Hello friend! 👋

My name is Yorrin, also known as ‘‘Fluentinvalue’’.

I am pleased to have you here for another interview! Today we are interviewing

from Atmos InvestCheck out the previous interview here:

If you’re currently not yet following me, consider doing so. I provide FREE content to help and inform you in your investment journey. From beginner to advanced, all info will be helpful. :-)

Subscribed

Kevin | Atmos Invest

I have been a follower of Kevin’s work for months. When I came across Kevin’s content over on X I knew I just found a goldmine of quality content. From excellent infographics, quality arguments, and top-tier content I knew I had to get him on for an interview, here we are.

In this interview, we will:

Get to know Kevin

Hear about his journey

Hear his views on niche markets and businesses

Know what Kevin looks for in niche businesses

Know how Kevin assesses the scalability

Know how Kevin analyzes the competitive landscape of a (small) business

Hear his biggest successes and pitfalls

And much more!

If you’re not yet following Oguz, check out his X & newsletter:

Click here for Kevin his Twitter/X

Click here for Kevin his Substack

Tell us a little bit about yourself. Who are you, where are you from, how old are you, and what are your hobbies besides investing?

I’m 43, living in Belgium with my wife and 8-year-old son. I graduated as a nuclear engineer and have been working in the nuclear industry since college. I developed a passion for finance and investing about 10 years ago. When I’m not reading books or annual reports, I enjoy gaming with my son, running, or dining out with the family.

Why did you start sharing your thoughts and opinions on X and Substack and what do you hope to reach with it in the short & longer term?

I do not know a lot of investors in my immediate surroundings who are as nerdy about the investing process as I am. So, my main goal when I started sharing my writings publicly was to connect with some amazing human beings who share this healthy obsession with the stock market. A second goal is to learn about the world through the lens that is business. The thing that has made humans so successful over the last 50,000 years is our ability to cooperate. Building a business is a prime example of how humans get together to achieve something no person can do alone. I find that fascinating. Researching a business like Adyen has shown me what happens when I swipe my card to buy something. I’ve researched several Polish companies in the past and now know a lot more about Poland as a country. I’m naturally curious about the world. The last goal was to learn in public and hopefully get some pushback on my writing. I do not have any specific goals to get to a certain number of subscribers or followers, I focus on the inputs and write 1 article every week. I consider it an honor that people read them and I enjoy the connections we make.

What are some driving factors that set you apart from others? (Experience, knowledge, etc) and how did this come about

That’s a great question. First off, there’s still an enormous amount I still need to learn. Humility is key I think. I was trained as a process engineer, so my natural tendency is to try to distill the investing process into tools and checklists to help me guide my decisions. On the behavioral front, I’m someone calm and rational. At my job, I’m the person people go to when things are overheating and they need a neutral analysis of the problem at hand. Instead of developing my weaknesses, I actively developed my strengths and honed in on these traits.

Can you share your journey into the world of investing, highlighting the pivotal moments that shaped your approach?

My journey is riddled with a mountain of mistakes. I went from investing in commodities like gold and platinum to crypto to blindly buying a company my bank recommended. These mistakes have nothing to do with the asset classes I mentioned. They have to do with the fact that I had no idea what I was doing. I was just betting on something to go up. The company I bought after being recommended by my bank (Mithra Pharmaceuticals) filed for bankruptcy last week. I lost 90% on that investment. Luckily it was only a small position. Only after reading several books on investing, and applying what I had learned did I start seeing some results.

I think there are 3 things you need to succeed in investing:

Know yourself, so that you can figure out what your edges are and align your strategy with your temperament.

As Peter Lynch has said, know what you own as it is the only way you can profit from the volatility of the stock market.

Luck. It’s important to avoid linking a mistake to the outcome. You can lose money and in hindsight still make the best decision. Or you may have made a terrible decision, and still get great results. I try to be humble and acknowledge luck in my investing results.

My current investing strategy can be described as spaghetti with hot sauce. I look for high-quality compounders that you can buy on a short-term pullback in price (the spaghetti). But I like something exciting, some spice when I eat spaghetti. So I add quality microcaps (the hot sauce) to the portfolio. These microcaps are not forever holdings, so they allow me to scratch that itch to trade and leave those high-quality compounders alone. It’s my current dual strategy where I think both styles reinforce each other.

What specific attributes do you look for in a (small), niche business before deciding to invest?

I look for high gross margin, cash-rich companies with low or manageable debt. Small businesses are by definition more fragile so I look for traits that reduce this fragility. Management and capital allocation skills are even more important with small companies as a bad decision can ruin the company.

The business has to be simple to understand, but this is usually the case when you go look for smaller companies. The company has to have a solid balance sheet. Small businesses are by definition more fragile, so the balance sheet comes before the income statement. Value equals growth, so the business needs to be growing its free cash flow. I like niches because there still is the possibility to find local competitive advantages. A small company rarely has a MOAT. They are still in the process of building their castle. The only way to find a company of this size with competitive advantages is as Bruce Greenwald says, to look for local competitive advantages. So the idea is to be very thoughtful about choosing your hunting ground or the game you want to play. If you choose the road of quality microcaps, you won’t have to compete with institutional investors who have a lot more resources and time than I have. But, be prepared for a lot of volatility and illiquidity. A microcap gaining or losing 50% in a day could be normal. I wouldn’t recommend this approach when starting as an investor.

Can you describe your evaluation process when assessing the potential of a new investment opportunity (with an example like your most recent investment)?

Here are the steps I use:

Step 1: Idea funnel or screener: sourcing investment ideas

Step 2: Quick check for red flags

Step 3: Create a one-pager, and write a summary, how SPECIAL is the company?

Step 4: Do a deep dive, and read everything I can on the company

Step 5: Put my analysis away for a couple of weeks to avoid commitment bias

Step 6: Reread my analysis, do a final check, and compare the opportunity cost. Is it better than what I already own or other opportunities?

These are the steps I used when I took a small position in Connexion Mobility, an Australian software company, catering to the fleet management business.

What are some red flags or warning signs that could immediately deter you from a company? Did you ever ignore one and face the consequences?

I want high insider ownership, ideally, several people in management own a part of the company. An increasing amount of cash on the balance sheet. Capital allocation decisions that benefit all shareholders. An upward future secular trend.

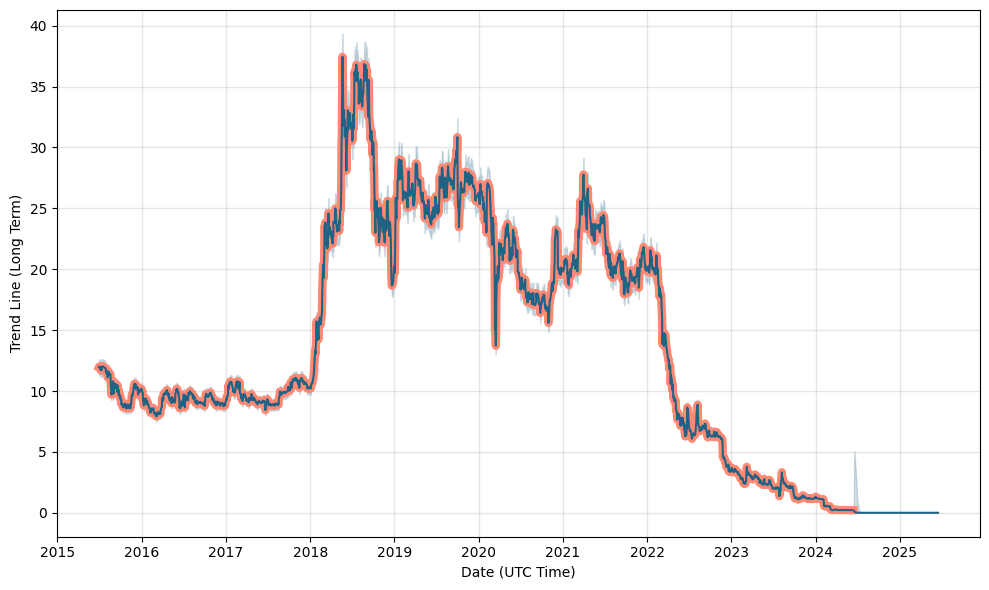

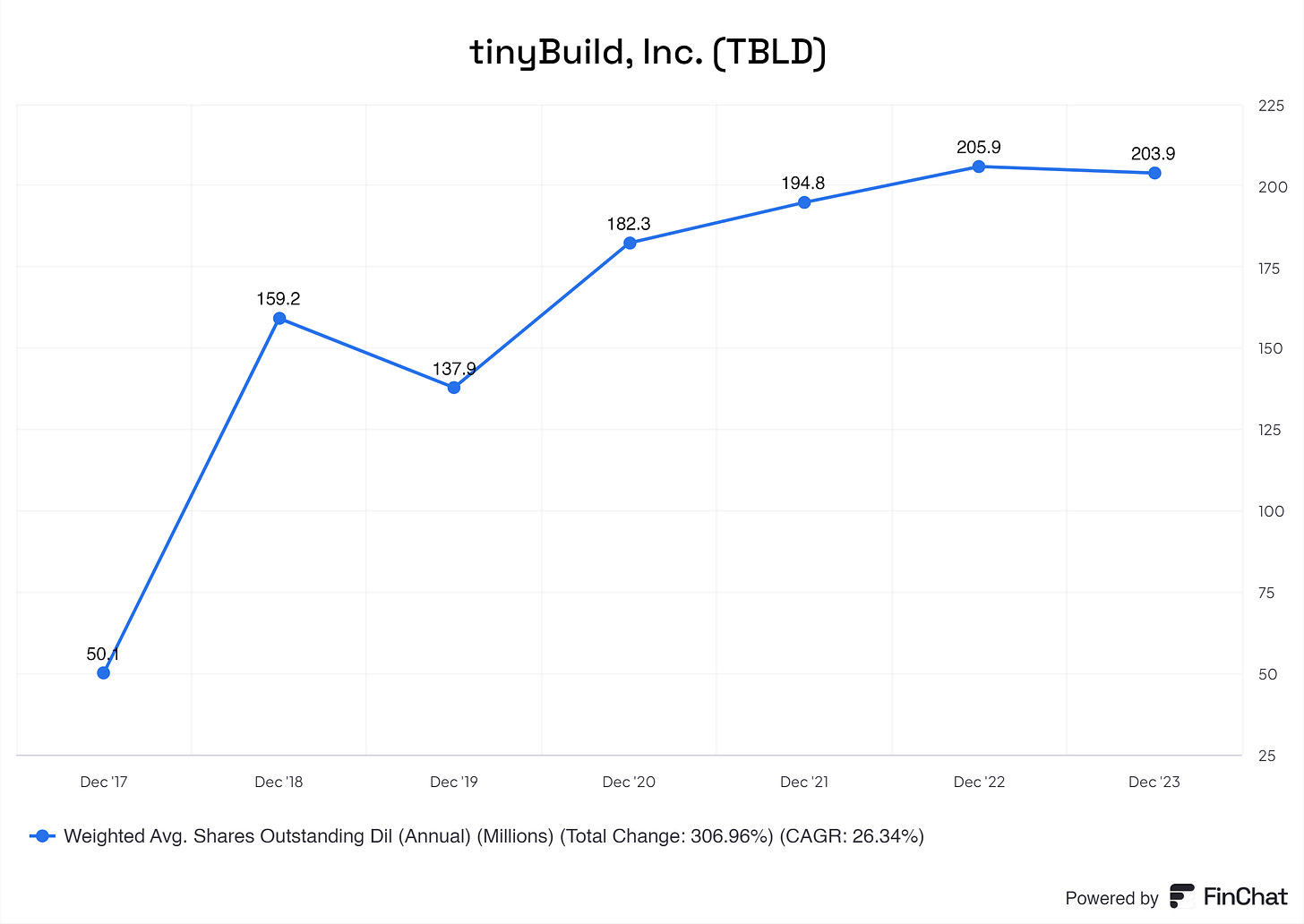

I’ve never ignored these in the past, but I misjudged them. An example is a small gaming company called Tinybuild (Ticker: TBLD). They had a pretty good cash position when I invested, but I greatly underestimated their cash burn to fuel their business operation. As a result, the company had to dilute and raise equity to keep the business going. This helped me to refine my process and look more deeply at working capital requirements, metrics like the cash conversion cycle, and the possible need for a capital raise.

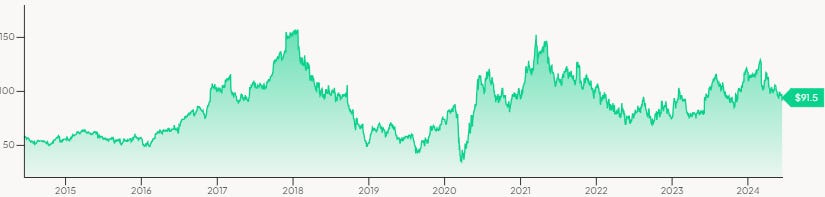

Editors note: currently TinyBuild Inc. has 397.22M shares outstanding which are not taken into the graph (HUGE dilution)

How do you evaluate the innovation potential of a small business, particularly in niche markets?

For innovation, I have to talk about Phil Fisher. Does the company actively look to build new product/service lines? How much is being spent on R&D? How are they investing for future growth? Do they need a lot of capital to grow? I don’t think this analysis differs from bigger companies in niche markets or not.

What aspects of a business model do you find most critical when deciding to invest (and why)?

I prefer a business model that brings in recurring revenue, which in some way ties the customer more tightly to the business. The ideal business model has some sort of network effect, but these are rare. Every analysis should include a deep dive into how the business makes money.

How do you assess the scalability of a small business operating in a niche market?

This is more tricky because it's sometimes harder to find data on potential market size when looking into smaller markets. The consequence is that it can take sometimes longer to research a small company because of the difficulty of finding sufficient data. Also, for a small company in a niche market, more often than not, its competitors are not public. So the way to asses scalability is identical independent of size, but it can be more challenging because of the lack of data.

How do you analyze the competitive landscape and position of a company within its niche market?

This is the same as the previous question. If you’re lucky, based on what type of market it is, you could do some scuttlebutting, and visit stores, competitors, and clients. This is a great way to increase the quality of your analysis.

How do you judge a company’s ability to adapt to market changes and disruptions?

It’s one of the questions on my checklist and depends on the nature of the business. One of my newest questions which I learned from Ian Cassel is: How can the company grow through a recession? I haven’t figured out exactly how to approach this but these are all important questions to ask when analyzing a company. We can also invert the question: Is the product or service the company is selling inevitable? Will it still be needed in a decade or 2?

How do your values and beliefs influence your investment decisions?

I’ve learned to remain flexible. To not cherish my current beliefs too firmly. What worked yesterday or today in the markets might not work anymore tomorrow. But there are some values or virtues I would never compromise on. Integrity. Hard work. Treating others as you would like to be treated. These I cherish, in life and business.

How do you mentally and strategically recover from a failed investment?

Every loss hurts. We know it hurts more than a win. I think it’s important to stay grounded in reality. If you’re playing the investing game, then you’re probably already better off than 90% of the world’s population. (a great book to get grounded and also more hopeful about where the world is going is Factfulness) In other words, I feel blessed that I’m able to do this. There are far worse things in life than a monetary loss. Thinking this way helps to temper emotional reactions in investing. As mentioned before, you do need to distinguish a loss from a mistake. Emotionally I have no problem with a loss, but if I make a dumb mistake, that can linger. My way to cope with this is to analyze the mistake in detail, write it down, and share it publicly to own it. Of course, I only manage my capital. A professional investor, managing other people’s hard-earned money might think differently

What has been your biggest success in your investment journey?

I would first state that the amount I’ve learned over the past decade I consider my biggest success. I’m not the investor I was a decade ago, and I hope to continue to learn in the next 10 years. When it comes to stock investing, I had a couple of multi-baggers in my portfolio. The first is Thor Industries, which I owned since 2019. I mentioned this one because it is the very first company that I knew, following Peter Lynch’s advice. I bought it at its low of 45 USD in 2019. When the COVID crash happened I was scrambling to gather all the cash I could find to buy more and managed to at 35 USD. I figured the lockdowns could potentially cause a boom for everything related in sales to the outdoors. I then sold all my shares at about 120 USD a year later very close to the top. I figured the outdoor rush was calming down and Thor looked overvalued at the time. But still, I was lucky to sell it near the top.

A second multi-bagger was Inmode, which I bought in the summer of 2020. There was a big discrepancy between its financial performance and the price in the market. It then went on a bull run in the following year and again I managed to sell close to the peak. I got back into Inmode about a year ago, but the investment case has changed now.

My conclusion for these 2 investments: I knew the companies very well which helped me to buy them at a good price. However, I have to admit I got lucky as I sold both of them close to their peak. These are smaller companies, but not the microcaps I’ve been looking into recently.

What has been your biggest failure and what did you take away from it?

As I mentioned before, my biggest failure was my investment in Tinybuild. The biggest mistake was not to have misjudged its working capital requirements but to oversize its position in my portfolio. Being in a bull market, I had experienced a string of multiple successes. Hubris kicked in. I thought I could size just like Charlie Munger, and bet big on my biggest conviction. So I increased the size of my position and suffered a big unrealized loss. I still hold the company and it has been executing well recently. But I might trim the position if I find a better investment opportunity. A lot of loss aversion is going on. But every day you wake up, you should be able to reset your portfolio to 0. What is the best opportunity today? And act accordingly. Since that costly mistake, I now size a position based on the amount of downside risk and no longer on my judgment of upside potential.

What are books, websites, videos, or any content you would recommend to the average investor to step up their game a little more?

There are many. One of my favorite books has nothing to do with investing: Atomic Habits because it teaches you how to build great habits that may eventually lead to great outcomes in health, life, and investing. Another book I love is Viktor Frankl’s Man’s Search for Meaning which tells his experiences as a psychiatrist in a concentration camp during the Second World War. It shows that a person is only in control of how he or she reacts to a certain situation. I think that’s important in investing and life. My favorite investing read is the Nomad Partnership Letters by Nick Sleep. Some of my favorite podcasts are the JRo Show by John Rotonti Jr. because of his focus on the investing process and of course podcasts like We Study Billionaires and Chit Chat Stocks.

Can you provide a detailed analysis of sectors or industries you currently view as undervalued, and explain the underlying factors driving your perspective

I’m a generalist and do not focus on any specific sectors. I do however focus more on countries like the United Kingdom, Poland, and Australia. These are more fertile hunting grounds for undervalued quality companies.

Is there a final message or insight you'd like to share with our audience about your investment philosophy, future projects, or the broader financial landscape?

My current investment philosophy has changed a lot over the last 10 years, and will probably continue to change in the future. I’ll continue to share my learnings every week and hope others get some use out of it. I’m a fundamental investor, so I follow the macro from very far away. I’m convinced the markets have spurs of inefficiency, and as long as there is a human factor involved, these inefficiencies will remain and money can be made.

Finally, what message or advice would you like to share with your audience, especially those who are just starting their investing journey?

You can read and learn as many books or articles as you can, nothing trumps experimenting and learning by doing. So I would recommend making small bets and learning from them. I only started at the age of 33, but with hindsight, I would start playing around with a small amount of capital as soon as possible. And if you lose money, put in a double amount of effort to analyze why this happened. Learn the language of accounting, without it, you should not invest in companies. A last piece of advice is the amount of time and curiosity you have. If you have no interest in reading an annual report, or you do not have the time to read them, I would just buy an index. It all comes back to knowing what you own. I have a lot of friends who are not interested or do not have the time to learn about a company. And when they say they just bought Amazon or Alibaba or any company that was featured in the media, I always ask them: What will you do when it drops 30%? If the answer is: I do not know, or I might sell. Get out. Now.

⚡Lightning round

If you could only rely on 10 metrics when you’re checking the income statement, balance sheet, cashflows, or KPIs, which 10 would you choose and why? (Think about total revenue, fcf, debt to equity, etc)

Growth: Sales growth, Past FCF/share CAGR - Normalized EPS growth

Efficiency: Past ROIC, ROIIC, reinvestment rate, CAPEX/sales

Fragility: Cash position growth, Long-term debt/earnings

If you were granted 100.000 cash to invest, lump sum, over 5 positions, which ones would you choose and why?

I’ve learned to build positions very slowly and take my sweet time. 5 positions is an extremely concentrated portfolio, too concentrated for my taste (I hold 11 positions). If I were forced to take 5 positions at 20% each, I would look for companies with great growth prospects (secular trends), very low downside risk, and companies that have already won (with big MOATs and will keep winning). I couldn’t build a microcap portfolio with only 5 positions. It’s too risky. I would look for 5 high-quality compounders and let them earn for the long term. In my portfolio, I combine these high-quality compounders with quality microcaps.

If you have 10 minutes with Peter Lynch, what would you ask or discuss and why?

What is so special about Mr. Lynch is the returns he achieved with the sheer amount of positions he had taken in the past. It was not easy. He made a lot of sacrifices and worked harder than anyone. I would probably ask questions like: What would he change or keep the same? Compared to those times, would he invest differently now? Can his success be attributed to a couple of big investments (like Buffett).

Would you rather invest in a groundbreaking tech startup with high risk but potentially massive returns, or a stable, well-established small business with steady, predictable growth?

I would go for the latter. Predictability is underrated. But you didn’t mention the price, and in the end, the price is all that matters!

If you could invest in any fictional company from a book, movie, or TV show, which one would it be and why?

True Blood from the True Blood series. It’s a small company in a very niche market with a monopoly!

Would you rather have Warren Buffett or Peter Thiel as a personal mentor for a year, and why?

Peter Thiel, because there’s a lot more written by and on Buffett. If you read everything available, I’m not sure you’ll learn a lot of new things.

✅ Do’s and ❌ Don’ts

Do

Know yourself

Know what you own

Price always matters

Volatility is your friend

Always remember the opportunity cost

Don’ts

Avoid high leverage

Don’t focus on profits, cash is what matters

Don’t copy a position, build conviction first

Don’t stress, if you’re investing, you’re doing fine

Don’t buy the story if the numbers are not aligned

That is it for today!

What an episode! Kevin has shown what I said in the intro, providing quality and excellent insights.

I want to thank Kevin for participating in this interview. I gained a lot of valuable information and I am thrilled to see more of Kevin in the future.

Do you want to see and read more from Kevin, follow Kevin on X and Substack via the links at the top of this interview.

Disclaimer

By viewing and reading articles published by Yorrin (FluentInValue) you agree to the disclaimer. You can read the disclaimer here.

I am enjoying the articles from Kevin. Does he have any podcasts that anyone has done with him on Youtube? Twitter?