Hello, friends! 👋

I'm excited to welcome you back to another insightful analysis. Today, we're analyzing Mastercard, one of the world’s most valuable fintech businesses.

If you missed my previous articles, you can catch up on them here:

If you haven't already, consider following me for more FREE content to enhance your investment journey. Whether you're a beginner or an advanced investor, you'll find valuable insights to help you make informed decisions. 😊

Table of contents

Corporate Analysis

1.1 Business Overview

1.2 Revenue BreakdownExecutive Leadership

2.1 CEO Experience

2.2 Employee Satisfaction Ratings

2.3 CEO Value CreationCompetitive and Sustainable Advantages (MOAT)

Industry Analysis

4.1 Current Industry Landscape and Growth Prospects

4.2 Competitive LandscapeRisk Assessment

Financial Stability

6.1 Asset Evaluation

6.2 Liability AssessmentCapital Structure

7.1 Expense Analysis

7.2 Capital Efficiency ReviewProfitability Assessment

8.1 Profitability, Sustainability, and Margins

8.2 Cash Flow AnalysisGrowth Analysis

9.1 Historical Growth Trends

9.2 Future Growth ProjectionsValue Proposition

10.1 Dividend Analysis

10.2 Share Repurchase Programs

10.3 Debt Reduction StrategiesFuture Outlook

Quality Rating

SWOT Analysis

Valuation Assessment

Conclusion

1. Corporate Analysis

1.1 Business Overview

Mastercard Incorporated, a technology company, provides transaction processing and other payment-related products and services in the United States and internationally. It facilitates the processing of payment transactions, including authorization, clearing, and settlement, and delivers other payment-related products and services.

The company offers integrated products and value-added services for account holders, merchants, financial institutions, businesses, governments, and other organizations, such as programs that enable issuers to provide consumers with credits to defer payments; prepaid programs and management services; commercial credit and debit payment products and solutions; and payment products and solutions that allow its customers to access funds in deposit and other accounts. It also provides value-added products and services comprising cyber and intelligence solutions for parties to transact and proprietary insights, drawing on the principled use of consumer and merchant data services.

In addition, the company offers analytics, test-and-learn, consulting, managed services, loyalty, processing, and payment gateway solutions for e-commerce merchants. It also provides open banking and digital identity platform services.

The company offers payment solutions and services under the MasterCard, Maestro, and Cirrus. Mastercard Incorporated was founded in 1966 and is headquartered in Purchase, New York.

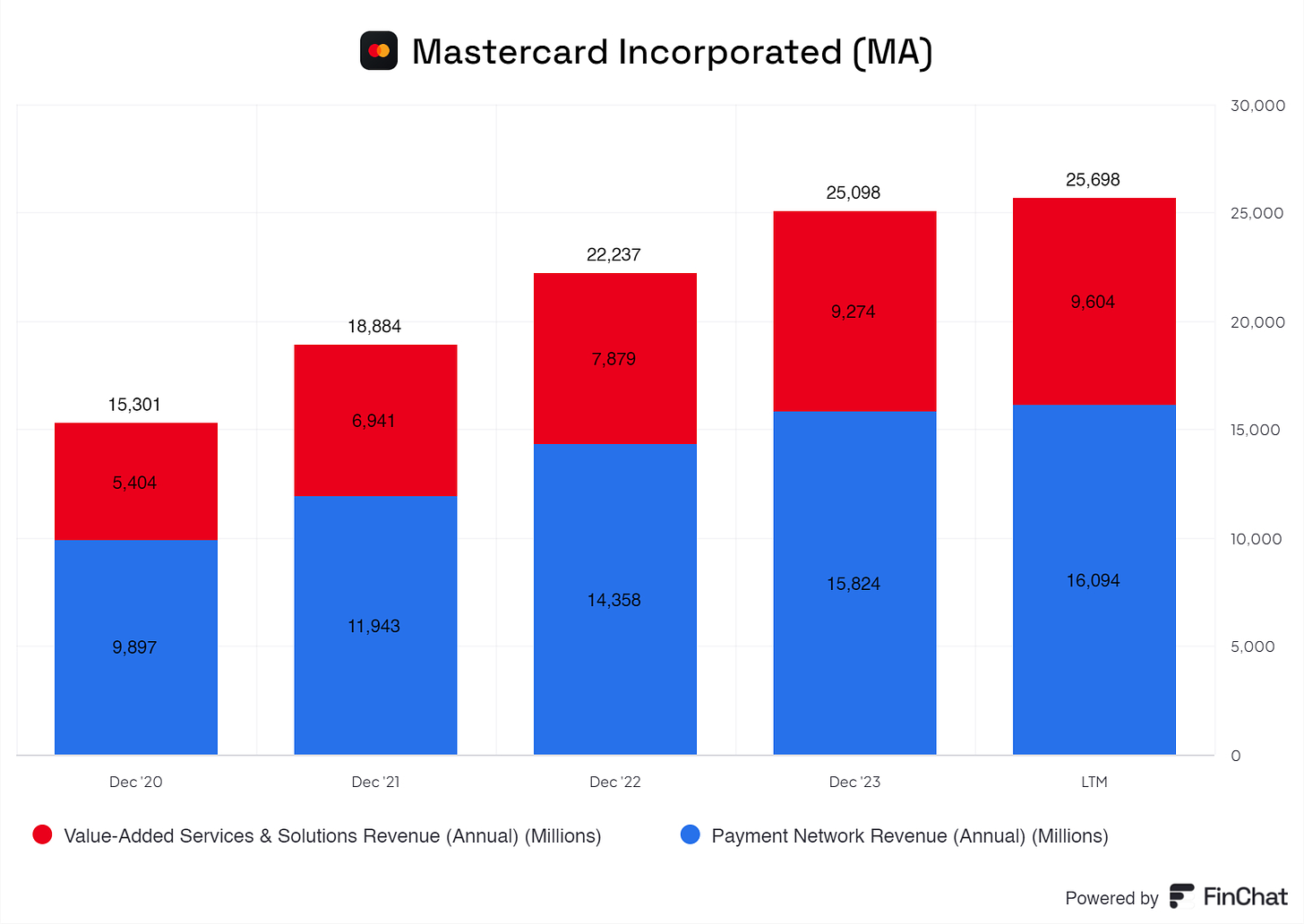

1.2 Revenue Breakdown

Mastercard’s revenue drivers are as follows:

Payment Network Revenue:

Domestic Assessments: Charges based on domestic dollar volume of activity (e.g., domestic purchase volume, domestic cash volume).

Cross-Border Assessments: Charges based on cross-border dollar volume of activity (e.g., cross-border purchase volume, cross-border cash volume).

Transaction Processing Assessments: Fees for switching and other network-related services.

Percentage of Total Revenue in 2023: $15.824 billion, accounting for approximately 63% of the total net revenue

Value-Added Services & Solutions:

Cyber and Intelligence Solutions: Growth in fraud and security solutions.

Data and Services Solutions: Consulting, marketing, and loyalty solutions.

ACH Batch and Real-Time Account-Based Payments and Solutions.

Processing and Gateway Services.

Open Banking Solutions.

Digital Identity Solutions.

Percentage of Total Revenue in 2023: $9.274 billion, accounting for approximately 37% of the total net revenue

Mastercard’s Payment Network revenue is the biggest revenue driver, accounting for 63% of its Total Revenues. Although it looks like Mastercard’s revenue is very concentrated on the Payment Network Revenue, this sector is a big pie chart with many segments, generating a modest stream of revenue. This spread-out portfolio gives Mastercard a good spreading, and if one or more sub-segments fall out, Mastercard still has many others to rely on, which is excellent. Businesses with heavily concentrated segments or high concentration in one country could be cautioned about.

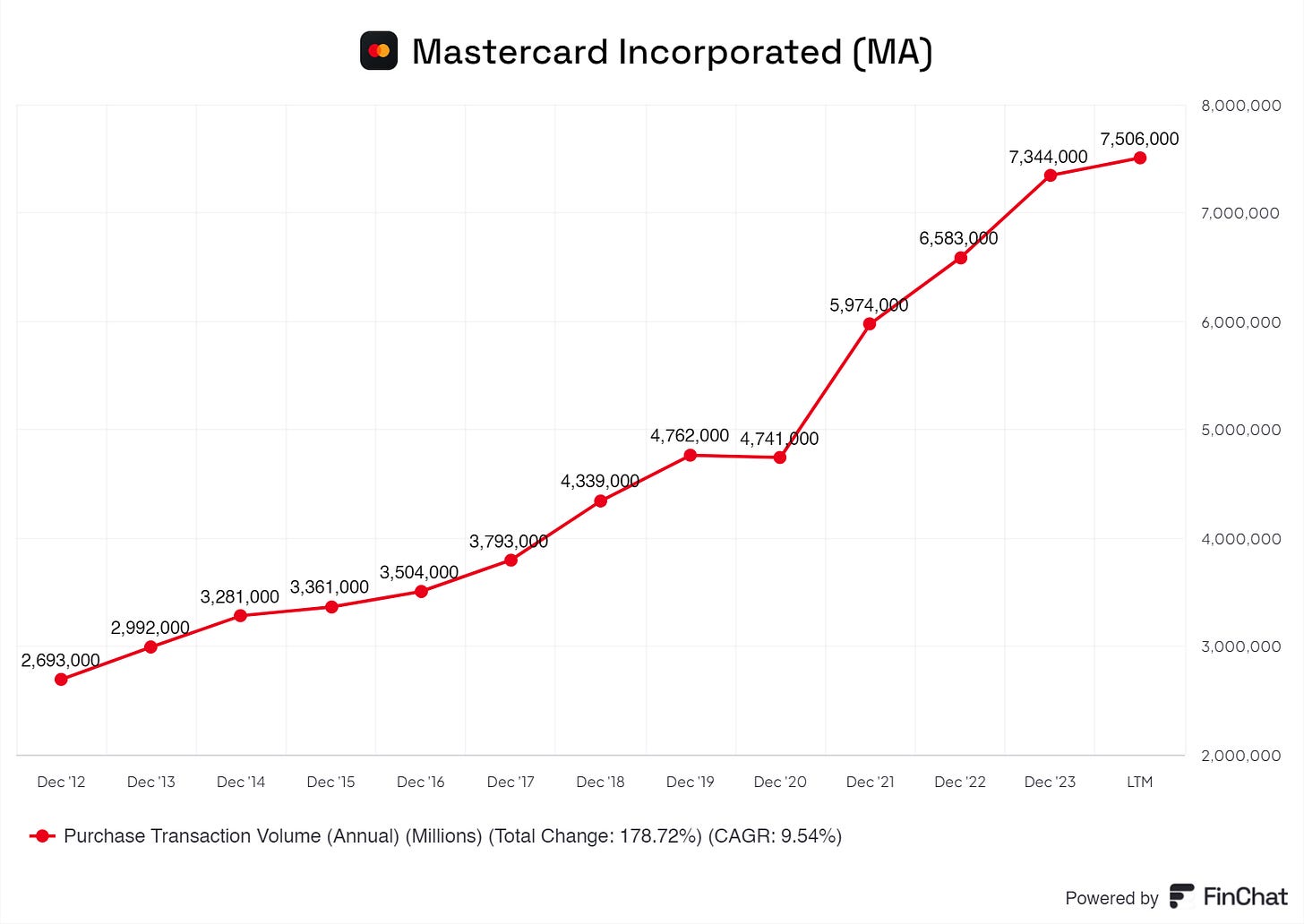

In addition, Mastercard's take rate is 0.3%, a modest rate that adds to its total revenue. This is especially true considering the excellent growth in Purchase Transactions. The increase in these volumes means Mastercard gets more out of its 0.3% take rate yearly.

Let us chat about the global diversification of Mastercard.

Mastercard reports in North American Markets (including the United States and Canada, excluding the U.S. Territories) and International Markets.

North American Markets (including the United States and Canada, excluding the U.S. Territories):

Revenue: $8.359 billion

Percentage of Total Revenue: 33.3%

International Markets:

Revenue: $16.739 billion

Percentage of Total Revenue: 66.7%

Mastercard’s revenue in the International Market is extremely broad. Do not the following, according to Mastercard: ‘‘No individual country, other than the United States, generates more than 10% of net revenue in 2023.’’. This tells investors that Mastercard is well diversified in other countries, such as the Netherlands, Japan, Germany, Spain, and other countries.

2. Executive Leadership

2.1 CEO Experience

As of the 1st of January 2021, Michael Miebach is the CEO of Mastercard. He took over after Ajay Banga left; Ajay Banga was Mastercard’s CEO from 2010 to 2020 and left the board at the end of 2021. During his tenure, Banga tripled revenues, increased net income sixfold, and grew market capitalization from under $30 billion to more than $300 billion. In 2020, he announced the creation of the Priceless Planet Coalition, a group of about 100 firms that make corporate investments to preserve the environment.

Now, over to Michael Miebach.

Michael Miebach started his journey as General Manager at Citi. Michael Miebach started working for Citi in 1994 and worked here until 2007, a whopping 13 years at Citi. After working at Citi, Michael Miebach started as Managing Director for Barclays Bank Plc in 2007 until 2010.

In 2010, Michael Miebach started with Mastercard as President of the Middle East & Africa; after 5 years, Michael Miebach grew to become the Chief Product Officer at Mastercard. Not so long after, 4 years later, Michael Miebach became the President, and in 2021, Michael Miebach was announced as the new CEO of Mastercard.

In 2015, Michael Miebach became a Board Member of Accion, and Michael Miebach is still a board member to this day. Michael Miebach is also a board member at Accion and World Resources Insitute, Metropolitan Opera, US-Inda Strategic Partnership Forum, IBM, and a Trustee for the United States Council for International Business. Michael Miebach is a busy man!

Michael Miebach owns 82,104 shares of Mastercard Inc (MA) as of March 15, 2024, worth $37 Million.

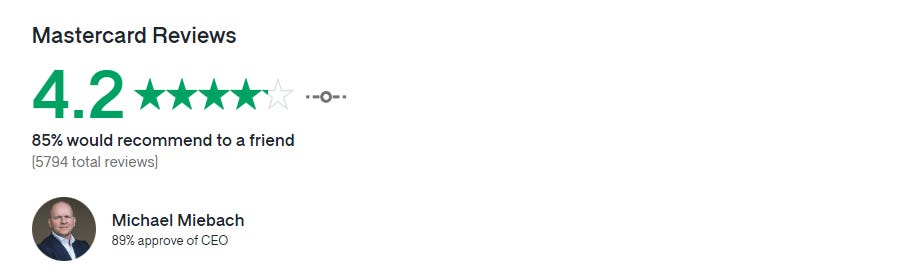

2.2 Employee Satisfaction Ratings

The overall sentiment for Michael Miebach is good! As I’ve read online, Michael Miebach is perceived to be a wonderful CEO, bringing value to the business, shareholders, and employees.

These scores are crucial for any business that wants to succeed in the long run. These high scores tell us that Mastercard can retain quality employees, keep them in the business for longer periods, keep employees happy, and offer excellent benefits and a prosperous future for employees.

This kind of culture for Mastercard helps it accelerate and involve employees in the business's success.

2.3 CEO Value Creation

Does Michael Miebach (and previously Ajay Banga) create value for its shareholders?

That's a big fat YES!

Under the management of Michael Miebach and Ajay Banga, Mastercard grew and is still growing to be an industry leader, along with Visa.

3. Competitive and Sustainable Advantage (MOAT)

So, a MOAT can be in either one or more of the following forms:

Brand Power

Patents

Scale and Cost Advantages

Switching Costs

Network Effect

Attracting Talent (I consider this a MOAT, others don’t. Decide for yourself)

Brand Power

Mastercard's brand power is significant due to its global recognition and reputation for reliability and security in the payments industry. Known worldwide for its secure and efficient payment processing solutions, Mastercard's brand symbolizes trust and innovation. This strong brand presence attracts top-tier customers, including major financial institutions, merchants, and governments, further reinforcing its market position and enabling premium service pricing.

Patents

Mastercard holds an extensive portfolio of patents that protect its technological innovations. These patents cover crucial aspects of payment technology, including transaction processing, fraud detection, cybersecurity solutions, and digital identity verification. The company's intellectual property rights create a significant barrier to entry for competitors, ensuring that Mastercard maintains its competitive edge and continues to lead the market in secure and efficient payment solutions.

In addition, we own a number of patents and patent applications relating to payment solutions, transaction processing, smart cards, contactless, mobile, biometrics, AI, security systems, blockchain and other technologies, which are important to our business operations.

- Mastercard Annual Report

Scale and Cost Advantages

Mastercard benefits from significant scale and cost advantages. As one of the largest payment processing networks globally, Mastercard achieves economies of scale in operations, R&D, and procurement. This scale allows Mastercard to spread its high R&D costs over a larger revenue base, reducing per-unit costs. Additionally, Mastercard's ability to invest heavily in cutting-edge technology development keeps it ahead of smaller competitors who lack similar financial resources.

Switching Costs

Switching costs for Mastercard's customers are exceptionally high. Financial institutions, merchants, and other partners deeply integrate Mastercard’s payment solutions into their systems, requiring substantial customization, training, and maintenance investment. Switching to another provider would involve financial costs, potential service disruptions, and significant time to requalify new systems. This creates a strong incentive for customers to remain with Mastercard.

Network Effect

Mastercard’s business exhibits a strong network effect. The widespread adoption of Mastercard's payment solutions by consumers, merchants, and financial institutions creates a de facto industry standard. As more entities use Mastercard's services, a larger pool of expertise, acceptance points, and support infrastructure develops around these systems, enhancing their attractiveness and convenience for other users and merchants globally.

Attracting Talent

Mastercard’s reputation as a leader in the payment processing industry helps it attract top talent worldwide. The company provides opportunities to work on cutting-edge technologies and solve complex financial and technological challenges. This ability to attract and retain highly skilled professionals ensures that Mastercard remains at the forefront of innovation, maintaining its competitive edge. While some might not consider talent attraction a traditional moat, for a high-tech company like Mastercard, having a continuous influx of top-tier talent is critical to sustaining its leadership and driving future growth.

4. Industry Analysis

4.1 Current Industry Landscape

Mastercard operates in a highly competitive industry; that is a fact. However, Mastercard benefits greatly from its duopoly with Visa. Mastercard and Visa both run the industry.

The barrier to entry is not extremely high. Therefore, new participants keep entering the market, trying to take market share, Mastercard or Visa. However, due to the sheer size of the Mastercard and Visa cards and their market share, having an impact on these two giants is nearly impossible. Mastercard is well aware of its competition and, therefore, spends immense amounts of cash on R&D to stay ahead of its competition and focus on its main competitor, Visa.

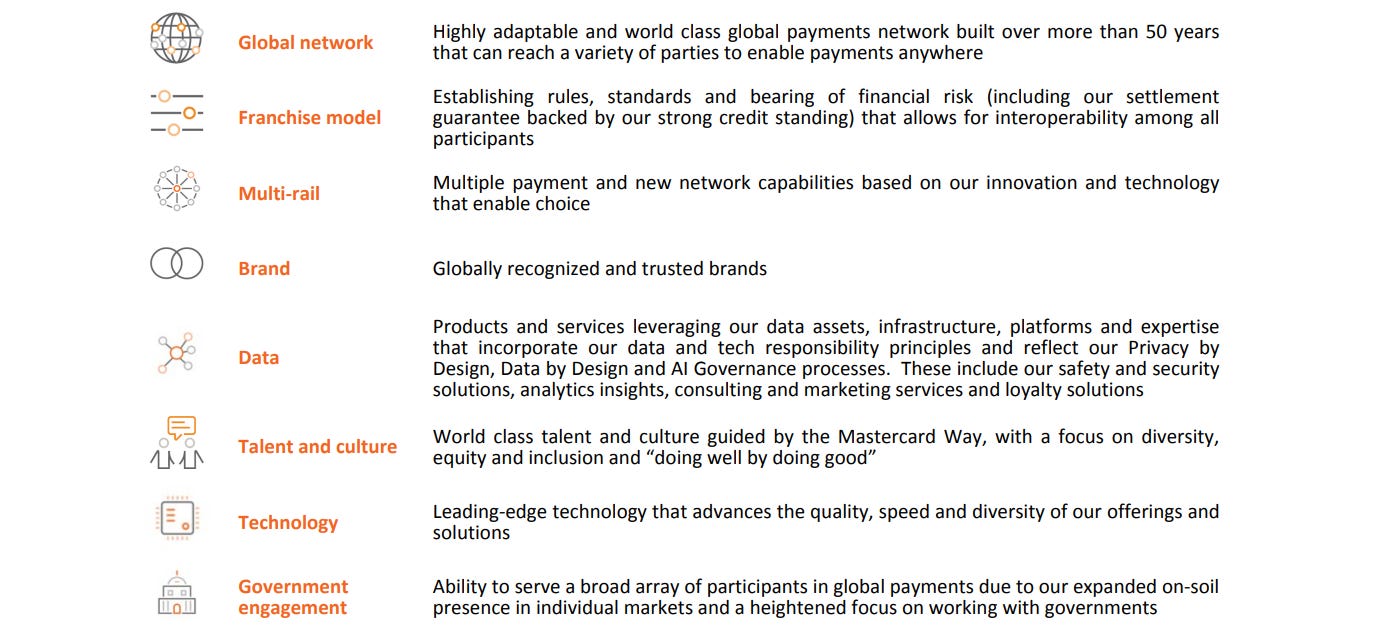

As shown above, Mastercard has excellent advantages over its competition based on its Global Network, Brand, Franchise model, talent, Technology, and data.

These items are not easy to replicate for new market participants. Mastercard has set a high barrier to competing with MasterCard or Visa. (Visa benefits greatly from almost all the same items.)

Fintech is growing excellently, and Mastercard and Visa will benefit greatly. However, due to its duopoly nature, most of the expected growth will end up in the pockets of Mastercard and Visa. The global fintech market was valued at USD 294.74 billion in 2023 and is projected to be worth USD 340.10 billion in 2024 and reach USD 1,152.06 billion by 2032, exhibiting a CAGR of 16.5% during the forecast period (2024-2032). North America dominated the global market with a share of 34.05% in 2023.

The pandemic accelerated the digital transformation we’re seeing today in financial services. Businesses and consumers are increasingly turning to online and mobile banking. In addition, financial technology companies offering payment and transaction processing services experienced a surge in demand as e-commerce, contactless payments, and digital wallets became more prevalent during the pandemic.

In addition, cloud computing is accelerating, and therefore, it offers fintech providers the ability to scale their infrastructure and services according to demand. This means that fintech businesses are more capable of managing their costs effectively. They can scale their resources up or down as needed, reducing the need to make massive upfront infrastructure investments, which is excellent for Mastercard and Visa.

Pssssst! If you like my content, consider sharing it with your friends or family.

4.2 Competitive Landscape

I identify Visa, PayPal, American Express, Fiserv, and Fidelity as Mastercard's main competitors. Once again, Visa is the real competitor, but some businesses operating in the same sector could also be seen as competitors.

We're painting a better picture if we compare Mastercard to its competitors on some basic metrics.

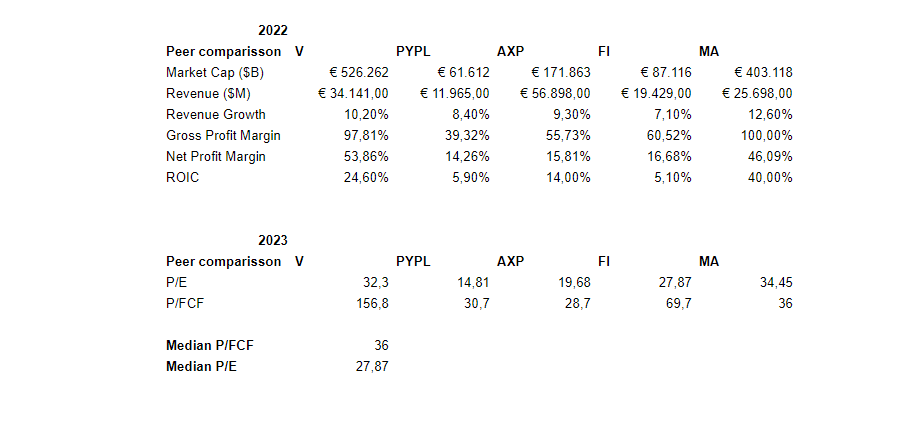

Regarding market capitalization and revenue, Mastercard is a significant player with a market cap of €403.118 billion and revenue of €25.698 billion in 2022. Visa leads the group with a market cap of €526.262 billion and revenue of €34.141 billion. Other competitors like PayPal (PYPL), American Express (AXP), and Fidelity National Information Services (FI) also show considerable market presence but lag behind Visa and Mastercard.

Mastercard outperformed its competitors in revenue growth, achieving a 12.60% increase in 2022. This is notably higher than FI’s 7.10%, PYPL’s 8.40%, and AXP’s 9.30% but slightly behind Visa’s 10.20%. This impressive growth rate underscores Mastercard’s robust business model and market demand for payment solutions.

Mastercard boasts a gross profit margin of 100.00%, uniquely positioned among its peers. Visa also has a high gross profit margin of 97.81%, while other competitors like PYPL (39.32%), AXP (55.73%), and FI (60.52%) show lower margins. Mastercard’s net profit margin of 46.09% remains competitive, with Visa leading at 53.86%, followed by AXP at 15.81%, FI at 16.68%, and PYPL at 14.26%. These figures indicate Mastercard’s strong profitability in the payments industry.

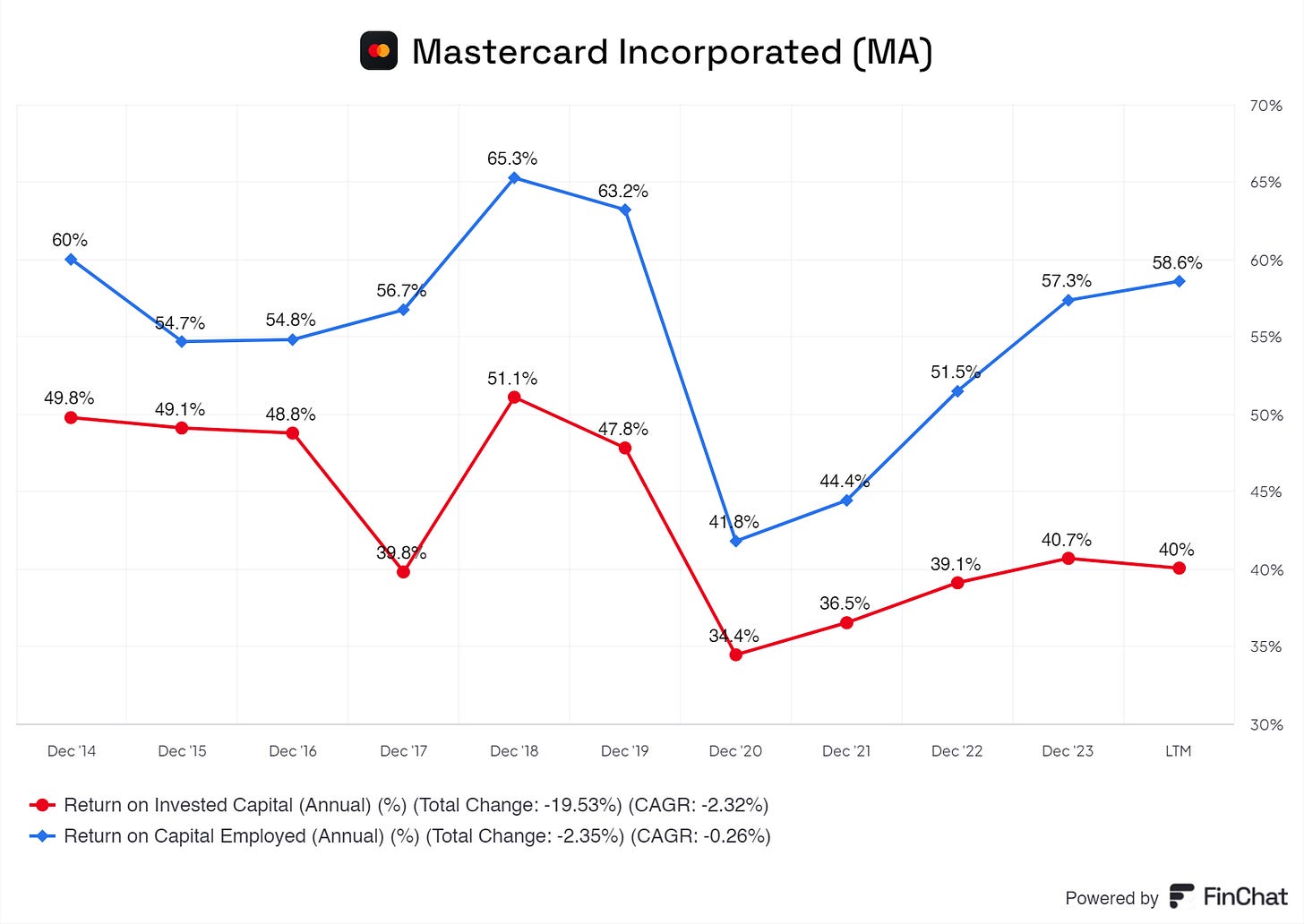

Mastercard’s ROIC of 40.00% is the highest among its peers, followed by Visa at 24.60%, AXP at 14.00%, PYPL at 5.90%, and FI at 5.10%. This strong ROIC indicates Mastercard’s efficient use of capital investments, contributing to its profitability and competitive edge.

In 2023, Mastercard’s Price-to-Earnings (P/E) ratio stands at 34.45, higher than PYPL’s 14.81, AXP’s 19.68, and FI’s 27.87, but lower than Visa’s 32.3. Mastercard's price-to-free cash flow (P/FCF) ratio is 36, which aligns closely with the median P/FCF for the group at 36. These valuation ratios suggest investors view Mastercard favorably, likely due to its strong growth prospects and market leadership.

Mastercard operates in a highly competitive and innovation-driven industry, requiring substantial investments in technology and security to maintain its position. Despite its strong financial metrics, competitors like Visa continue to challenge its market share. Mastercard must continue focusing on innovation, operational efficiency, and strategic partnerships to sustain its leadership and drive future growth.

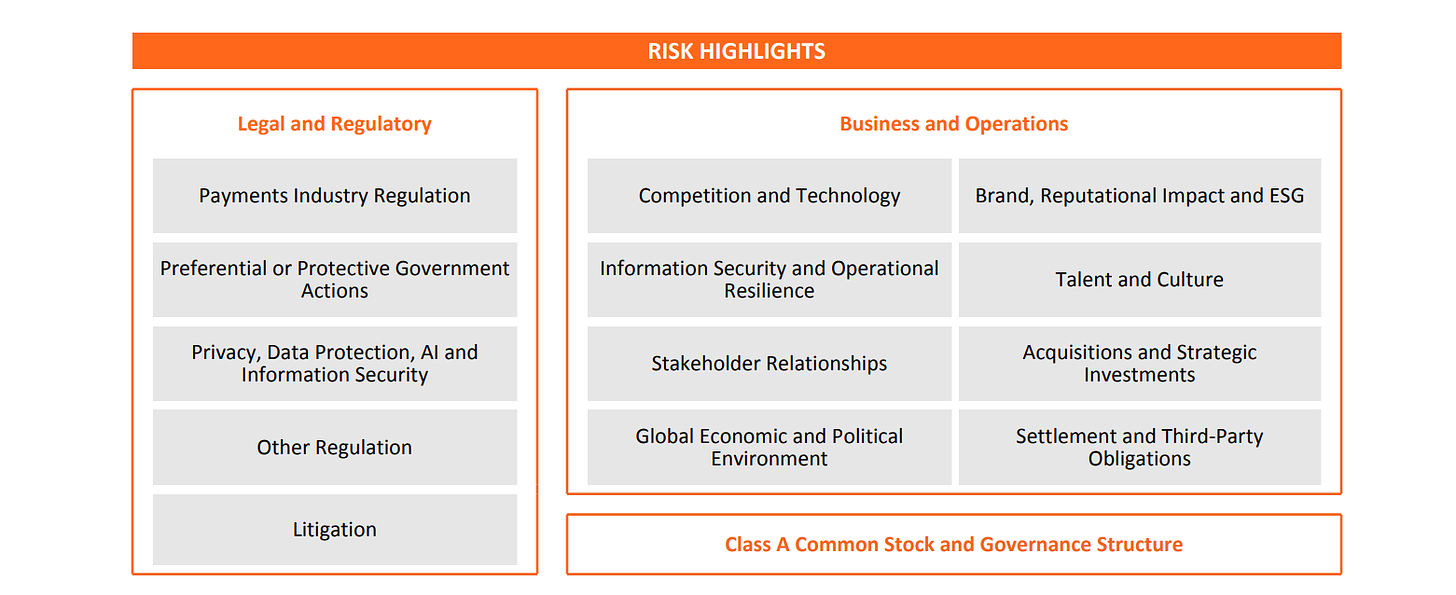

5. Risk Assessment

Mastercard is in a heavily regulated industry that is highly scrutinized by lawmakers and other high officials. Here are some of the risks I consider to be something we need to watch out for.

Usually, I dig deeper to find more risks, but Mastercard has its risks figured out, and there was limited time needed to deepen our risks further.

Regulations

It wouldn’t be the first time lawmakers have dabbled in cutting fees or limiting fees for many businesses.

Illinois lawmakers in the closing hours of the General Assembly’s spring session became the first in the nation to ban banks and credit card companies from charging retailers a seemingly small fee on sales taxes and tips.

Lawmakers have been around for ages and have been a pain in the *** for many financial institutions that have some form of fees. Scrutiny from these parties will most definitely stay on the horizon for the time being.

We’ve known from other laws, like the highly controversial abortion law, that when one state goes through with it, others follow like bees. This is no different in the financial world with its regulations.

Operational Risks

As businesses increasingly move operations online and store data in the cloud, they become more vulnerable to cyber attacks, including ransomware and other threats. With its extensive cloud-based operations, Mastercard is a prime target for such attacks. Ensuring robust cybersecurity measures is essential to mitigate these risks.

Technological Changes

The rapid pace of digital transformation means new ideas for improved and faster products are constantly emerging. Mastercard must continuously invest in research and development to innovate, acquire, and implement these new ideas, ensuring they remain at the forefront of the industry.

6. Financial Health

6.1 Assets Assessment

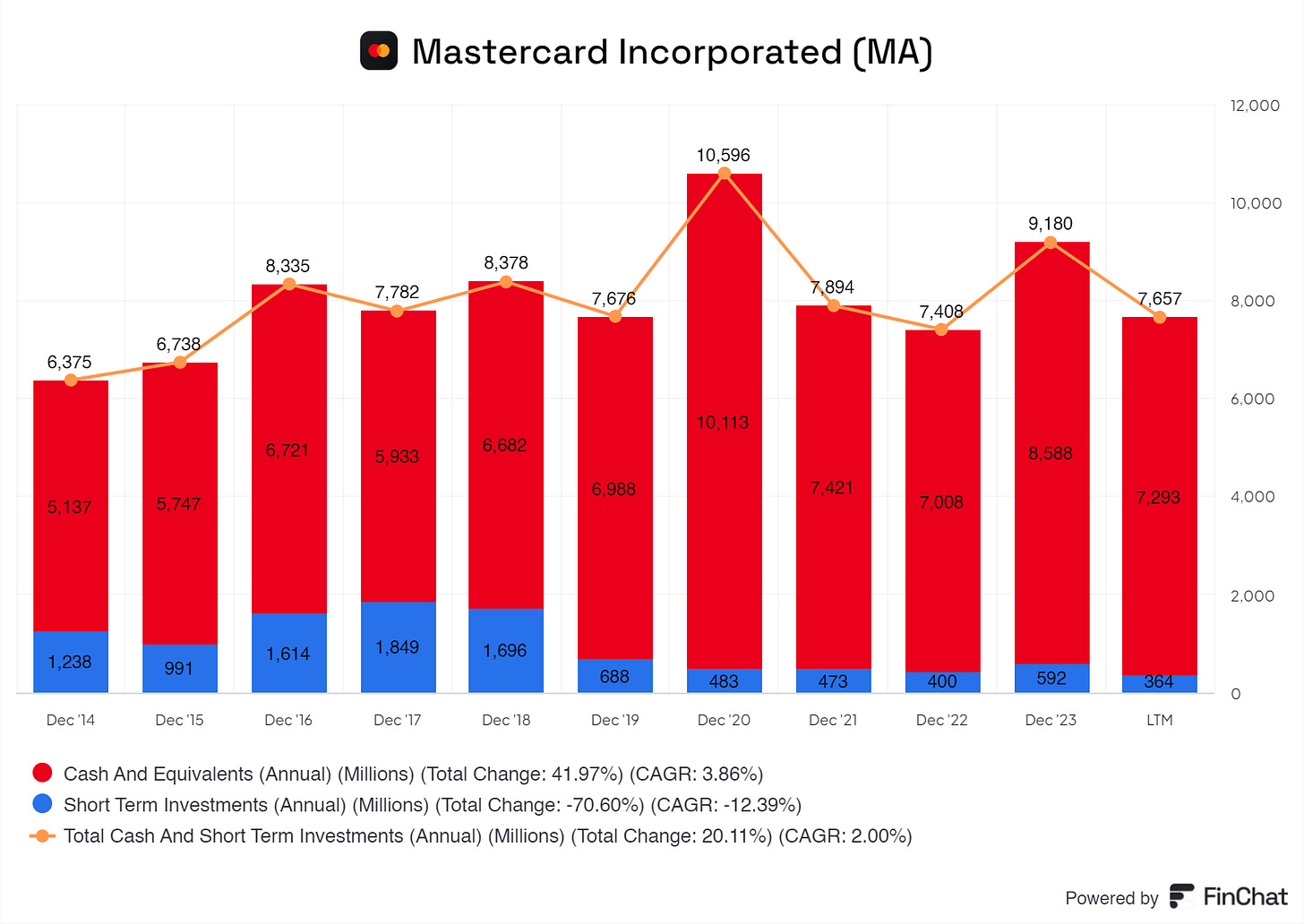

Mastercard has solid Cash And Equivalents and Short-Term Investment positions. As many of you know, cash is king, and businesses with a solid cash position always have a special place in my heart.

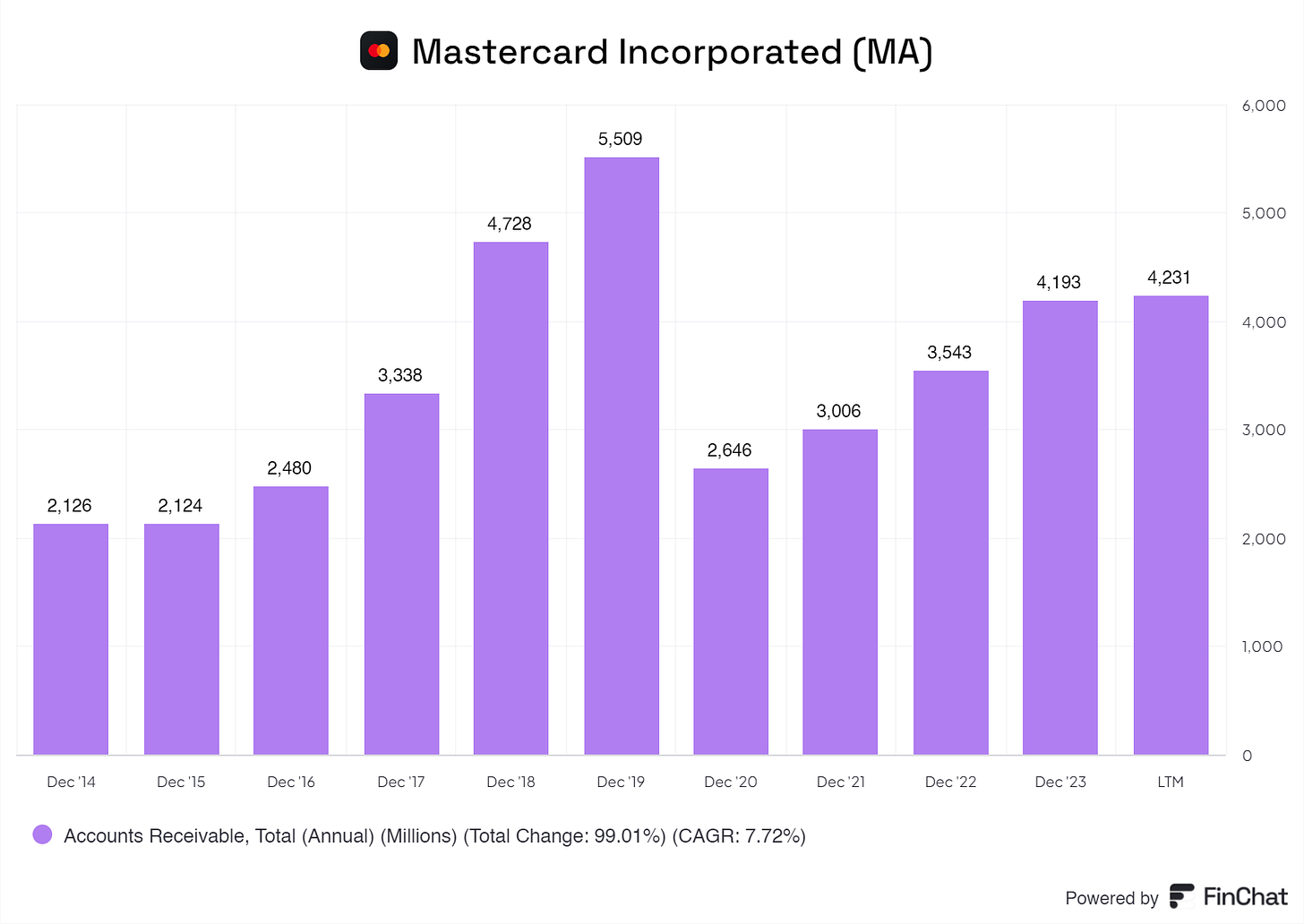

What did shock me was that Mastercard has relatively low Account Receivables on the balance sheet. I expected this number to be higher due to the nature of the business, but Mastercard really does manage it well.

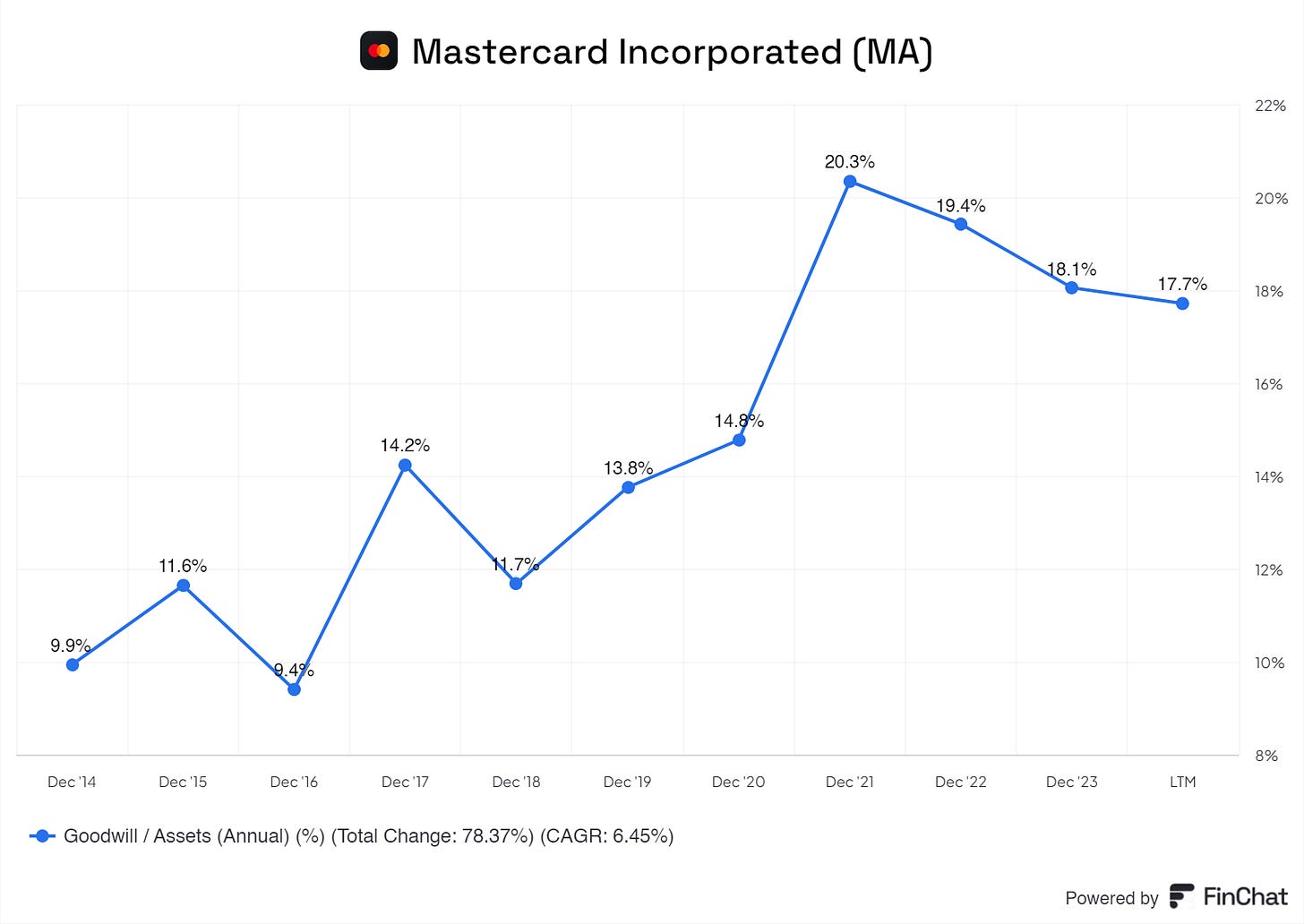

We see a sharp increase in Goodwill on the balance sheet for Mastercard. This is due to the premiums paid for the acquisitions Mastercard has performed. Some of these acquisitions are:

Adaptive Payments

Arcus

Oltio

IfOnly

Truaxis

Baffin Bay Networks

Dynamics Yield

The premiums paid for these acquisitions are notable on the balance sheet. Luckily, the Goodwill-to-Asset ratio dropped from its peak in 2021. Goodwill will be on the balance sheet since Mastercard enjoys strategic acquisitions.

The items listed above really were nitpicked out of the Mastercard assets. Mastercard has an excellent asset sheet.

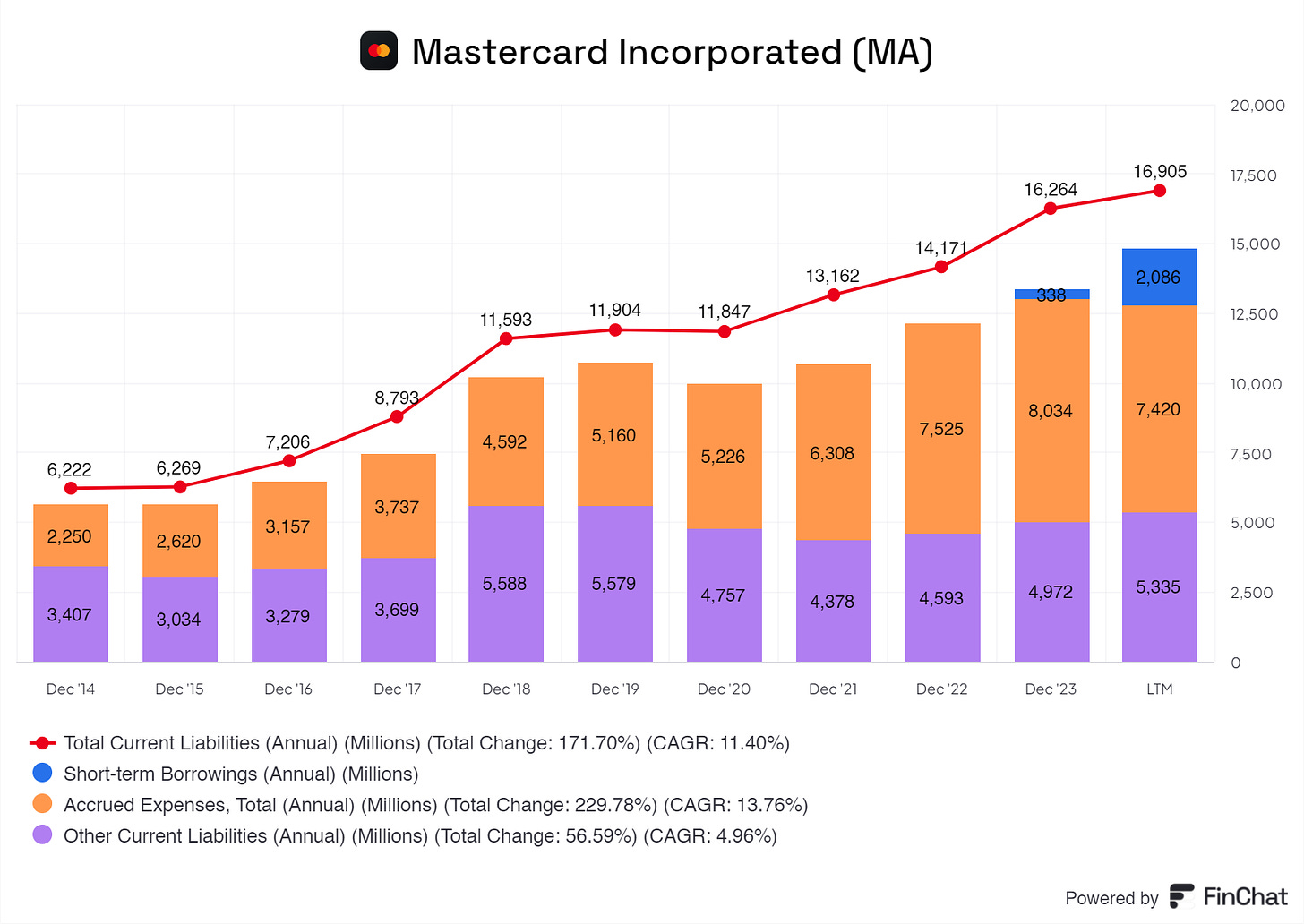

6.2 Liabilities Assessment

Most of Mastercard’s Total Current Liablities are Accrued Expenses, Short-Term borrowings, and other smaller current liabilities. These are nothing note-worthy. Mastercard is extremely capable of paying off liabilities. Again, Mastercard has an excellent balance sheet, so I am nitpicking here.

Mastercard’s biggest liability is its Long-Term Debt. But, again, investors should not be worried about this. Mastercard leverages its debt excellently, and management is well aware of it and how it is leveraged.

All in all, the balance sheet of Mastercard is excellent, to say it lightly.

7. Capital Structure

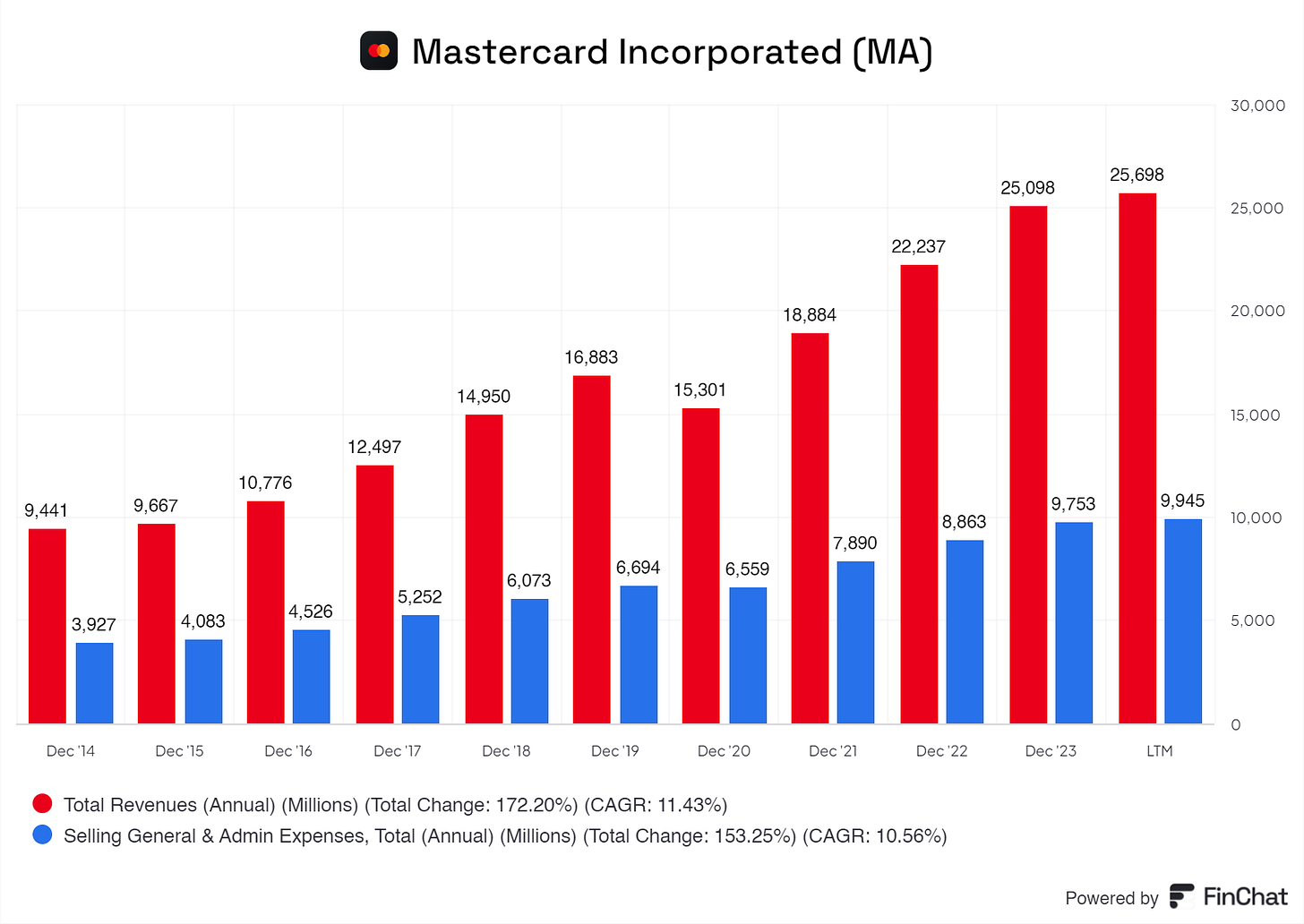

7.1 Expense Analysis

Mastercard's biggest expense is SG&A expenses. Mastercard is showing that even SG&A will be less of an expense over the years.

In 2014, SG&A was 41.6% of its total Revenue, and as of today, it is 38.7%, showing that Mastercard is growing its Total Revenue far faster than its SG&A expenses. Also, in the last four years, we see that Mastercard is keeping its SG&A expenses under control, and growth in that expense is slowing down, giving more Net Revenue to the business.

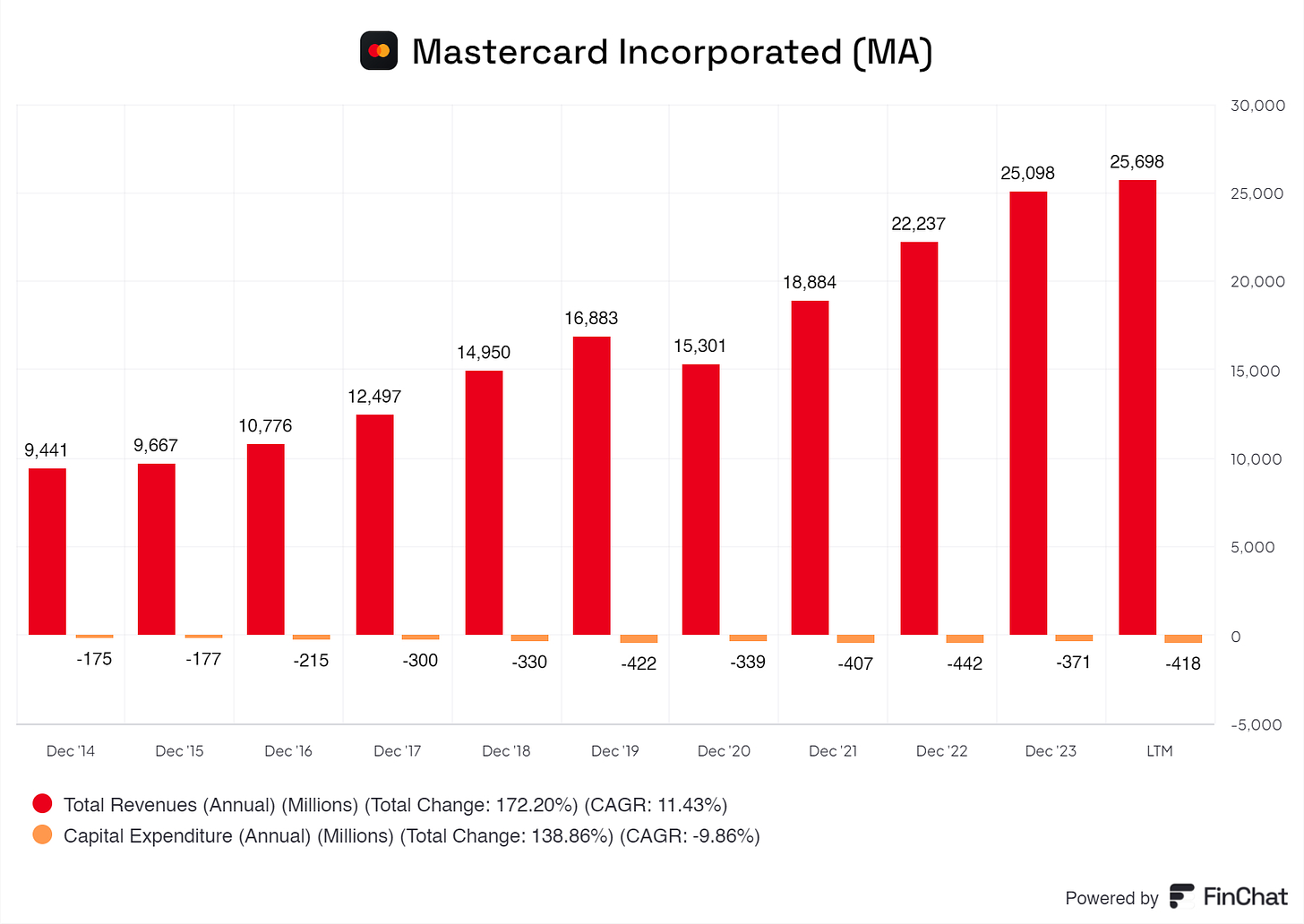

CAPEX is also extremely low for a business like Mastercard.

Mastercard is a software business, so it is extremely CAPEX-light. LTM CAPEX-to-Total Revenue is 1.62%…yes, you read that right. Mastercard's CAPEX average is below 2%, and that’s excellent. Lower CAPEX costs give Mastercard more room for investing in new acquisitions, projects, and shareholders.

Mastercard is a business that does not need to make many investments or incur many expenses to grow.

7.2 Capital Efficiency Review

Mastercard has an excellent track record of ROIC and ROCE. In short, this tells me that ASML’s management can deploy cash for profitable projects that create excellent shareholders and business returns. Even with the drop in 2020, Mastercard’s ROIC and ROCE are far above the S&P 500 average of 16%. A high ROIC and ROCE usually signal that the business has a solid MOAT, and Mastercard does.

8. Profitability Assessment

8.1 Profitability, Sustainability, and Margins

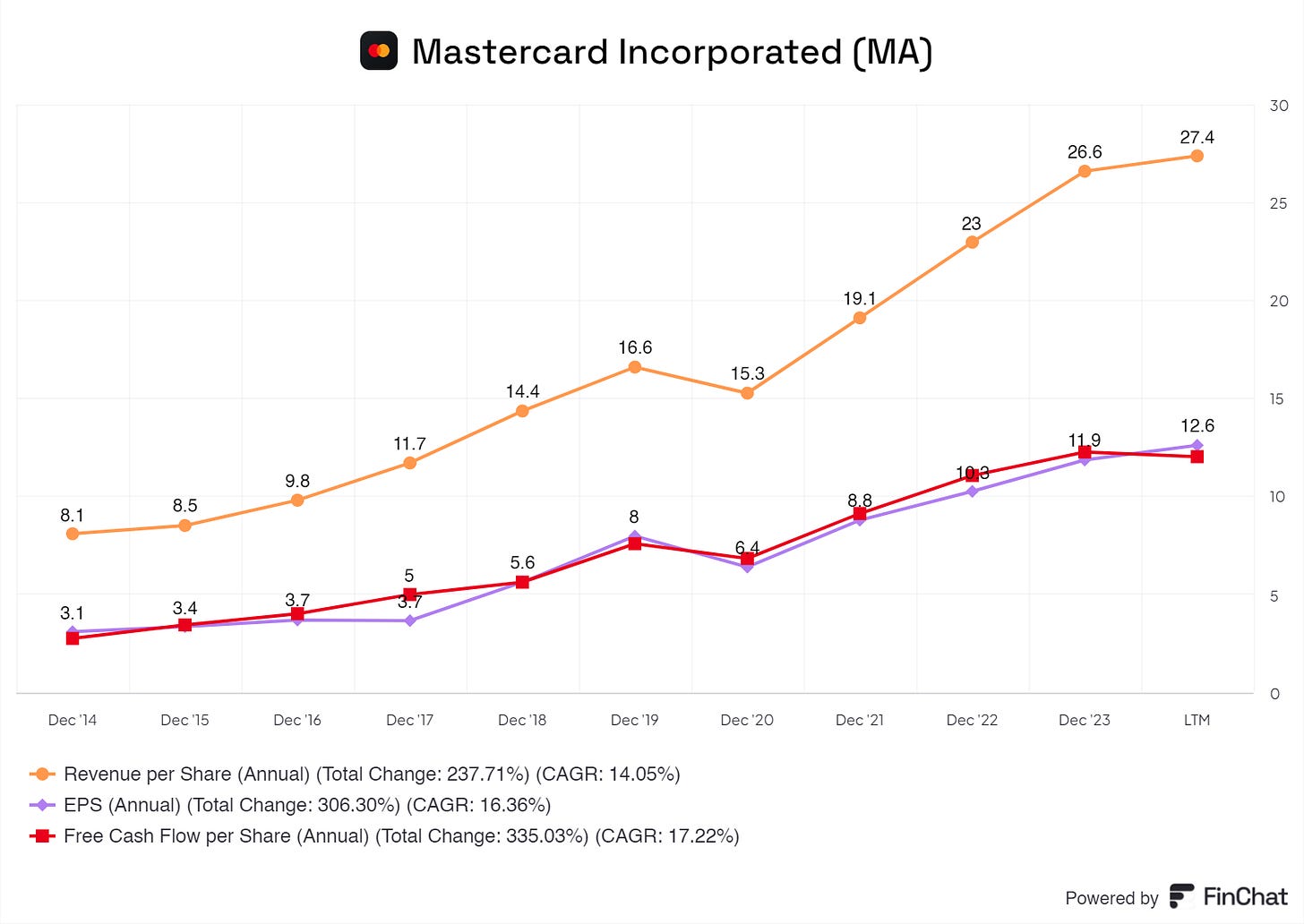

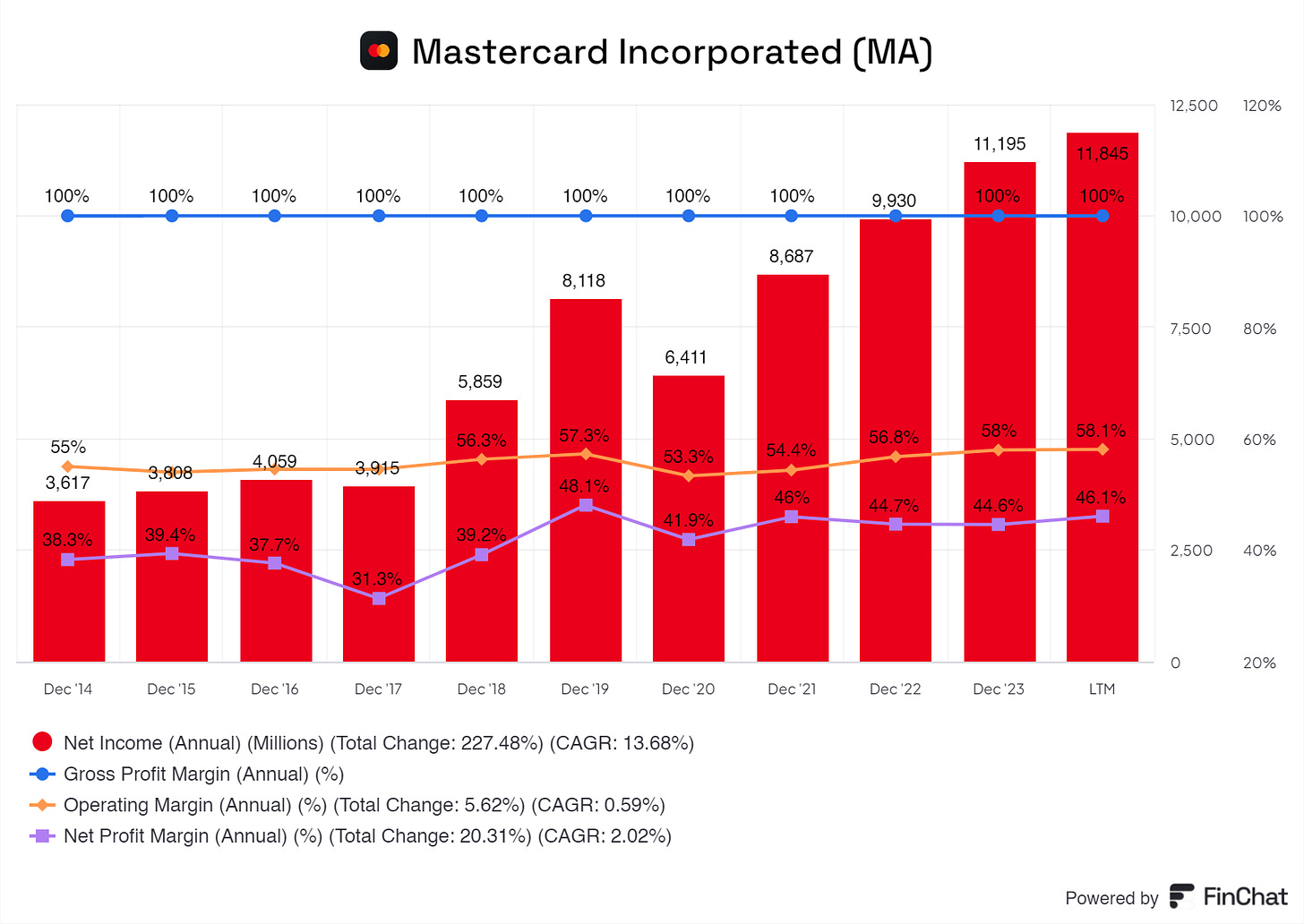

I mean, look at this. Mastercard has the world's best Gross Profit Margins and excellent Operating and Net Profit Margins and generates excellent net revenues with a CAGR of 13.68% from 2014 up until the last twelve months. Gross Profit Margins have been stable, and the Operating and Net Profit Margins have been on the increasing side of the spectrum. Management is really capable of bettering this business year over year.

8.2 Cash Flow Analysis

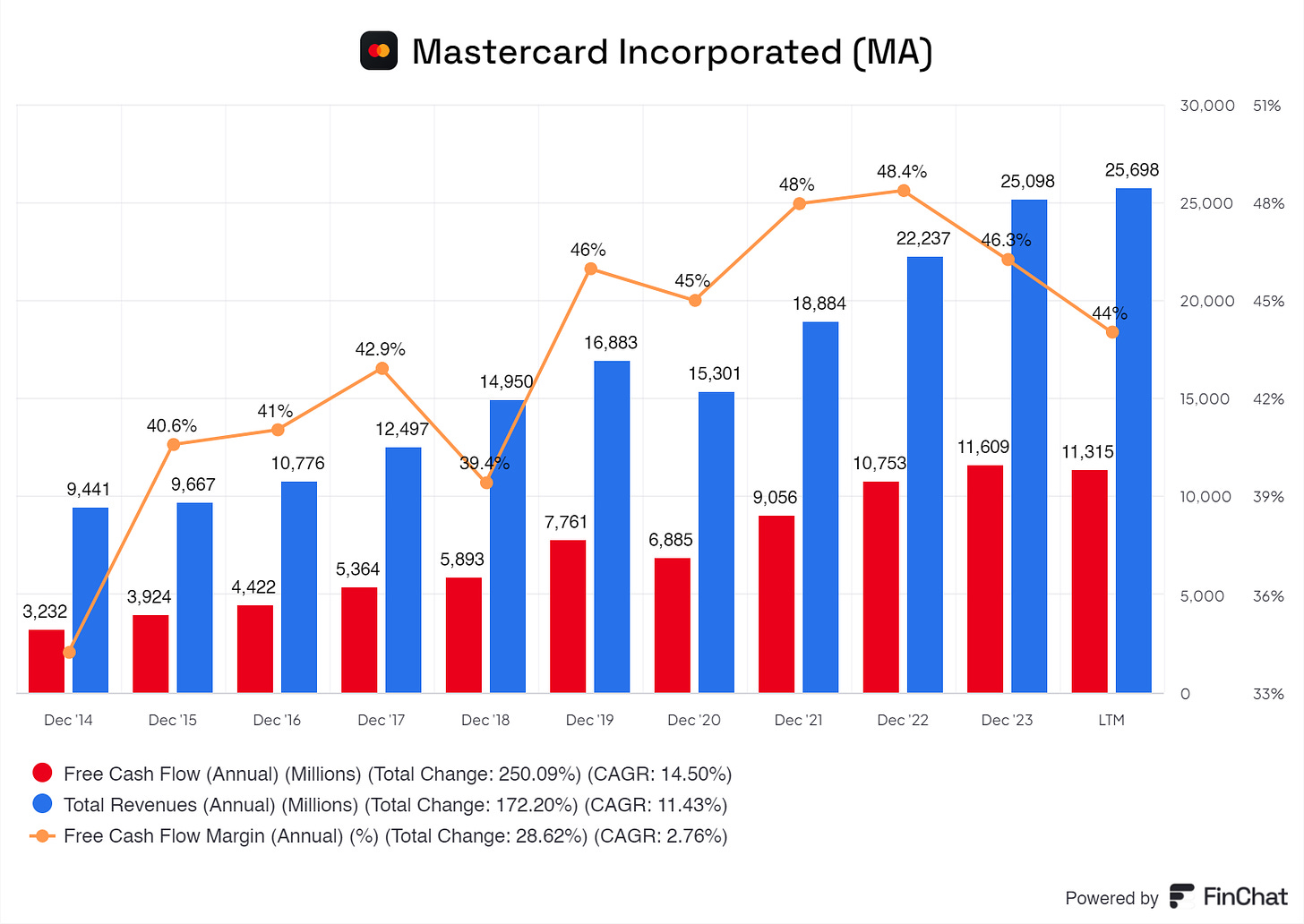

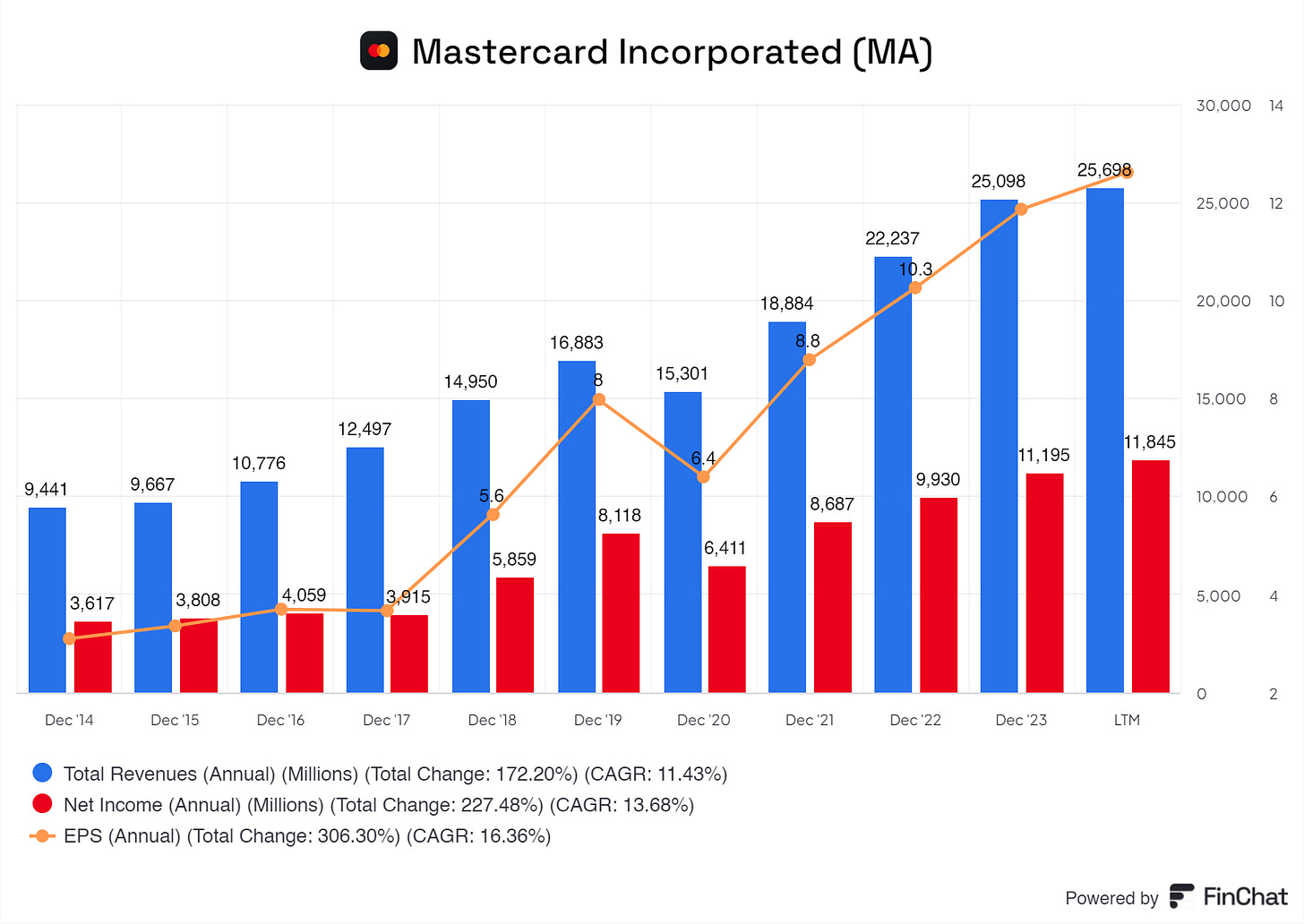

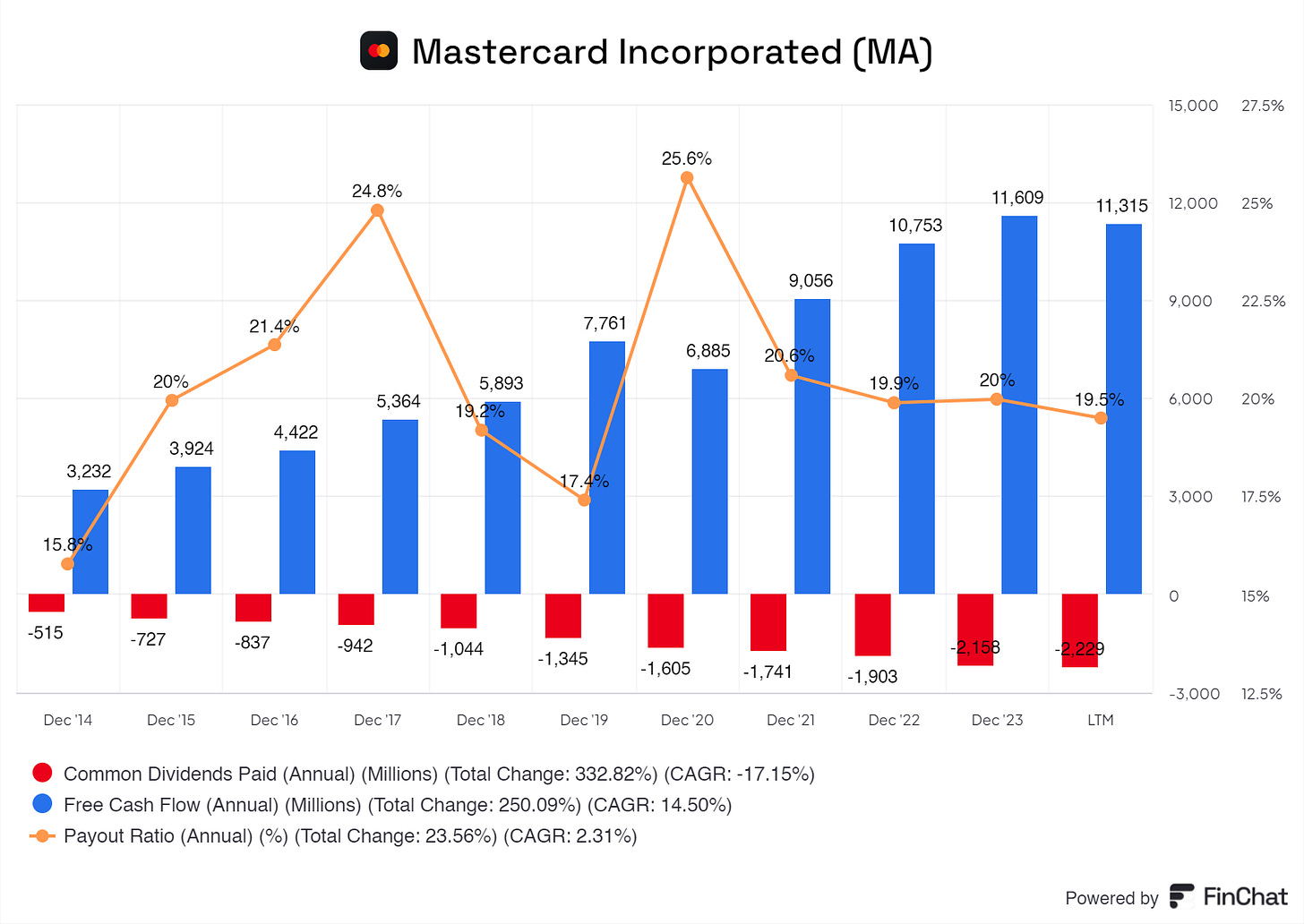

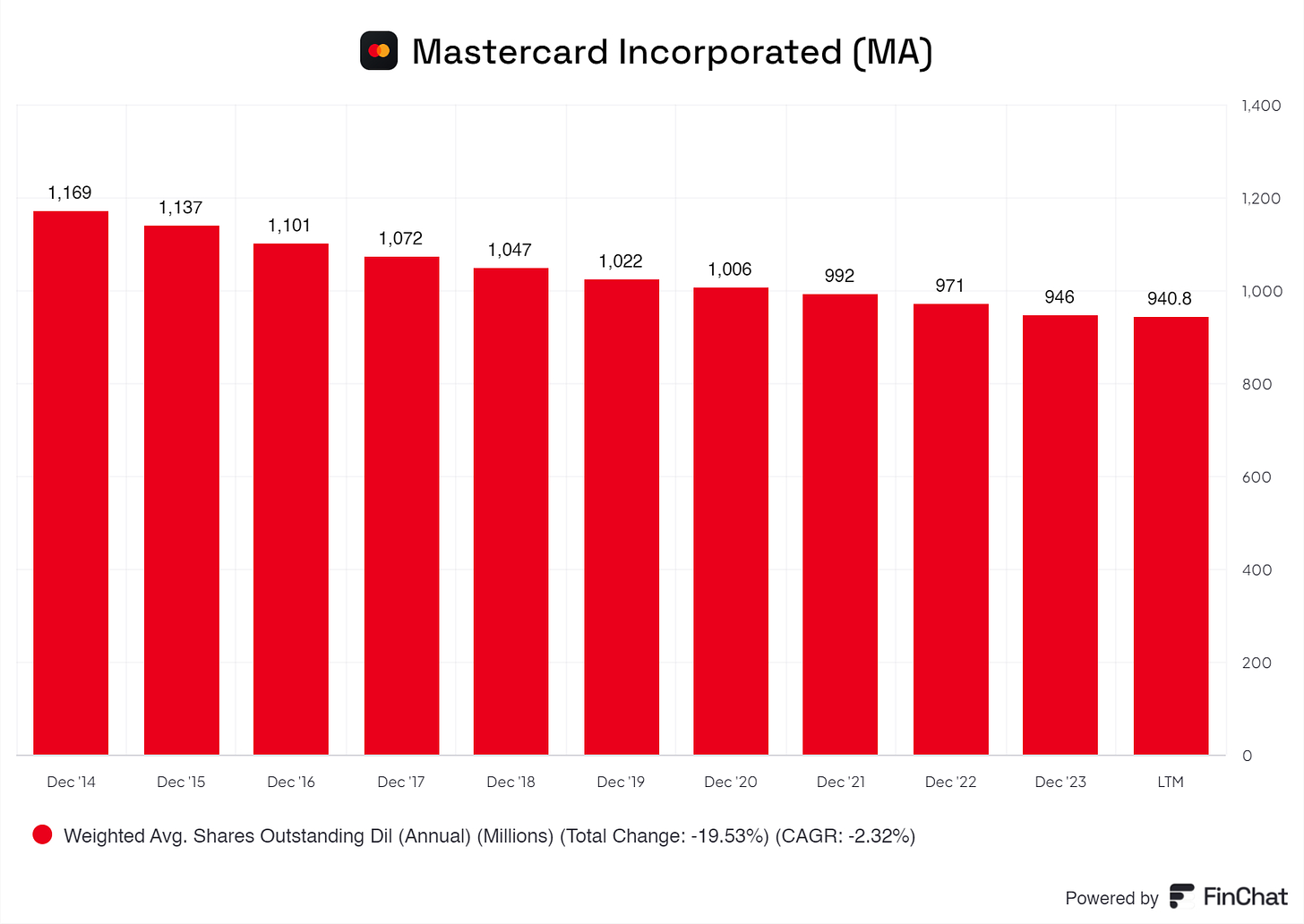

The chart highlights Mastercard's robust financial growth, with significant increases in total revenue and free cash flow. Total revenues for Mastercard have shown a consistent upward trend from December 2014 to the Last Twelve Months (LTM) period, reaching $25,698 million in the LTM period from $9,441 million in December 2014. Similarly, free cash flow has also shown an upward trend, increasing from $3,232 million in December 2014 to $11,315 million in the LTM period.

The free cash flow margin represents the percentage of revenue converted into free cash flow. This margin has varied over the years, peaking at 48.4% in December 2021 and slightly decreasing to 44% in the LTM period. Despite these fluctuations, the margin has remained relatively high, showcasing Mastercard's ability to generate substantial free cash flow from its revenues.

The consistent growth in revenue and free cash flow suggests that as Mastercard's revenue increases, it is effectively managing its operations to convert a significant portion of its revenue into free cash flow. In recent years, especially from 2020 onwards, the free cash flow margin has been relatively stable around the mid-40% range. This stability indicates that Mastercard has possibly reached a mature phase in its cash flow generation capabilities.

Overall, the financial trends depicted in the chart reflect a strong and growing company with solid cash generation capabilities.

9. Growth Analysis

9.1 Historical Growth Trends

Mastercard has historically been growing at excellent rates, nothing unusual. With a Total Revenue CAGR of 11.43%, this seems doable for Mastercard's foreseeable future, especially with the projected growth. Mastercard's Net Income is also growing with a CAGR of 13.68%, nothing too crazy, and it can continue.

9.2 Future Growth Projections

According to my research and projections, I expect Mastercard to grow at 15% for the next 5 years. With the increasing market, Mastercard will benefit greatly from this, as will Visa. Analysts online also expect Mastercard to grow in the double digits; most of them argue that 18-20% is doable for Mastercard.

I am more cautious, though. Although there is a lot of expected growth, the industry could be very disruptive with its competitors, and there might be a chance that Mastercard and Visa need to give in on some aspects. Therefore, I am expecting a lower growth of around 15%. Still, 15% is excellent and should be celebrated if Mastercard hits it.

10. Value Proposition

10.1 Dividends Analysis

Mastercard pays a modest dividend to its shareholders. Usually, I’m not a big fan of businesses paying a dividend, but I would love to see this money reinvested. But, due to the nature of high cash flows from Mastercard, this dividend almost has no impact on its b’s business. Mastercard still has enough Free Cash Flow to invest in other projects without worrying about a dime.

Mastercard stated in its annual report that it is dedicated to continuing to pay dividends to give back to its shareholders, making it reliant on these dividends.

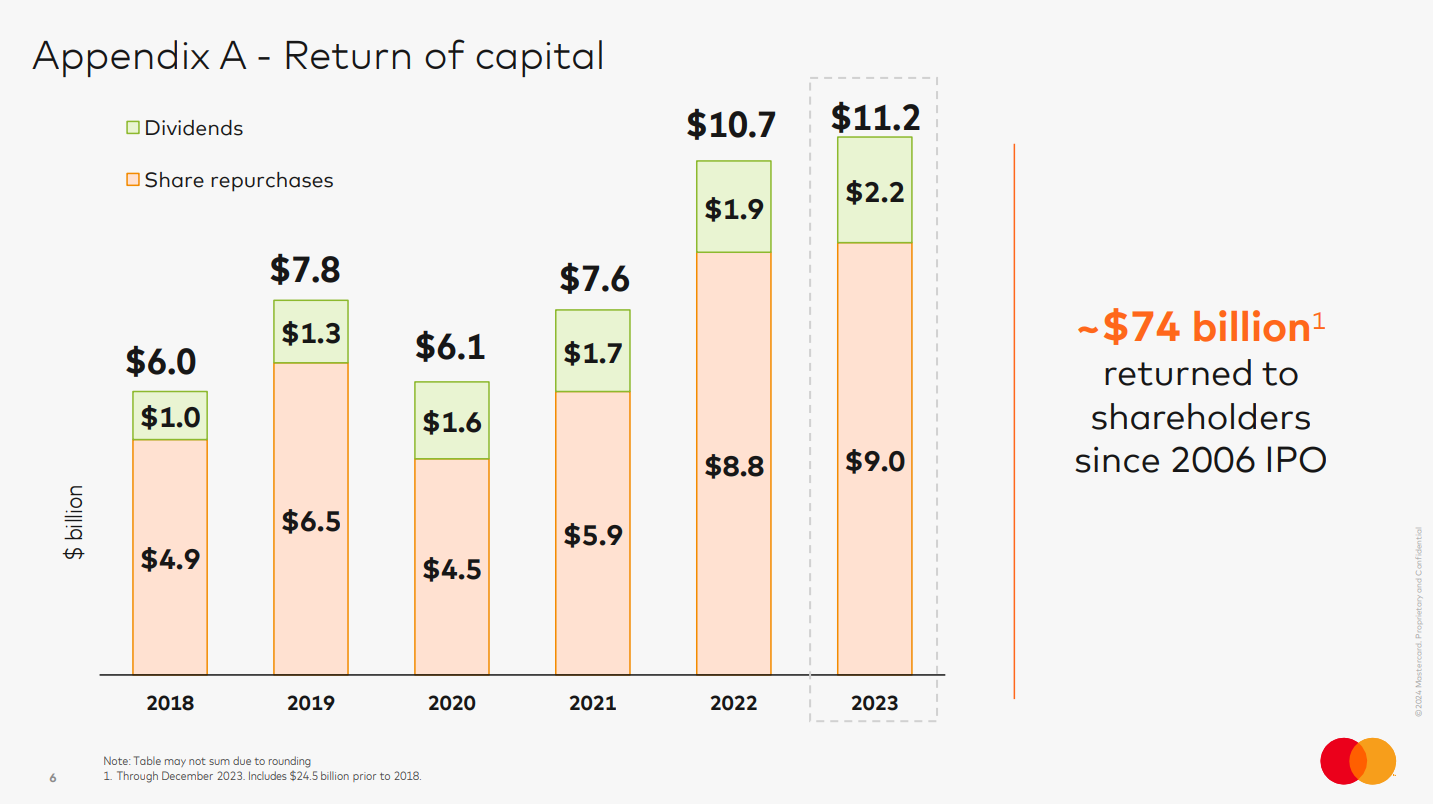

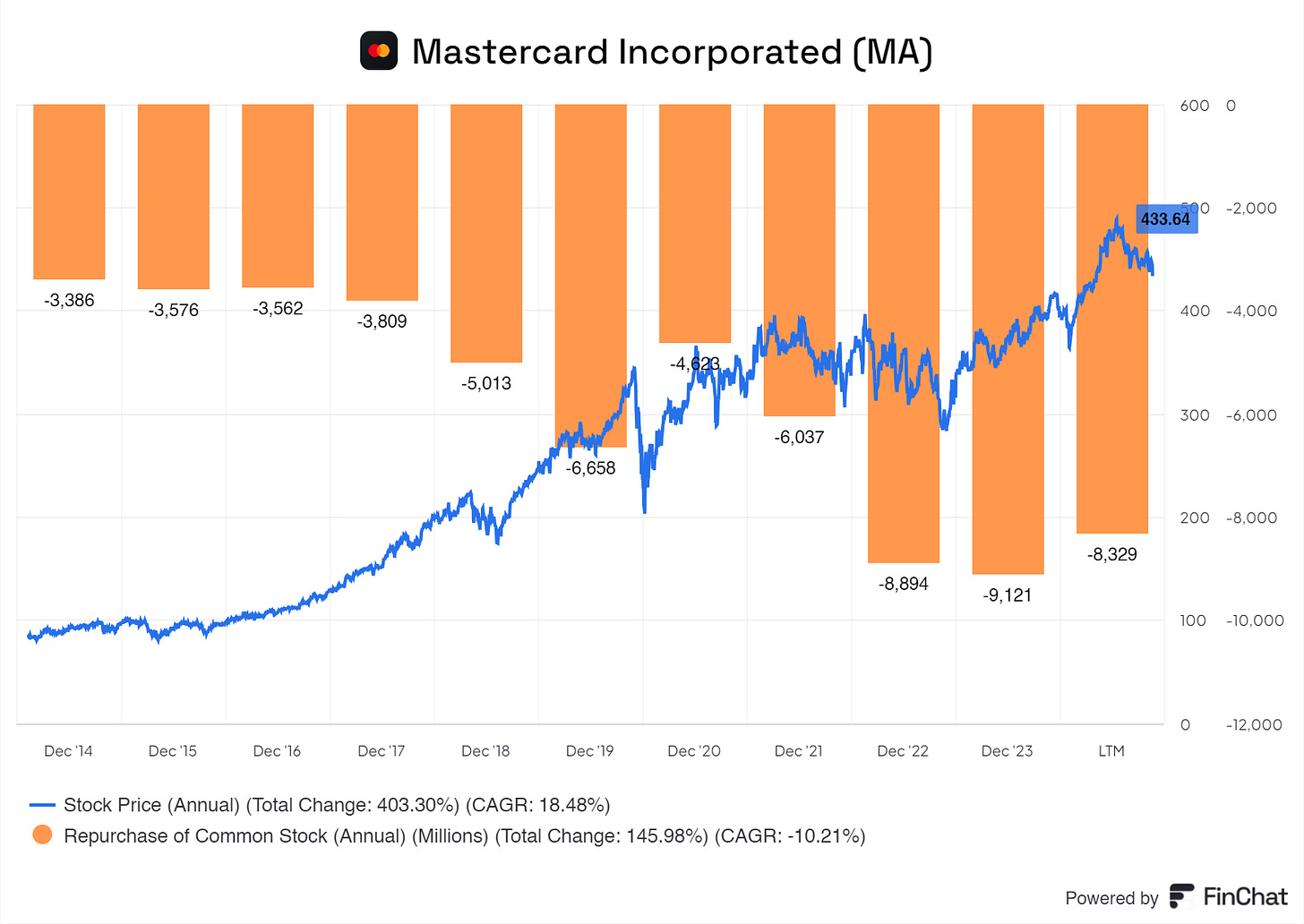

10.2 Share Repurchase Programs

Mastercard is driving more and more value to its shareholders via share buybacks.

Repurchased shares of our common stock are considered treasury stock. In December 2023, December 2022 and November 2021, our Board of Directors approved share repurchase programs of our Class A common stock authorizing us to repurchase up to $11.0 billion, $9.0 billion and $8.0 billion, respectively. The program approved in 2023 will become effective after the completion of the share repurchase program approved in 2022. The timing and actual number of additional shares repurchased will depend on a variety of factors, including cash requirements to meet the operating needs of the business, legal requirements, as well as the share price and economic and market conditions.

- Mastercard Annual Report

Mastercard does not blindly repurchase its shares; it does so strategically. Mastercard buys its shares back when they see it fit, which is actually good timing to buy the shares back, as shown below.

10.3 Debt Reduction Strategy

Mastercard, as it should, is not worried about its debt positions. Management manages Mastercard’s debt position well and leverages it well. Matured debt is being paid off or refinanced properly, as it should.

11. Future Outlook

The future for Mastercard is bright. Although government interference might impact Mastercard’s operations, demand will increase due to the extremely fast innovation cycle we’re in now. As discussed earlier, the end of a slow cycle and a new boom era in the digital payments industry are near. This new cycle could impact Mastercard's revenue positively and provide wonderful growth for now, and we can enjoy this ride.

I do want to double down on the potential risk for Mastercard. Because Mastercard has one of the best global payment systems, everybody worldwide, including world leaders and governments, might try to regulate or influence its operations to benefit their economies or industries. This will result in laws and regulations that might make it harder for Mastercard to operate to its full extent. How will this look, from whom, to what extent, and for how long is a guessing game? I recommend considering this when evaluating the business and using your safety metrics. For instance, I use a higher discount rate and more pessimistic growth rates to reflect some ‘‘fear’’ I might have with Mastercard. But again, this is my outlook.

From a management and balance sheet perspective, Mastercard is a no-brainer. With the leadership team, I’m sure Mastercard will have a bright future. As mentioned earlier, the management team is knowledgeable and experienced.

Mastercard's balance sheet is solid, robust, and made for growth. We see that Mastercard is going for growth, which is exactly what we want to see.

In addition, Mastercard has excellent growth ahead, creating wonderful shareholder returns via share repurchases and a solid dividend.

I wish I could say more, but Mastercard is one of those quality businesses where nothing is going wrong or what could go wrong.

12. Quality Rating

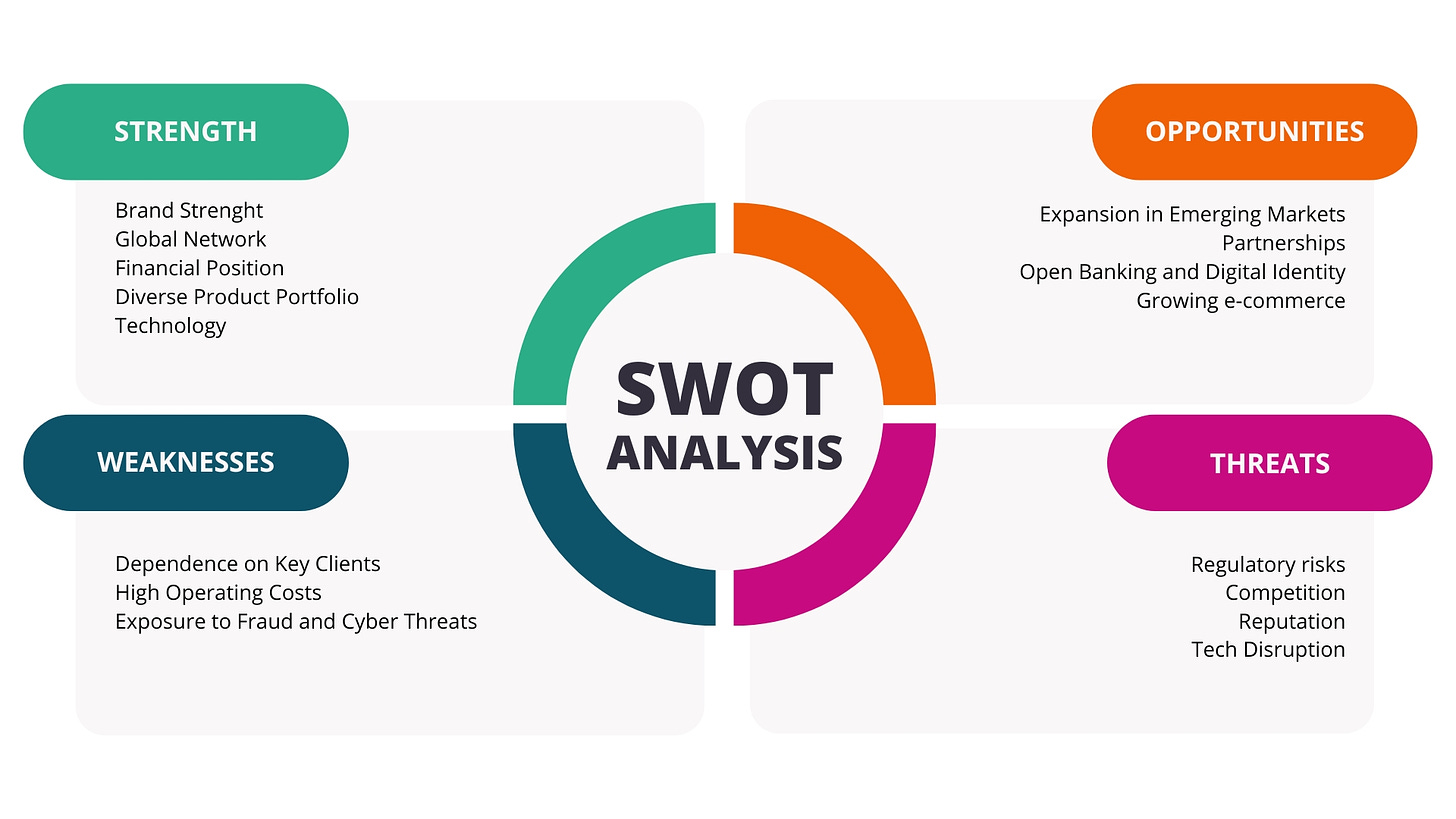

13. SWOT Analysis

14. Valuation Assessment

Let us crunch some numbers!

DCF: $520,33 per share

Multiple Valuation: $345,89

Benjamin Graham’s Valuation: $402,75

Analysts Average: $472,38

Average of: $410,33

Current Price MA: $432,82

Mastercard is reasonably priced if we look at the average compared to its current price. With the expected growth and keeping an eye on the excellence of the business, paying a slight premium wouldn’t be the worst decision if you’re interested in Mastercard.

Sharing my content would be greatly appreciated!

End note

Thank you for reading this investment case on Mastercard!

With every investment case, I am trying to improve my writing and how I communicate my findings with you all. Because I started not too long ago, some posts might change in layout or other aspects before I find the layout that suits my best wishes; sorry in advance.

As of now, thank you so much for your time! I hope you found some valuable information in this investment case.

Thanks for reading FluentInValue! Subscribe for free to receive new posts and support my work.

Disclaimer

I do not own any shares of MA and do not intend to buy shares in the next 3 months.

By reading my posts, being subscribed, following me, and visiting my Substack, you agree to my disclaimer. You can read the disclaimer here.