Hey there, fellow investor! 👋

Before we dive in, I need your support to keep these articles FREE.

If you're enjoying this content, here's how you can help:

Like the article

Share it on your social media

Comment below to join the conversation

Your engagement means everything. Thanks for being part of the journey! Now, let's get started.

Welcome back to another deep dive into the world of investments. Today, we’re shifting gears to analyze Tesla—the reigning titan of the automotive industry.

If you’re new here or missed my previous articles, feel free to catch up:

If you haven’t already, hit that follow button for FREE insights to fuel your investment journey. Whether you’re just starting or a seasoned investor, there’s something here for everyone.

Once you’ve finished this analysis, I’d love to hear your thoughts! Be sure to comment, drop a like, and share it with your Substack community if this resonates with you. Your support makes all the difference! 😊

Table of contents

Corporate Analysis

1.1 Business Overview

1.2 Revenue BreakdownExecutive Leadership

2.1 CEO Experience

2.2 Employee Satisfaction Ratings

2.3 CEO Value CreationCompetitive and Sustainable Advantages (MOAT)

Industry Analysis

4.1 Current Industry Landscape and Growth Prospects

4.2 Competitive LandscapeRisk Assessment

Financial Stability

6.1 Asset Evaluation

6.2 Liability AssessmentCapital Structure

7.1 Expense Analysis

7.2 Capital Efficiency ReviewProfitability Assessment

8.1 Profitability, Sustainability, and Margins

8.2 Cash Flow AnalysisGrowth Analysis

9.1 Historical Growth Trends

9.2 Future Growth ProjectionsValue Proposition

10.1 Dividend Analysis

10.2 Share Repurchase Programs

10.3 Debt Reduction StrategiesFuture Outlook

Quality Rating

SWOT Analysis

Valuation Assessment

Conclusion

1. Corporate Analysis

1.1 Business Overview

Tesla, Inc. designs, develops, manufactures, leases, and sells electric vehicles and energy generation and storage systems in the United States, China, and internationally. It operates in two segments: Automotive and Energy Generation and Storage. The Automotive segment offers electric vehicles and sells automotive regulatory credits and non-warranty after-sales cars, used cars, retail merchandise, and vehicle insurance services. This segment also provides sedans and sport utility vehicles through direct and used vehicle sales, a network of Tesla Superchargers and in-app upgrades; purchase financing and leasing services; services for electric vehicles through its company-owned service locations and Tesla mobile service technicians, and vehicle limited warranties and extended service plans. The Energy Generation and Storage segment engages in the design, manufacture, installation, sale, and leasing of solar energy generation and energy storage products and related services to residential, commercial, and industrial customers and utilities through its website, stores, and galleries, as well as through a network of channel partners; and provision of service and repairs to its energy product customers, including under warranty, as well as various financing options to its solar customers. The company was formerly known as Tesla Motors, Inc. and changed its name to Tesla, Inc. in February 2017. Tesla, Inc. was incorporated in 2003 and is headquartered in Austin, Texas.

1.2 Revenue Breakdown

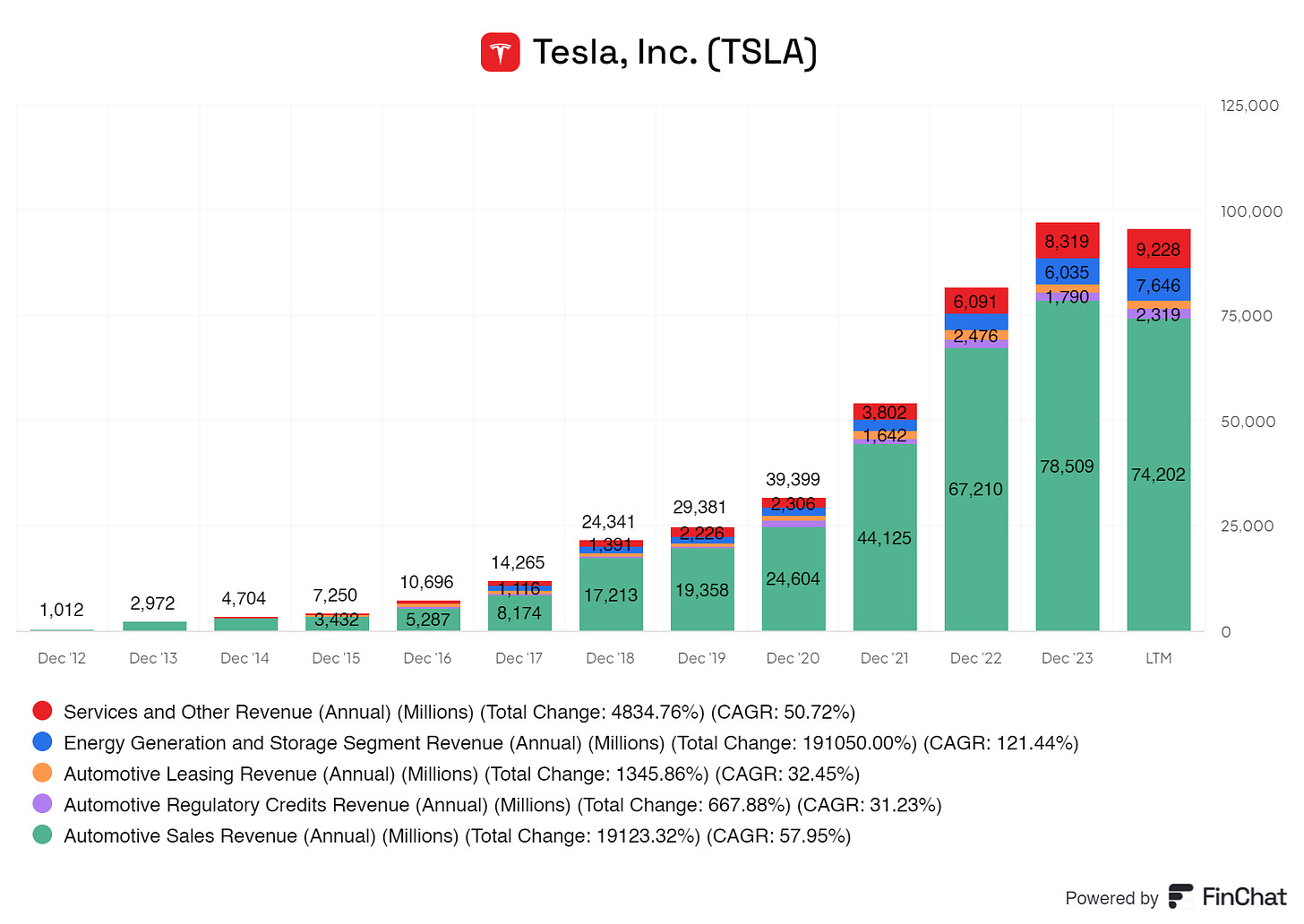

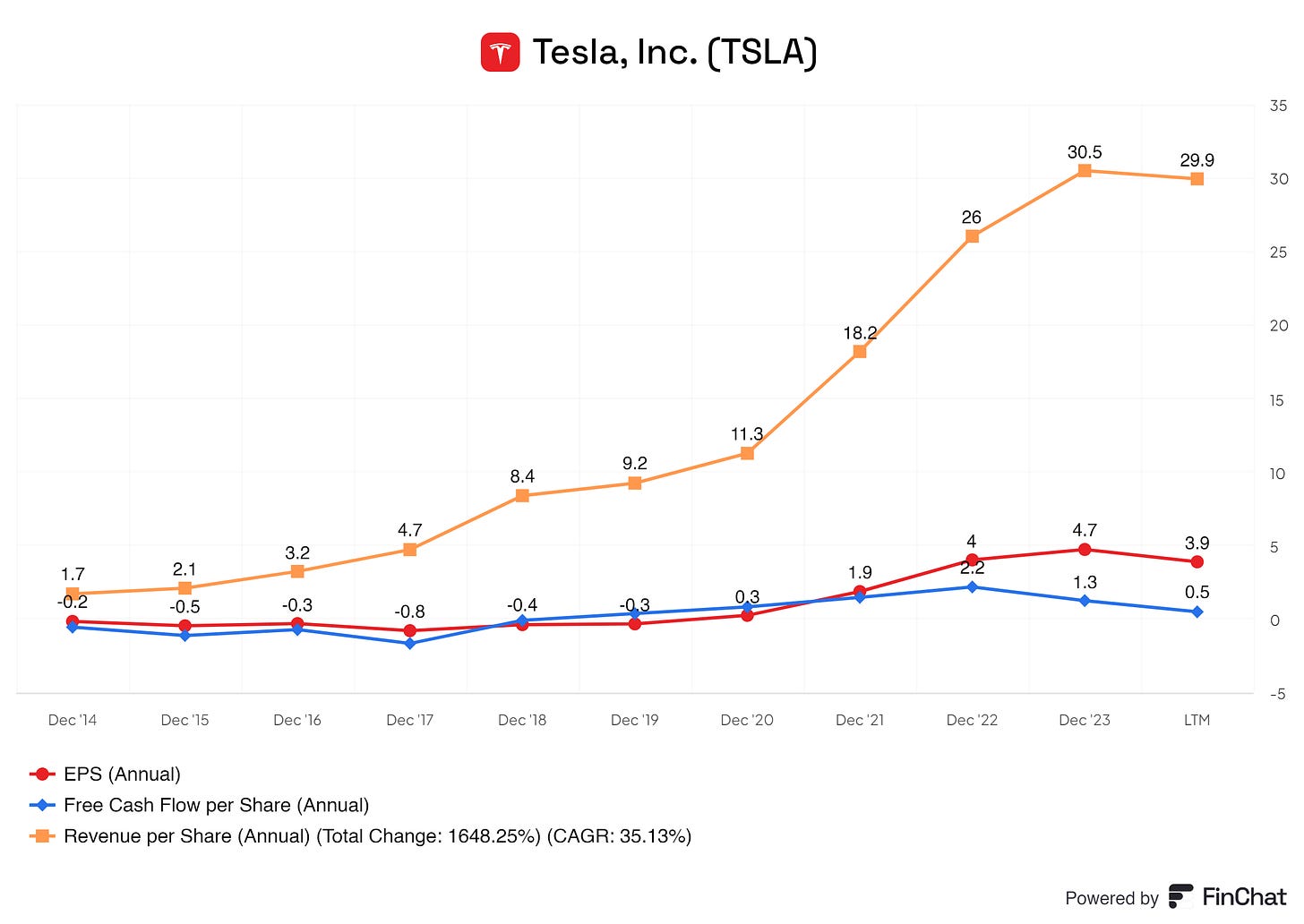

Tesla’s primary revenue drivers are as follows:

Service and Other Revenue

This includes revenue from servicing Tesla vehicles, used vehicle sales, vehicle insurance, and non-warranty after-sales services. Tesla also generates revenue from merchandise sales and fees for its premium connectivity services.Products: Vehicle servicing, used car sales, insurance, merchandise, premium connectivity services.

Energy Generation and Storage Revenue

Tesla's energy division focuses on providing clean energy solutions. This includes selling and installing solar energy systems, solar panels, and energy storage products like the Powerwall, Powerpack, and Megapack.Products: Solar panels, Solar Roof, Powerwall, Powerpack, Megapack.

Automotive Leasing Revenue

Tesla offers vehicle leasing options for both consumers and businesses. Leasing revenue is generated from customers leasing Tesla vehicles, such as the Model 3, Model Y, Model S, and Model X, over fixed terms.Products: Leasing of Tesla vehicles (Model 3, Model Y, Model S, Model X).

Automotive Regulatory Credits Revenue

Tesla earns revenue by selling regulatory credits to other automakers that need them to comply with emission regulations. Tesla accumulates these credits through its production of zero-emission vehicles.Products: Zero-emission regulatory credits.

Automotive Sales Revenue

This is Tesla’s most significant revenue driver, including revenue from directly selling its electric vehicles to consumers and businesses. Tesla offers a range of vehicles, including the Model 3, Model Y, Model S, and Model X.Products: Model 3, Model Y, Model S, Model X, Cybertruck.

To put these figures into perspective, here’s a percentage overview of the different streams of revenue compared to Tesla’s Total Revenue.

Tesla’s main revenue driver is, of course, the Automotive Sales of its cars. However, we see a clear revenue shift from its Energy and Storage. Enery accounted for roughly 0.13% of its total revenue in 2014, but as of today, Enery is approximately 8.02% of Tesla’s total revenue, significant growth. Its service revenue has been stable between 5% and 10% and is not too shabby. We see that Automotive Lease is growing in figures, but the percentage-wise went from 4.16% in 2014 to 2.02% today. Although the Automotive Lease is growing, it’s become more obsolete in Tesla’s total revenue. Tesla’s automotive credit department has been stable at between 4% and 10%, and it is also not too shabby here.

We can see that Tesla’s primary focus is on the sales of its cars and the growing demand for energy solutions, giving the energy creation and storage option. With the future in mind, more eyes are on generating and storing sustainable energy; we could see more growth for Tesla here.

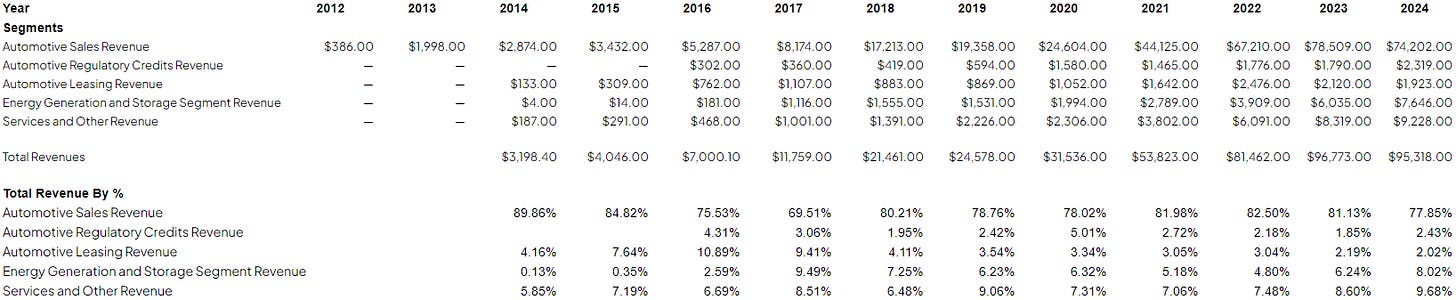

Now, let us see how globally diversified Tesla is.

Looking at the global sales of Tesla, we see a couple of exciting things happening.

In the United States, we see a sharp rise in sales from 2014 to 2019. From 2019, we see a sharp decline, percentage-wise. In 2019, 51.48% of Tesla’s total revenue came from The United States; in 2020, 48.22%; in 2021, 44.54%; in 2022, 49.78%, 2023 46.74%, and as of today, 47.92% comes from The United States. Usually, this could paint a worrisome picture, but in the case of Teslas, it is not.

Although United States sales declined percentage-wise, we’re seeing significant growth in China. China was 12.12% of the total sales in 2019, which grew to 21.35% today. Tesla is growing, and the Chinese market started favoring Teslas in 2019.

In the other countries, we see a steady graph. Sales have been between 20% and 30 % in Europe and other countries, which is pretty stable. We do see sales booms in 2015 and 2019, but not exceptional declines in Tesla’s sales.

2. Executive Leadership

2.1 CEO Experience

I think we all know Elon Musk, the CEO of Tesla. You might know him for his sometimes absurd tweets or public appearances. Let us dive a little deeper into his career!

Elon Musk was born to a South African father and a Canadian mother. He showed an impressive knack for computers and entrepreneurship from a young age. At just 12, he created a video game and sold it to a computer magazine. In 1988, Musk left South Africa after securing his Canadian passport. He didn't want to support the apartheid regime by serving in the military, and he also saw more excellent opportunities in the United States.

PayPal and SpaceX

Musk initially studied at Queen’s University in Kingston, Ontario, before transferring to the University of Pennsylvania in 1992. By 1997, he had earned dual bachelor's degrees in physics and economics. He briefly enrolled in Stanford's graduate program in physics but left after two days, believing that the internet had more potential to shape the future than his academic pursuits. In 1995, Musk co-founded Zip2, a company that provided maps and directories to online newspapers. Compaq acquired Zip2 in 1999 for $307 million. After that success, Musk founded X.com, an online financial services company that later evolved into PayPal. In 2002, eBay purchased PayPal for $1.5 billion.

Musk’s vision extended beyond Earth; he was passionate about making humanity a multi-planetary species. However, he was frustrated by the high costs of space travel, which led him to start SpaceX in 2002. SpaceX aimed to develop more cost-effective rockets, beginning with the Falcon 1, launched in 2006, and the larger Falcon 9, which first took off in 2010. The Falcon Heavy followed in 2018, boasting the ability to carry nearly double the payload of its closest competitor at a fraction of the cost. SpaceX’s plans include the Super Heavy-Starship system, which is expected to carry massive payloads and could revolutionize space travel to the Moon, Mars, and beyond. SpaceX has also been instrumental in developing the Dragon spacecraft, designed to transport cargo and astronauts to the International Space Station (ISS). In 2020, Dragon carried astronauts Doug Hurley and Robert Behnken to the ISS. Musk is not only the CEO of SpaceX but also played a pivotal role as the chief designer of the Falcon rockets, Dragon, and Starship. SpaceX is also tasked with building the lunar lander for NASA’s Artemis mission, which aims to return astronauts to the Moon by 2025.

Tesla

Musk has long been passionate about the potential of electric vehicles. In 2004, he became one of the key investors in Tesla Motors (now Tesla), an electric car company founded by Martin Eberhard and Marc Tarpenning. Tesla unveiled its first car, the Roadster, in 2006. This sleek, high-performance sports car could travel 245 miles on a single charge, distinguishing it from earlier electric vehicles, often seen as dull and impractical. Tesla’s IPO in 2010 raised around $226 million. Two years later, the Model S sedan was launched and received widespread praise for its performance and design. Tesla followed up with the Model X SUV in 2015, and then, in 2017, the more affordable Model 3 would become the best-selling electric car in history.

Elon Musk is the largest Tesla shareholder, holding 715.022 million shares, representing 20.6% of Tesla ownership.

2.2 Employee Satisfaction Ratings

The overall score for Elon Musk on Glassdoor looks solid. It's nothing too crazy or something we should be worried about.

With Tesla's global size, the rating I see on Comparably is surprisingly good. With a CEO like Elon Musk, who can be a handful to deal with at times, I had expected a rather lower rating. Overall, employees and employers seem to align and help Tesla provide value. Remember, your employees can make or break your business or image.

2.3 CEO Value Creation

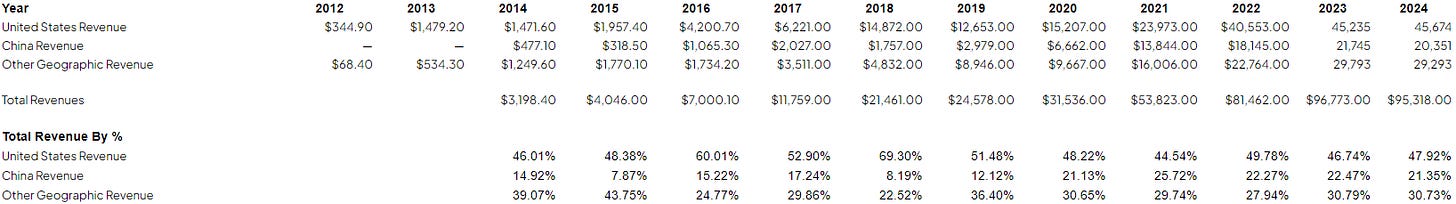

Elon Musk has a beautiful backstory and satisfied employees working for Tesla, but if Elon Musk creates value for its shareholders, let us take a look!

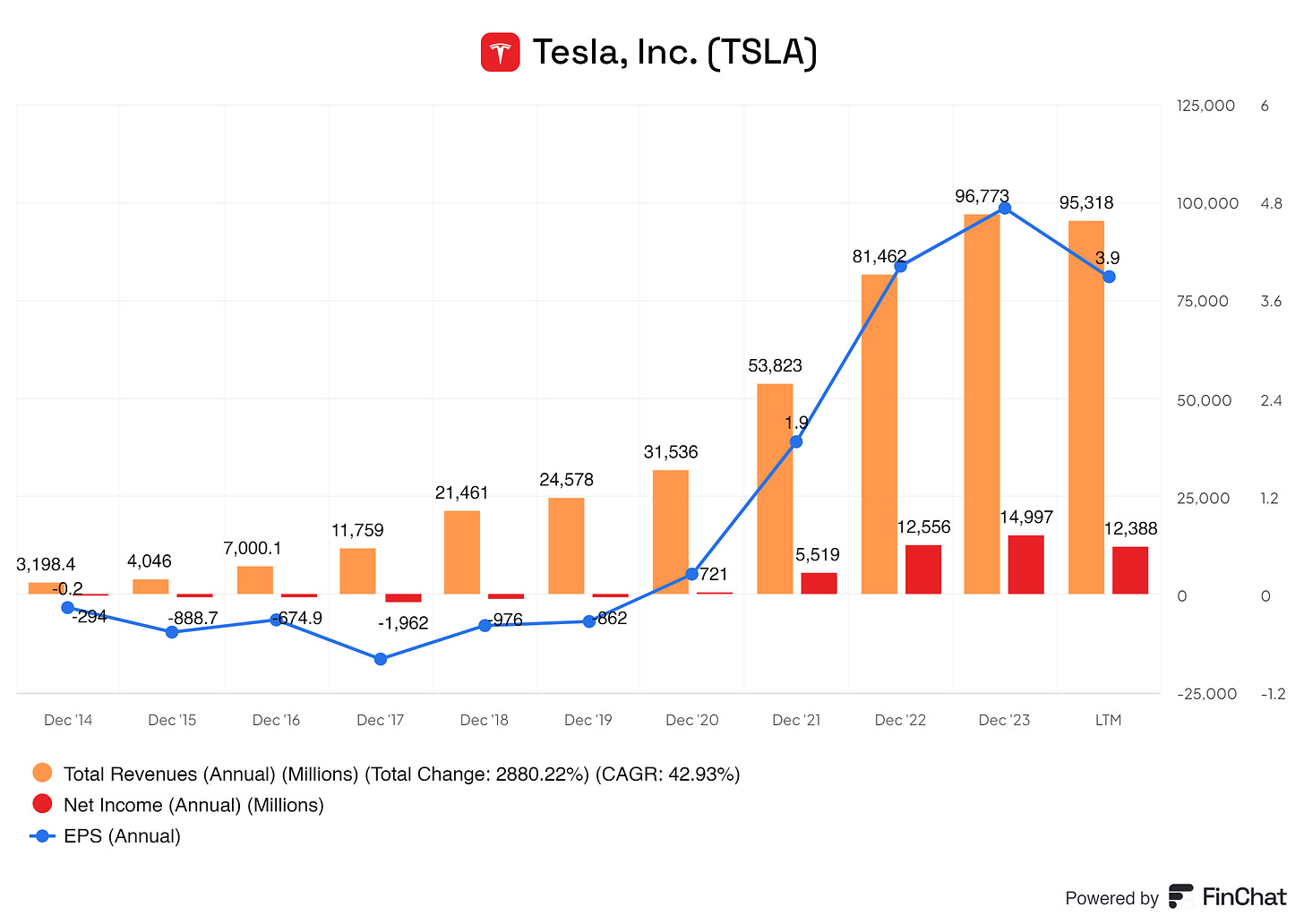

If we look at the per-share ratio, Elon Musk is proving shareholder value. Although we see a decline in EPS, FCF per share, and revenue per share, the overall trend of these three per-share items is upwards.

3. Competitive and Sustainable Advantage (MOAT)

So, a MOAT can be in either one or more of the following forms:

Brand Power

Patents

Scale and Cost Advantages

Switching Costs

Network Effect

Attracting Talent (I consider this a MOAT, others don’t. Decide for yourself)

Brand Power

Tesla is synonymous with innovation and sustainability, redefining what an electric vehicle (EV) can be. The company has positioned itself as a leader in the EV market, attracting a loyal and growing customer base. Its association with cutting-edge technology, such as autopilot features and over-the-air updates, sets it apart from traditional automakers. Tesla’s focus on renewable energy solutions, such as solar products and energy storage, extends its brand beyond cars, resonating with environmentally conscious consumers and investors alike.

Patents

Tesla's patent portfolio covers significant technological advancements, especially in battery technology and electric drivetrains. Elon Musk's decision to open-source Tesla’s patents in 2014 may seem counterintuitive, but it has fostered industry collaboration and accelerated the adoption of EVs. This move strengthens Tesla's position as an industry leader and sets the standard for future developments in the EV space, giving it an indirect competitive edge.

Scale and Cost Advantages

Tesla benefits from a vertically integrated business model, including manufacturing its own batteries at the Gigafactories. This scale gives Tesla significant cost advantages, particularly in battery production, which is the most expensive component of an electric vehicle. By controlling more of its supply chain, Tesla can optimize costs while maintaining high production standards. This scalability is one of the company's strongest competitive advantages, allowing it to drive down the price of its vehicles while maintaining profitability.

Switching Costs

Tesla's ecosystem creates substantial switching costs for customers. With proprietary charging infrastructure like the Supercharger network, Tesla owners enjoy convenient and reliable access to fast charging stations. This network is a powerful incentive for Tesla customers to remain within the brand, as switching to a competitor might result in less charging convenience. Additionally, Tesla's constant software updates and integration with its energy products (Powerwall, Solar Roof) lock consumers into its ecosystem.

Network Effect

Tesla’s Autopilot and Full Self-Driving (FSD) capabilities gain value as more users adopt them, creating a network effect. Tesla collects vast amounts of driving data from its vehicles, which feeds back into its AI algorithms, improving the FSD software for all users. The more people use Tesla’s autonomous driving features, the smarter and more capable the system becomes, reinforcing Tesla’s position as a leader in self-driving technology.

Attracting Talent

Tesla's reputation as an industry disruptor and its commitment to innovation attract top talent worldwide. Employees are drawn to the opportunity to work on cutting-edge technologies that are reshaping the future of transportation and energy. Tesla offers a dynamic work environment that fosters creativity and innovation, which is critical to maintaining its competitive edge. The company's mission to accelerate the world’s transition to sustainable energy is a powerful motivator for employees passionate about making a global impact.

4. Industry Analysis

4.1 Current Industry Landscape and Growth Prospects

High inflation rates, higher raw materials and labor costs, and many other factors are battling themes for automotive businesses, including Tesla.

In 2022, sales of automotive products slowed down due to a shortage of semiconductors. Since the pandemic, the automotive business has steadily grown at single-digit rates.

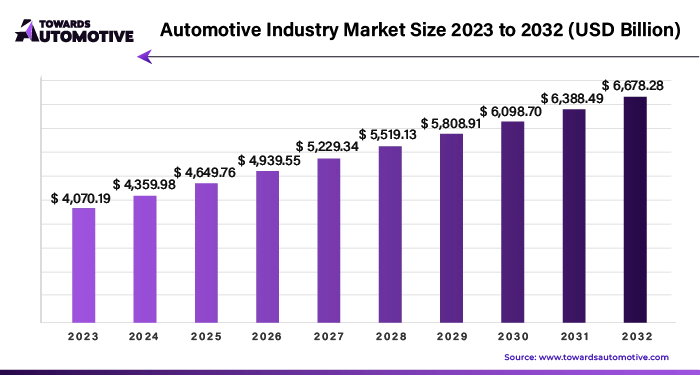

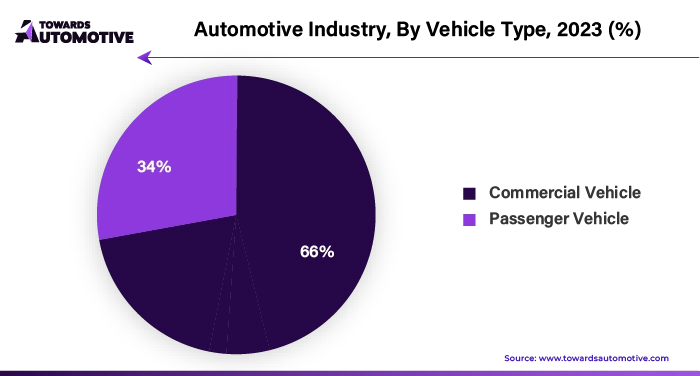

The global automotive industry is estimated to be at roughly 4,400 billion in 2024 and is expected to reach approximately 6,600 billion by the end of 2032, growing at a CAGR of approximately 6%.

The demand for large vehicles, including long-distance buses and larger cars, is rising due to increased investment in public transportation. Local governments are being pressured to modernize existing transport systems to better serve passengers' changing needs and reduce road congestion caused by private vehicles. In response, companies like UBS Univers Busservice GmbH and MarinoBus are introducing longer buses equipped with advanced driver assistance systems and LED lighting to enhance long-distance travel experiences.

The automotive industry is set for significant growth, largely fueled by the increasing demand for electric vehicles (EVs) across various segments, from compact passenger cars to buses and trucks. This growth is being driven by rising environmental awareness around the impact of fossil fuels, increasing fuel prices, and the expanding number of EV manufacturers entering the market. As a result, EVs have become more affordable, with increased competition lowering prices that were previously high due to limited choices.

In addition, automotive companies are targeting emerging markets in regions like India, China, and Africa, where the growing middle-income population is driving demand for cost-effective private vehicles. Manufacturers are responding by introducing affordable models tailored to local preferences. For instance, Maruti Suzuki launched the Fronx SUV in South Africa, offering an affordable option that caters to regional tastes.

Automakers are also making strategic shifts toward a fully electric future. In September 2023, Nissan announced plans to stop producing internal combustion engine (ICE) vehicles in Europe, committing to an all-electric lineup by 2030. Similarly, Renault revealed plans to launch at least two new fully electric models in its Kwid car segment within the next three to four years.

Rising investments in charging infrastructure, particularly fast-charging networks that enable long-distance travel, are further supporting the growth of the EV sector. This infrastructure development is expected to accelerate the adoption of EVs even further in the coming years.

4.2 Competitive Landscape

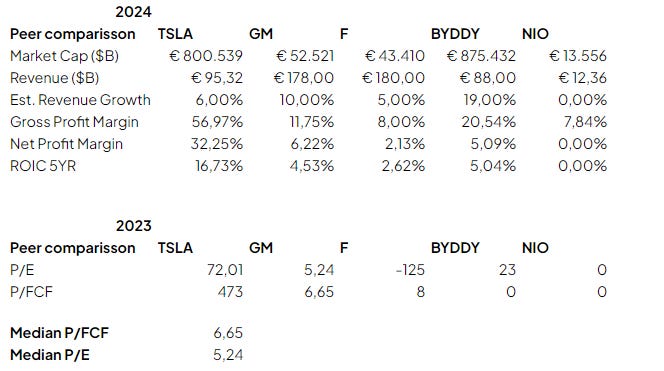

I identify General Motors, Ford, Byd, and Nio as some of Tesla’s main competitors. There are many more, but to keep track, we’ll stick to these.

Tesla stands tall among its automotive peers in market capitalization and its approach to innovation, profit generation, and overall business strategy. When we compare Tesla to traditional automotive giants like GM, Ford (F), and even newer players such as BYD (BYDDY) and NIO, it becomes clear that Tesla is operating in a league of its own.

In 2024, Tesla boasts an astronomical market capitalization of €800.54 billion, dwarfing its competitors. BYD often hailed as a formidable challenger in the electric vehicle (EV) space, trails behind at €875.43 billion, with GM and Ford coming in at €52.52 billion and €43.41 billion, respectively. While GM and Ford are traditional automotive leaders with much more significant revenues than Tesla, at $178 billion and $180 billion, Tesla’s smaller revenue of $95.32 billion comes with a different narrative. Despite having smaller revenues than its legacy peers, Tesla's focus on profitability and growth remains unmatched.

Tesla's estimated revenue growth of 6.00% is modest compared to BYD's 19.00%, but Tesla's gross profit margins of 56.97% are significantly higher than those of GM (11.75%) and Ford (8.00%), showcasing the company's ability to generate massive profits from every dollar of revenue. In contrast, traditional automakers are grappling with much slimmer profit margins, a signal of their challenges in transitioning to EV production.

What truly sets Tesla apart is its Net Profit Margin of 32.25%, a staggering figure compared to the 6.22% of GM and 2.13% of Ford. Even BYD, despite its growth, has a net profit margin of only 5.09%. Even while expanding its operations globally and investing heavily in innovation, Tesla's ability to maintain such a high level of profitability reflects its strong pricing power and efficient cost structure.

Tesla’s focus on profitability extends to its Return on Invested Capital (ROIC), a key metric for evaluating how effectively a company uses its capital to generate returns. Tesla’s 16.73% ROIC over five years showcases its ability to deploy capital efficiently, far outpacing GM (4.53%) and Ford (2.62%). Even BYD, known for its rapid growth, lags at 5.04%. NIO, in comparison, shows 0.00% for both net profit margin and ROIC, indicating that it is still in an early stage of its development with profitability far from being realized.

When it comes to valuation, Tesla operates on a different spectrum. In 2023, Tesla's Price-to-Earnings (P/E) ratio stood at 72.01, which would typically be seen as highly high by traditional automotive companies. However, compared to GM’s 5.24 and Ford’s negative valuation (-125), it becomes apparent that investors value Tesla not just for its current earnings but for its future potential. This confidence is further reflected in Tesla’s Price-to-Free Cash Flow (P/FCF) of 473, which is sky-high compared to GM’s 6.65 and BYD’s 8. Tesla's massive valuation reflects the market's belief in its ability to scale, innovate, and dominate the EV landscape.

5. Risk Assessment

Market Saturation and Increasing Competition

Risk: As more legacy automakers and new entrants transition to electric vehicles, Tesla’s market share could face significant pressure. Companies like BYD, General Motors (GM), and Ford ramp up their EV production, with more models entering the market at competitive price points.

Impact: Increased competition could reduce Tesla’s sales growth and potentially compress its profit margins. With competitors offering more diverse models, consumers might be drawn to alternatives, especially in markets where Tesla's offerings are limited.

Mitigation: Tesla needs to continuously innovate and expand its product portfolio by using models like the Cybertruck and Semi to stay ahead of competitors.

Production and Supply Chain Challenges

Risk: Tesla has historically faced production delays, notably with the Model 3 and the forthcoming Cybertruck. The company also faces risks related to sourcing essential materials, such as lithium and cobalt, which are crucial for battery production.

Impact: Any disruption in the supply chain or production processes could delay deliveries, increase costs, and hurt Tesla’s profitability. Additionally, rising commodity prices could squeeze Tesla's margins, especially as it scales production.

Mitigation: Tesla is investing heavily in its Gigafactories and securing long-term supply contracts for critical materials. The company’s vertical integration strategy helps mitigate some of these risks by providing more control over the supply chain.

Regulatory and Political Risks

Risk: Tesla operates in multiple countries, each with different regulatory environments. Regulatory changes, such as emissions standards, tax incentives, or government subsidies, can significantly impact Tesla's operations. For example, the reduction of EV subsidies in key markets such as China or the United States could reduce demand.

Impact: If EV incentives are scaled back or if governments impose stricter regulations on autonomous driving, Tesla’s sales and product development could face significant setbacks. Moreover, geopolitical tensions and trade tariffs between key markets could increase operational costs.

Mitigation: Tesla should engage actively with regulators and policymakers to ensure alignment with future standards and capitalize on new opportunities like the push for clean energy transitions globally.

Technological and Innovation Risks

Risk: While Tesla is known for its cutting-edge technology, including self-driving features, the EV market is highly dynamic. Technological advancements by competitors or delays in Tesla’s own innovations (such as Full Self-Driving software) could negatively impact its competitive advantage.

Impact: If Tesla fails to maintain its technological edge or if competitors surpass Tesla in areas like battery technology or autonomous driving, Tesla could lose its leadership position. Any malfunction or safety issue related to its self-driving software could also lead to significant reputational damage and regulatory scrutiny.

Mitigation: Tesla needs to maintain significant research and development investments and ensure that it remains at the forefront of innovation, particularly in areas like autonomous driving and energy storage.

Global Economic and Financial Risks

Risk: Tesla’s performance is tied to global macroeconomic conditions. Factors such as rising interest rates, inflation, or a global economic downturn could negatively affect consumer demand for high-priced electric vehicles.

Impact: If consumers reduce spending due to economic instability, Tesla could see a slowdown in sales. Additionally, tightening monetary policies or difficulty accessing capital markets could affect Tesla’s ability to fund its growth plans.

Mitigation: Tesla needs to build a buffer by maintaining a strong balance sheet, including ample cash reserves and manageable debt levels, to weather potential economic downturns. It can also continue to expand into more affordable segments to capture price-sensitive consumers.

Dependence on CEO Elon Musk

Risk: Tesla’s identity and success are closely linked to its high-profile CEO, Elon Musk. His leadership, innovation, and vision are seen as key to Tesla’s achievements. However, Musk's involvement in multiple ventures, including SpaceX, Twitter, and Neuralink, could result in divided attention.

Impact: If Musk stepped down or faced controversies affecting his reputation, it could hurt Tesla’s stock and investor confidence. Additionally, Tesla's reliance on a charismatic leader exposes it to risks related to succession planning.

Mitigation: Tesla must ensure strong leadership at all levels and potentially groom a successor or bolster its executive team to reduce overreliance on a single individual.

6. Financial Health

6.1 Assets Assessment

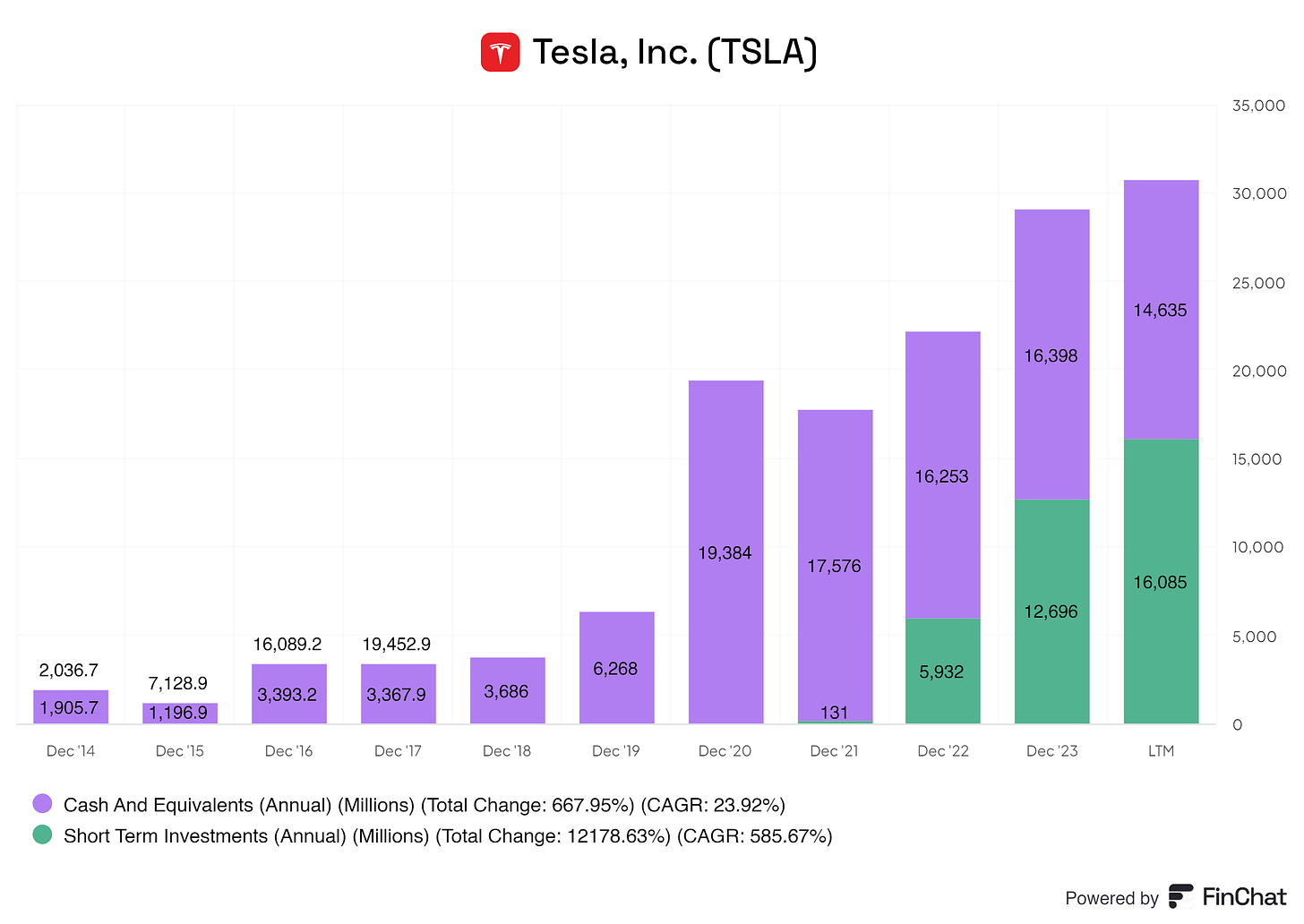

Tesla has a modest assets sheet. I’m a big fan of increasing cash positions and short-term investment positions in businesses, an Tesla fits this criteria.

On an average basis, YoY, Tesla is growing its cash and equivalents and short-term investments position, helping Tesla be more prepared for headwinds.

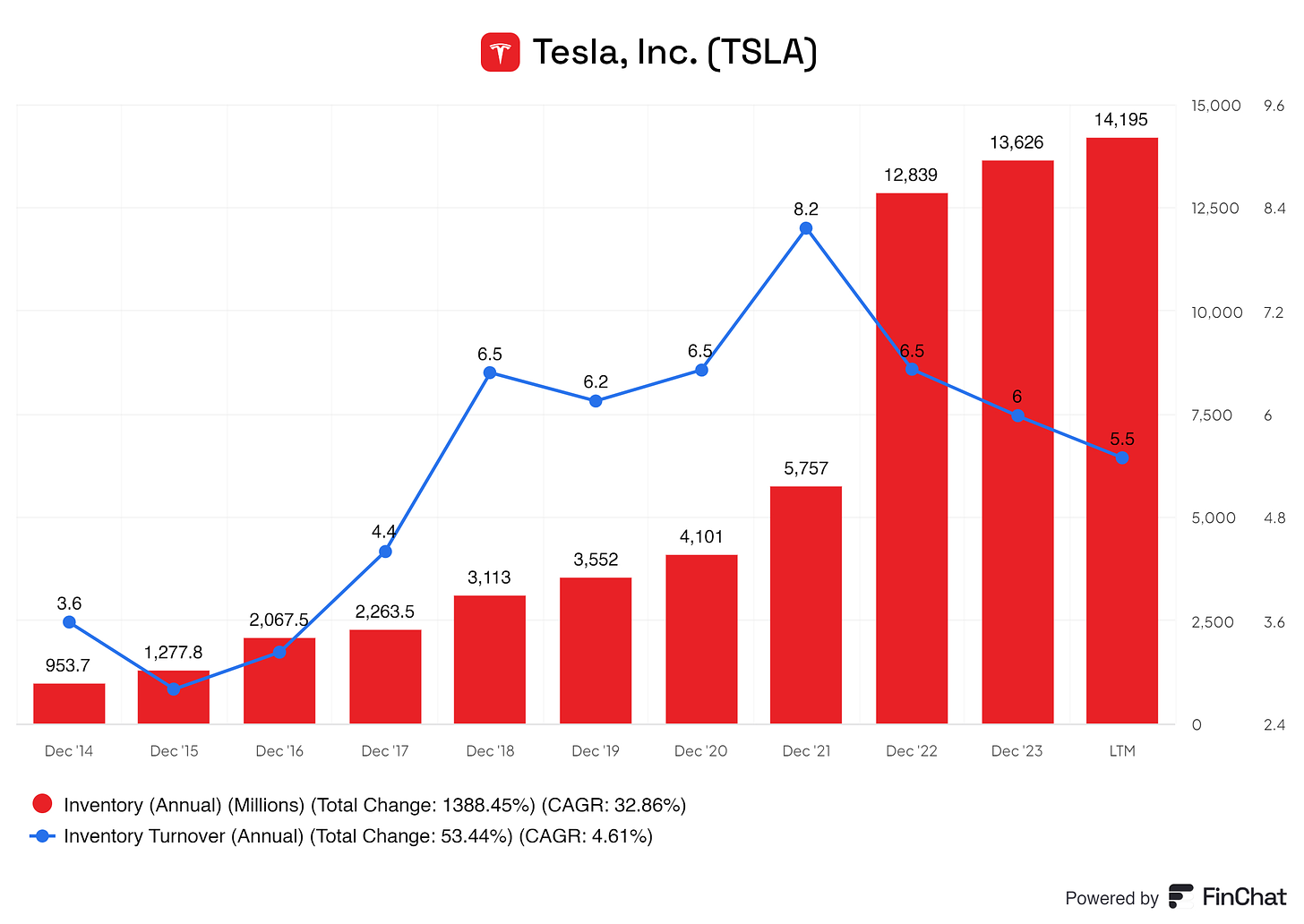

Some investors might not like Tesla's rapidly increasing inventory. But linked to this rapidly growing inventory is a inventory turnover rate of 5.5, making any worries obsolete.

A turnover ratio 5.5 suggests that Tesla is efficiently moving its inventory, replenishing stock more than five times per year. In the automotive industry, where production and sales cycles can be lengthy, this is a positive indicator that Tesla can sell cars quickly, avoiding excessive inventory buildup.

A higher turnover ratio, like 5.5, means Tesla converts inventory into cash relatively quickly, which benefits liquidity. This efficiency allows the company to reinvest in production, pay off suppliers, and fund operations more smoothly. Additionally, maintaining lower inventory levels suggests optimized cash flow management.

An increase in inventory could be a response to the rise in raw material prices. Tesla’s strategy of holding modest inventory levels might shield it from immediate price hikes.

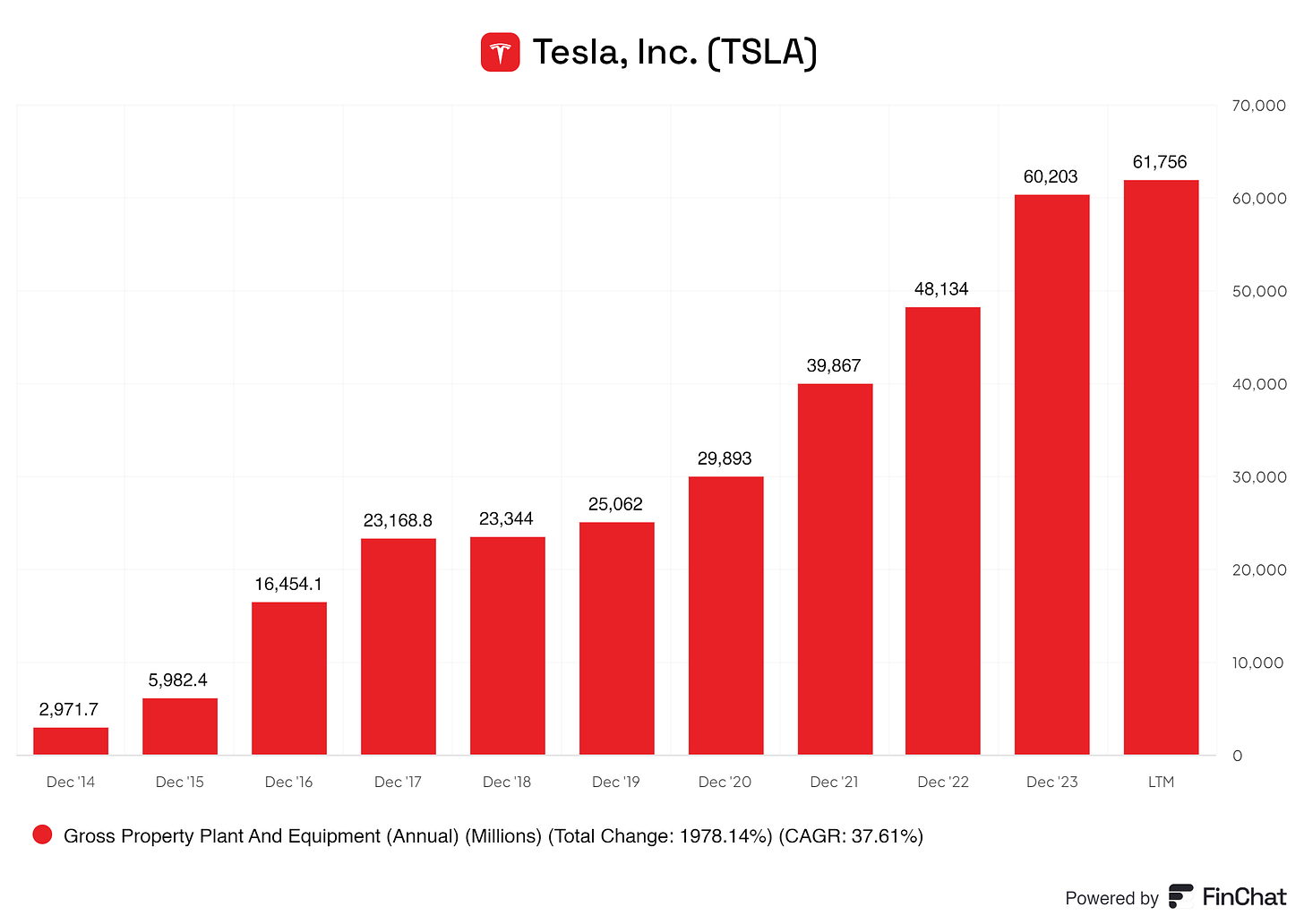

Like many growth-oriented companies, Tesla continues to invest steadily in Property, Plant, and Equipment (PPE), signaling future growth, which is a positive sign for the company's long-term trajectory.

6.2 Liabilities Assessment

Tesla also benefits from a healthy liabilities sheet. There’s some debt, but this is obsolete and completely covered by either their assets or OCF.

7. Capital Structure

7.1 Expense Analysis

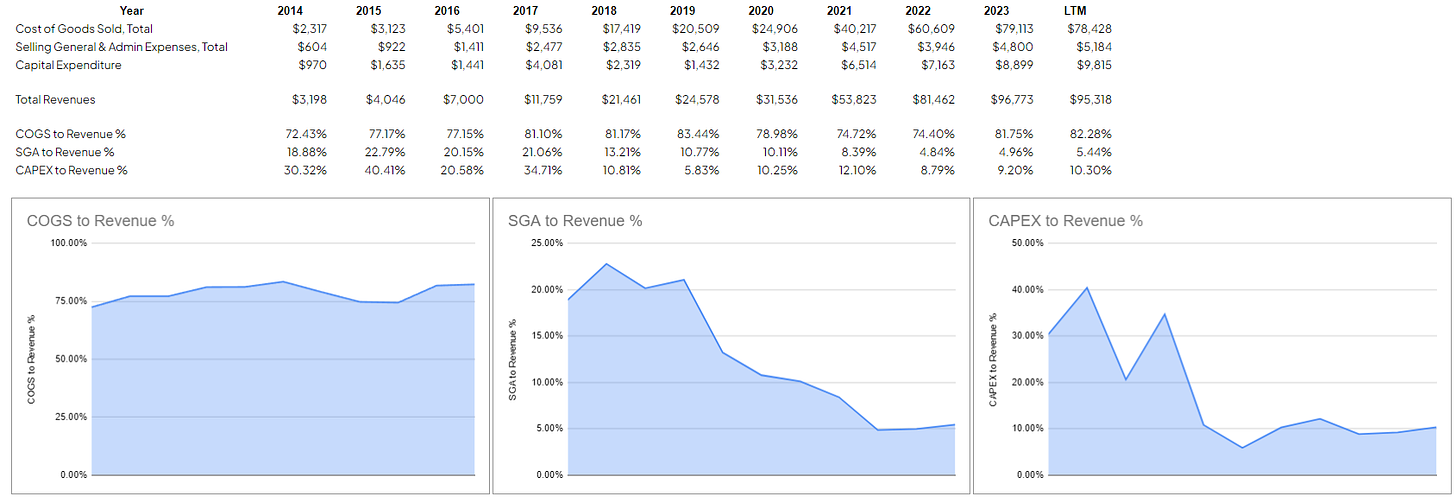

We get a clear picture of Tesla's cost structure. Tesla has lowered its SGA costs (Selling, General, and Administrative) year-over-year while keeping CAPEX steady. COGS (Cost of Goods Sold) is also stable.

Compared to other automotive businesses like Ford or General Motors, Tesla is more efficient in managing and maintaining steady cost levels. Many companies are seeing costs spike in the current high inflationary environment, but Tesla's excessive inventory seems to protect it from immediate increases.

While Tesla's costs are high (as expected for an automotive business), the company is managing them effectively, with no significant issues arising from maintaining these levels.

7.2 Capital Efficiency Review

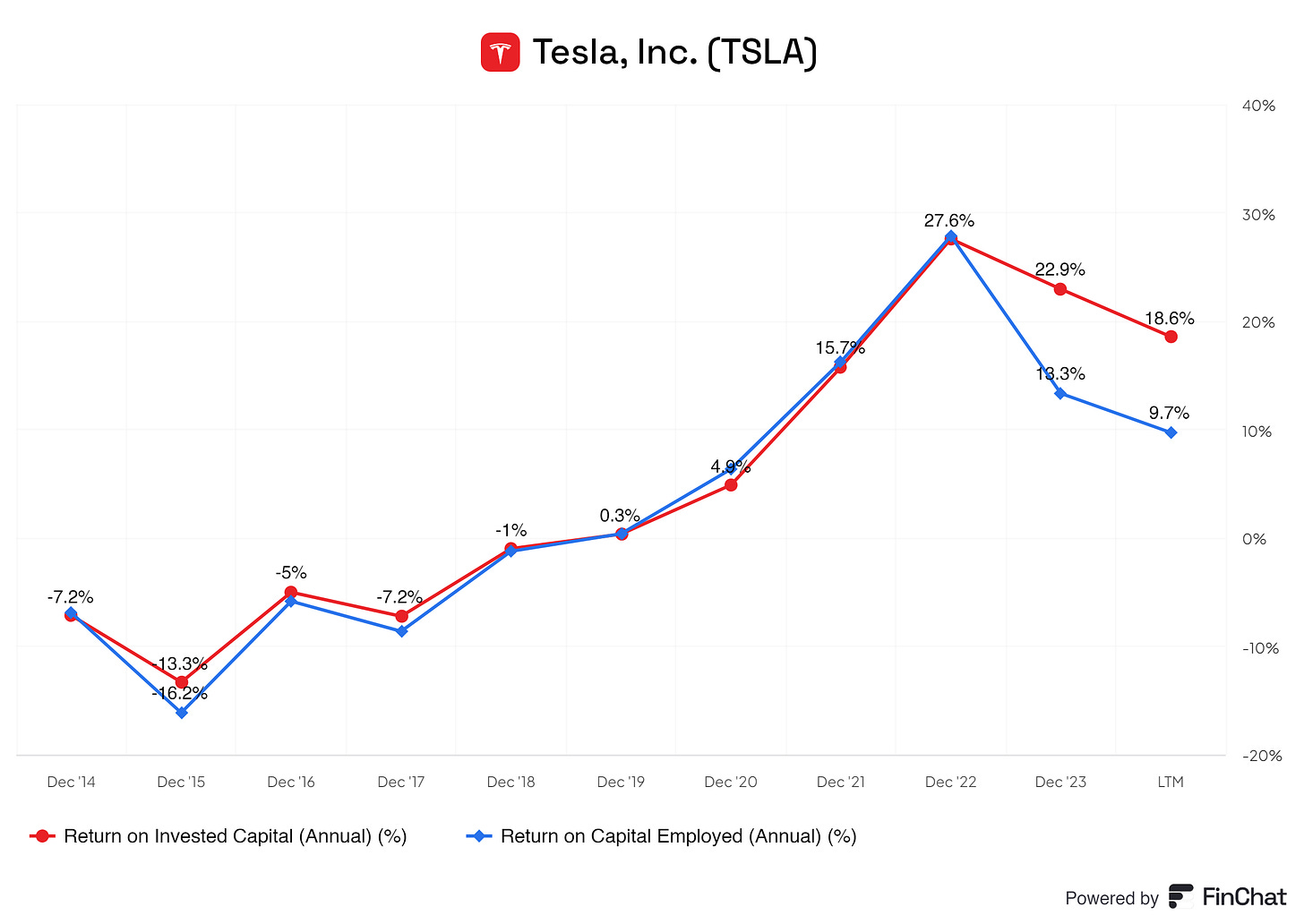

Tesla benefits from a solid ROIC and ROCE; fortunately, there are no talks of capital being destroyed. Tesla's WACC is roughly 10%; If ROIC < WACC: The company is generating returns lower than its cost of capital, which is seen as capital destruction. The company is not earning enough to cover the cost of financing, leading to a loss in value for investors. For now, Tesla has a modest ROIC compared to its peers/competitors. For automotive businesses, it’s rare to have ROIC or ROCE in the mid-to-high teens.

8. Profitability Assessment

8.1 Profitability, Sustainability, and Margins

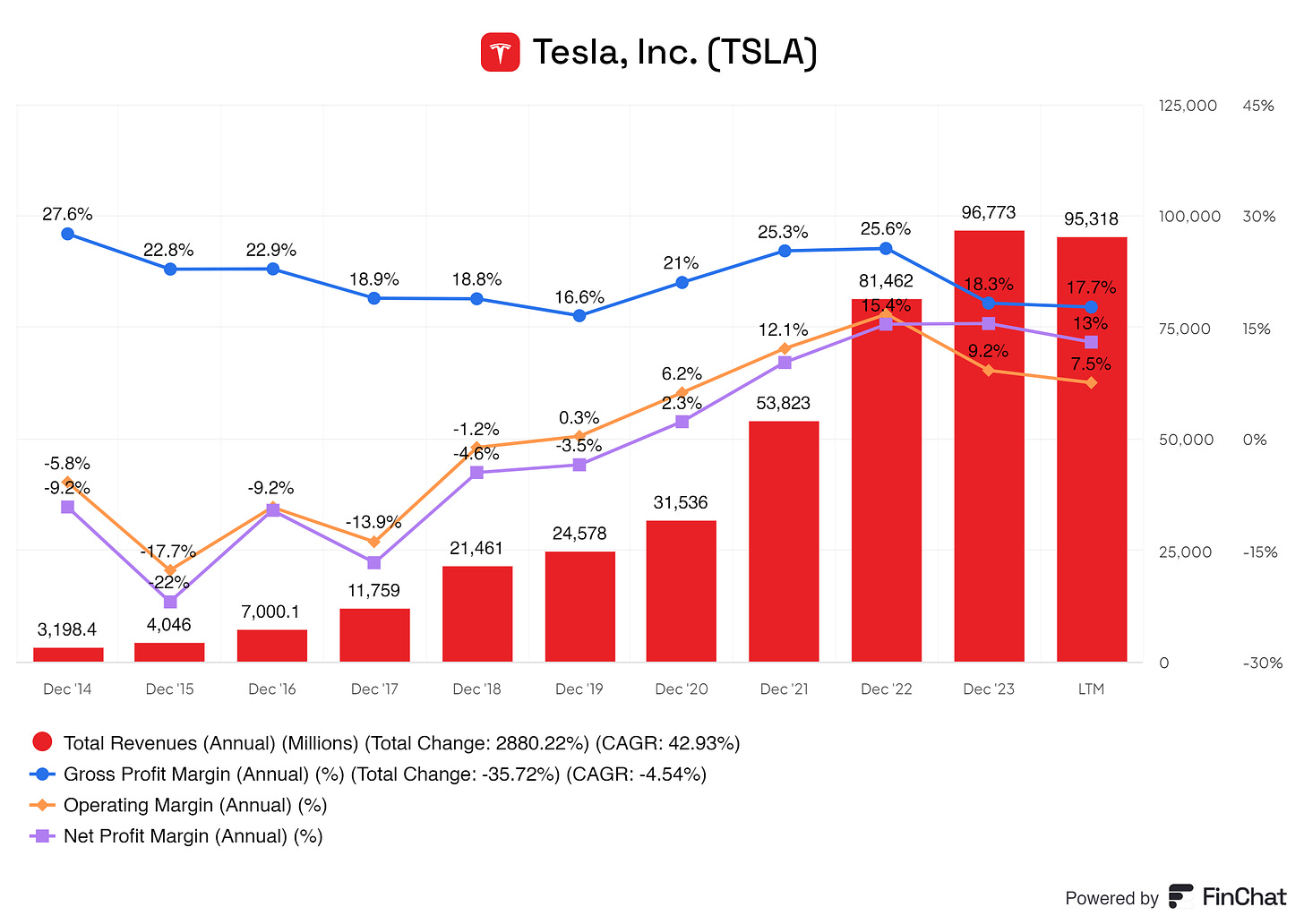

Tesla has demonstrated exceptional revenue growth over the past decade, with a 10-year CAGR of 42.93%, driven by its continued expansion into global markets and its diversification beyond just electric vehicles. While Tesla's revenue growth is slowing slightly, the company still shows remarkable top-line expansion as it scales up production and enters new segments like energy storage and autonomous driving.

Tesla's Gross Profit Margin, which has decreased since its peak, remains healthy at 17.7%. Although there has been a slight decline, this is still a strong indicator that Tesla is managing to maintain reasonable control over production costs, even as it scales up operations across the globe. The margin compression may reflect increased competition and the price cuts Tesla has been implementing to maintain its market share. However, management’s ability to keep margins in a competitive range shows that Tesla is still running efficiently.

The Operating Margin tells a similar story. While Tesla has reached a peak of 18.3%, it currently stands at 13%, which is still above industry averages and reflects strong operational efficiency. Tesla’s ability to manage its costs, scale production, and innovate while still maintaining double-digit operating margins is impressive and shows the strength of its management team.

Tesla's Net Profit Margin, currently at 7.5%, has declined somewhat from its high of 9.2%. While not as high as some traditional automakers or tech giants, Tesla’s profitability is still solid, especially considering the massive growth investments Tesla continues to make in new markets and technologies. While it may not yet rival the net profit margins of some competitors, Tesla’s ability to stay profitable while growing at this pace is a testament to the company’s resilience and potential.

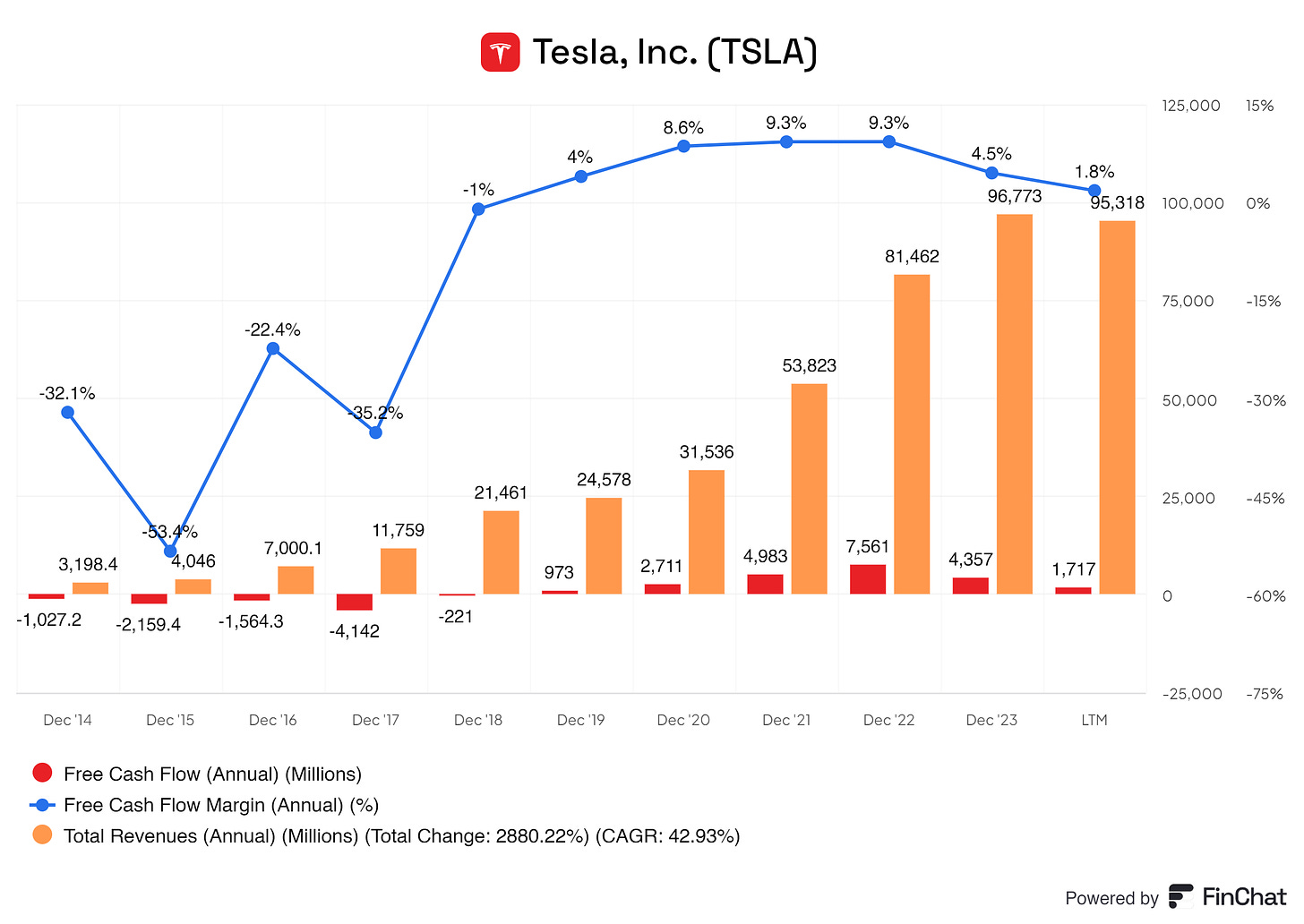

8.2 Cash Flow Analysis

Judging Tesla on its cash flow is nonsense, of course. Tesla is in the creation of Automotive primarily and this requires a lot of cash to be able to finance future growth and the production of its products. As we can see in the chart, there’s not much free cash flow left at the end of the ride for Tesla, this should not be worrying. Just like ASML, Tesla is a expense heavy business that need to be funded adequately to be able to provide its products.

9. Growth Analysis

9.1 Historical Growth Trends

Historically speaking, Tesla has been performing quite alright. It took a some years to become profitable, but with the bright future ahead for Tesla I think staying profitable will be the least of its worries. Tesla is expected to benefits of the automotive and energy products/service which will in return yield excellent results due to the early investments that Tesla made in the business.

9.2 Future Growth Projections

In the coming years, hurdles are expected, especially due to the high inflationary environment, which puts pressure on businesses, particularly Tesla. A modest growth of 5% to 8% is anticipated in the near term.

Once the environment stabilizes, consumer demand in the automotive sector is expected to drive growth. With increasing demand for long-distance cars and energy storage, Tesla stands to benefit greatly from these trends.

To capitalize on this future growth, Tesla must continue investing heavily in both its automotive and energy sectors, positioning itself to reap the benefits of rising demand.

10. Value Proposition

10.1 Dividends Analysis

Tesla does not pay a dividend, thankfully. Tesla does not have the right breathing room to be able to distribute these dividends. Also, all the cash should be reinvested in the business to keep on growing.

10.2 Share Repurchase Programs

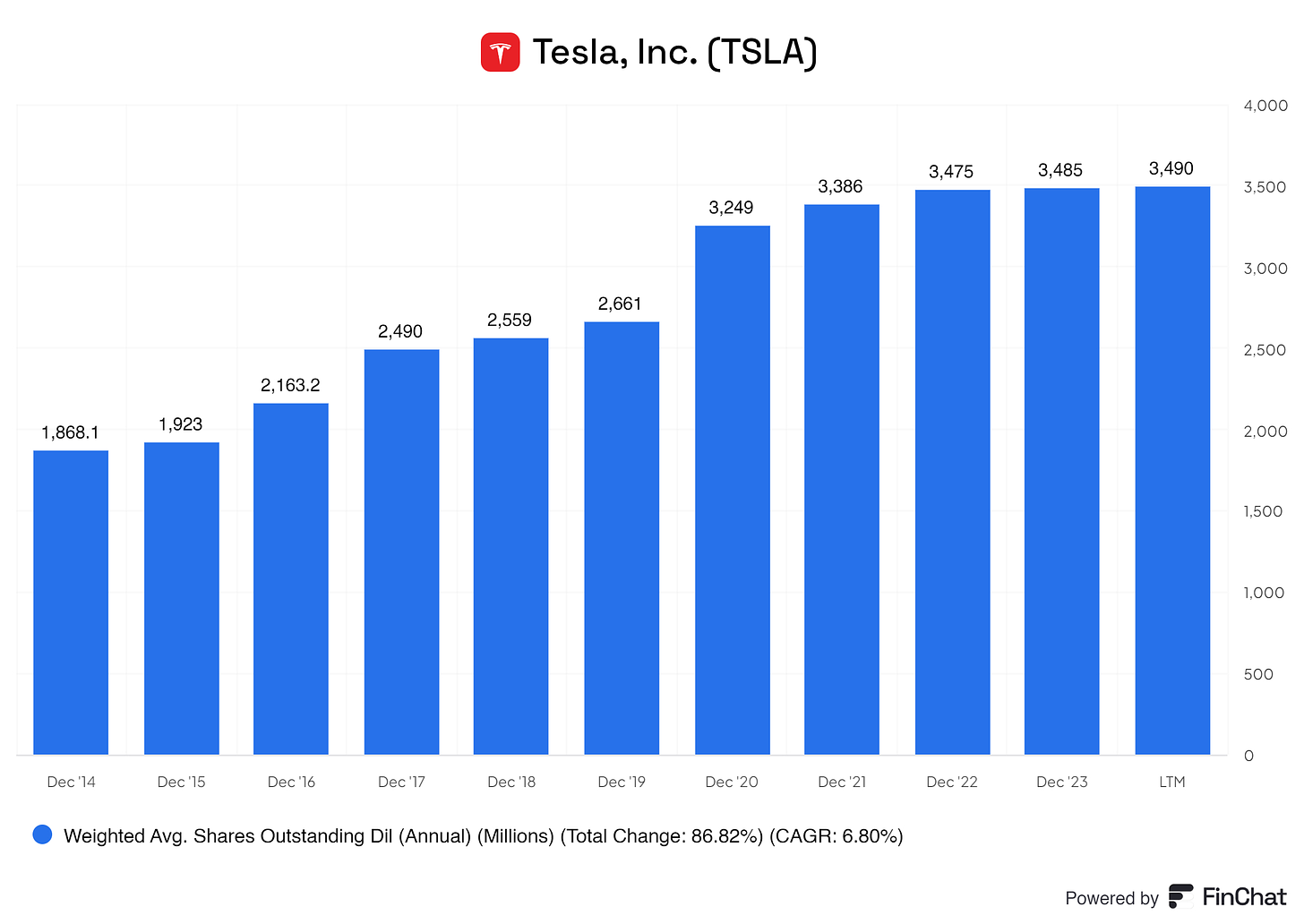

Ouch… Tesla is not buying back ANY stock as of now and is continuing to distribute more common stock, diluting shareholders YoY. Yes, with the current phase of Tesla some investors might argue this is the right thing to do to gain capital to further boost the growth of Tesla, but there's still dilution and I think at the current phase Tesla should be looking at dimming this down, what it looks like what might be happening already, thankfully.

10.3 Debt Reduction Strategy

There’s some reduction of debt, but Tesla is not focussed on reducing major chuncks of its debt and this is something I agree with. Tesla its debt its very well managed and can be mainted like this. :-)

11. Future Outlook

Tesla’s future is filled with exciting opportunities as the company continues to innovate and expand beyond just electric vehicles. With the global shift toward sustainability and clean energy, Tesla is uniquely positioned to benefit from multiple high-growth industries, including energy storage, autonomy, and advanced manufacturing.

Tesla’s energy storage division is poised for explosive growth as the world moves toward renewable energy solutions. The increasing demand for efficient energy storage systems, both for households and large-scale utilities, gives Tesla a major advantage. With its Gigafactories scaling up production and ambitious plans to increase storage capacity, Tesla is set to play a significant role in the global energy transition. This could eventually lead to its energy business rivaling, or even surpassing, its EV division in revenue generation.

Tesla’s Full Self-Driving (FSD) technology is continually evolving, and while it may be in the early stages, its potential is vast. The autonomous vehicle market is expected to grow substantially in the coming years, and Tesla, with its rich dataset of real-world miles driven, is far ahead of most competitors. As the technology matures, Tesla's dominance in this space will likely expand, opening up new revenue streams such as robo-taxis, mobility services, and licensing the FSD software to other automakers.

Tesla’s manufacturing capabilities are also set to grow, with new Gigafactories being built and planned in strategic locations around the world. As Tesla continues to ramp up production in key markets such as China and Europe, it will be able to meet increasing global demand for electric vehicles. The company’s strong brand presence, combined with its ability to manufacture at scale, gives Tesla a significant edge in expanding its market share.

Tesla’s commitment to sustainability and innovation ensures that it will continue to be a leader in green technologies. The company’s advancements in battery technology, renewable energy integration, and vehicle performance will keep it at the forefront of the clean energy revolution. This, coupled with Tesla’s unique approach to vertically integrating its supply chain and focusing on high-efficiency production, makes the company a key player in shaping the future of transportation and energy.

12. Quality Rating

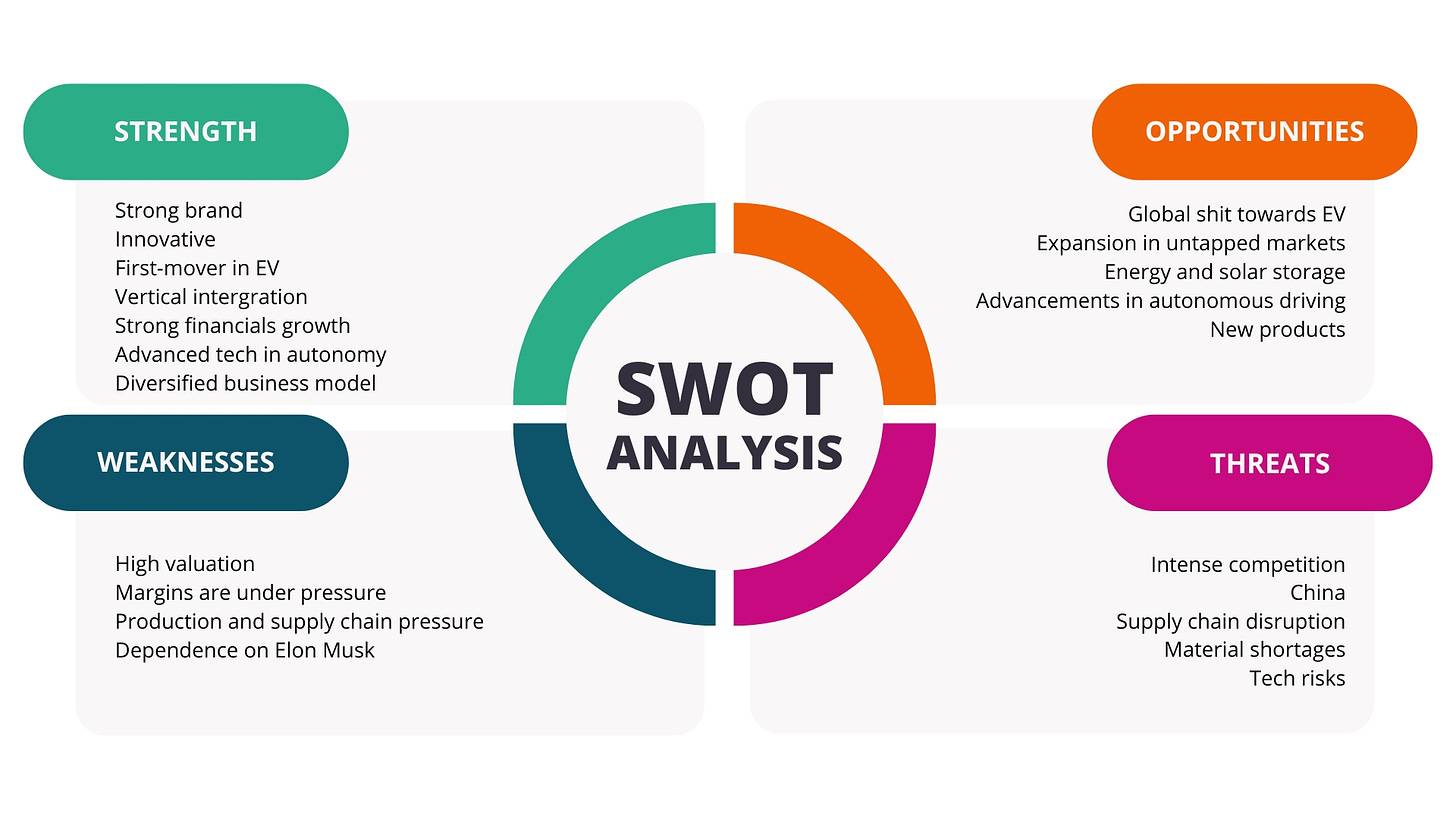

13. SWOT Analysis

14. Valuation Assessment

Let us crunch some numbers!

DCF: (Discount Cash Flow on Tesla has no added value, makes no sense)

Multiple Valuation: $169,78

Benjamin Graham’s Valuation: $124,45

Analysts Average: $216,16

Average of: $170,13

Current Price: $254.99

Tesla, in my honest opinion, is extremely overpriced. With the current modest outlook, the current share price is not justified in my honest opinion.

End note

Thank you for reading this investment case on Tesla!

With every investment case, I am trying to improve my writing and how I communicate my findings with you all. Because I started not too long ago, some posts might change in layout or other aspects before I find the design that suits my best wishes; sorry in advance.

As of now, thank you so much for your time! I hope you found some valuable information in this investment case.

Disclaimer

I do not own Tesla shares. I do not intend to buy Tesla shares within three to six months.

By reading my posts, being subscribed, following me, and visiting my Substack, you agree to my disclaimer. You can read the disclaimer here.

I bought 5,000 shares of Tesla 5 years ago now in 2019. When I retired in 2022 I sold about a third of my stock in May 2022 at about $315/sh. It has been a wild ride for sure. Up 1200% and down 50 to 73% many times. If a person just bought after large downdrafts they would have done fantastic even if they just traded it. I prefer to just buy and hold, selling only to transfer money out of a workplace retirement account in 2022. I think it is a cutting edge innovation company with a dynamic, committed CEO. Until Musk runs out of new ideas I am not selling this business. In 5 years this company could look just as different then as it did 5 years ago when I bought it. I plan to buy more when the next recession happens.

Thanks