Hello friend! 👋

My name is Yorrin, also known as ‘‘Fluentinvalue’’.

I am pleased to have you back here for another investment case. This time, we are discussing Copart.

In case you have missed previous articles, click on the link below:

If you’re currently not yet following me, consider doing so. I provide FREE content to help and inform you in your investment journey. From beginner to advanced, all info will be helpful. :-)

Copart, founded in 1982 with just a single salvage yard in California, Copart grew into a global leader source for online vehicle auctions. With just one yard in 1982 to 200 locations in more than 11 countries with a staggering 170.000 vehicles up for auction every day!

Copart specializes in reselling used, wholesale, and salvage title vehicles, serving various sellers including big insurance companies, rental firms, and charities.

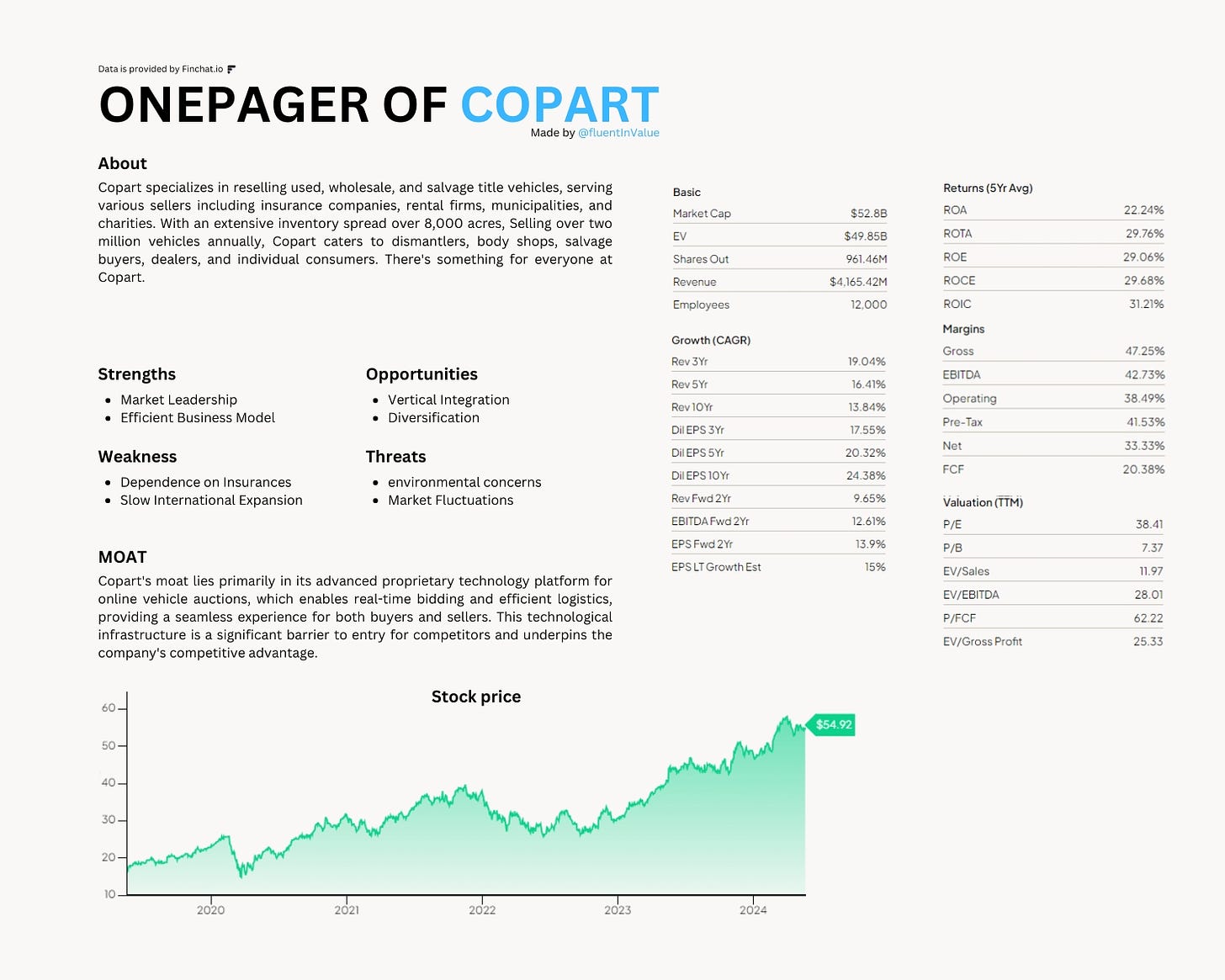

Copart currently has a market capitalization of $52.8B with an enterprise value of $49.85B, and more than 12,000, this is a giant.

But, is this giant good enough for our investable universe, does Copart generate desired returns, and is there a solid future for Copart?

Today we will dive into the world of cars and Copart!

Copart - General information

Company name: Copart Inc.

Ticker: CPRT

Stock price: $54.59

Market cap: $52.8

Revenue: $4.165,42M

Industry: Retail Trade

If you’re into these kinds of investment theses, consider checking out the following Zoetis, Duolingo, and Adobe. These are available for FREE on my Substack page.

Copart One Pager

Step-by-step

To get a better understanding of the business, I recommend doing the following also for yourself the next time you’re eager to invest in a business. This method has helped me pick quality companies, understand their business, and know when to get it & when to get out)

In analyzing a stock, I follow the following steps:

1. Business model

Yes, I know Copart. Copart is one of the first stocks that I bought when I started my investing journey.

To put it simply, Copart generates its revenue from online auctions of its vehicles. Copart buys and sells used and salvaged vehicles. From both the buying and selling side, Copart takes a fee. This fee adds up for Copart because Copart daily has 170.000+ vehicles for sale, talking about lovely fees. ;-)

Copart employs a bidding system where buyers can place bets on vehicles they want to buy. All bids are open to view. This means that all participants can see bids and up those bids, making the bidding extremely competitive for all participants.

Here is an overview of the process

2. Management

The management story of Copart is like a love story, haha. When I first dove into Copart I was amazed by how management came about, the story of Willis Johnson and Jay Adir is something I love to see in a business. This story adds some charming aspects to the business, making it more ‘‘human’’.

In 1982 Willis Johnson founded Copart. From 1982 until February 2010, he served as Chief Executive Officer, and from 1986 until 1995, he also served as President. Willis was an officer and director of U-Pull-It, Inc., a self-service auto dismantler, which he co-founded, from 1982 until 1994 when he sold his interest in the company.

Into Willis's life came Jay! Jay is Willis's son-in-law. The story goes that Willis did not like Jay that much in the beginning but they grew closer and closer to one another in the later years.

Jay joined Copart in 1989, taking on various roles within the company, no notable big roles. Willis made sure Jay started like how he did, at the very beginning. His early involvement allowed Jay to gain a deep understanding of the business and the salvage vehicles auction industry.

So far so good, right?

Jay assisted Willis in making Copart the giant auctioneer it is today, helping it expand globally and acquire other solid businesses to make Copart more efficient. In 2010, Jay Adair succeeded Willis Johnson as the CEO of Copart. This transition marked a new era for the company, with Adair continuing to build on Johnson’s legacy while implementing new strategies to drive Copart’s expansion and technological advancement.

Jeff Liaw has served as CEO and a member of the board of directors of Copart since April 2024. He served as Co-CEO from March 2022 to April 2024. Jeff joined Copart in 2016 as CFO and additionally served as President of the company from 2019-2022.

Individual insider ownership: 8.69%

3. Competitive & sustainable advantage (MOAT)

From a wonderful story from its management, we dive into the MOAT of Copart and its competitive and sustainable advantages over its peers.

Is there a MOAT for Copart? Let us talk about it!

So, a MOAT can be in either one, or more, of the following forms:

Brand power

Patents

Scale and cost advantages

Switching costs

Networking effect

Attracting talent

Copart has a moderate MOAT in brand power, a big MOAT in scale and advantage, and a big MOAT in its networking effect.

Copart has built a solid reputation for reliability and trust, its brand power MOAT. Copart its strong brand helps in maintaining customer loyalty. Insurances, companies, dealerships, and individual buyers often prefer sticking with a known and trusted company. Copart has placed itself in front of the desks of all those buyers. Due to being well-recognized globally, it aids in its marketing efforts and helps attract new customers. The brand’s recognition and reputation can be a decisive factor for clients when choosing a vehicle auction platform. The perception of high quality in service and support further enhances the brand's power. Copart’s consistent performance in delivering value to its customers reinforces its brand strength.

Copart has an extensive network of over 200 facilities worldwide, allowing it to spread its fixed costs over a larger number of transactions. This greatly reduces the per-unit costs of each auctioned vehicle, giving Copart big cost advantages over any smaller competitor. The company’s large scale enables substantial investments in infrastructure, technology, and innovation. These investments improve operational efficiency and service quality, further lowering costs and enhancing customer satisfaction.

Due to its scale, Copart can negotiate better terms with suppliers and service providers, further reducing operational costs.

Comes with its networking effect, Copart has a vast network of buyers and sellers. The more participants on the platform, the more valuable the platform becomes to each user. Buyers have access to a wide variety of vehicles, and sellers benefit from a large pool of potential buyers. As the platform attracts more users, the increased activity generates more data and insights, allowing Copart to optimize its services further. This self-reinforcing loop attracts even more users, enhancing the network effect. The large volume of transactions gives Copart access to valuable data on market trends, customer preferences, and pricing. This data can be used to enhance the user experience, set competitive prices, and offer targeted marketing, further solidifying the network effect.

So, does Copart have a MOAT? Yes, yes it does. Copart has a solid MOAT.

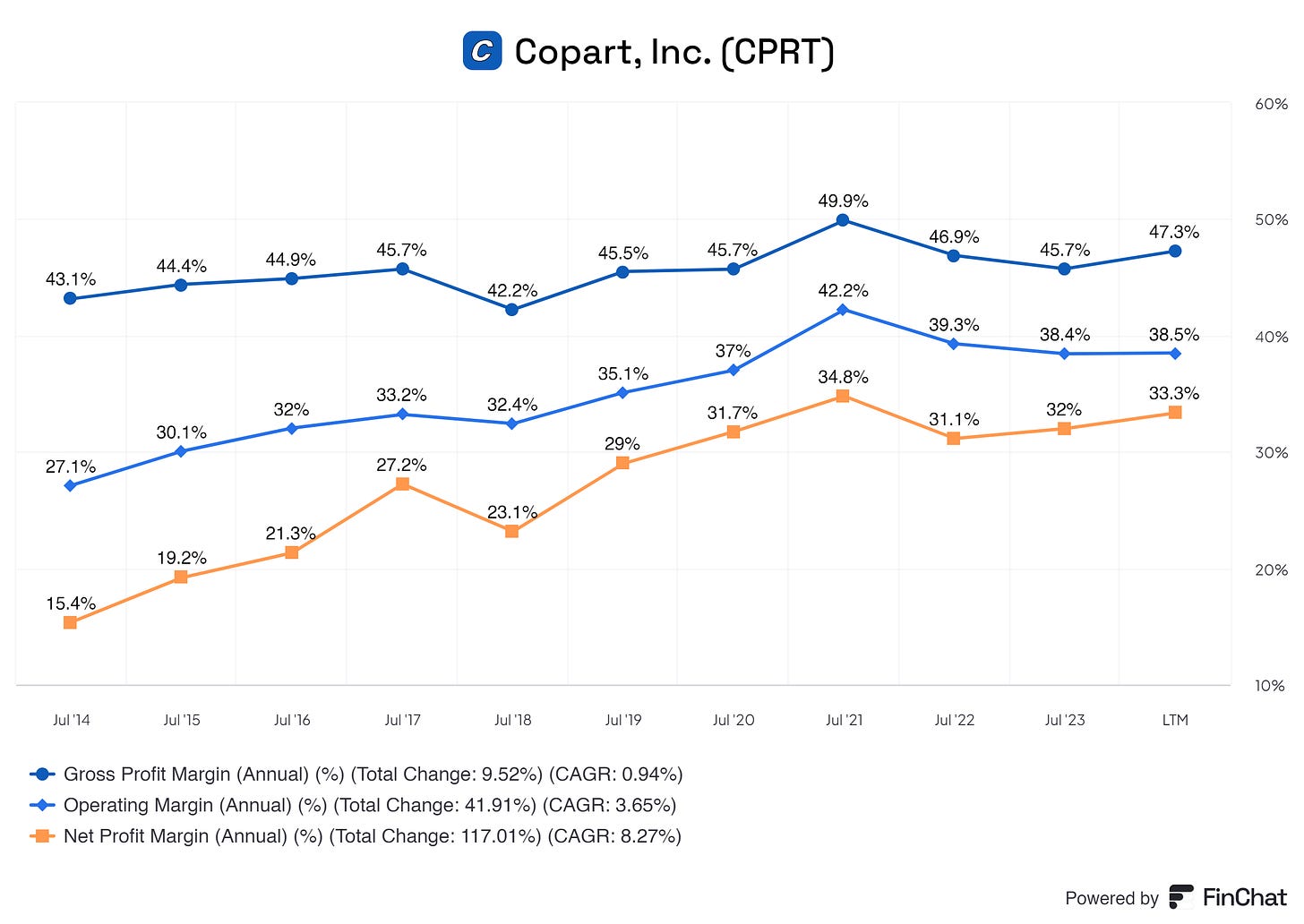

A MOAT sometimes translates into a higher margin business, check Copart its margins down here, numbers do not lie.

4. Industry and peers

We’ve talked a lot about Copart being a solid business with good management and wonderful margins. But, is there more growth to be expected for Copart, and how is Copart its peers playing along in this field? Let’s dive into the industry and its peers.

Copart is currently the market leader, sharing the market with IAA, and KAR. Copart and IAA currently both have a market share of roughly 40%, creating a duopoly. If you know me, you should know I like companies that operate in a mono- or duopoly. Of course, there might be competitors entering the business, trying to disrupt this duopoly. But, I think this is for now a lost cause. Copart and IAA are both dominant players, innovating YoY to keep their position or even grow.

Copart and IAA both benefit from their reinvestments into the business to further scale their operations, making it more efficient. Both have the free cash flow to invest in their operations to keep this duopoly alive.

That’s all fun and games, but is there more growth to come in this sector? Yes.

Copart is effectively achieving higher total loss rates, which have now returned to levels seen before the pandemic and are anticipated to continue rising. This enhancement in total loss rates bodes well for the future of the salvage market. Additionally, I am optimistic about growth in non-insurance segments, particularly with a notable rise in dealer vehicles and the success of Copart Blue. The transfer of salvage volume from IAA to Copart by major insurers like USAA, potentially adding a significant number of cars to the platform each year, highlights Copart’s increasing market share and the strength of its client relationships.

5. Risks

Growth and acquisitions are Copart its drivers to increasing revenue and growth.

The majority of Copart its clients are insurance companies. As of late, almost 70% of its revenue derives from insurance.

Can Copart keep successfully expanding globally? (I mean, check out: Walmart in Germany, Best Buy in the UK, eBay in China, Target in Canada, Tesco in the U.S.A, and and many more. Expansion is extremely challenging)

Change in insurance practices

Electric vehicles (EVs) and autonomous vehicles, could disrupt traditional vehicle auction markets.

Enough with the scaring about the potential risks, let’s dive into the balance sheet!

6. Balance sheet

Something I appreciate about Copart is its low liabilities. Copart barely has any real debt! With assets totaling 8.010,6M LTM and liabilities totaling 814,4M LTM, there are no real issues here.

Something notable is that accounts receivable did have a massive jump. This means there is still a heaping stack of cash that needs to come in. Copart was on the right track keeping account receivable on the lower side, which I prefer. If this is a one-time thing, I do not mind. Copart furthermore has a solid inventory and enough cash on hand, nothing crazy or odd to be seen over on its Assets.

Accounts payable are also on the higher side, let us hope it is a one-time thing here. Its interests are also very manageable, nothing too crazy.

Usually, I see some things I see that make me second look into the balance sheet, but Copart has one hell of a solid balance sheet.

I wish I could tell you more, but Copart has one hell of a solid balance sheet (one of the reasons I like the company and own a big chunk of it)

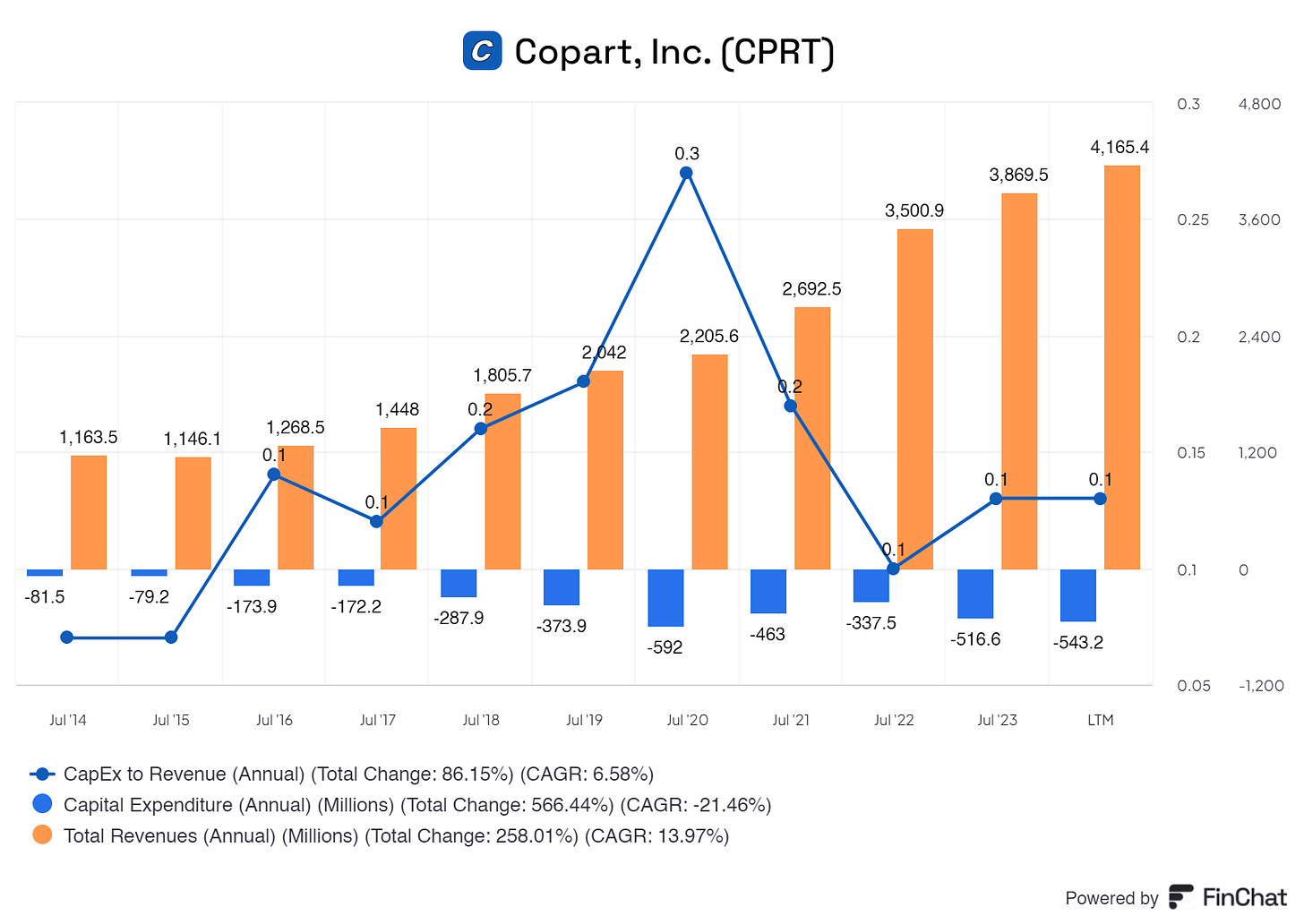

7. Capital intensity & allocation

We see here Copart can grow at modest rates while keeping capital expenditures under control. This low ratio puts less of a financial strain on the company and its shareholders.

Adding to this Copart has a low CapEx to OCF, also loving the low strain on the company and its shareholders.

Capital allocation

Let us chat about the crucial metric, ROIC.

Copart from day one is shown to be investing its money in projects, assets, and more that generate a return. To this day we see that Copart is getting more efficient in deploying its capital, generating more returns. This might not seem that interesting but think about the following.

Copart is deploying cash. This cash in return comes back greater due to the profitable investments that are made. This means they get heaps of money in return and return can reinvest this money once again. This is a compounding effect all investors must love, Copart is generating returns for the business and shareholders like a madman.

8. Profitability

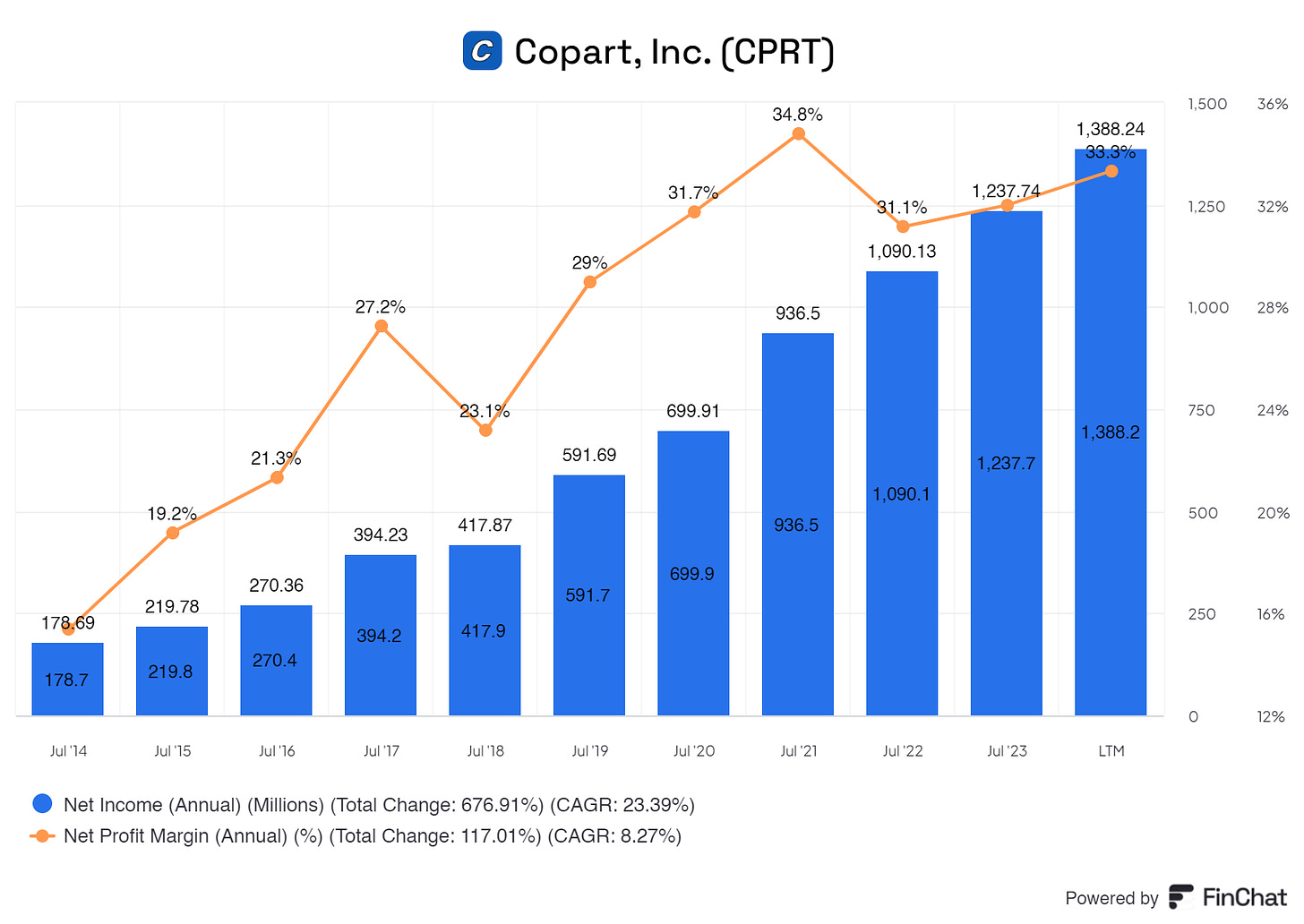

Copart is very profitable! In the last decade, Copart has seen nothing but profits.

Copart is showing to be increasing its Gross Profit and Net margin, allowing for more net income to be generated over the long run.

The growth and margins Copart is showing, we could see this growth continue in the coming years. While acting in a duopoly, Copart should not see any issues where it has to cut in either margin to attract more customers or grow net revenue.

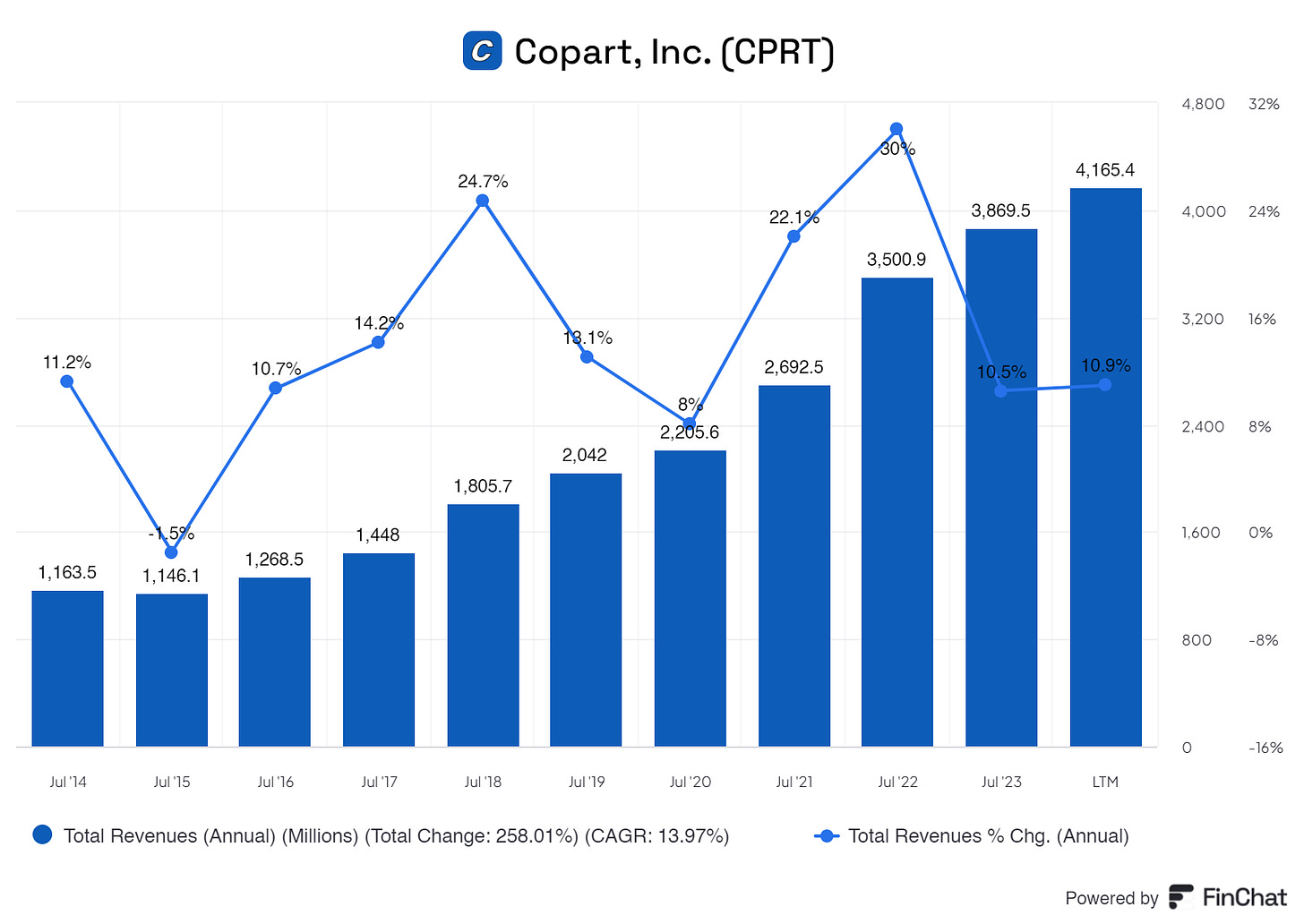

9. Historical and future growth

Copart is growing its total revenue YoY with modest rates, nothing too crazy. from 2014 till today, the average growth is 13.99%, which is sustainable. We need to keep in mind that Copart is not yet in its maturing phase. So, asking for %10+ returns is not asking a beaver to start walking. We do need to keep in mind that Copart has endured a pandemic, giving a skewed image of the growth in those years. Copart could keep up the pace it is at now, averaging around 8% to 11% average growth.

So, yes. The historical growth is modest and can be kept up by Copart in the future if it maintains its solid investments, as shown by its ROIC.

10. Value

Copart is known for creating shareholder value. They do this by optimizing their operations, acquiring business to make their chain more efficient and drive long-term costs lower, and giving back money to reinvest into the business.

Copart thankfully does not dilute shareholders. There have been increases and decreases, but nothing worrying like the massive issuing of new shares.

Copart does not issue dividends. Sorry to the dividend investors out there ;-).

The main value comes from operations and Copart is investing in expanding and making its operations more efficient. This way they can lower costs, free up more capital, and invest this into the business to grow further and further.

11. Outlook

Copart has a bright future ahead of itself!

With solid investments and YoY improvements in its operations, Copart is becoming more and more efficient.

The market Copart operates in will be a solid market for the years to come if you ask me. The EV trend might cause some troubles, just like the insurance reliance of Copart. Will this be an issue in the short term, I do not know. I do know that we have competent management and the wheels. I trust Copart with my investment and foresee a good future.

Copart benefits from a solid balance sheet, good investments, wonderful management, and great business. Copart is a chunk of my portfolio for a reason, I love the company.

12. Valuation

Is Copart investable? Let’s see!

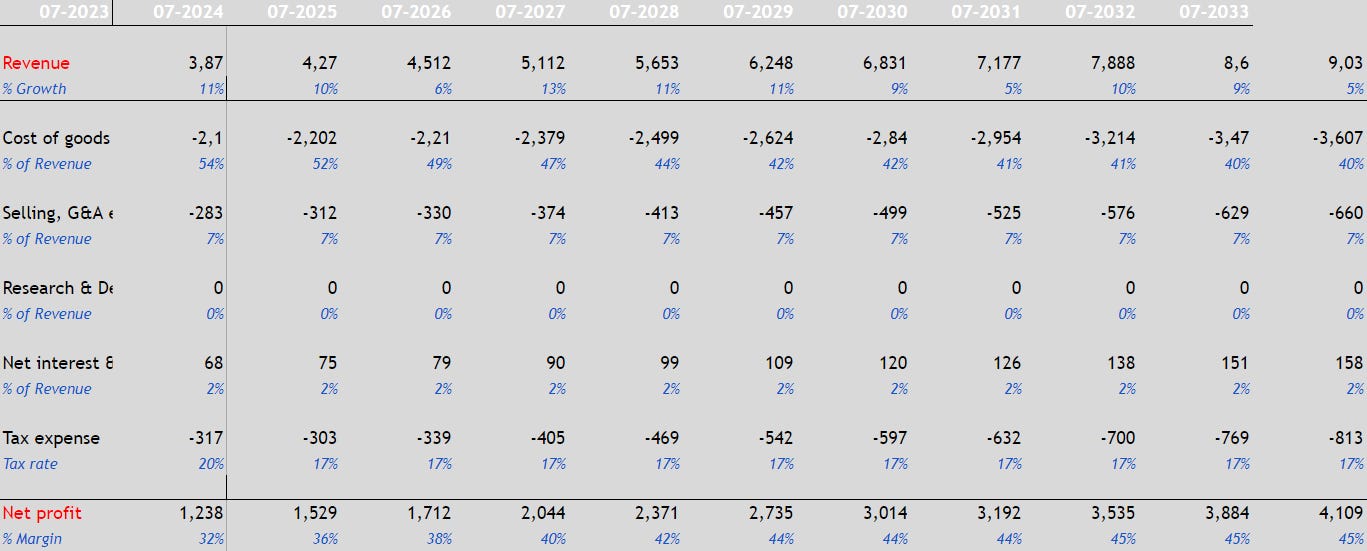

My DCF (10 years, WACC / Discount Rate of 7.9%, and long-term growth of 4%) comes out to a fair price of 67.37 USD.

Projections

Although Copart is ‘‘expensive’’ as of now, I think Copart is in a good position to add to one’s portfolio.

EV/Sales are on the higher side and so are EV/FCF, EV/OCF, and EV/EBIT.

For quality companies, you pay quality prices.

BONUS

Checklist:

Revenue growth 5Y > 5% ✅

Revenue growth 10Y > 5% ✅

Gross Profit growth 5/10yr > 7% ✅

ROIC > 15% ✅

ROCE > 20% ✅

debt-to-fcf < 5 ✅

debt-to-equity <0.8 ✅

Interest cover rate > 5 ✅

Net debt / EBITDA < 3 ✅

Shares outstanding 5Y CAGR < 0% ✅

Free Cash Flow growth 5Y > 5% ✅

Free Cash Flow margin > 80% ✅

SBC as a % of rev < 1% ✅

Net income incease YoY ✅

High profit quality >80% ✅

Goodwill / Assets > 20% ✅

CAPEX / Sales > 7% ❌

CAPEX / OCF > 25% ❌

Copart ticks a lot of my boxes ;-)

End note

Thank you for reading this investment case on Copart!

With every investment case, I am trying to improve my writing and how I communicate my findings with you all. Because I started not too long ago, some posts might change in layout or other aspects before I find the layout that suits my best wishes, sorry in advance.

As of now, thank you so much for your time! I hope you found some valuable information in this investment case.

Disclaimer

By reading my posts, being subscribed, following me, and visiting my Substack you agree to my disclaimer. You can read the disclaimer here.