The Magic of Compounding: How to Supercharge Your Investment Portfolio for Long-Term Growth

Discover why compounding is the key to exponential portfolio growth, actionable strategies to leverage its power, and timeless advice from legendary investors.

Hey there, partner! 👋

Before we dive in, I need your support to keep these articles FREE.

If you're enjoying this content, here's how you can help:

Like the article

Please share it on your favorite social media channel

Comment on this article to join the conversation

Your engagement means everything. Thanks for being part of the journey! Now, let's get started.

Compounding, often referred to as the "eighth wonder of the world," is one of the most effective and reliable ways to build long-term wealth. It’s a principle that has stood the test of time, serving as the cornerstone of financial success for future investors. Yet, despite its simplicity, many fail to fully grasp or utilize its potential.

This article examines the mechanics of compounding, explores its profound impact on investment portfolios, and provides actionable strategies to harness its power. We incorporate research-backed data, historical case studies, visual aids, and real-life scenarios to give you a comprehensive understanding of this game-changing concept.

What Is Compounding?

Compounding is reinvesting your returns to generate additional earnings over time. Unlike simple interest, where returns are calculated only on your initial principal, compounding grows your wealth exponentially by including the returns already generated.

To illustrate its exponential power, let’s consider this example:

If you invest $10,000 at an annual return of 7%, you’ll earn $700 in the first year, growing your total to $10,700. By reinvesting those returns, your second-year earnings will be based on $10,700 instead of $10,000. This "snowball effect" accelerates, turning modest investments into a fortune.

Why Compounding Is Essential for Your Portfolio

1. Exponential Growth Over Time

The longer your investments remain untouched, the greater the effect of compounding. Time amplifies small contributions into significant wealth. Research proves this point time and again:

Dalbar Research Findings: A 30-year study by Dalbar revealed that long-term equity investors earned significantly higher returns than those who frequently traded. Investors who remained in the market allowed compounding to generate outsized returns.

Case Study of the S&P 500: A $1,000 investment in the S&P 500 in 1980, with dividends reinvested, would be worth over $100,000 today. This staggering growth is the result of compounding.

“Compounding is the greatest mathematical discovery of all time.”

— Albert Einstein

2. Reinforces the Long-Term Perspective

Compounding shifts your focus from chasing short-term gains to staying invested for the long haul. This mindset reduces emotional reactions to market volatility, helping you maintain discipline through downturns.

“Time in the market beats timing the market.”

— Ken Fisher

3. Dividends: The Unsung Heroes of Compounding

Reinvesting dividends turbocharges your portfolio’s growth. According to the S&P Dow Jones Indices, reinvesting dividends has historically contributed 40% of total stock market returns.

4. Overcomes Inflation

Compounding doesn’t just grow your wealth — it preserves your purchasing power. With inflation averaging around 3% annually, investments that compound at a higher rate ensure your money retains and increases its value.

How to Harness the Power of Compounding

1. Start Early and Stay Consistent

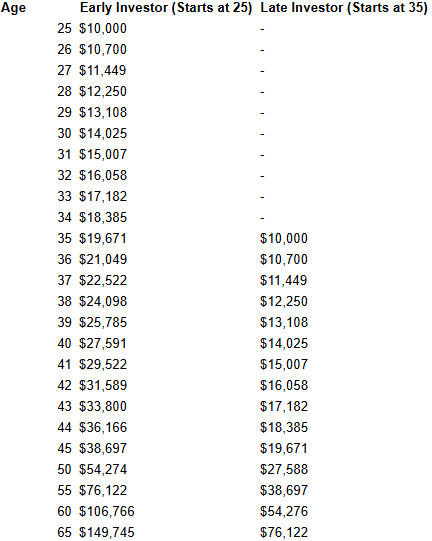

The earlier you begin, the more time your investments have to compound. Here’s a comparison:

(Both invest $10,000 at an annual return of 7%, but the early investor starts 10 years earlier)

Starting early doubles your portfolio size, even with the same contributions.

2. Reinvest Returns

Reinvest dividends, interest, and capital gains to maximize compounding. For example:

A $10,000 investment in a dividend-paying stock yielding 4% grows to $48,010 in 30 years if dividends are reinvested. Without reinvestment, it grows to only $22,000.

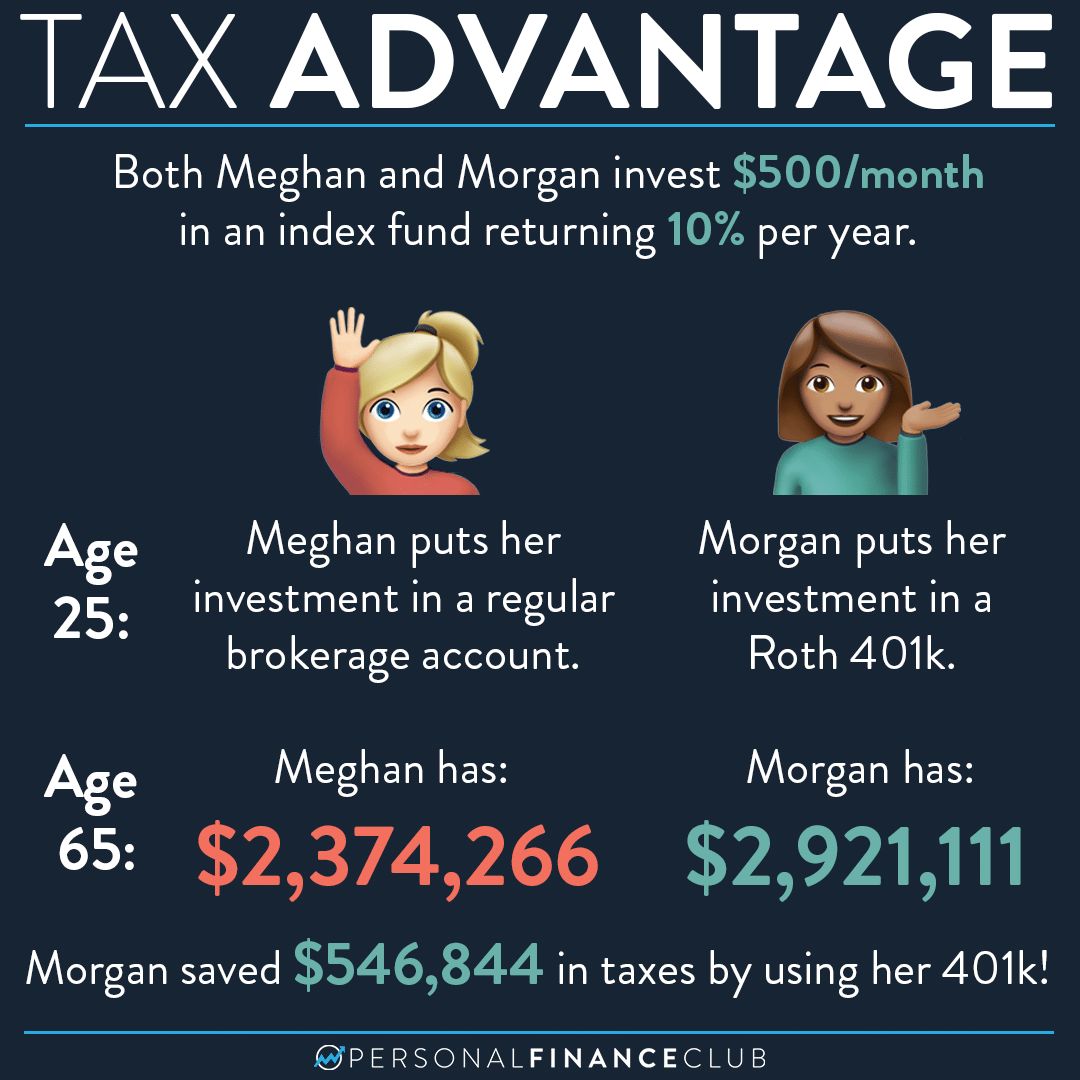

3. Use Tax-Advantaged Accounts

Invest in tax-deferred or tax-free accounts like IRAs, 401(k)s, or ISAs to accelerate compounding. Avoiding taxes on annual gains allows your portfolio to grow faster.

Research That Proves the Power of Compounding

1. The Power of Starting Early

Research by Vanguard shows that starting at age 25 versus 35 can result in a portfolio 50-60% larger by retirement, even with the same total contributions. Time is the single most critical factor in maximizing compounding.

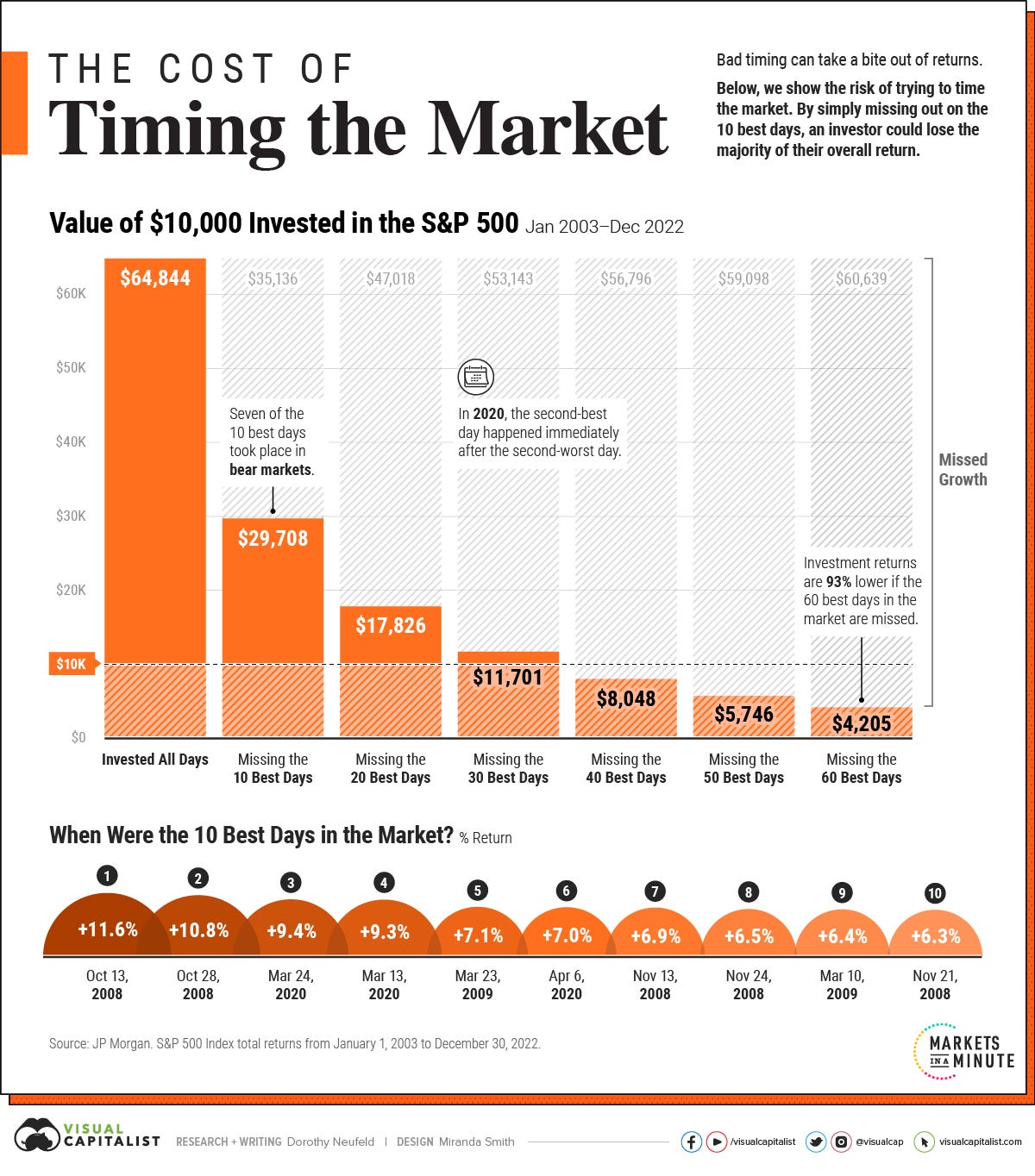

2. Long-Term Investing vs. Market Timing

A study by Fidelity revealed that investors who stayed fully invested in the S&P 500 from 1980 to 2020 achieved annualized returns of 10.83%. Those who missed the market’s 10 best days saw returns drop to 5.92%. Compounding rewards patience, not perfect timing.

The cost of trying to time the market.

Real-World Case Studies

Warren Buffett and Berkshire Hathaway

Buffett is a walking testament to compounding. Starting with just $10,000, he has amassed over $100 billion. What’s fascinating is that 99% of his wealth was earned after his 50th birthday. The exponential nature of compounding magnifies wealth dramatically over time.

The Dow Jones Index: Over a Century of Growth

In 1900, the Dow was at 40 points. Today, it exceeds 35,000 points. With dividends reinvested, $1 invested in the Dow in 1900 would be worth millions — a perfect example of compounding across generations.

Common Pitfalls That Disrupt Compounding

Interrupting the Process

Withdrawing returns or selling investments early can derail compounding. The first rule of compounding is not to interrupt it unnecessarily.High Fees

Even a 1% annual fee can cost you hundreds of thousands of dollars over a lifetime. Stick to low-cost funds and minimize trading costs.Inflation Ignorance

Ensure your portfolio outpaces inflation to maintain purchasing power.

Beyond Investing: Compounding in Life

Compounding applies to more than just money. Here’s how it works in other areas:

Personal Growth: Learning one new skill a year compounds a wealth of expertise over time.

Relationships: Regular, meaningful connections grow into robust professional networks.

Health: Incremental changes in fitness or diet lead to long-term health improvements.

Actionable Takeaways

Set It and Forget It: Automate your investments and reinvest returns to avoid emotional decision-making.

Play the Long Game: View your portfolio as a garden — plant seeds, water them consistently, and let time do the rest.

Visualize Your Growth: Use compound interest calculators or portfolio tools to project your wealth over decades.

The Final Word: Plant the Seeds of Compounding Today

Compounding is the simplest, most reliable way to build wealth. Whether you’re 25 or 35, it’s never too early — or too late — to start. Every dollar you invest today sets the stage for exponential growth tomorrow.

“Someone is sitting in the shade today because someone planted a tree a long time ago.”

— Warren Buffett

Your future self will thank you for the seeds you plant today. Start now and let the magic of compounding transform your financial future.

That wraps up today’s deep dive! I hope this article inspired you to take action and embrace the incredible power of compounding. It’s not just a financial strategy—it’s a game-changing principle that can transform your future. Start today, stay consistent, and let time work its magic.

Thank you for investing your time with me. I truly appreciate your patience and curiosity. I’d love to hear your thoughts, and I look forward to having you join me in my next article as we continue this journey together. Until then, make every decision count!

Disclaimer

By reading my posts, subscribing, following me, and visiting my Substack in general, you agree to my disclaimer. You can read the disclaimer here.

But, life has to be led. Optimize lifetime living standard is what we all want. Look into Fisher, Modigliani, Friedman and others. It will put savings and investment in a better context.