Hello, friends! 👋

I'm excited to welcome you back to another insightful analysis. Today, we're analyzing ASML, one of the world’s most valuable chip businesses.

If you missed my previous articles, you can catch up on them here:

If you haven't already, consider following me for more FREE content to enhance your investment journey. Whether you're a beginner or an advanced investor, you'll find valuable insights to help you make informed decisions. 😊

Table of contents

Corporate Analysis

1.1 Business Overview

1.2 Revenue BreakdownExecutive Leadership

2.1 CEO Experience

2.2 Employee Satisfaction Ratings

2.3 CEO Value CreationCompetitive and Sustainable Advantages (MOAT)

Industry Analysis

4.1 Current Industry Landscape

4.2 Industry Growth Prospects

4.3 Competitive LandscapeRisk Assessment

Financial Stability

6.1 Asset Evaluation

6.2 Liability AssessmentCapital Structure

7.1 Expense Analysis

7.2 Capital Efficiency ReviewProfitability Assessment

8.1 Profitability, Sustainability, and Margins

8.2 Cash Flow AnalysisGrowth Analysis

9.1 Historical Growth Trends

9.2 Future Growth ProjectionsValue Proposition

10.1 Dividend Analysis

10.2 Share Repurchase Programs

10.3 Debt Reduction StrategiesFuture Outlook

Quality Rating

SWOT Analysis

Valuation Assessment

Conclusion

1. Corporate Analysis

1.1 Business Overview

ASML Holding N.V. develops, produces, markets, sells, and services advanced semiconductor equipment systems for memory and logic chipmakers, including lithography, metrology, and inspection-related systems. The company also provides extreme ultraviolet lithography systems and deep ultraviolet lithography systems, comprising immersion and dry lithography solutions, to manufacture various ranges of semiconductor nodes and technologies.

It also offers metrology and inspection systems, including YieldStar optical metrology solutions to measure the quality of patterns on the wafers and HMI e-beam solutions to locate and analyze individual chip defects. In addition, the company provides computational lithography and software solutions to create applications that enhance the setup of the lithography system and mature products and services that refurbish used lithography equipment and offer associated services.

It operates in Japan, South Korea, Singapore, Taiwan, China, the Netherlands, Europe, the United States, and the rest of Asia. The company was formerly known as ASM Lithography Holding N.V. and changed its name to ASML Holding N.V. in 2001.

ASML Holding N.V. was founded in 1984 and is headquartered in Veldhoven, the Netherlands.

1.2 Revenue Breakdown

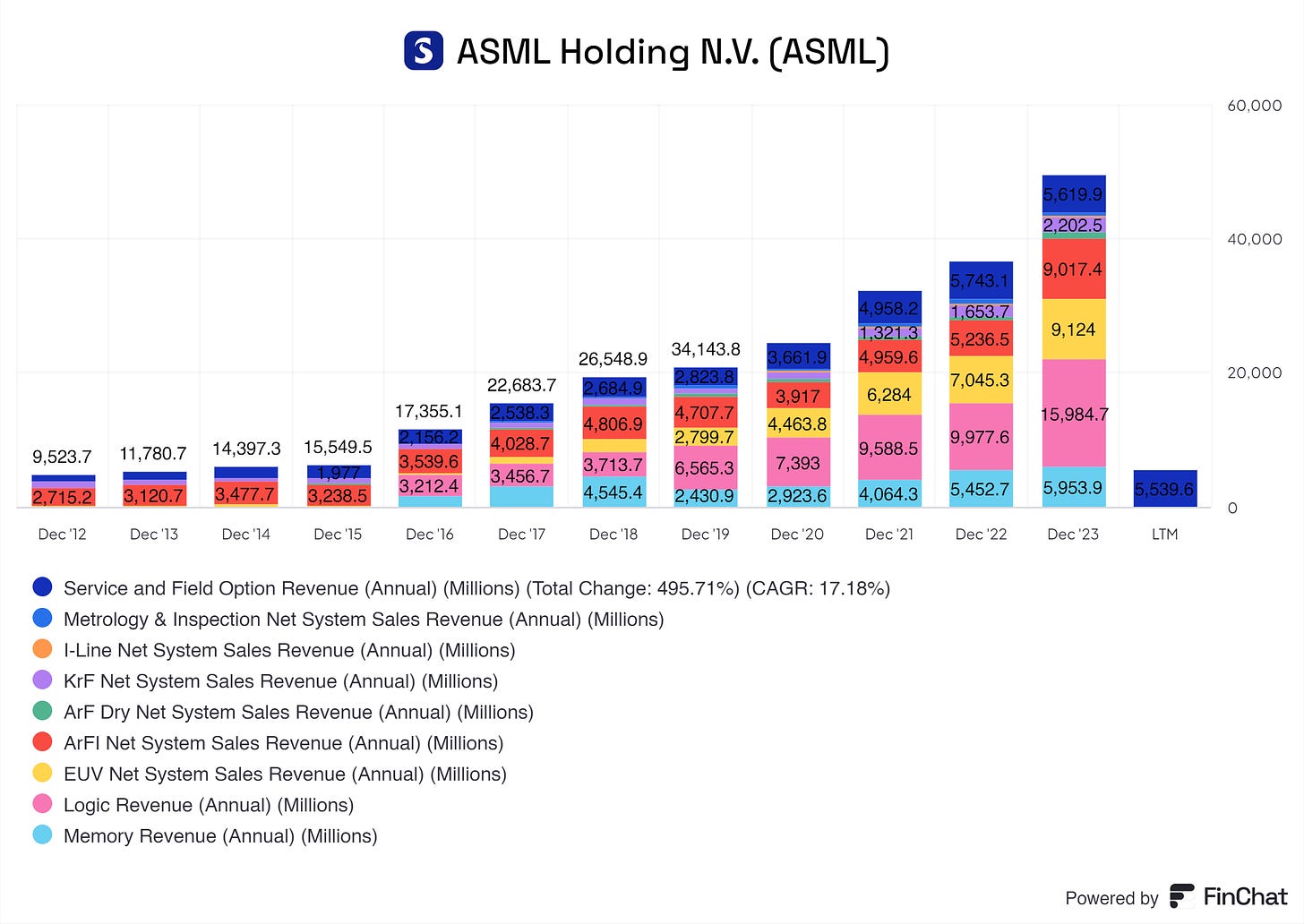

ASML’s revenue drivers are as follows:

Service and Field Option Revenue: Revenue generated from installed equipment maintenance, upgrades, and field options.

Metrology and Inspection: Tools and systems for measuring and inspecting semiconductor wafers.

I-Line Systems: Photolithography systems that use i-line (365 nm wavelength) ultraviolet light.

KrF Systems: Photolithography systems that use Krypton Fluoride (KrF) lasers emitting deep ultraviolet light at 248 nm.

ArF Dry Systems: Photolithography systems using Argon Fluoride (ArF) lasers with a 193 nm wavelength in a dry (non-immersion) environment.

EUV Systems: Extreme Ultraviolet (EUV) lithography systems using 13.5 nm wavelength light.

Logic Revenue: Revenue derived from selling equipment and services to logic chip companies.

Memory Revenue: Revenue from selling equipment and services to companies that produce memory chips.

ArFI Systems: Argon Fluoride Immersion (ArFI) lithography systems use an immersion technique with 193 nm wavelength light.

ASML’s revenue mainly comes from its most advanced EUV chipmaking system. As of 2023, the EUV system accounts for 33.17% of its Total Revenue. This is, of course, because this machine is the most advanced machine in the chip industry. As mentioned in its annual report, this machine's demand is through the roof.

‘‘Our strong order intake in the fourth quarter clearly supports future demand.’’

- Peter Wennink

After the EUV system, the ArFI System follows. The ArFI accounts for 32.72% of its Total Revenue.

Arf Systems accounts for 2.83% of its Total Revenue, the KrF system for 7.99%, and the I-Line for 1.01%.

We can see that ASML has a broad range of revenue streams, focusing mostly on the EUV system, ArFI system, and the Service and Field option (which accounts for 20.39% of its Total Revenue). It is wonderful to see that ASML, an excellent business, is not heavily reliant on one product. In the best case, we see multiple products and the servicing of these products. Due to the complicated nature, warranty and service contracts, training, and certifications of the ASML products, the services are a revenue stream that will not disappear or be outsourced by customers to others.

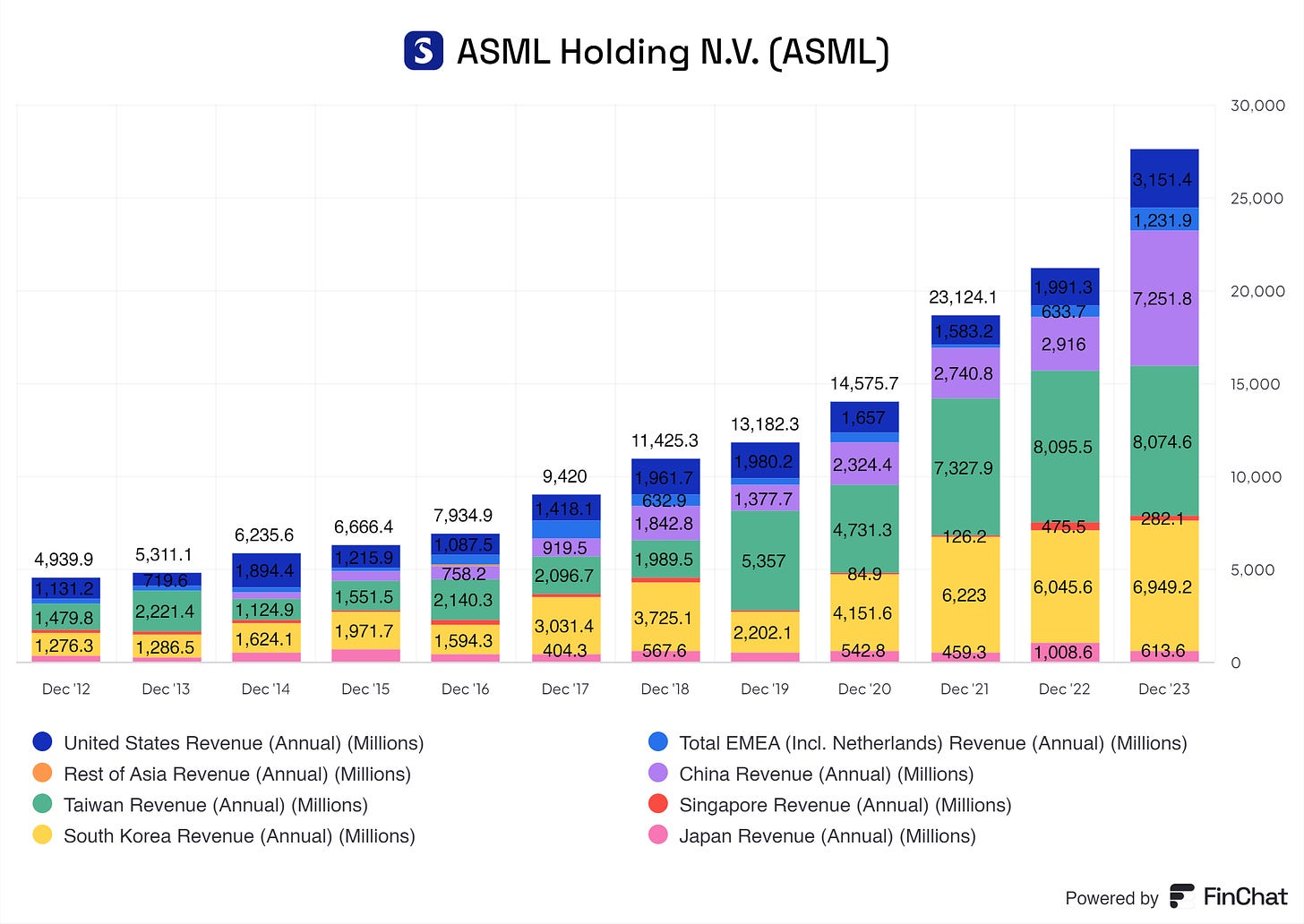

Now, let us look at the revenue by geography and ASML’s customers!

Right off the bat, we can see that Taiwan, China, South Korea, and the United States of America dominate ASML's revenue streams.

Taiwan: If you think of Taiwan, you think of TSMC, and you’re correct! Customers in Taiwan represented 29.3% of ASML’s 2023 total net sales and 38.2% of ASML’s 2022 total net sales. At the end of 2024, ASML will deliver its most advanced EUV system to TSMC. TSMC has always been a big ASML customer.

The United Microelectronics Corporation and Powerchip Technology Corporation are ASML clients in Taiwan.

China: China is a unique story. Due to increasing attention between the USA and China, a ‘‘chip act’’ hinders ASML from providing the EUV system to China. China mainly receives the DUV systems (ArFI System, ArF System, KrF System, and I-Line System). These systems are older but still make or assist in making high-end chips.

Some of ASML's larger clients in China are Semiconductor Manufacturing International Corporation (SMIC), Huahong Group, Yangtze Memory Technologies Co., Ltd. (YMTC), ChangXin Memory Technologies (CXMT), Huali Microelectronics Corporation (HLMC), and SMIC (Silicon Manufacturing Corporation). Customers in China represented 26.3% of ASML’s 2023 total net sales.

South Korea: Customers in South Korea represented 25.2% of our 2023 total net sales and 28.6% of our 2022 total net sales. Some of ASML’s biggest clients in South Korea are Samsung Electronics, SK Hynix, and DB HiTek.

United States of America: When you think of the U.S.A., do you think of Intel? And again, you’re right! Intel Corporation, Micron Technology, and GlobalFoundries are some of ASML's client list names. Customers in the U.S.A. represented 11.59% of ASML’s total net revenue.

In summary, ASML has a broad portfolio of extremely innovative and highly demanded products. These products come with a steady stream of service revenue, which is a wonderful bonus on top of top-line revenue.

In addition, ASML is wonderfully spread out globally. Although immense tensions globally hinder some ASML activities, ASML can provide its clients with machines.

2. Executive Leadership

2.1 CEO Experience

On April 25, 2024, Christophe Fouquet started his new role as ASML’s President and Chief Executive Officer. His four-year appointment term as CEO begins as those of outgoing CEO Peter Wennink and outgoing Chief Technology Officer (CTO) Martin van den Brink come to a close.

Christophe Fouquet started his career at Applied Materials as Global Product Manager. Christophe Fouquet fulfilled this role from 1997 to 2001. After this endeavor, Christophe Fouquet started at KLA-Tencor as Director of Marking from 2003 to 2008.

In 2008, Christophe Fouquet worked with ASML in a Management position in Marketing and Product Management until 2013. After 2013, Christophe Fouquet became the Executive Vice President of Applications and fulfilled this role until 2018. In 2018, Christophe Fouquet became the Executive Vice President of EUV and a member of the Board of Management. Christophe Fouquet did this until 2022. In 2022, Christophe Fouquet fulfilled the role of Chief Business Officer and Member of the Board.

Now, in 2024, Christophe Fouquet is the new CEO of ASML.

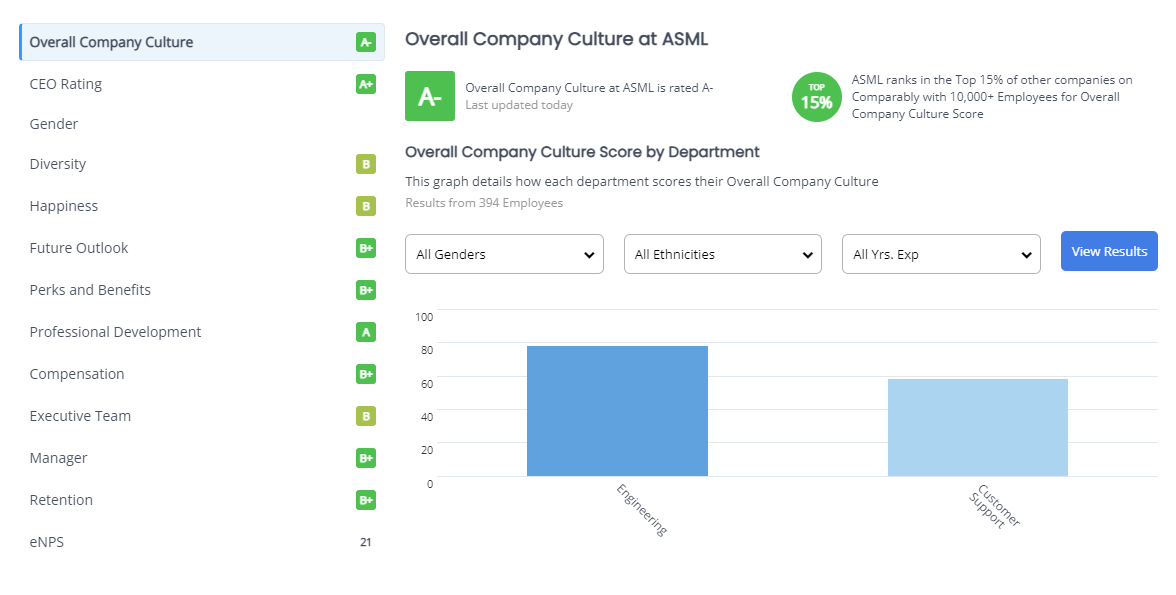

2.2 Employee Satisfaction Ratings

Employee satisfaction tells us a lot about the culture, the CEO, management, the work environment, employee engagement, and more.

From sources like Comparably and Glassdoor, I noticed that the overall sentiment of ASML’s employees is extremely positive. This indicates that ASML is not only a thriving business but also takes care of the people who make it a thriving business.

This high level of happiness, future outlook, CEO rating, compensation, perks, and benefits tells me that ASML can keep its engineers who help it innovate, beating its competition, which is crucial.

2.3 CEO Value Creation

Does Christophe Fouquet create value for the business and its shareholders?

Yes, he does!

Under Peter Wennink’s & Christophe Fouquet's rule, ASML continued to thrive in the market. Even in uncertain times like the pandemic, ASML continued to deliver value by increasing revenue.

3. Competitive and Sustainable Advantage (MOAT)

So, a MOAT can be in either one or more of the following forms:

Brand Power

Patents

Scale and Cost Advantages

Switching Costs

Network Effect

Attracting Talent (I consider this a MOAT, others don’t. Decide for yourself)

Brand Power

ASML’s brand power is substantial due to its technological leadership and reputation for quality. Known globally for producing the most advanced lithography machines, especially in the EUV segment, ASML’s brand symbolizes cutting-edge innovation and reliability. This strong brand presence attracts top-tier customers like TSMC, Samsung, and Intel, further reinforcing its market position and enabling premium pricing for its equipment.

Patents

ASML holds an extensive portfolio of patents that protect its technological innovations. These patents cover crucial aspects of lithography technology, including EUV systems, DUV systems, metrology, and inspection. The company's intellectual property rights create a significant barrier to entry for competitors, ensuring that ASML maintains its competitive edge and continues to lead the market in advanced semiconductor manufacturing technologies.

‘‘Patents are a way to protect ASML’s R&D investments from unauthorized use by third parties, including exploitation by our competitors, customers, suppliers and co-developers. We innovate and develop our technology with our ecosystem partners, which comprise many different companies and institutions, each of which requires a dedicated way of dealing with intellectual property matters.’’

Source: Annual report ASML

Scale and Cost Advantages

ASML benefits from significant scale and cost advantages. As the largest supplier of photolithography equipment, ASML achieves economies of scale in production, R&D, and procurement. This scale allows ASML to spread its high R&D costs over a larger revenue base, reducing per-unit costs. Additionally, ASML’s ability to invest heavily in cutting-edge technology development keeps it ahead of smaller competitors who lack similar financial resources.

Switching Costs

Switching costs for ASML’s customers are exceptionally high. Semiconductor manufacturers integrate ASML's machines deeply into their production lines, requiring substantial customization, training, and maintenance investment. Switching to another supplier would involve financial costs, potential disruptions in production, and significant time to requalify new equipment. This creates a strong incentive for customers to remain with ASML.

Network Effect

While ASML's business does not exhibit a traditional network effect like social media platforms, it does have an indirect network effect. The widespread adoption of ASML’s equipment by leading semiconductor manufacturers creates a de facto industry standard. As more companies use ASML machines, a larger pool of expertise and support infrastructure develops around these systems, further enhancing their attractiveness to other manufacturers.

Attracting Talent

ASML’s reputation as a leader in semiconductor manufacturing technology helps it attract top talent from around the world. The company allows employees to work on cutting-edge technologies and solve complex engineering challenges. This ability to attract and retain highly skilled professionals ensures that ASML remains at the forefront of innovation, maintaining its competitive edge. While some might not consider talent attraction a traditional moat, for a high-tech company like ASML, having a continuous influx of top-tier talent is critical to sustaining its leadership and driving future growth.

‘‘One of the reasons why so many talented people choose ASML as an employer is because we give them the opportunity to work at the sharp end of technology and make a real difference, while also supporting their health and well-being. We put a lot of effort into this, providing our employees with opportunities and the best environments to develop their talent, to feel respected and to thrive’’

- Peter Wennink

4. Industry Analysis

4.1 Current Industry Landscape

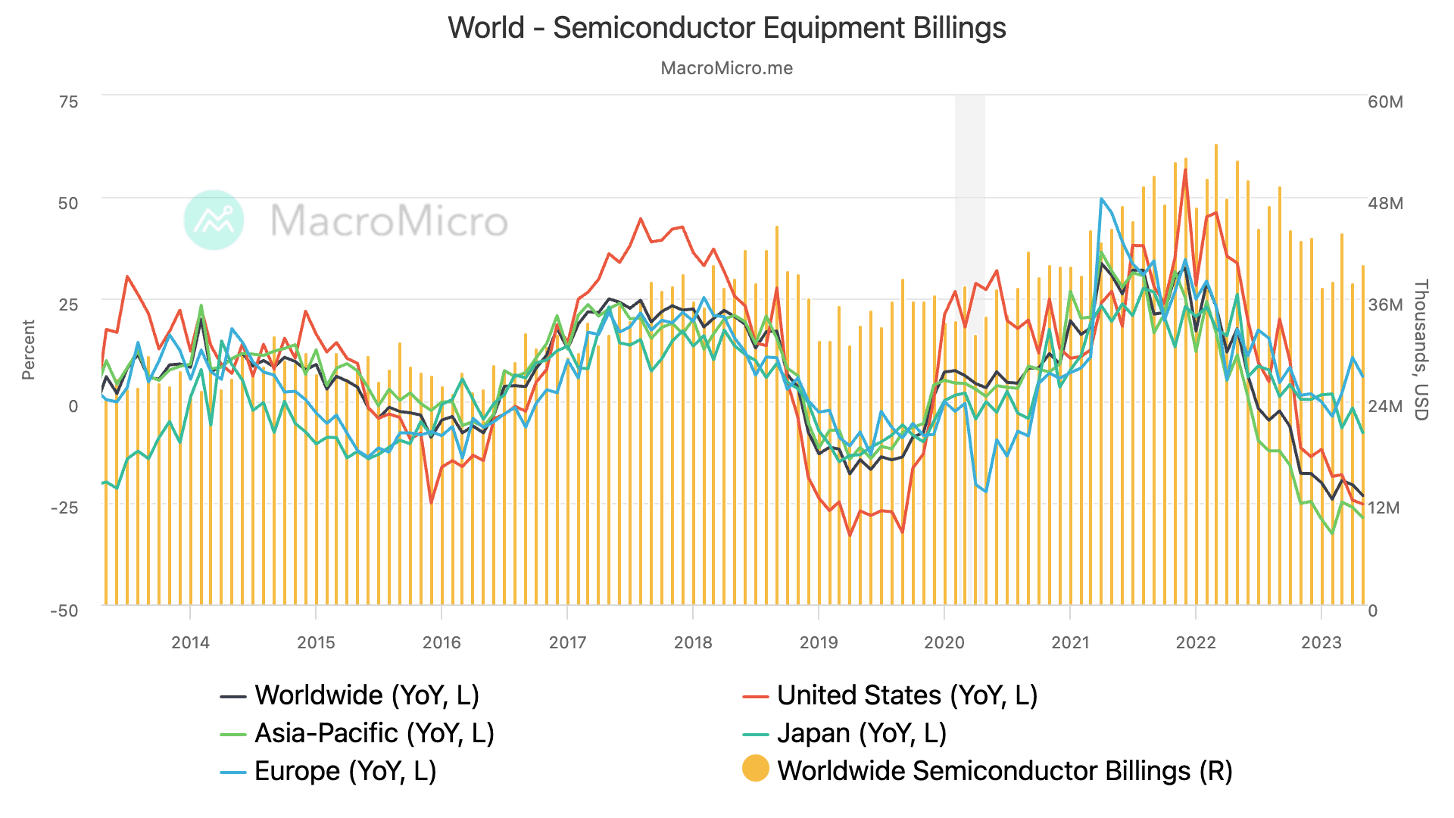

The semiconductor industry has always been extremely competitive and cyclical. There’s a lot of demand for ASML’s products now, but ASML and investors are well aware that, due to its cyclicality, demand could easily die down for a period before picking back up again.

‘‘We also face competition from new competitors with substantial financial resources, as well as from competitors driven by the ambition of self-sufficiency in the geopolitical context. Furthermore, we face competition from alternative technological solutions or semiconductor manufacturing processes.’’

ASML is well aware of its current competitors and how they’re impacting the industry as a whole, further stating:

‘‘We also compete with providers of applications that support or enhance complex patterning solutions, such as Applied Materials Inc. and KLA-Tencor Corporation. These applications effectively compete with our Applications offering, which is a significant part of our business.’’

According to ASML, the semiconductor industry is working through the bottom of the cycle.

As shown above, if we examine the previous year more closely, we can see the bottom of the cycle and the potential for upward movement in demand. Of course, cyclicality is unpredictable, and the past does not guarantee future outcomes, but it is something we can hold on to.

Multiple sources, such as ASML, KLA, Canon, and other competitors, have also noticed that we might be experiencing a turnaround. This could indicate that the ‘‘bottom’’ has been reached.

Even though we’re at the bottom of the curve, there's still sufficient demand for ASML's products.

If we could see this turn-around soon, we might also be in for a big one.

4.2 Industry Growth Prospects

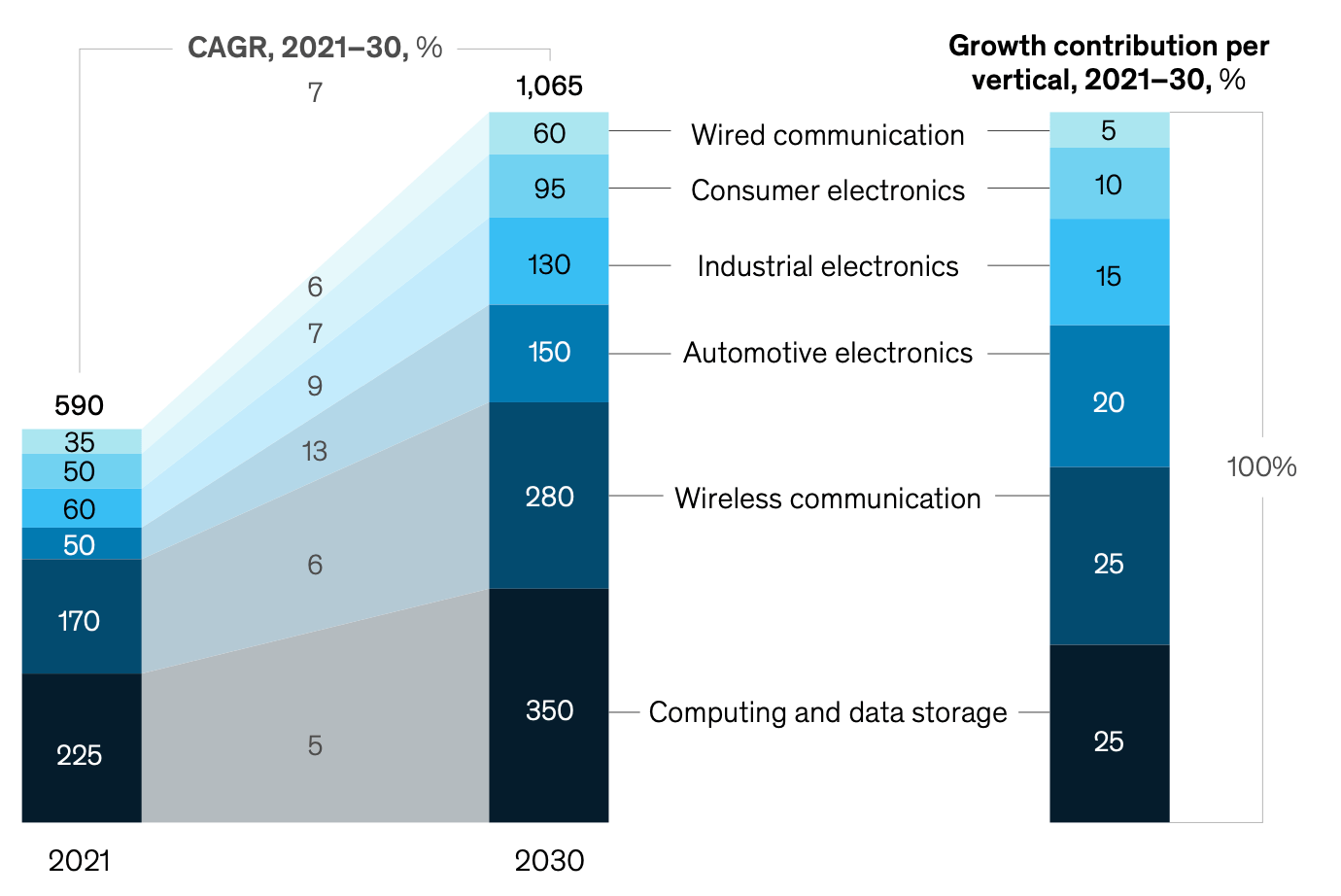

The global semiconductor market is valued at around $611.35B, while the 2022 market size was $590B, a YoY growth of 3.62%. With a possible turn-around around the corner, aiming for a market size of $1.065B doesn’t seem out of the ordinary and is very much possible. Some analysts even argue that the $1T might be hit as soon as 2028, which sounds reasonable. Of course, this might slip a few years due to supply chain constraints and geopolitical forces.

“If you take automotive, for example, we questioned what the car in 2030 looks like,” said Ondrej Burkackey, senior partner at McKinsey & Co. and one of the firm’s Semiconductors and Business Technology practice leaders. “We expect that silicon content per car will double by 2030. Any new functionality, such as driver-assistance features — it doesn’t have to be full autonomy — needs more semiconductors.

The largest chunk comes from computing and data storage. Today, roughly 40% of the industry is in computing and data storage. If this sector grew by a mere 5%, it could contribute around $400B. The second largest segment accounts for roughly 30% of the total: wireless communication, your beloved phone. These segments will grow substantially due to innovation, demand, and consumer needs. Most of this is fueled, of course, by new features.

The semiconductor industry is expected to grow substantially.

4.3 Competitive Landscape

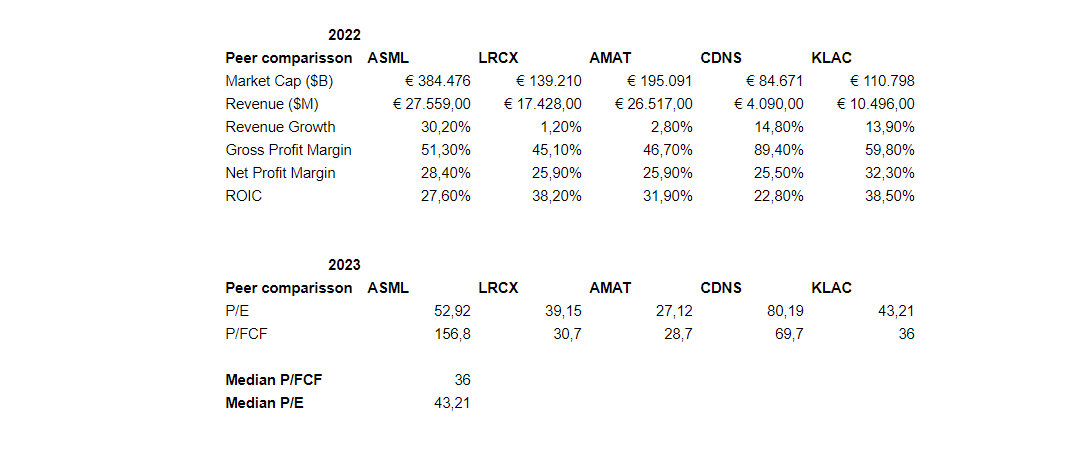

I identify Lam Research (LCRX), Applied Materials (AMAT), Cadence Design Systems (CDNS), and KLA (KLAC) as ASML’s main competitors, so I’ll discuss them here. Although these firms do not sell EUV technology, I guess that it will not take much longer before the competitors catch up to ASML. Multiple companies, like the Chinese firm SMIC, have been coming forward to release EUV soon.

We're painting a better picture if we compare ASML to its competitors on some basic metric.

Regarding market capitalization and revenue, ASML leads the pack with a market cap of €384.476 billion and revenue of €27.559 billion in 2022. While Applied Materials (AMAT) is a strong contender with a market cap of €195.091 billion and revenue of €26.517 billion, it is not far behind ASML. Other competitors like Lam Research (LRCX), Cadence Design Systems (CDNS), and KLA Corporation (KLAC) also show significant market presence but lag behind ASML and AMAT.

ASML significantly outperformed its competitors in revenue growth, achieving a 30.20% increase in 2022. This is notably higher than LRCX’s 1.20%, AMAT’s 2.80%, CDNS’s 14.80%, and KLAC’s 13.90%. This impressive growth rate underscores ASML’s mighty business model and market demand for its products, particularly in the advanced lithography sector.

ASML boasts a gross profit margin of 51.30%, placing it in a strong position among its peers. However, CDNS leads with an impressive 89.40% gross profit margin, followed by KLAC at 59.80%. Despite this, ASML’s net profit margin of 28.40% remains competitive, with LRCX at 25.90%, AMAT at 25.90%, CDNS at 25.50%, and KLAC at 32.30%. These figures indicate that while ASML is profitable, there is variability in margin performance across the industry.

ASML’s ROIC of 27.60% is solid but not the highest among its peers. KLAC leads with an ROIC of 38.50%, followed by LRCX at 38.20% and AMAT at 31.90%. CDNS’s ROIC is 22.80%, showing a diverse range of efficiency in capital utilization among these companies. ASML’s strong ROIC indicates efficient use of its capital investments, contributing to its profitability.

In 2023, ASML's Price-to-Earnings (P/E) ratio stands at 52.92, which is higher than LRCX’s 39.15, AMAT’s 27.12, CDNS’s 80.19, and KLAC’s 43.21. The Price-to-Free Cash Flow (P/FCF) ratio for ASML is 156.8, significantly higher than its competitors, with LRCX at 30.7, AMAT at 28.7, CDNS at 69.7, and KLAC at 36. The median P/FCF and P/E for the group are 36 and 43.21, respectively. ASML’s higher valuation ratios suggest investors are willing to pay a premium for its stock, likely due to its growth prospects and market leadership.

ASML operates in a CAPEX and R&D-intensive industry, requiring substantial capital for continuous innovation and expansion. Despite its strong financial metrics, the competitive landscape is fierce. Companies like AMAT are catching up, and any missteps by ASML could result in a loss of market share. Maintaining its leadership will require ASML to continue its heavy investments in research and development while managing operational efficiencies.

5. Risk Assessment

Like any other business, ASML carries its fair share of risks. Let's examine the potential risks. Here, I discuss risks that I think might carry some weight.

Competition

The semiconductor industry is competitive. If you lack research and development, you’re replaced within a heartbeat. With all competitors increasingly aiming for better DUV and EUV systems, ASML’s position could be threatened, and its margins and sales could be impacted. ASML’s competitors all have vast amounts of capital and patents, making them horrible to have as competitors.

Geopolitical

ASML is receiving considerable attention from governments worldwide, with the USA being a major obstacle. For instance, the USA limits ASML's sales in China, preventing ASML from doing more business with China. ASML also relies on export licensing from the Dutch government. Any considerable issues with the licensing and ASML will be impacted. Due to the global geopolitical tension, ASML is on everybody’s radar for sanctions, limitations, and more.

Customer Dependency

Even though ASML has a broad portfolio of products and operates globally, historically, it has sold a substantial number of systems to customers in limited numbers. AML’s largest customer amounted to €8,772.9 million, or 31.8% of total net sales in 2023, compared with 7,046.9 million, or 33.3% of total net sales in 2022. In 2023, 53.9% of total net sales were made to two customers.

Any impact that might result in the loss of these customers could adversely impact ASML’s top—and bottom-line revenue.

6. Financial Health

6.1 Assets Assessment

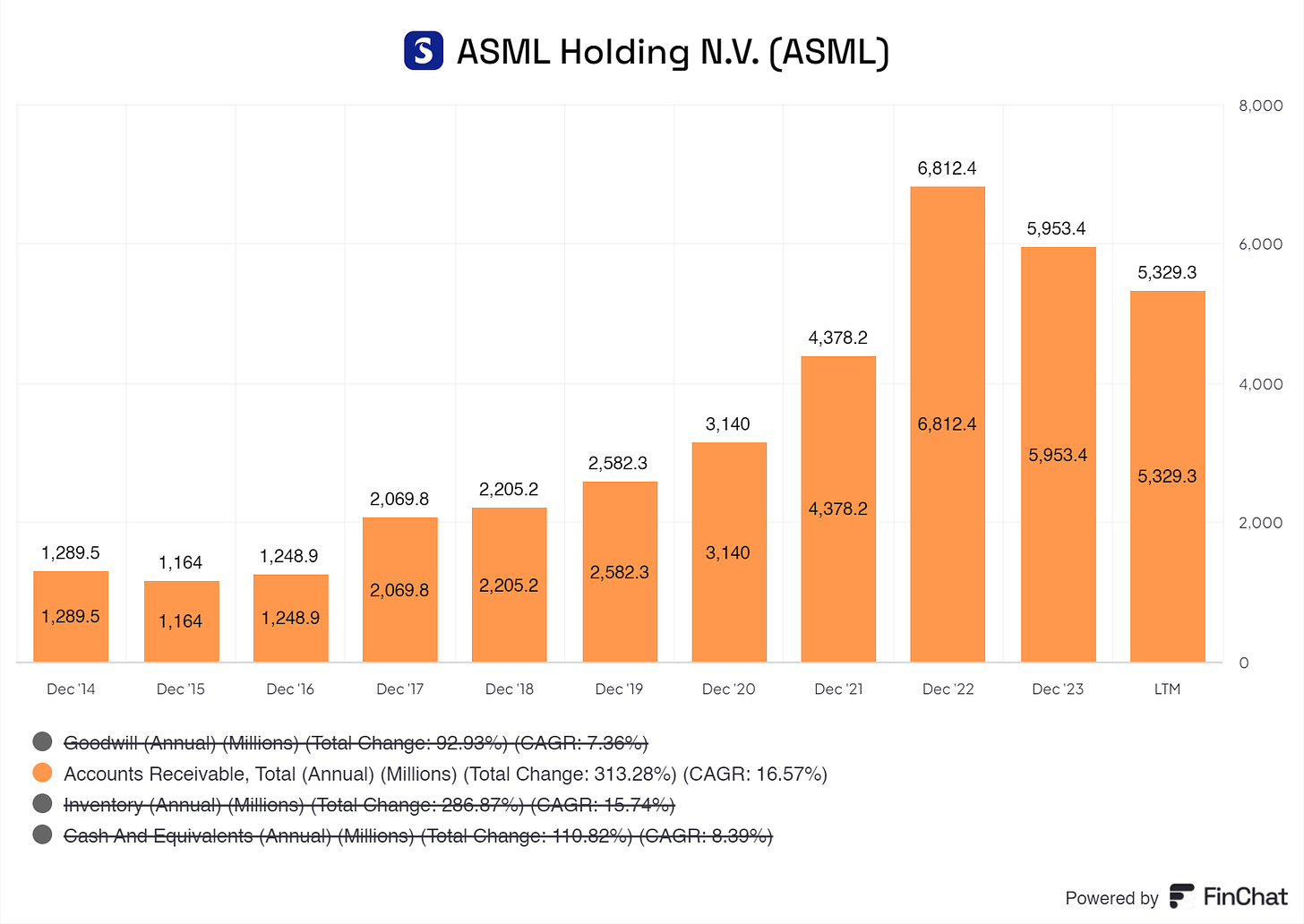

Looking at ASML's assets, I notice a few things; let's discuss them.

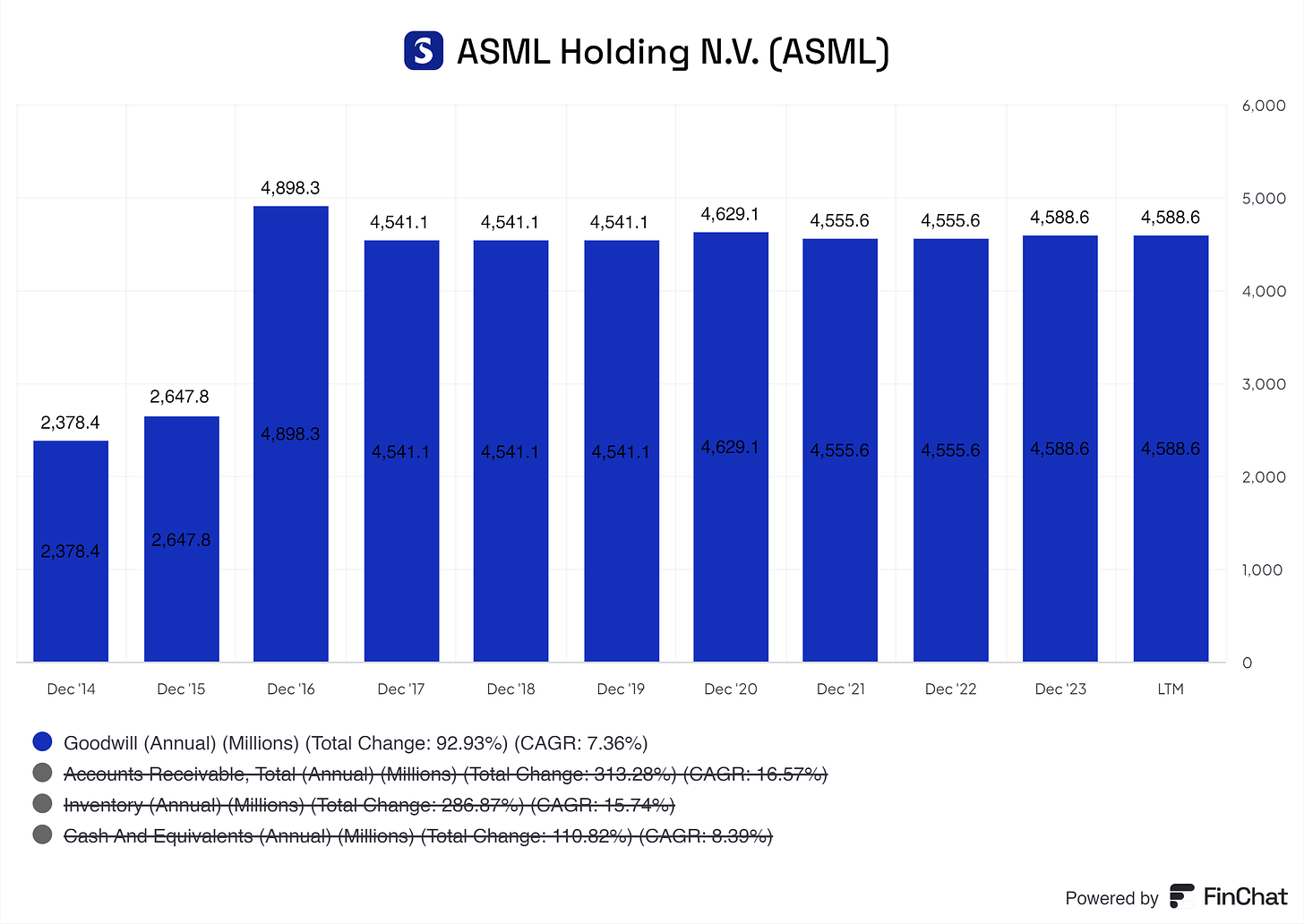

Goodwill: ASML has made acquisitions and paid some premiums for these acquisitions; those are goodwill.

In 2023, they concluded the acquisitions of EO Technical Solutions, LLC (PAS 5500 parts repair company) and part of the semiconductor equipment activities from Philips Engineering Solutions; this resulted in a Goodwill increase of roughly 33M. ASML is not new to acquisitions. In November 2012, ASML acquired Cymer; in July 2016, ASML acquired Hermes Microvision Brion Technologies in January 2006. We still see the Goodwill from some of the acquisitions on the balance sheet.

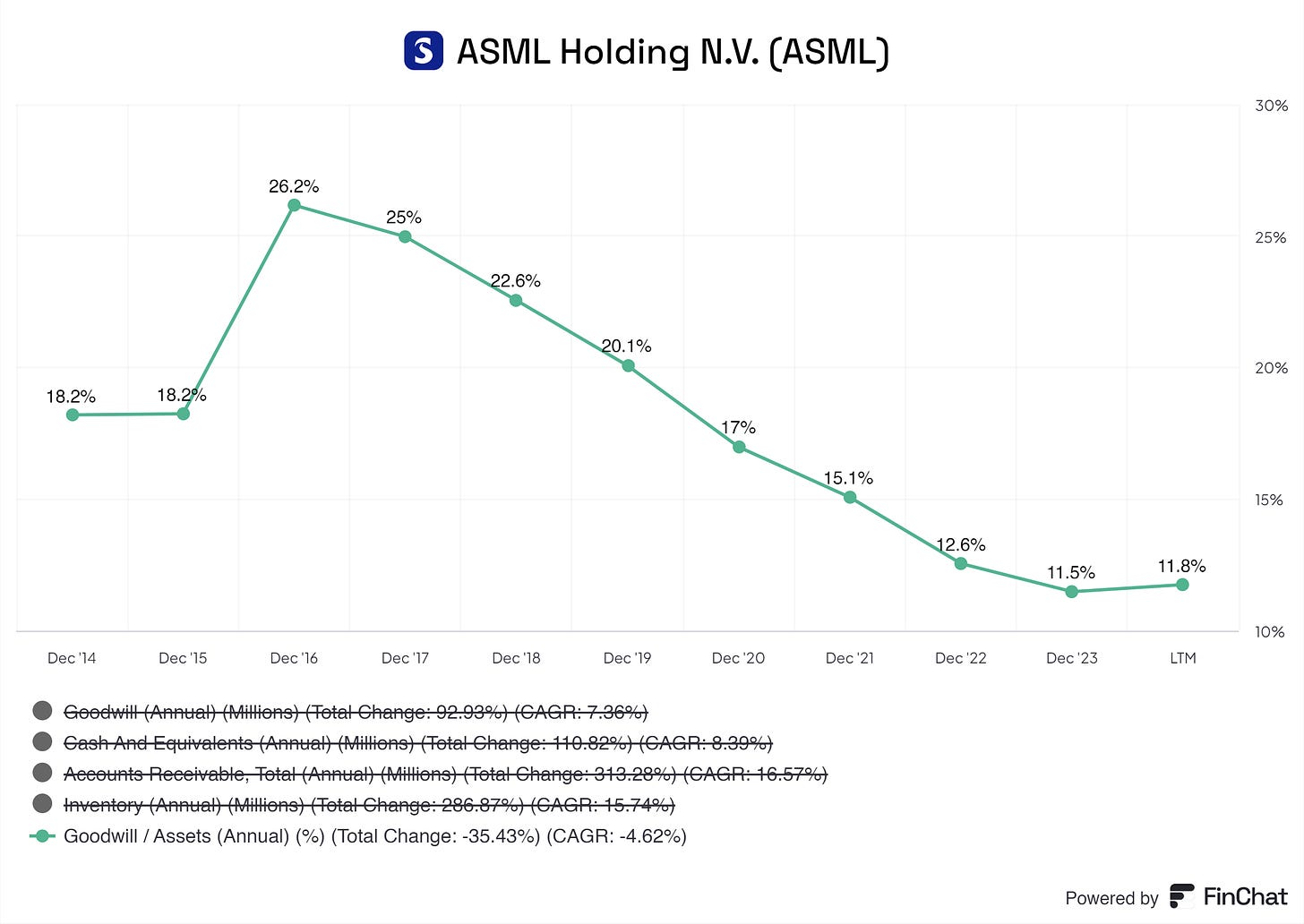

Thankfully, the Goodwill-to-asset ratio is dropping below 20%. In my investable universe, I prefer businesses with a Goodwill-to-asset ratio below 20%, and ASML fits the criteria.

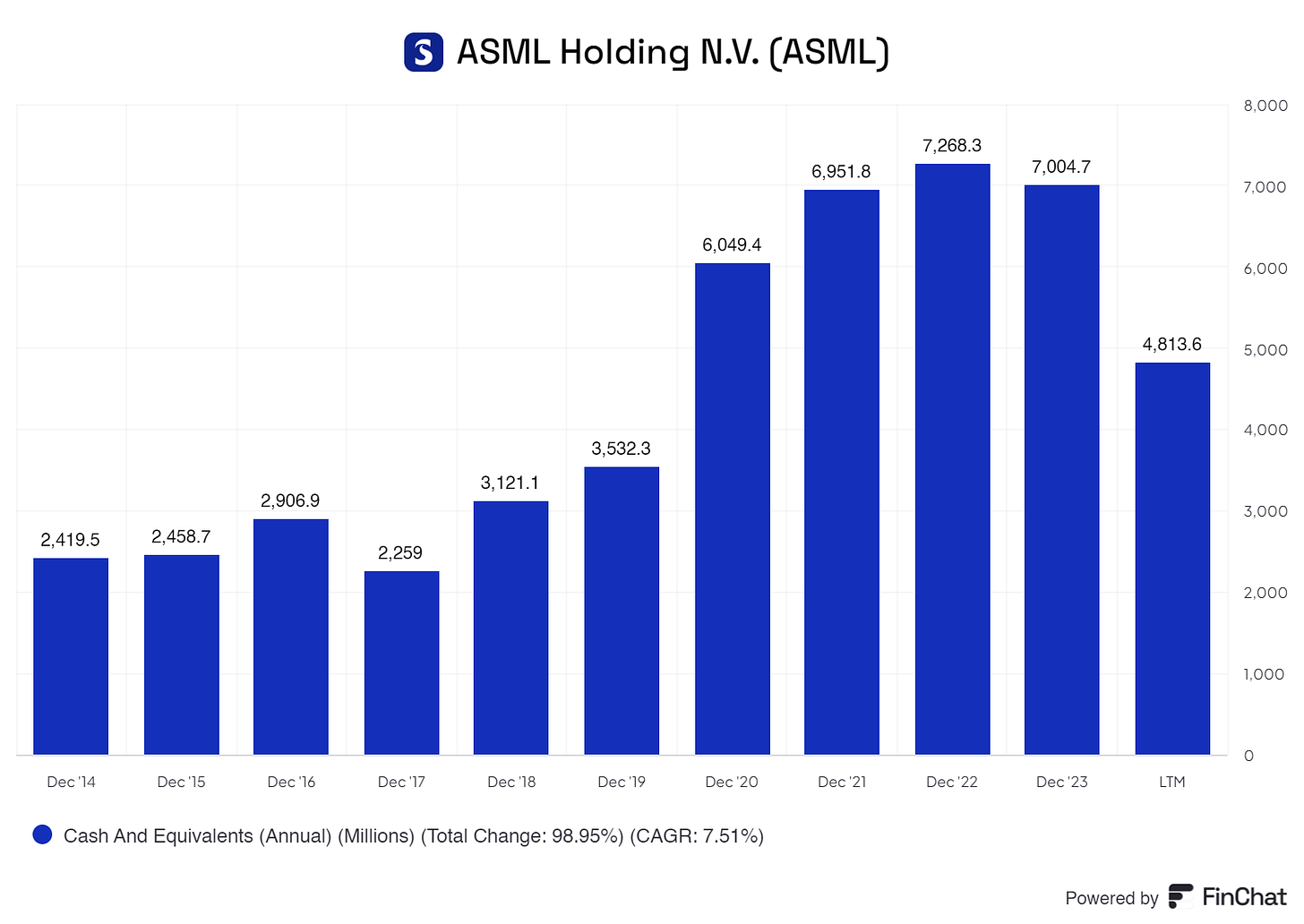

Cash And Equivalents: from 2022 to 2023, we see a YoY decrease of (3.63%). This is due to an increase in inventory and reducing contract liabilities. This is a good use of cash, and I do not mind a cash drop.

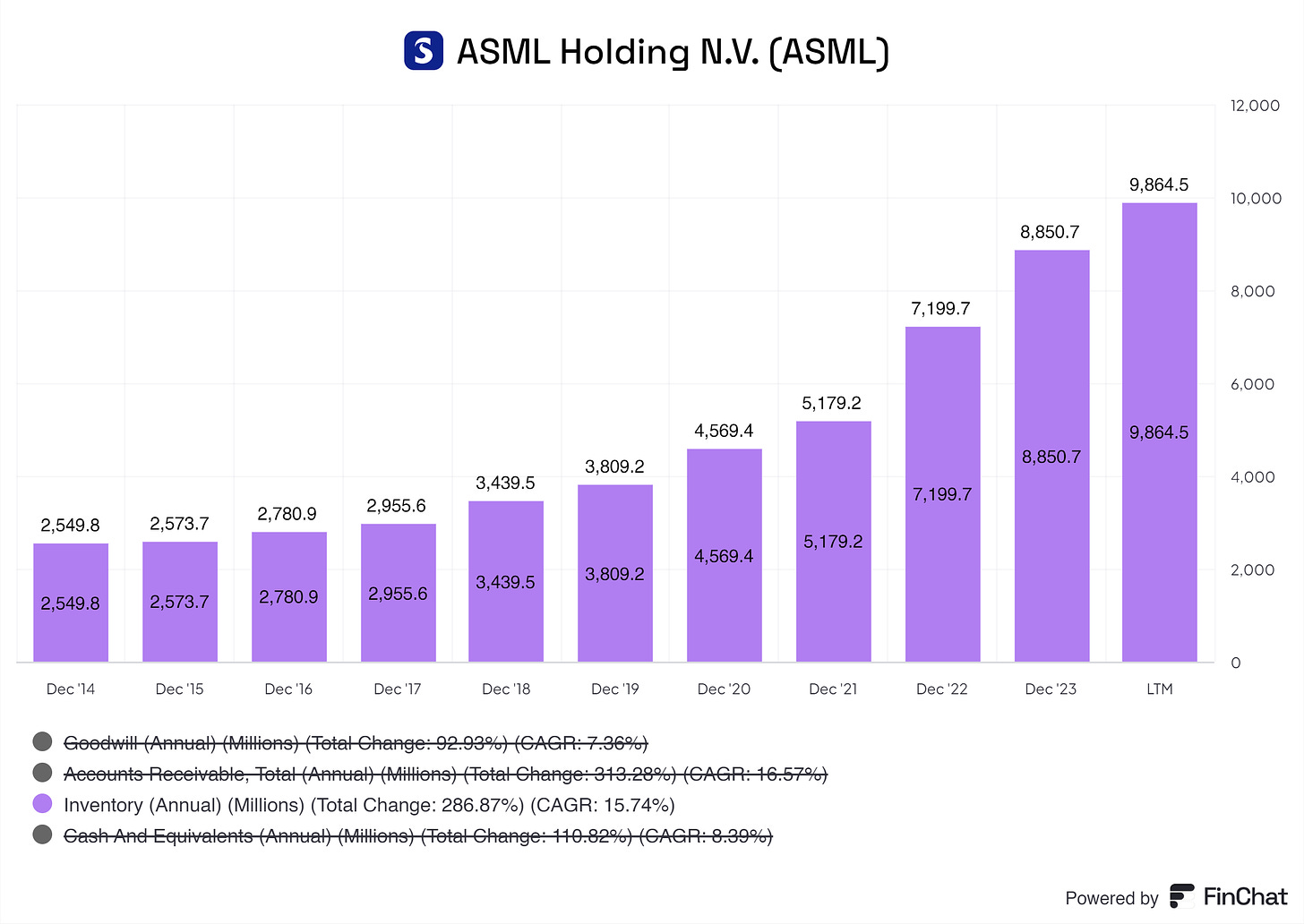

Inventory: As I’ve mentioned, inventory is growing due to investments made to improve it. ASML has a big backlog of orders, and the increase in inventory allows for the fulfillment of these orders and preparation for coming orders. As mentioned earlier, demand might skyrocket again, and ASML is positioning itself rather well for this expectation. The risks of inventory, obsolescence, or increased holdings costs diminish if the demand does rally as expected.

Accounts Receivables: This indicates that ASML is selling more and more on credit. Of course, this could be part of ASML’s growth strategy but should be managed accordingly. Luckily, we see this management from 2022 forward.

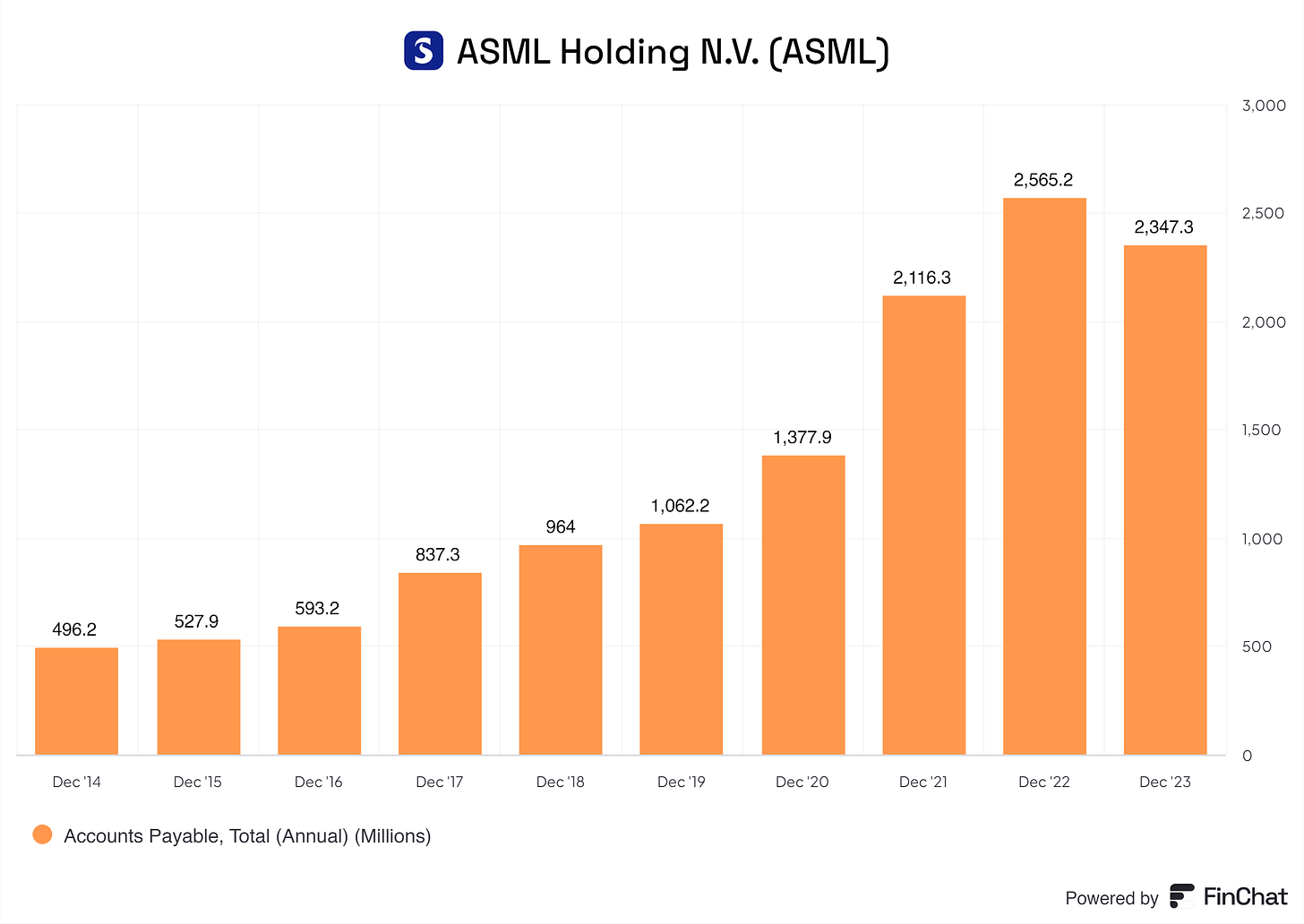

6.2 Liabilities Assessment

Account Payable: ASML is growing and investing in growth, so seeing Account Payable grow is expected. This indicates that ASML has negotiated favorable payments with its suppliers, allowing it to manage its cash flows more efficiently. Increasing accounts payable can be a strategic move to optimize cash flow. By extending payment terms, ASML can preserve cash for other strategic investments or operational needs.

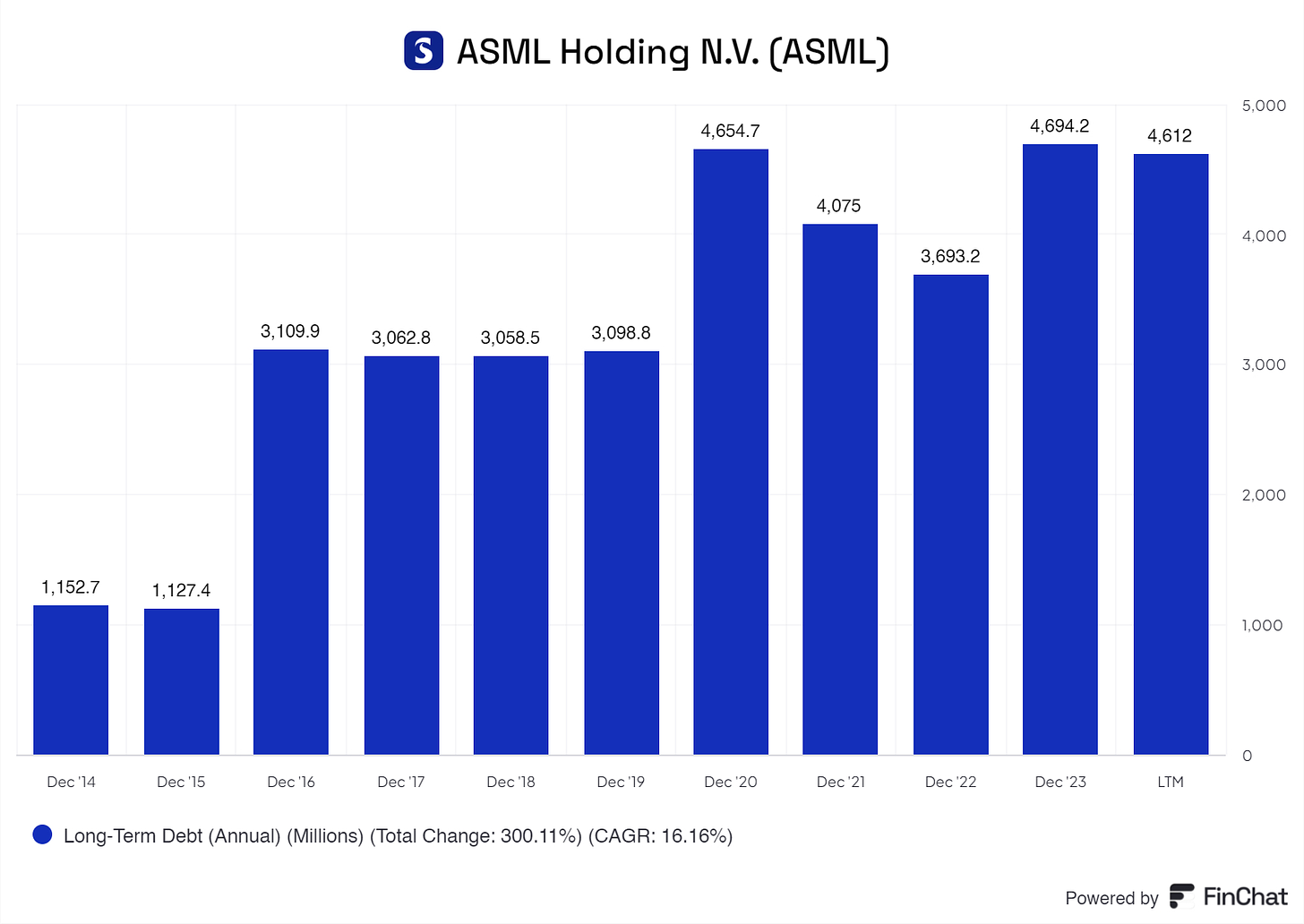

Long-Term Debt: The increase in long-term debt likely reflects ASML's investments in expanding its production capacity to meet growing demand for its lithography systems, particularly EUV (Extreme Ultraviolet) lithography machines.

ASML appears to be strategically using debt to finance its growth initiatives. By leveraging debt, ASML can invest in key areas without diluting shareholder equity. The variability in debt levels over the years suggests active debt management. For example, the debt decreased in 2021 to €4,075 million from €4,654.7 million in 2020, indicating possible repayment or refinancing activities.

7. Capital Structure

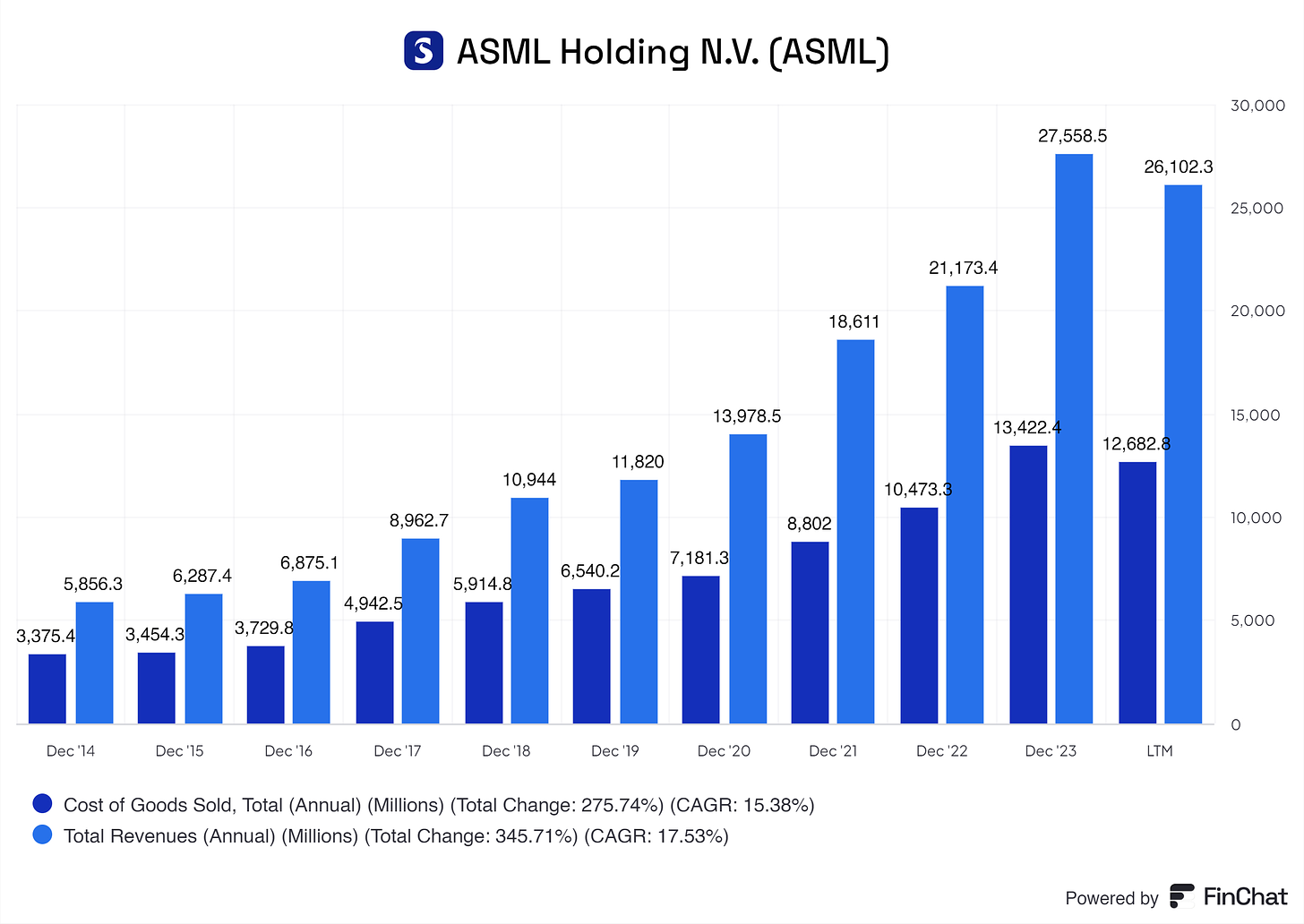

7.1 Expense Analysis

ASML’s business is CAPEX heavy, requiring a lot of COGS and Capital Expenditures to support its operations.

As shown in the graph above, COGS sales comprise a large portion of ASML’s total sales. LTM COGS takes up 48.59% of total sales. In 2023, COGS was 48.70% of ASML’s sales; in 2022, it was 49.46%; in 2021, 47.29%; in 2020, it was 51.37%; and in 2019, it was 55.33%. We’re seeing that ASML is becoming more efficient and reducing its COGS-to-sales ratio. In the semiconductor industry, the average COGS-to-sales ratio is about 50%, and ASML aligns with the average. That’s wonderful news. For ASML, staying in this range is perfect for the next 5 years.

This cost is mainly due to the complexity of machines and the high level of skill required in their production.

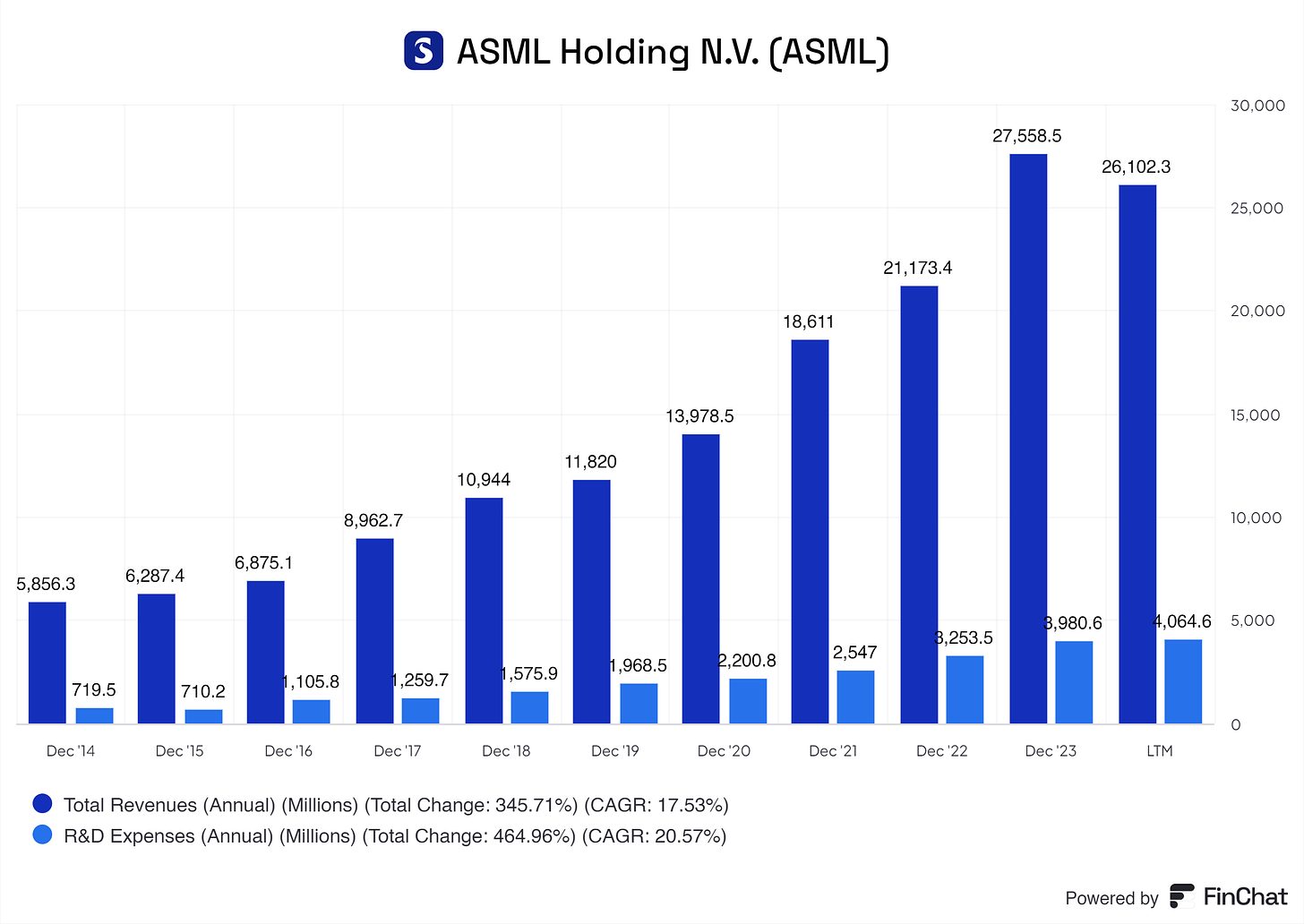

Another driver of ASML’s capital expenses is R&D.

R&D is an expense that could use some attention in some businesses, but not for ASML. ASML needs to invest substantial cash into research to remain the industry leader. LTM R&D took up 15.57% of Total Revenue in 2023. This was 11.81% in 2022, 12.03% in 2021, 11.83% in 2020, 14.08% in 2019, and 13.33% in 2019.

ASML mentioned to keep its R&D level in between the 10-15% range of its sales, with Martin A. van den Brink saying

‘‘We aim for R&D spend to be in the 10-15% range of revenue. As our revenue increases rapidly, so too does our financial commitment to supporting innovation – in 2023, we invested €4.0 billion in R&D. Of that amount, we spend around 10% on pure explorative research that aims to fill the innovation pipeline. We continue to work with our partners, for example by investing in a high-transmissive illuminator with ZEISS.’’

- Martin A. van den Brink

ASML is dedicated to spending enough capital on research and development to keep ahead of its competition.

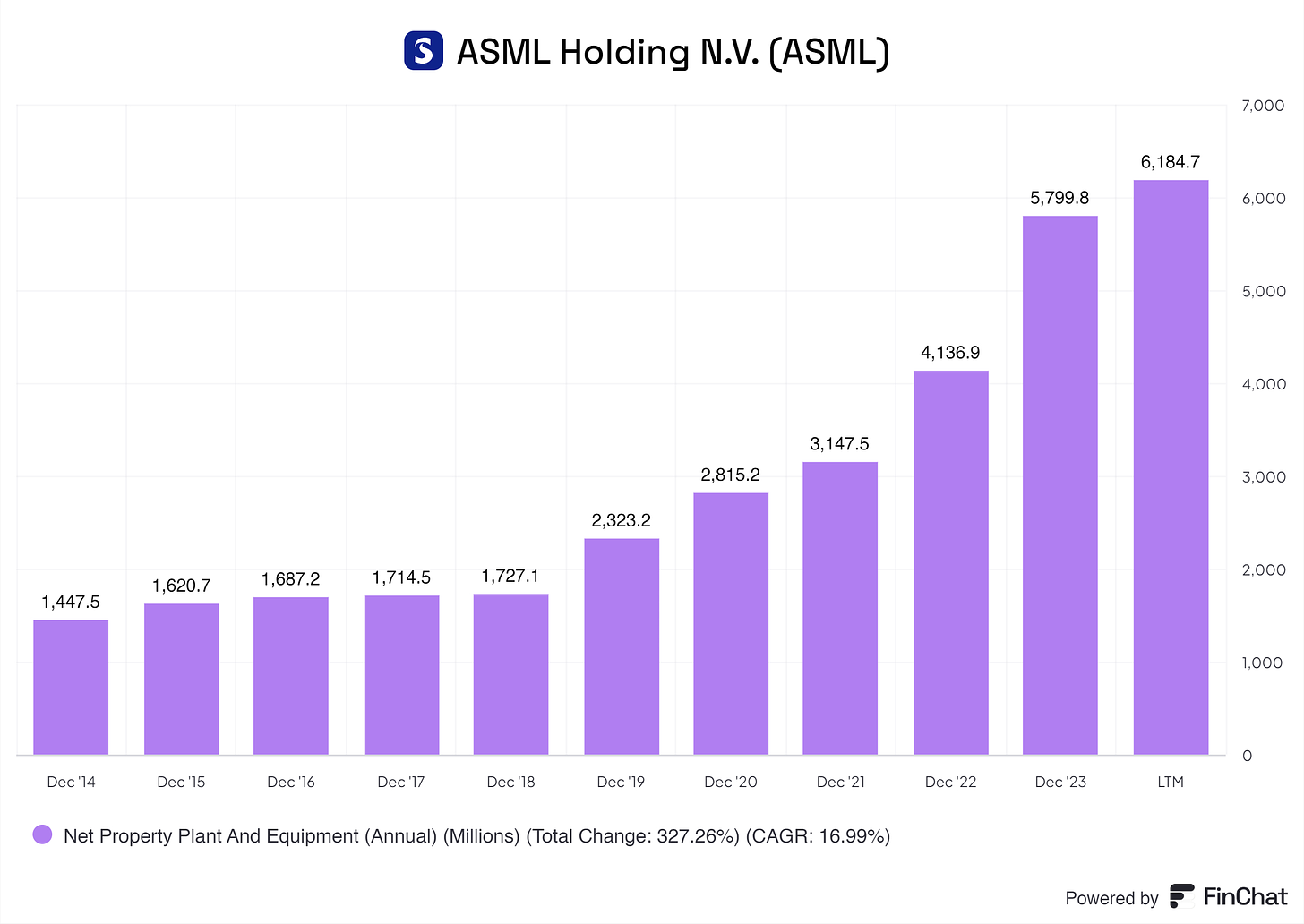

CAPEX

ASML’s main capital expenditure is PPE purchases.

ASML said the following in its annual statement about PPE

‘‘Capital expenditures in 2023 increased compared to 2022 and relates to the expansion and upgrades of facilities, prototypes, evaluation and training systems. We expect that our capital expenditures (purchases of property, plant and equipment) in 2024, will be approximately €2.1 billion. These expenditures are expected to mainly consist of further expansion and upgrades of facilities. We expect to finance these capital expenditures through cash generated by operations and existing cash and cash equivalents.’’

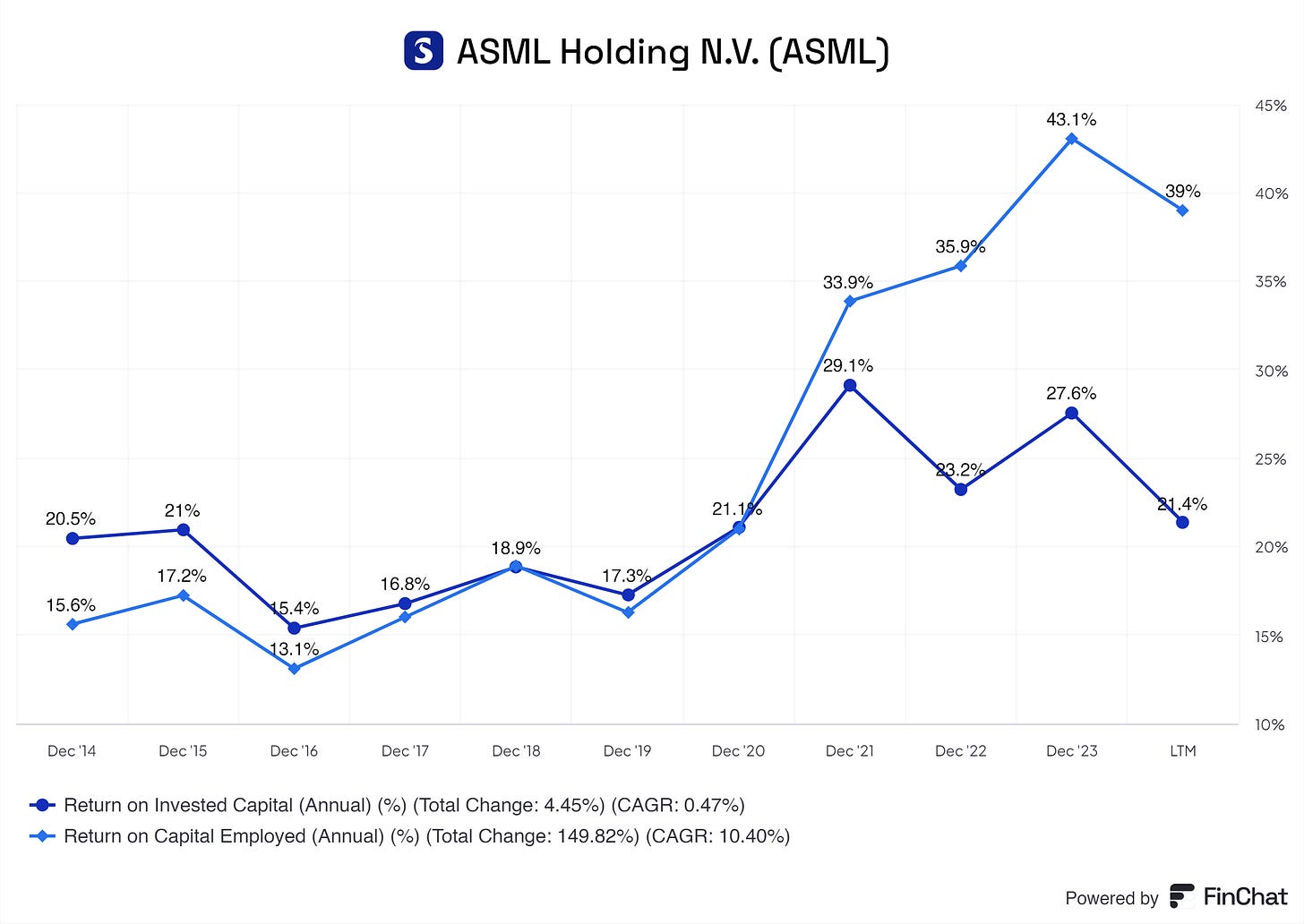

7.2 Capital Efficiency Review

In ASML’s case, I prefer looking over the business' ROIC and ROCE.

ASML has a solid track record of improving its ROIC and ROCE. In short, this tells me that ASML’s management can deploy cash on profitable projects that create excellent shareholder and business returns. Although we see a smaller decline in the short term, overall, ASML is still beating the S&P 500 average of 13% and above my threshold of 20%. Excellent metrics!

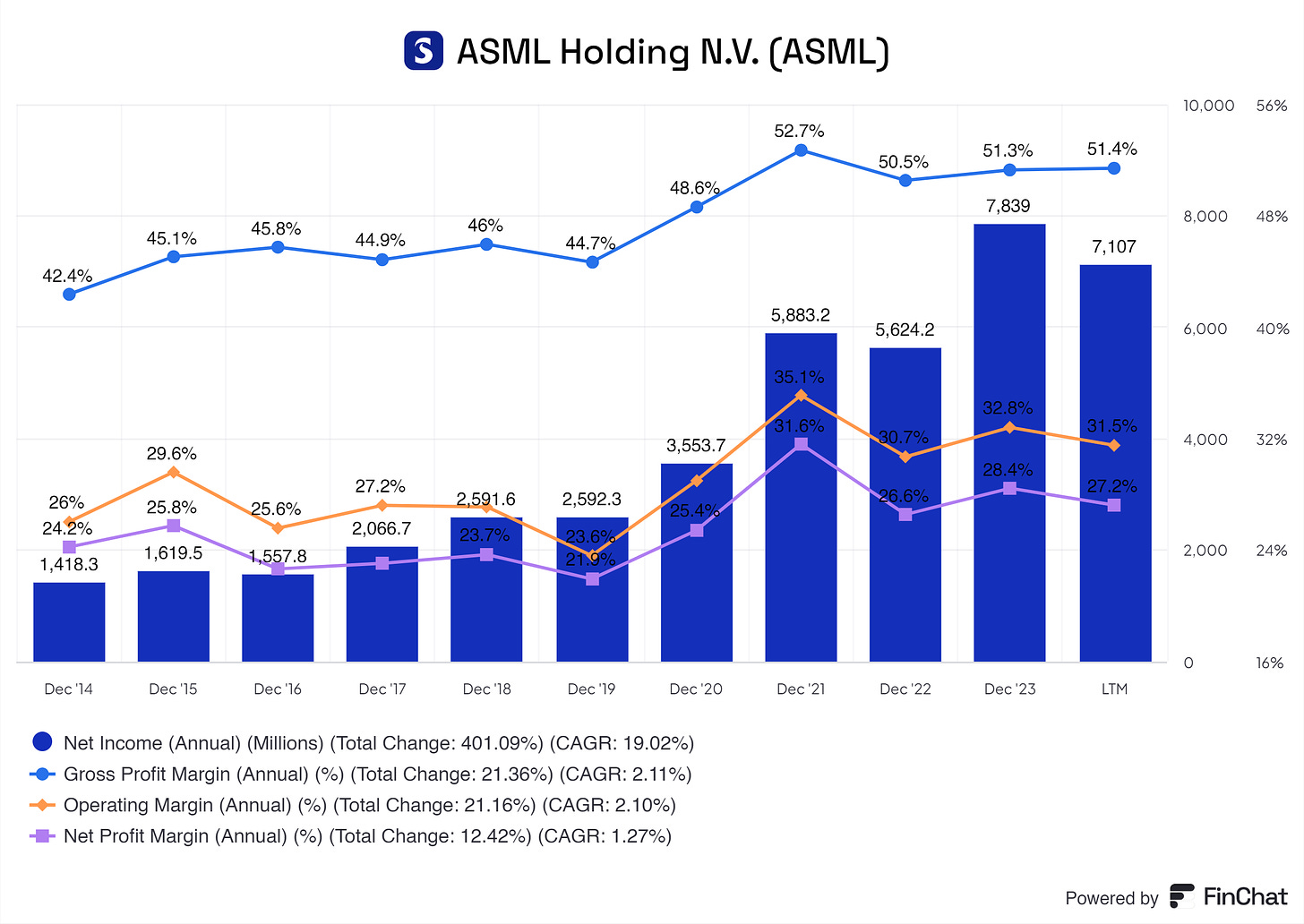

8. Profitability Assessment

8.1 Profitability, Sustainability, and Margins

ASML's Net Income, Gross Profit Margins, Operating Margins, and Net Profit Margins show excellence across the board. If we compare these to the competitors' averages, ASML fits theirs. If I were a shareholder of ASML, I would not be worried about its profitability or margins. These margins are sustainable if ASML keeps investing to maintain its position. The margins are on par with the industry.

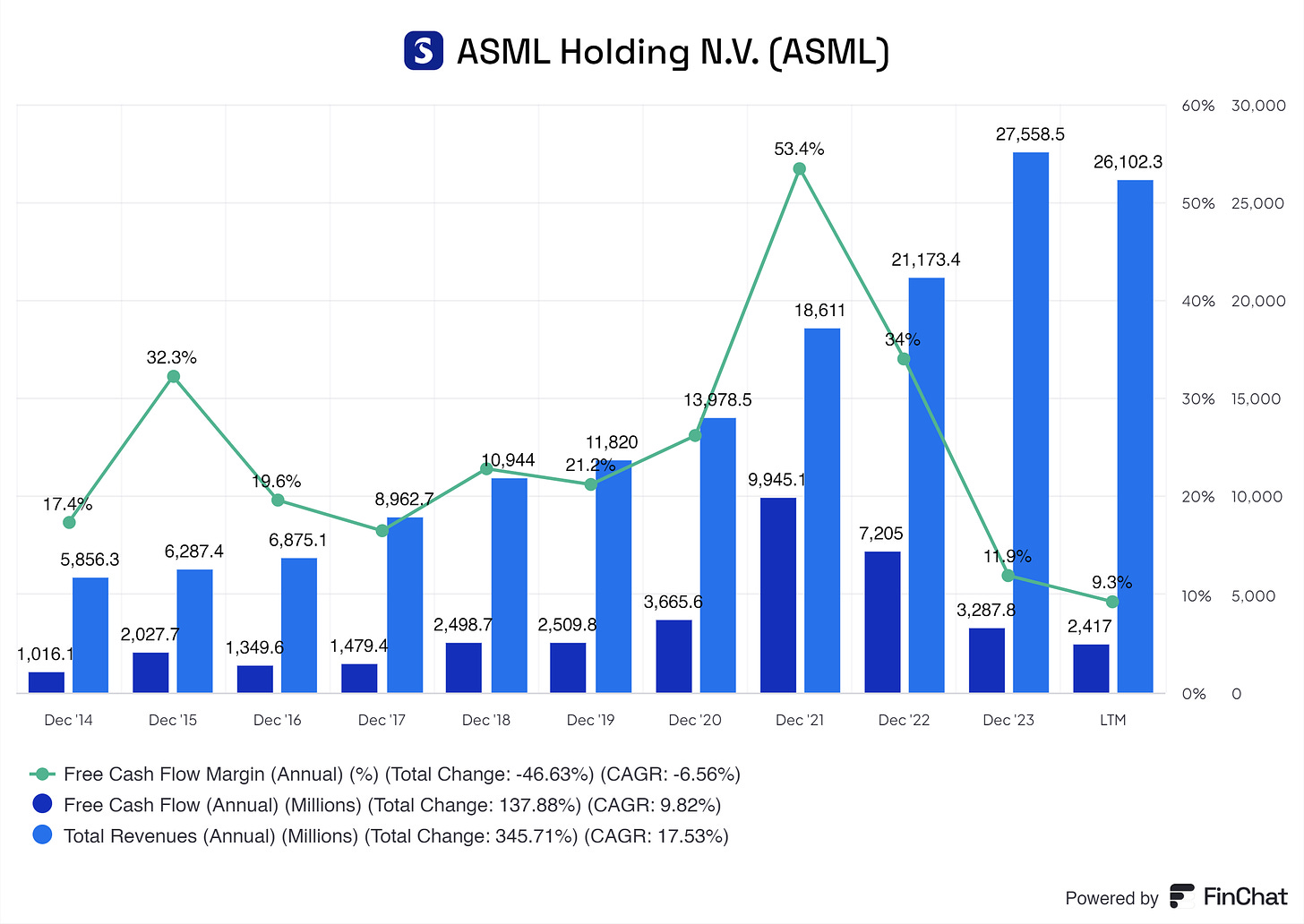

8.2 Cash Flow Analysis

Free cash flow is one of the most important, if not the most, for a business. Free cash flow can be used to reinvest in the business via projects, reduce debt, pay dividends, and perform share repurchases.

From 2022, we see that ASML is sizing down its FCF position, with its FCF margin dropping significantly due to fewer FCFs coming from its total sales.

ASML had the following to say about this.

‘‘Attention was paid to free cash flow, which was relatively low compared to prior years given the challenging economic climate as well as because ASML decided to support customers and suppliers in navigating liquidity issues.’’

This tells me that this reduction YoY in ASML’s fcf is not permanent. I expect ASML to get back on track for an 18-25% FCF margin when demand increases.

9. Growth Analysis

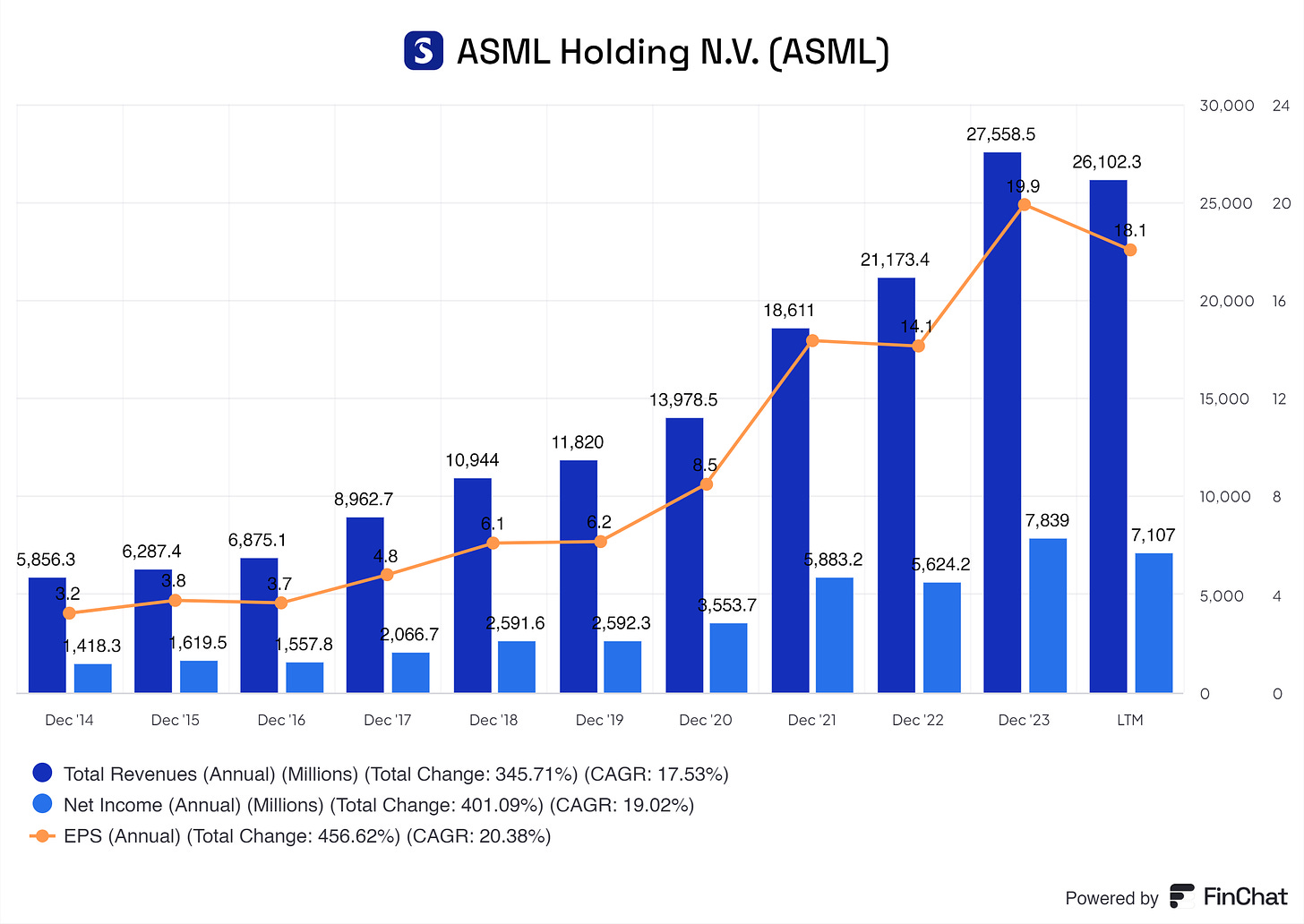

9.1 Historical Growth Trends

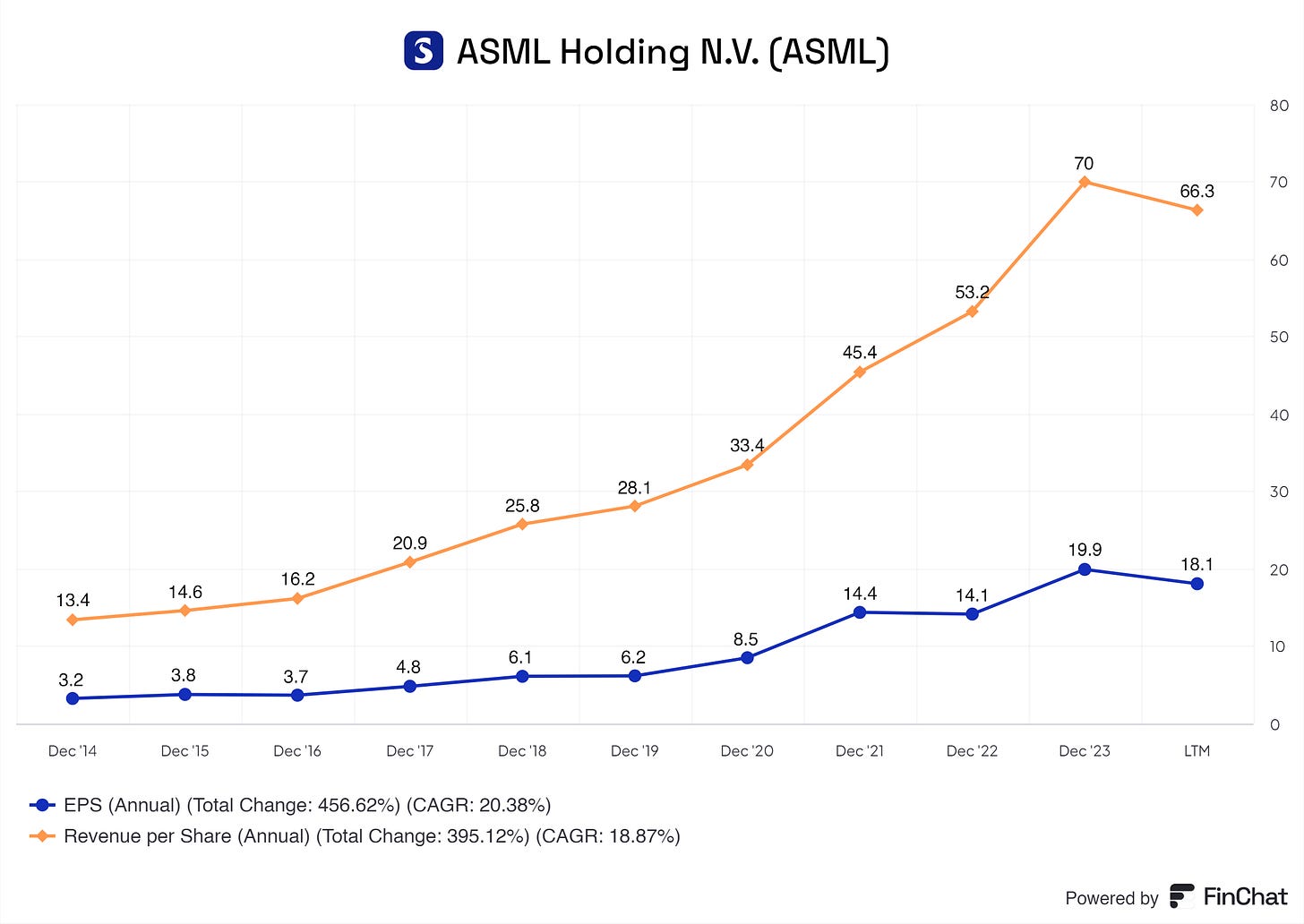

Historically, ASML has been growing at modest rates, nothing too crazy. With a Total Revenue CAGR of 17.53%. Its Net Income grew at a CAGR of 19.02%, and its EPS with a CAGR of 20.83%. These are reasonable growth numbers and nothing that does not seem replicable for the near future, especially with the end of the cycle around the corner.

9.2 Future Growth Projections

I hope to see growth of roughly 20% over the next five years. With the coming new semiconductor cycle, I am sure ASML will benefit greatly and grow at high double-digit rates. As we discussed in the Industry Growth part, the TAM of semiconductors will increase greatly with innovations in communication, automotive, and all other sectors.

Last year, a slippery slope hurt many of ASML’s customers and slowed sales growth for ASML. We see that management acknowledged this and improved massively, bracing for increased customer demand and being able to deliver.

I consider the potential risks associated with regulations and the Chips Act. If this were not a real concern, I would have chosen a higher growth rate for ASML.

I see a bright future ahead for ASML, with heaps of growth!

10. Value Proposition

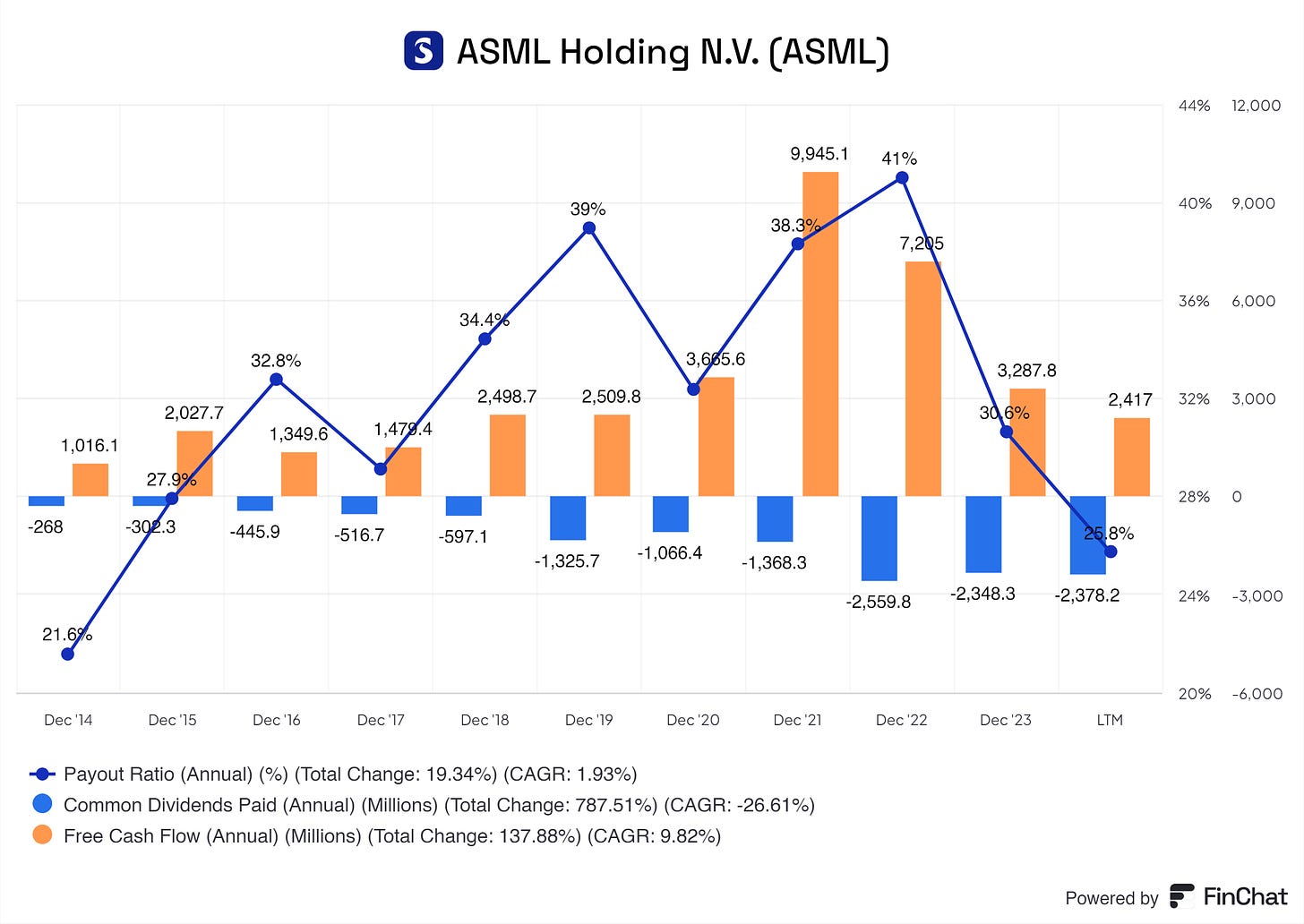

10.1 Dividends Analysis

ASML does pay a dividend, but I would argue that you should not buy into ASML for its dividends but for its growth.

For the dividend investors among us, you will be okay with getting your dividends from ASML and possibly increasing them. ASML has lacked FCF growth since 2020, but as mentioned earlier, that is not to stay. ASML is capable of paying dividends and increasing its dividends in the future.

ASML’s annual report shows that ASML is dedicated to creating shareholder value via dividends as a thank you.

‘‘we expect to continue to return significant amounts of cash to our shareholders through a combination of growing dividends….’’

10.2 Share Repurchase Programs

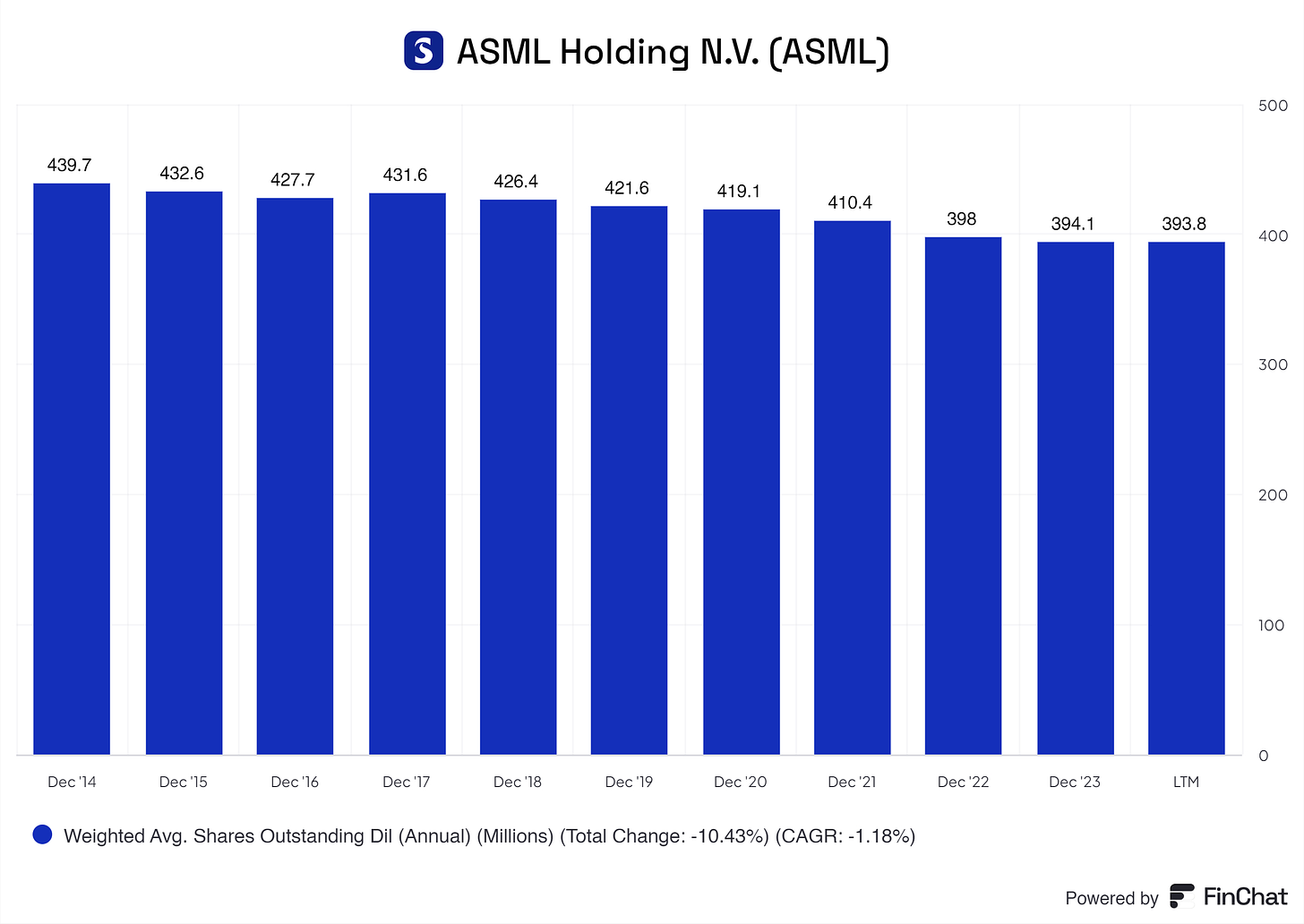

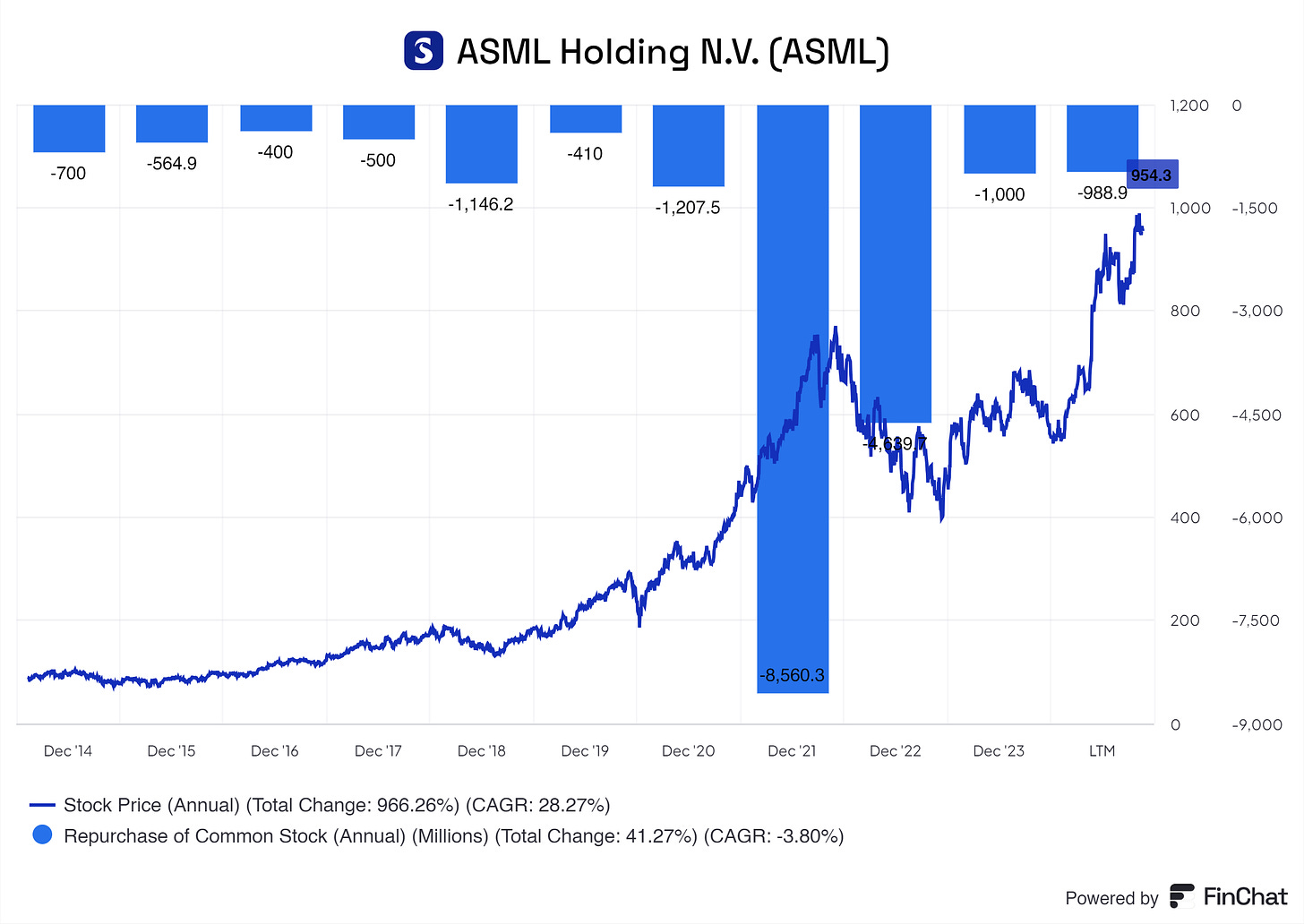

ASML pays a dividend; does it buy back its shares? YES!

‘‘In addition to dividend payments, we intend to return cash to our shareholders on a regular basis through share buybacks’’

ASML is one hell of an investment. In addition to dividends, ASML buys its shares back at a wonderful rate. This, in return, increases EPS, FCF per share, and Revenue per Share and creates more value per share for every shareholder.

ASML plans to keep doing so according to its annual report, which states the following:

‘‘On November 10, 2022, we announced a new share buyback program to be executed by December 31, 2025. As part of this program, ASML intends to repurchase shares up to an amount of €12 billion, of which we expect a total of up to 2 million shares will be used to cover employee share plans.’’

The graph above shows that ASML repurchases shares when the price is right, not solely to buy back shares. This tells us investors that ASML thinks about the right time to repurchase shares!

Just wonderful!

10.3 Debt Reduction Strategy

ASML's focus is less on reducing its debt. Yes, ASML pays off matured debt or refinanced it. But, it might be too much to ask heavily to reduce debt for continuing growth, doing share buybacks, and paying dividends.

ASML does pay off debts, but it is not very noticeable. in 2021, ASML paid off debts, and so in 2022 and the last twelve months, bit by bit.

11. Future Outlook

The future for ASML is bright. Although government interference might impact ASML’s sales, demand will increase due to the extremely fast innovation cycle we’re in now. As discussed earlier, the end of a slow cycle and a new boom era in the semiconductor industry are near. This new cycle could impact sales for ASML and provide wonderful growth for now, and we can enjoy this ride.

I do want to double down on the potential risk of ASML. Due to the nature of ASML having the best of the best systems, everybody around the world, including world leaders and governments, wants to impact its enemies and benefit from it. This will result in laws and regulations that might make it harder for ASML to operate to its full extent. How will this look, from who, to what extent, and for how long is a guessing game? I recommend considering this when evaluating the business and using your safety metrics. I, for instance, use a higher discount rate and more pessimistic growth rates, so my estimates reflect some ‘‘fear’’ that I might have with ASML. But again, this is my outlook.

From a management and balance sheet perspective, ASML is a no-brainer. With the new CEO, Christophe Fouquet, I’m sure ASML will have a bright future. As mentioned in Chapter 2, Christophe Fouquet is a knowledgeable man with experience in the field.

The balance sheet of ASML is solid, robust, and made for growth. We see that ASML is going for growth, which is exactly what we want to see.

In addition, ASML has excellent growth ahead, creating wonderful shareholder returns via share repurchases and a solid dividend.

I wish I could say more, but ASML is one of those quality businesses where nothing is going wrong or what could go wrong.

12. Quality Rating

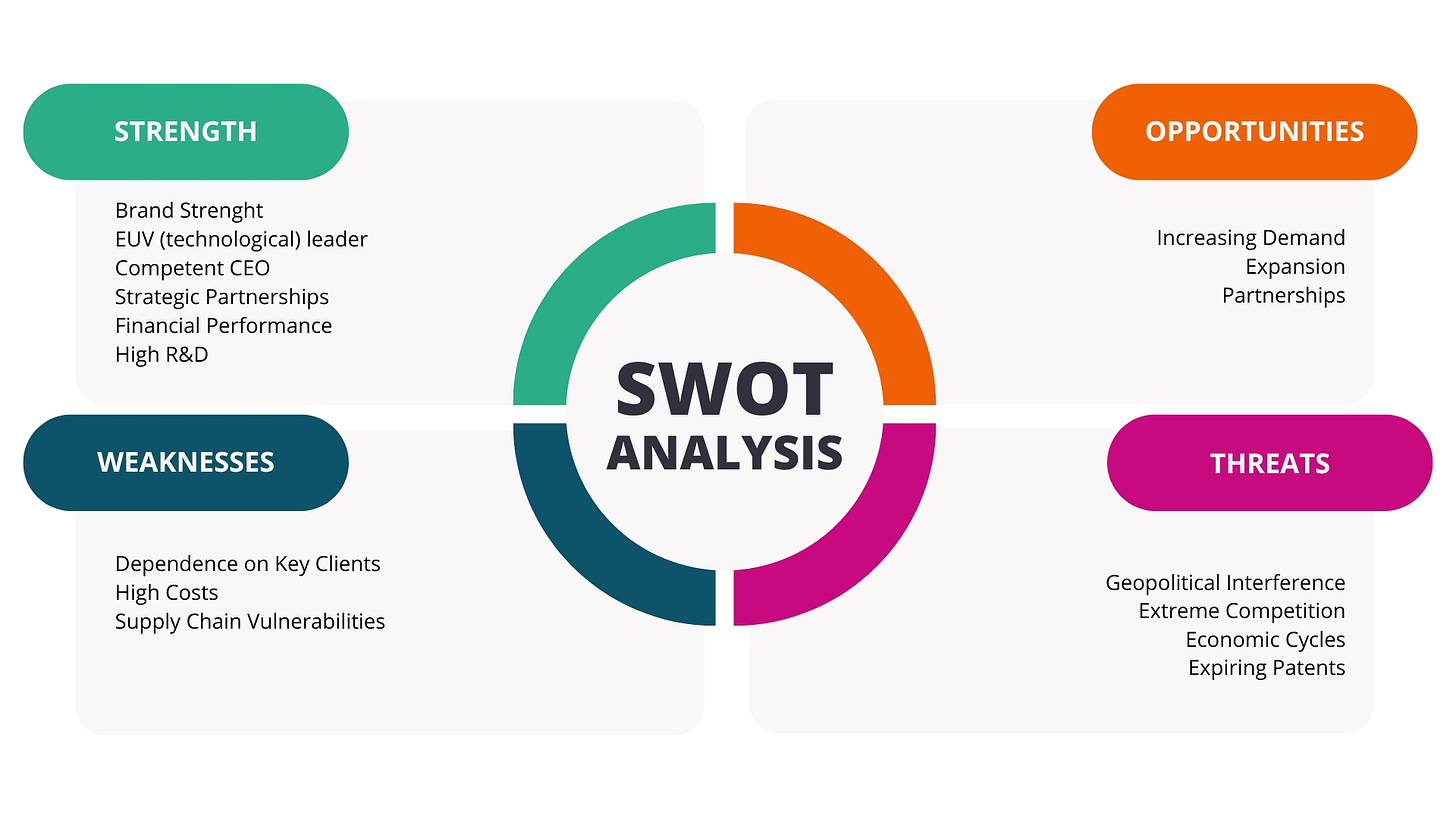

13. SWOT Analysis

14. Valuation Assessment

Let us crunch some numbers!

DCF: $1.179,65 per share

Multiple Valuation: $741,41

Benjamin Graham’s Valuation: $742,75

Analysts Average: $1.10,97

Average of: $938,40

Current Price ASML: $1.033,49

So, ASML is a bit overvalued to me. These are my calculations with my assumptions. Therefore, you can have different results. Do your research and calculations and go from there. I would love to own ASML, just not at the current valuation.

Please let me know what you think about this article via the poll. This will help me improve every article.

End note

Thank you for reading this investment case on ASML!

With every investment case, I am trying to improve my writing and how I communicate my findings with you all. Because I started not too long ago, some posts might change in layout or other aspects before I find the layout that suits my best wishes; sorry in advance.

As of now, thank you so much for your time! I hope you found some valuable information in this investment case.

Thanks for reading FluentInValue! Subscribe for free to receive new posts and support my work.

Disclaimer

I do not own any shares of ASML and do not intend to buy shares in the next 3 months.

By reading my posts, being subscribed, following me, and visiting my Substack, you agree to my disclaimer. You can read the disclaimer here.

This is quite a good analysis.

One small observation. Did you intend to include the graph for cash and equivalents in section 6.1? It is missing if so. I am keen to look at this analysis again and will revert if i have any other suggestions, but net net , this is very comprehensive. Thank you .

The biggest risk that i see is the geo-political risk , and so am pondering a bit, even with the price coming down below the levels that you have suggested. :) Cheers.

Extremely comprehensive analysis! One factor you didn't figure into the equation was insider ownership, which is low. Chip companies are all the rage now as you pointed out the high valuation. They are cyclical, but I might consider buying one if the insiders owned more of it. Thanks