Hello friend! 👋

My name is Yorrin, also known as ‘‘Fluentinvalue’’.

I am pleased to have you back here for the first-ever ‘‘Best Buy’’! Why now? Good question.

The market is in general currently pretty overvalued in my opinion. Almost all stocks are currently trading at high multiples, making them pricey investments.

But, there is an exception on the horizon…

Ulta Beauty!

P.S.

If you’re currently not yet following me, consider doing so. I provide FREE content to help and inform you in your investment journey. From beginner to advanced, all info will be helpful. :-)

General information

Company name: Ulta Beauty Inc.

Ticker: ULTA

Stock price: $381.78

Market cap: $18.3B

Revenue: $11.21B

Industry: Retail Trade

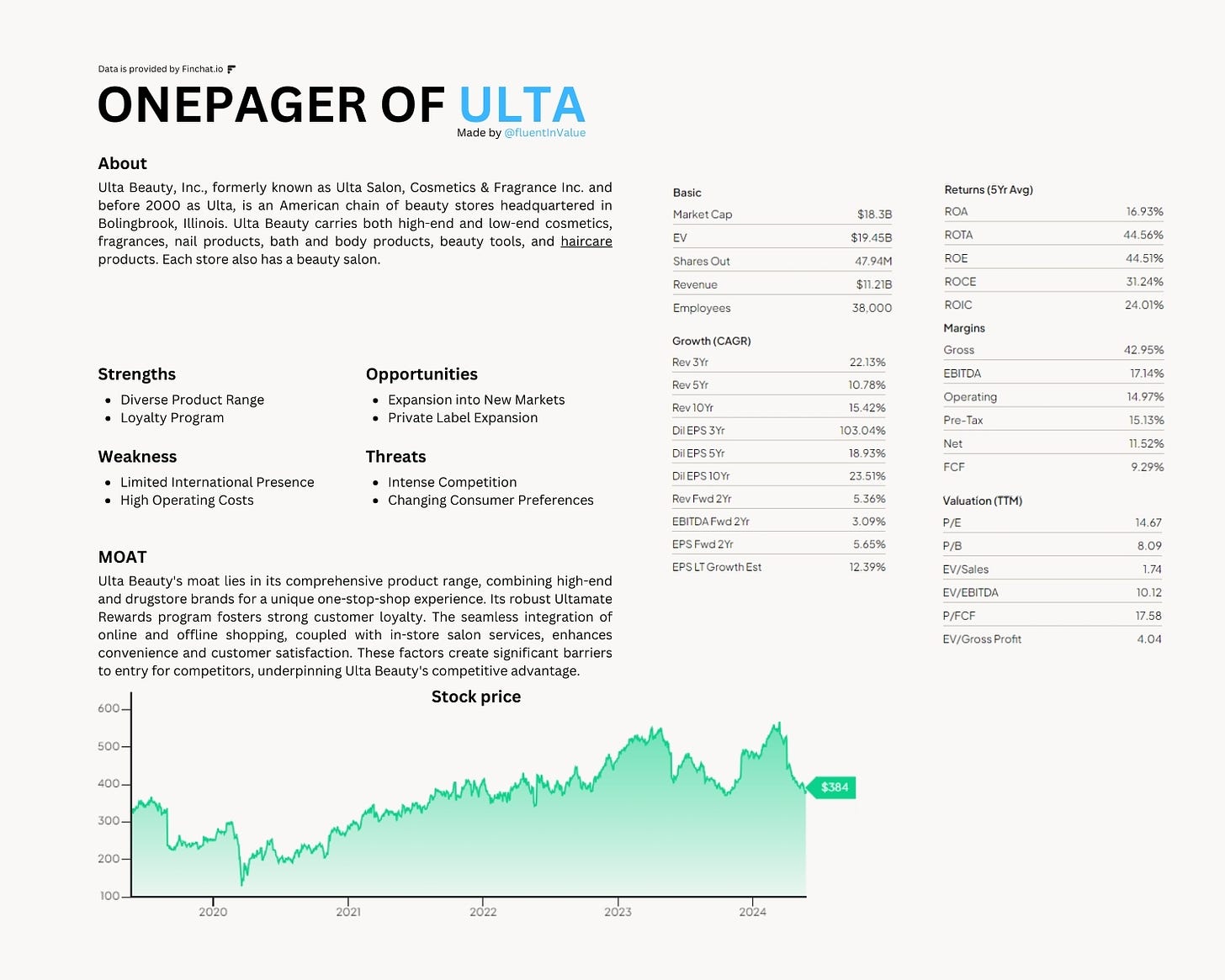

Ulta one-pager

Ulta Beauty's most recent stock plummet

Ulta Beauty is a retail giant in The United States with a total of 1.385 stores and new stores opening YoY. Only last year Ulta Beauty opened 40 new stores and as of February Ulta Beauty opened another 30 stores. This should tell you that Ulta Beauty is a giant that keeps getting bigger and bigger.

The company reported FY23 results back in March, beating analyst estimates. However, the guidance from Ulta Beauty for FY24 was rather ‘‘weak’’, causing the share price to drop drastically. Investors expected to see a larger increase in growth estimates because of the international expansion notice Ulta Beauty gave, expanding over to Mexico in 2025.

Ulta Beauty announced a joint venture with Grupo Axo, however, investors did not respond well to this news. The plan, according to analysts and investors, lacked clarity and lust. This and the cautious guidance from Ulta Beauty for FY24 caused the share price to plummet.

As shown below, the share price of Ulta Beauty fell from $567.18 per share down to $384 as of today.

Is this reaction valid though is the follow-up question.

In my opinion, this is an overreaction from the market.

Expansion in Mexico

Ulta Beauty is planning to expand its operations to Mexico in 2025, this creates immense opportunities for us shareholders and the company.

The CEO said the following:

The Mexican beauty market is sizeable, growing, and has significant beauty whitespace. Our research suggests there is a healthy awareness of the Ulta Beauty brand with local beauty enthusiasts, and we also see strong engagement in our stores located in geographically adjacent markets. After extensive evaluation, we’ve prioritized a partnership, and asset-light approach to enable us to move quickly, and I am excited to announce we have formed a joint venture with Axo, a Ulta Beauty in Mexico in 2025. As a result of this approach, we do not expect this venture to be material to our financials in 2024.

Yes, the announcement is a bit underwhelming, haha. But the core of the story is what matters, Ulta Beauty is expanding its operations over the border. To put it bluntly, more exposure means more revenue coming into the pockets of the business and ultimately the shareholders too.

Something we also need to keep an eye out for is Sephora. Sephora has already made its name in Mexico. So, for Ulta Beauty to grow, they will need to put in a lot of effort, this is not going to be an easy ride for them.

Also, stores like Superama and others alike, Ulta Beauty have some fierce competition. I do think Ulta Beauty will outshine the competition. Ulta Beauty is known for their excellent service and in-store experience, something the competition can learn from.

But, is there a beauty market in Mexico? Yes!

The total Mexican Beauty market is roughly valued at $10B. With a population of roughly 130 million people who are improving their standards of living dramatically YoY, Mexico provides enough room for future growth.

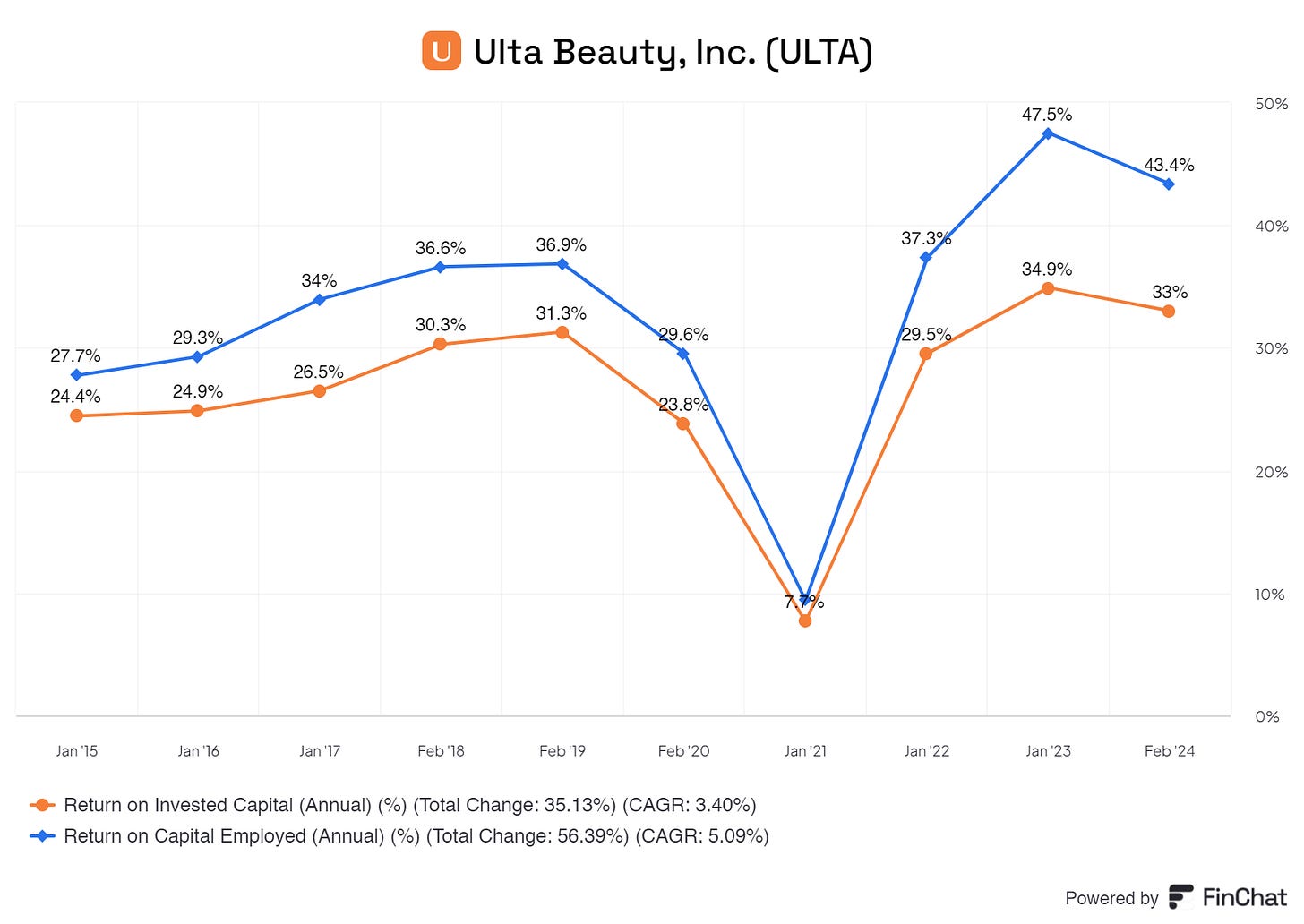

Quality capital allocators

Management of Ulta Beauty is showing to improve their capital allocation skills YoY, check the ROIC.

Yes, in 2021 there was a ‘‘slight’’ dip. But, management is showing to allocate free cash flow to very profitable projects, creating solid returns for the company and its shareholders.

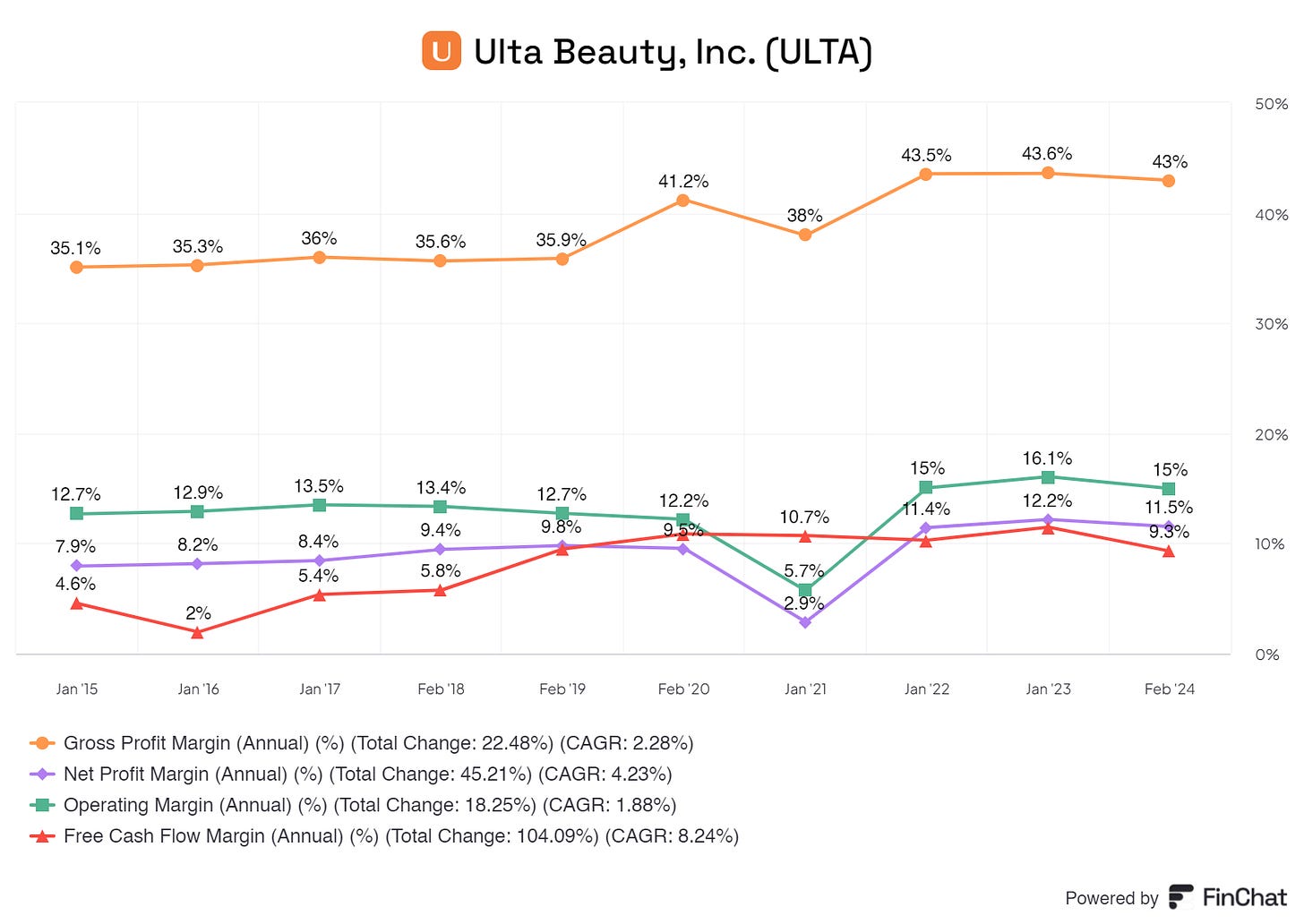

Margins

Ulta Beauty profits from solid margins. Investors argue that these margins are the first to fold under pressure in the beauty sector, but I doubt it.

Ulta Beauty has already sustained these wonderful margins since 2014, competition has always been here and never left and come back. Ulta Beauty profits from an extremely loyal customer base, allowing these margins.

I do not see anytime soon that there will be a disruptor disrupting so heavily that Ulta Beauty needs to tackle its margins to stay relevant and compete with the others. Ulta Beauty has been competing for a while now with these margins and creating above-modest results.

The free cash flow margin, something I love, is high for a retailer. This means the revenue Ulta Beauty creates is of high quality, converting a lot into free cash flow. (for a retailer)

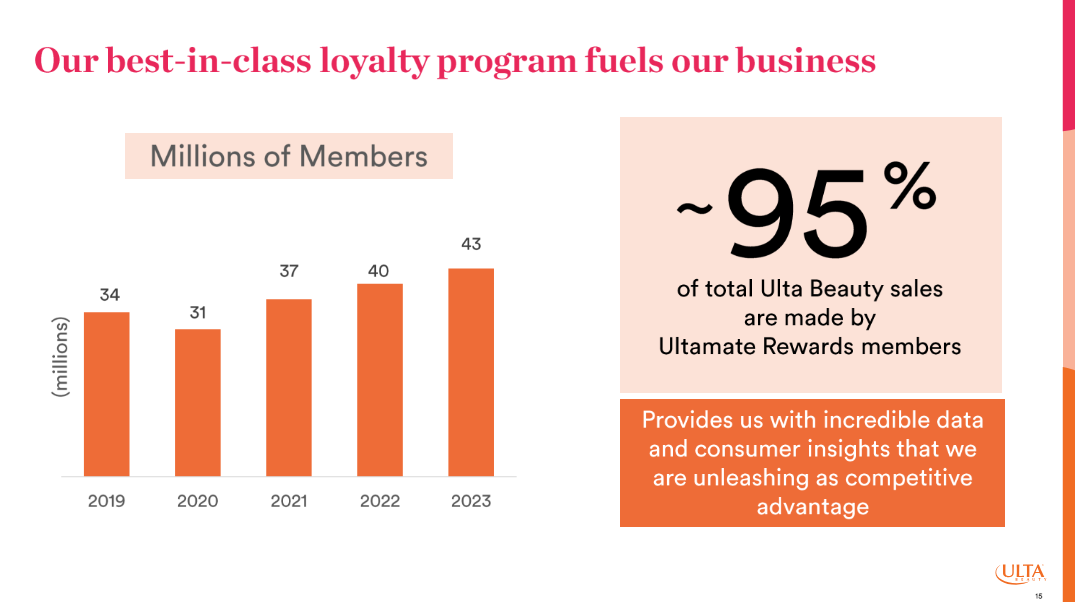

Loyalty program

Holy cow…

Almost all the customers of Ulta Beauty are part of the loyalty program that Ulta Beauty offers, talking about customer loyalty.

Ulta Beauty benefits from extremely loyal customers, its loyalty program, in-house services, superb service, and a wide range of supplies for the beauty enthusiast.

Why is it a good buy?

Ulta Beauty almost has no debt on the balance sheet.

Steadily growing revenue

Expansion internationally

Domestic expansion via new stores and partnerships

The beauty market is a somewhat cyclical-proof sector

Ulta Beauty buys back shares

SCB to revenue is below 1%

ROIC of 34%

ROCE of 47%

And last but not least, Ulta Beauty is currently extremely cheap!

Ulta Beauty is trading a a P/E of 14.67 while its 5Y avg. is a P/E of 21.92, EV/SALES of 1.74 while the 5Y avg. is 2.47, EV/EBIT 11.59 while its 5Y avg. EV/EBIT 21.75, I could go on for a bit. Ulta right now is valued at a solid discount.

With my DCF it comes out to $608.93 and my fair value calculation comes out to $673.27. Even with a solid margin of safety, you are buying Ulta Beauty at a modest discount with a solid upside potential.

Conclusion

I have bought Ulta Beauty at its current level.

I think Ulta Beauty is undervalued and being wrongfully punished for some minor hiccups. These hiccups do not affect Ulta Beauty in the long run, I am pretty sure of this.

Management is capable of generating a solid return, being capital allocators, having a keen eye for investors, and knowing how to keep this pace going.

At the current multiples, Ulta Beauty is a steal!

Yes, there are some risks like the Mexican market not working out, competition, and regulations and laws, but these are deemed no issue to me. I am confident in Ulta Beauty and its management to keep growing in the ever-growing beauty industry. This market will grow, exponentially, and I am certain Ulta Beauty is poised for success and growth within the beauty market.

But as always, be sure to do your research! Just because I like and bought the stock does not mean you should buy the stock too.

Disclaimer

By reading my posts, being subscribed, following me, and visiting my Substack you agree to my disclaimer. You can read the disclaimer here.