers and partners who create applications and integrations that enhance the Salesforce platform, making it even more attractive to new and existing customers.

Attracting Talent

Salesforce is considered one of the best places to work, attracting top talent in the tech industry. Its commitment to innovation, diversity, and social responsibility makes it an appealing employer. Talented employees drive further innovation and maintain Salesforce’s competitive edge, which can be viewed as a MOAT despite differing opinions on its significance.

These competitive advantages help Salesforce maintain its leadership position in the CRM market and protect it from competitive threats.

4. Industry Analysis

4.1 Current Industry Landscape and Growth Prospects

The global customer relationship management (CRM) market was valued at USD 65.59 billion in 2023, and it is projected to expand at a robust compound annual growth rate (CAGR) of 13.9% from 2024 to 2030. Key trends such as the hyper-personalization of customer service, the integration of artificial intelligence and automation, and the implementation of effective social media customer service are driving this growth. These trends are expected to reduce costs, enhance response times, boost customer satisfaction, and increase the adoption of CRM platforms across various industries.

The increasing adoption of digital technology and CRM tools is anticipated to accelerate digital transformation and optimization for established and emerging businesses. CRM tools support various business functions and processes in marketing, sales, and customer service, which is expected to boost the utilization of cloud technology and collaboration tools, contributing to market growth.

Departments such as sales, marketing, customer services, and support progressively incorporate CRM systems with AI to enhance customer experience and feedback, thereby strengthening customer relationships. For example, in April 2022, Salesforce, Inc., a cloud-based software company, introduced CRM analytics with new AI-powered insights for sales, marketing, and service teams across industries like BFSI, retail, and IT and telecom.

As understanding customer behavior and preferences becomes increasingly crucial, organizations adopt CRM strategies to deliver optimal real-time performance and maintain a competitive edge. Rapid advancements in business intelligence, embedded analytics, the Internet of Things (IoT), and artificial intelligence are being integrated into CRM solutions, driving product enhancement and innovation among CRM vendors.

For example, in June 2021, Salesforce.com, Inc. unveiled new capabilities within Digital 360 aimed at helping enterprises enhance their digital activities and provide the next generation of digital experiences, commerce, and marketing. These advanced features offered by CRM suites are expected to support the growth of the CRM industry over the forecast period.

Pssssst! If you like my content, consider sharing it with your friends or family.

4.2 Competitive Landscape

I identify Microsoft (with Microsoft Dynamics 365), Oracle, SAP SE, Adobe, Hubspot, and ServiceNow as competitors of Salesforce. (I exclude private businesses)

All the businesses listed above are extremely active in CRM.

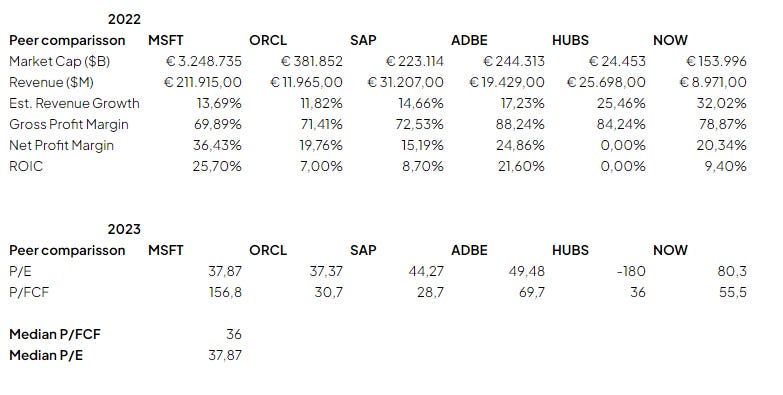

Salesforce is a significant player in customer relationship management (CRM), facing competition from several key companies. Regarding market capitalization and revenue, Microsoft (MSFT) leads with a market cap of €3.248.735 billion and revenue of €211.915 million in 2022. Oracle (ORCL) follows with a market cap of €381.852 billion and revenue of €11.965 million. SAP (SAP), Adobe (ADBE), HubSpot (HUBS), and ServiceNow (NOW) also have notable market presences, but they do not surpass Microsoft.

Salesforce exhibits robust revenue growth, a crucial aspect in which it competes closely with HubSpot, which has an impressive 25.46% growth rate, and ServiceNow, 32.02%. This growth is higher than Microsoft's 13.69%, Oracle's 11.82%, SAP's 14.66%, and Adobe's 17.23%, indicating Salesforce’s strong market demand and successful business model.

Regarding gross profit margin, Salesforce is comparable to Adobe (88.24%) and HubSpot (84.24%). These margins reflect Salesforce’s ability to scale its SaaS offerings effectively. While not explicitly listed, Salesforce’s margins are typically robust, contributing to its competitive positioning.

Salesforce faces challenges in net profit margins when compared to industry leaders. Microsoft has a net profit margin of 36.43%, and Adobe follows with 24.86%. Oracle (19.76%) and SAP (15.19%) also show solid profitability. Improving its net profit margin would help Salesforce enhance its competitive stance.

When looking at Return on Invested Capital (ROIC), Salesforce should aim to match the efficiency of companies like Microsoft (25.70%) and Adobe (21.60%). ServiceNow and HubSpot show areas for improvement in this metric, with ServiceNow at 9.40% and HubSpot at 0.00%, indicating a potential area where Salesforce could excel by improving capital efficiency.

For valuation ratios in 2023, Salesforce’s P/E ratio should be considered against competitors like Microsoft (37.87), Oracle (37.37), SAP (44.27), Adobe (49.48), and ServiceNow (80.3). These figures highlight strong investor confidence in these companies’ earnings potential. Maintaining competitive P/E and P/FCF ratios is essential for Salesforce to remain attractive to investors. For P/FCF, HubSpot stands at 36, aligning closely with the median for the group, while ServiceNow’s P/FCF is 55.5.

In summary, Salesforce shines in revenue growth and gross profit margins, reflecting its strong market demand and scalable business model. However, it faces challenges in net profit margins and needs to improve its ROIC and valuation ratios to maintain a competitive edge. Focusing on profitability and efficient capital use will be crucial for Salesforce to sustain its leadership in the CRM market.

5. Risk Assessment

Talent

Salesforce’s talent retention is crucial. The company's success relies heavily on attracting and retaining skilled personnel. Competition for talent in Salesforce’s sector is intense, and losing key members of the management team or critical development and operations personnel could make Salesforce's business growth and growth outlook hard.

It wouldn’t be the first time Microsoft, Amazon, NVIDIA, AMD, or another big player has taken personnel from another business…

Acquisitions

Additionally, Salesforce's growth strategy, which includes frequent acquisitions of complementary businesses and technologies, presents various challenges. These acquisitions may not always yield the anticipated business or financial benefits and can be difficult to integrate, potentially disrupting Salesforce's operations and diverting resources from its core business. Furthermore, entering new markets where Salesforce has limited experience or competitors have a stronger foothold can introduce additional risks.

Regulatory

Legal and regulatory risks also pose substantial challenges. Evolving data privacy laws, regulations regarding cloud computing, AI services, and cross-border data transfers can limit the adoption of Salesforce's services and impose significant compliance costs. Non-compliance with these regulations can result in severe penalties and damage to the company's reputation.

Competition

The competitive landscape is another significant risk. Salesforce operates in highly competitive markets where it must continually innovate and expand its services to stay ahead. Failure to do so could impair revenue growth and negatively impact operating results. Maintaining and enhancing its brand is critical, but this requires substantial investments, and failure to protect it could materially affect Salesforce's business.

Unfortunately, other bigger names have the capital to make the acquisitions or improvements before Salesforce can due to these businesses' higher budgets.

6. Financial Health

6.1 Assets Assessment

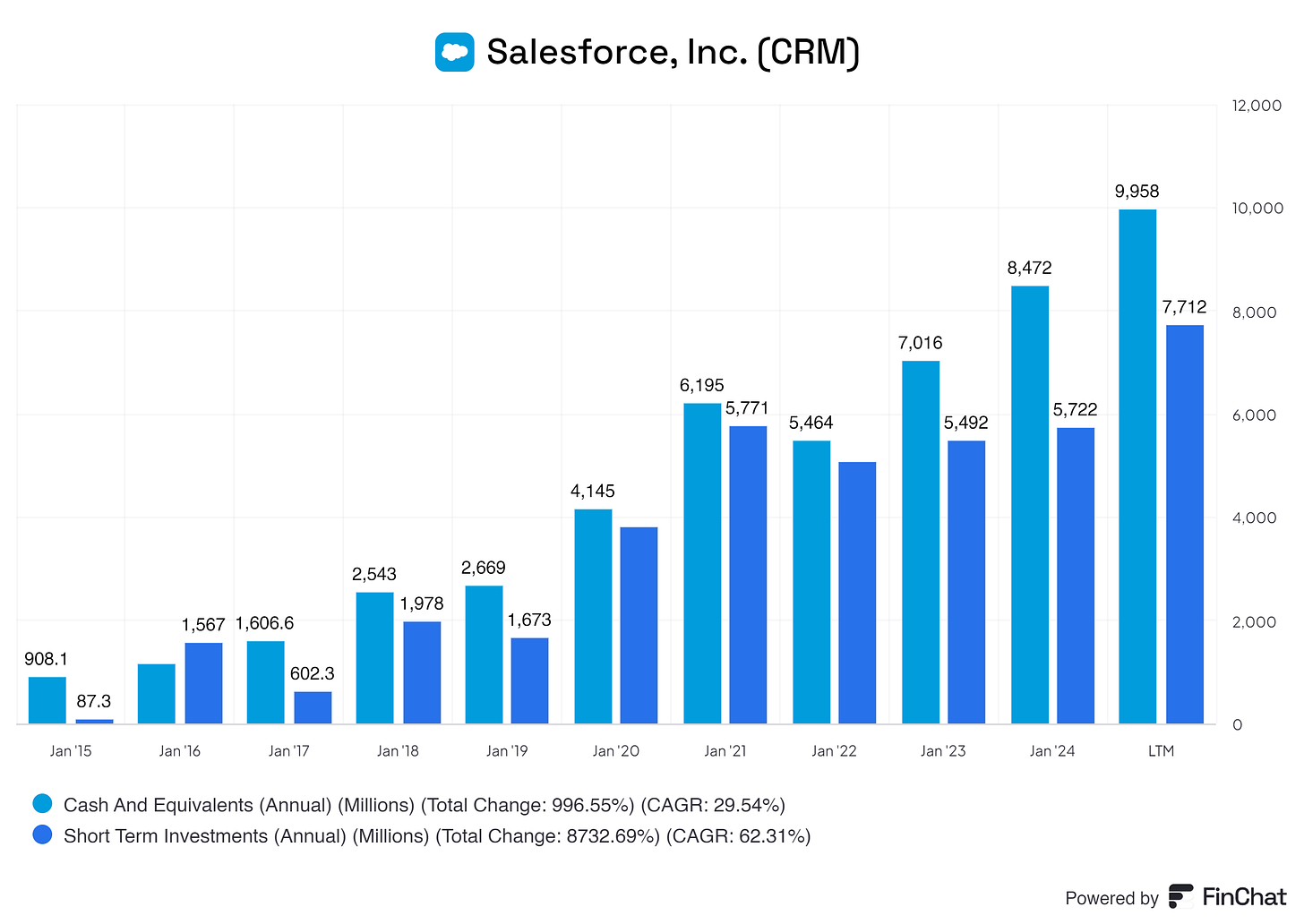

Salesforce has an excellent Assets sheet. Businesses with cash and short-term investments are wonderful to have in your portfolio. Businesses with a solid cash position on their balance sheet provide a safety net for potential lawsuits, economic downturns, unexpected costs, needed investments, and much more. This cash position means there’s no need to liquidate assets to generate equity when Salesforce needs it.

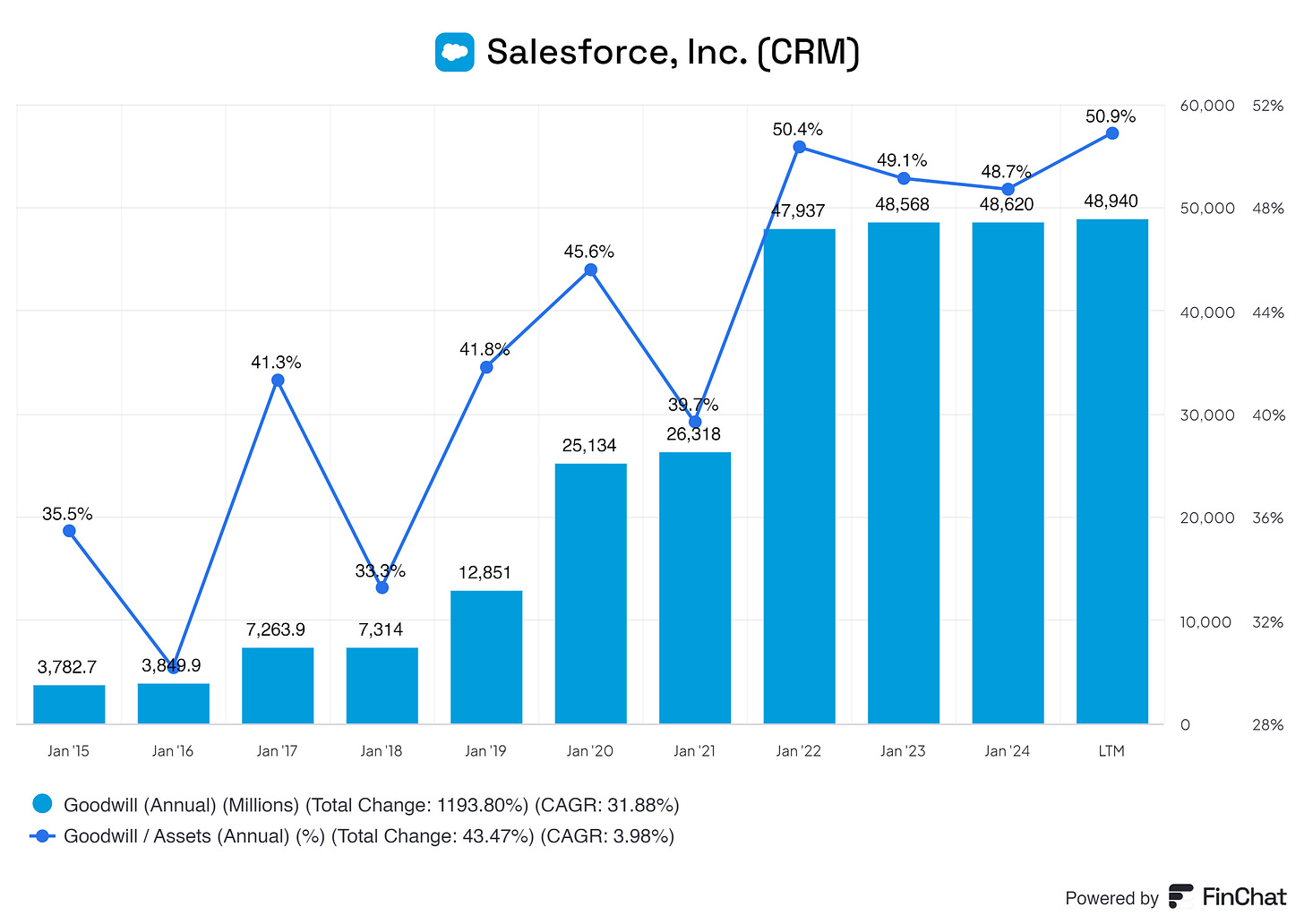

As mentioned, Salesforce is into acquisitions, which shows on the balance sheet.

Salesforce is paying tons of premiums for its acquisitions (Goodwill typically represents the premium paid over the fair value of the acquired companies’ net assets). Ideally, a Goodwill-to-Assets percentage would be below 20%; Salesforce is at 50.9% as of the last twelve months.

Of course, Salesforce is focused on substantially growing the business. Asking for a 20% Goodwill-to-Assets ratio would ask Salesforce to limit or pause its growth phase. While goodwill reflects investment in future growth and strategic positioning, it also highlights potential risks. If the acquired entities do not generate the anticipated returns, Salesforce may need to write down goodwill, negatively impacting financial statements. As mentioned in the Risk Assessment, we see that Salesforce heavily relies on its acquisitions.

Here are some of Salesforce’s acquisitions:

Slack – $27.7B, Dec 1, 2020

Tableau – $15.7B, Jun 10, 2019

MuleSoft – $6.5B, Mar 20, 2018

Demandware – $2.8B, Jun 1, 2016

ExactTarget – $2.5B, Jun 4, 2013

ClickSoftware – $1.35B, Aug 7, 2019

Vlocity – $1.33B, Feb 26, 2020

Krux – $800M, Oct 3, 2016

Quip – $750M, Aug 1, 2016

Buddy Media – $649M, Jun 4, 2012

Datorama – $800M, July 16, 2018

SalesforceIQ – $390M, July 11, 2014

Heroku – $212M, Dec 8, 2010

Radian6 – $276M, May 2, 2011

SendGrid – $2B, Feb 5, 2019

MapAnything – $225M, May 30, 2019

Acumen Solutions – $570M, Dec 01, 2020

PredictionIO – undisclosed, Feb 19, 2016

Bonobo AI – $45M, May 15, 2019

Spiff – undisclosed, Feb 1, 2024

For now, we need to see if Salesforce's acquisitions are worth the premium; time will tell.

Besides these two notes, there’s little more room to discuss Salesforce’s Assets. They have a solid asset sheet and positive net equity.

6.2 Liabilities Assessment

Due to the acquisitions, Salesforce’s debt increased significantly. Of course, this is a normal response to acquiring businesses; you also take over its debt (mostly). So, to spare you time, I will not discuss these in detail.

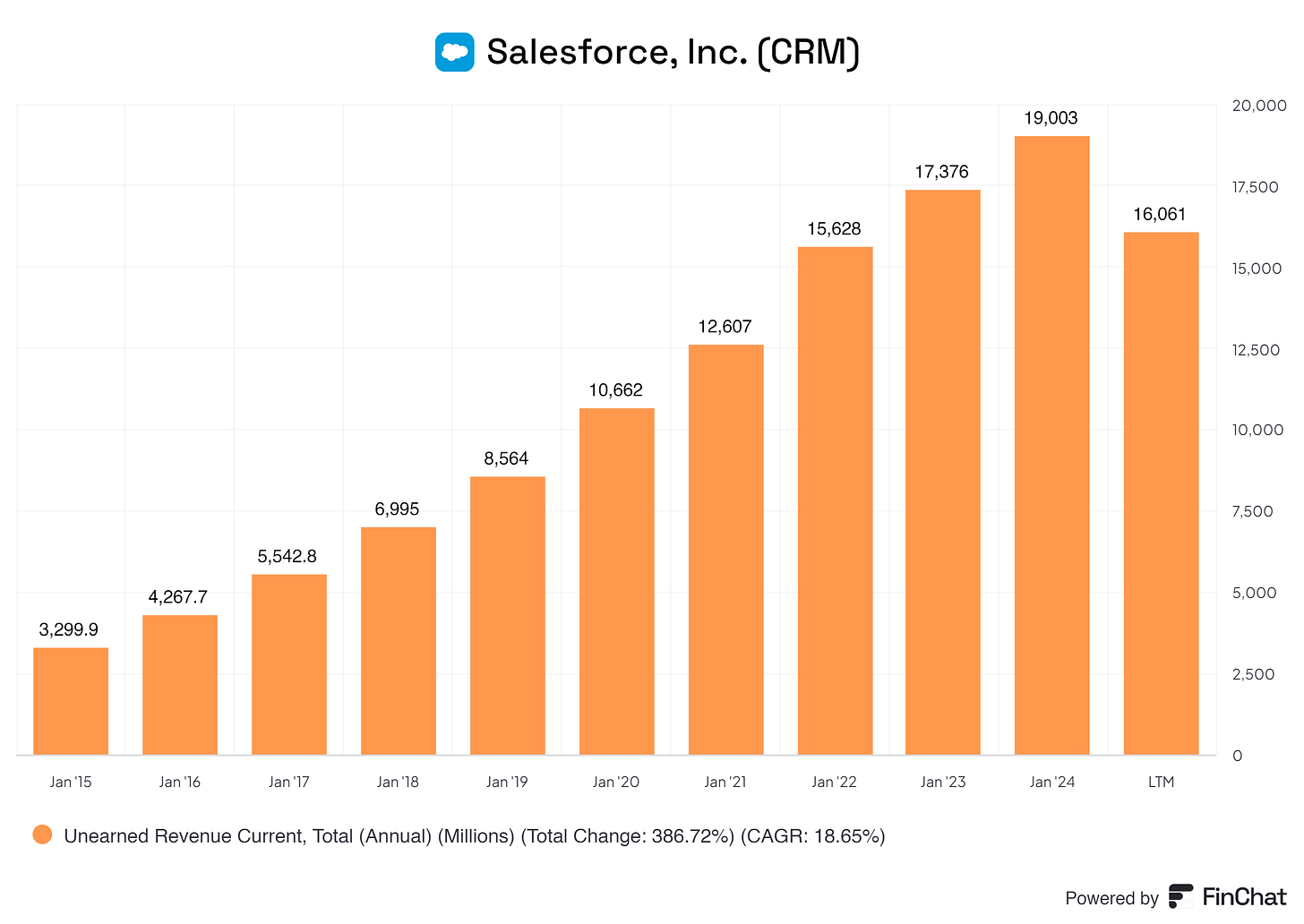

We do see a solid increase in Unearned Revenue on the balance sheet. This tells me that customers show high confidence in Salesforce’s products and services. Customers are willing to pay upfront, which reflects trust in Salesforce’s ability to deliver value to the customer.

Receiving payments in advance improves the company's cash flow. This influx of cash can be used for various purposes, such as reinvestment in the business, paying down debt, or enhancing liquidity.

In addition, an increase in unearned revenue is common for companies with subscription or contract-based business models and indicates business stability. It reflects recurring revenue streams and long-term customer commitments.

7. Capital Structure

7.1 Expense Analysis

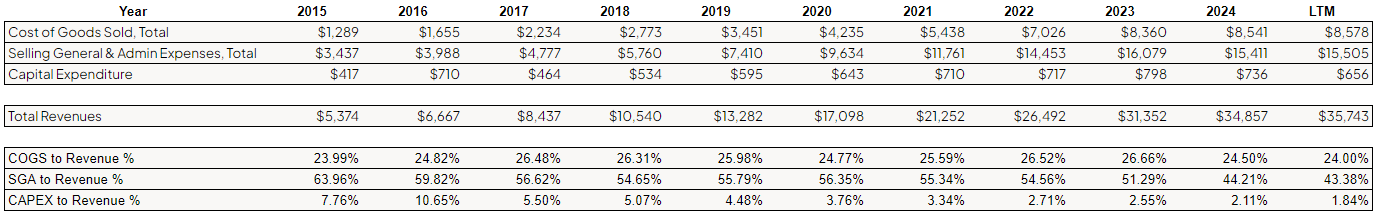

The table overviews Salesforce's key financial metrics from 2015 to the latest trailing twelve months (LTM). Cost of Goods Sold (COGS) has increased from $1,289 million in 2015 to $8,578 million in the latest period. COGS has fluctuated slightly as a percentage of revenue, staying within a range of approximately 23.99% to 26.66%, with the most recent figure being 24.00%. This relatively stable COGS percentage indicates that Salesforce has managed to maintain a consistent cost structure relative to its revenue growth.

Selling, General & Administrative (SG&A) expenses have significantly increased from $3,437 million in 2015 to $15,505 million in the latest period. However, as a percentage of revenue, SG&A has generally decreased from 63.96% in 2015 to 43.38% in the latest period. This decline in SG&A as a percentage of revenue suggests improved operational efficiency and better cost management relative to revenue growth.

Capital Expenditure (CAPEX) has fluctuated over the years, peaking at $798 million in 2023 and most recently at $656 million. As a percentage of revenue, CAPEX has decreased from 7.76% in 2015 to 1.84% in the latest period. The declining CAPEX percentage indicates that Salesforce is achieving revenue growth without proportional increases in capital spending, implying efficient use of capital and investment in less capital-intensive growth areas.

Total revenue has grown from $5,374 million in 2015 to $35,743 million in the latest period. This substantial growth demonstrates Salesforce's successful expansion and increasing market penetration.

The stable COGS-to-revenue ratio suggests that Salesforce has managed its production and service delivery costs effectively as it scales. The decreasing SG&A to revenue ratio indicates that Salesforce is achieving economies of scale and improving its operating efficiency. The CAPEX to revenue ratio reduction shows that Salesforce's revenue growth is not heavily dependent on capital expenditure, leading to better cash flow management and less dependency on capital for growth.

Overall, Salesforce has shown impressive revenue growth, reflecting its strong market position and effective business strategy. The company has maintained a relatively stable cost structure regarding COGS while significantly improving its SG&A efficiency. Lowering CAPEX relative to revenue indicates that Salesforce is managing its investments efficiently, possibly focusing on less capital-intensive areas for growth. These trends collectively suggest that Salesforce is growing sustainably with improving operational efficiencies and effective cost management. Investors can view these trends as positive indicators of Salesforce's financial health and strategic execution.

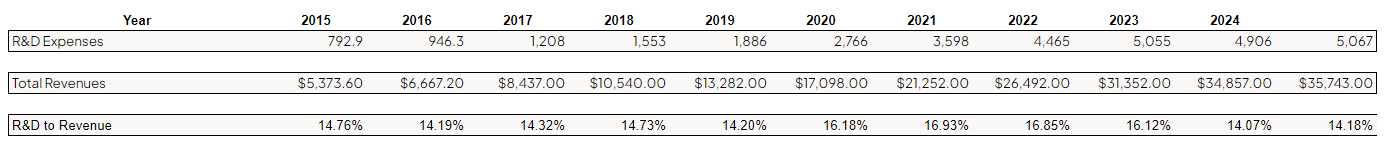

Another big expense is R&D.

Salesforce invests heavily in staying ahead of the CRM game and its peers. We can see that Salesforce can invest more and more of its revenue while the strain on its total revenue decreases. This tells me that Salesforce's R&D expenses are paying off.

7.2 Capital Efficiency Review

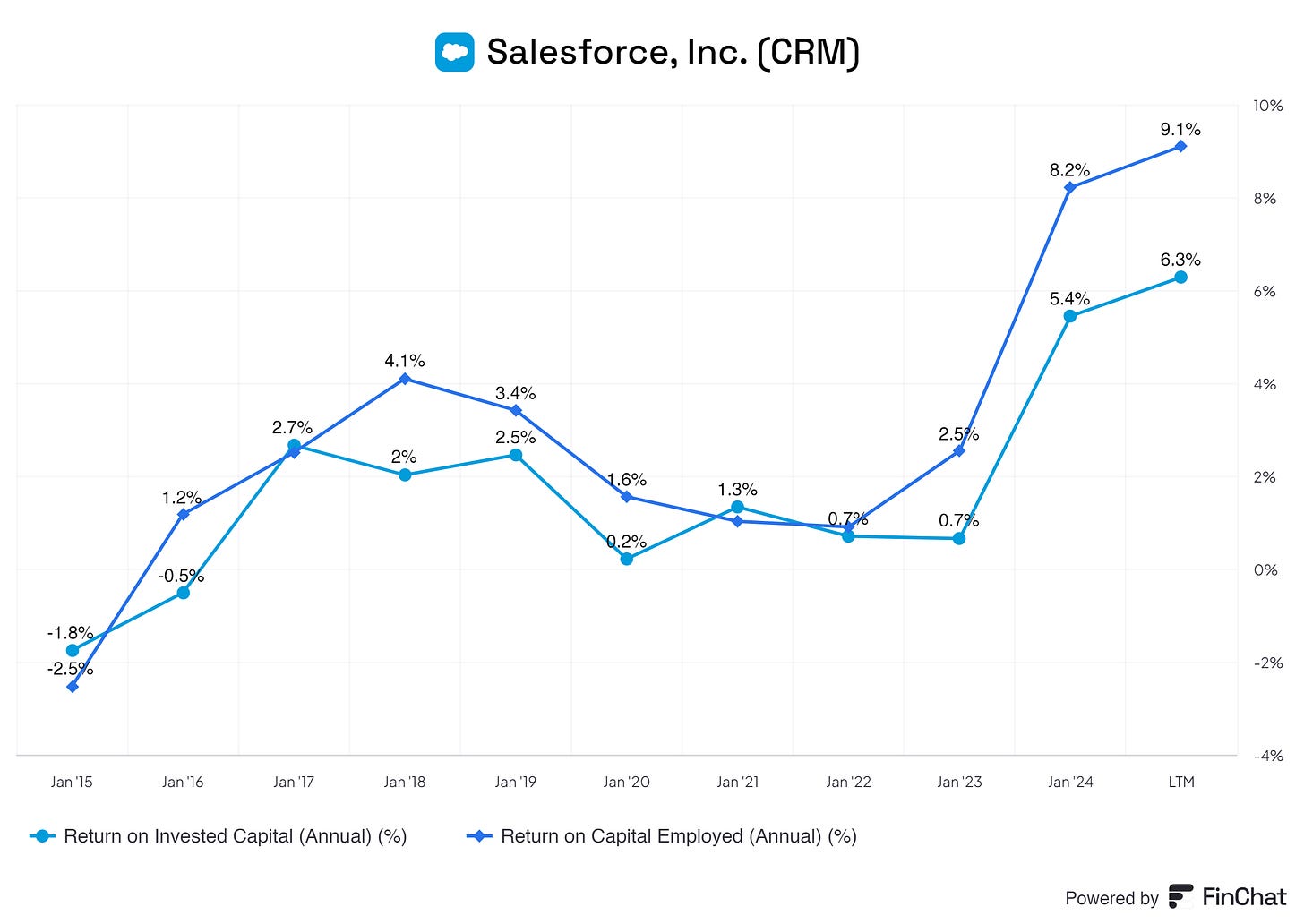

The chart shows the Return on Invested Capital (ROIC) and Return on Capital Employed (ROCE) for Salesforce from January 2015 to the latest trailing twelve months (LTM). In January 2015, ROIC and ROCE were initially negative, with ROIC at -2.5% and ROCE at -1.8%, indicating that Salesforce was not generating positive returns on its invested capital and capital employed.

From January 2016 to January 2018, both ROIC and ROCE showed improvement. ROIC increased to 2.7% in January 2017 and peaked at 4.1% in January 2018, while ROCE followed a similar trend, reaching 2% in January 2018. This period reflects improved operational efficiency and better returns on capital investments.

However, from January 2019 to January 2021, both metrics declined. ROIC dropped from 3.4% in January 2019 to a low of 0.7% in January 2021, while ROCE decreased from 2.5% to 0.2% in the same period. This decline coincides with major acquisitions, including Tableau for $15.7 billion in June 2019 and Slack for $27.7 billion in December 2020. These large acquisitions significantly increased Salesforce's capital base, initially reducing returns as the company integrated these new assets and incurred associated costs.

The metrics started to improve again from January 2022 onwards. ROIC increased from 0.7% in January 2022 to 9.1% in the latest period, while ROCE rose from 0.7% to 6.3%. This significant improvement reflects Salesforce's enhanced profitability and effective use of capital in recent years, likely due to the successful integration of acquired companies and the realization of synergies from these acquisitions.

The chart highlights periods of challenges and recovery in Salesforce's ability to generate returns on invested capital and capital employed. The recent upward trend suggests that Salesforce has successfully navigated previous difficulties and is now generating stronger investment returns, indicating improved financial health and operational efficiency. Ideally, I would like to see an ROIC and ROCE above 15%; in Salesforce's case, this will probably not happen anytime soon due to the acquisitions.

8. Profitability Assessment

8.1 Profitability, Sustainability, and Margins

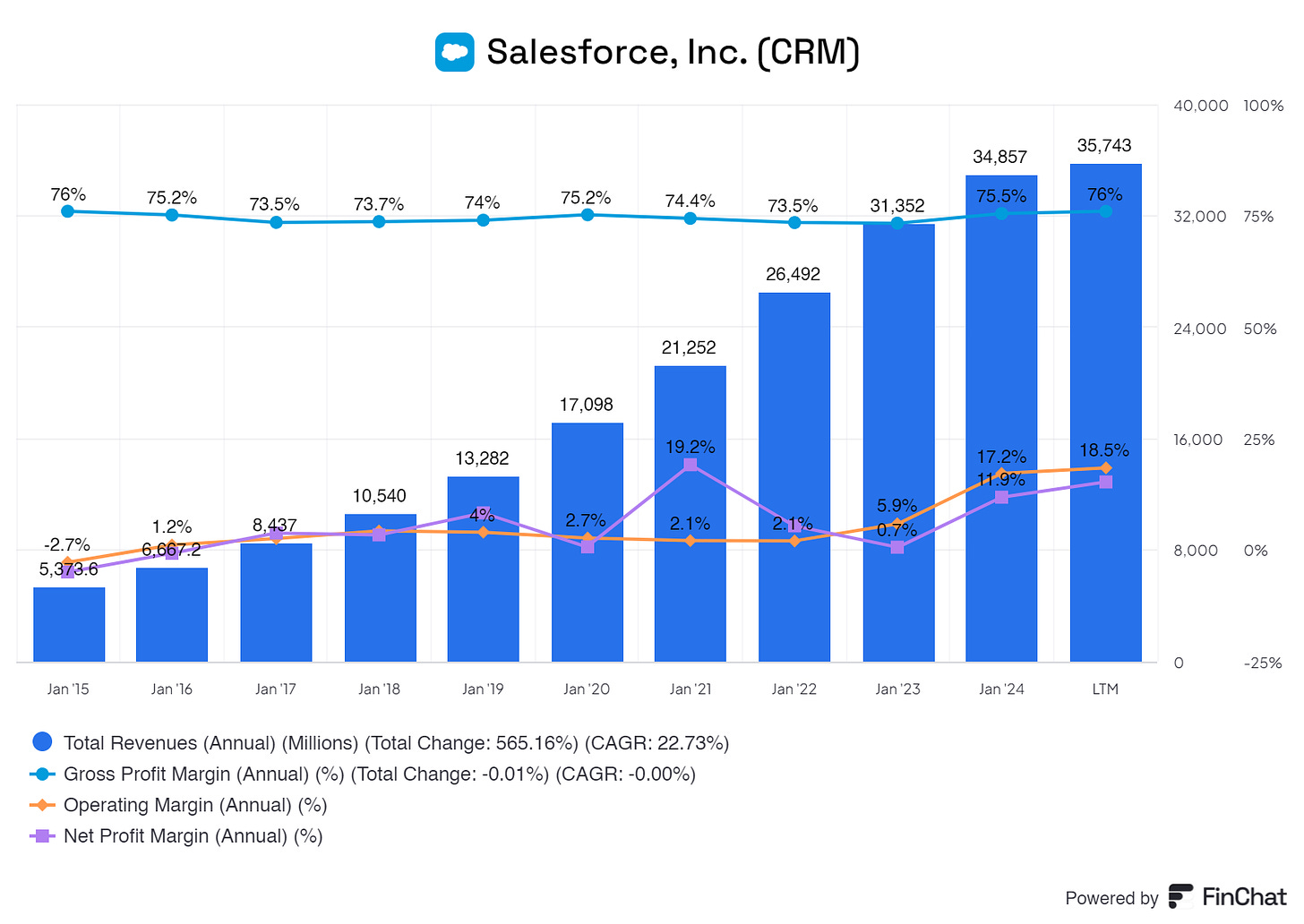

Salesforce has modest margins across the board. Due to its nature, Salesforce benefits from excellent Gross Profit Margins, as expected. For tech businesses, margins above 40% are a must for me. Although there’s a lot of fluctuation in Salesforce's net income, the margins are modest and seem to be improving YoY.

8.2 Cash Flow Analysis

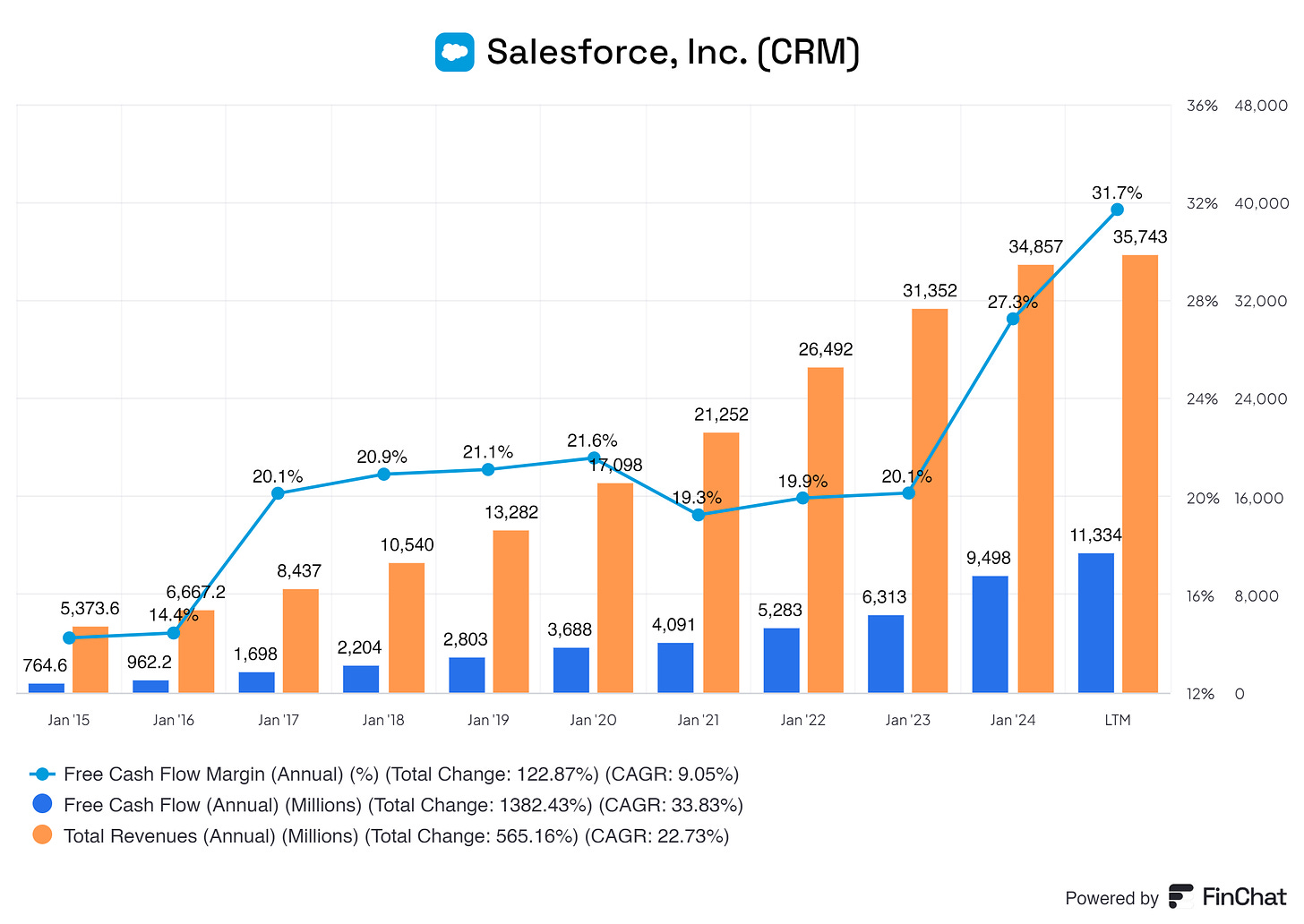

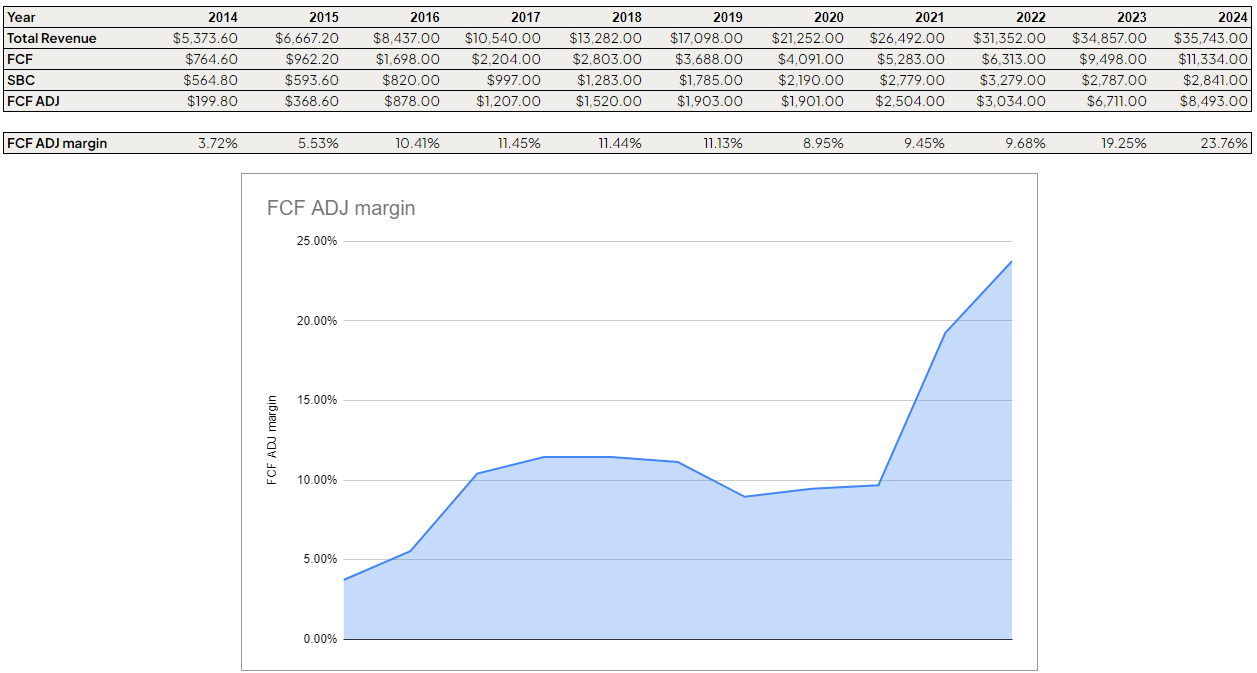

As expected, Salesforce has a solid conversion of its Total Revenue to Free Cash Flow. Ideally, I would love to see a constant 30-40% Free Cash Flow margin for Salesforce’s type of business.

Stock-based compensation boosts Free Cash Flow. However, Salesforce's actual Free Cash Flow paints a different picture.

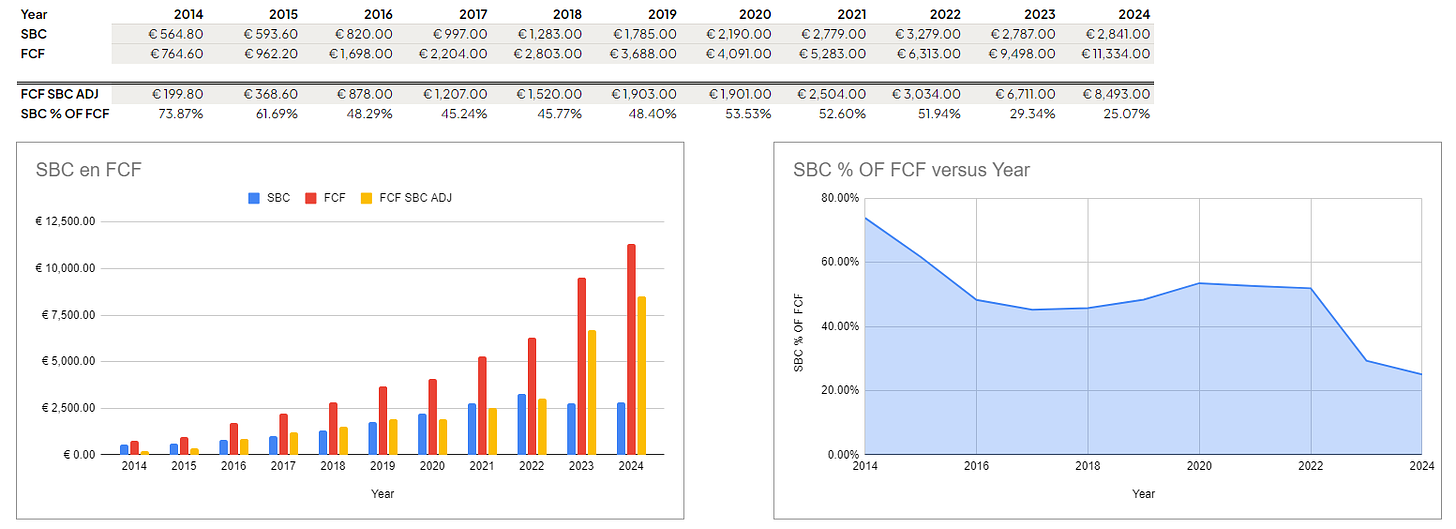

Stock-based compensation has been a great driver for Salesforce's free cash flow. In 2018, 73.87% was SBC… Salesforce is getting a grip on its SBC. Currently, 25.07% of the Free Cash Flow consists of SBC. With businesses like Salesforce, a higher SBC is ‘‘normal’’ for a business. Although I get that tech businesses have higher SBC, more than 5% is something I would rather avoid.

Salesforce’s SBC is needed to retain talent and motivate its employees, which I understand. However, with the decrease in SBC, employees are not leaving. Therefore, I hope that Salesforce will tame SBC even more in the foreseeable future.

Here’s Salesforce's actual Free Cash Flow and SBC adj. Free Cash Flow Margin.

9. Growth Analysis

9.1 Historical Growth Trends

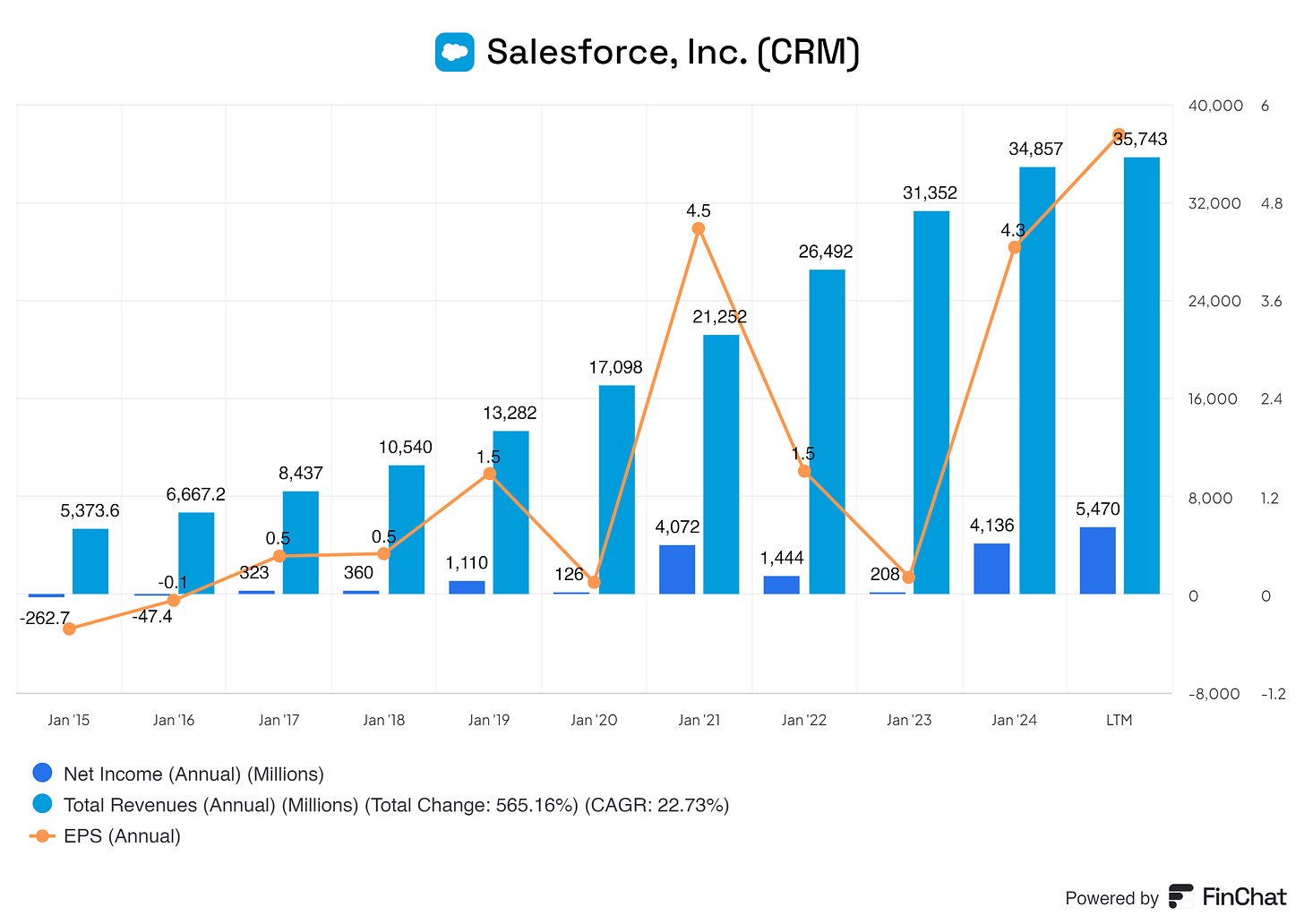

This has to be one of the most choppy overviews I’ve seen thus far. Nevertheless, Salesforce is growing rapidly. Total Revenue grew over the past 10 years with an excellent CAGR of 22.73%. Historically, Salesforce has been growing at an excellent rate. In this overview, I do not consider any issues or concerns. Even during the pandemic, Salesforce pushed its products to its customers, signaling the need for the products and services from Salesforce.

But does the future contain more growth?

9.2 Future Growth Projections

From my research and dabbling into research papers from larger funds, we all conclude that Salesforce is experiencing excellent growth.

For the next five years, analysts project roughly 18% growth. I project roughly 20% growth. I base my opinion on the fact that CRM is becoming more crucial in every business, and Salesforce offers a high-end product that automates or improves every CRM aspect. I expect more growth overall in the CRM industry and, therefore, more growth in Salesforce.

10. Value Proposition

10.1 Dividends Analysis

Salesforce does not pay a dividend. In the latest twelve months, Salesforce paid one dividend.

We also enhanced our capital return strategy with the initiation of our first-ever cash dividend, which began in fiscal year 2025.

- Salesforce Annual Proxy

I do not think dividends are the way to go for Salesforce. Salesforce should allocate its capital to acquisitions, R&D, and new projects.

Dividends tell me a business is losing ideas on adding more value for shareholders besides dividends. Of course, everybody thinks about this in their way, and I support different thinking; all power to you.

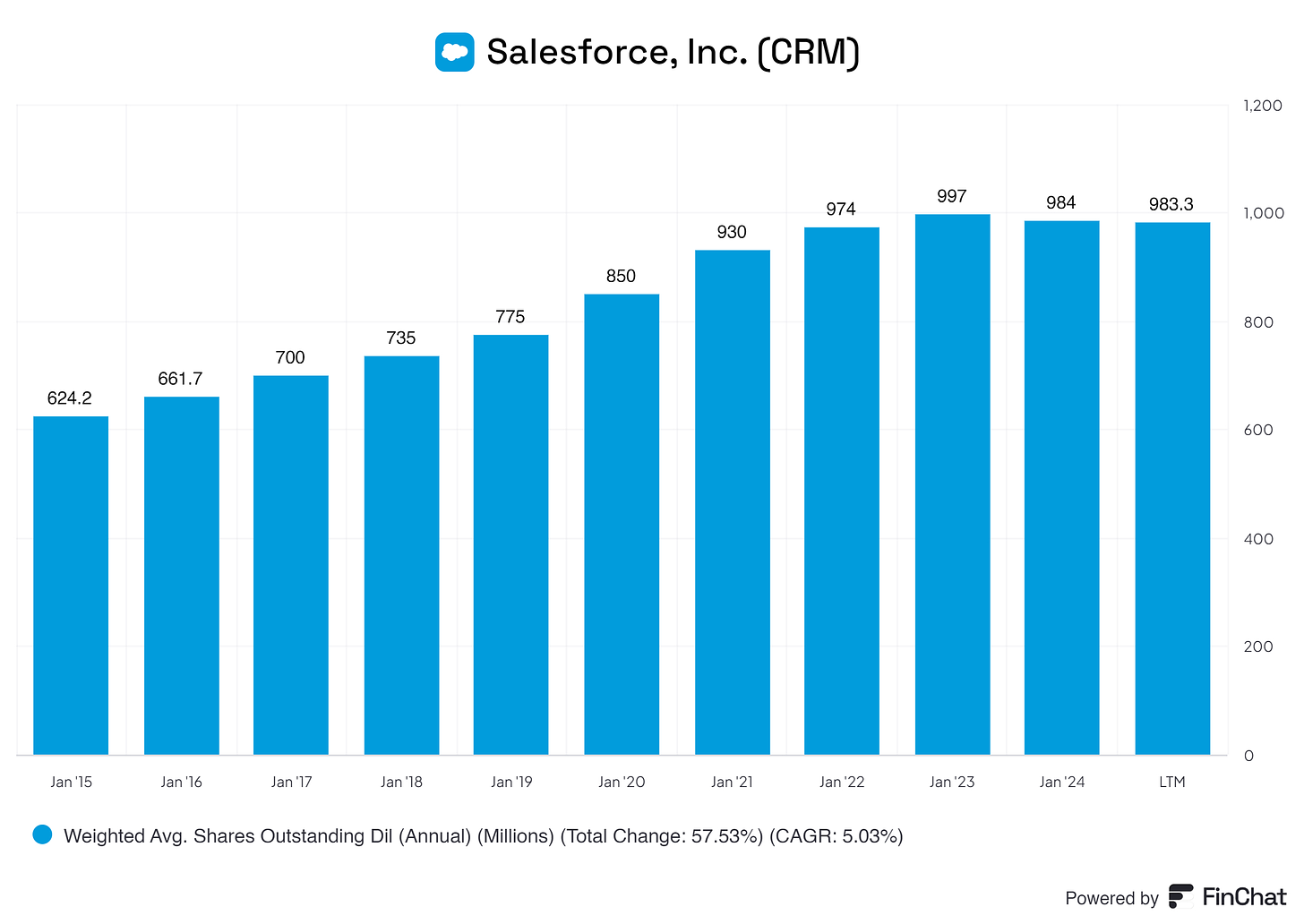

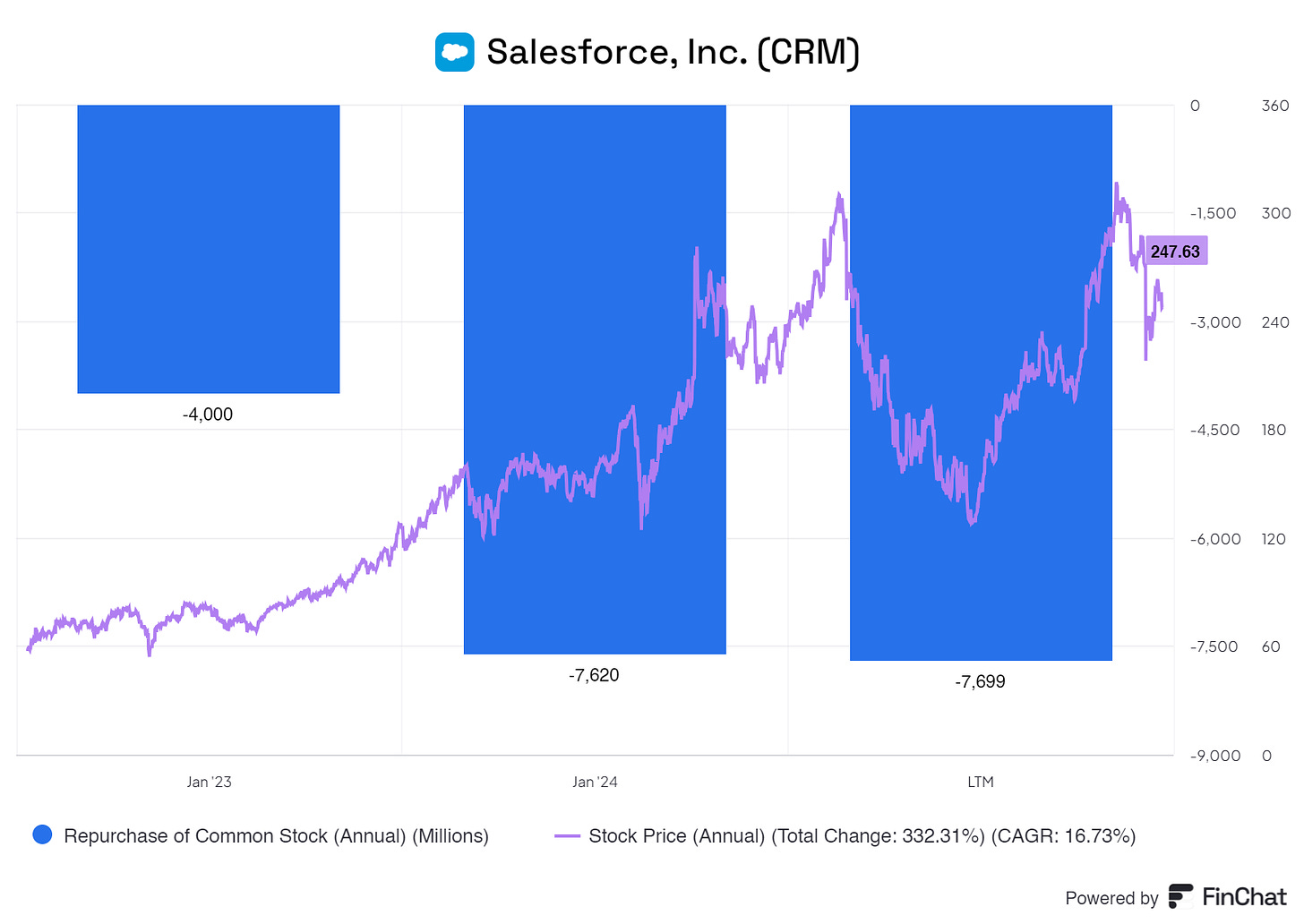

10.2 Share Repurchase Programs

For the fiscal year, total capital returned in the form of share repurchases was $7.7 billion, or more than 80% of the fiscal year free cash flow, which more than fully offset dilution of our stockbased compensation. Since the inception of the repurchase program, we have returned $11.7 billion to stockholders. Additionally, our board approved a $10 billion increase to our share repurchase plan, bringing the total authorization to $30 billion.

- Salesforce Annual Proxy

Salesforce dilutes its shareholders from 2014 up to 2023. After 2023, Salesforce will repurchase shares, as stated above. I’m thrilled that Salesforce is cutting down on stock-based compensation and repurchasing shares. In its hyper-growth stage, we seldom avoid dilution, especially in the tech sector.

Salesforce is now taking the initiative to create shareholder value by buying back its shares and limiting dilution via stock-based compensation, which will also improve its Free Cash Flow position.

Lately, Salesforce has been buying back shares when Salesforce’s price is more favorable, indicating that management has put thoughts behind the repurchase program they initiated.

10.3 Debt Reduction Strategy

Salesforce has a negative Net Debt, so its debt is manageable. However, in the growth phase, debt reduction is not Salesforce’s top priority; all power to them!

11. Future Outlook

Salesforce's main revenue drivers are diversified across several segments, providing a robust foundation for future growth and stability. These segments include Sales Cloud, Service Cloud, Platform services, Integration and Analytics, Marketing and Commerce, and Professional Services. As of January 2024, Salesforce reported a total revenue of $34,857 million, with each segment contributing significantly to this total. Sales Revenue accounted for 21.75% ($7,580 million), Service Revenue for 23.65% ($8,245 million), Platform & Other Revenue for 18.97% ($6,611 million), Integration and Analytics Revenue for 14.89% ($5,189 million), Marketing & Commerce Revenue for 14.09% ($4,912 million), and Professional Services & Other Revenue for 6.66% ($2,320 million). This diversification ensures that Salesforce has multiple revenue streams to rely on, reducing the risk associated with dependency on a single segment.

Salesforce's global revenue distribution indicates a strong presence in the U.S. and Canada, which accounted for 66.81% of its total revenue in 2023. Europe contributed 23.32%, and Asia accounted for 9.87%. While the heavy American customer base is a strength, further expansion into international markets could provide additional stability and growth opportunities. Increasing exposure outside the American market would help mitigate risks associated with regional economic downturns.

Under the leadership of Marc Benioff, Salesforce has achieved remarkable success, becoming the #1 global CRM software provider. Benioff's visionary approach and extensive experience have driven Salesforce's growth and innovation. His commitment to equality and social responsibility has also enhanced the company's reputation and attractiveness as an employer, contributing to its ability to attract and retain top talent.

Salesforce's competitive advantages, or MOATs, include strong brand power, numerous patents protecting its innovative technologies, significant scale and cost advantages, high customer switching costs, and a robust network effect. The company's reputation as a leading CRM provider, combined with its extensive ecosystem of third-party developers and partners, further solidifies its market position. Additionally, Salesforce's ability to attract and retain talent ensures continued innovation and competitiveness.

The CRM market is expected to grow significantly, with a projected compound annual growth rate (CAGR) of 13.9% from 2024 to 2030. Key trends such as hyper-personalization, AI and automation integration, and effective social media customer service are driving this growth. Salesforce is well-positioned to benefit from these trends, offering advanced CRM solutions that enhance customer satisfaction and operational efficiency.

Salesforce faces some risks, including the challenge of retaining top talent, effectively integrating acquisitions, navigating regulatory changes, and maintaining its competitive edge in a highly competitive market. The company's growth strategy relies heavily on acquisitions, which can present integration challenges and financial risks. However, Salesforce's strong cash position and diversified revenue streams provide a buffer against these risks.

Financially, Salesforce has shown impressive revenue growth and operational efficiency. The company has managed to maintain a stable cost structure relative to revenue growth, with decreasing SG&A expenses as a percentage of revenue, indicating improved cost management. Capital expenditure as a percentage of revenue has also declined, suggesting efficient capital use and investment in less capital-intensive growth areas.

Looking ahead, Salesforce's strong market position, diversified revenue streams, and continued focus on innovation and strategic acquisitions provide a solid foundation for sustained growth. The company's ability to adapt to market trends and effectively manage its resources will be crucial in maintaining its competitive edge and delivering value to shareholders.

12. Quality Rating

13. SWOT Analysis

14. Valuation Assessment

Let us crunch some numbers!

DCF: $251.45

Multiple Valuation: $262,58

Benjamin Graham’s Valuation: $224.28

Analysts Average: $295.17

Average of: $258,37

Current Price MA: $247.63

If we compare the average of the four valuations to Salesforce’s current price, Salesforce looks undervalued.

Let me know what you think by leaving a comment!

End note

Thank you for reading this investment case on Salesforce!

With every investment case, I am trying to improve my writing and how I communicate my findings with you all. Because I started not too long ago, some posts might change in layout or other aspects before I find the layout that suits my best wishes; sorry in advance.

As of now, thank you so much for your time! I hope you found some valuable information in this investment case.

Thanks for reading FluentInValue! Subscribe for free to receive new posts and support my work.

Disclaimer

I do not own any Salesforce shares and do not intend to buy any in the next three months.

By reading my posts, being subscribed, following me, and visiting my Substack, you agree to my disclaimer. You can read the disclaimer here.

Well Written Yorrin: I think they will have difficulties to grow. Think it is a sell currently