Hello friend! 👋

My name is Yorrin, also known as ‘‘Fluentinvalue’’.

I am pleased to have you back here for another investment case. This time, we are discussing the multinational software giant in financials, Intuit.

In case you have missed previous articles, click on the link below:

If you’re currently not yet following me, consider doing so. I provide FREE content to help and inform you in your investment journey. From beginner to advanced, all info will be helpful. :-)

Intuit is a global leader in financial software solutions.

Intuit serves over 100 million customers worldwide, providing essential tools for small businesses, consumers, and accounting professionals. With flagship products like QuickBooks, TurboTax, and Mint, Intuit reported a total revenue of $14.0 billion for the fiscal year ending in July 2023.

This powerhouse continues to expand its capabilities with strategic acquisitions and innovative AI-driven solutions, aiming to simplify financial tasks and enhance financial literacy globally. As of 2024, Intuit is further strengthening its market presence by launching new services tailored to diverse financial needs, solidifying its position as a crucial player in the financial technology sector. With a robust customer base and a reputation for reliability and innovation, Intuit boasts one of the highest customer satisfaction rates in the industry, with 92% of users recommending their products.

But, is Intuit a viable investment opportunity right now? Let's explore the details.

Intuit - General information

Company name: Intuit Inc.

Ticker: INTU

Stock price: $573.9

Market cap: $160.43B

Revenue: $15.81B

Industry: Technology Services / Packages Software

If you’re into these kinds of investment theses, consider checking out the following Ulta Beauty, Copart, and Adobe. These are available for FREE on my Substack page

Intuit One Pager

Step-by-step

1. Business model

The business model of Intuit is straightforward and effective. Intuit operates in the financial software sector, offering a range of products and services designed to simplify financial tasks for individuals, small businesses, and accounting professionals. Intuit's flagship products include:

QuickBooks: Small business accounting and financial management software.

TurboTax: Tax preparation and filing software for individuals and small businesses.

Mint: Personal financial management tool.

Credit Karma: Credit monitoring and financial advisory services.

Mailchimp: Email marketing and automation platform.

ProConnect: Professional tax software for accountants and tax professionals.

An impressive aspect of Intuit's business model is its diversified product portfolio, which addresses various financial needs across different customer segments. This diversification not only enhances revenue stability but also provides a resilient business foundation, making it a reliable choice for investors.

2. Management

The CEO of Intuit is Sasan Goodarzi. Let us dive into his experience.

Sasan Goodarzi started his journey at Honeywell in 1993, where he held senior leadership roles for nine years until 2002. (Honeywell is a multinational conglomerate primarily operating in aerospace, building technologies, performance materials, and safety solutions.)

After Honeywell, Sasan Goodarzi worked for Invensys as Global President, Product Group. He held this role for two years before joining Intuit in 2004. (Invensys was a multinational corporation focused on automation, controls, and information technologies, now part of Schneider Electric.)

At Intuit, Sasan Goodarzi initially took on senior leadership roles from 2004 to 2010. He then left to become the CEO of Nexant from 2010 to 2011. (Nexant provides intelligent grid software, clean energy solutions, and consulting services to utilities, energy enterprises, and chemical companies.)

Following his tenure at Nexant, Sasan Goodarzi joined Atlassian as a member of the Board of Directors in 2018, a position he holds to this day. (Atlassian is a leading provider of collaboration and productivity software for teams, known for products like Jira, Confluence, and Trello.)

In addition to his role at Atlassian, Sasan Goodarzi co-founded the Goodarzi Foundation and remains active in both.

Returning to Intuit in 2011, Sasan Goodarzi served as CIO for two years. He then advanced to Executive Vice President & General Manager for nearly three years, followed by Executive Vice President of the Small Business segment for almost three years. In 2019, he became the CEO of Intuit.

As of now, Sasan Goodarzi has been the CEO of Intuit for the past five and a half years.

Sasan K Goodarzi currently owns a total of 1 stock. Sasan K Goodarzi owns 65,324 shares of Intuit as of December 6, 2023, with a value of $37 Million.

Account for 0.23% of the total outstanding shares on Intuit.

3. Competitive & sustainable advantage (MOAT)

Intuit is run by a competent CEO, but, does Intuit have a sustainable advantage? Let us chat about it.

So, a MOAT can be in either one, or more, of the following forms:

Brand power

Patents

Scale and cost advantages

Switching costs

Network effect

Attracting talent (I consider this a MOAT, others don’t. Decide for yourself)

Brand Power

Intuit has established one of the strongest brand names in the financial software industry. Intuit is known for its user-friendly and reliable software solutions, including QuickBooks, TurboTax, and Mint. The company's reputation for innovation and customer-centric service is bolstered by high customer satisfaction and loyalty. Intuit's brand is further strengthened by widespread recognition and trust in its ability to simplify complex financial tasks for individuals and businesses alike.

Scale and Cost Advantages

Intuit benefits significantly from scale and cost advantages. With over 100 million customers worldwide, Intuit can leverage its size to negotiate better terms with partners, invest heavily in R&D, and achieve economies of scale in marketing and distribution. These advantages enable Intuit to offer competitive pricing while maintaining healthy profit margins, supporting continuous innovation and market expansion.

Switching Costs

Switching costs for Intuit's products are relatively high, especially for businesses using QuickBooks. Once integrated into a company’s financial processes, switching to a different software can be costly and time-consuming, involving data migration, retraining employees, and potential disruptions to business operations. This creates a significant barrier for customers to switch to competitors, enhancing Intuit's customer retention.

Network Effect

Intuit benefits from strong network effects, particularly through its QuickBooks ecosystem. As more small businesses use QuickBooks, it attracts more accountants, third-party developers, and service providers to the platform, enhancing its value and functionality. This network effect creates a self-reinforcing cycle that increases the attractiveness of Intuit’s offerings to new customers, further solidifying its market position.

Attracting Talent

Intuit's brand power, innovative culture, and market leadership make it an attractive employer for top talent in the tech and financial sectors. The company’s commitment to employee development, diversity, and inclusion, as well as its strong mission to power prosperity around the world, helps attract and retain skilled professionals. Talented employees drive Intuit’s innovation and customer satisfaction, contributing to its competitive edge.

Summary

Intuit's moat is primarily built on brand power, scale and cost advantages, switching costs, network effects, and its ability to attract top talent. While it may not heavily rely on patents, the combination of these factors creates a robust competitive advantage, allowing Intuit to maintain its leadership in the financial software industry and continue delivering value to its customers and shareholders.

4. Industry

So far, we know Intuit is led by an excellent CEO, Sasan Goodarzi, with a strong brand presence and a diverse product offering in the financial software sector.

But is there more growth on the horizon for Intuit, and how does it stack up against its peers in the financial software industry?

Intuit currently holds a leading position in the financial software market, sharing the space with other major players like Oracle, SAP, and Microsoft. Intuit's flagship products, QuickBooks, TurboTax, and Mint, dominate their respective niches, creating a competitive yet favorable environment. This strong market position provides stability and allows Intuit to thrive by continually innovating and expanding its offerings.

Intuit benefits significantly from its reinvestment strategy, continuously scaling its operations to improve efficiency and customer experience. This strategy is supported by strong free cash flow, enabling Intuit to invest in expanding its product suite, enhancing its AI capabilities, and developing new financial solutions.

Is there more growth to be expected in this sector? Absolutely.

Intuit is strategically positioned to capitalize on several growth opportunities. The increasing demand for digital financial solutions, driven by the rise of remote work and the gig economy, positions Intuit well to capture a broader audience. Moreover, Intuit's commitment to innovation, as seen in its development of AI-driven tools and its expansion into areas like credit monitoring and email marketing, continues to drive growth and deepen customer engagement.

Additionally, Intuit's strategic acquisitions, such as Credit Karma and Mailchimp, are significant growth drivers. These acquisitions not only extend Intuit's reach to new customer segments but also leverage synergies to boost sales and enhance the overall product ecosystem.

Intuit is also making strides in the digital space. The company's investment in cloud computing and mobile platforms enhances customer convenience and drives online sales growth. These digital enhancements are crucial as cloud-based solutions and mobile accessibility continue to grow in importance.

Lastly, the expansion of Intuit's AI-driven financial tools adds a high-margin revenue stream, further boosting profitability. This focus on innovative technology not only differentiates Intuit from competitors but also strengthens customer loyalty.

In summary, Intuit's leadership in the financial software industry, coupled with strategic investments in product expansion, digital innovation, and strategic acquisitions, positions it for continued growth. The company's ability to adapt to consumer trends and leverage technological advancements ensures it remains a dominant player in the market, with ample opportunities for future expansion.

5. Risks

Intuit's Growth Strategy

Intuit has experienced significant growth through its suite of financial software products, particularly its flagship products like QuickBooks and TurboTax. Acquisitions have also played a vital role in expanding its offerings and customer base.

Majority of Revenue from Software Sales

Intuit generates the majority of its revenue from software sales, including subscriptions and one-time purchases. While the company has made efforts to transition to subscription-based models, a significant portion of its revenue still comes from traditional software sales.

Can Intuit Sustain Growth Amidst Changing Trends?

Change in Consumer Behavior

The shift towards cloud-based solutions and mobile applications presents both opportunities and challenges for Intuit. The company must continuously innovate and adapt its products to meet evolving consumer preferences and technological advancements. Failure to keep pace with these trends could result in a loss of market share to more agile competitors.

Economic Factors

Intuit's revenue streams are closely tied to the overall economic environment. Economic downturns can impact small businesses and individuals, leading to reduced spending on financial software and services. Prolonged economic challenges could adversely affect Intuit's revenue and profitability.

Security and Data Privacy Concerns

As a provider of financial software, Intuit faces significant scrutiny regarding the security and privacy of customer data. Any breaches or concerns regarding data protection can erode consumer trust and damage the company's reputation. Additionally, the cost of implementing advanced security measures and addressing potential breaches can be substantial.

The government implementing its own filing app/website

Intuit offers services to assist with tax filings. The U.S. government has hinted at developing its own system for free public use, which could significantly impact Intuit's tax-related products and services. If such a system is implemented, Intuit may experience a decline in its customer base and revenue from these offerings.

Regulatory Changes

Intuit operates in a highly regulated industry, subject to changes in tax laws, financial regulations, and data protection laws. Adapting to these changes while ensuring compliance can be challenging and may impact the company's operations and profitability. Regulatory compliance requires continuous monitoring and adjustments, which can be resource-intensive.

Competition from Fintech Startups

Intuit faces competition from both established players and emerging fintech startups offering innovative financial solutions. Maintaining its competitive position requires continued investment in research and development and strategic partnerships. The rapidly evolving fintech landscape means that Intuit must stay ahead of new entrants and technological advancements to retain its market leadership.

Integration and Management of Acquisitions

While acquisitions have been a key growth strategy for Intuit, integrating and managing these acquisitions can pose significant challenges. Failure to effectively integrate acquired companies, technologies, and cultures can result in operational inefficiencies and negatively impact the anticipated benefits of these acquisitions.

Technological Disruption

The financial software industry is characterized by rapid technological changes. Intuit must continuously innovate to avoid obsolescence. Failing to leverage emerging technologies such as artificial intelligence, blockchain, and machine learning can lead to a competitive disadvantage.

International Expansion Risks

While Intuit has a strong presence in the U.S. market, expanding internationally presents additional risks, including compliance with local regulations, cultural differences, and market acceptance. Successfully navigating these challenges is crucial for capturing growth opportunities outside the U.S.

Balance sheet

Intuit benefits from an overall healthy balance sheet. As many of you know I love when companies are able to generate cash and keep enough cash on the balance sheet, Intuit has shown to keep improving its cash position.

Intuit benefits from a healthy growing cash position. Intuit is capable of paying almost all of its current liabilities with its cash position, lowering the debt burden on the business.

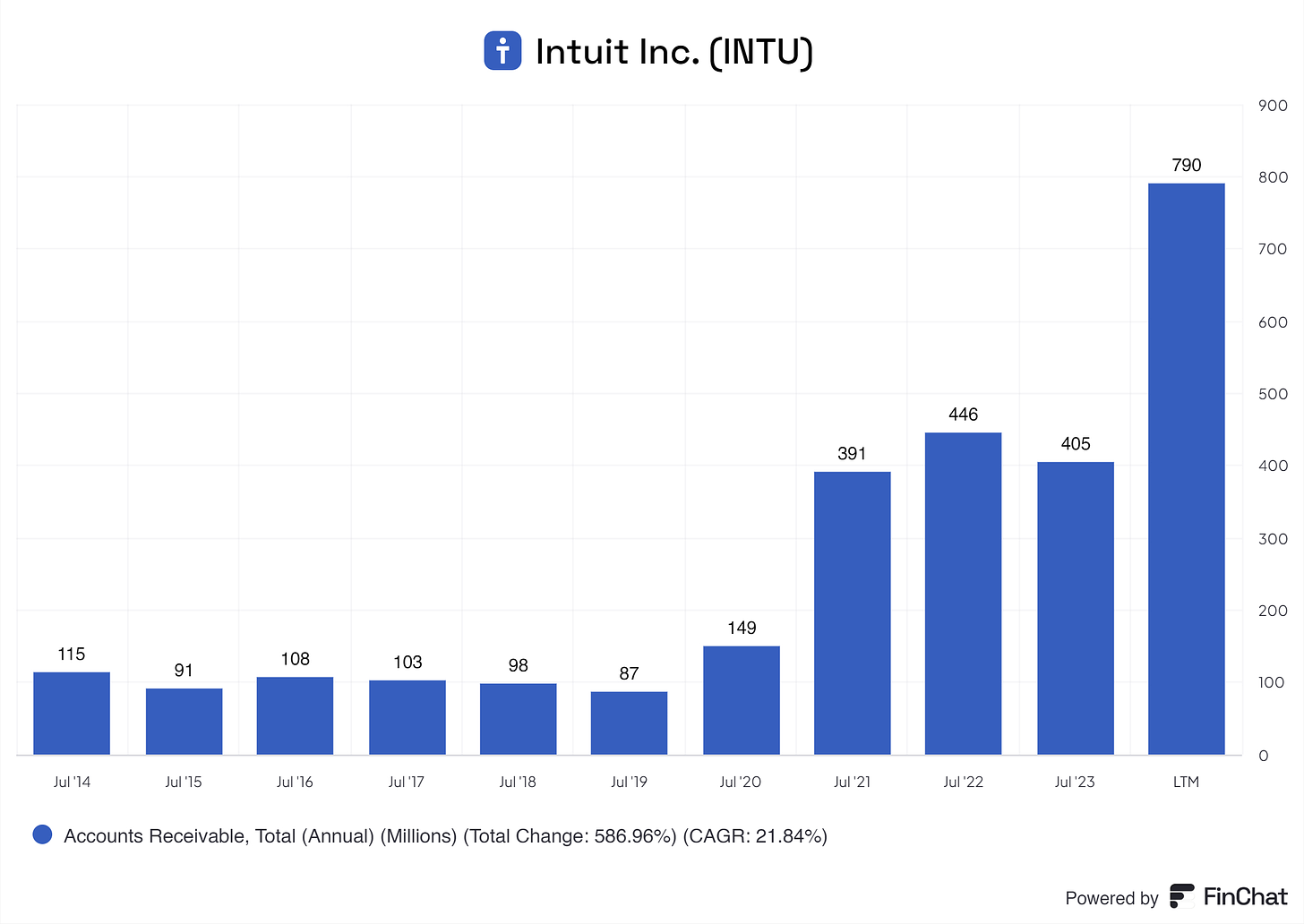

Something I notice is that accounts receiveables is growing at substantial rates. This could indicate that Intuit is having ‘‘struggles’’ getting the money for its products and services from the users/consumers. Of course, this might also be due to Intuit extending credit terms to customers in order to boost sales, resulting in higher volume of outstanding recievables. In my research I had trouble giving a definite answer on this question.

Also, Intuit shows an significant increase in Goodwill. This is, of course, due to Intuit its acquisitions. Intuit is paying premiums for these acquisitions, we need to see if the premium paid for the acquisitions was worth it. In the short term it is tough to see if it was worth the premium, hence the significant increase in Goodwil.

Now over to Intuit its liabilities.

Intuit is showing a solid side here, nothing too crazy. Intuit current liabilities mostly consist of unearned current revenue (payments recieved in advance, service or product has not been delivered yet) and current income taxes payable. The income tax payables also do not deem any worrying. Intuit has shown to be solid in making payments, nothing too worrying.

Intuit is growing its long-term debt substantially due to its aquisitions

Again, this is not something we should worry about as of now. Intuit is acquiring businesses, therefore also taking on the debts of those businesses. If the acquisition is adding value to the business Intuit will pay the debt without any angry shareholders.

Once again, these only become ‘‘issues’’ as soon as the business acquired does not live up to the expectations shareholders/Intuit itself have.

In summary, the balance sheet looks healthy and nothing crazy. We see significant increase in Goodwill and debt, but this should not raise any issues if Intuit is capable of properly using these acquisitions to generate more revenue for the business.

7. Capital

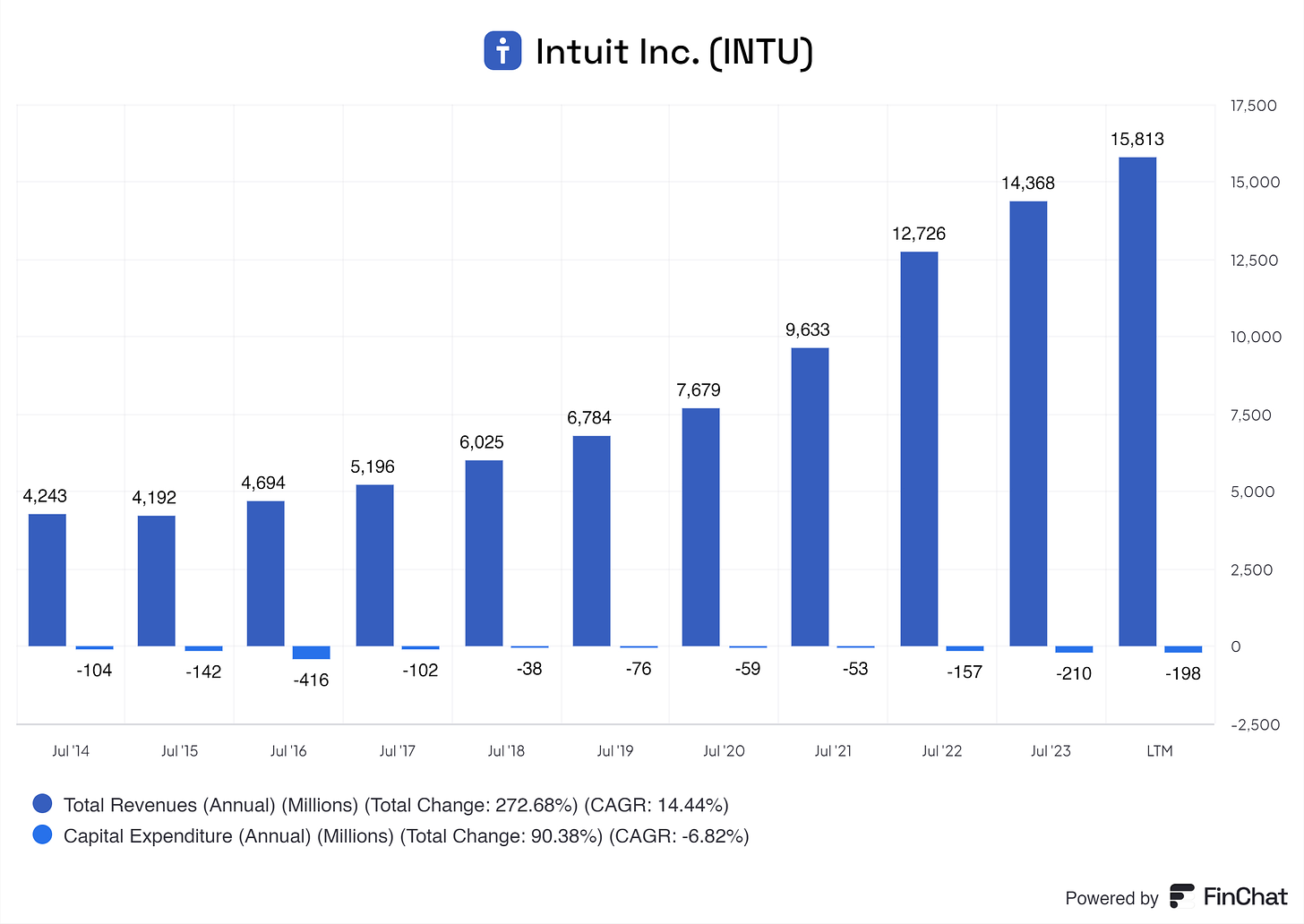

Intuit is a software business, so its CAPEX should not be an issue here.

And as we can see, it isn’t.

LTM CAPEX accounts for 1.25%, in 2023 CAPEX accounted for 1.46%, and in 2022 CAPEX accounted for 1.23%. These are healthy ratios and I would not expect anything different from a software business.

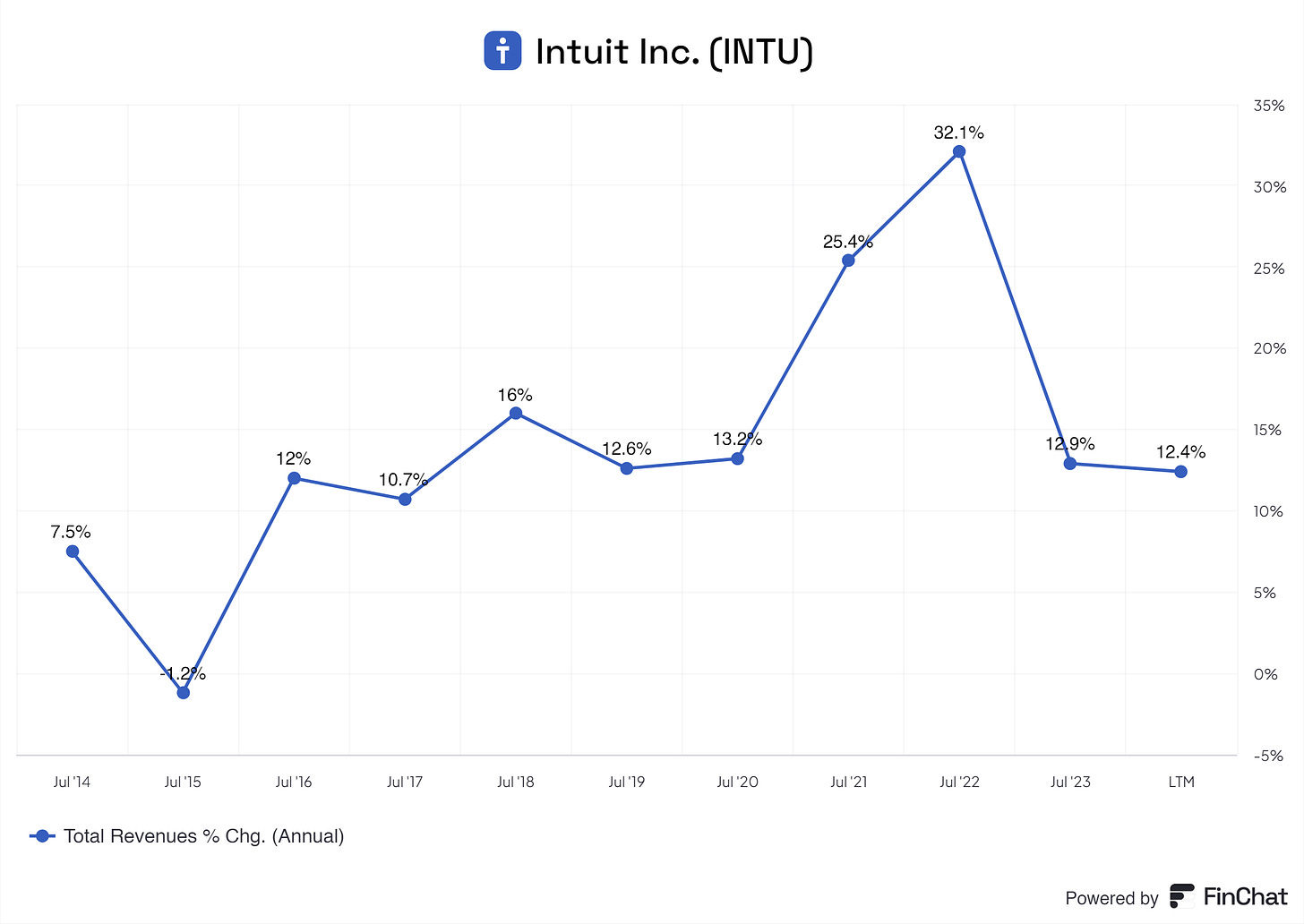

Intuit is investing minimal compared to its total revenue but growing substantially. In 2021 to 2022 Intuit grew 32.1%, from 2022 to 2023 Intuit grew 12.9% and LTM Intuit is growing 12.4%.

In addition, Intuit is generating excellent OCF (operational cash flow) from its services and products. In comparison to its CAPEX we get another excellent view of the business.

Intuit has limited CAPEX, increasing cash for the business and shareholders.

Intuit said the following about their CAPEX

Expect capex as % of revenue ~2-3% going forward

Source: Investor Presentation

In summary, Intuit is achieving significant revenue growth with relatively low levels of CAPEX, indicating that Intuit is operating extremely efficiently and effectively utilizing its resources. This suggests that Intuit's business model and strategies are driving growth without requiring heavy capital expenditures.

Is Intuit also showing excellency in its capital allocation, though? Let us dive into this!

Capital allocation

This is not something I like seeing, at all.

From 2014 up until 2017 Intuit was showing solid increases in its ROIC ( return on invested capital) and ROCE (return on capital employed) even showed increase from 2014 up until 2019. But, after 2017 for ROIC and 2019 for ROCE, its went downhill for Intuit, showing that management is getting less efficient with its capital, or didn’t it?

A driver for this drop? Acquisistions.

2019 Acquisitions. Origami Logic

2018 Acquisitions. Applatix

2017 Acquisitions. Exactor

2016 Acquisitions. XyLeo Labs

2015 Acquisitions. ZeroPaper

2014 Acquisitions. CustomerLink

2013 Acquisitions. Payvment

Acquisitions are primarily financed with debt, not equity, skrewing the ROCE. Also, the cost of financing the acquisition (such as interest expenses on debt used for financing) can also impact the overall ROIC.

If we keep seeing lower levels of ROIC and ROCE we can assume the acquisitions did destroy shareholder value, for now it will become a waiting game, that's the underlying ‘‘risks’’ of acquisitions, its a waiting game.

Intuit will keep doing strategic acquisitions according to management

Use acquisitions to accelerate speed and velocity, growth in talent and technology, and fill out our product roadmap

Source: Investor Presentation

8. Profitability

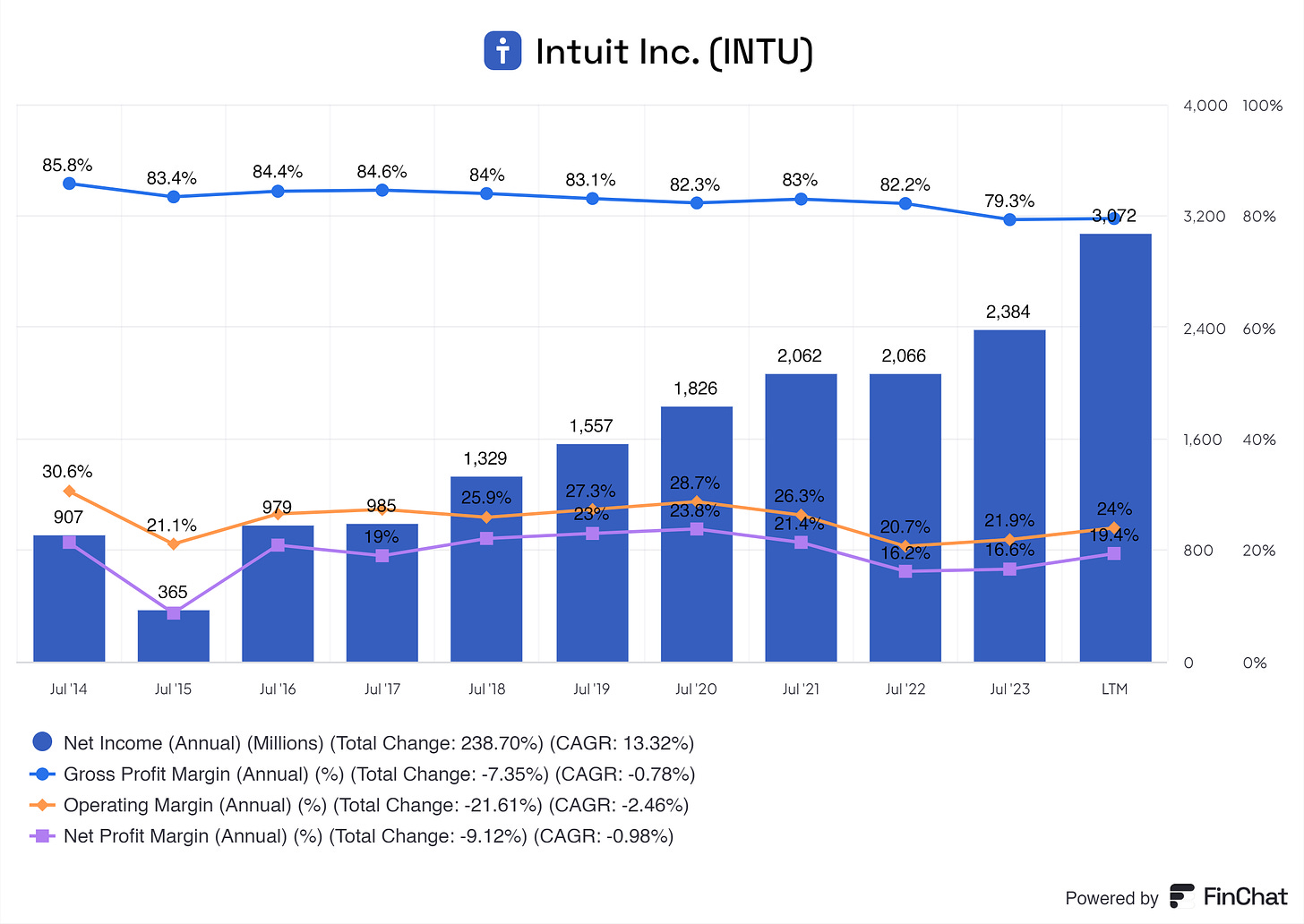

As shown above Intuit is very capable of generating solid net revenues, even during the pandemic.

Intuit benefits from excellent Gross Profits margins, Operating Margins, and Net Profit Margins. Although we’ve seen slight decreased in Intuit its margins, overall, the margins are excellent and is something Intuit can flaunt with.

Something Intuit is also doing excellent is generating solid free cash flows from its operations with increasing free cash flow margins.

Intuit is generating well amounts of free cash flow, excellent. These cash flows can then be reinvested for future growth of the business or pay-off its debts.

9. Historical & future growth

Intuit has been growing significantly, with in 2020 taking a real growth spurt.

Intuit has shown consistent and sustainable growth over the years, a notable achievement in the tech industry where growth can often be volatile.

Intuit's total revenues, Gross Profits, Operating Income, and Net Income have all seen steady increases, reflecting its robust performance.

The company's revenue growth is driven by expanding its suite of financial software products, improving e-commerce capabilities, and increasing its customer base. As the demand for financial management solutions continues to rise, Intuit's diverse product offerings and strategic initiatives, such as partnerships and acquisitions, are expected to support ongoing revenue growth. However, growth rates may moderate as the market matures and competition intensifies.

Gross profit growth reflects Intuit's ability to manage costs effectively and increase sales. Continued investment in product innovation and customer acquisition should sustain gross profit growth. Nevertheless, rising costs and potential disruptions in the supply chain could impact profit margins.

Net income growth indicates strong operational performance and efficient cost management. As Intuit continues to expand its market presence and optimize its operations, net income is likely to grow. However, external factors such as economic downturns and changes in regulatory environments could pose risks to maintaining this growth rate.

Operating income growth is fueled by increasing revenues and effective cost controls. Investments in technology and operational enhancements are expected to further improve efficiency. However, factors like increased operating expenses and market competition could affect future growth prospects.

Key Factors for Sustaining Growth

Expansion Strategy: Intuit's ability to expand its product portfolio and market reach through acquisitions and partnerships will be crucial for sustaining growth.

Digital Transformation: Enhancing digital capabilities and user experience, as well as integrating new technologies like AI and machine learning, will drive growth in the digital space.

Customer Engagement: Strengthening customer relationships through loyalty programs and personalized services will drive customer retention and revenue growth.

Regulatory Compliance: Adapting to changing regulatory environments and ensuring compliance with industry standards will be essential for maintaining trust and credibility.

Operational Efficiency: Continued investments in automation, process optimization, and talent development will help improve efficiency and reduce costs.

Economic Resilience: Monitoring economic conditions and adapting business strategies accordingly will mitigate risks associated with economic downturns and market fluctuations.

In conclusion, Intuit's consistent growth trajectory reflects its strong market position and effective execution of strategic initiatives. Sustaining this growth will require ongoing innovation, strategic partnerships, and a focus on operational excellence to navigate challenges and capitalize on emerging opportunities in the dynamic financial technology landscape.

10. Value

Intuit is overall not diluting shareholders, phew.

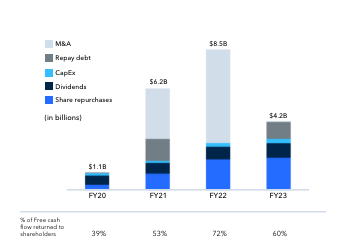

Intuit from FY20 up to FY23 has used increasing cash positions to buyback shares.

Intuit point out in multiple presentations and earnings calls that they want to generate shareholders return by strategically buying back shares when in access of cash or the market provides the right opportunity, giving the hint they really have thought out the buybacks program, excellent.

This, of course, reflects in per share basis.

Intuit is increasing earnings per share, free cash flow per share, and revenue per share YoY. This means that for every share you own of Intuit you get more in return YoY, again excellency from Intuit.

10. Outlook

Looking ahead for Intuit, the company appears poised for continued growth and success in the financial technology sector. With a solid track record of consistent revenue and profit increases, Intuit has established itself as a leader in providing innovative software solutions for financial management.

One key aspect of Intuit's outlook is its ongoing commitment to product innovation and digital transformation. By continuously enhancing its software offerings and investing in new technologies such as artificial intelligence and machine learning, Intuit aims to remain at the forefront of the industry and meet the evolving needs of its customers.

Additionally, Intuit's strategic partnerships and acquisitions play a vital role in its growth strategy. By collaborating with other companies and integrating complementary products and services into its ecosystem, Intuit expands its market reach and strengthens its competitive position.

Moreover, Intuit's focus on customer engagement and satisfaction is expected to drive continued growth. Through initiatives like loyalty programs and personalized services, Intuit aims to build strong relationships with its customers and drive long-term loyalty and revenue growth.

While Intuit faces challenges such as regulatory compliance and market competition, the company's robust financial position and proactive approach to risk management should help mitigate potential risks and ensure sustained growth.

In conclusion, Intuit's outlook is positive, with opportunities for growth and innovation in the financial technology sector. By staying agile, customer-focused, and committed to excellence, Intuit is well-positioned to capitalize on emerging trends and maintain its leadership position in the industry.

11. Quality score

Quality Score for Intuit:

1. Financial Performance: 9.5/10

Revenue Growth: Intuit has consistently achieved strong revenue growth, reflecting its market leadership and the effectiveness of its financial software solutions.

Profit Margins: The company boasts impressive gross and operating margins, indicating efficient cost management and robust profitability.

Balance Sheet Strength: Intuit maintains a solid balance sheet with low debt levels and substantial cash reserves, ensuring financial stability and flexibility.

2. Market Position: 9/10

Brand Power: Intuit is a highly recognized and respected brand in the financial technology industry.

Market Share: The company holds a dominant market position in providing financial management solutions, underpinned by a strong market presence.

Competitive Advantage: Intuit benefits from a diverse product range and strategic partnerships, which provide a sustainable competitive edge

3. Growth Potential: 8.5/10

E-commerce Expansion: There are significant growth opportunities in online sales, driven by enhanced digital capabilities.

Product Innovation: Intuit continues to innovate, integrating new technologies into its software offerings.

Strategic Partnerships: Collaborations with financial institutions and businesses are expanding Intuit's market reach and customer base.

4. Operational Efficiency: 8.5/10

Customer Experience: Intuit offers user-friendly and efficient software solutions, resulting in high customer satisfaction.

Cost Management: The company implements effective cost-saving measures without compromising on product quality or service standards.

Service Innovation: Regular updates and improvements to software features and functionality demonstrate Intuit's commitment to operational excellence.

5. Innovation: 8/10

Product Innovation: Intuit consistently introduces new features and updates to its software products, staying ahead of market trends.

Digital Innovation: Significant investments in technology and user experience enhancements underscore the company's innovative approach.

Service Innovation: Continuous improvements in customer support and service offerings enhance overall user satisfaction.

6. Customer Loyalty: 9/10

Brand Loyalty: Intuit enjoys a loyal customer base due to the reliability and effectiveness of its software solutions.

Customer Satisfaction: High levels of customer satisfaction are evident in positive feedback and repeat usage.

Community Engagement: The company actively engages with users through forums, support communities, and educational resources, fostering a strong community.

7. Risk Management: 7.5/10

Economic Sensitivity: Intuit's exposure to economic downturns may impact demand for financial software solutions, necessitating proactive risk management.

Security Risks: Potential cybersecurity threats and data breaches pose risks; however, Intuit has robust measures in place to mitigate these threats.

Regulatory Risks: Compliance with evolving regulations and changes in tax laws presents challenges, but Intuit is committed to maintaining high compliance standards.

Overall Quality Score: 8.4/10

Intuit scores highly across most dimensions, particularly in financial performance, market position, and customer loyalty. The company's strong growth potential is driven by innovation and operational efficiency. Nevertheless, ongoing attention to risk management and regulatory compliance is crucial for sustaining long-term success. Overall, Intuit is a high-quality company with promising growth prospects in the financial technology sector.

12. SWOT analysis

Strengths:

Strong Brand Recognition:

Intuit is well-known for its flagship products such as TurboTax, QuickBooks, and Mint, which have a strong market presence and brand loyalty.

Robust Financial Performance:

Consistent revenue growth, high profit margins, and a strong balance sheet with low debt levels and substantial cash reserves.

Market Leadership:

Leading market share in the financial software industry, particularly in small business accounting and personal finance management.

Product Innovation:

Continuous development and integration of new technologies into products, keeping them competitive and user-friendly.

Strategic Partnerships:

Collaborations with financial institutions, educational organizations, and other businesses enhance product offerings and market reach.

Customer Loyalty and Satisfaction:

High levels of customer satisfaction and a loyal customer base due to reliable and effective software solutions.

Weaknesses:

Dependence on Seasonal Revenue:

Products like TurboTax generate significant revenue during the tax season, leading to potential seasonal fluctuations in income.

Limited International Presence:

While strong in the U.S. market, Intuit has a less robust presence internationally, limiting its global growth potential.

High Product Pricing:

Intuit's products are often priced higher than competitors, which could be a barrier for small businesses or individual users with limited budgets.

Complexity in Product Usage:

Some users may find Intuit's products complex, particularly small business owners without a strong financial background, which could affect user experience and adoption rates.

Opportunities:

Expansion into Emerging Markets:

Growing demand for financial management solutions in emerging markets presents significant growth opportunities.

E-commerce Growth:

Increasing online sales and enhanced digital capabilities can drive revenue growth, especially with the rise of e-commerce businesses.

AI and Machine Learning Integration:

Leveraging AI and machine learning can enhance product features, improve customer experience, and streamline operations.

Cloud-Based Services:

Expanding cloud-based solutions and services can attract new customers and provide recurring revenue streams.

Acquisitions and Strategic Alliances:

Acquiring complementary businesses and forming strategic alliances can enhance product offerings and market reach.

Threats:

Economic Downturns:

Economic fluctuations and downturns can reduce demand for Intuit's products, especially for small businesses.

Intense Competition:

The financial software industry is highly competitive, with numerous players offering similar products, which could impact market share.

Cybersecurity Risks:

Increasing threats of data breaches and cyber-attacks could compromise customer data and damage Intuit's reputation.

Regulatory Changes:

Changes in tax laws, financial regulations, and compliance requirements can pose challenges and increase operational costs.

Technological Disruption:

Rapid technological advancements can lead to obsolescence of existing products if Intuit fails to innovate at the same pace.

In summary, Intuit Inc. is a strong player in the financial software industry, with robust financial performance, strong brand recognition, and a loyal customer base. The company has significant opportunities for growth, particularly through international expansion, AI integration, and cloud-based services. However, it must address its weaknesses, such as dependence on seasonal revenue and limited international presence, while managing threats from economic downturns, intense competition, and cybersecurity risks to sustain long-term success.

12. Valuation

For my valuation, I use a DCF, Multiples Valuation, and Benjamin Graham Valuation, and average those out including analysts’ averages.

DCF: $534.64 (Growth rate of 14%, perpetual growth of 3%, and discount rate of 9,50%)

Multiples valuation: $483.74

Benjamin Graham valuation: $333.32

Analysts average: $722

Average comes out to $518.42 and Intuit current price is $573.9

These figures are the result of a bull-case since I am bullish on the business. :-)

End note

Thank you for reading this investment case on Intuit!

With every investment case, I am trying to improve my writing and how I communicate my findings with you all. Because I started not too long ago, some posts might change in layout or other aspects before I find the layout that suits my best wishes, sorry in advance.

As of now, thank you so much for your time! I hope you found some valuable information in this investment case.

Disclaimer

I do not own any shares of Intuit and do not intend on buying shares in the next 6 months.

By reading my posts, being subscribed, following me, and visiting my Substack you agree to my disclaimer. You can read the disclaimer here.