Invest Beyond Finances: Building a Richer Life Outside the Market

Why True Wealth Isn’t Just Measured in Numbers—How to Invest in Your Health, Relationships, and Personal Growth for a Fulfilling Life

As investors, we often hear the mantra: "Put your money to work for you." But how often do we stop to think about investing the same energy into our personal lives, social connections, and health? While building wealth and securing financial independence are worthwhile goals, they shouldn’t come at the cost of leading a balanced and fulfilling life. Legendary investor Warren Buffett once said, “The best investment you can make is in yourself.”

This article explores why investing in your personal life is as crucial as growing your portfolio. It is backed by research, actionable steps, and reflective questions to help you build a balanced life.

What Happens When Life Becomes All About Finances?

The allure of financial growth often leads seasoned investors into a mindset of constant frugality, delayed gratification, and a singular focus on wealth accumulation. However, research reveals the limitations of this approach.

The Happiness Plateau

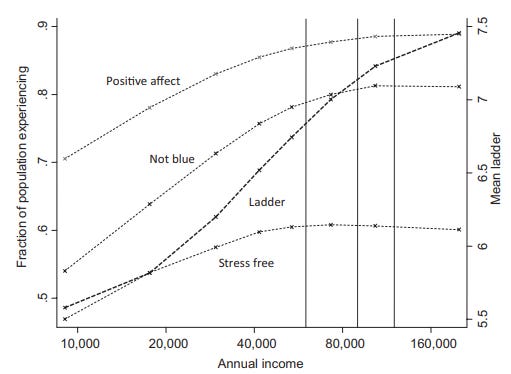

A Princeton University study found that happiness derived from income plateaus at an annual salary of $75,000. Beyond this point, additional earnings bring diminishing returns to life satisfaction. This is often called the “happiness threshold.”

Read their wonderful study by clicking here

The Power of Meaningful Activities

A separate study published in the Journal of Positive Psychology highlighted that people who invest time in meaningful activities—such as nurturing relationships, pursuing hobbies, or volunteering—report significantly higher happiness levels than those who focus solely on financial success.

The Balanced Investor: Diversify Your Happiness Portfolio

Think of your life as a portfolio. In addition to financial wealth, it includes personal growth, relationships, and physical and mental health. Here’s how to “allocate” your time and energy for maximum returns.

1. Compound Your Skills

Why it matters: Just as compounding interest works wonders for your investments, compounding skills and knowledge improves your quality of life.

Research Insight: A Harvard study found that individuals who continually pursue personal growth report greater resilience, creativity, and long-term happiness.

Action Steps:

Dedicate 1-2 hours weekly to learning something unrelated to investing, such as cooking, painting, or photography.

Take a course that sharpens your non-financial skills (e.g., public speaking, coding, or creative writing).

Journaling allows you to reflect on your progress. Apps like Day One or a simple notebook can help you track growth over time.

2. Strengthen Your Relationships

Why it matters: A 75-year-long Harvard Study of Adult Development revealed that the quality of relationships is the strongest predictor of happiness and health. People with strong social bonds live longer and are happier.

Action Steps:

Schedule weekly “social investments,” like having dinner with close friends, calling family, or playing chess with a buddy.

Volunteer your time or mentor others. Research from the University of Exeter shows that volunteering boosts happiness and self-esteem.

Rekindle old friendships or join a club (e.g., chess, hiking, or book clubs) to meet new people.

3. The Foundation of a Rich Life

Why it matters: Without health, wealth becomes meaningless. Virgil’s famous quote still resonates: “The greatest wealth is health.”

Research Insight: A study published in The Lancet found that regular physical activity reduces the risk of depression by up to 26%. Similarly, mindfulness practices like meditation lower stress and improve focus.

Action Steps:

Start a fitness routine. Even 20 minutes of walking daily can make a difference.

Practice mindfulness for 10 minutes a day. Apps like Calm or Headspace are great for beginners.

Track your sleep and nutrition. Wearables like FitBit or apps like MyFitnessPal can help you stay consistent.

‘‘Health is the first wealth." – Ralph Waldo Emerson

Solid Actionable Blueprint for a Balanced Life

Step 1: Assess Your Life Portfolio

Create a “Life Portfolio Allocation” chart to visualize how you allocate time and energy. For example:

40% Personal Growth

30% Relationships

20% Health

10% Financial

Reflect: Which area needs more investment?

Step 2: Set SMART Goals Beyond Money

Define what a rich life means using the SMART framework (Specific, Measurable, Achievable, Relevant, Time-bound). For example:

Travel to three new countries in the next year.

Host a dinner party every two months.

Run a 5k in the next six months.

Step 3: Reallocate Resources

Automate financial tasks (e.g., savings and investments) to free up mental bandwidth.

Use saved time to prioritize neglected areas like health or relationships.

Step 4: Build Daily Systems

Incorporate habits into your daily routine:

A fitness tracker for health goals.

A planner for scheduling social time.

Journaling to track personal development.

Step 5: Quarterly Check-Ins

Revisit your “Life Portfolio” every three months.

Adjust allocations based on what’s working or needs improvement.

Challenge: Take Action in 7 Days

Here’s a simple challenge to start building a balanced life:

Day 1: Reflect on which area of life needs attention. Write it down.

Day 2: Schedule one small action, like calling a loved one or going for a walk.

Days 3-5: Spend 15 minutes each day working toward a personal growth goal.

Days 6-7: Reflect on how these actions made you feel and plan your next steps.

What did you focus on this week, and how did it feel?

Final Thoughts

Charlie Munger famously said, “The big money is not in the buying and selling, but in the waiting.” The same applies to life: plant seeds in your health, relationships, and personal growth, and watch them flourish over time.

What’s one area of your life that you’ve been neglecting? What small action can you take today to start investing in it?

By diversifying your life portfolio, you’ll not only build wealth but also create a meaningful, well-rounded life.

Thank you for taking the time to read this article. In a world that often equates success with financial wealth, you’ve taken a step back to reflect on something deeper: what it means to live a truly fulfilling life. That alone sets you apart.

Remember, investing is about more than just money—it’s about building a life where every “asset class” flourishes. Your relationships, health, personal growth, and joy are just as critical to your overall portfolio as your financial returns. After all, the richest life is one where your heart, mind, and spirit are as abundant as your bank account.

So, as you continue your journey toward financial success, don’t forget to invest in the things that make life worth living. Wealth is not the end goal—it’s the tool that allows you to craft a life that you and those around you can cherish.

Here’s to building a balanced portfolio of happiness, health, and prosperity. You have everything you need to start today—make it count.

Reach out. Connect deeply. Live fully.

Disclaimer

By reading my posts, subscribing, following me, and visiting my Substack in general, you agree to my disclaimer. You can read the disclaimer here.