Too tired to read the article? You can listen to it here!

Hey there, partner! 👋

Before we dive in, I need your support to keep these articles FREE.

If you're enjoying this content, here's how you can help:

Like the article

Please share it on your social media

Comment below to join the conversation

Your engagement means everything. Thanks for being part of the journey! Now, let's get started.

In investing, “cash is trash” has become a powerful statement—and for good reason. Once considered a haven in times of economic uncertainty, cash is now often seen as a stagnant and even self-sabotaging asset class. With inflation at the forefront of economic discussions worldwide, investors prioritizing cash over other asset classes risk watching their wealth gradually erode. In this article, we’ll explore why holding excessive amounts of cash may not be as safe as it seems and delve into why proactive investing can be a more effective means to maintain and grow wealth in today’s economic environment.

1. The Erosion of Purchasing Power Through Inflation

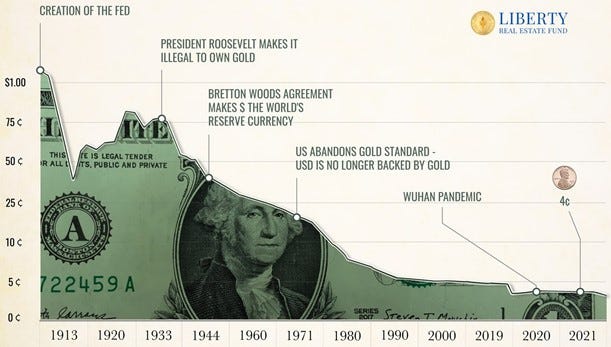

One of the most significant factors impacting cash’s value is inflation—the gradual price increase and decrease in purchasing power. In a low-inflation environment, holding cash might have been a viable option. However, inflation has surged in recent years due to various factors, including government spending, supply chain disruptions, and heightened demand for goods and services. When inflation rises, the value of cash held in savings accounts or under mattresses decreases, making it worth less than in previous years.

"Inflation is taxation without legislation."

— Milton Friedman

Imagine holding $100,000 in cash. With an annual inflation rate of 3%, your money will lose approximately $3,000 in purchasing power each year. Over a decade, your money could lose nearly 30% of its original value. Inflation is a silent, persistent force that erodes wealth over time. Even though your cash balance may look the same, its real-world utility shrinks, leading to what many call a “negative return.” Simply put, inflation is the hidden tax on cash.

2. Opportunity Cost: What Are You Missing Out On?

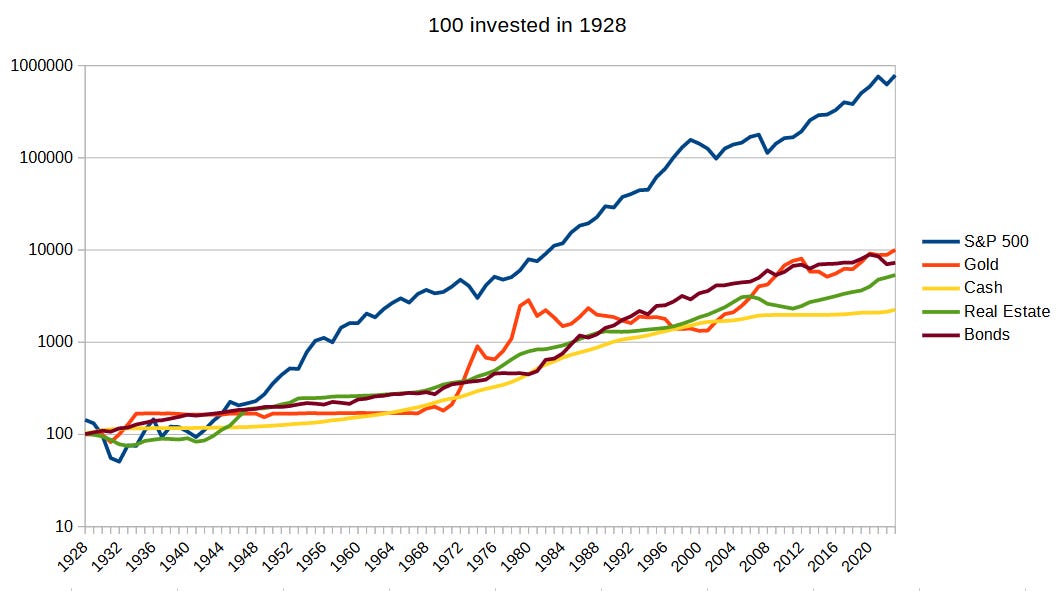

Another important consideration for investors is the concept of opportunity cost—the potential gains that could have been earned by investing in other assets. While cash offers liquidity and flexibility, holding onto it comes at the expense of returns that could be earned elsewhere. Historically, stocks, bonds, real estate, and even commodities have provided significantly higher returns over the long term than cash.

Over the past century, the U.S. stock market, for instance, has returned an average of around 7% annually, adjusted for inflation. Meanwhile, cash held in savings accounts has often earned close to zero after accounting for inflation. This stark difference means that long-term cash holders miss out on substantial wealth-building opportunities that other asset classes can offer. Over time, the cumulative effect of missed opportunities can lead to drastically lower wealth.

"The big money is not in the buying and selling, but in the waiting."

— Charlie Munger

3. The Illusion of Safety

One of the reasons people gravitate toward cash is the perception that it is “safe.” It’s true that cash, especially when stored in bank accounts insured by federal agencies, doesn’t face the same volatility as stocks, real estate, or other investments. But safety, in this case, can be a double-edged sword. While cash doesn’t fluctuate in nominal terms, the steady erosion of its value due to inflation makes it a risky proposition regarding long-term purchasing power.

This illusion of safety is particularly harmful during economic downturns. While cash holders may feel reassured by seeing the same amount in their accounts, they fail to realize that their wealth is slowly slipping away. Meanwhile, those who invest strategically in assets that outpace inflation—such as equities, real estate, or inflation-protected bonds—are better positioned to weather economic storms.

"In investing, what is comfortable is rarely profitable."

— Robert Arnott

4. Central Bank Policies: Fueling the Fire

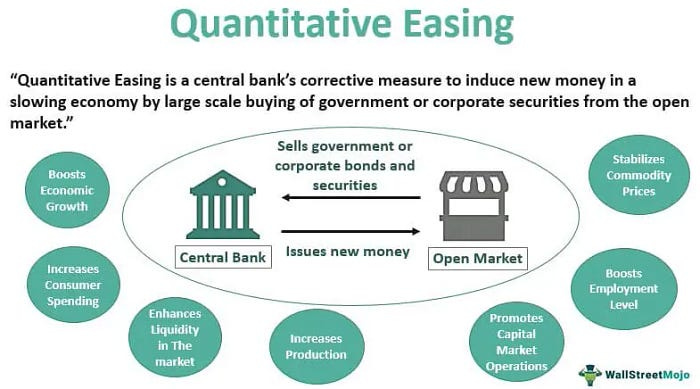

Central bank policies around the world play a critical role in determining the value of cash. In recent years, central banks have pursued aggressive monetary policies, including quantitative easing and low interest rates, which have expanded the money supply and spurred inflationary pressures. When interest rates are low, the returns on cash and cash equivalents are reduced to near zero, making them unattractive for investors seeking real growth.

Quantitative easing, a process in which central banks purchase assets to inject liquidity into the financial system, has also contributed to currency devaluation. By printing money, central banks dilute the value of existing cash in circulation, leading to the classic supply-demand imbalance. The more dollars or euros in the system, the less valuable each becomes. Consequently, the purchasing power of cash savings erodes even further, reinforcing the notion that cash is indeed trash.

"We learn from history that we do not learn from history."

— Georg Wilhelm Friedrich Hegel

5. Cash as a Tactical Asset, Not a Wealth-Building Strategy

While cash plays a role in an investor’s portfolio, it should not be mistaken for a wealth-building asset. Savvy investors understand that money can be helpful as a tactical asset—a buffer for emergencies or a reserve to seize future investment opportunities. In the short term, cash can help reduce risk during market volatility or provide liquidity for expenses. However, over the long term, holding large cash positions as a primary investment strategy limits growth potential and exposes one to significant inflationary risk.

A diversified portfolio, on the other hand, offers protection against various economic cycles. Stocks, bonds, commodities, and real estate respond differently to inflation, interest rate changes, and economic shifts, allowing for balance and growth potential. If held in excess, cash fails to keep up with the power of compounding returns that these asset classes offer. Investors who aim for long-term success should view cash as a temporary resting place for capital, not as a core holding.

"I’d be a bum on the street with a tin cup if the markets were always efficient."

— Bill Gross

6. Alternatives to Cash: Inflation-Resistant Assets

"Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria."

— Sir John Templeton

For investors wary of inflation, there are several alternatives to holding large cash reserves. Each of these asset classes provides a way to preserve purchasing power while offering growth potential:

Equities: Stocks historically outperform inflation in the long run, as companies can raise prices in response to inflation, passing costs onto consumers and preserving profit margins.

Real Estate: Real assets like property have intrinsic value and tend to appreciate during inflationary periods. As property values rise, real estate provides income through rent and offers a hedge against inflation.

Commodities: Tangible assets like gold, silver, and oil often perform well in inflationary environments. When cash loses value, the commodity demand can increase, driving up prices and preserving purchasing power.

Inflation-Protected Bonds: Treasury Inflation-Protected Securities (TIPS) and similar instruments adjust their principal and interest payments according to inflation rates, offering a stable income stream that keeps pace with inflation.

Cryptocurrencies: Although a relatively new asset class, specific cryptocurrencies offer a decentralized, deflationary alternative to traditional currencies. However, they are highly volatile and should only be considered part of a diversified strategy.

7. The Bottom Line: Cash’s Role in a Balanced Portfolio

To be clear, this article is not an argument for abandoning cash altogether. Cash is essential to any financial plan, providing security, liquidity, and flexibility in uncertain times. Emergency funds, for instance, should still be held in cash or cash-equivalent assets to ensure easy access when needed. Additionally, having some cash reserves allows investors to seize opportunities when markets dip or crises emerge.

However, the amount of cash held should be carefully considered. For long-term wealth building, most of an investor’s portfolio should be allocated to assets with a proven track record of outpacing inflation. In an inflationary environment, a diversified mix of equities, real estate, and inflation-protected assets can help counter the effects of rising prices and create a pathway for growth.

In the end, cash, when used wisely, serves a purpose. Yet, as an investment, it falls short in the face of inflation, opportunity costs, and central bank policies. For the long-term investor, cash is trash—a stagnant holding that does more harm than good in the quest for financial security and growth. By understanding cash limitations and proactively seeking alternatives, investors can safeguard their wealth and navigate the challenges of an ever-evolving economic landscape.

Final Thoughts

In an increasingly complex financial environment, understanding the actual cost of holding cash is essential for investors at all levels. Inflation, central bank policies, and missed opportunities underscore why cash is best seen as a liquidity tool, not an asset for wealth creation. By diversifying portfolios and investing in assets that offer actual returns, investors can protect their purchasing power and position themselves for a prosperous future.

"The stock market is filled with individuals who know the price of everything, but the value of nothing."

— Philip Fisher

In today’s world, cash may feel safe—but in the long term, it’s a liability.

Disclaimer

By reading my posts, being subscribed, following me, and visiting my Substack, you agree to my disclaimer. You can read the disclaimer here.