Hims and Hers; Redefining Wellness and Telemedicine for a New Generation

How the Direct-to-Consumer Health Brand Is Revolutionizing Access to Personal Care, One Click at a Time

Hey there, partner! 👋

Before we dive in, I need your support to keep these articles FREE.

If you're enjoying this content, here's how you can help:

Like the article

Please share it on your social media

Comment below to join the conversation

Your engagement means everything. Thanks for being part of the journey! Now, let's get started.

Welcome back to another deep dive into the world of investments. Today, we’re shifting gears to analyze Lululemon—the reigning titan of the activewear industry.

If you’re new here or missed my previous articles, feel free to catch up:

If you haven’t already, hit that follow button for FREE insights to fuel your investment journey. Whether you’re just starting or a seasoned investor, there’s something here for everyone.

Once you’ve finished this analysis, I’d love to hear your thoughts! Be sure to comment, drop a like, and share it with your Substack community if this resonates with you. Your support makes all the difference! 😊

Table of contents

Corporate Analysis

1.1 Business Overview

1.2 Revenue BreakdownExecutive Leadership

2.1 CEO Experience

2.2 Employee Satisfaction Ratings

2.3 CEO Value CreationInside- and institutional ownership

Competitive and Sustainable Advantages (MOAT)

Industry Analysis

5.1 Current Industry Landscape and Growth Prospects

5.2 Competitive LandscapeRisk Assessment

Financial Stability

7.1 Asset Evaluation

7.2 Liability AssessmentCapital Structure

8.1 Expense Analysis

8.2 Capital Efficiency ReviewProfitability Assessment

9.1 Profitability, Sustainability, and Margins

9.2 Cash Flow AnalysisGrowth Analysis

10.1 Historical Growth Trends

10.2 Future Growth ProjectionsValue Proposition

11.1 Dividend Analysis

11.2 Share Repurchase Programs

11.3 Debt Reduction StrategiesFuture Outlook

Quality Rating

SWOT Analysis

Valuation Assessment

Conclusion

1. Corporate Analysis

Hims & Hers Health, Inc. operates a multi-specialty telehealth platform that connects consumers to licensed healthcare professionals. The company offers a range of health and wellness products and services that customers purchase on its websites and mobile applications. It also provides prescription medication repeatedly and ongoing care from healthcare providers; it also offers over-the-counter drug and device products, cosmetics, and supplement products, primarily focusing on wellness, sexual health and wellness, skincare, and hair care. The company's curated non-prescription products include vitamin C, melatonin, biotin, and collagen protein supplements in the wellness category; moisturizers, serums, and face wash in the skincare category; condoms, climax delay spray and wipes; vibrators, and lubricants in the sexual health and wellness category; and shampoos, conditioners, scalp scrubs, and topical treatments, such as minoxidil in the hair care category. In addition, it offers medical consultation services, as well as health and wellness products through wholesale partners. The company is based in San Francisco, California.

1.2 Revenue Breakdown

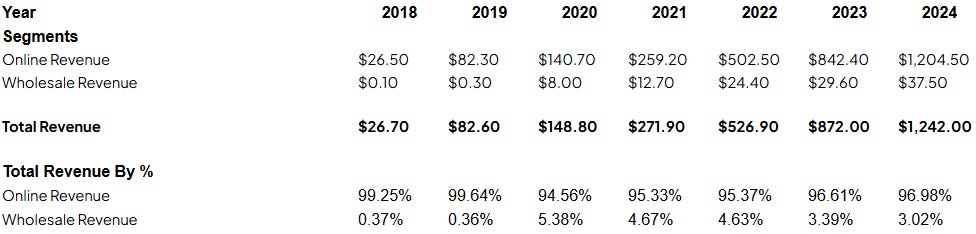

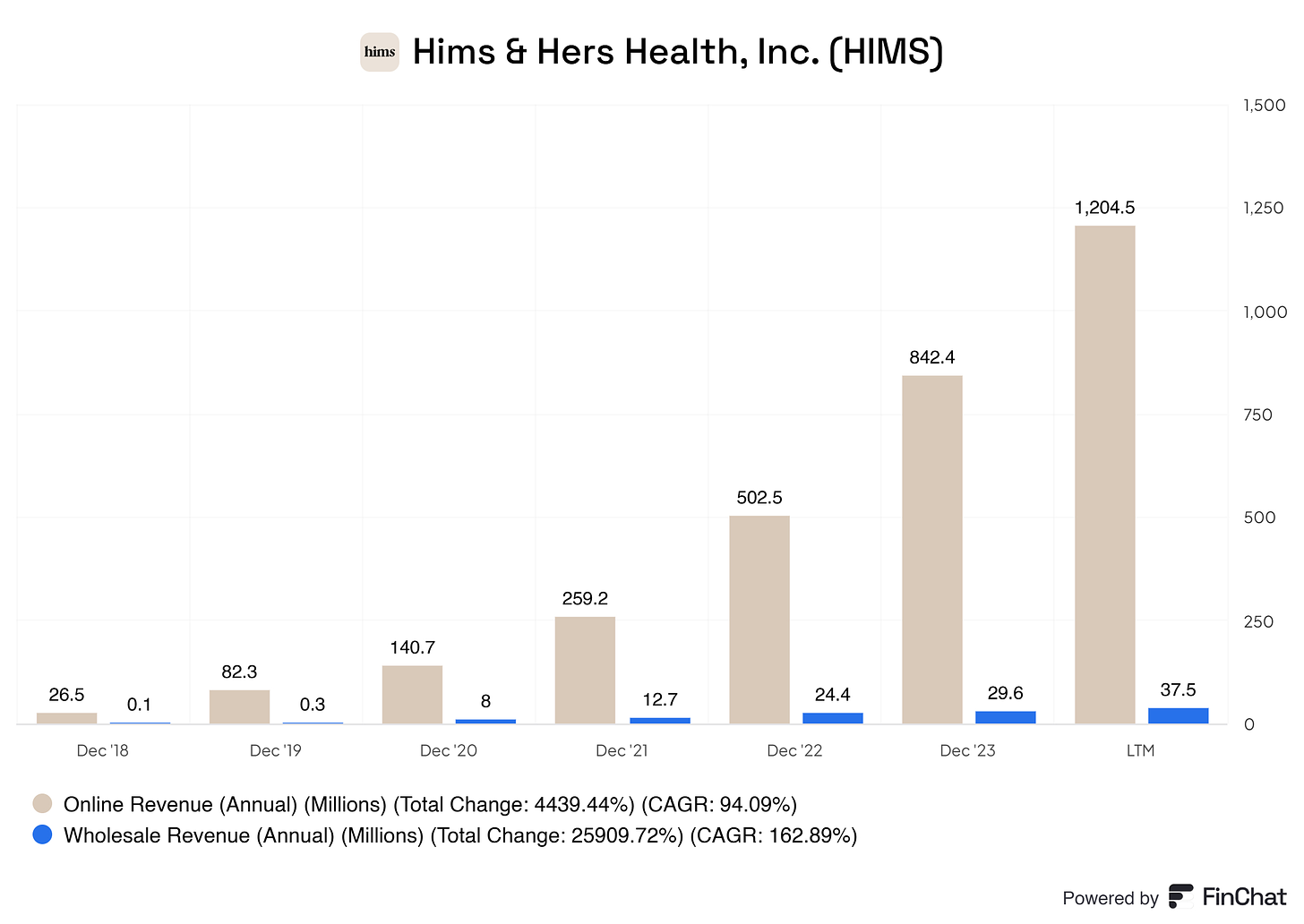

Hims and Hers's product lines are split into Wholesale and online Revenue. Unfortunately, Hims and Hers does not report what product sells the best or worst per category.

Online Revenue: This includes sales of products and services on the Hims & Hers platform, primarily through subscription-based models.

Wholesale Revenue: This includes non-prescription product sales to retailers through wholesale purchasing agreements and to third-party platforms through consignment arrangements.

If we examine the percentages of Hims and Hers, we can see that online revenue is the primary revenue driver. Hims and Hers is a telemedicine business, so we could’ve expected dominant online sales.

Management of Hims and Hers said in their Q3 2024 earnings call that their primary focus will remain on their online sales and subscriptions. This segment offers the best margins and aligns with their strategic focus for the longer term, which I agree with. While wholesale revenue is profitable and helps with brand awareness, it complements the core online subscription business. Hims and Hers focuses on acquiring, retaining, and expanding relationships with its online subscribers, emphasizing the subscription business strategically.

The table above shows that Hims and He’s online revenue is roughly 96.82% of their total sales. As wholesale will continue to grow, I am confident that online revenue will grow at a more rapid rate due to the strategic plans of its management.

Management focuses on expanding their personalized solutions, leveraging technology, investing in automation and capacity, exploring strategic M&A opportunities, and concentrating on subscription-based customers; management had the following to say about this in their Q3 2024 earnings call:

"We are continuing to expand the variety of personalized solutions available on our platform, including more form factors, multi-condition treatments, and dosage options."

"Leveraging technology to enable more efficient provider communication and support for patients has driven strong retention rates for our GLP-1 weight loss solutions."

"We are investing in automation and capacity at our affiliated pharmacies to support the growing demand for personalized solutions, including GLP-1 treatments."

"We are exploring strategic M&A opportunities that could accelerate the evolution of our platform and capabilities."

"We maintain a focus on acquiring, retaining, and expanding relationships with our subscription-based customers, who now make up the majority of our revenue."

Now, let us dive into the global diversification of Hims and Hers!

Hims and Hers solely operates in the United States across all 50 states and the United Kingdom. In early 2021, it acquired a UK-based Honest Health Limited, which allowed it to start a business in the UK. It is now operating as Hims and Hers UK Limited.

Unfortunately, Hims & Hers Health, Inc. does not provide a revenue breakdown by country in their earnings calls, quarterly or annual reports. The available documents focus on the company's overall financial performance, key business metrics, and strategic initiatives but do not specify revenue generated from different geographic regions.

Hims and Hers also did not mention any current or future global expansion. Their primary goal is the company’s performance, growth, and strategic initiatives within the United States.

2. Executive Leadership

2.1 CEO Experience

Andrew Dudum is the co-founder and CEO of Hims and Hers; let's explore his experience and past endeavors more deeply.

Founder & Chief Executive Officer

Hims & Hers

September 2016 – Present (8 years, 3 months)

Hims & Hers offers a modern approach to health and wellness. Its mission is to eliminate stigmas and make it easier for people to access care and treatment for conditions that affect their daily lives. The company aims to create an open and honest culture of care accessible to everyone, regardless of who they are or where they live. Since its launch in November 2017, Hims & Hers has raised over $200 million in funding and has become one of the fastest-growing direct-to-consumer brands in history.

Cofounder & General Partner

Atomic

2013 – Present (11 years, 11 months)

Atomic is both a company builder and a venture fund. The firm prototypes new companies and assembles teams to scale the most promising ideas into independent ventures. Founded in 2013, Atomic has been supported by prominent investors such as Peter Thiel, Marc Andreessen, and other leading venture capitalists in Silicon Valley. Atomic operates out of the Presidio in San Francisco.

Partner

Cherubic Ventures

November 2016 – Present (8 years, 1 month)

Cherubic Ventures is an early-stage, technology-focused venture capital firm based in Silicon Valley and Greater China. The firm’s mission is to connect Silicon Valley with Greater China and to become the best and earliest partner to the next iconic company. Cherubic Ventures has built a community of over 100 portfolio companies, 200+ founders, and 300+ founder advisors, VCs, and corporate partners to support its most talented founders as they grow their businesses.

Founder

LendforPeace.org

September 2007 – 2013 (5 years, 5 months)

LendforPeace.org provided direct micro-loans to Palestinian women in the West Bank and Gaza. In 2012, LendforPeace partnered with Kiva to utilize the Kiva.org platform for loan management and capital distribution. Major investors and advisors included Craig Newmark of Craigslist, the Clinton Global Initiative, Ashoka, USAID, the Harvard Kennedy School’s International Consulting Organization, and the Davis Project for Peace.

Education

The Wharton School

Bachelor’s Degree, Management & Economics

At Wharton, the curriculum focused on new product development and venture capital. Andrew was active in the Private Equity & Venture Capital Club, Wharton’s Venture Initiation Program, and the Beta Theta Pi fraternity.

2.2 Employee Satisfaction Ratings

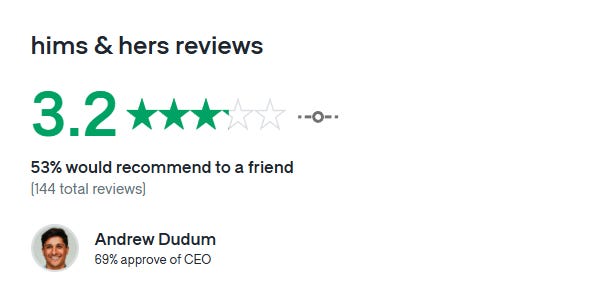

So, Hims and Hers does not score well with the (ex) employees who have left a review of the business. Hims and Hers currently has 1.046 employees. These types of smaller firms usually show a relatively high score on Glassdoor.

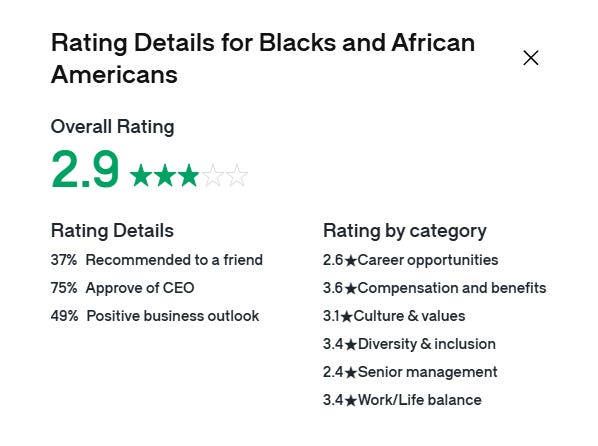

According to Glassdoor, Hims and Hers scored rather awfully with the Black or African American employees; this group gave Hims and Hers a 2.9 out of 5. If I take a closer look at the reviews, this is primarily driven by the lack of diversity within the business; someone wrote:

‘‘My entire team (besides the senior manager who was Indian) was all white women (I am a Black woman), and only my manager seemed to be welcoming (at the beginning); since my role wasn’t clearly defined, I tried to do my best to offer solutions to problems that I could identify and my other team members either completely dismissed me or responded with utter disinterest."

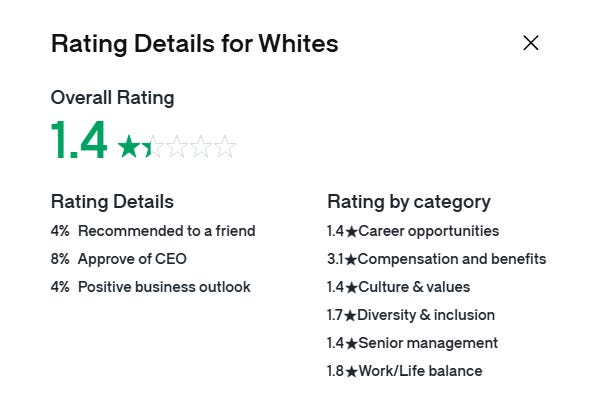

Hims and Hers also score a whopping 1.4 under the white group.

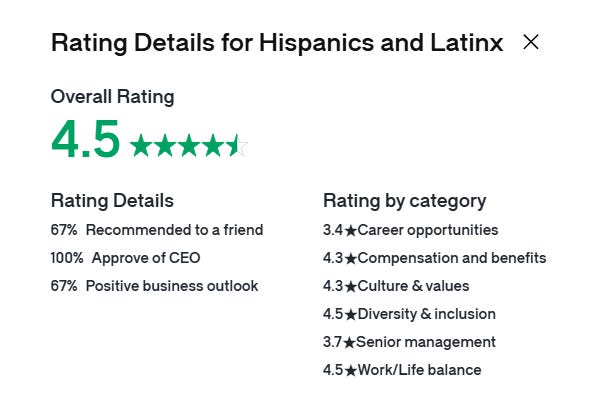

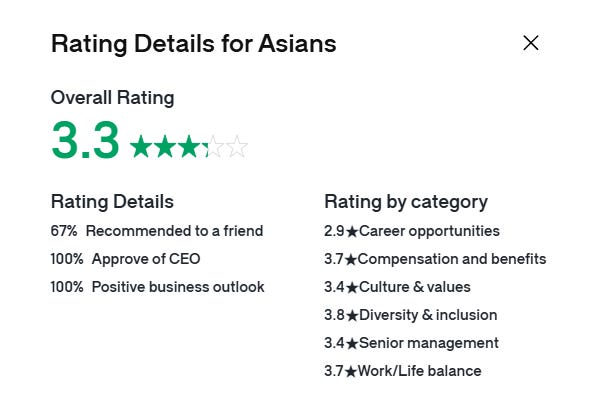

Hims and hers do seem to score better among the Asian group and the Hispanic or Latinx group, as of now.

There are many mixed reviews for Hims and Hers, but, as I mentioned earlier, I expect a business of this size, with just over 1,000 employees, to score better. It is more common than not that these types of smaller firms have a closer and more connected culture. The fact that Hims and Hers are lacking in groups does ring some alarm bells.

A counterargument can be that a firm in its hyper-growth phase might be focused on its financial goals rather than its culture. However, I am convinced that growth comes from a warm and good culture within the business. Hims and Hers could be well-off trying to improve their overall culture within the business, but that’s my hot take on their culture. I do not run a business and trust Andrew and his management.

I usually give the following analogy to investors who do not think a good culture has any impact.

Imagine you’re in a family with a father, a mother, and three other siblings. Your father and mother are managing, ensuring everything goes according to plan in its household or other daily tasks. If the siblings are rivaling, being a nuisance, not feeling appreciated, needing more validation, or quickly drifting off, Then there’s a poorer family, right? Fixing your household will result in more trust and growth over the long term.

Would you agree with me here?

2.3 CEO Value Creation

Alright, enough about the culture of Hims and Hers. Let us dive into the value that it, or isn’t, created by the CEO Andrew Dudum.

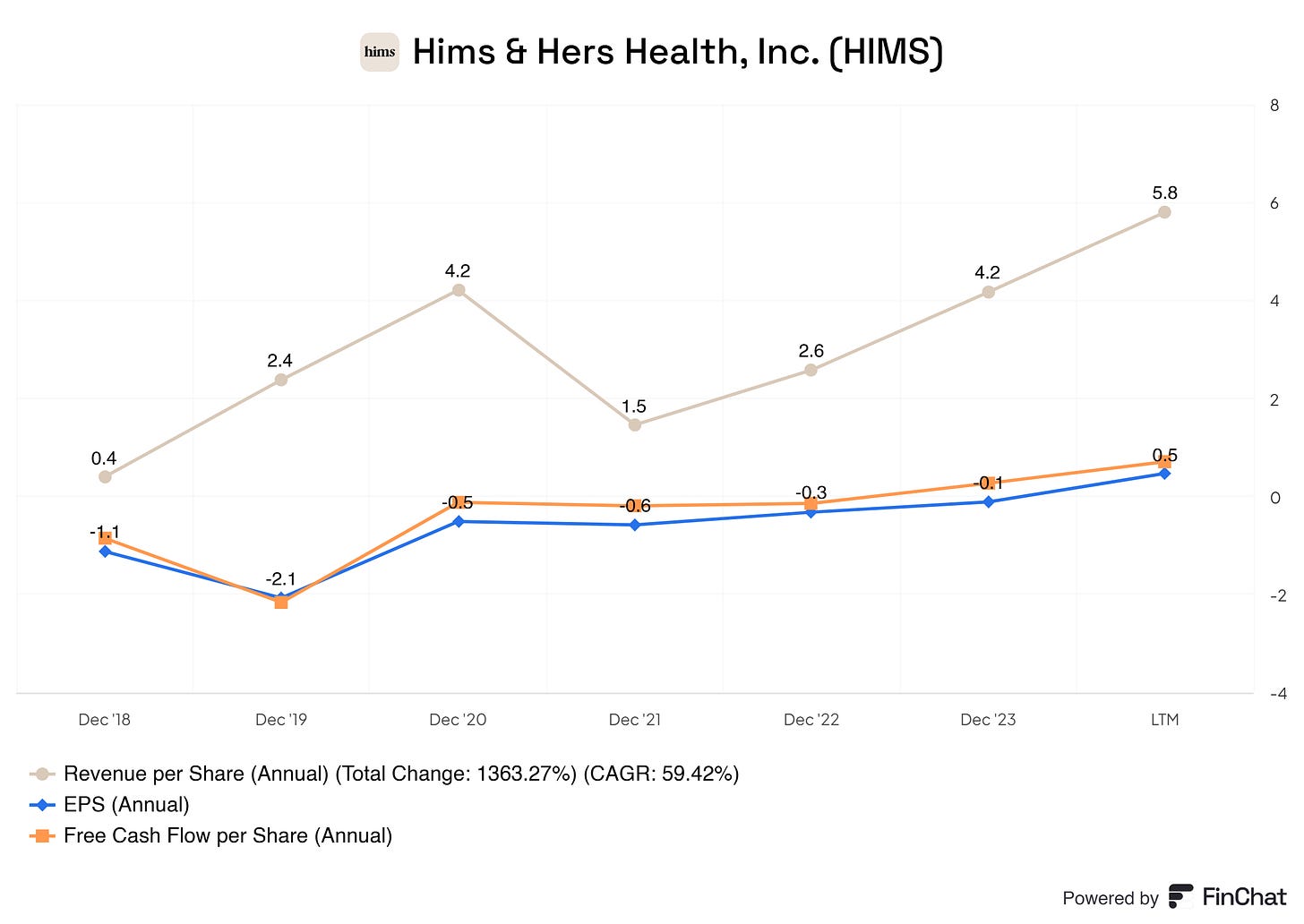

Hims and Hers is growing; it’s in his growth phase. Therefore, I will be more ‘gentle’ concerning their EPS and Free Cash Flow per share. When a business is in its growth phase, its EPS and FCF per share can be everywhere.

Hims and Hers show solid and sustainable revenue per share growth. Their EPS and FCF per share are not all over the place, but they are improving overall YoY. This indicates that Andrew Dudum and management manage their per-share segment well. I see a clear path, sustainable growth, and a promising trajectory for their per-share segments.

Therefore, I would say that Andrew and management are creating value for its shareholders.

3. Inside- and institutional ownership

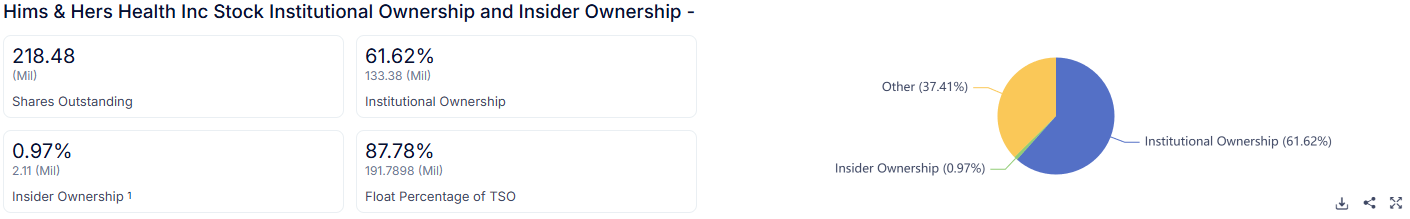

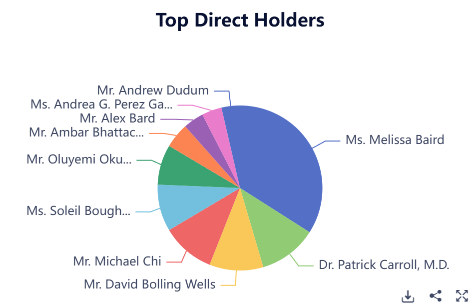

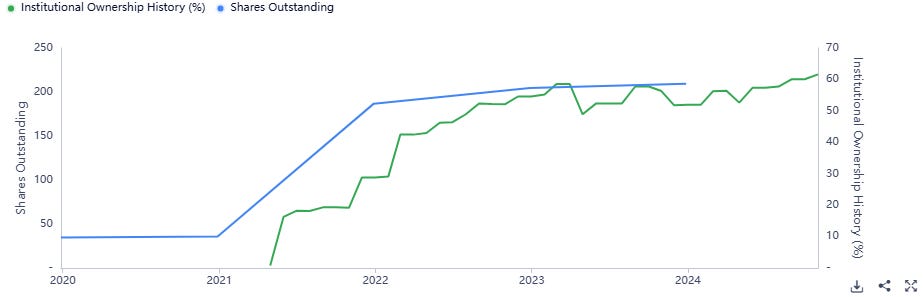

Insiders own roughly 0.97%; this isn’t much.

Andrew Dudum owns of these insiders ownership ‘only’ 3.62%. Melissa Baird owns the most shares, roughly 34% of which are insider-owned shares.

Talking about no skin in the game, right?

Institutional ownership is increasing. This means the big players are getting more involved in the business, which could be a positive sign. Of course, do not use this solely in your investment thesis. Remember Fisker? Yeah, institutional buying kept happening until they went bankrupt.

4. Competitive and Sustainable Advantage (MOAT)

The MOAT for Him and Hers is tricky, but let's try it, shall we?

So, a MOAT can be in either one or more of the following forms:

Brand Power

Patents

Scale and Cost Advantages

Switching Costs

Network Effect

Attracting Talent (I consider this a MOAT, others don’t. Decide for yourself)

Brand Power

Hims & Hers has established itself as a powerful and recognizable brand, especially in direct-to-consumer health and wellness. The company has focused heavily on destigmatizing healthcare, making it more accessible and open. Its branding is modern, approachable, and inclusive, which appeals to a broad audience, particularly younger consumers who may feel alienated by traditional healthcare providers. The brand power is vital because of its innovative approach to healthcare and its transparency and relatability, which resonates with consumers seeking quality and convenience. This is especially important in industries like health and wellness, where trust and credibility are critical.

Patents

While Hims & Hers may not traditionally have many proprietary patents, its competitive advantage comes from its innovative approach to offering healthcare products and services. The company focuses on telemedicine, which relies on technology, convenience, and an extensive network of licensed healthcare providers. The technology platform for telehealth and its unique product offerings (such as treatments for hair loss, sexual health, skincare, etc.) could be seen as a differentiated asset, but in terms of patents, the company’s moat may not be as strong as some in highly patented industries like pharmaceuticals or tech.

Scale and Cost Advantages

Hims & Hers has substantial scale advantages. The company’s direct-to-consumer model allows for a more efficient cost structure by bypassing traditional intermediaries like retail pharmacies. This scale also gives the company significant bargaining power with suppliers and manufacturers, leading to better pricing and margins. Additionally, their vertically integrated business model, including their in-house telemedicine service, helps lower costs and streamline operations. As the company continues to grow, these cost advantages will likely increase, making it more difficult for smaller competitors to replicate their success.

Switching Costs

Switching costs for customers in the healthcare and wellness space are generally low, particularly for consumers who can easily switch between service providers. However, Hims & Hers has created a "sticky" customer relationship through its subscription-based services, convenience, and personalized care. The simplicity of using the platform (e.g., access to doctors, automatic prescription renewals) could encourage customers to stay long-term, but if a customer decided to switch to a competitor, the process wouldn’t be prohibitively complicated. Still, switching costs might be higher for customers who have built a relationship with the brand or personalized care than for generic alternatives.

Network Effect

Hims & Hers benefits from a network effect, particularly in how its telemedicine platform operates. The more people use the service, the better the company can refine and optimize its healthcare offerings, improve product recommendations, and expand its network of healthcare providers. Additionally, the company’s ability to cross-sell multiple health and wellness products through a single platform creates a reinforcing cycle that strengthens its position in the market. As the customer base grows, it becomes more attractive to potential investors, partners, and new users, further accelerating growth.

Attracting Talent

While Hims & Hers has been able to attract talent, it may face challenges in this area compared to other companies with more established reputations or unique perks. The competition for top talent in both the tech and healthcare sectors is fierce, and Hims & Hers, despite being a high-growth company, may not offer the same level of brand prestige or long-term stability that larger, more established companies can provide. Additionally, as the company scales, maintaining a solid culture and ensuring employees feel connected to the mission could become more complex; Hims and Hers are already struggling with their culture, as per the reviews. Employees may be attracted initially by the innovative aspects of the company, but as the organization grows rapidly, the work environment could feel less personal, and the company's values may not be as straightforward or consistent. This could significantly lead to higher turnover or difficulty retaining high-quality talent as the company expands and faces growing pains.

In summary, Hims & Hers' MOAT primarily lies in its brand power, scale and cost advantages, and network effects. While it may not have a traditional patent-based moat, it compensates with a robust customer-centric model and innovative approach. The switching costs are relatively low, but customer retention through personalization and ease of use can still make it a challenging competitor to displace.

5. Industry Analysis

5.1 Current Industry Landscape and Growth Prospects

The wellness and digital health industry is experiencing rapid expansion, spurred by consumer demand for accessible, convenient, and personalized healthcare options. With increasing awareness around mental health, preventive care, and wellness-focused lifestyles, the market is set to grow significantly. The global healthcare services market is projected to expand from USD 13.31 trillion in 2024 to USD 22.57 trillion by 2031, with digital health and wellness at the forefront, capitalizing on a CAGR of approximately 8.27% through 2031. Consumer brands offering integrated digital platforms, like Hims and Hers, benefit from these shifting dynamics.

2. Demand Drivers for Digital Health and Wellness Services

Consumer-Driven Healthcare: There’s a strong demand for personalized healthcare experiences that allow consumers to access care on their terms, from virtual consultations to wellness products. Increased emphasis on mental health and proactive health management has fueled interest in on-demand services.

Shift to Preventive and Holistic Wellness: Consumers are increasingly focusing on wellness over acute care, opting for solutions that support mental, physical, and sexual health proactively. Preventive health measures, from mental wellness to lifestyle products, are gaining momentum in daily health routines.

3. Telehealth and Virtual Care Growth

Remote Consultations and Convenience: The adoption of telehealth and remote patient monitoring has surged since the COVID-19 pandemic, and demand remains high as people seek convenient, on-demand access to healthcare professionals.

Mental Health and Behavioral Services: Mental health services are critical growth areas, especially those available virtually. Companies providing mental health resources and virtual consultations are essential to meeting this rising demand.

Expanding Consumer Access: Affordable pricing and subscription-based access allow broader demographics to utilize preventive and wellness services, especially for underserved communities.

4. Wellness and Digital Pharmacy Services

Digital pharmacy services are expanding beyond traditional prescriptions, focusing on holistic wellness, including supplements, skincare, and lifestyle products. Companies like Hims and Hers, which offer tailored products for hair care, skin care, mental health, and sexual wellness, are aligning with key industry trends.

Integrated Health and Lifestyle Offerings: Brands are incorporating lifestyle and health products into their digital pharmacies, providing consumers with a one-stop solution for wellness and healthcare needs.

Subscription-Based Models: Subscription services for wellness and healthcare products, including mental health support and dermatology treatments, are significant in building customer loyalty and recurring revenue.

Health and Wellness Market Segmentation: Focusing on skincare, mental health, and sexual wellness highlights key segments with substantial demand, catering to consumers looking for accessible, private, personalized solutions.

5. Key Industry Trends and Growth Drivers

Personalization and Data-Driven Insights: Consumers value personalized healthcare solutions, from mental health plans to skincare routines. Data-driven insights allow brands to tailor offerings to individual needs, creating more robust customer engagement.

Digital Transformation and Consumer Engagement: Digital tools that enhance consumer engagement—such as mobile apps, telehealth consultations, and virtual mental health services—are central to building a solid digital health brand.

Affordable, Accessible Wellness: High healthcare costs drive consumers toward more affordable, alternative solutions. Offering direct-to-consumer access to health services and wellness products addresses this gap, empowering people to manage their health quickly.

6. Regional Growth Focus

North America: Leading in digital health adoption due to high consumer demand for wellness and mental health support. The U.S. remains the largest market, with increasing investments in digital healthcare infrastructure.

Europe: Digital wellness is growing rapidly, driven by a strong focus on mental health support and consumer-friendly digital healthcare policies.

Asia-Pacific: A high-growth region with increasing demand for accessible healthcare and wellness services, particularly among young consumers seeking digital health solutions.

5.2 Competitive Landscape

The competition is exceptionally fierce. It is a high-margin business, and prominent players like healthcare providers and bio-businesses, who possess large amounts of capital, could try to enter it.

Hims & Hers Health's main competitors include Natera (NTRA), Fresenius Medical Care (FMS), Sotera Health (SHC), Option Care Health (OPCH), Surgery Partners (SGRY), Guardant Health (GH), BrightSpring Health Services (BTSG), PACS Group (PACS), Veracyte (VCYT), and LifeStance Health Group (LFST). These companies are all part of the "healthcare" industry.

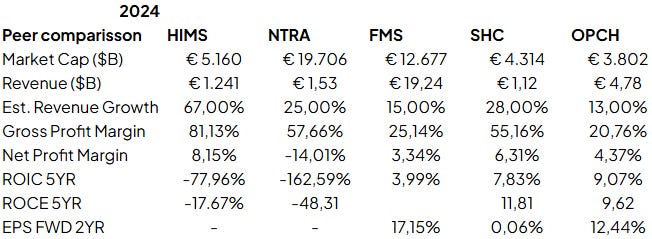

In 2024, a comparison of various companies in the healthcare sector—HIMS, NTRA, FMS, SHC, and OPCH—shows diverse performances across growth, profitability, and investment returns.

HIMS stands out with a strong estimated revenue growth of 67.00%, well above its peers, highlighting its aggressive growth trajectory. NTRA follows with a 25.00% growth estimate, while FMS, SHC, and OPCH project more modest growth rates at 15.00%, 28.00%, and 13.00%, respectively.

In terms of gross profit margin, HIMS leads with an impressive 81.13%, significantly outperforming its competitors, which indicates efficient cost management and pricing power. NTRA also shows a solid margin at 57.66%, while FMS lags considerably with a 25.14% margin. SHC and OPCH show moderate margins at 55.16% and 20.76%, respectively.

The net profit margin for HIMS is 8.15%, demonstrating its profitability, whereas NTRA experiences a negative margin of -14.01%, indicating challenges in achieving profitability. FMS, SHC, and OPCH have lower but positive net margins of 3.34%, 6.31%, and 4.37%, respectively.

Looking at return on invested capital (ROIC) over five years, FMS and SHC show positive returns at 3.99% and 7.83%, while HIMS and NTRA have negative returns of -77.96% and -162.59%, respectively, suggesting they are not yet efficiently using their capital. OPCH also displays a positive ROIC of 9.07%, indicating relatively efficient capital usage in this peer group.

For return on capital employed (ROCE) over five years, SHC leads with 11.81%, followed by OPCH at 9.62%. HIMS, NTRA, and FMS show negative ROCE values of -17.67%, -48.31, and an unspecified low level, indicating room for improvement in capital utilization among these companies.

Finally, EPS forward 2-year estimates show varied expectations, with FMS projected at 17.15%, OPCH at 12.44%, and SHC barely positive at 0.06%. HIMS and NTRA lack estimates in this area.

This analysis reflects a diverse sector landscape, where HIMS’s high growth rate and strong margins contrast with NTRA's negative profitability, while companies like FMS, SHC, and OPCH show more stable but modest financial metrics.

6. Risk Assessment

1. Market Risks

Consumer Demand Fluctuations: Hims & Hers operates in the healthcare and wellness space, particularly targeting lifestyle, beauty, and wellness products that may be seen as non-essential by consumers. Economic downturns or shifts in consumer spending habits could lead to reduced demand.

Competitive Pressure: The market for telehealth and wellness products is highly competitive, with both established healthcare providers and new digital health startups vying for market share. Competitors with larger resources, more diverse service offerings, or stronger brand recognition could potentially capture Hims & Hers’ target demographic.

2. Regulatory Risks

Telehealth Regulation Variability: Hims & Hers provides healthcare services across multiple states, each with its own telehealth regulations. Compliance with varying state and federal regulations can be challenging, and any regulatory changes, such as stricter telemedicine laws or reimbursement policies, could impact operations and profitability.

FDA and Product Compliance: Many of Hims & Hers' products, such as prescription drugs, are subject to FDA oversight. Non-compliance with FDA regulations, or changes in these regulations, could lead to recalls, legal consequences, and a loss of consumer trust.

Data Privacy and Security Laws: As a provider of telehealth services, Hims & Hers must comply with strict data privacy laws, including HIPAA (Health Insurance Portability and Accountability Act) in the U.S. Any data breach or violation could result in costly penalties, lawsuits, and reputational damage.

3. Operational Risks

Reliance on Third-Party Suppliers and Fulfillment Partners: Hims & Hers relies on third-party suppliers for manufacturing and fulfillment services. Supply chain disruptions, quality control issues, or supplier insolvency could lead to product shortages, delays, and a decline in customer satisfaction.

Customer Acquisition and Retention: The company’s growth model depends heavily on customer acquisition through digital marketing and retention via subscription services. Rising digital advertising costs or declining conversion rates could increase the customer acquisition cost, affecting profitability. Failure to retain customers could further impact revenue growth.

Quality and Consistency of Healthcare Services: As a telehealth provider, ensuring consistent quality and continuity of healthcare services is essential. Any decline in service quality, or incidents of medical misdiagnosis, could result in lawsuits, reputational damage, and a loss of customer trust.

4. Financial Risks

Profitability and Cash Flow: As of recent reports, Hims & Hers has not yet achieved sustained profitability and has a negative return on invested capital (ROIC). Its cash flow might not be enough to sustain operations without additional funding. Dependency on external financing may expose the company to risks associated with capital availability and market conditions.

High Marketing Costs: The company’s growth strategy relies on high marketing and advertising spending. If this spending doesn’t translate into a sustainable customer base, it could lead to prolonged losses. Additionally, if digital ad costs increase or advertising effectiveness declines, it would directly impact financial performance.

Stock Volatility and Market Sentiment: Hims & Hers is a growth-oriented company, and its stock price may be highly sensitive to market sentiment, especially in relation to tech and healthcare stocks. Negative news or economic downturns could lead to significant stock volatility, affecting investor confidence and access to additional capital.

5. Legal and Reputational Risks

Litigation Exposure: As a healthcare provider, Hims & Hers is exposed to potential lawsuits related to medical malpractice, product liability, or data breaches. High-profile lawsuits or settlements could result in significant financial costs, as well as harm to its brand.

Reputational Impact from Product Issues: Any quality issues or negative publicity surrounding its products—whether due to adverse effects, mislabeling, or recalls—could harm its reputation. As a consumer-facing brand, any negative news could quickly spread, reducing customer trust and impacting sales.

Dependence on Brand Image: Hims & Hers markets itself as a modern, accessible healthcare brand focused on transparency and customer service. Any incident that contradicts this image, whether from poor customer experiences or controversial business practices, could damage the brand's reputation and customer loyalty.

6. Technological and Cybersecurity Risks

Cybersecurity Threats: As an online healthcare provider, Hims & Hers stores sensitive customer information, making it a potential target for cyberattacks. A significant data breach could not only result in financial and legal consequences but also harm its reputation and lead to loss of consumer trust.

Technology Reliance and Downtime: The company’s reliance on digital platforms and technology makes it vulnerable to technical failures, system downtime, and outages. Any prolonged downtime could impact customer service and sales, as well as damage brand perception.

Data Privacy Compliance: Adhering to stringent data privacy regulations, such as HIPAA, is crucial. A data breach or failure to comply with data protection laws could lead to regulatory fines, lawsuits, and reputational damage.

7. Strategic and Growth Risks

Dependence on Key Markets: Hims & Hers generates most of its revenue in the U.S., and any economic downturn or regulatory changes within the U.S. market could disproportionately impact the company. Limited international presence means it has less diversification to mitigate U.S.-specific risks.

Execution Risks in Growth Strategy: Hims & Hers aims for high growth, including entering new markets and expanding its product line. If management fails to execute these strategies effectively, it could lead to resource wastage, strategic missteps, and lower-than-expected growth.

Evolving Consumer Preferences: Trends in wellness, telehealth, and e-commerce can shift rapidly. The company must adapt to changing consumer preferences, which can be costly and require continuous investment in product development and marketing. Failure to do so could lead to a decline in market relevance and competitiveness.

7. Financial Health

7.1 Assets Assessment

For the new readers. During these assessment I either talk about worrying items or items I love to see on the balance sheet. If something is not covered, you can expect that it is either in-line with the industry average, manageable, or something not worth mentioning.

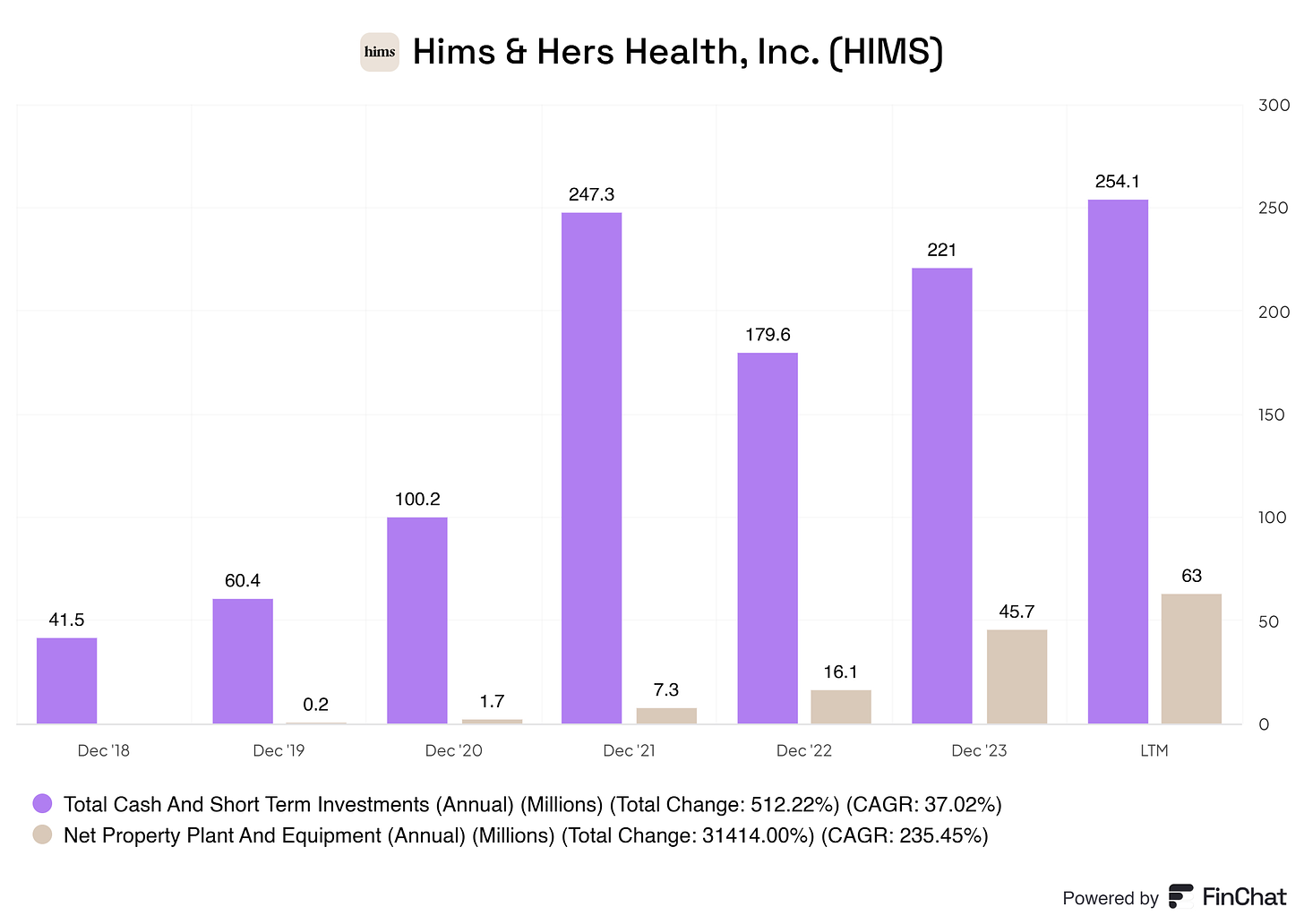

Hims & Hers Health has shown remarkable financial growth, particularly in terms of its cash holdings. Over the years, the company’s total cash and short-term investments have expanded substantially, reaching $254.1 million in the latest reported period. This 512.22% increase since 2018 reflects a compound annual growth rate (CAGR) of 37.02%, a testament to Hims & Hers' commitment to maintaining a strong cash position.

In times of economic uncertainty, this solid cash reserve is a strategic asset, allowing the company to weather downturns, seize new opportunities, and fund operations without the need for external financing. Cash holdings like these offer stability and flexibility, giving Hims & Hers a significant advantage as it navigates the dynamic healthcare sector.

Additionally, the company has grown its net property, plant, and equipment significantly, rising from near zero in 2018 to $63 million in the latest period, with a CAGR of 235.45%. This reflects their investment in physical infrastructure, which strengthens their operational capabilities.

7.2 Liabilities Assessment

On their liabilities there’s not much to mention. Their liabilities sheet look extremely solid and nothing we should take not of or be worried about for in the future.

Most of the ‘liabilities’ comes from their leases (which I am against that it is a liability, but that’s for another day), accrued expenses, and accrued payable.

(the above in short: wages, salaries, interest, utilities, and rent)

8. Capital Structure

8.1 Expense Analysis

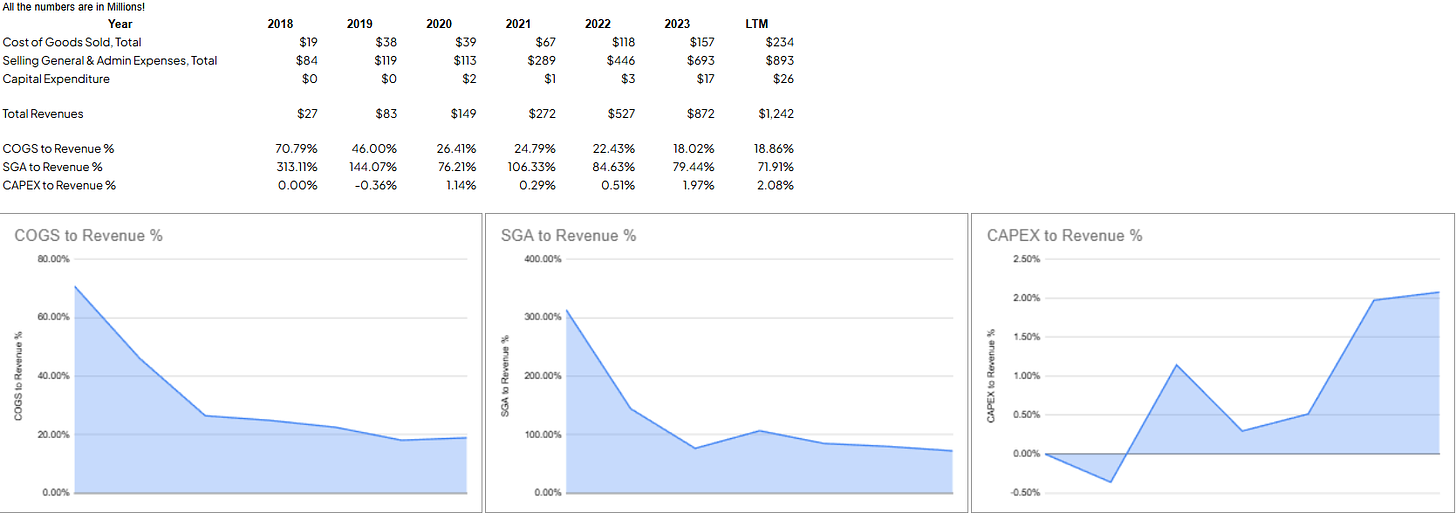

The chart provides a detailed overview of Hims & Hers Health, Inc.'s financial performance over several years, focusing on key metrics such as Total Revenue, COGS, SG&A Expenses, and CAPEX. From 2018 to the Last Twelve Months (LTM), Hims & Hers has shown substantial growth in revenue while managing costs effectively.

Total Revenue has seen significant growth, rising from $27 million in 2018 to $1,242 million in LTM. This upward trajectory reflects the company’s rapid expansion and growing customer base within the telehealth and wellness market.

Cost of Goods Sold (COGS) has increased from $19 million in 2018 to $234 million in LTM. However, COGS as a percentage of revenue has improved considerably, dropping from 70.79% in 2018 to 18.86% in LTM. This indicates enhanced cost-efficiency in product sourcing, production, and supply chain management, leading to better gross margins as the company scales.

Selling, General, and Administrative (SG&A) Expenses have also risen, from $84 million in 2018 to $893 million in LTM. Despite this increase, SG&A as a percentage of revenue has decreased significantly, from 313.11% in 2018 to 71.91% in LTM. This trend demonstrates Hims & Hers' ability to scale operations while improving cost efficiency in marketing, administrative functions, and overall operations.

Capital Expenditures (CAPEX), which reflect investments in infrastructure, have grown from nearly zero in the early years to $26 million in LTM. CAPEX as a percentage of revenue has increased from 0.00% in 2018 to 2.08% in LTM, signaling the company’s commitment to investing in its operational infrastructure to support continued growth.

Overall, Hims & Hers has managed to grow its revenue rapidly while improving cost efficiency, as evidenced by decreasing percentages in COGS and SG&A relative to revenue. The company's increasing CAPEX indicates a strategic focus on building a solid infrastructure to sustain and support its future expansion.

The chart showcases Research & Development (R&D) Expenses for Hims & Hers Health, Inc. from 2018 through 2024, alongside total revenue and R&D as a percentage of revenue. This data highlights the company’s investment in innovation and product development as it scales its operations in the healthcare and wellness industry.

R&D Expenses have increased from $0 in 2018 to $69 million in 2024. This upward trend demonstrates Hims & Hers’ commitment to developing new products, enhancing existing offerings, and maintaining a competitive edge through continuous innovation.

Total Revenue has grown significantly, rising from $27 million in 2018 to $1,242 million in 2024. This increase reflects the company's successful market expansion and growing consumer demand for its telehealth services and wellness products.

R&D to Revenue ratio initially started at 7.53% in 2020, increased slightly to 8.24% in 2021, and has since stabilized around the 5.5% range from 2022 to 2024. This consistency suggests that Hims & Hers has established a sustainable R&D investment strategy that balances innovation with revenue growth.

Overall, Hims & Hers has demonstrated a strong commitment to R&D, which is essential in a competitive and rapidly evolving industry like healthcare. By consistently allocating a portion of its revenue to R&D, the company is positioning itself for long-term growth through product advancements and enhancements that meet changing consumer needs.

8.2 Capital Efficiency Review

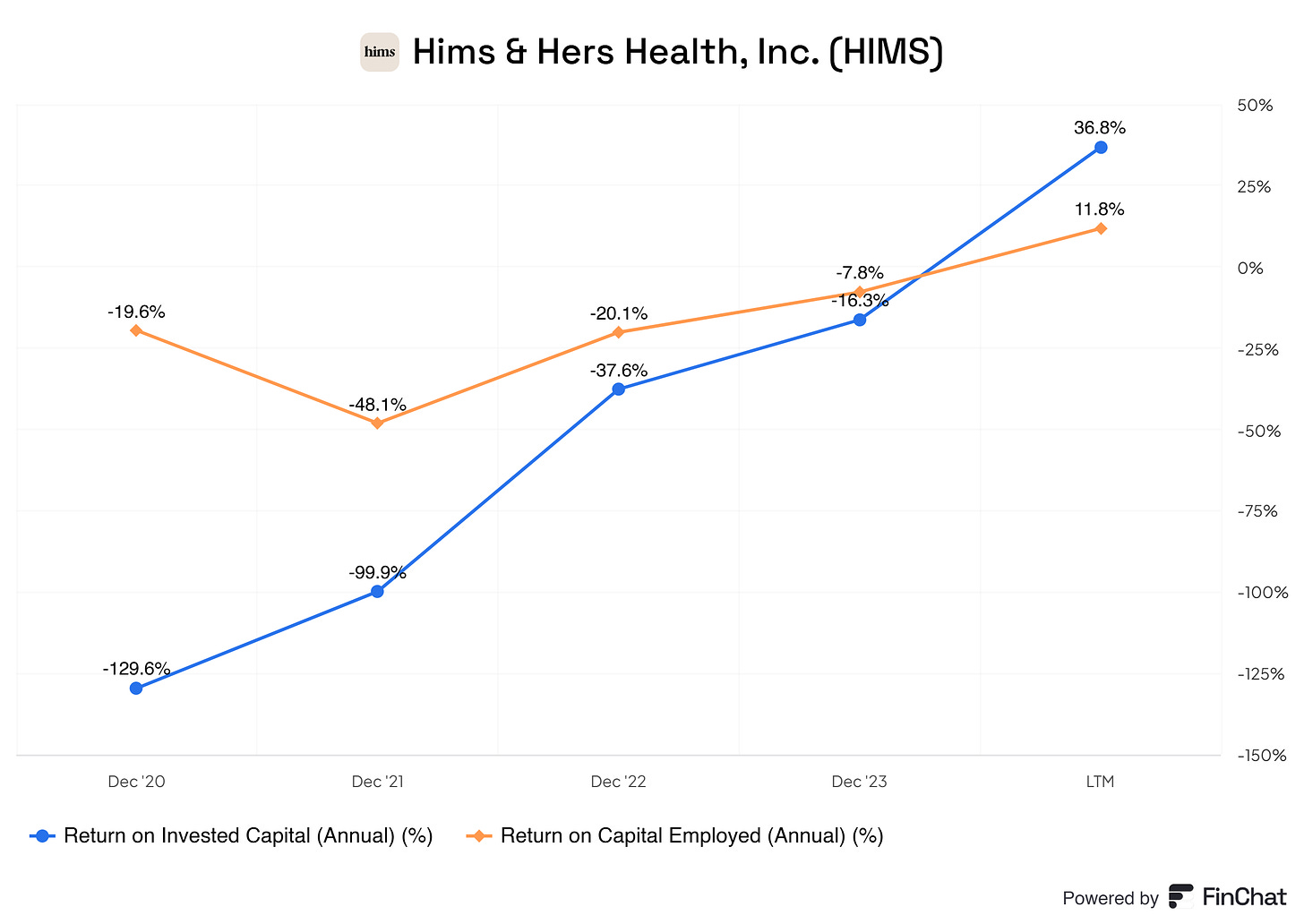

The chart displays the Return on Invested Capital (ROIC) and Return on Capital Employed (ROCE) for Hims & Hers Health, Inc. (HIMS) from December 2020 to the Last Twelve Months (LTM). These metrics are essential indicators of the company's efficiency in generating returns from its investments and overall capital.

Return on Invested Capital (ROIC) has shown remarkable improvement over the period. Starting from a low of -129.6% in December 2020, ROIC improved significantly to -99.9% in December 2021, -37.6% in December 2022, and -16.3% in December 2023, reaching a positive 36.8% in LTM. This upward trend reflects Hims & Hers' efforts to enhance its investment efficiency, ultimately turning negative returns into positive gains as the business matures.

Return on Capital Employed (ROCE) also demonstrates a positive trajectory. Beginning at -19.6% in December 2020, ROCE dipped to -48.1% in December 2021 but then recovered to -20.1% in December 2022. By December 2023, it had further improved to -7.8%, and as of LTM, ROCE reached a positive 11.8%. This progression highlights the company’s success in optimizing its capital usage and achieving more productive returns.

The significant turnaround in both ROIC and ROCE indicates that Hims & Hers has been able to utilize its capital more effectively, shifting from substantial negative returns to positive, growth-oriented outcomes. This improvement in capital efficiency is a promising signal for the company’s long-term financial health and potential for sustainable profitability.

9. Profitability Assessment

9.1 Profitability, Sustainability, and Margins

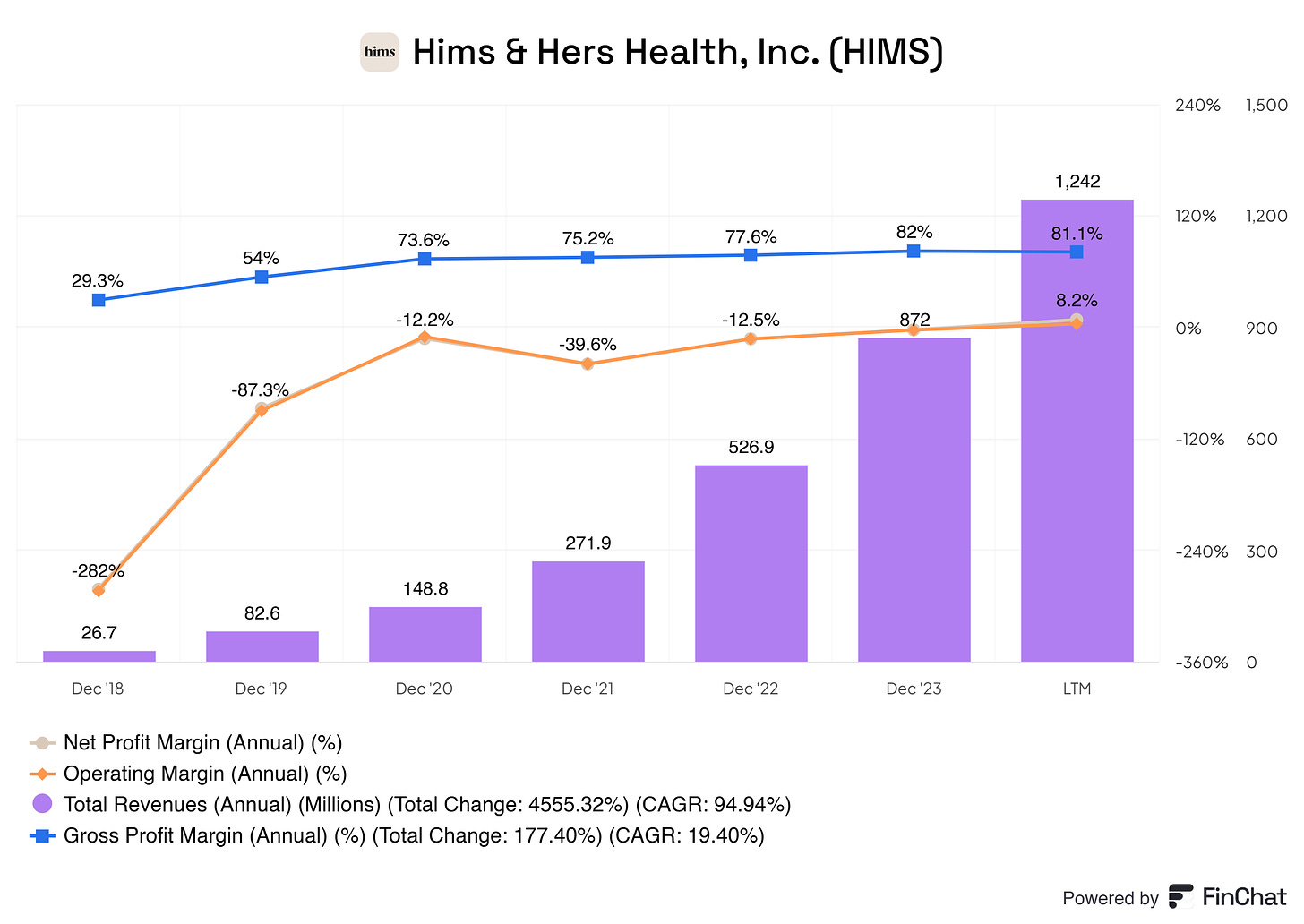

Hims & Hers Health has shown impressive growth in profitability, sustainability, and margins, demonstrating a solid trajectory over the past few years. The company’s consistent improvement in Gross Profit Margin—from 29.3% in 2018 to 81.1% in the Last Twelve Months (LTM)—signals a strong foundation for sustainable profitability. This increase suggests that Hims & Hers has successfully optimized its cost structure and has built significant pricing power, which is a positive indicator for long-term margin stability.

The Operating Margin has also improved substantially, rising from a deeply negative -282% in 2018 to -12.5% in the LTM. Although still negative, the upward trend in operating margin highlights the company’s efforts to reduce operational losses as revenue scales. If Hims & Hers continues this trajectory, it is likely to achieve positive operating margins in the near future, which would solidify its path to sustainable profitability.

Furthermore, the company’s Net Profit Margin has made remarkable progress, turning positive at 8.2% in LTM after significant losses in prior years. Achieving a positive net margin is a critical milestone for Hims & Hers, indicating that its business model is beginning to generate actual profit. This shift suggests that the company’s strategies for cost management and revenue growth are proving effective and could support continued profitability.

However, the sustainability of this trajectory depends on several factors:

Revenue Growth Rate: Hims & Hers has experienced an extraordinary revenue growth rate, with a compound annual growth rate (CAGR) of 94.94% from 2018 to LTM. While this growth has been instrumental in driving margin improvements, sustaining such a high rate may be challenging as the company matures. A gradual deceleration in revenue growth is typical as companies scale, so maintaining profitability as growth rates normalize will be essential.

Operational Efficiency: Continued improvements in operational efficiency are crucial to maintain margin expansion. Hims & Hers will need to ensure that its Selling, General, and Administrative (SG&A) expenses do not grow disproportionately with revenue. The company has already made strides in this area, but maintaining cost discipline as it scales will be key to sustaining positive margins.

Market Competition: As a player in the telehealth and wellness industry, Hims & Hers faces competition from both established healthcare providers and emerging digital health startups. Competitive pressures could impact pricing power, customer acquisition costs, and, ultimately, margins. The company’s ability to differentiate its services and retain customer loyalty will be important in sustaining its profitability.

Investment in R&D and CAPEX: Hims & Hers has been steadily investing in Research & Development (R&D) and Capital Expenditures (CAPEX) to support product innovation and infrastructure growth. While these investments are crucial for long-term sustainability, they also represent ongoing expenses. Balancing investment with profitability will be essential for maintaining healthy margins.

9.2 Cash Flow Analysis

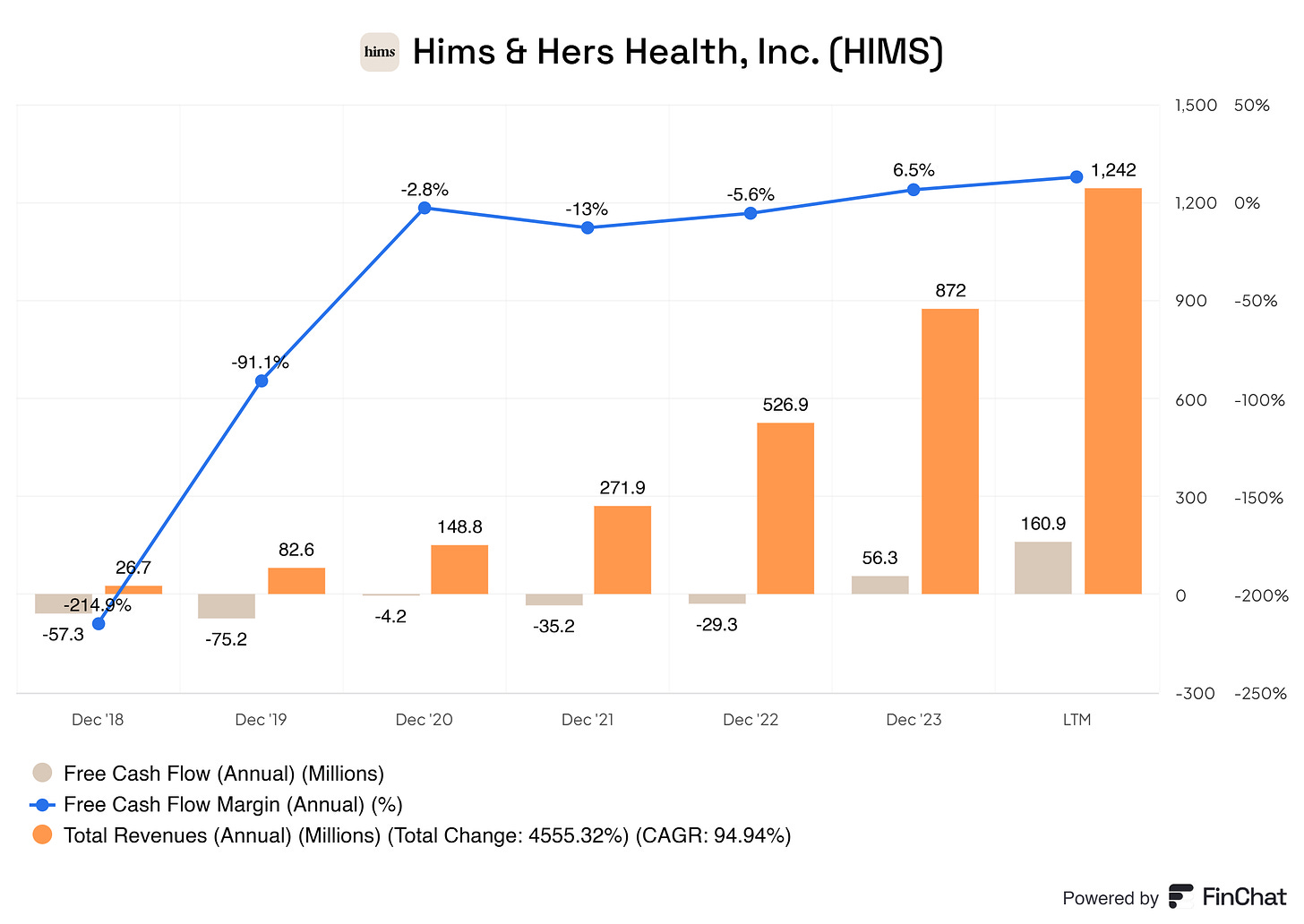

This chart highlights the Free Cash Flow (FCF), Free Cash Flow Margin, and Total Revenues for Hims & Hers Health from December 2018 to the Last Twelve Months (LTM). These metrics provide insights into the company’s cash generation capabilities in relation to its revenue growth over time.

Total Revenue has shown significant growth, rising from $26.7 million in December 2018 to $1,242 million in LTM, with a total change of 4,555.32% and a compound annual growth rate (CAGR) of 94.94%. This growth trajectory reflects the company's successful expansion in the telehealth market, fueled by increasing consumer demand for its services.

Free Cash Flow (FCF) has also improved substantially, turning positive in recent years. Starting at -$57.3 million in 2018, FCF gradually improved, reaching $56.3 million in December 2023 and further increasing to $160.9 million in LTM. This shift from negative to positive FCF demonstrates that Hims & Hers has achieved a level of cash generation that supports its operations and potential reinvestment in growth.

Free Cash Flow Margin has followed a similar positive trend. It was deeply negative at -214.9% in December 2018, but it has steadily improved, reaching positive 6.5% in December 2023 and stabilizing around this level in LTM. The improvement in FCF margin indicates that Hims & Hers has successfully managed its expenses in relation to revenue, allowing it to retain more cash from operations.

Overall, the data suggests that Hims & Hers is on a sustainable path, with revenue growth translating into stronger free cash flow generation. This positive trend in FCF and FCF margin positions the company well for continued growth and provides financial flexibility for future investments, product innovation, and expansion. As long as Hims & Hers maintains this trajectory, it should continue to strengthen its financial standing and support its strategic objectives.

10. Growth Analysis

10.1 Historical Growth Trends

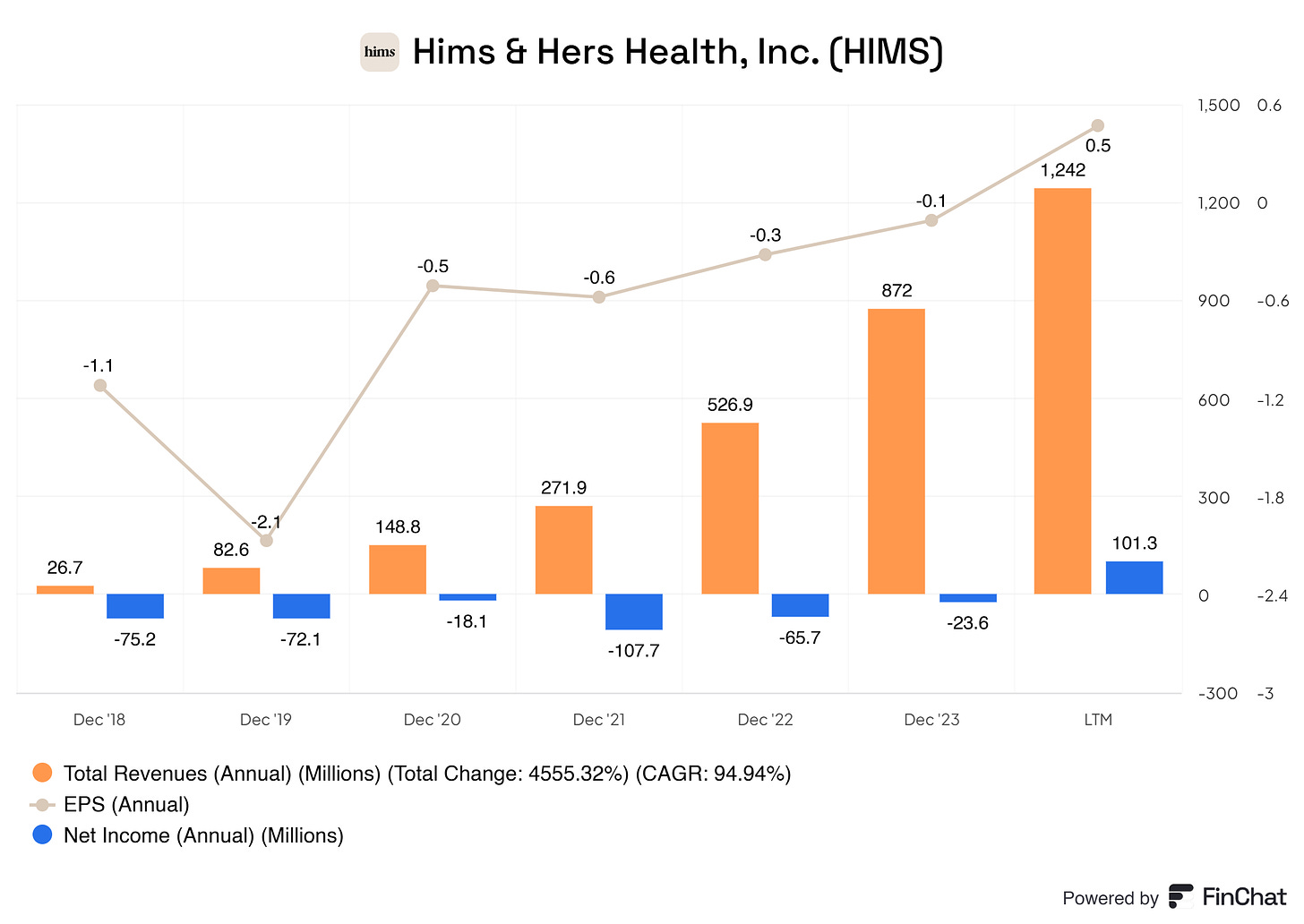

This chart illustrates Total Revenues, Earnings Per Share (EPS), and Net Income for Hims & Hers Health, Inc. (HIMS) from December 2018 through the Last Twelve Months (LTM), highlighting the company’s historical growth trends and profitability trajectory.

Total Revenue has experienced exponential growth, rising from $26.7 million in December 2018 to $1,242 million in LTM, with a total change of 4,555.32% and a compound annual growth rate (CAGR) of 94.94%. This rapid increase underscores Hims & Hers’ successful expansion in the digital health market and reflects the growing demand for its products and services. The consistent upward trend suggests a strong historical foundation, which could continue if the company maintains effective strategies and market positioning.

Net Income has shown significant improvements over time, despite being negative in most years. Starting at -$75.2 million in 2018, Net Income has trended positively, reaching -$23.6 million in December 2023 before finally achieving a positive $101.3 million in LTM. This positive net income indicates a major shift toward profitability and marks a turning point in the company's financial performance. If Hims & Hers can sustain this profitability, it will be well-positioned for long-term growth.

Earnings Per Share (EPS) has followed a similar path, moving from negative values in prior years (e.g., -$1.1 in 2018) to a positive EPS of $0.5 in LTM. This improvement in EPS reflects the company’s successful efforts in managing costs and increasing revenue per share, which is a positive indicator for potential future earnings growth.

Observations on Historical Growth Trends

The past growth of Hims & Hers has been marked by rapid revenue expansion, decreasing net losses, and the achievement of positive earnings. Key factors contributing to these trends include successful customer acquisition, efficient cost management, and a strategic focus on high-demand digital health services. Notable improvements in both Net Income and EPS suggest that the company has effectively transitioned from a high-growth phase with substantial losses to a more balanced, profitable model.

Potential for Continuation of Trends

Given the company's historical growth trajectory, there is potential for these trends to continue if Hims & Hers maintains its current strategies. Factors that could support ongoing growth include continued investment in R&D for new product offerings, optimization of operational efficiency, and expansion into new markets. If the company sustains its revenue growth while controlling costs, there is a strong likelihood that it can build on its recent profitability gains.

Overall, Hims & Hers has demonstrated a successful historical growth trend, transitioning from negative to positive earnings and revenue expansion. With careful management, this trajectory appears sustainable, suggesting the company could continue to deliver strong financial performance and shareholder value.

9.2 Future Growth Projections

1. Revenue Growth Projections

Next Year (2025): Given the expected 68% growth rate, Hims & Hers is projected to achieve revenue of approximately $2.085 billion in 2025, up from $1.242 billion in the LTM. This substantial growth aligns with the company’s historical CAGR of 94.94%, suggesting continued market expansion and strong consumer demand for its telehealth and wellness products.

Following Years (2026-2028): While a 68% growth rate is exceptional, revenue growth is likely to decelerate as the company matures. Assuming a gradual decline in growth rates to 50% in 2026, 40% in 2027, and 30% in 2028, projected revenues could reach approximately:

2026: $3.128 billion

2027: $4.379 billion

2028: $5.693 billion

These estimates assume that Hims & Hers continues to expand its market share, introduces new products, and retains a high rate of customer acquisition while maintaining customer loyalty.

2. Profitability Projections (Gross, Operating, and Net Margins)

Gross Profit Margin: Historically, Hims & Hers has demonstrated a strong upward trend in gross margin, reaching 81.1% in LTM. As the company scales, it’s likely to sustain a gross margin in the 80-85% range due to increased economies of scale, optimized supply chain management, and strengthened pricing power. A conservative estimate projects a gross margin of 83% over the next few years, translating to the following gross profit estimates:

2025: $1.73 billion

2026: $2.6 billion

2027: $3.63 billion

2028: $4.72 billion

Operating Margin: Operating margins have improved significantly, moving from deeply negative figures to -12.5% in LTM. With revenue growth and operational efficiencies, Hims & Hers could achieve positive operating margins by 2025. Projected operating margins are estimated to be:

2025: 5% (positive for the first time)

2026: 10%

2027: 15%

2028: 18%

This progression reflects the company’s commitment to cost control, decreasing SG&A expenses relative to revenue, and optimized R&D investments. Achieving these operating margins would yield operating income of approximately:

2025: $104 million

2026: $313 million

2027: $657 million

2028: $1.02 billion

Net Profit Margin: With net margins improving from negative figures to 8.2% in LTM, Hims & Hers is on a path toward sustainable profitability. Projected net margins are expected to stabilize around 12-15% as the company optimizes its operational costs and scales efficiently. This would result in net income projections as follows:

2025: 10% net margin, yielding $209 million

2026: 12% net margin, yielding $376 million

2027: 14% net margin, yielding $613 million

2028: 15% net margin, yielding $854 million

3. Free Cash Flow (FCF) and Capital Expenditures (CAPEX)

Free Cash Flow (FCF): Hims & Hers has recently transitioned to positive FCF, reaching $160.9 million in LTM. As profitability improves, FCF is expected to grow proportionally with revenue and net income. Assuming FCF margins stabilize around 10-15% of revenue, FCF projections are as follows:

2025: 10% FCF margin, resulting in $209 million

2026: 12% FCF margin, resulting in $376 million

2027: 13% FCF margin, resulting in $570 million

2028: 15% FCF margin, resulting in $854 million

CAPEX: With recent CAPEX at 2.08% of revenue, Hims & Hers has shown a commitment to infrastructure investment. Given the expected growth, CAPEX as a percentage of revenue may slightly decrease as economies of scale are achieved. Projecting CAPEX at around 1.5-2% of revenue, expected CAPEX could range as follows:

2025: $31-42 million

2026: $47-63 million

2027: $66-88 million

2028: $85-114 million

This level of CAPEX will support ongoing infrastructure and technology investments essential for sustaining growth in the competitive telehealth sector.

4. Earnings Per Share (EPS) Growth

With positive net income projected, EPS should improve as well. Assuming the number of shares remains stable, projected EPS could increase in tandem with net income:

2025: EPS of approximately $1.1 based on net income of $209 million

2026: EPS of approximately $2.0 based on net income of $376 million

2027: EPS of approximately $3.2 based on net income of $613 million

2028: EPS of approximately $4.5 based on net income of $854 million

5. Return on Invested Capital (ROIC) and Return on Capital Employed (ROCE)

As profitability improves, ROIC and ROCE are also expected to rise. Recent trends show ROIC turning positive, and it is projected to stabilize around 15-20% by 2028 if the company maintains operational efficiency and profitability. ROCE is likely to follow a similar trend, with projected values reaching 12-15% by 2028, indicating effective capital utilization.

11. Value Proposition

11.1 Dividends Analysis

Hims and Hers, thankfully, does not pay a dividend. Hims and Hers is committed to returning shareholder value to growing the business substantially. Therefore, paying dividends would not give them the right amount of room to invest for future growth.

10.2 Share Repurchase Programs

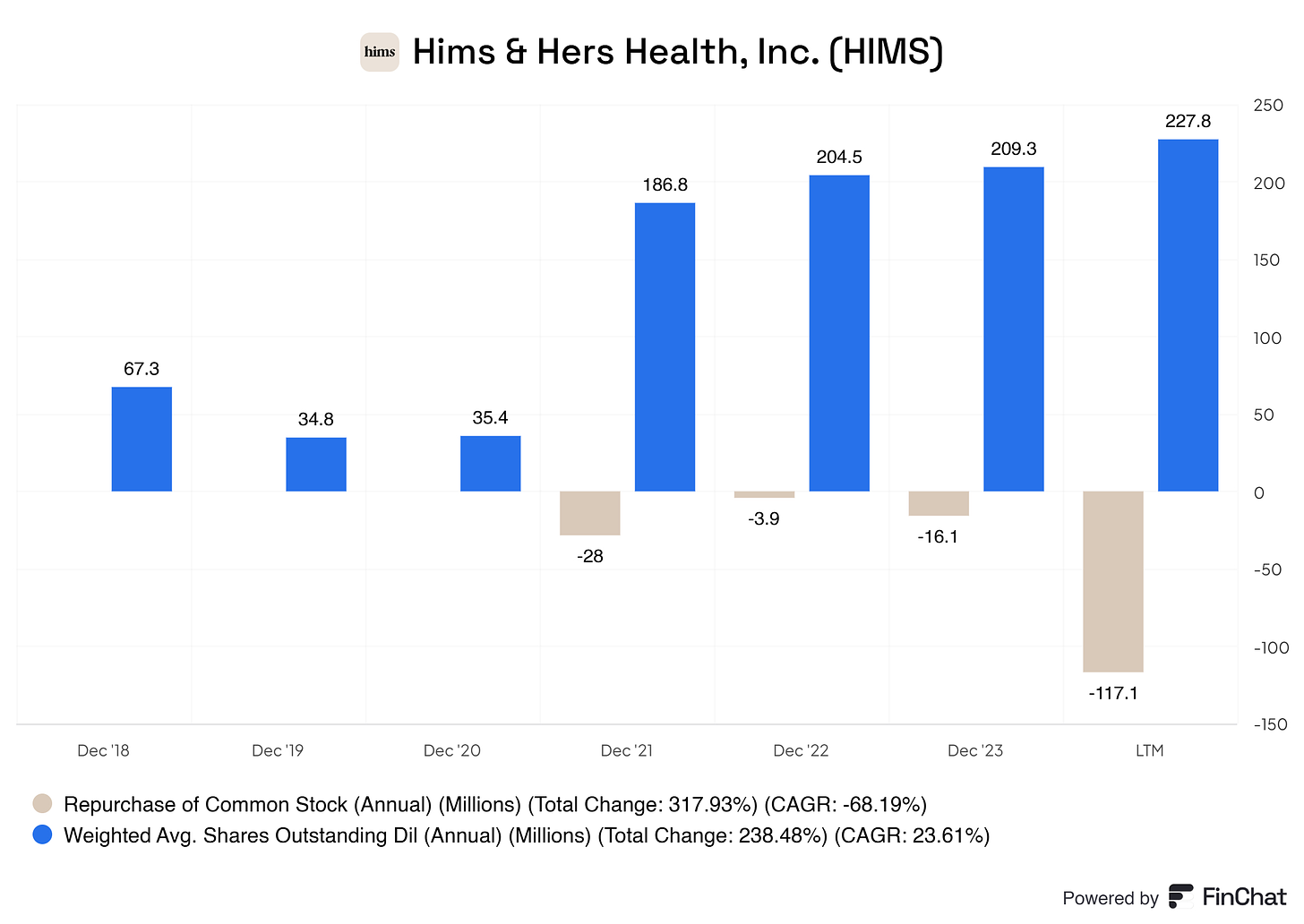

This chart shows Repurchase of Common Stock and Weighted Average Shares Outstanding (Diluted) for Hims & Hers Health from December 2018 to the Last Twelve Months (LTM), providing insight into the company’s share issuance and buyback activities.

Weighted Average Shares Outstanding (Diluted) has increased from 67.3 million in December 2018 to 227.8 million in LTM, representing a total change of 238.48% with a compound annual growth rate (CAGR) of 23.61%. This steady increase in shares outstanding suggests that Hims & Hers has likely issued additional shares over the years to raise capital, supporting its rapid growth and expansion. However, share dilution can impact earnings per share (EPS), making it essential for the company to balance growth funding with shareholder value.

Repurchase of Common Stock has fluctuated over the period, with a notable recent buyback of -$117.1 million in LTM, following smaller buybacks of -$3.9 million in December 2022 and -$16.1 million in December 2023. This recent substantial repurchase activity indicates that Hims & Hers is taking steps to manage share dilution and return value to shareholders, a positive signal for investor confidence.

11.3 Debt Reduction Strategy

There’s some debt reduction, but debt is not a worry for Hims and Hers. In addition, they should (and are) using debt to leverage their business. This is done in a sustainable way. :-)

12. Future Outlook

1. Revenue Growth and Market Expansion

Hims & Hers is on a rapid growth trajectory, evidenced by its recent compound annual growth rate (CAGR) of 94.94% in revenue and projected growth of 68% next year, which would bring revenue to an estimated $2.085 billion in 2025. This growth is driven by several key factors:

Increasing Demand for Telehealth and Wellness Products: The digital health sector is expanding, and Hims & Hers is well-positioned to capture market share by catering to growing consumer interest in telehealth and personalized wellness products.

Product and Service Diversification: Continued investment in R&D and innovation should allow Hims & Hers to introduce new products and services, deepening its market reach. This expansion into different health and wellness areas will be essential for sustaining long-term growth.

Geographic Expansion: While much of Hims & Hers' current revenue is likely generated within the U.S., there is substantial potential for international expansion. Penetrating new geographic markets could provide a meaningful boost to revenue in the coming years.

Revenue growth will likely decelerate slightly as the company matures, stabilizing at 50% in 2026, 40% in 2027, and 30% in 2028. These projected growth rates would result in revenues of approximately $5.7 billion by 2028, establishing Hims & Hers as a major player in the healthcare industry.

2. Profitability and Margin Expansion

Gross Profit Margin: Hims & Hers has shown consistent improvements in gross profit margin, reaching 81.1% in the LTM. Given its pricing power and efficiencies gained through scale, the company is projected to maintain an 80-85% gross margin over the next several years. This high margin reflects efficient cost management, potentially driven by strong supplier relationships and optimized production and logistics.

Operating and Net Margins: After years of negative operating margins, Hims & Hers is on track to reach positive operating profitability. Projected operating margins could reach:

5% in 2025

10% in 2026

15% in 2027

18% in 2028

Net profit margins, which have recently turned positive at 8.2%, are expected to further stabilize at around 15% by 2028. Achieving these margins would represent a successful transition from a high-growth startup phase to a profitable, mature company. This growth in profitability will also drive Earnings Per Share (EPS) higher, projected to reach approximately $4.5 by 2028.

Free Cash Flow (FCF): The transition to positive free cash flow of $160.9 million in LTM reflects Hims & Hers’ growing operational efficiency and reduced reliance on external funding. With sustained revenue growth and profitability, FCF margins are expected to stabilize around 10-15% of revenue by 2028. This will enable the company to reinvest in growth, pursue strategic acquisitions, or return capital to shareholders.

3. Strategic Investments and Capital Expenditures

Capital Expenditures (CAPEX): Hims & Hers has made measured investments in CAPEX, which currently sits at around 2.08% of revenue. As the company grows, CAPEX is expected to decrease as a percentage of revenue while remaining robust enough to support infrastructure and technological advancements. CAPEX is projected to remain at 1.5-2% of revenue, ensuring that the company’s physical and technological infrastructure is well-equipped to meet future demand.

Research & Development (R&D): R&D expenses as a percentage of revenue have been maintained around 5-8%, with a recent figure of 5.52% in LTM. This steady investment reflects a focus on innovation, essential for maintaining a competitive edge in the digital health space. Sustained R&D spending will allow Hims & Hers to continuously enhance its product offerings, keeping pace with changing consumer preferences and medical advancements.

4. Capital Structure and Share Repurchases

Share Issuance and Buybacks: Hims & Hers increased its shares outstanding significantly in the early years to fund rapid growth, resulting in some dilution. However, recent buyback activity (e.g., $117.1 million repurchased in LTM) indicates a shift toward managing share count and enhancing shareholder value. If the company continues to generate strong free cash flow, additional share repurchases may be expected, which could further improve EPS and demonstrate a commitment to shareholder returns.

Return on Capital: With improving profitability, Return on Invested Capital (ROIC) and Return on Capital Employed (ROCE) are projected to stabilize in the range of 15-20% and 12-15%, respectively, by 2028. These metrics will indicate the company’s effectiveness in generating returns from its investments, showcasing Hims & Hers as a financially disciplined and capital-efficient enterprise.

5. Competitive Position and Strategic Risks

Telehealth and Digital Health Market Competitiveness: Hims & Hers operates in a competitive environment with both established healthcare providers and emerging digital health players. Maintaining a strong brand, competitive pricing, and high-quality services will be essential to protect market share. The company’s diverse product portfolio and focus on customer experience give it an advantage, but ongoing investment in innovation and customer acquisition will be necessary.

Regulatory Environment: As a telehealth provider, Hims & Hers faces a dynamic regulatory landscape, especially in the U.S. market. Changes in healthcare regulations, data privacy laws, and telehealth reimbursement policies could impact the business. The company will need to maintain a strong compliance framework to adapt to regulatory changes and avoid disruptions.

Economic Conditions: While healthcare spending is often resilient, economic downturns could impact consumer spending on wellness and non-essential health products, potentially affecting demand for some of Hims & Hers’ offerings. However, the company’s strong cash position and focus on essential telehealth services could provide a buffer against economic fluctuations.

6. Future Growth Catalysts

Product and Service Expansion: The company’s commitment to R&D and innovation positions it well to expand into new product categories, including mental health, nutrition, dermatology, and chronic condition management. Expanding its telehealth capabilities and service offerings could attract a broader customer base and diversify revenue sources.

International Expansion: Entering new geographic markets outside the U.S. could be a significant growth driver. As demand for telehealth grows globally, Hims & Hers could establish itself as a leading international digital health provider. Strategic partnerships, local regulatory compliance, and cultural adaptation will be key to successful international growth.

Acquisitions and Partnerships: With increasing free cash flow and a healthy balance sheet, Hims & Hers could pursue strategic acquisitions to expand its capabilities, technologies, or customer base. Partnerships with established healthcare providers or insurers could also enhance its credibility and extend its reach.

Hims & Hers is positioned for robust growth in the coming years, driven by strong revenue expansion, improving profitability, and disciplined capital allocation. The company’s commitment to innovation, operational efficiency, and share buybacks reflects a balanced approach to growth and shareholder value creation. While potential risks such as regulatory changes and economic downturns exist, Hims & Hers’ strong market position, brand, and focus on essential health services make it well-equipped to navigate these challenges.

In summary, if Hims & Hers continues to execute its growth strategy effectively, it could see substantial financial gains, expanded market presence, and sustained profitability. The projected revenue of nearly $5.7 billion and a net income of over $850 million by 2028 highlight the company’s potential to become a major player in the digital health and wellness industry, delivering long-term value for shareholders.

13. Quality Rating

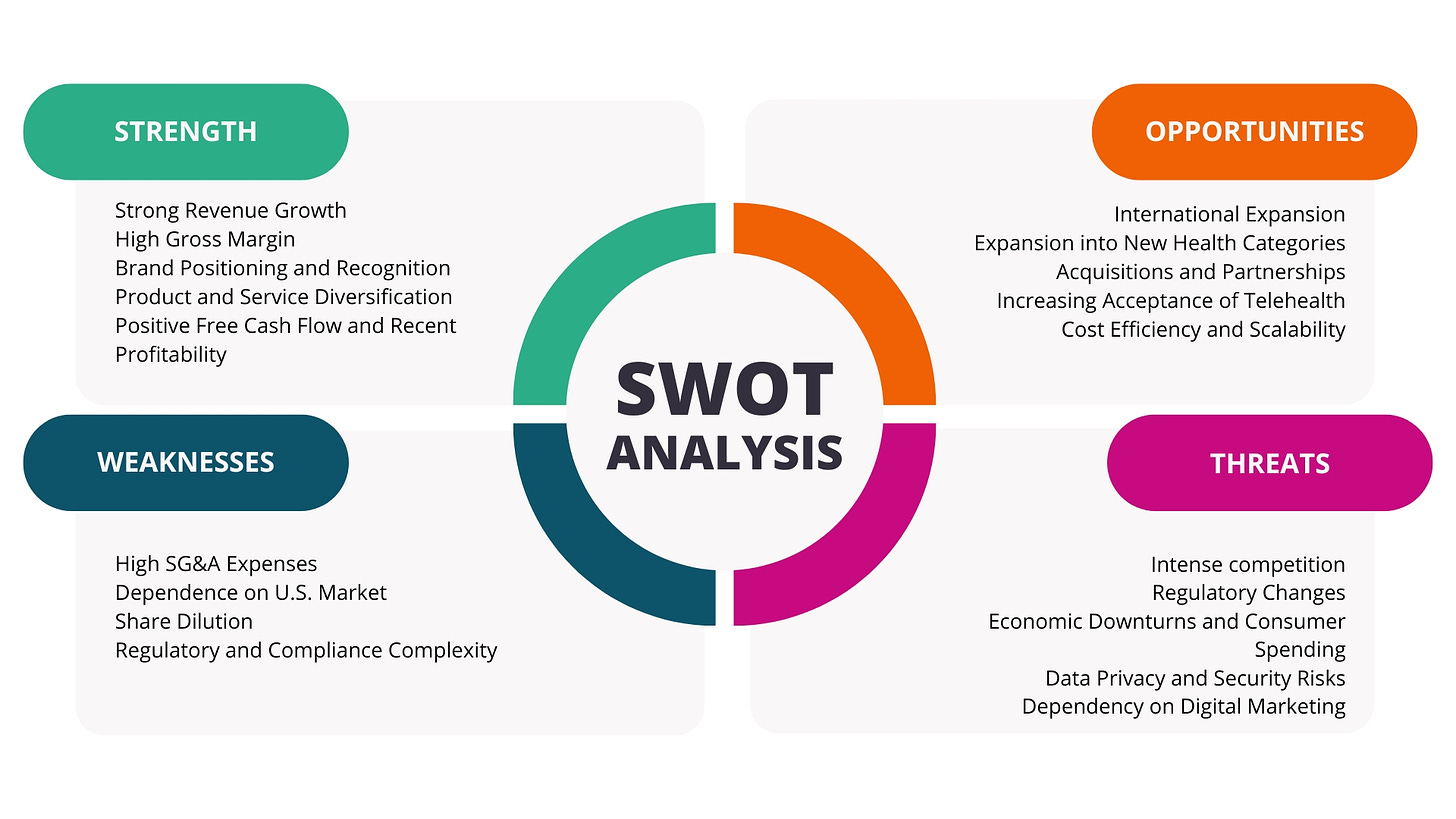

14. SWOT Analysis

15. Valuation Assessment

Before we head over to the valuation of Hims and Hers. Please consider following me here on Substack, like this article, and share it with your following on your favorite social media platform(s).

I put a lot of effort and time in making these investment cases to help you better understand the business.

Let us crunch some numbers!

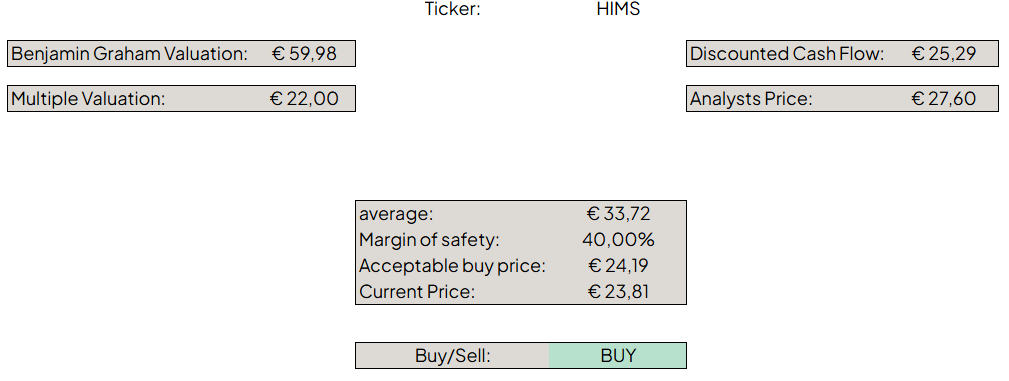

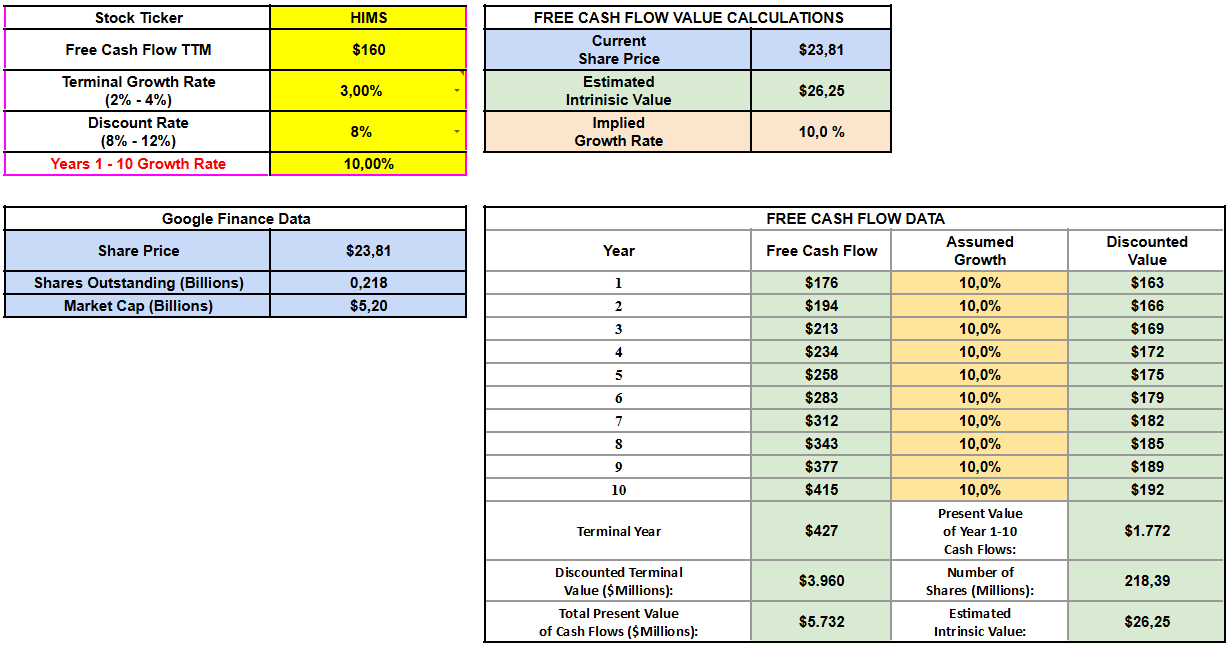

DCF: $25,29

Multiple Valuation: $22,00

Benjamin Graham’s Valuation: $59,98

Analysts Average: $27,60

Average of: $33,72

Current Price: $23,81

Due note, these are assumptions made on the 60% to 70% growth for the next year with declining growth we projected in this investment case! If Hims and Hers can not reach these targets, this valuation is too high.

In addition, here’s my reverse DCF calculation on Hims and Hers. :-)

End note

Thank you for reading this investment case on Hims and Hers!

With every investment case, I am trying to improve my writing and how I communicate my findings with you all. Because I started not too long ago, some posts might change in layout or other aspects before I find the design that suits my best wishes; sorry in advance.

As of now, thank you so much for your time! I hope you found some valuable information in this investment case.

Disclaimer

I do not own Hims and Hers shares. I might be buying into Hims and Hers within the next three to six months.

By reading my posts, being subscribed, following me, and visiting my Substack, you agree to my disclaimer. You can read the disclaimer here.