Hello friend! 👋

My name is Yorrin, also known as ‘‘Fluentinvalue’’.

I am pleased to have you back here for another investment case. This time, we are discussing the beauty giant, Ulta Beauty.

In case you have missed previous articles, click on the link below:

If you’re currently not yet following me, consider doing so. I provide FREE content to help and inform you in your investment journey. From beginner to advanced, all info will be helpful. :-)

Ulta Beauty is the American giant in beauty supplies.

Ulta Beauty currently has 1395 stores in the U.S.A., more than 15.500.00 total square footage, opening more than 30+ stores YoY, and as of Feb 2024 has a total revenue of 11.2073M.

This giant is expanding globally in 2025 over the borders to Mexico, creating more solid investment opportunities for investors. As of now, we see excellent growth in all sectors Ulta Beauty operates in, and one of the most loyal customers with its customers’ program, 98% is signed up for its program!

But, is Ulta Beuty investable as of now? Let us chat about it.

Ulta Beauty - General information

Company name: Ulta Beauty, Inc.

Ticker: ULTA

Stock price: $387.56

Market cap: $18.47B

Revenue: $11.3B

Industry: Specialty Stores / Retail Trade

If you’re into these kinds of investment theses, consider checking out the following Zoetis, Copart, and Adobe. These are available for FREE on my Substack page.

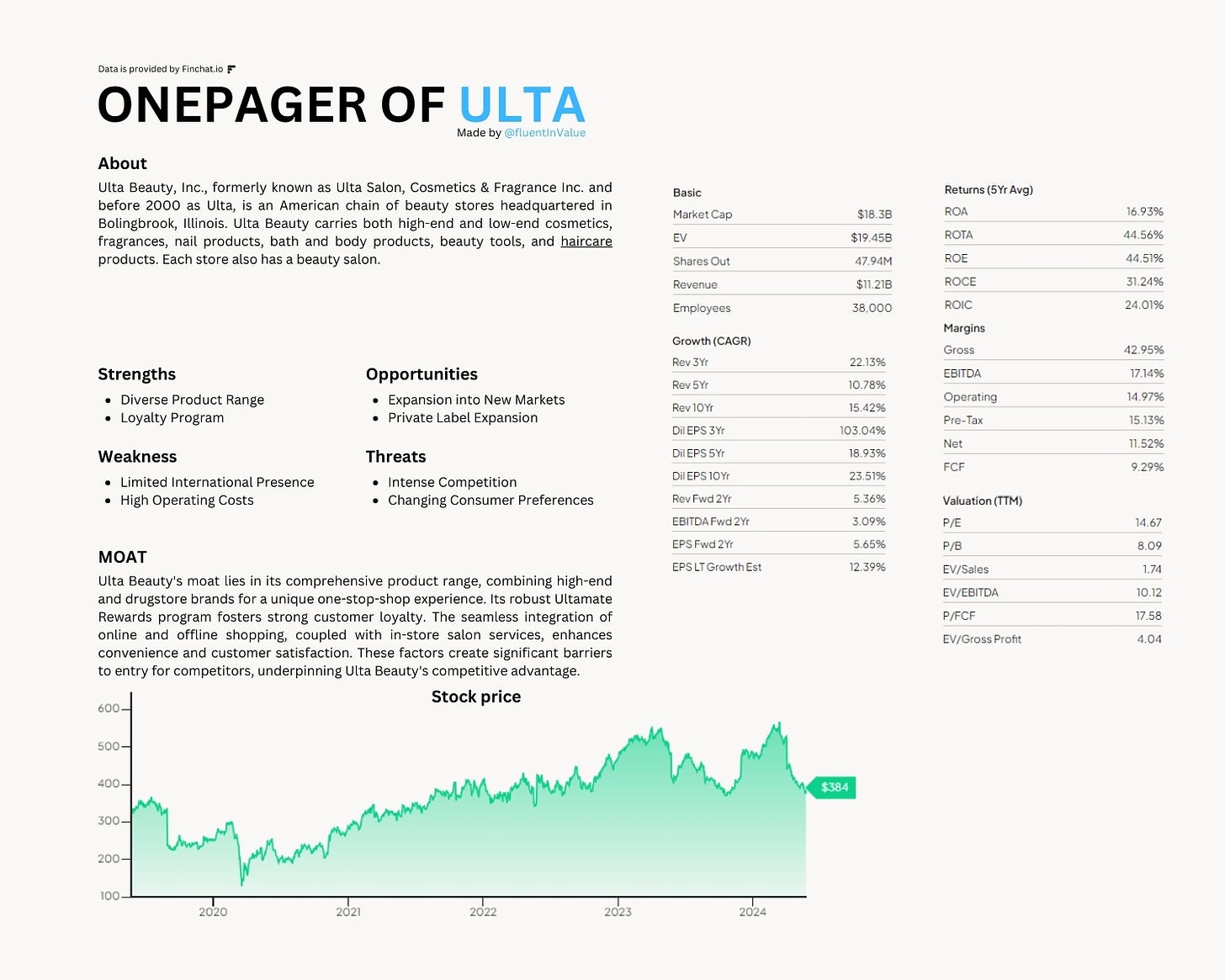

Ulta Beauty One Pager

Step-by-step

To better understand the business, I recommend doing the following for yourself the next time you’re eager to invest in a business. This method has helped me pick quality companies, understand their business, and know when to get it & when to get out)

In analyzing a stock, I follow the following steps:

1. Business model

The business model of Ulta Beauty is not too hard to grasp. Ulta Beauty operates in the beauty sector, selling private labels and other labels in its stores. Ulta Beauty offers cosmetics, hair care, and styling products, skincare products, fragrance and bath products, service (getting your hair done), and smaller accessories.

Something excellent to see is that Ulta is well diversified in the products offering, not heavily relying on certain products. This gives us investors a safe harbor.

2. Management

Dave Kimbell is the current CEO of Ulta Beauty.

Dave Kimbell has been the CEO of Ulta Beauty since June 2021, bringing a lot of quality and value to the business.

Dave Kimbell is a CEO who is known in the business, let’s go over his experience.

Dave Kimbell started in 1989 as a Commercial Loan Officer for the National City Bank. He did this up until 1994, 5 years. After this endeavor, David Kimbell went to work for P&G (Procter & Gamble) in 1996 as a brand manager. Also here Dave Kimbell stayed for 5 years before joining PepsiCo as Vice President of Marketing.

As we can see, Dave Kimbell has already worked at the giants of today (P&G and PepsiCo were already giants too back in those days).

In 2008 David Kimbell went to work for Seventh Generation as Chief Marketing Officer and Senior Vice President, doing this till 2014. After this Dave Kimbell went to work for Ulta Beauty, starting as Chief Marketing Officer in 2014. After one year Dave Kimbell grew in position, becoming Chief Merchandising and Marketing Officer. Dave Kimbell did this for 4 years before growing to become the President and Chief Merchandising and Marketing Officer. After just 9 months Dave Kimbell grew to become the President! Almost 2 years later Dave Kimbell became the CEO of Ulta Beauty and still is for the last 3 years.

We can see that Dave Kimbell has an impressive resume with one of the biggest companies in the consumer sector. This is crucial in the role of the CEO of the biggest consumer brand.

Dave Kimbell passes my test for the experience part. Dave Kimbell has worked at giants, in the growth phase and has shown to perform well during those times. Something I love to see.

CEO ownership of Ulta Beauty: 0.075%

3. Competitive & sustainable advantage (MOAT)

From a wonderful story from its management, we dive into the MOAT of Ulta Beauty and its competitive and sustainable advantages over its peers.

Is there a MOAT for Ulta Beauty? Let us talk about it!

So, a MOAT can be in either one, or more, of the following forms:

Brand power

Patents

Scale and cost advantages

Switching costs

Networking effect

Attracting talent (I consider this a MOAT, others don’t. Decide for yourself)

Brand Power

Ulta Beauty has established one of the best and strongest brand names out there in the U.S.A. in the beauty retail market.

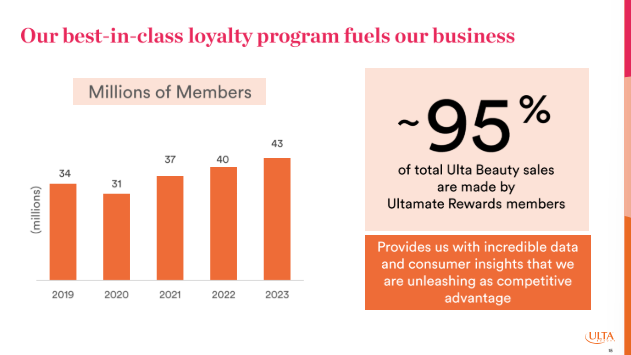

Ulta Beauty is known for its wide variety of products, excellent customer-centric service (backed by mostly positive reviews), and loyalty program. Its brand power is enhanced by its reputation of offering both high-end and drugstore brands, catering to a broader customer base. The brand’s loyalty program, Ultamate Reward, is highly popular (95% of sales are made by Ultamate Rewards members!)

Scale and Cost Advantages

Ulta Beauty benefits from scale and cost advantages due to its extensive network of stores and robust online presence. Its large scale allows it to negotiate better terms with suppliers, benefit from economies of scale in advertising and distribution, and offer competitive pricing to customers. These cost advantages help Ulta Beauty maintain healthy profit margins and reinvest in its growth.

Network Effect

Ulta Beauty does not benefit significantly from network effects in the traditional sense (where the value of a product or service increases as more people use it). However, its extensive customer base and popular loyalty program create a community of engaged shoppers, which indirectly boosts its attractiveness and drives more traffic to its stores and online platforms.

Attracting Talent

Ulta Beauty's brand power and market position help it attract top talent in the retail and beauty industry. The company's commitment to employee development, inclusive culture, and opportunities for career growth make it an attractive employer. Skilled and knowledgeable staff enhance the customer experience, further strengthening the brand.

Summary

Ulta Beauty's moat is primarily built on brand power, scale and cost advantages, and its ability to attract talent. While it does not heavily rely on patents or network effects, and switching costs in the industry are inherently low, Ulta Beauty effectively leverages its brand, operational scale, and skilled workforce to maintain a competitive edge in the beauty retail market.

4. Industry

So far we know Ulta Beauty is run by an excellent CEO, David Kimbell, Ulta Beauty has a well-diversified product offering and an extremely loyal customer base.

But is there more growth on the horizon for Ulta Beauty, and how does it stack up against its peers in the beauty retail industry?

Ulta Beauty currently holds a leading position in the beauty retail market, sharing the space with other major players like Sephora and department store beauty sections. Ulta Beauty and Sephora are the dominant forces, creating a highly competitive but still favorable environment for both. This duopoly in the specialty beauty retail sector provides stability and allows both companies to thrive by continually innovating and expanding their offerings.

Ulta Beauty benefits significantly from its reinvestment strategy, continuously scaling its operations to improve efficiency and customer experience. This strategy is supported by strong free cash flow, enabling Ulta Beauty to invest in expanding its store network, enhancing its e-commerce platform, and developing exclusive product lines and beauty services.

Is there more growth to be expected in this sector? Absolutely.

Ulta Beauty is strategically positioned to capitalize on several growth opportunities. The increasing consumer focus on self-care and beauty, coupled with Ulta's expansive product range that includes both high-end and affordable options, positions the company well to capture a broader audience. Moreover, Ulta's loyalty program, Ultimate Rewards, continues to drive repeat business and deepen customer engagement.

Additionally, Ulta Beauty's partnership with Target, which places Ulta shop-in-shops within Target stores, is a significant growth driver. This collaboration not only extends Ulta's reach to new customers but also leverages Target's extensive footprint to boost sales and brand visibility.

Ulta is also making strides in the digital space. The company's investment in its online platform and omnichannel capabilities, such as buy online, pick up in-store (BOPIS), and same-day delivery, enhances customer convenience and drives online sales growth. These digital enhancements are crucial as e-commerce continues to grow in importance.

Lastly, the expansion of Ulta's brand and exclusive products adds a high-margin revenue stream, further boosting profitability. This focus on proprietary brands not only differentiates Ulta from competitors but also strengthens customer loyalty.

In summary, Ulta Beauty's leadership in the beauty retail industry, coupled with strategic investments in store expansion, digital innovation, and exclusive product offerings, positions it for continued growth. The company's ability to adapt to consumer trends and leverage partnerships ensures it remains a dominant player in the market, with ample opportunities for future expansion.

5. Risks

Growth and acquisitions are Ulta Beauty's drivers to increasing revenue and growth.

The majority of Ulta Beauty's sales come from its physical stores. Despite significant investment in e-commerce, over 70% of revenue still derives from in-store purchases.

Can Ulta Beauty keep successfully expanding its store network?

Change in consumer behavior: With increasing online shopping trends, Ulta must continuously adapt its business model to maintain its competitive edge.

Economic downturns: As a retailer of non-essential goods, Ulta's sales are highly sensitive to economic cycles. A significant downturn could negatively impact consumer spending on beauty products.

Supply chain disruptions: Ulta's extensive product range depends on a complex supply chain. Any significant disruptions can impact product availability and sales.

Competition from online-only beauty retailers: As the e-commerce beauty market grows, Ulta faces competition from online-only retailers that may offer more competitive pricing and convenience.

Enough with the potential risks, let’s dive into the balance sheet!

6. Balance sheet

Usually, I am not a fan of net debt on the balance sheet. Ulta has a net debt of 1.386M, but this is not anything to worry about in Ulta’s case. Ulta Beauty currently has a net debt-to-EBITDA ratio of 0.7. This means Ulta Beauty has no issues completely wiping its debt off the balance sheet, this ratio tells me they can without needing a full year, that’s wonderful. If the net debt-to-EBITDA was higher I would be worried, anything above 3.0 is considered a risk to me.

Ulta Beauty benefits from a solid cash position, we love cash. The current cash position is 766M

CASH = KING

Ulta Beauty its current assets and total assets are modestly above its current liabilities and total liabilities, so nothing to worry about here too. Most of its liabilities are the leases for the tons of stores Ulta Has. This is a liability, but not a heavy-bearing one in my opinion. Their stores generate profits and are needed. If there were a lot of loans, with high interest, I would be worried.

Something I also love is that Ulta Beaty's Accounts Receivables are not rising at extreme rates. This means Ulta Beauty has no issues getting money from the consumers at an acceptable timespan, lovely.

The ratios are all very favorable for Ulta Beauty, I see no liquidity issues now or coming in the short term.

7. Capital

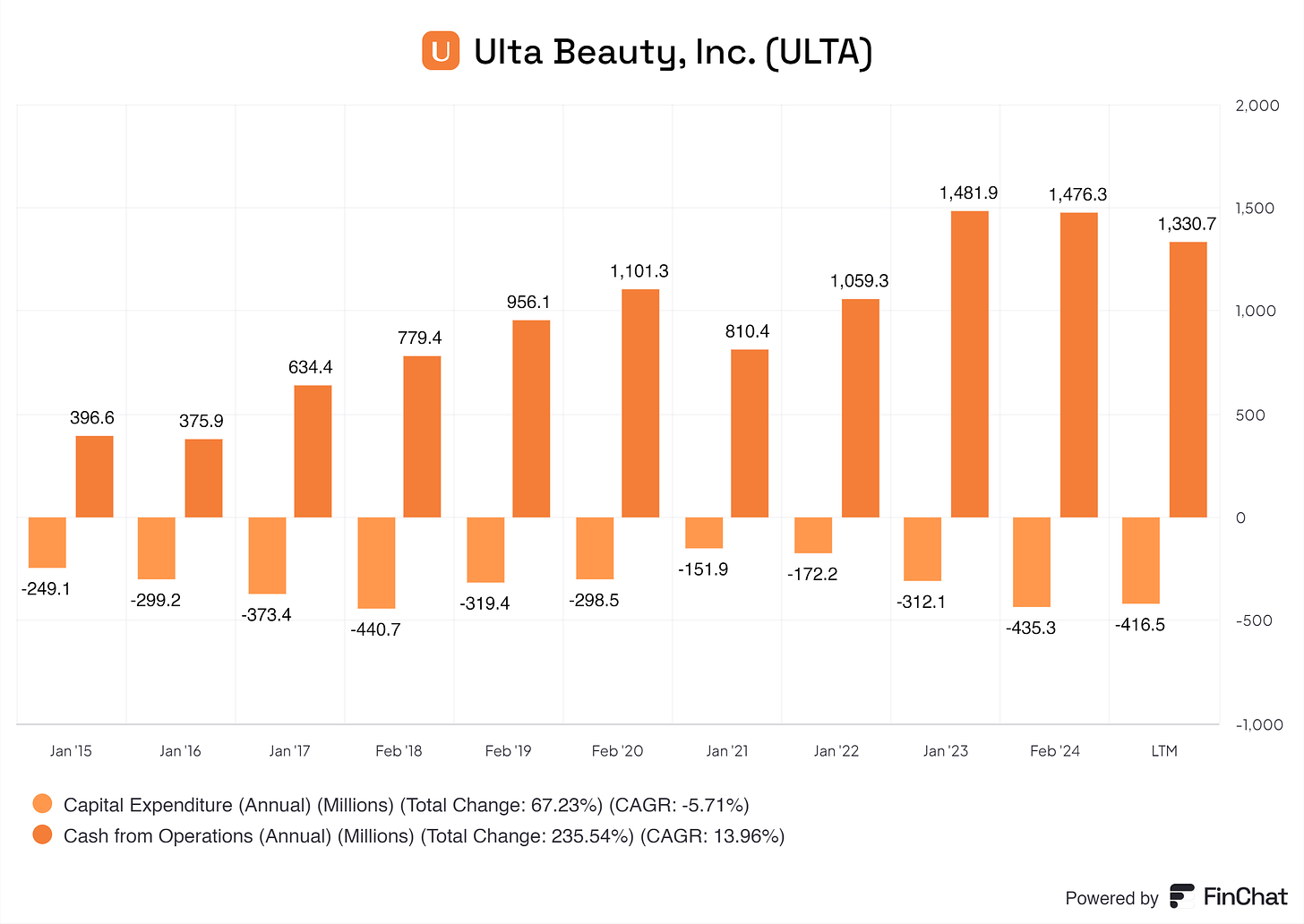

Ulta Beauty its CAPEX to revenue is excellent!

As of LTM CAPEX accounts for 3% of its total revenue, this is excellent to me. This low percentage of CAPEX puts less strain on the business and its operations.

CAPEX to OCF is a little bigger strain.

in Feb ‘24 CAPEX was 28% to its OCF. Anything below 30% or 35% is favorable to me, Ulta Beauty stays below it on average which is solid!

Now about capital allocation!

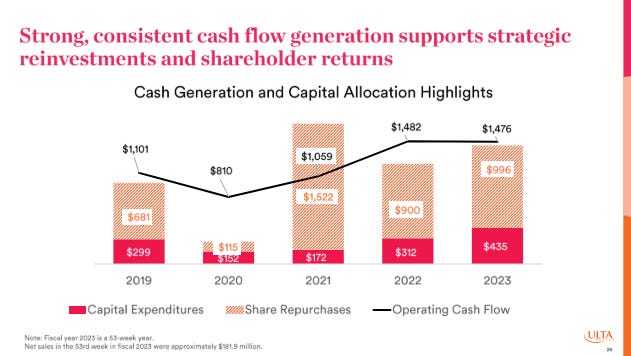

Capital allocation

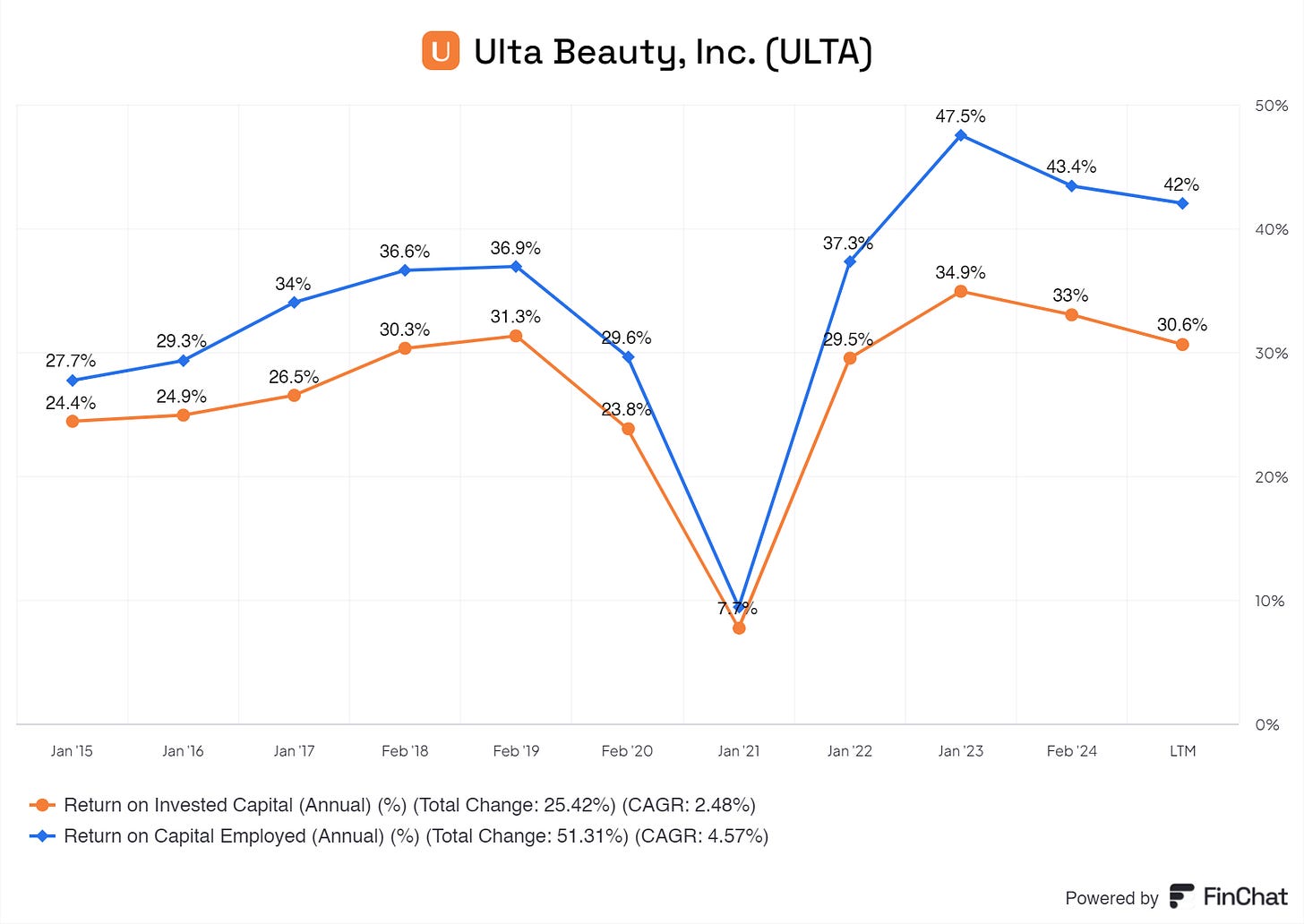

Ulta Beauty is a capital allocator giant!

The smaller dip in ‘21 is neglectable. This was the height of the pandemic, and almost all businesses had issues all over the board with their business.

We see that Ulta Beauty is YoY getting better and better with allocating its money to profitable projects, let us hope the expansion into Mexico will be one too.

Ulta Beauty is planning on increasing this too. Ulta Beauty is planning on maximizing growth from its core categories, fueling the growth of cross-category strategic platforms and adjacencies, differentiating Ulta Beauty Through exclusive brands, products, and their own private label business, and driving profitability through a focused approach on assortment, inventory, and promotional optimization.

Ulta is also planning on expanding and enhancing its presence.

I recommend checking out there Investor Presentation. You will get a good feeling on how Ulta Beauty will do its best to expand, generate more profits, increase profitability, and generate more shareholder and customer returns.

8. Profitability

Ulta Beauty is profitable.

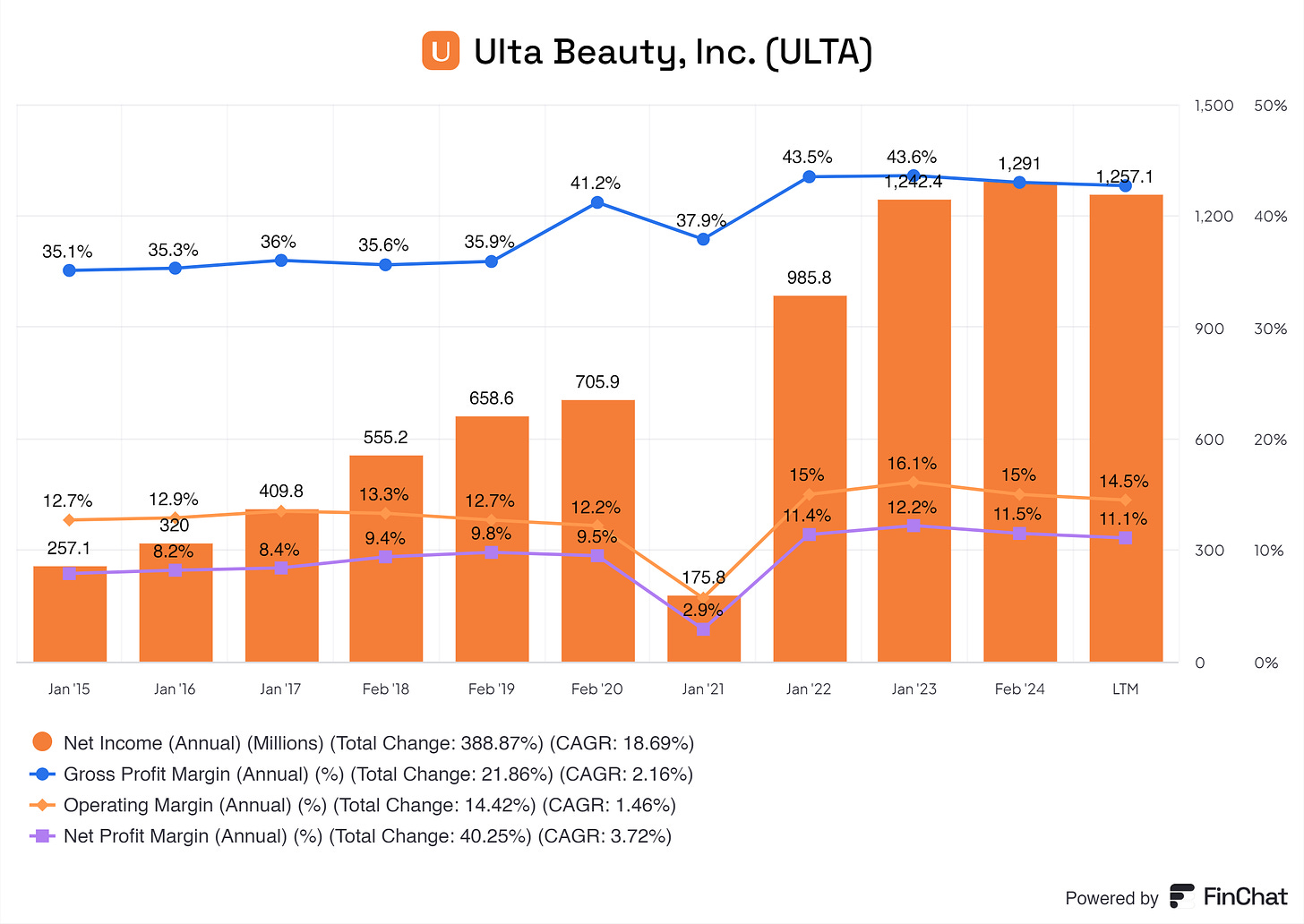

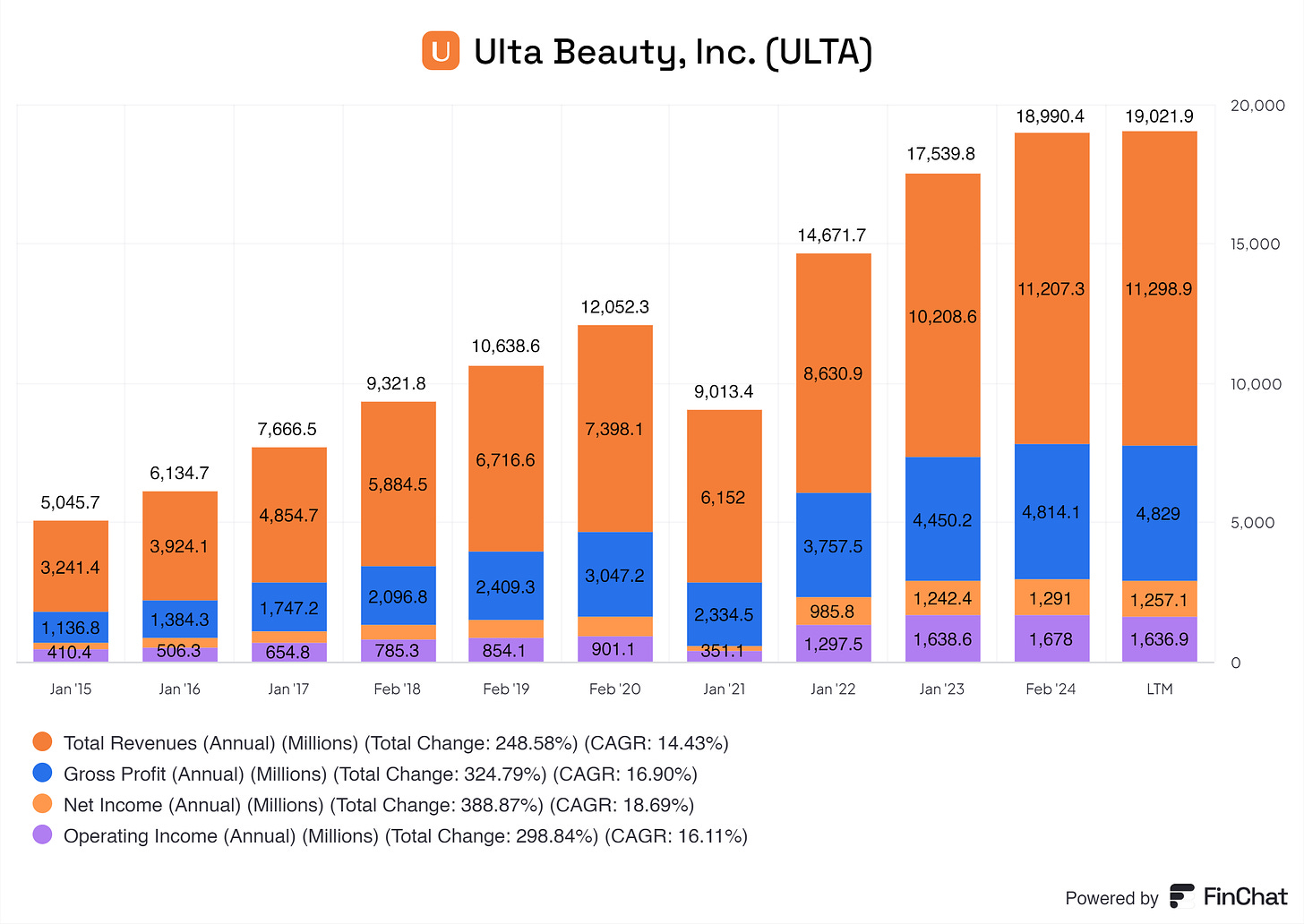

Ulta Beauty benefits from solid Gross Profit margins, Operating margins, and Net Profit margins. Of course, ‘21 was a special year, impacting the overall CAGR and net return of that year. If we leave that year out we see that Ulta Beauty is capable of consistently growing its revenue.

Ulta Beauty benefits from the sector it operates in. The beauty sector is a sector that will never disappear, people want to look good. And, this sector offers great scale opportunities in margins and expansions.

9. Historical & future growth

Ulta Beauty has been growing at a solid and sustainable rate. In a lot of tech companies, you will see immense growth in the earlier years and a slowdown YoY.

Ulta Beauty has been shown to grow its total revenues, Gross Profits, Operating Income, and Net Income at sustainable rates.

Ulta has shown consistent revenue growth, which is driven by expanding its store footprint, enhancing its e-commerce capabilities, and increasing same-store sales. As the beauty market continues to grow, Ulta's diversified product offerings and strategic partnerships (e.g., with Target) should support ongoing revenue growth. However, the growth rate may moderate as the market becomes more saturated and competition increases.

Gross profit growth reflects Ulta's ability to manage costs and increase sales. The company's private label products and exclusive brands contribute higher margins. Continued investment in supply chain efficiencies and cost management should help sustain gross profit growth. However, rising costs and potential supply chain disruptions could impact margins.

Net income growth indicates strong operational performance and cost control. As Ulta continues to expand and optimize its operations, net income is likely to grow. However, external factors such as economic downturns, increased competition, and changes in consumer behavior could pose risks to maintaining this growth rate.

Operating income growth is driven by increasing revenues and effective cost management. Investments in technology and supply chain enhancements are expected to improve operational efficiency further. Yet, potential headwinds like increased operating costs and market competition could affect future growth.

Key Factors for Sustaining Growth:

Expansion Strategy: Ulta's ability to continue opening new stores in profitable locations and expanding its presence in existing markets is crucial. The Target partnership is a key part of this strategy.

E-commerce Growth: Enhancing the online shopping experience, expanding digital marketing, and integrating omnichannel services (like BOPIS and same-day delivery) will be critical for capturing a larger share of the growing e-commerce market.

Consumer Trends: Staying ahead of beauty and wellness trends, and continuously updating product offerings to meet consumer demands will help sustain growth. Ulta's diverse product portfolio, including exclusive brands, will play a significant role.

Loyalty Programs: Strengthening customer loyalty through programs like Ultamate Rewards will drive repeat business and increase customer lifetime value.

Operational Efficiency: Continued investments in supply chain optimization, technology, and staff training will help maintain cost efficiency and improve profit margins.

Economic Conditions: The broader economic environment will influence consumer spending on non-essential items like beauty products. Ulta’s ability to adapt to economic fluctuations will impact its growth sustainability.

In conclusion, while Ulta Beauty has demonstrated strong growth across various financial metrics, sustaining these growth rates will depend on its ability to adapt to market conditions, continue innovating, and effectively manage operational efficiencies and costs. The company’s strategic initiatives and investments in technology and partnerships position it well for future growth, though it must navigate potential risks and challenges in a dynamic market environment.

10. Value

Does Ulta Beauty bring actual value to its shareholders? Let’s find out!

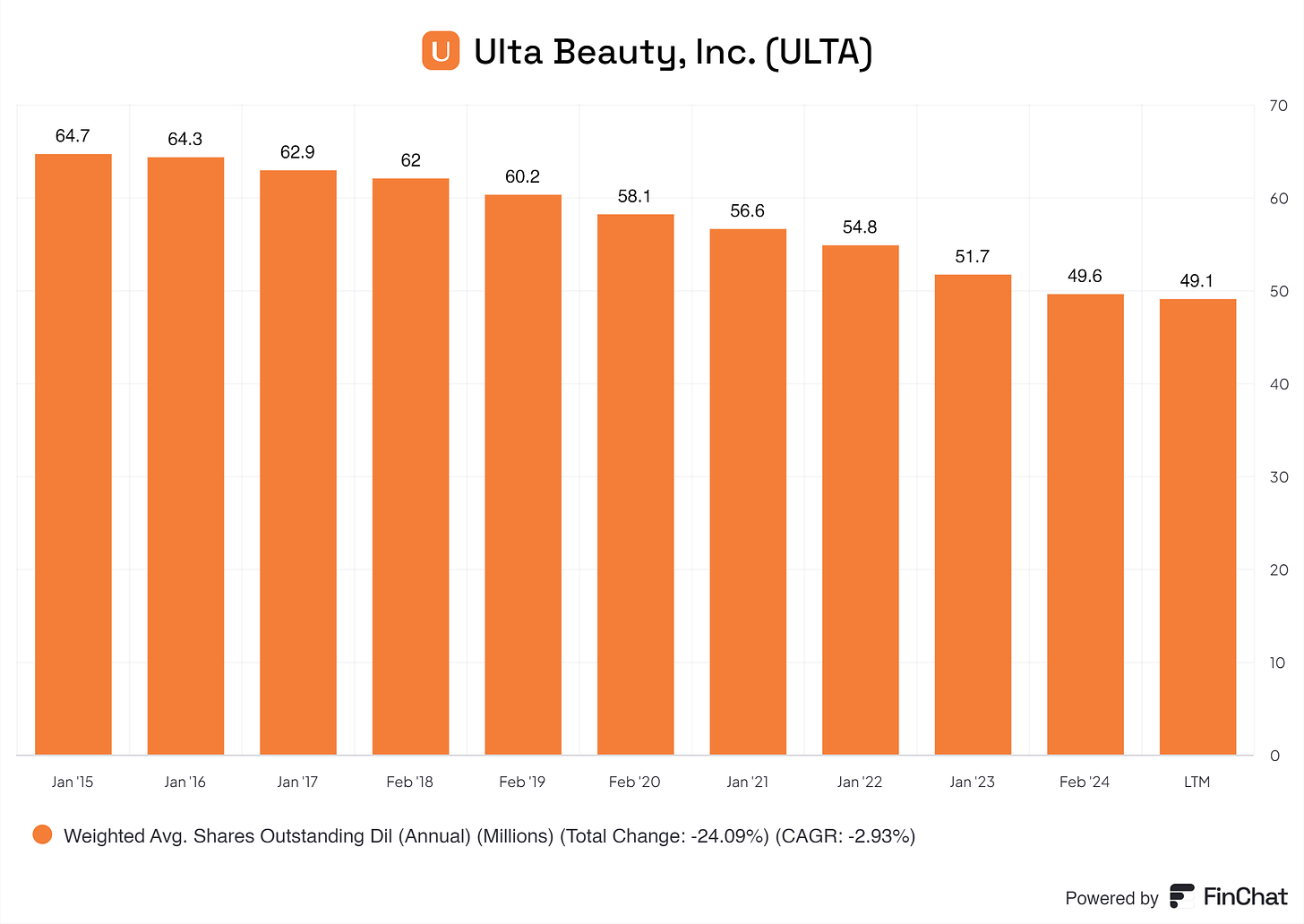

Ulta Beauty has been aggressively buying back its shares, this is excellent.

Ulta Beauty also lets us know that it is dedicated to keep doing so, generating more and more value for us shareholders. In the past, Ulta Beauty has been buying back shares and will continue doing so.

Ulta Beauty is also creating more value per share.

Ulta Beauty is YoY generating more revenue, earnings, and cold-hard cash per share. We see solid growth in earnings per share and FCF per share, excellent execution here.

10. Outlook

The beauty industry is projected to continue its robust growth, driven by increasing consumer interest in self-care, wellness, and personal grooming. The global beauty market, encompassing skincare, cosmetics, hair care, and fragrances, is expected to reach $758 billion by 2025. Key trends shaping the industry include the rise of e-commerce, the shift towards clean and sustainable beauty products, and the increasing influence of social media and influencers in shaping consumer preferences.

Tailwinds for Ulta Beauty

Consumer Trends: The growing focus on self-care and wellness will drive demand for beauty products. Ulta's diverse product range, including both high-end and affordable options, positions it well to capture a broad customer base.

E-commerce Growth: The acceleration of online shopping presents significant opportunities. Ulta’s investments in enhancing its digital platform, offering services like buy online, pick up in-store (BOPIS), and same-day delivery, will be crucial for capturing market share in the e-commerce space.

Loyalty Program: Ulta's Ultamate Rewards program, with over 37 million members, drives repeat business and deeper customer engagement. Enhancing this program with personalized offers and experiences will further strengthen customer loyalty.

Private Label Expansion: Expanding its private label and exclusive product offerings can boost margins due to higher profitability. Ulta’s ability to introduce innovative and high-quality private label products will be a key growth driver.

Partnerships: The strategic partnership with Target, placing Ulta shop-in-shops within Target stores, expands Ulta’s reach and attracts new customers. This partnership leverages Target's extensive footprint to boost sales and brand visibility.

Expansion to Mexico

Entering the Mexican market presents a significant growth opportunity. With a growing middle class and increasing consumer spending on beauty products, Mexico is a promising market for Ulta. Key considerations for successful expansion include:

Localization: Adapting product offerings and marketing strategies to meet local preferences and cultural nuances.

Store Locations: Selecting strategic locations in urban centers with high foot traffic to maximize visibility and accessibility.

Partnerships: Collaborating with local influencers and leveraging social media to build brand awareness and engage with new customers.

Increasing Margins

To enhance profitability, Ulta can focus on the following strategies:

Supply Chain Optimization: Investing in technology and logistics to streamline operations and reduce costs.

Private Label Growth: Increasing the share of private label products, which typically offer higher margins than third-party brands.

Cost Management: Implementing cost-saving measures across operations without compromising customer experience.

Risks

Economic Downturns: As a retailer of non-essential goods, Ulta is vulnerable to economic fluctuations. Reduced consumer spending during recessions could impact sales and profitability.

Supply Chain Disruptions: Global supply chain issues could affect product availability and increase costs, impacting margins.

Competition: The beauty retail market is highly competitive, with strong competition from both brick-and-mortar and online-only retailers. Maintaining market share and customer loyalty amidst this competition will be challenging.

Regulatory Changes: Changes in regulations related to product safety, advertising, and environmental impact could increase compliance costs and affect operations.

Conclusion

Ulta Beauty is well-positioned for future growth, leveraging industry tailwinds and strategic initiatives to expand its market presence and enhance profitability. The company’s focus on e-commerce, private label growth, and strategic partnerships will drive sustained revenue growth. However, Ulta must navigate potential risks, including economic downturns, supply chain disruptions, and increasing competition. With a strategic approach to expansion, particularly in new markets like Mexico, and continuous innovation in product offerings, Ulta Beauty can capitalize on emerging opportunities and maintain its leadership in the beauty retail industry.

Quality Score

Quality score is something new I will be adding to this, and future, investment cases. Here you can see how I qualify the quality of the business.

1. Financial Performance: 9/10

Revenue Growth: Ulta has shown strong and consistent revenue growth over the years.

Profit Margins: Impressive gross and operating margins, reflecting efficient cost management.

Return on Equity: High ROE indicates effective use of shareholder funds.

Balance Sheet Strength: Strong balance sheet with manageable debt levels and substantial cash flow.

2. Market Position: 9/10

Brand Power: Ulta is a well-recognized and respected brand in the beauty industry.

Market Share: Holds a leading position alongside major competitor Sephora, creating a duopoly in the specialty beauty retail sector.

Competitive Advantage: Strong positioning with a wide range of products, exclusive brands, and a compelling loyalty program.

3. Growth Potential: 8/10

E-commerce Expansion: Significant opportunities in online sales, leveraging enhanced digital capabilities.

Store Expansion: Continuous growth in physical store count, including new markets like Mexico.

Private Label Products: The expansion of high-margin private label offerings presents substantial growth potential.

Strategic Partnerships: Collaboration with Target enhances growth prospects.

4. Operational Efficiency: 8/10

Supply Chain Management: Investments in technology and logistics to streamline operations.

Cost Management: Effective cost-saving measures without compromising customer experience.

Store Operations: Efficient and customer-friendly store layouts and operations.

5. Innovation: 7/10

Product Innovation: Regular introduction of new and exclusive products, including private labels.

Digital Innovation: Investments in omnichannel capabilities and personalized customer experiences.

Service Innovation: In-store beauty services add unique value to the customer experience.

6. Customer Loyalty: 9/10

Loyalty Program: Ultamate Rewards program with over 37 million members driving repeat business.

Customer Experience: High customer satisfaction with personalized services and extensive product range.

Community Engagement: Strong engagement through social media and beauty events.

7. Risk Management: 7/10

Economic Sensitivity: Exposure to economic downturns impacting consumer spending.

Supply Chain Risks: Potential disruptions could affect product availability and costs.

Competitive Risks: A highly competitive market with constant pressure from other retailers.

Regulatory Risks: Need to comply with evolving regulations in product safety and environmental impact.

Overall Quality Score: 8.1/10

Ulta Beauty scores high in most dimensions, particularly in financial performance, market position, and customer loyalty. The company has strong growth potential, driven by strategic investments in e-commerce, store expansion, and private label products. Operational efficiency and innovation are also notable strengths, although there is room for improvement in risk management, particularly regarding economic sensitivity and supply chain disruptions.

Overall, Ulta Beauty is a high-quality company with a solid foundation and promising growth prospects, balanced by a need to navigate potential risks effectively.

SWOT analysis

Strengths

Strong Brand Power:

Ulta Beauty is a well-recognized and respected brand in the beauty retail industry, known for its wide range of products and services.

Diverse Product Range:

Offers both high-end and affordable beauty products, catering to a broad customer base.

Includes skincare, cosmetics, haircare, and fragrances, along with beauty tools and accessories.

Compelling Loyalty Program:

Ultamate Rewards program with over 37 million members drives repeats business and customer engagement.

Strategic Partnerships:

Partnership with Target to place Ulta shop-in-shops within Target stores expands reach and brand visibility.

Robust Financial Performance:

Strong revenue growth, impressive profit margins, and a healthy balance sheet.

Integrated Customer Experience:

Combines online and in-store shopping with services like buy online, pick up in-store (BOPIS), and same-day delivery.

Private Label and Exclusive Products:

High-margin private label products and exclusive brand offerings differentiate Ulta from competitors and boost profitability.

Weaknesses

Dependence on Physical Stores:

Despite growth in e-commerce, a significant portion of revenue still comes from physical stores, making Ulta vulnerable to shifts toward online shopping.

High Operating Costs:

Maintaining a large network of stores and an extensive product range incurs significant costs.

Limited International Presence:

Primarily operates in the United States, with limited exposure to international markets, which constrains global growth potential.

Economic Sensitivity:

Sales of non-essential beauty products can be affected by economic downturns and changes in consumer spending behavior.

Opportunities

E-commerce Expansion:

Accelerating online sales growth through enhanced digital capabilities and a seamless omnichannel experience.

International Expansion:

Exploring new markets, particularly in Latin America (e.g., Mexico), to diversify revenue streams and reduce dependence on the U.S. market.

Innovation in Product Offerings:

Continued innovation in private label and exclusive products to meet changing consumer preferences and increase margins.

Health and Wellness Trends:

Leveraging the growing consumer focus on health, wellness, and self-care to introduce new product lines and services.

Sustainable and Clean Beauty:

Expanding offerings in sustainable and clean beauty products to attract environmentally conscious consumers.

Enhanced Loyalty Program:

Further personalization of the Ultamate Rewards program to increase customer retention and lifetime value.

Threats

Intense Competition:

Facing strong competition from other beauty retailers, both brick-and-mortar (e.g., Sephora) and online-only (e.g., Amazon).

Economic Downturns:

Vulnerability to economic cycles and potential reductions in consumer spending on non-essential goods.

Supply Chain Disruptions:

Global supply chain issues could impact product availability and increase costs, affecting profitability.

Regulatory Changes:

Evolving regulations related to product safety, advertising, and environmental impact could increase compliance costs.

Technological Advancements:

Need to continuously invest in technology to keep up with industry advancements and consumer expectations in the digital space.

Changing Consumer Preferences:

Rapidly changing beauty trends and consumer preferences require constant innovation and adaptation to stay relevant.

Conclusion

Ulta Beauty is a strong player in the beauty retail industry with several competitive advantages, including a strong brand, a diverse product range, and a compelling loyalty program. However, it faces challenges such as high operating costs, dependence on physical stores, and intense competition. By capitalizing on opportunities in e-commerce, international expansion, and product innovation, Ulta can continue to grow and strengthen its market position. Managing risks related to economic downturns, supply chain disruptions, and regulatory changes will be crucial for sustaining long-term success.

Valuation

For my valuation, I use a DCF, Multiples Valuation, and Benjamin Graham Valuation, and average those out including analysts’ averages.

DCF: $679,65 (2,50 perpetual growth rate, 11% growth rate, and 8% discount rate)

Multiples valuation: $575,31 (this includes the multiples of companies in the same sector and size)

Benjamin Graham's valuation: $663,40

Analysts average: $488,78

Total average = $601,79 per share!

Taking a 20% margin of safety (error) an acceptable buy price would be $481,43 and below.

These numbers are on a street and bullcase mixed, keep this in mind.

End note

Thank you for reading this investment case on Ulta Beauty!

With every investment case, I am trying to improve my writing and how I communicate my findings with you all. Because I started not too long ago, some posts might change in layout or other aspects before I find the layout that suits my best wishes, sorry in advance.

As of now, thank you so much for your time! I hope you found some valuable information in this investment case.

Disclaimer

By reading my posts, being subscribed, following me, and visiting my Substack you agree to my disclaimer. You can read the disclaimer here.