Hello, friends! 👋

I'm excited to welcome you back to another insightful analysis. Today, we're analyzing Chipotle Mexican Grill, Inc., the king of the food industry.

If you missed my previous articles, you can catch up on them here:

If you haven't already, consider following me for more FREE content to enhance your investment journey. Whether you're a beginner or an advanced investor, you'll find valuable insights to help you make informed decisions. 😊

After you've explored this deep dive, I'd love to hear your thoughts! Please take a moment to drop a comment, give this post a like, and if you found it valuable, share it with your Substack community. Your support means the world!

Table of contents

Corporate Analysis

1.1 Business Overview

1.2 Revenue BreakdownExecutive Leadership

2.1 CEO Experience

2.2 Employee Satisfaction Ratings

2.3 CEO Value CreationCompetitive and Sustainable Advantages (MOAT)

Industry Analysis

4.1 Current Industry Landscape and Growth Prospects

4.2 Competitive LandscapeRisk Assessment

Financial Stability

6.1 Asset Evaluation

6.2 Liability AssessmentCapital Structure

7.1 Expense Analysis

7.2 Capital Efficiency ReviewProfitability Assessment

8.1 Profitability, Sustainability, and Margins

8.2 Cash Flow AnalysisGrowth Analysis

9.1 Historical Growth Trends

9.2 Future Growth ProjectionsValue Proposition

10.1 Dividend Analysis

10.2 Share Repurchase Programs

10.3 Debt Reduction StrategiesFuture Outlook

Quality Rating

SWOT Analysis

Valuation Assessment

Conclusion

1. Corporate Analysis

1.1 Business Overview

Chipotle Mexican Grill, Inc. and its subsidiaries own and operate Chipotle Mexican Grill restaurants. As of February 15, 2022, it owned and operated approximately 3,000 restaurants in the United States, Canada, the United Kingdom, France, Germany, and the rest of Europe.

The company was founded in 1993 and is headquartered in Newport Beach, California.

1.2 Revenue Breakdown

Chipotle’s primary revenue drivers are as follows:

Delivery Service Revenue

Description:

Revenue is generated from the sale of food and beverages at Chipotle restaurants, which includes various customizable menu items centered around fresh, high-quality ingredients.

Products:

Burritos, Bowls, Tacos, and Salads: Revenue from Chipotle’s core offerings, including customizable burritos, bowls, tacos, and salads made with grilled meats, fresh vegetables, and beans.

Sides and Extras: Revenue from additional menu items such as chips, guacamole, queso, and beverages.

Catering Services: Revenue from large events or group gatherings orders, offering customized meal packages.

Food & Beverage Revenue

Description:

Revenue is generated from orders placed through Chipotle’s delivery service, whether directly through their app, website, or third-party delivery platforms. This stream has grown significantly due to increased demand for convenience.

Products:

Direct Delivery: Revenue from orders placed directly through Chipotle’s digital platforms.

Third-Party Delivery: Revenue is generated from partnerships with third-party delivery services like DoorDash, Uber Eats, and Grubhub, where Chipotle earns a portion of the sale.

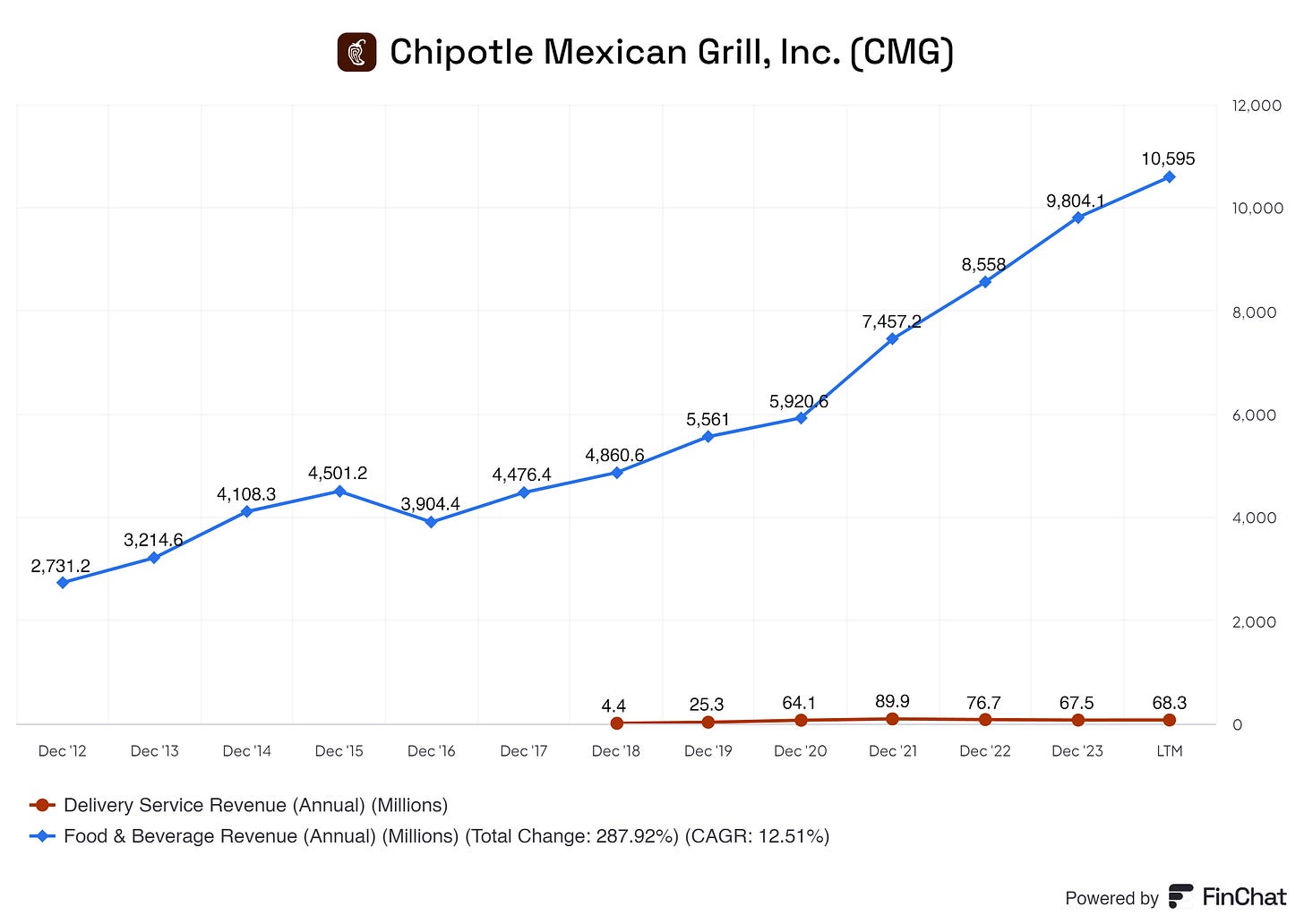

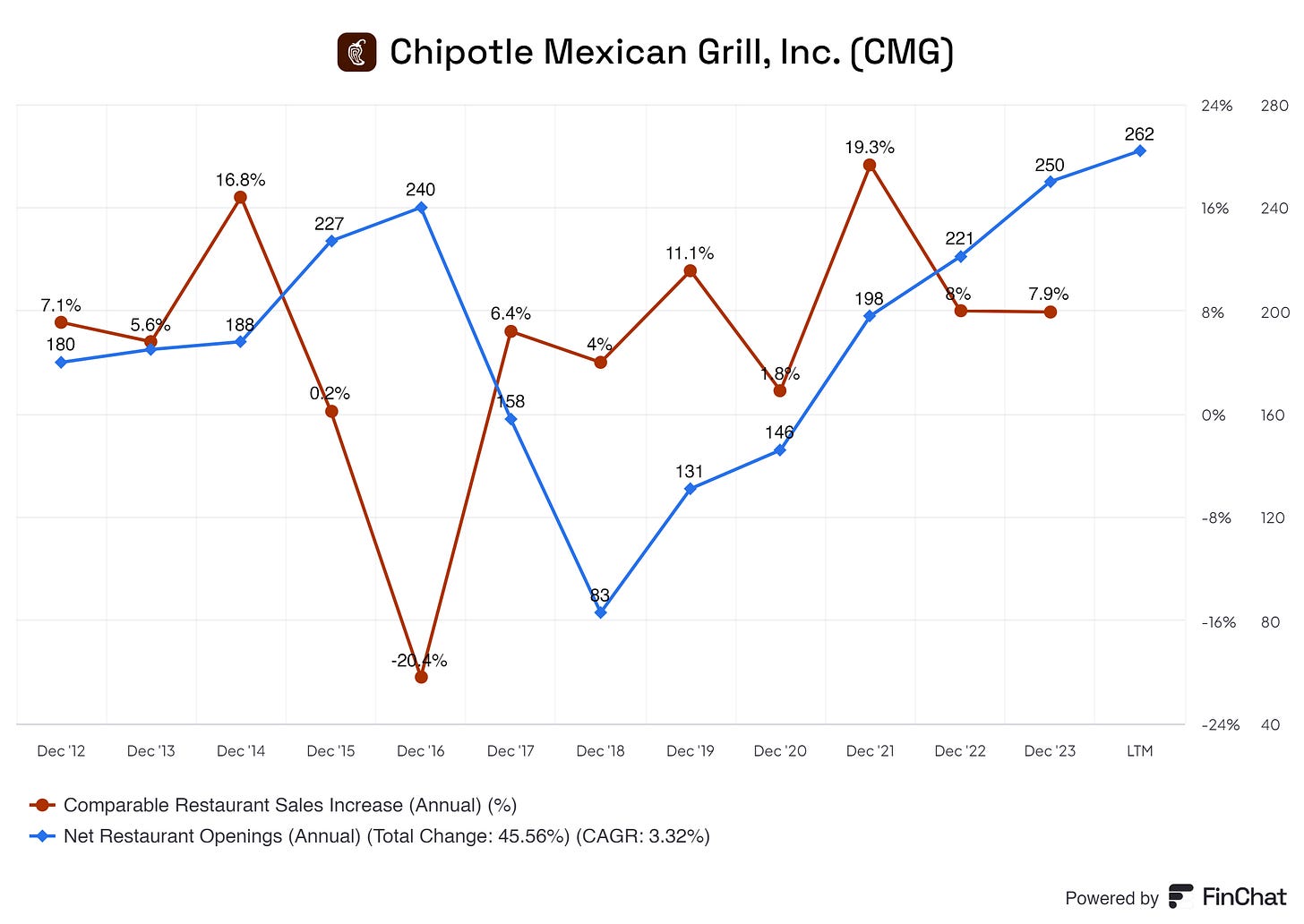

We can see that Chipotle’s most significant revenue driver is its revenue from its restaurants.

From 2014 to 2017, in-store sales were 100% of Chipotle’s revenue. With COVID, more consumers started ordering food online, and in that same period, Chipotle's Delivery Service segment grew. The overall growth is insignificant; we can see that Chipotle’s focus, and that of the consumer, is on in-store sales.

I noted in my previous article on Amazon that more revenue streams create a safe net for a business. Of course, in an ideal environment, we would love to see this for Chipotle. But Chipotle is a restaurant, and setting up different streams is off the table. Chipotle should solely focus on providing one thing: food.

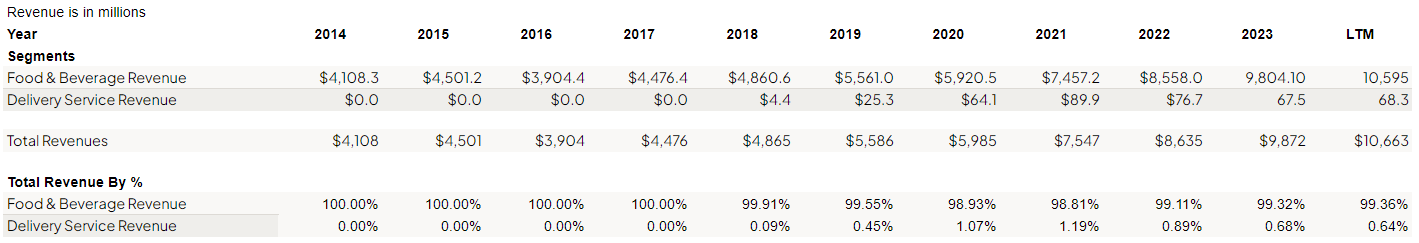

Chipotle is also getting more efficient with its in-store sales, as shown below by the Average Restaurant Sales metric. This metric refers to the average revenue a single restaurant location generates over a specific period (usually a year).

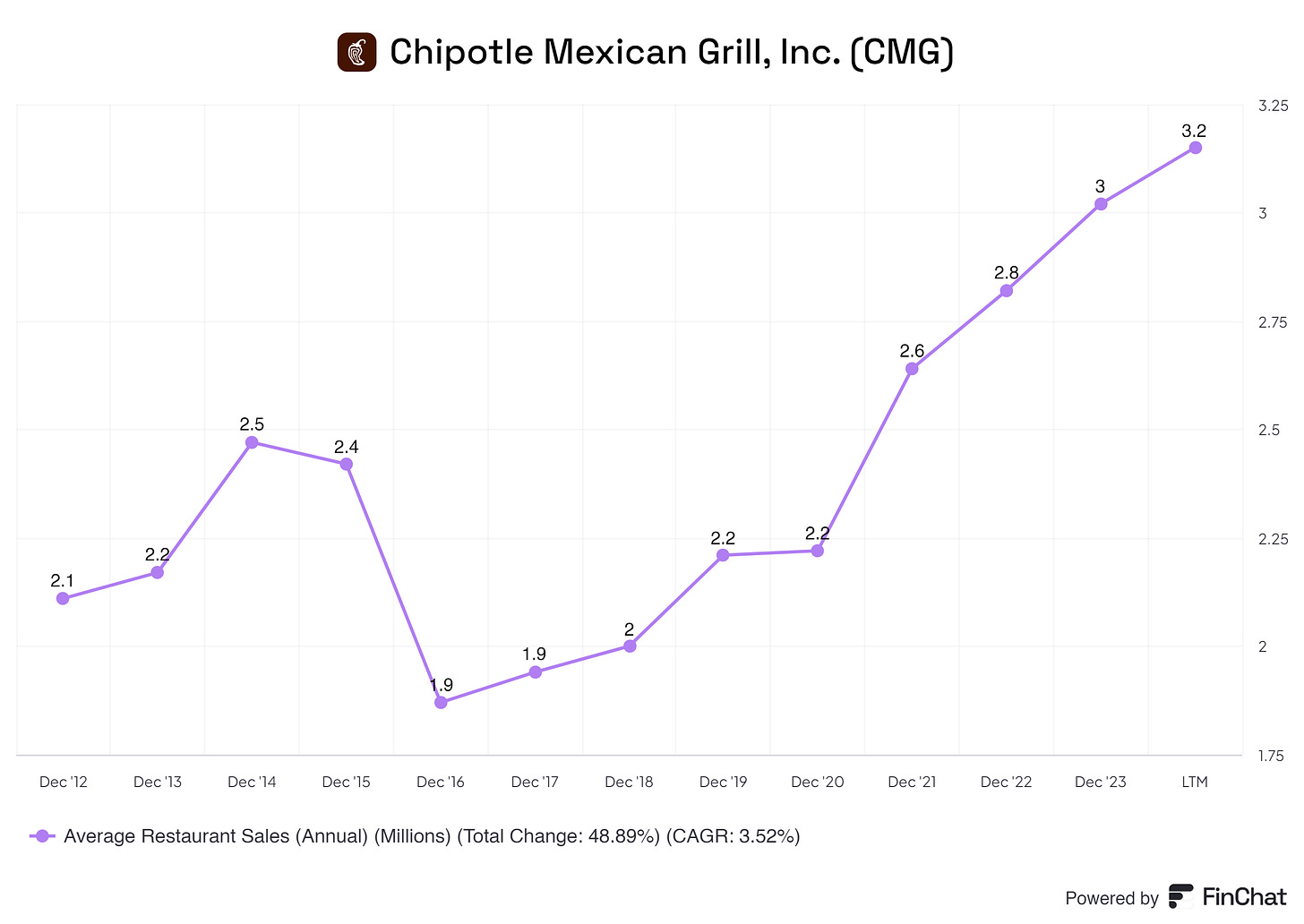

Moreover, Chipotle's Same-Store Sales, also called Comparable Restaurant Sales, have experienced substantial growth, as highlighted below. Despite the rapid expansion of new store openings year over year, Chipotle continues to see a remarkable surge in sales at its existing locations.

Chipotle is driving up revenue per consumer and location and opening new locations. It is showing us astounding results!

Let us check how diversified Chipotle is around the globe!

Chipotle operates 66 international restaurants. Most of Chipotle’s revenues come from its operations in the United States. Chipotle operates, as of December 31 2023, 3,371 Chipotle restaurants throughout the U.S., which is the primary source of revenue. Chipotle operates in Canada, the United Kingdom, France, and Germany.

Chipotle noted in its 2023 annual statement that it’s focused on expanding its existing restaurant footprint in North America and internationally. The report mentions that this strategy includes introducing Chipotle to new international markets where the company currently does not operate.

In 2023, Chipotle signed its first-ever development agreement to open restaurants in the Middle East in partnership with the Alshaya Group. The initial focus will be on opening new Chipotle restaurants in Dubai and Kuwait, with plans to expand further across the region.

So, Chipotle is currently concentrated in the United States, but expansion is on the horizon—that’s a solid sign. Expansion drives more consumers and, therefore, more revenue, creating more value for the business and its shareholders. The only "risk" is that Chipotle’s high hygiene and service standards must be maintained during this expansion. I’m curious about these developments!

2. Executive Leadership

2.1 CEO Experience

So, as of writing this article, the CEO Brian Niccol left to manage Starbucks a a couple of days ago. Due to this recent change, I will still be talking about Brian Niccol since the new CEO of Chipotle, Scott Boatwright, just started the CEO role.

Brian Niccol has been the CEO of Chipotle Mexican Grill since February 2018, bringing his extensive leadership experience to the company.

Before joining Chipotle, Brian Niccol served as the CEO of Taco Bell from January 2015 to February 2018, where he played a pivotal role in doubling system sales, opening 2,000 new restaurants, and transforming Taco Bell into a global brand. His growth strategy focused on international expansion, food innovation, digital technology, and new daypart offerings.

Before his role as CEO, Niccol was President of Taco Bell under Yum! Brands from May 2013 to January 2015. During this time, he revitalized the brand by integrating digital, social, and mobile technology and successfully launched Taco Bell's breakfast menu.

Earlier in his career, Brian Niccol was the Chief Marketing and Innovation Officer at Taco Bell from October 2011 to May 2013. He introduced the iconic "Live Más" tagline, repositioning Taco Bell as a brand focused on experience, and launched the groundbreaking Doritos Locos Tacos.

Before his tenure at Taco Bell, Niccol was the General Manager of Pizza Hut USA for Yum! Brands from February 2011 to October 2011, where he managed a $5 billion business and oversaw over 6,000 restaurants.

Niccol’s career includes his time as Chief Marketing Officer at Pizza Hut from 2007 to February 2011, where he led the introduction of online and mobile ordering. This service has grown into a billion-dollar business.

Before entering the restaurant industry, Brian Niccol spent nearly ten years at Procter & Gamble, where he held various marketing roles, including Associate Marketing Director, Brand Manager, and Assistant Brand Manager, from May 1996 to November 2005.

With over two decades of experience in brand management and leadership, Brian Niccol has a proven track record of driving growth and innovation across multiple significant brands.

The estimated net worth of Brian R Niccol is at least $63 Million as of 2024-08-16. Brian R Niccol is the Chairman and ex-CEO of Chipotle Mexican Grill Inc. and owns about 1,133,450 Chipotle Mexican Grill Inc. stock worth over $61 Million.

Brian Niccol owns roughly 0.08% of Chipotle’s total outstanding shares.

2.2 Employee Satisfaction Ratings

The overall score for Brian Niccol is solid! Given Chipotle's size, we expected a lower score, but this is above my expectations. This means that (ex) employees are satisfied with Brian Niccol.

Again, the same applies here; overall, it is a solid score. This shows that management's improvement in the conditions for its workers pays off. In return, this helps employees stick around longer, be more involved in the business, be willing to go the extra mile, and overall help boost Chipotle.

2.3 CEO Value Creation

Did Brian Niccol add value to the business and create value for its shareholders?

Yes, he did!

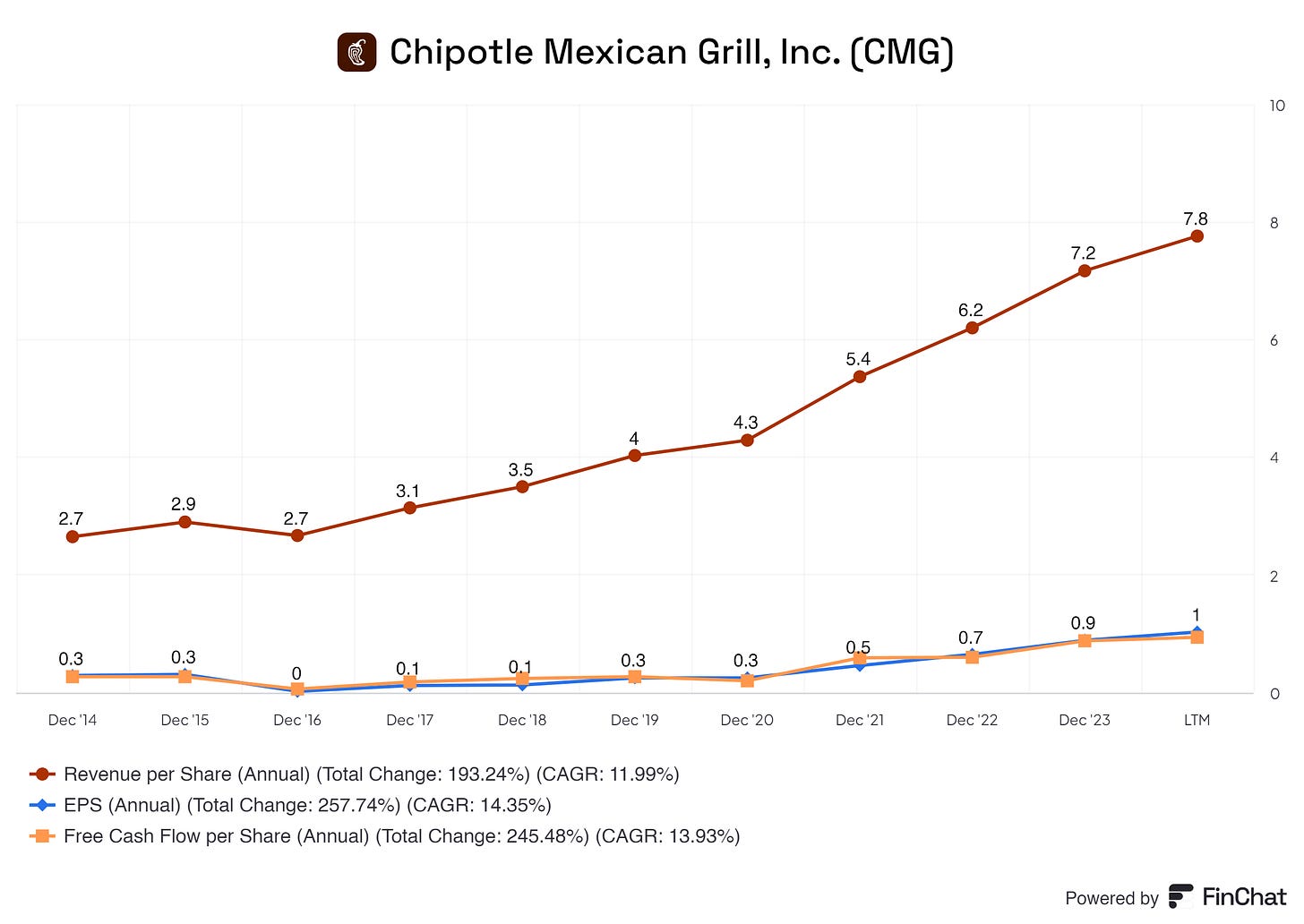

From 2017, when Brian Niccol started, we see that these three metrics continued their significant growth.

3. Competitive and Sustainable Advantage (MOAT)

So, a MOAT can be in either one or more of the following forms:

Brand Power

Patents

Scale and Cost Advantages

Switching Costs

Network Effect

Attracting Talent (I consider this a MOAT, others don’t. Decide for yourself)

Brand Power

Chipotle is synonymous with high-quality, responsibly sourced ingredients and a focus on "Food with Integrity." The brand has built a strong reputation for offering fresh, customizable meals catering to various dietary preferences. This commitment to sustainability and quality resonates with health-conscious consumers, leading to strong brand loyalty and a dedicated customer base. Chipotle’s brand is recognized for its emphasis on ethical sourcing, differentiating it from many competitors in the fast-casual segment.

Patents

Chipotle actively protects its brand and intellectual property through trademarks such as “Chipotle,” “Chipotle Mexican Grill,” “Food with Integrity,” and “Responsibly Raised.” The company has registered these trademarks in various countries and takes legal action against entities that infringe upon its intellectual property. This legal protection helps maintain the distinctiveness of the Chipotle brand and prevents dilution of its market position.

Scale and Cost Advantage

With over 3,400 restaurants, primarily in the United States, Chipotle benefits from significant economies of scale. Its large footprint allows it to negotiate better terms with suppliers, streamline operations, and optimize logistics. This scale enables Chipotle to maintain competitive pricing while ensuring profitability. Additionally, the company’s focus on efficient restaurant layouts and operations supports cost control, which is essential in the highly competitive restaurant industry.

Network effect

Chipotle’s loyalty program, Chipotle Rewards, is crucial to customer retention. The program incentivizes repeat visits and provides valuable data on customer preferences and behaviors, which Chipotle uses to personalize marketing efforts and enhance customer experiences. This high level of customer engagement and the ease of earning and redeeming rewards contribute to solid customer loyalty and increased sales.

Attracting Talent

Chipotle strongly emphasizes attracting, developing, and retaining top talent. The company offers competitive compensation packages, extensive training programs, and opportunities for career advancement. Chipotle’s efforts to foster a diverse, equitable, and inclusive work environment are also highlighted as key to attracting and retaining employees. To enhance employee satisfaction and engagement, the company has invested in various initiatives, including a Debt-Free Degree program, leadership development programs, and mental health support.

This combination of strong brand identity, ethical supply chain practices, scale efficiencies, customer loyalty, talent attraction, and digital innovation creates a formidable MOAT for Chipotle, enabling it to maintain its competitive advantage in the highly competitive restaurant industry.

4. Industry Analysis

4.1 Current Industry Landscape and Growth Prospects

The global foodservice market was valued at USD 3,236.92 billion in 2023 and is expected to grow to USD 3,486.58 billion in 2024, eventually reaching USD 6,348.75 billion by 2032. This growth represents a compound annual growth rate (CAGR) of 7.78% over the forecast period. In the United States, the food service market is also projected to expand significantly, with an estimated value of USD 1,767.54 billion by 2030.

Food service establishments include any business preparing and serving food for on-premise dining, takeout, or delivery. This encompasses food service retailers, table and counter service, and various food service providers. The global market is experiencing growth, mainly driven by increased fast food consumption due to rising household incomes, more people entering the workforce, and the convenience fast food businesses offer.

During the initial stages of the COVID-19 pandemic, there were substantial shifts in consumer behavior towards restaurants and dining. Lockdowns and strict dine-in restrictions, as part of broader pandemic measures, initially limited consumer access to in-person dining experiences. Even as these restrictions began to lift, concerns over the potential spread of COVID-19 continued to influence customer behavior, leading to a dip of nearly 30% in industry sales for 2020.

Is there growth on the horizon? Yes, there is.

Increased spending on food consumed out of home

Growing incomes in developing countries

Rise in the number of working women (families, therefore, start eating out more, and the mom has less time to cook a meal)

The increasing number of foodcourts and food malls

Consumers have less time, and delivery increases

4.2 Competitive Landscape

I identify Chipotle’s competitors/peers as MacDonalds, Yum, and Starbucks.

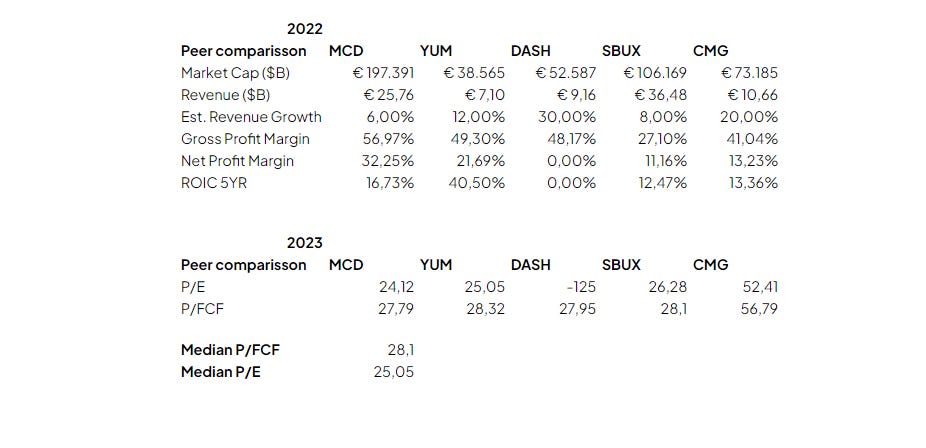

Chipotle (CMG) is a prominent player in the fast-casual dining industry, competing with significant companies such as McDonald's and Yum! Brands, DoorDash, and Starbucks. In 2022, Chipotle had a market capitalization of €73.185 billion, positioning it well among its peers, although trailing behind McDonald's (€197.391 billion) and Starbucks (€106.169 billion).

Chipotle reported revenue of €10.66 billion in 2022, which is lower than McDonald's (€25.76 billion) and Starbucks (€36.48 billion) but higher than Yum! Brands (€7.10 billion). This reflects Chipotle's strong market presence and ability to generate substantial revenue despite being a smaller player in terms of market cap.

Chipotle's estimated revenue growth rate of 20.00% in 2022 was robust, surpassed only by DoorDash's impressive 30.00% growth. This growth rate highlights Chipotle's ongoing expansion and ability to attract customers in a competitive market. It outperformed both Starbucks (8.00%) and McDonald's (6.00%) in revenue growth, showcasing its dynamic growth strategy.

Regarding gross profit margin, Chipotle's margin of 41.04% was lower than McDonald's (56.97%) and Yum! Brands (49.30%) but higher than Starbucks (27.10%) and DoorDash (48.17%). This indicates Chipotle's efficient operations, though there is room for improvement compared to industry leaders like McDonald's.

Chipotle's net profit margin of 13.23% in 2022 was solid, especially compared to Starbucks (12.47%) and Yum! Brands (21.69%). While not leading in this metric, Chipotle maintains a healthy margin, contributing to its profitability and long-term sustainability.

In terms of Return on Invested Capital (ROIC) over five years, Chipotle's 13.36% is respectable, though it lags behind Yum! Brands (40.50%) and McDonald's (16.73%). This suggests that while Chipotle effectively uses its capital, it could further enhance its efficiency to compete with the top performers in this metric.

For 2023, Chipotle's Price-to-Earnings (P/E) ratio stands at 52.41, significantly higher than McDonald's (24.12), Yum! Brands (25.05), and Starbucks (26.28). This high P/E ratio reflects strong investor confidence in Chipotle's growth potential, although it also suggests that the market has high expectations for the company's future performance.

Chipotle's Price-to-Free Cash Flow (P/FCF) ratio of 56.79 in 2023 is also notably higher than its peers' median P/FCF of 28.1. This indicates that investors expect significant future cash flow generation from Chipotle, underscoring the importance of converting growth into free cash flow.

In conclusion, Chipotle excels in revenue growth and maintains strong profitability with a robust market capitalization. However, the company faces challenges matching the efficiency and margins of larger competitors like McDonald's and Yum! Brands. To sustain its growth and meet investor expectations, Chipotle should focus on improving its gross profit margin and ROIC while continuing to capitalize on its strong revenue growth and market demand.

Pssssst! Let me know what you think by leaving a comment.

5. Risk Assessment

Reliance on key suppliers

Chipotle's reliance on specific suppliers for crucial ingredients means that any disruptions in the supply chain—whether due to natural disasters, labor issues, or geopolitical events—could affect the availability and cost of ingredients, impacting operations and profit margins.

Change in consumer behavior

The consumer is one of the most cyclical things out there. Any shift in diet or needs from the consumer could impact Chipotle. A strong trend in the healthy lifestyle scene could slightly impact Chipotle if It does not keep track of its menu and the items listed.

Expansion

Chipotle wants to expand its operations globally. This could be a hit, but as we’ve seen, expanding to different countries comes with many new challenges: finding the right employees, maintaining high-quality food and hygiene, complying with local laws and regulations, and much more that could negatively impact Chipotle’s operations if done poorly.

Competition

Chipotle is in a fierce industry competition-wise. Big players like Starbucks and McDonald's, those with the right capital, could start implementing new ideas for their menu, driving customers from Chipotle over to its competitors. Chipotle must be at the top, monitoring everything to ensure it can uphold its current dominant position.

6. Financial Health

6.1 Assets Assessment

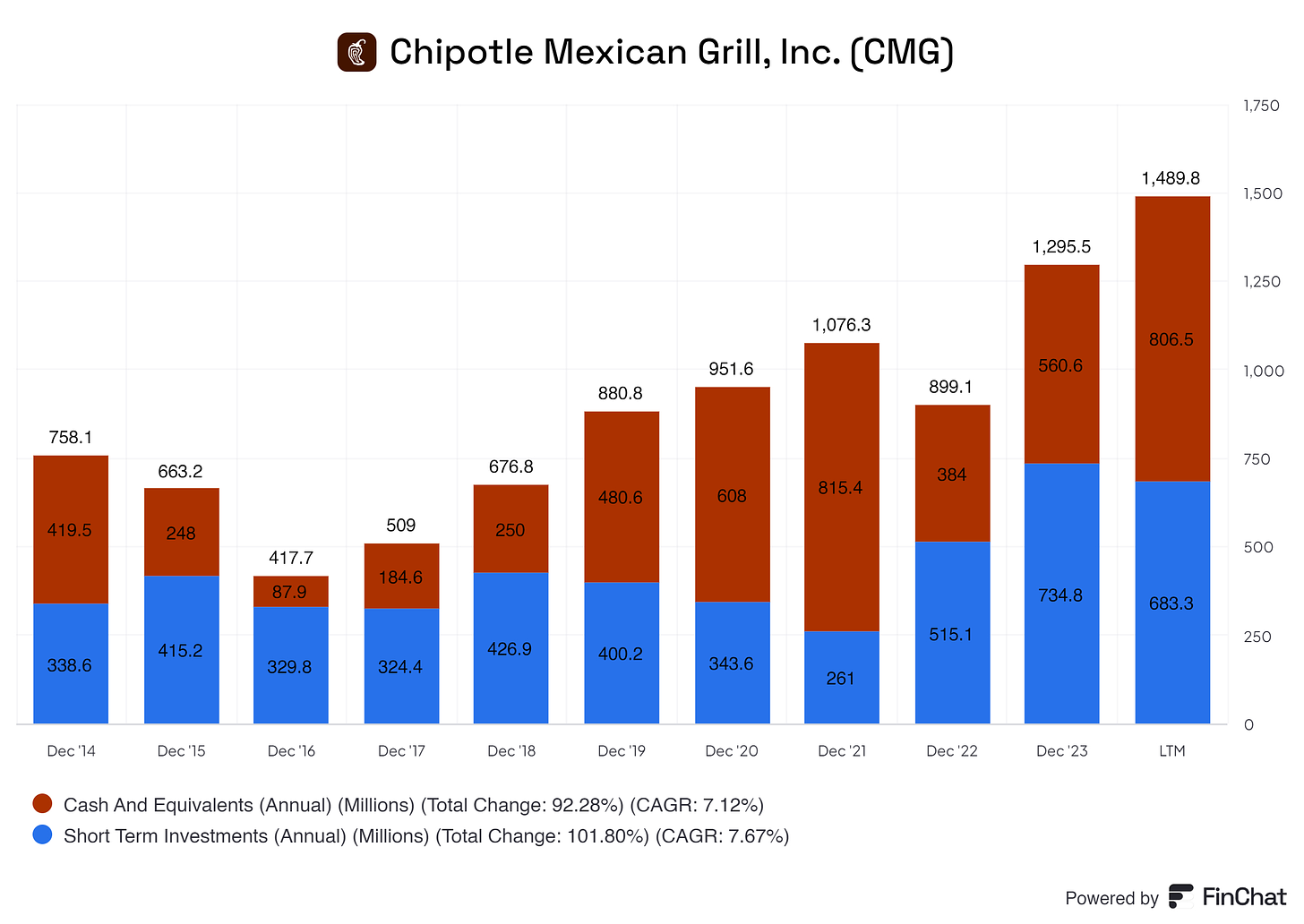

Chipotle has an excellent balance sheet, one without Net Debt. It also has a modest amount of cash and short-term investments on the balance sheet, which is solid. Although its cash position is a bit choppy, there’s enough cash on its balance for my liking. Chipotle has enough liquidity and is consistently growing its positions YoY.

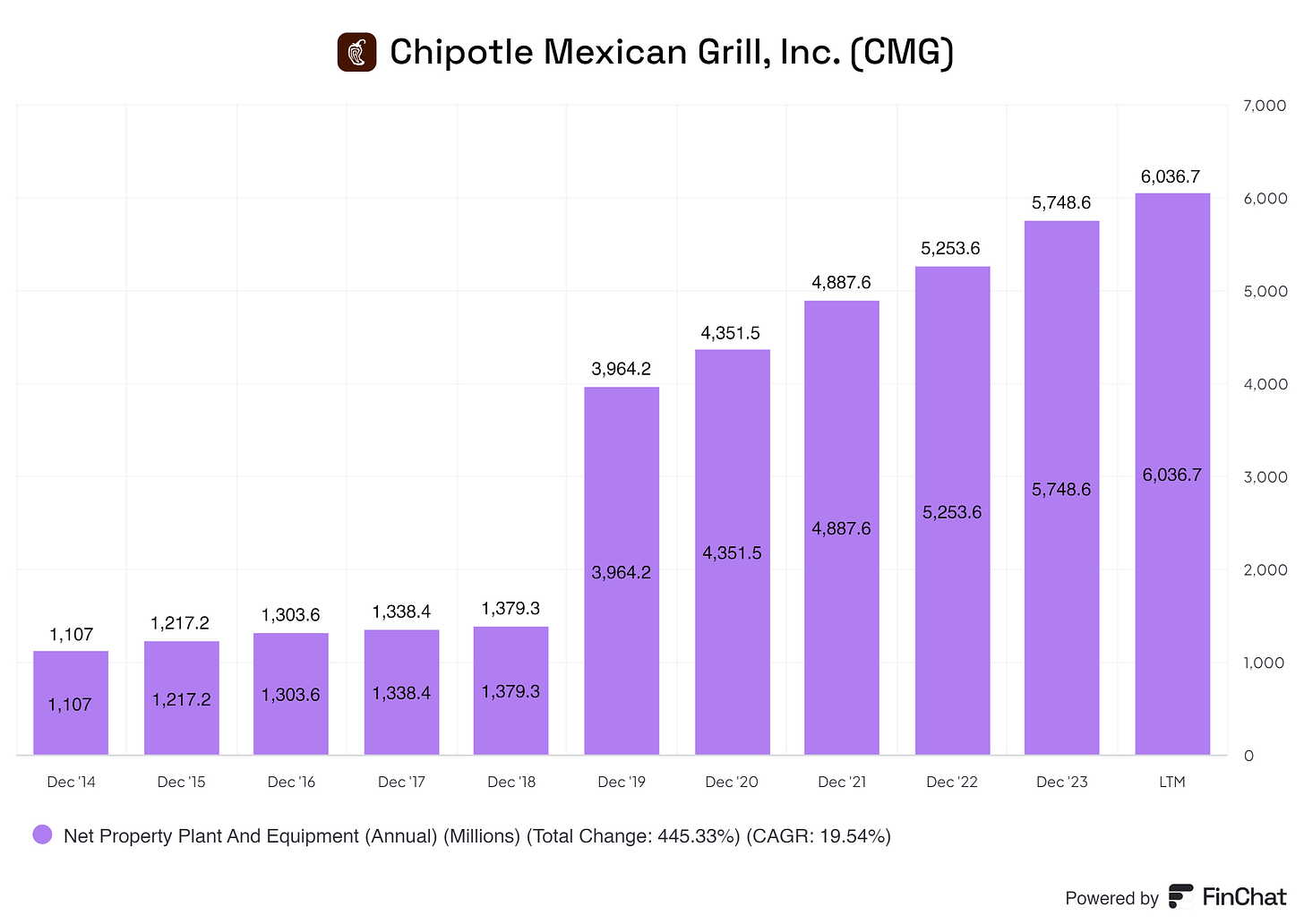

Moreover, Chipotle’s PPE (Property, Plant, and Equipment) immediately caught my eye. Chipotle seems to be investing heavily in the business. If executed correctly, this investment will yield higher returns for the business and its shareholders in the long haul. Just like Amazon invests a lot of cash into PPE for future growth, so does Chipotle.

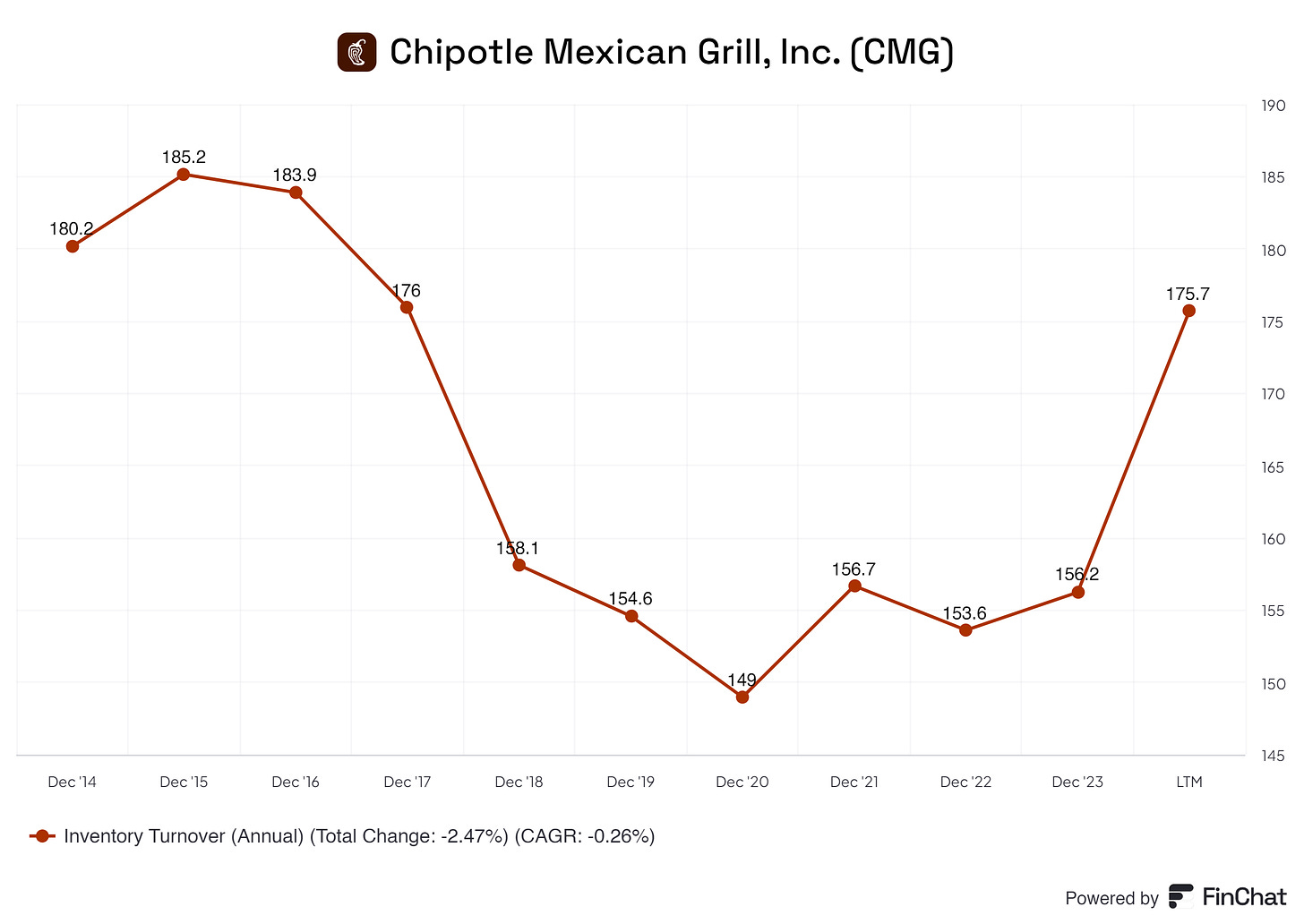

Other than this, there’s nothing notable on the balance sheet. Chipotle maintains its inventory correctly, having an inventory turnover of 175 LTM. This high ratio for its inventory turnover indicates that Chipotle is selling inventory quickly, which is a sign of solid sales performance and effective inventory management.

As shown above, Chipotle's turnover is excellent; since 2022, even YoY has improved! This efficiency tells us a lot about management and the workers/managers handling the restaurant’s day-to-day business.

6.2 Liabilities Assessment

Most of Chipotle's liabilities are in long-term leases. I do not think we should be worried about these. Chipotle needs to lease buildings and places to fulfill its operations. As of the last twelve months, long-term leases are $4,014.5, and Chipotle’s Total Liabilities are $5,208. This shows that besides the leases, Chipotle doesn’t have many burdens regarding loans.

Chipotle’s Account Payments are increasing but not at worrying rates; these are almost unimportant. Chipotle has an excellent, extremely healthy balance sheet, and there are no worries on its assets or liabilities side of the balance sheet. This shows that Chipotle’s management is running the business efficiently.

7. Capital Structure

7.1 Expense Analysis

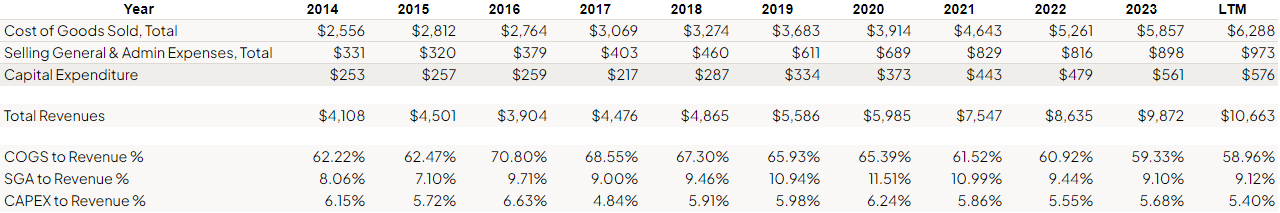

This view provides us with a better understanding of Chipotle’s expenses.

Cost of Good Sold makes up the majority of Chipotle’s spending. Of course, Chipotle needs resources to make the food the consumer eats. We see a notable trend, showing that COGS is a decreasing burden for Chipotle. In 2014, COGS was 62.22% of its total revenue. In 2023, COGS was 59.33% of Chipotle’s total revenue. Although it doesn’t seem like much, this does show that Chipotle is improving in negotiating prices with its suppliers, driving its costs lower, and this, in return, allows for more freed-up cash, otherwise spent on suppliers, for Chipotle to spend.

SGA is increasing, and this is happening at average speeds. Costs like advertising, marketing, sales commissions, expenses for its staff, and promotional activities are growing. This, in return, is (hopefully) yielding a return in the long run. Also, increases in salary demands, human resource expenses, legal expenses, and other costs unfortunately drive up these costs for Chipotle.

In short, it’s natural and happens.

On the CAPEX (Capital Expenditures) side, there’s also growth. Chipotle is a CAPEX ‘‘heavy’’ business, meaning that capital expenditures are needed for its day-to-day operations. We see a decrease in the burden of CAPEX to its total revenue from 2015 (6.15%) up until 2023 (5.68%). This means that revenues are growing faster than the needed CAPEX or that management is efficiently managing its CAPEX.

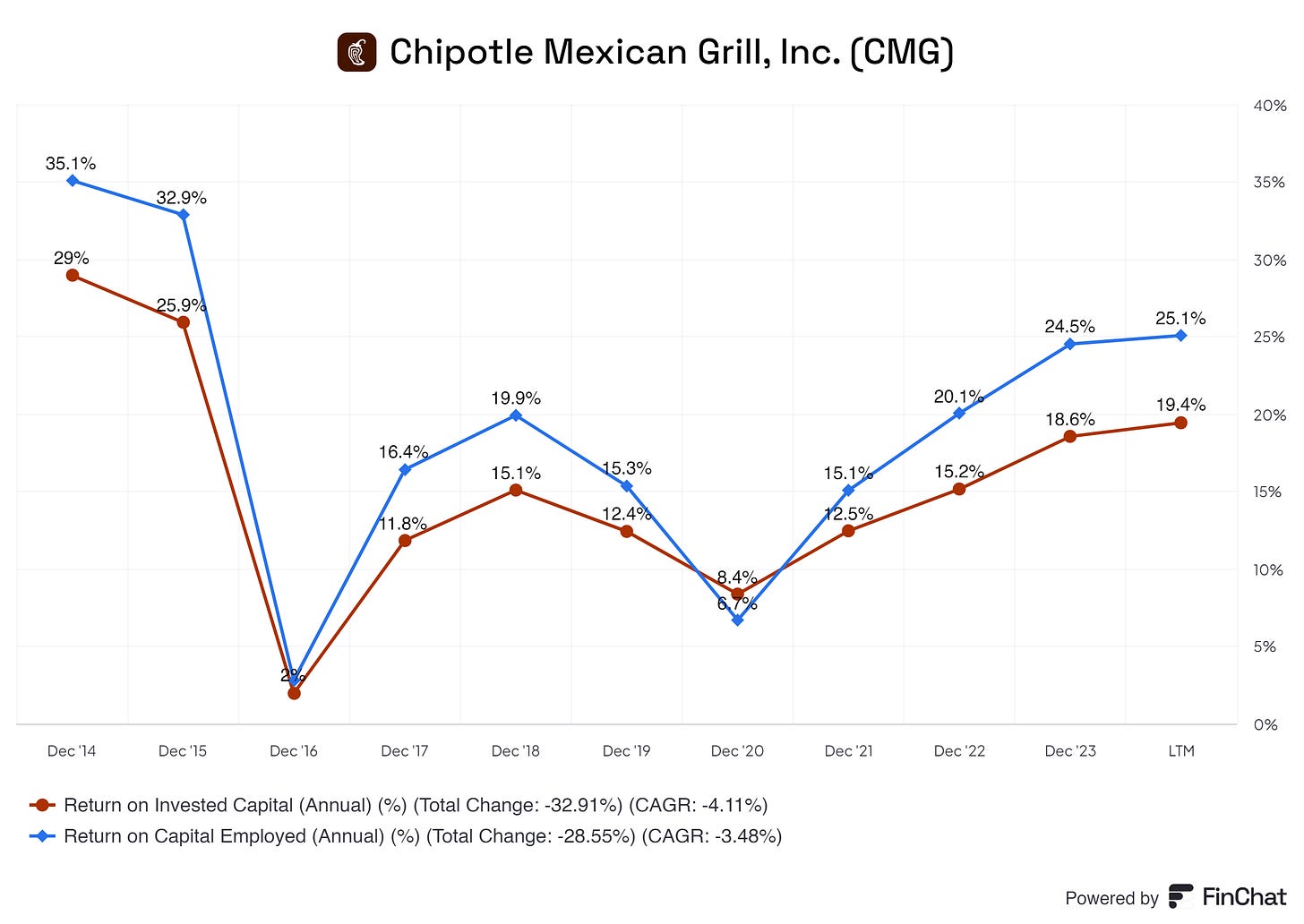

7.2 Capital Efficiency Review

Chipotle’s ROIC (Return on Invested Capital) and ROCE (Return on Capital Employed) show that management can deploy cash on profitable projects. In short, for every $1 Chipotle invests in a project, they return $0.18 on an 18.1% ROIC basis within a year, like in 2023. An ROIC and ROCE to my liking is one on or above 15%, and Chipotle fits this need. Since 2020, Chipotle's YoY has been improving its ROIC and ROCE, showing that management is YoY picking higher-yielding projects and investments.

I wouldn’t mind investing large sums of cash in a business that yields these returns on its investments and projects.

8. Profitability Assessment

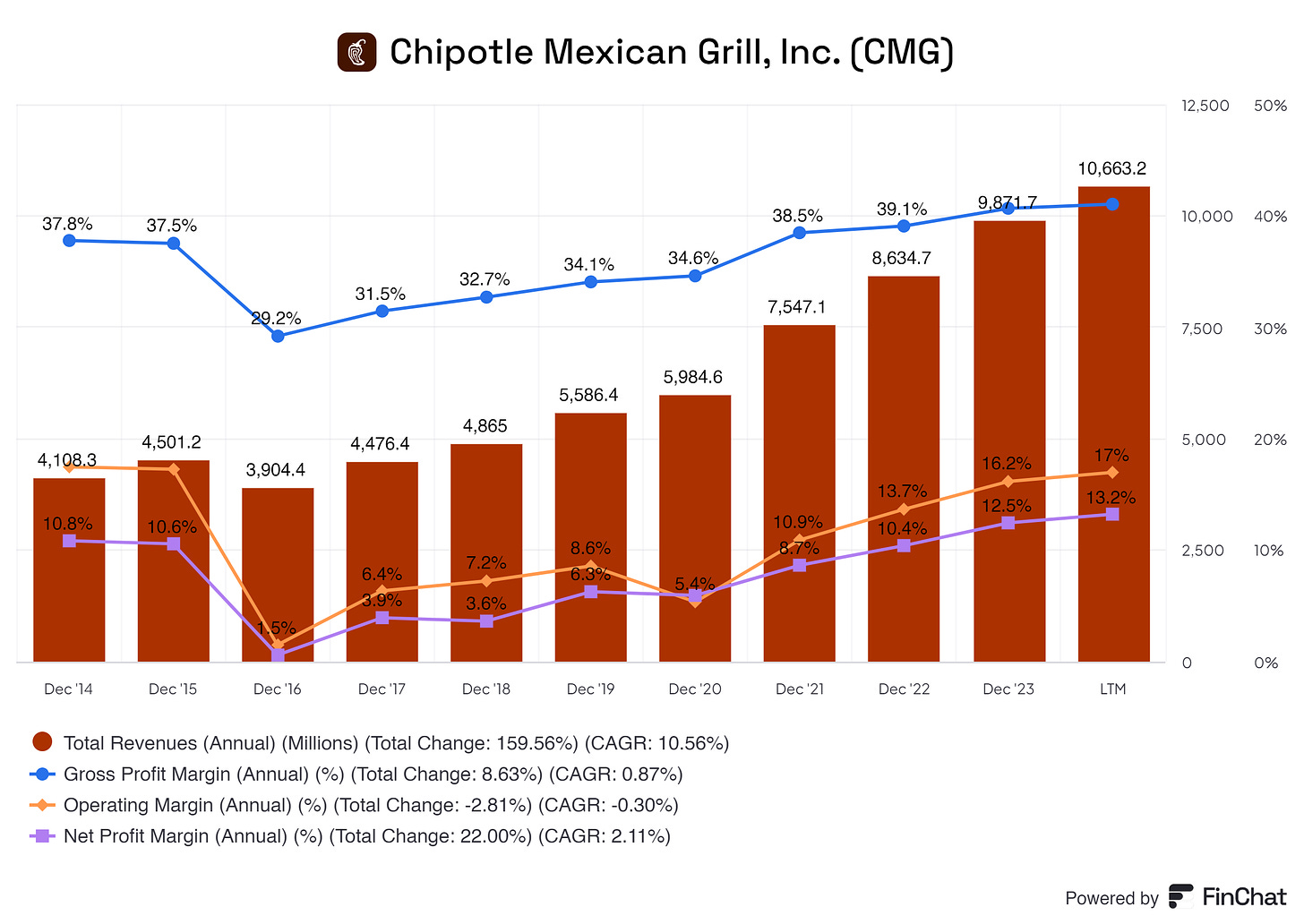

8.1 Profitability, Sustainability, and Margins

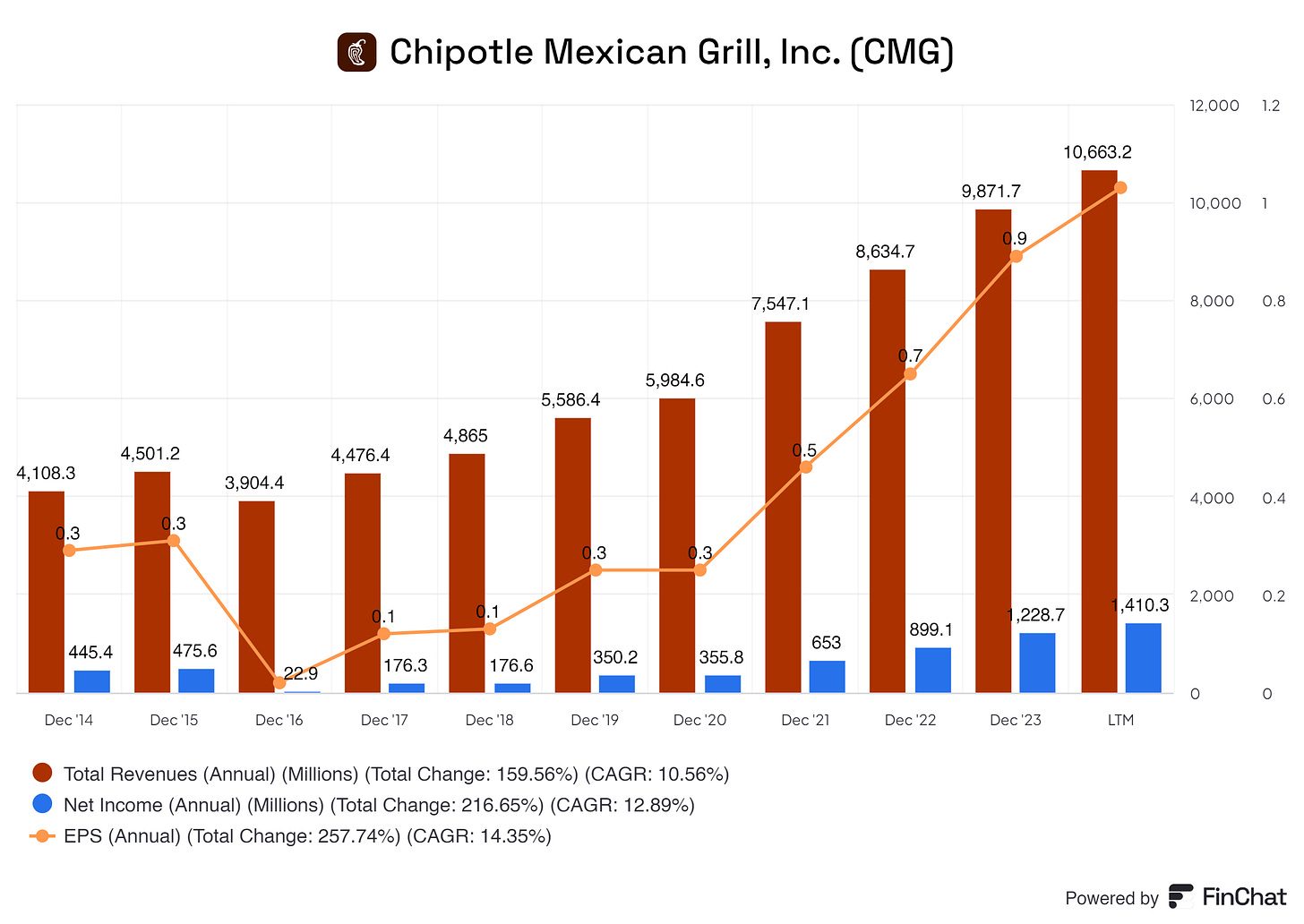

Chipotle has excellent revenue growth with a 10YR CAGR of 10.56. I expect Chipotle to keep growing at these rates; it is sustainable for Chipotle. While Chipotle is expanding nationally and internationally, revenue will climb due to these expansions.

Chipotle’s Gross Profit Margin has increased since 2016 YoY, which is excellent. This shows us that management efficiently boosts prices and maintains expenses, driving up its Gross Profit Margin. Again, some margin increases could be expected, but if Chipotle keeps these margins and outperforms its peers, I will be more pleased with the results.

Operating Margins are the same story. Currently, Chipotle is at a very healthy level, beating most of its peers again. Chipotle’s management is efficiently managing its operations, increasing its margin, and generating higher profit from each dollar of revenue.

Their Net Profit Margin is in line with the industry and within a healthy range. Businesses like MacDonald’s and Starbucks outperform Chipotle here by a mile, but Chipotle's being in line with the industry average is just fine.

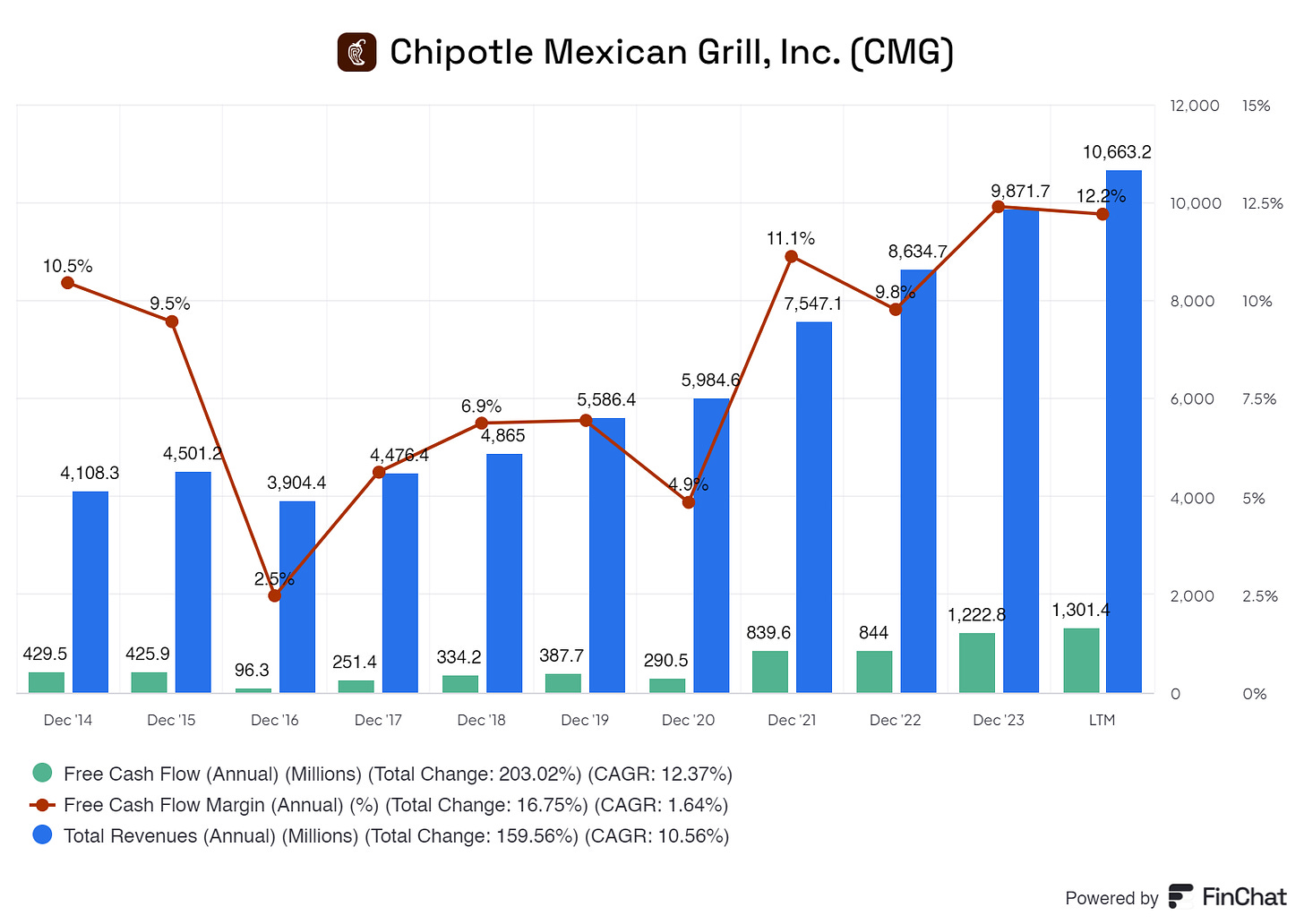

8.2 Cash Flow Analysis

Chipotle is a COGS-heavy business, eating up roughly 60% of its total revenue. Even then, Chipotle is increasing its Free Cash Flow margin YoY, converting more Free Cash Flow from its total revenue. Since 2020, Chipotle has expanded its Free Cash Flow Margin YoY, converting more cash.

Chipotle’s Free Cash Flow position is steadily increasing at excellent rates and reliability.

In general, I am impressed that this type of business has grown its Free Cash Flow Margin and FCF position this much.

9. Growth Analysis

9.1 Historical Growth Trends

Historically speaking, Chipotle has been performing excellently. Chipotle has been outperforming the S&P 500 consistently, growing its revenue at beautiful rates and vise versa for its net income. We do not see any EPS, sales, or net income jumps but lovely, consistent, and future-proof growth.

9.2 Future Growth Projections

With the current outlook, I expect Chipotle to grow roughly 9% in the following year. Due to the fears regarding consumer spending and fears of a recession (I am not fearful of a recession, but some are), lower growth is anticipated. I do expect Chipotle to pick up speed within two years when the economy recovers.

Chipotle is eager to expand nationally and internationally, driving up its sales. Therefore, after the current slowdown, I expect around 11-14% growth for Chipotle. Chipotle has shown to be very resilient, and management has shown to handle different situations extremely well. This behavior is usually rewarded with above-average growth for the business. I do hope that the new CEO will uphold Chipotle's current high standards in the industry.

10. Value Proposition

10.1 Dividends Analysis

I’m pleased to announce that Chipotle does not pay a dividend. Dividends aren’t bad inherently, but with Chipotle's ambition for growth, this cash can be used adequately to grow its business. Dividends are in place when a business has matured; Chipotle is a long shot away from maturity.

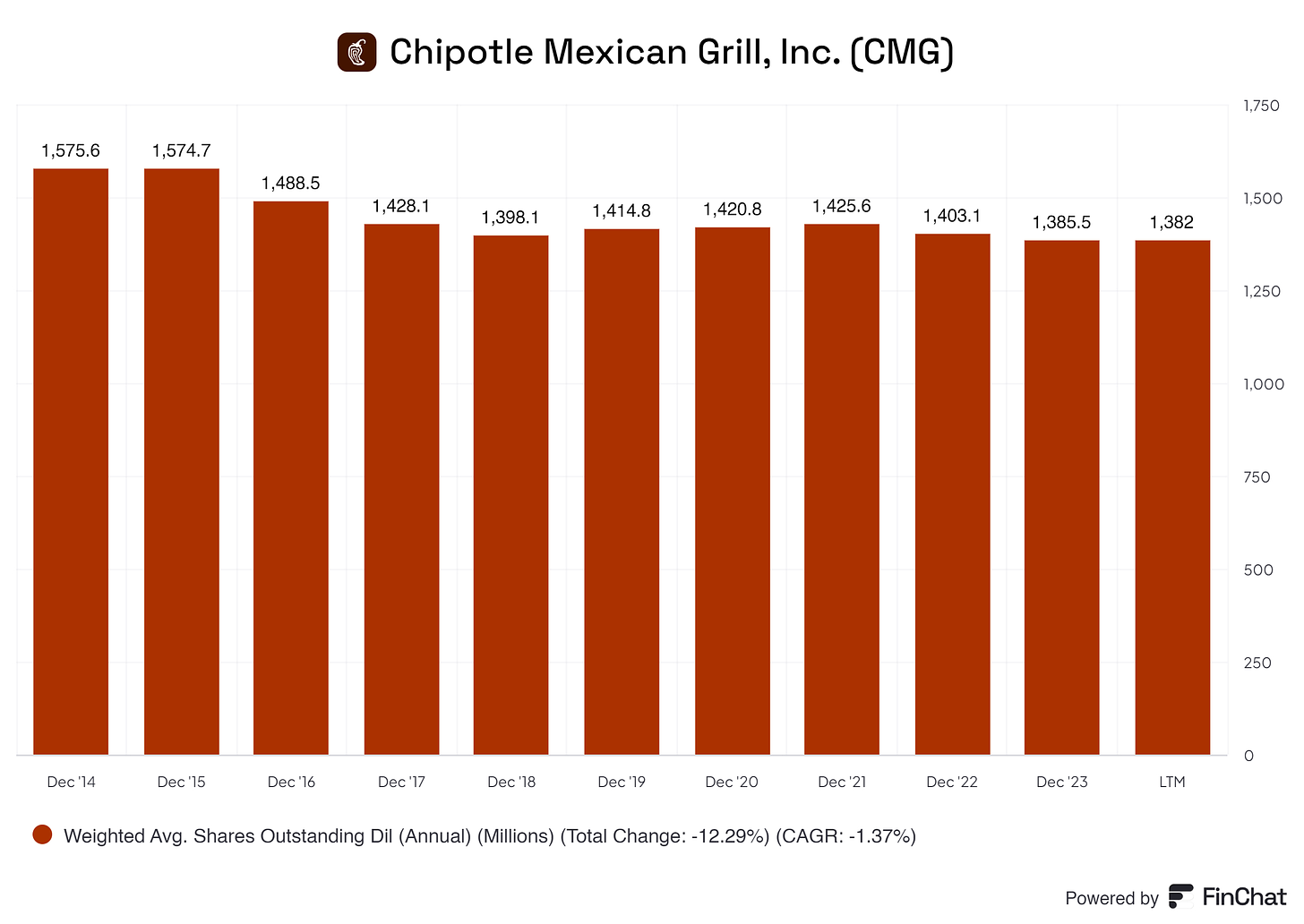

10.2 Share Repurchase Programs

Chipotle is dedicated to returning shareholder value by repurchasing shares. Chipotle is reducing its outstanding shares by 1.37% per year on average, which is modest.

10.3 Debt Reduction Strategy

Debt? What debt? Chipotle has no worries about debt or reducing it. ;-)

11. Future Outlook

The future for Chipotle looks exceptionally promising! While it's true that Brian Niccol, the dynamic and visionary CEO who played a crucial role in Chipotle's recent successes, has moved on, the company remains well-positioned to thrive. Chipotle has established a solid foundation with the right strategies and resources to ensure continued growth and prosperity. The blueprint set forth by Niccol and his team provides a clear path forward, and the building blocks are firmly in place for sustained success.

As the restaurant industry experiences robust growth, Chipotle is strategically positioned at the heart of this expansion, poised to capitalize on the increasing demand for high-quality, fast-casual dining experiences. Chipotle’s strong brand reputation, built on a commitment to sourcing high-quality ingredients and preparing fresh, flavorful food, resonates with a broad and diverse consumer base. The company’s ability to adapt its menu to cater to evolving tastes and preferences further enhances its appeal, drawing in customers from all demographics and regions.

Looking ahead, Chipotle is set to experience significant growth. The company boasts a strong balance sheet, providing the financial flexibility to invest in new opportunities and navigate any challenges. At the helm, a competent and experienced management team continues to steer the company with a clear vision and effective strategies. Coupled with a dedicated and passionate workforce, Chipotle is well-equipped to maintain its high service and food quality standards, central to its enduring success.

Furthermore, Chipotle's strong relationships with suppliers ensure a reliable and consistent supply chain, allowing the company to deliver on its promise of "Food with Integrity." This commitment to responsible sourcing strengthens the company’s reputation and customer loyalty. With a solid and growing customer base, Chipotle has a robust platform to build future successes, leading the fast-casual dining sector and delivering exceptional value to shareholders and customers.

12. Quality Rating

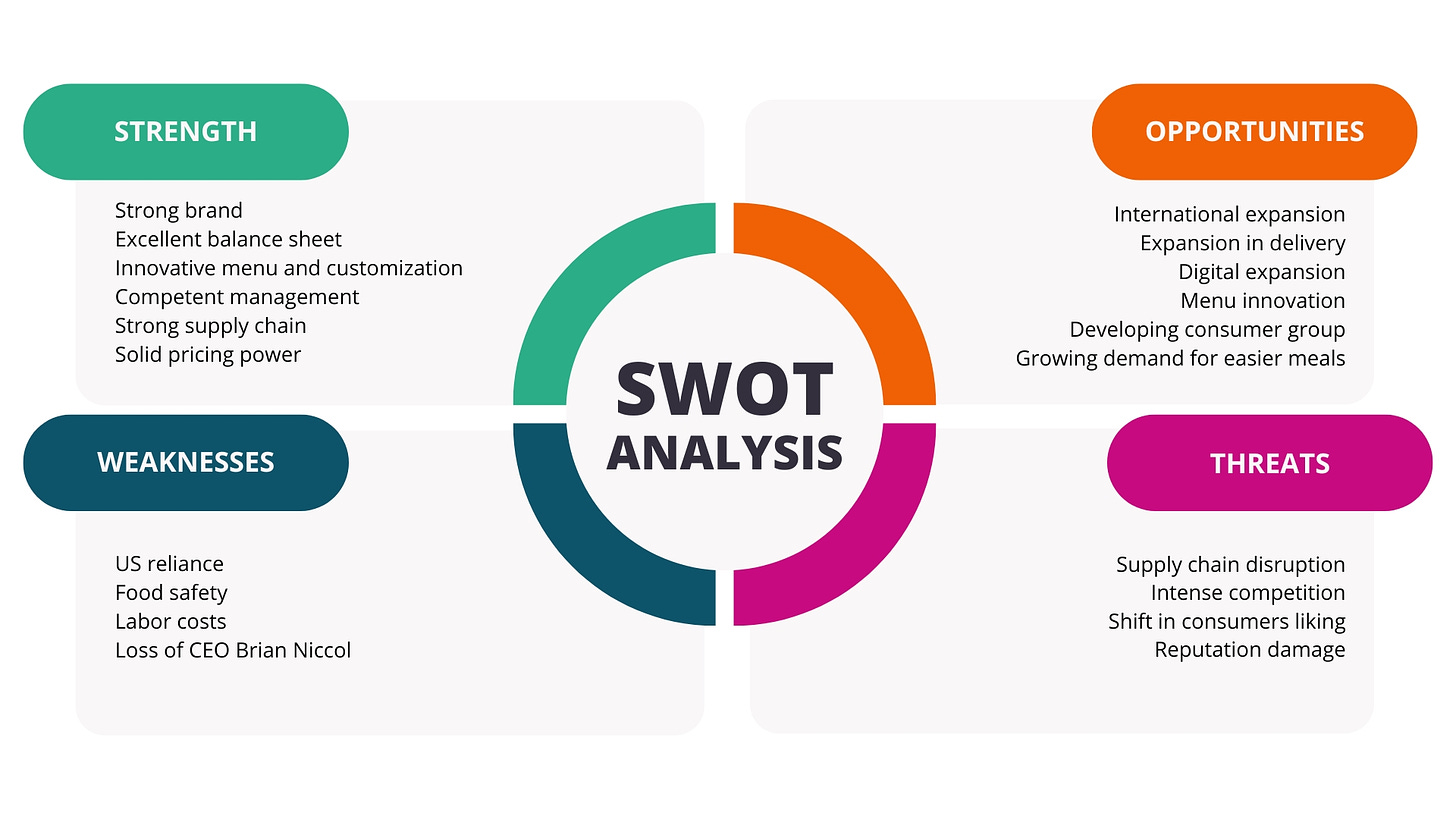

13. SWOT Analysis

14. Valuation Assessment

Let us crunch some numbers!

DCF: $33.59

Multiple Valuation: $24.69

Benjamin Graham’s Valuation: $22.15

Analysts Average: $63

Average of: $35.86

Current Price: $53.9

With the average price compared to the current price for Chipotle, it’s incredibly overpriced. Currently, Chipotle trades at a PE of 53.09, which is high. There’s a lot of growth expected for Chipotle, and it is priced in; therefore, entering now wouldn’t be the best idea. In addition, Chipotle’s P/FCF is sitting at a whopping 56.79, and its EV/OCF at 40.8…

The business is incredibly overpriced, and I would wait for a more realistic price to enter.

End note

Thank you for reading this investment case on Chipotle!

With every investment case, I am trying to improve my writing and how I communicate my findings with you all. Because I started not too long ago, some posts might change in layout or other aspects before I find the design that suits my best wishes; sorry in advance.

As of now, thank you so much for your time! I hope you found some valuable information in this investment case.

Disclaimer

I do not own Chipotle shares. I do not intend to buy Chipotle shares within three to six months.

By reading my posts, being subscribed, following me, and visiting my Substack, you agree to my disclaimer. You can read the disclaimer here.