Hello friend! 👋

My name is Yorrin, also known as ‘‘Fluentinvalue’’.

I am pleased to have you back for another investment case. This time, we are discussing Adyen, a fintech powerhouse.

In case you have missed previous articles, click on the link below:

If you’re not following me yet, consider doing so. I provide FREE content to help and inform you in your investment journey. From beginner to advanced, all info will be helpful. :-)

Adyen is a global leader in payment solutions.

Adyen serves thousands of businesses worldwide, providing essential payment processing tools for various sectors, including retail, hospitality, and e-commerce. With flagship services like its unified commerce platform and advanced fraud prevention, Adyen reported a total revenue of €1.62 billion for the fiscal year ending in December 2023.

This powerhouse continues to expand its capabilities with strategic partnerships and innovative AI-driven solutions, aiming to simplify payment processes and enhance transaction security globally. As of 2024, Adyen is further strengthening its market presence by launching new services tailored to diverse payment needs, solidifying its position as a crucial player in the payment technology sector. With a robust customer base and a reputation for reliability and innovation, Adyen boasts one of the highest customer satisfaction rates in the industry, with 94% of users recommending their services.

But is Adyen a viable investment opportunity right now? Let's explore the details.

Adyen - General information

Company name: Adyen N.V.

Ticker: ADYEN

Stock price: $1,133.2

Market cap: €35.18B

Revenue: €1,626.06M

Industry: Technology Services / Packages Software

If you’re into these kinds of investment theses, consider checking out the following: Intuit, Copart, and Adobe. These are available for FREE on my Substack page.

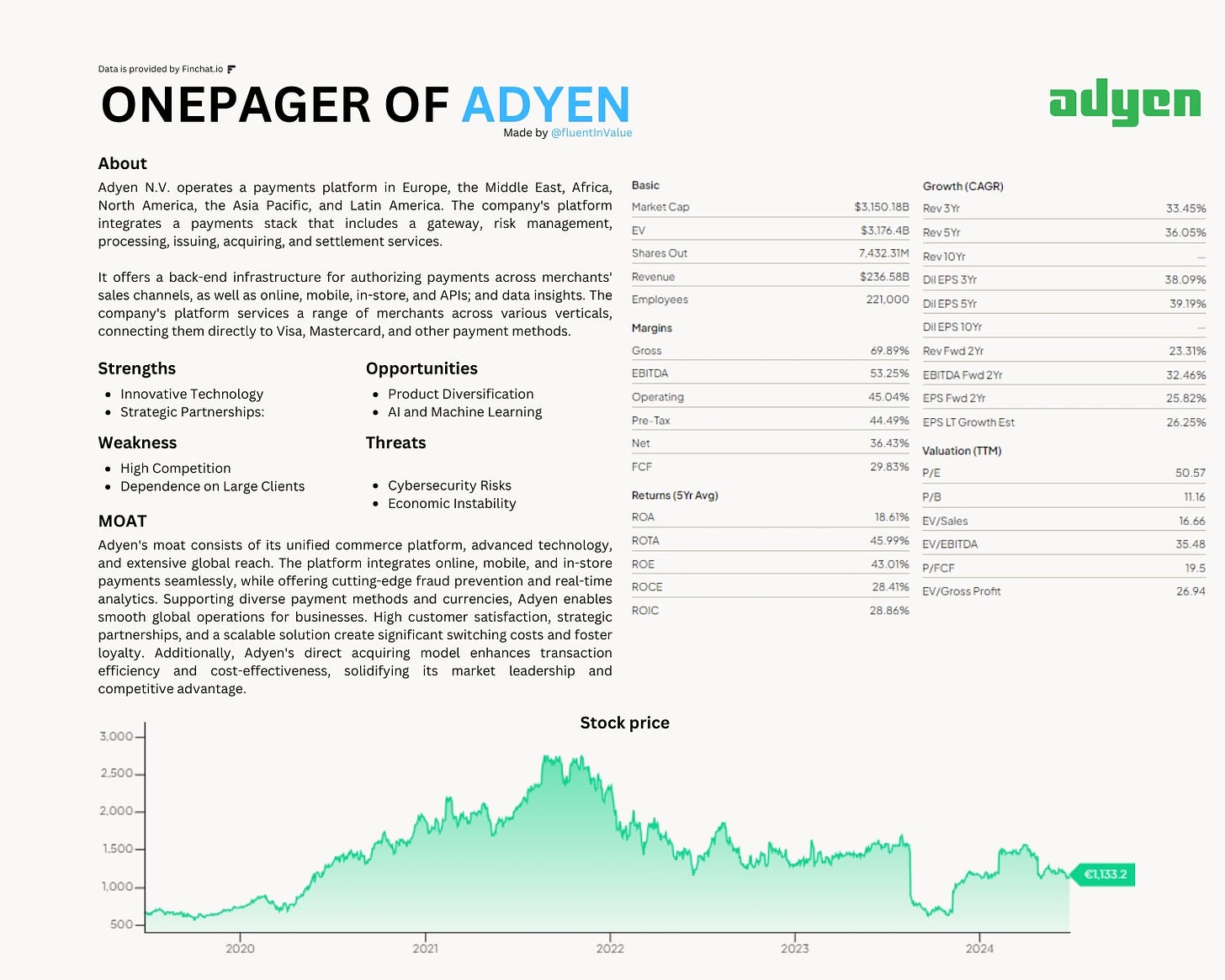

Adyen One Pager

Step-by-step

To better understand the business, I recommend doing the following for yourself the next time you’re eager to invest in a business. This method has helped me pick quality companies, understand their business, and know when to get it & when to get out)

In analyzing a stock, I follow the following steps:

1. Business model

Adyen's business model is robust and innovative. Adyen operates in the payment solutions sector, offering a range of products and services designed to simplify payment processes for businesses of all sizes. Adyen's key offerings include:

Unified commerce platform: Integrates online, mobile, and in-store payments seamlessly.

Real-time fraud prevention: Advanced tools to detect and prevent fraudulent transactions.

Global payment processing: Supports a wide range of payment methods and currencies.

Data analytics: Real-time insights and analytics for better decision-making.

Direct acquiring: bypass traditional intermediaries for faster and more cost-effective transactions.

An impressive aspect of Adyen's business model is its comprehensive and scalable solution that caters to diverse payment needs across different customer segments. This comprehensive approach enhances revenue stability and provides a resilient business foundation, making it a reliable choice for investors.

Some notable Adyen customers are:

2. Management

Pieter van Does, the co-founder and current CEO of Adyen. Let us dive into his past experiences.

In 1995, Pieter van Does started working for the biggest bank in The Netherlands, ING. Pieter van Does became the Operational Management Corporate Finance, Pieter van Does fulfilled this job until 1996.

After leaving ING in 1996, Pieter van Does started a Fast Track Management Program at Elsevier. Pieter van Does did this from 1996 up until 1999, three years.

In May of 1999, Pieter van Does became the CCO of Bibit Global Payment Services to build up a company with over 10m/y profits, providing international e-commerce merchants with a platform on an ASP model that gives access to over 60 domestic and international payment methods. Pieter van Does was the CCO from 1999 up until 2004.

After leaving Bibit Global Payments Services, Pieter van Does became Head of Sales and Account Management for the Royal Bank of Scotland. Pieter van Does did this for 2 years and quit in 2006. In 2006, Adyen was born.

From 2006 until today, Pieter van Does, the co-founder and CEO, built the empire known as Adyen.

From Pieter van Does's previous experience, I can acknowledge that Pieter van Does has experience in the sector and building a million-dollar business, such as Bibit.

Key People

Pieter van der Does - CEO and Co-Founder.

Arnout Schuijff - Co-Founder.

Ingo Uytdehaage - CFO.

Mariëtte Swart - Chief Legal and Compliance Officer.

Alexander Matthey - Chief Technology Officer.

Kamran Zaki - Chief Operating Officer

Pieter van Does holds 922.539 shares in Adyen, accounting for 2.97% of the total outstanding shares.

Is Pieter van Does creating shareholder value? YES!

3. Competitive & sustainable advantage (MOAT)

An excellent and competent CEO runs Adyen, but does Adyen have a sustainable advantage? Let us chat about it.

So, a MOAT can be in either one or more of the following forms:

Brand power

Patents

Scale and cost advantages

Switching costs

Network effect

Attracting talent (I consider this a MOAT, others don’t. Decide for yourself)

Brand power

Adyen has established a strong brand name in the payment solutions industry. Adyen is known for its seamless, reliable, and innovative payment processing solutions. The company's reputation is built on its cutting-edge technology and high customer satisfaction. Adyen's brand is further strengthened by its global presence and trust in its ability to handle complex payment processes for businesses of all sizes.

Scale and cost advantages

Adyen benefits significantly from scale and cost advantages. Serving thousands of businesses worldwide, Adyen can leverage its size to negotiate better terms with payment networks and partners, invest heavily in R&D, and achieve economies of scale in marketing and distribution. These advantages enable Adyen to offer competitive pricing while maintaining healthy profit margins, supporting continuous innovation and market expansion.

Switching costs

Switching costs for Adyen's products are relatively high, especially for businesses deeply integrated with its unified commerce platform. Transitioning to a different payment solution can be costly and time-consuming, involving data migration, system integration, retraining employees, and potential disruptions to business operations. This creates a significant barrier for customers to switch to competitors, enhancing Adyen's customer retention.

Network effect

Adyen benefits from strong network effects, particularly through its integrated payment ecosystem. As more businesses use Adyen, more payment methods, banks, and third-party service providers are being attracted to the platform, enhancing its value and functionality. This network effect creates a self-reinforcing cycle that increases the attractiveness of Adyen’s offerings to new customers, further solidifying its market position.

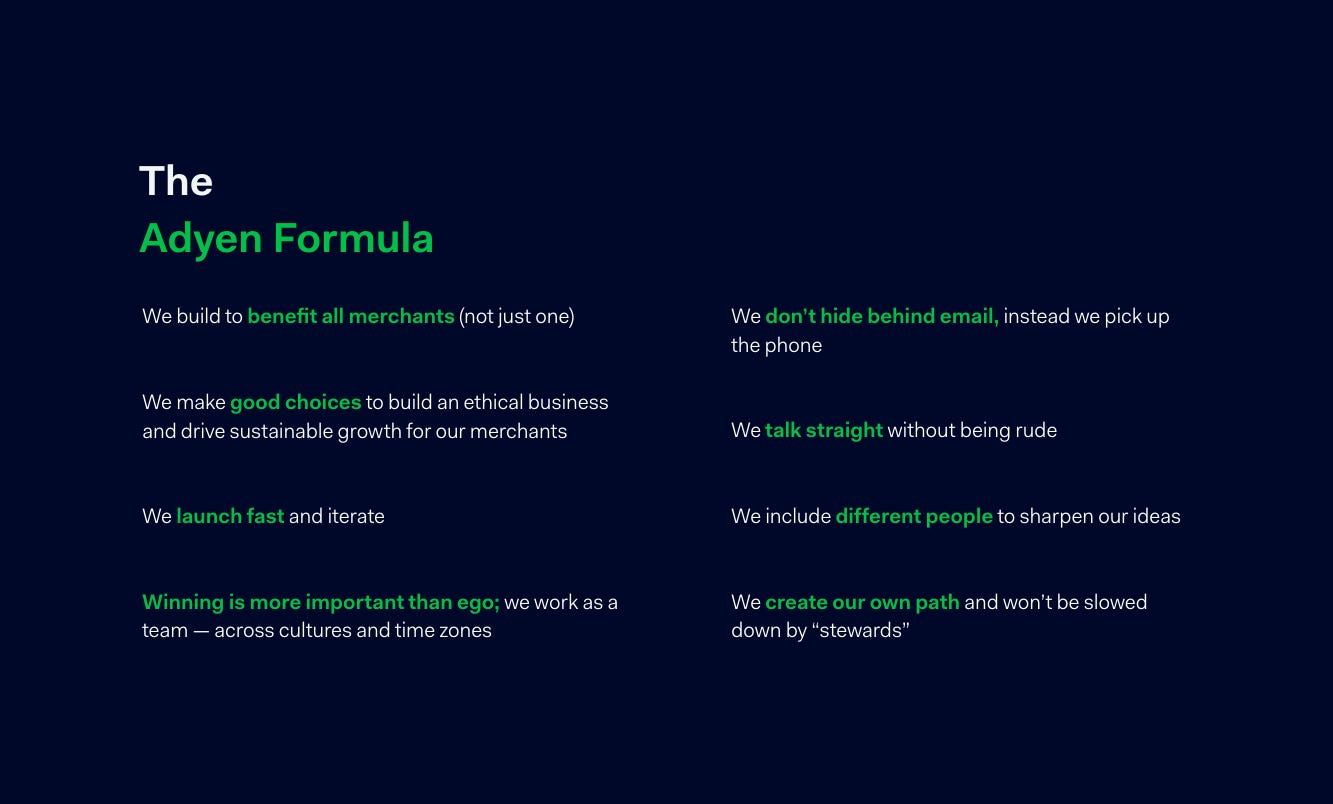

Attracting talent

Adyen's brand power, innovative culture, and market leadership make it an attractive employer for top talent in the tech and financial sectors. The company’s commitment to employee development, diversity, and inclusion and its strong mission to make payments frictionless helps attract and retain skilled professionals. Talented employees drive Adyen’s innovation and customer satisfaction, contributing to its competitive edge.

“The board still oversees every hire, regardless of the role. You cannot be hired at Adyen without speaking to one of the six board members. The reason we do it is to put the bar high to ensure that only the best talent join Adyen.”- Pieter van der Does

Summary

Adyen's moat is primarily built on brand power, scale and cost advantages, switching costs, network effects, and its ability to attract top talent. While it may not heavily rely on patents, the combination of these factors creates a robust competitive advantage, allowing Adyen to maintain its leadership in the payment solutions industry and continue delivering value to its customers and shareholders.

4. Industry

So far, we know an excellent CEO leads Adyen with a strong brand presence and a diverse product offering in the payment solutions sector.

But is there more growth on the horizon for Adyen, and how does it compare to its peers in the payment solutions industry?

Adyen is leading in the payment solutions market, sharing the space with other major players like PayPal, Stripe, and Square. Adyen's flagship unified commerce platform dominates its niche, creating a competitive yet favorable environment. This strong market position provides stability and allows Adyen to thrive by continually innovating and expanding its offerings.

Adyen benefits significantly from its reinvestment strategy, which continuously scales its operations to improve efficiency and customer experience. This strategy is supported by strong free cash flow, enabling Adyen to invest in expanding its product suite, enhancing its AI capabilities, and developing new payment solutions.

Is there more growth to be expected in this sector? Absolutely.

Adyen is strategically positioned to capitalize on several growth opportunities. The increasing demand for digital payment solutions, driven by the rise of e-commerce and mobile payments, positions Adyen well to capture a broader audience. Moreover, Adyen's commitment to innovation, as seen in its development of AI-driven tools and its expansion into fraud prevention and data analytics, continues to drive growth and deepen customer engagement.

Additionally, Adyen's strategic partnerships are significant growth drivers. These partnerships extend Adyen's reach to new customer segments and leverage synergies to boost sales and enhance the overall product ecosystem.

Adyen is also making strides in the digital space. The company's investment in cloud computing and mobile platforms enhances customer convenience and drives online sales growth. These digital enhancements are crucial as cloud-based solutions and mobile accessibility continue to grow in importance.

Expanding Adyen's AI-driven payment tools adds a high-margin revenue stream, further boosting profitability. This focus on innovative technology differentiates Adyen from competitors and strengthens customer loyalty.

In summary, Adyen's leadership in the payment solutions industry and strategic investments in product expansion, digital innovation, and strategic partnerships positions it for continued growth. The company's ability to adapt to consumer trends and leverage technological advancements ensures it remains a dominant player in the market, with ample opportunities for future expansion.

Adyen’s primary competitors include:

PayPal

Stripe

Square

Braintree

Worldplay

iZettle

Payoneer

5. Risks

Adyen's growth strategy

Adyen has experienced significant growth through its comprehensive payment solutions, particularly its unified commerce platform. Strategic partnerships and technological innovation have also played a vital role in expanding its offerings and customer base.

Majority of revenue from Payment Processing

Adyen generates most of its revenue from payment processing fees, including online, mobile, and in-store transactions. While the company is investing in expanding its suite of services, a significant portion of its revenue still comes from traditional payment processing.

Can Adyen Sustain Growth Amidst Changing Trends?

Change in consumer behavior

The shift towards digital and mobile payments presents opportunities and challenges for Adyen. The company must continuously innovate and adapt its products to meet evolving consumer preferences and technological advancements. Failure to keep pace with these trends could result in a loss of market share to more agile competitors.

Economic factors

Adyen's revenue streams are closely tied to the overall economic environment. Economic downturns can impact consumer spending and business operations, reducing transaction volumes. Prolonged economic challenges could adversely affect Adyen's revenue and profitability.

Security and data privacy concerns

As a provider of payment solutions, Adyen faces significant scrutiny regarding the security and privacy of customer data. Any breaches or concerns regarding data protection can erode consumer trust and damage the company's reputation. The cost of implementing advanced security measures and addressing potential breaches can also be substantial.

Regulatory changes

Adyen operates in a highly regulated industry subject to changes in financial regulations and data protection laws. Adapting to these changes while ensuring compliance can be challenging and may impact the company's operations and profitability. Regulatory compliance requires continuous monitoring and adjustments, which can be resource-intensive.

Competition from fintech startups

Adyen faces competition from established players and emerging fintech startups offering innovative payment solutions. Maintaining its competitive position requires continued investment in research and development and strategic partnerships. The rapidly evolving fintech landscape means that Adyen must stay ahead of new entrants and technological advancements to retain its market leadership.

Integration and management of partnerships

While strategic partnerships have been a key growth strategy for Adyen, integrating and managing these partnerships can pose significant challenges. Failure to effectively integrate partner technologies and operations can result in operational inefficiencies and negatively impact the anticipated benefits.

Technological disruption

Rapid technological changes characterize the payment solutions industry. Adyen must continuously innovate to avoid obsolescence. Failing to leverage emerging technologies such as artificial intelligence, blockchain, and machine learning can lead to a competitive disadvantage.

International expansion risks

While Adyen has a strong presence in multiple markets, expanding internationally presents additional risks, including compliance with local regulations, cultural differences, and market acceptance. Successfully navigating these challenges is crucial for capturing growth opportunities globally.

Summary

Adyen's growth strategy relies on leveraging its innovative payment solutions, strategic partnerships, and technological advancements. The company's ability to adapt to changing consumer behaviors, economic conditions, and regulatory environments is key to sustaining its growth. By continuing to invest in security, compliance, and international expansion, Adyen is well-positioned to maintain its leadership in the payment solutions industry and capitalize on future opportunities.

6. Balance sheet

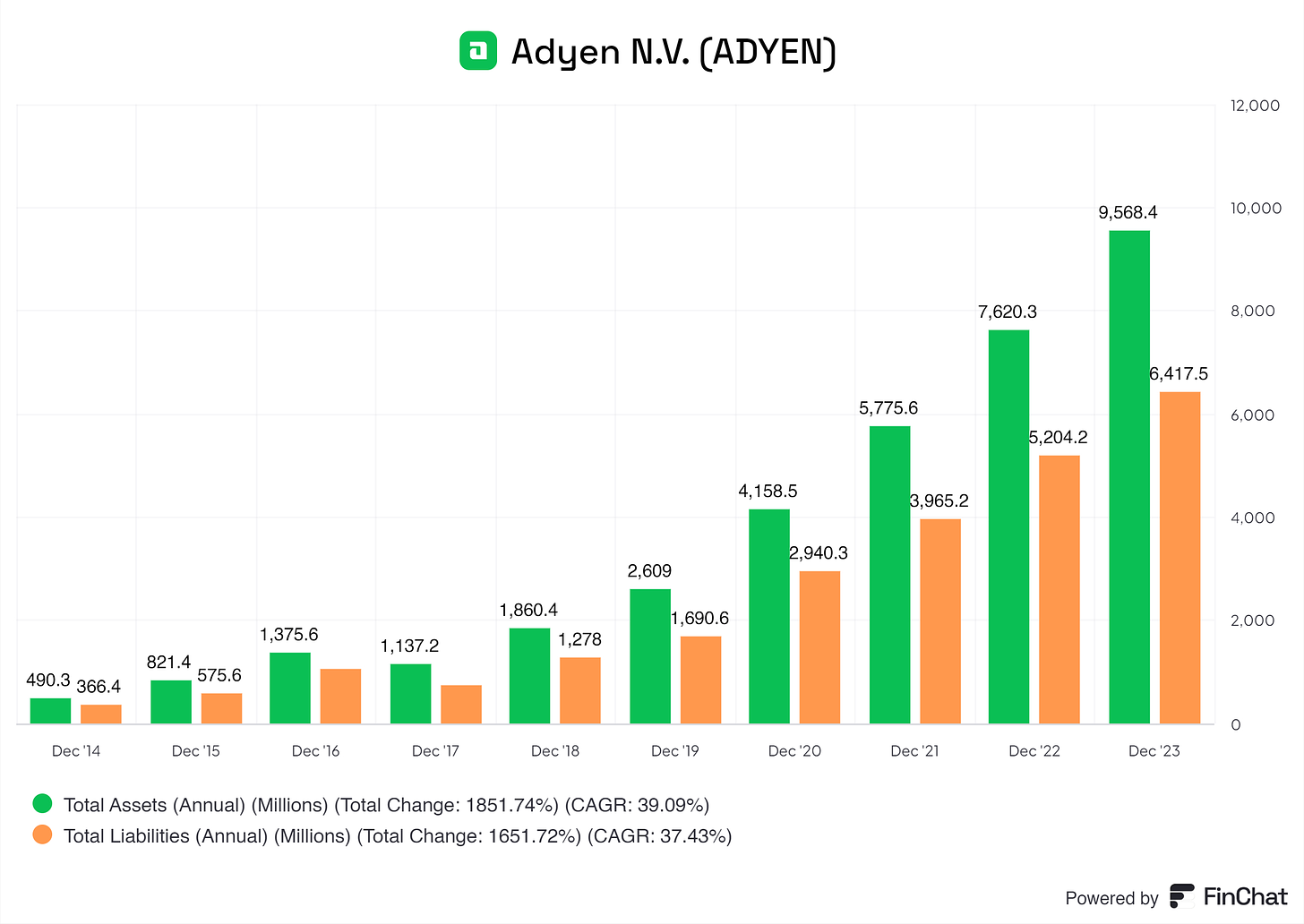

Adyen benefits from a robust and excellent balance sheet.

Adyen's cash and cash equivalents have grown significantly, from €330.9 million in 2014 to €8,307 million in 2023. This indicates strong liquidity and the ability to fund operations and investments without external financing.

Adyen is growing its cash position consistently YoY, giving it more breathing room for (economic) downturns.

Accounts receivable have grown significantly from €8.4 million in 2014 to €134.3 million in 2023, increasing sales and business volume.

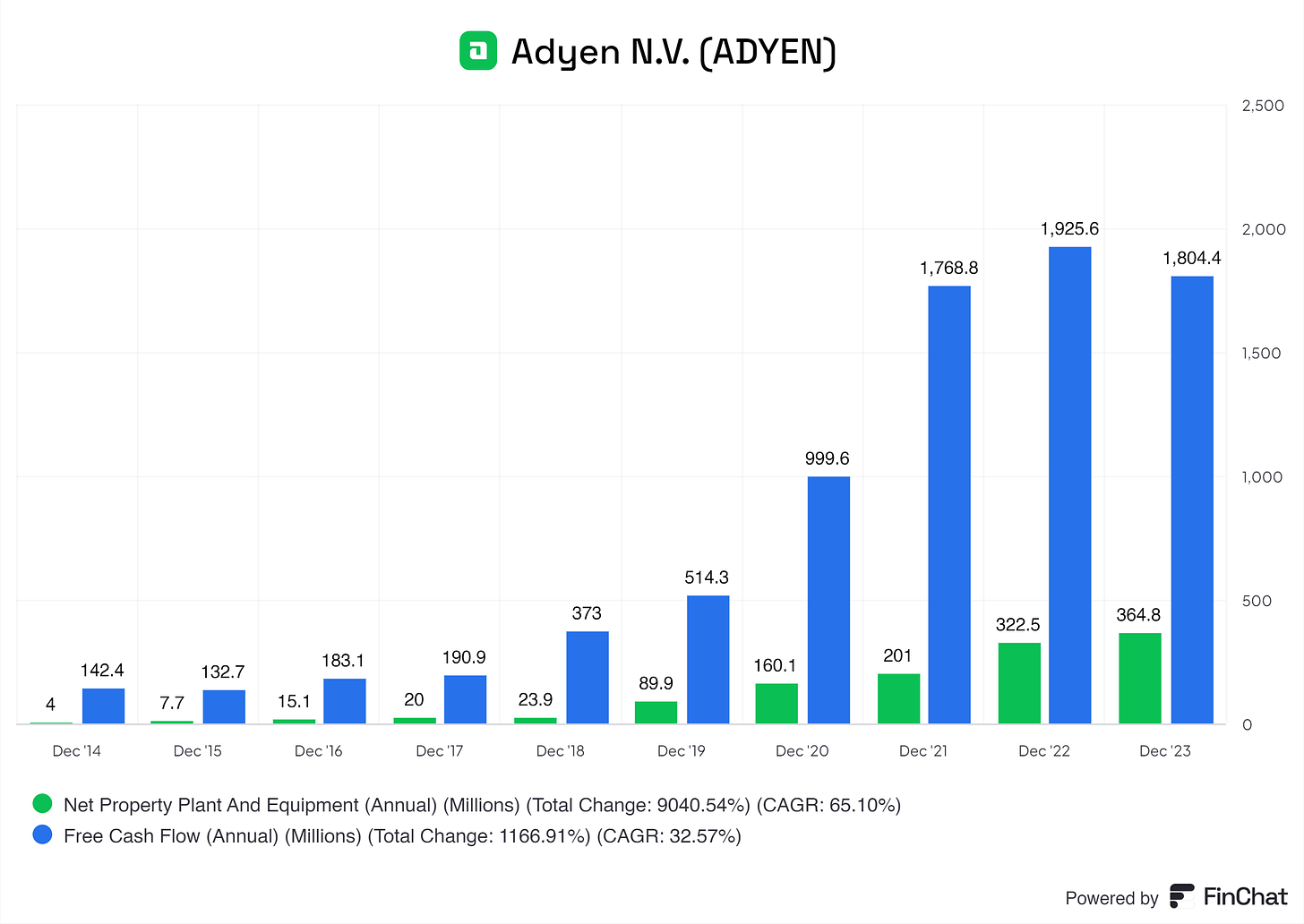

We see a rise in Net Property Plant And Equipment on Adyen's balance sheet, from 4M in ‘14 to 364.8M in ‘23. This is due to its investment in new technologies, scaling its operations, strategic investments, and innovation. Adyen is financing these activities with its Free Cash Flow, not debt, which is excellent. Using debt could be useful for strategic investments, but it brings the burden of debt and interest on this debt.

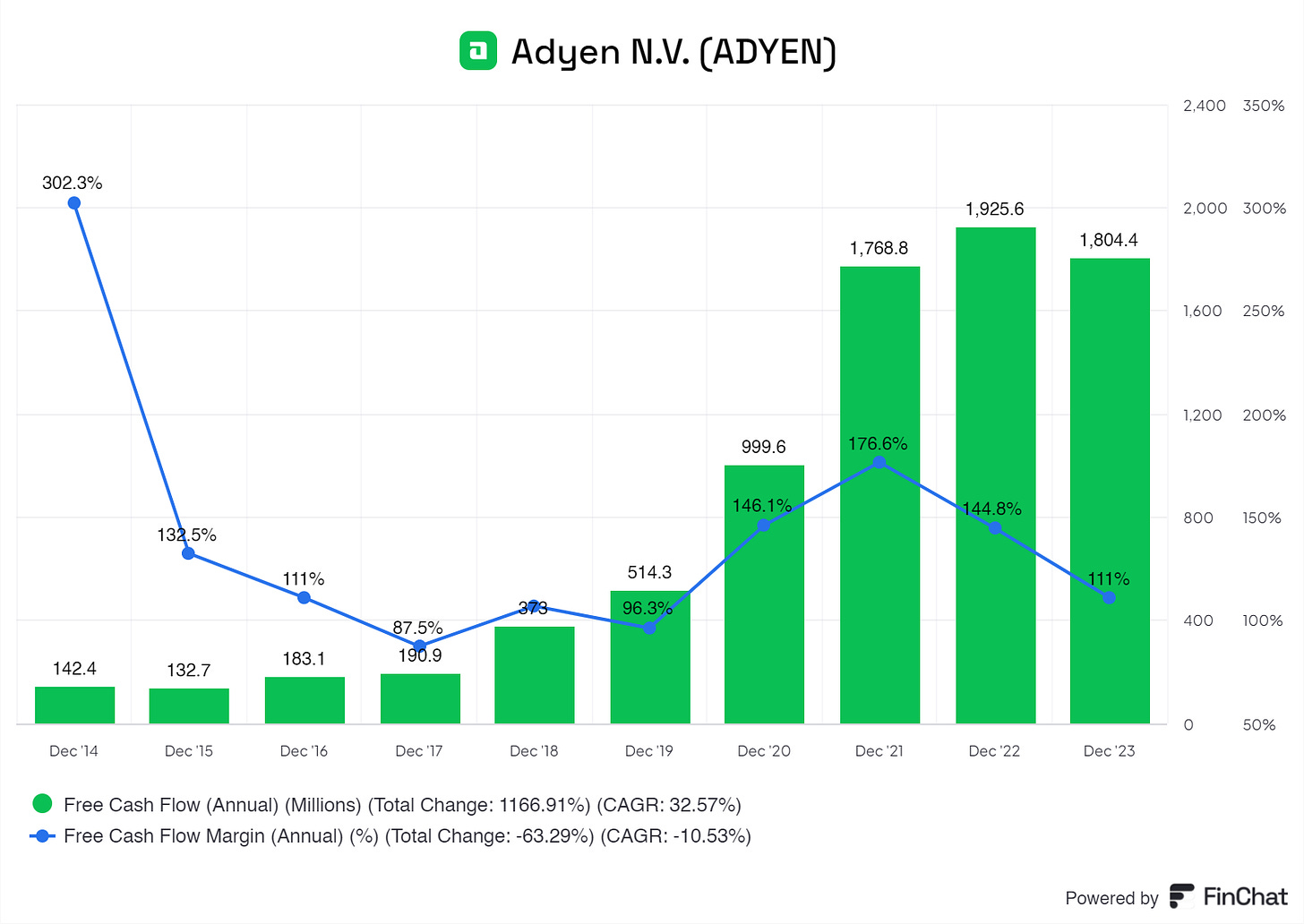

Adyen generates an excellent amount of Free Cash Flow year over year, with a CAGR of 32.57% from 2014 until today.

If we look at Adyen's liabilities, I will still be thrilled about the business!

Adyen’s Total Liabilities increased from €366.4 million in 2014 to €6,417.5 million in 2023. This is the normal consequence of growth. Adyen is going all in on growth. Adyen still has a much larger total asset position than total liabilities, which is an excellent result here.

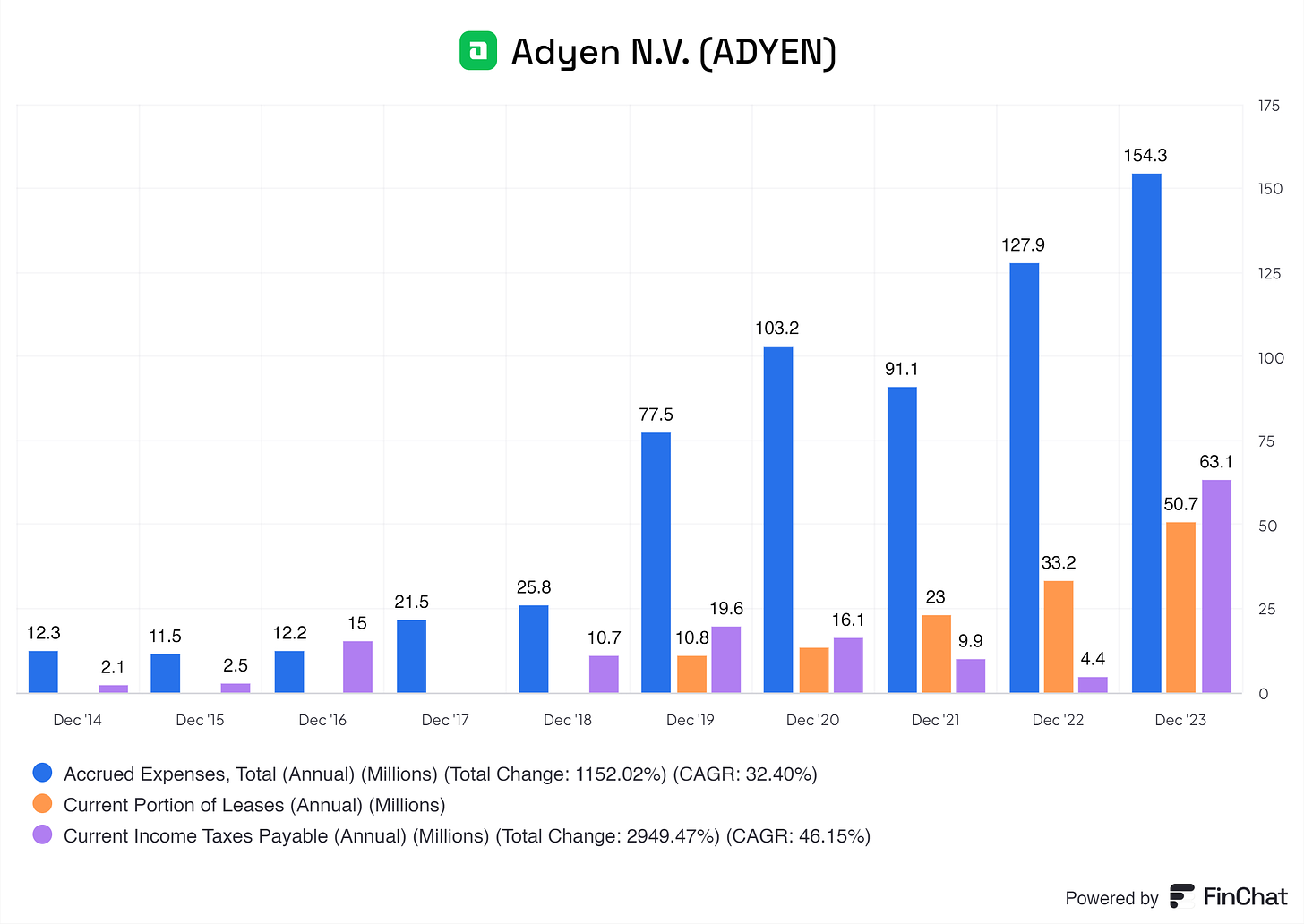

Adyen's biggest liabilities are the Accrued Expenses, Leases, and Income Taxes that must be paid. I am not concerned about these liabilities. Adyen generates the cash to cover these expenses.

7. Capital

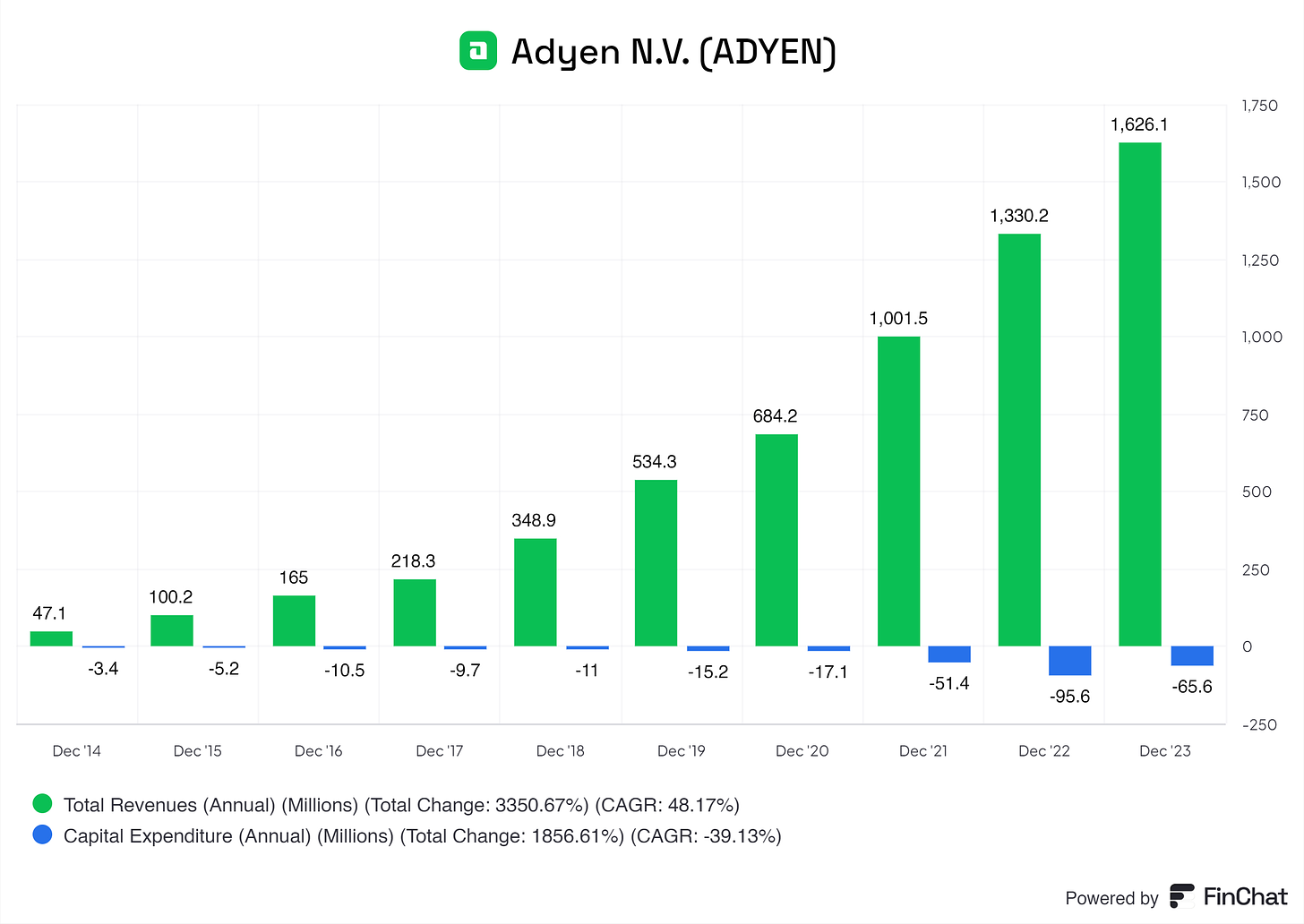

Capital expenditures can be taxing a business. Is it for Adyen?

No! Adyen has limited CAPEX pressure compared to its Total Revenue, which allows for more breathing room. Adyen averages 4.81% CAPEX to Revenue.

Of course, we could expect this from Adyen. Adyen is a technology business that is less capital-intensive than industries like manufacturing or energy. Its core operations rely more on software development, cloud services, and digital infrastructure than physical assets.

Adyen also partners with various technology and payment service providers. These collaborations can reduce the need for in-house infrastructure investment, thereby lowering CAPEX. Adyen can minimize direct investments in physical infrastructure by utilizing third-party data centers and network services.

Adyen strongly emphasizes managing operational costs and improving efficiency. Investments are made in areas that directly contribute to revenue growth and customer acquisition rather than in capital-intensive projects. Investing in automation and innovative technologies helps streamline operations and reduce the need for extensive capital investments.

Summary

The low CAPEX to total revenue ratio for Adyen can be attributed to its business model's inherent efficiency and scalability. As a technology and service-oriented company, Adyen requires less capital than more asset-heavy industries. By leveraging cloud technologies, strategic partnerships, and focusing on operational efficiency, Adyen can sustain significant revenue growth without proportional increases in capital spending. This efficient use of resources allows Adyen to maintain a robust financial position and invest strategically in areas that drive growth and innovation.

Capital Allocation

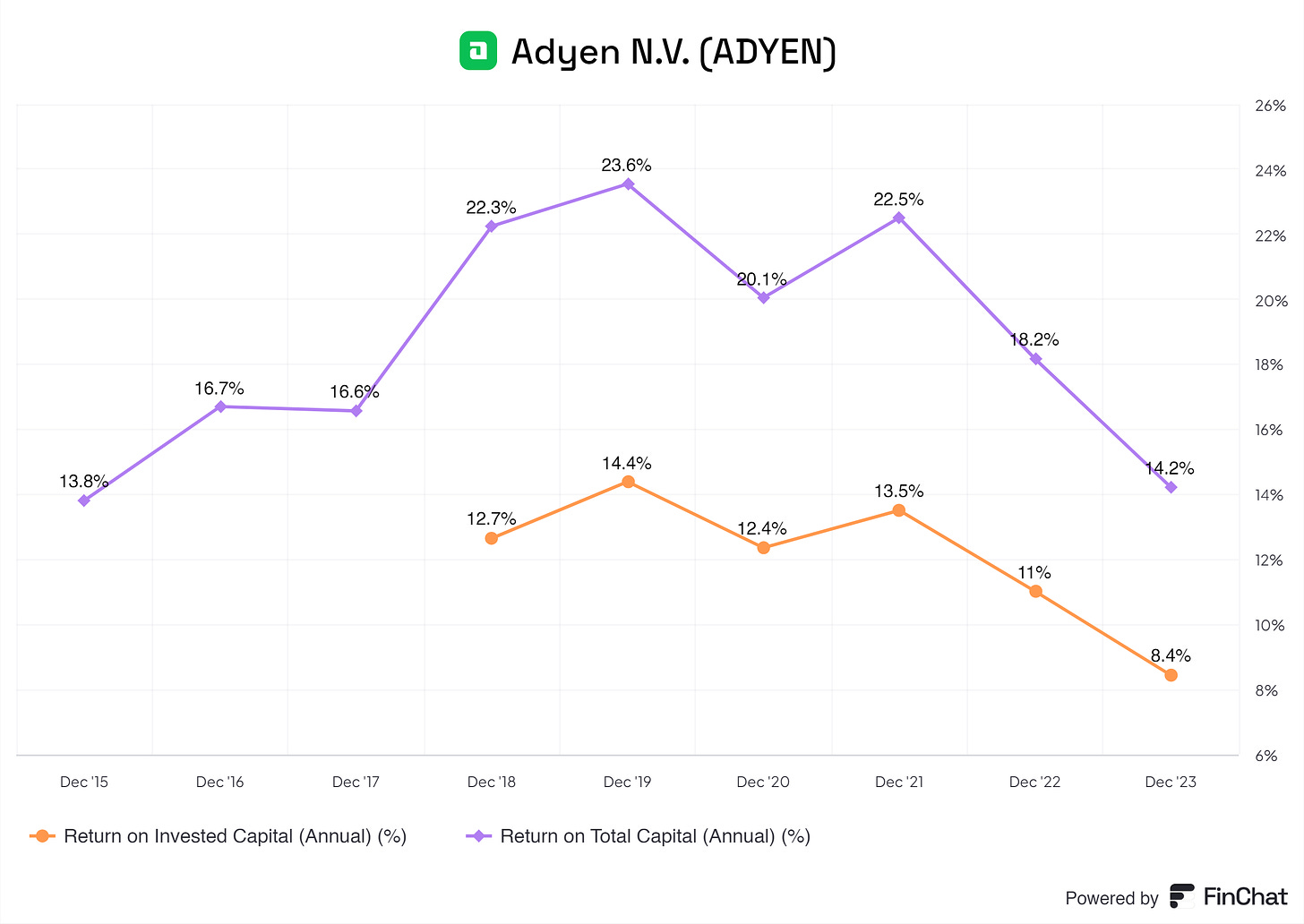

From ‘21, we have seen YoY decreasing ROIC and ROCE, the most important metrics for Adyen.

Is this telling us that management is getting worse with allocating cash to profitable projects? Not in the case of Adyen.

Adyen is steadily investing in future growth. These investments are the hitman on the current ROIC and ROCE for Adyen. Due to Adyen making investments, we need to see in the future how these pay off regarding the ROIC and ROCE.

Yes, ROIC and ROCE are declining, but this is the consequence of the future growth that Adyen is not investing in.

8. Profitability

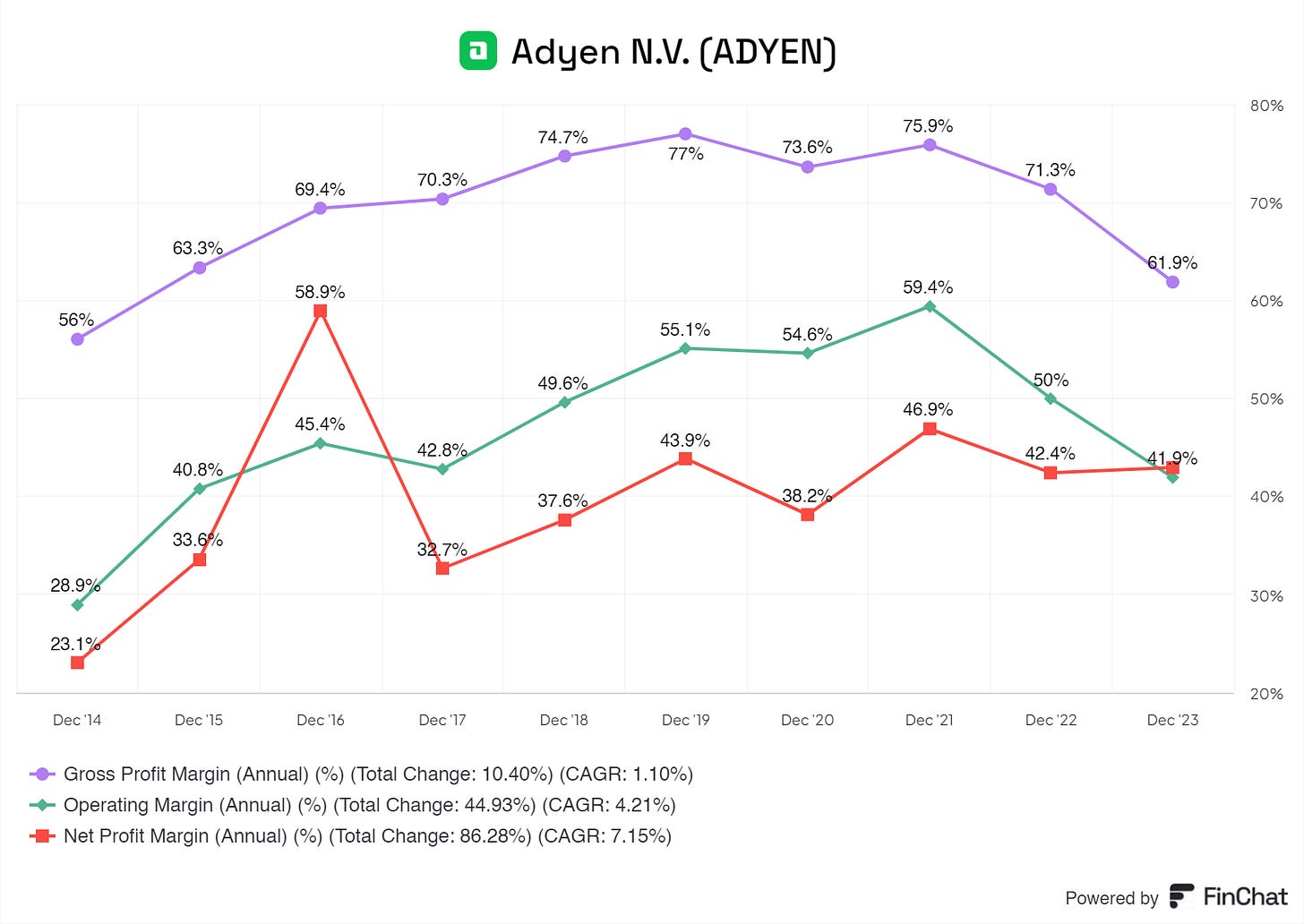

Adyen is excellent in its profitability.

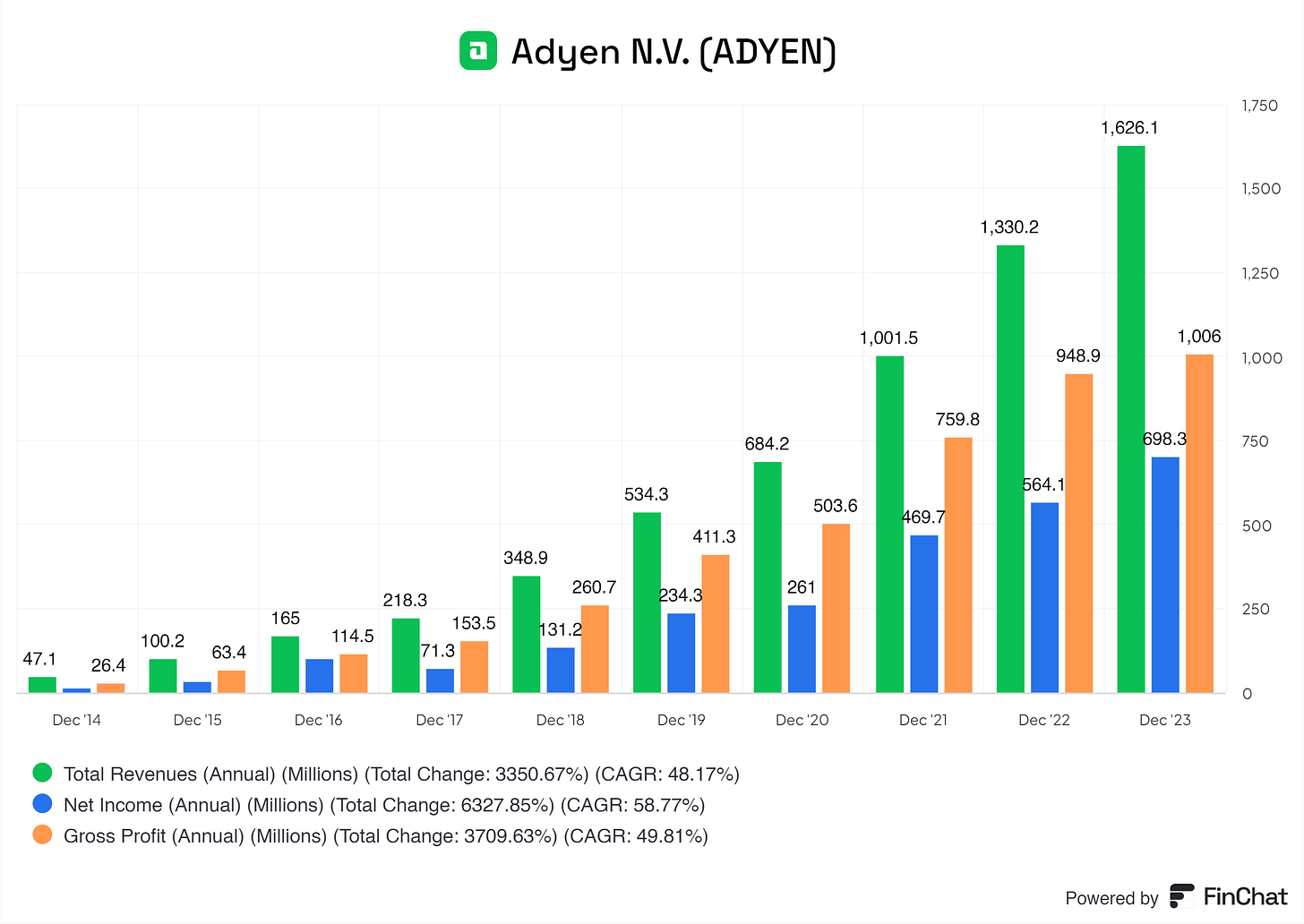

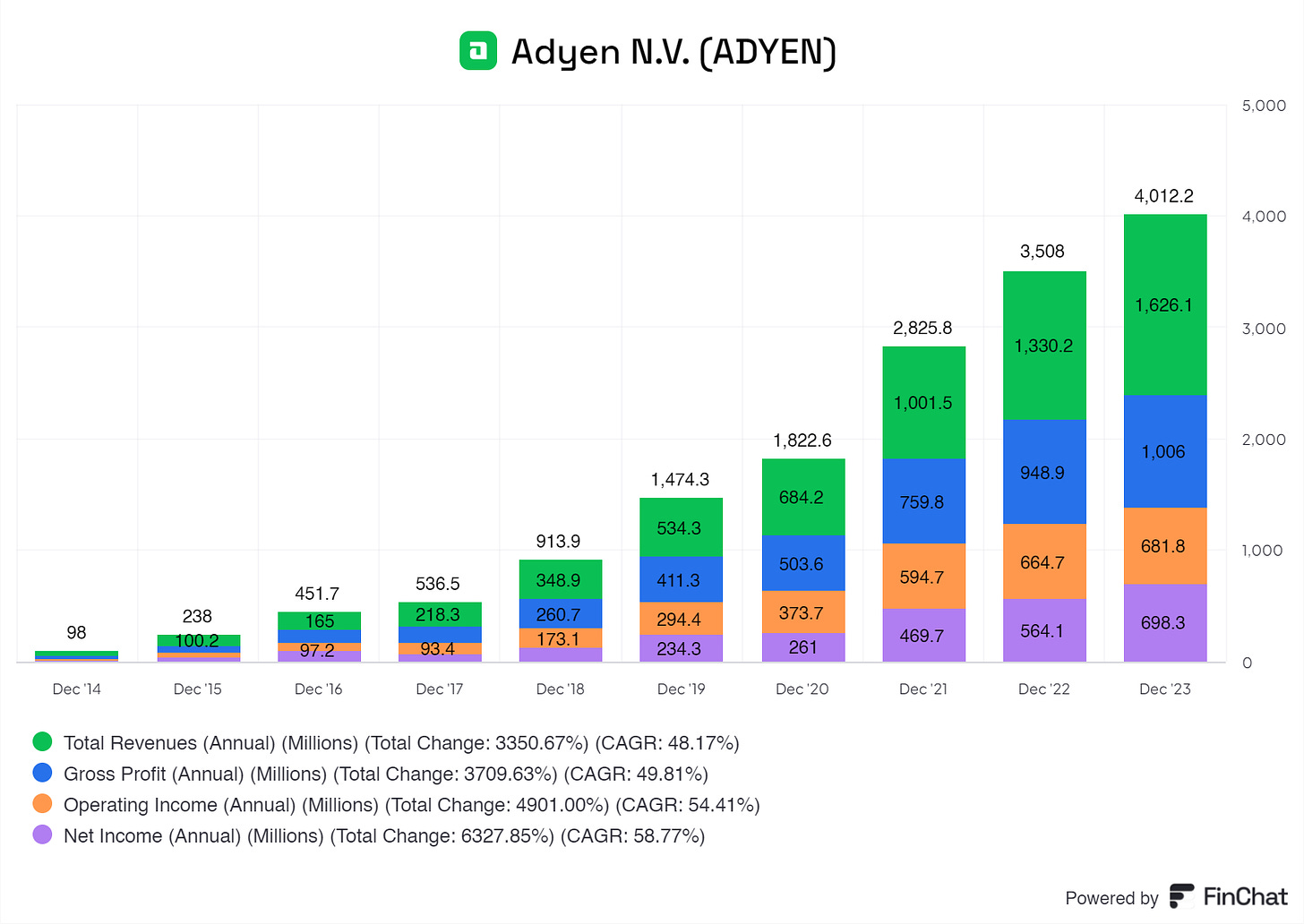

Adyen is growing excellently in its Total Revenues, Net Income, and Gross Profit. Adyen benefits from a strong product, desire from all over the world, and all sorts of businesses that ramp up the demand and the revenues Adyen is receiving from this rapid demand.

With these revenues and profits come excellent margins. We do see some decline in recent years, but I think this will rebound again. Adyen is growing, and for growth, there will be periods where you need to hand over margins, lowering ROIC and ROICE, as mentioned before, to stimulate overall growth. When the growth investments are in full swing, we can see Adyen’s margins and capital efficiency rebound to prior levels.

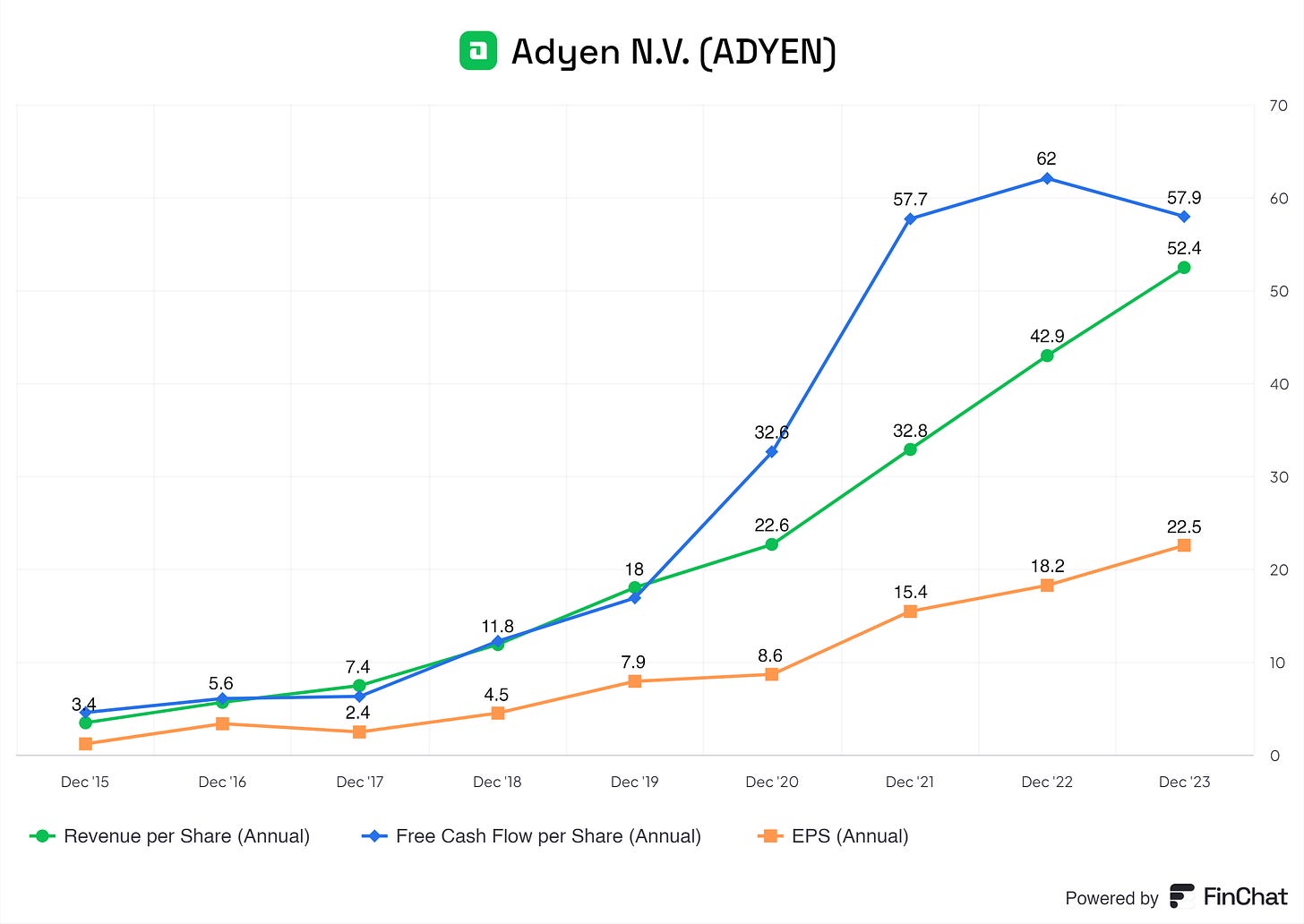

While driving up revenue YoY, Adyen provides the business with excellent Free Cash Flow.

As shown above, Adyen is very capable of turning its revenue into Free Cash Flow. This Free Cash Flow can be used to invest in growth via new projects and debt reduction; Adyen does not actively buy back shares.

9. Historical & future growth

Adyen is a growing business, can its historical growth be projected into the future?

Adyen has shown consistent and sustainable growth over the years, a notable achievement in the competitive payment processing industry, where growth can often be volatile.

Adyen's total revenues, gross profits, operating income, and net income have all seen steady increases, reflecting its robust performance.

The company's revenue growth is driven by expanding its global reach, innovating its technology platform, and increasing its customer base. As the demand for digital payment solutions continues to rise, Adyen's diverse product offerings and strategic initiatives, such as entering new markets and forming partnerships, are expected to support ongoing revenue growth. However, growth rates may moderate as the market matures and competition intensifies.

Gross profit growth reflects Adyen's ability to manage costs effectively and increase sales. Continued investment in product innovation and customer acquisition should sustain gross profit growth. Nevertheless, rising costs and potential disruptions in the market could impact profit margins.

Net income growth indicates strong operational performance and efficient cost management. As Adyen continues to expand its market presence and optimize its operations, net income is likely to grow. However, external factors such as economic downturns and changes in regulatory environments could pose risks to maintaining this growth rate.

Operating income growth is fueled by increasing revenues and effective cost controls. Investments in technology and operational enhancements are expected to improve efficiency further. However, factors like increased operating expenses and market competition could affect future growth prospects.

Key Factors for Sustaining Growth

Expansion Strategy: Adyen's ability to expand its product portfolio and market reach through acquisitions and partnerships will be crucial for sustaining growth.

Digital Transformation: Enhancing digital capabilities and user experience and integrating new technologies like AI and machine learning will drive growth in the digital space.

Customer Engagement: Strengthening customer relationships through loyalty programs and personalized services will drive customer retention and revenue growth.

Regulatory Compliance: Adapting to changing regulatory environments and ensuring compliance with industry standards will be essential for maintaining trust and credibility.

Operational Efficiency: Continued investments in automation, process optimization, and talent development will help improve efficiency and reduce costs.

Economic Resilience: Monitoring economic conditions and adapting business strategies will mitigate risks associated with economic downturns and market fluctuations.

In conclusion, Adyen's consistent growth trajectory reflects its strong market position and effective execution of strategic initiatives. This growth will require ongoing innovation, strategic partnerships, and a focus on operational excellence to navigate challenges and capitalize on emerging opportunities in the dynamic payment-processing landscape.

10. Value

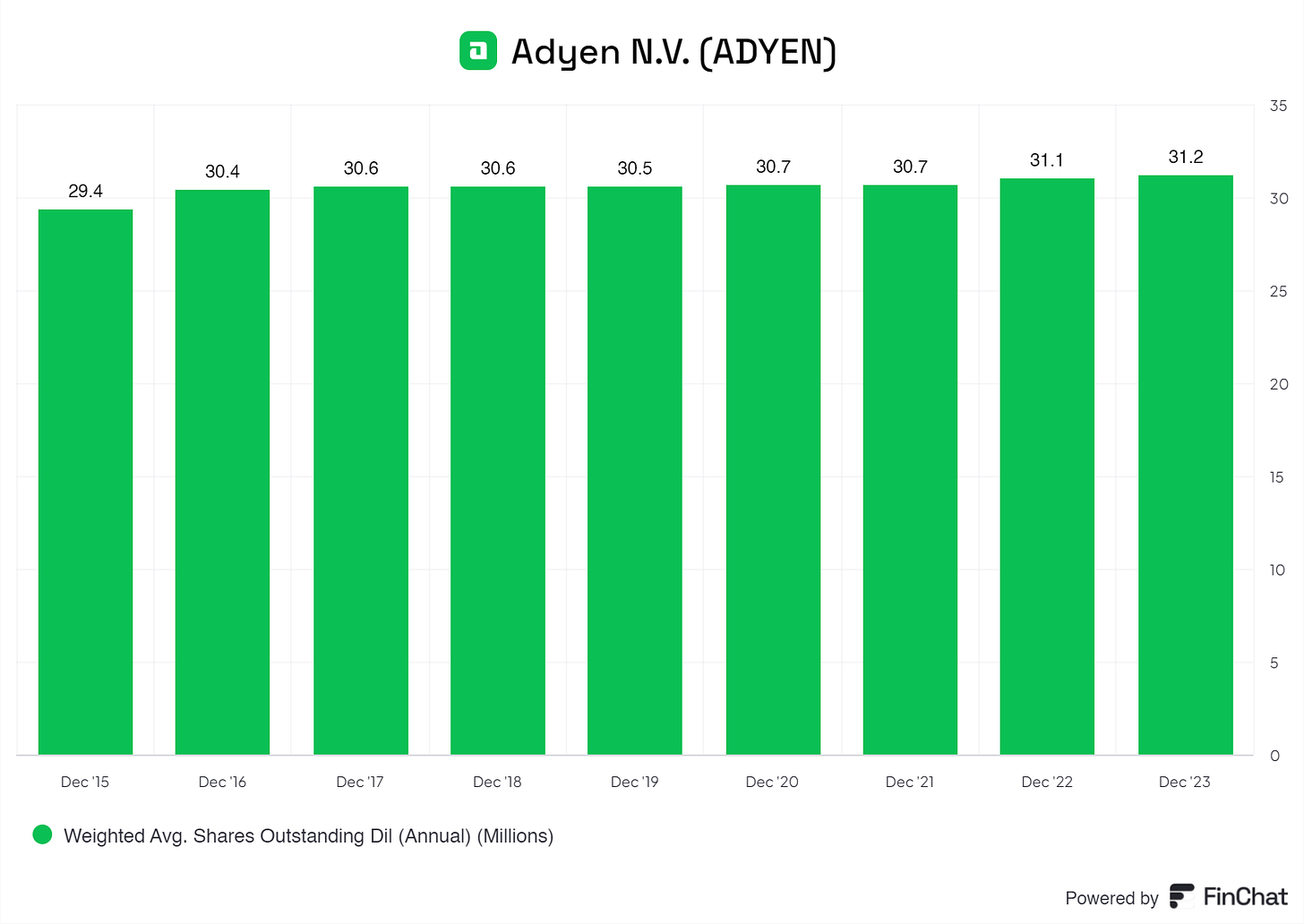

Adyen has raised some equity by increasing its outstanding shares, but it’s very limited. I would argue that this is not considered diluting shareholders. The outstanding shares increased from 29.4M to 31.2M in 8 years; this is neglectable.

Adyen is in its growth phase and needs all the equity it can to become the dominant player and dominate market share. After its growth phase, we could see Adyen focussing on creating more shareholder value via share buybacks. For now, I would see growth over share buybacks. Adyen's growth adds more value than share buybacks.

Luckily, Adyen also does not pay a dividend. All the Free Cash Flow Adyen generates is being pushed back into the business to maximize its growth.

Growth is the value for its shareholders in Adyen’s current phase.

Luckily for us investors, Adyen provides excellent value for shareholders via steadily growing EPS, Revenue per share, and Free Cash Flow per share.

11. Outlook

Adyen appears poised for continued growth and success in the payment processing industry. With a solid track record of consistent revenue and profit increases, Adyen has established itself as a leader in providing innovative and reliable payment solutions.

One key aspect of Adyen's outlook is its ongoing commitment to technology innovation and digital transformation. By continuously enhancing its payment platform and investing in new technologies such as artificial intelligence and machine learning, Adyen aims to remain at the forefront of the industry and meet the evolving needs of its customers.

Additionally, Adyen's strategic partnerships and market expansions play a vital role in its growth strategy. By collaborating with other companies and entering new geographic markets, Adyen expands its market reach and strengthens its competitive position. Strategic acquisitions could further bolster its service offerings and market presence.

Moreover, Adyen's focus on customer engagement and satisfaction is expected to drive continued growth. Through initiatives like tailored payment solutions and exceptional customer service, Adyen aims to build strong relationships with its clients, fostering long-term loyalty and revenue growth.

While Adyen faces challenges such as regulatory compliance and increasing market competition, the company's robust financial position and proactive approach to risk management should help mitigate potential risks and ensure sustained growth.

In conclusion, Adyen's outlook is positive, with opportunities for growth and innovation in the payment processing sector. By staying agile, customer-focused, and committed to excellence, Adyen is well-positioned to capitalize on emerging trends and maintain its leadership position in the industry.

12. Quality score

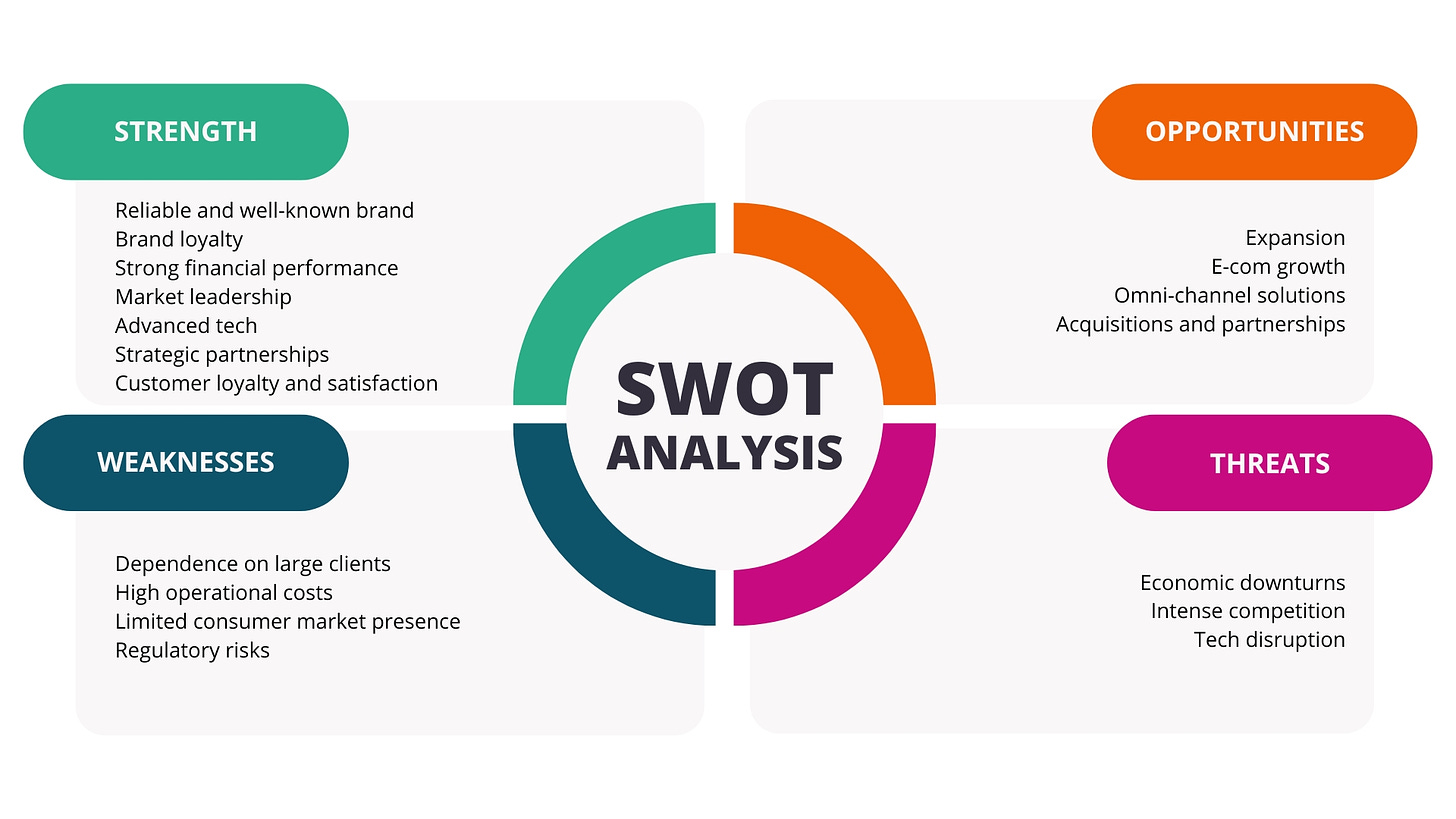

13. SWOT analysis

12. Valuation

For my valuation, I use a DCF, Multiples Valuation, and Benjamin Graham Valuation and average those, including analysts’ averages.

DCF: $1.325,06 (Growth rate of 20%, perpetual growth of 3%, and discount rate of 9,50%)

Multiples valuation: $987,43

Benjamin Graham's valuation: $1.012,24

Analysts average: $1.623

The average comes out to $1.236,93 and Intuit's current price is $1.223,06

These figures result from a bull case since I am bullish on the business. :-)

End note

Thank you for reading this investment case on Adyen!

With every investment case, I am trying to improve my writing and how I communicate my findings with you all. Because I started not too long ago, some posts might change in layout or other aspects before I find the layout that suits my best wishes, sorry in advance.

As of now, thank you so much for your time! I hope you found some valuable information in this investment case.

Disclaimer

I do not own any shares of Adyen and do not intend to buy shares in the next 6 months.

By reading my posts, being subscribed, following me, and visiting my Substack, you agree to my disclaimer. You can read the disclaimer here.

Hi,

Would you mind using a slightly different structure than Compounding Quality?