Hey there, partner! 👋

Before we dive in, I need your support to keep these articles FREE.

If you're enjoying this content, here's how you can help:

Like the article

Please share it on your social media

Comment below to join the conversation

Your engagement means everything. Thanks for being part of the journey! Now, let's get started.

Welcome to another edition of ‘‘Best Buys’’. In these articles, I lay out what I think now is the best business to buy at a fair price.

Today, we’re looking at ASML N.V., the semiconductor giant in the Netherlands. I’ve previously done a deep dive on ASML; you can check it out by clicking here. This deep dive provides a more detailed insight into the complex business; I recommend you read that deep dive before continuing here or making any decisions, like buying the stock.

ASML shares have fallen 20% since the summer due to concerns about export restrictions, especially those to China, where ASML earns a considerable portion of its total revenue. The U.S. has been a big player in the scrutiny with restrictions and controls on the semiconductor industry by increasing regulatory pressure.

Now, with increasing innovations, increased demand, and priced-in risks, ASML might be an attractive buy lately; let's discuss it briefly and evaluate the business!

Quick Business Overview

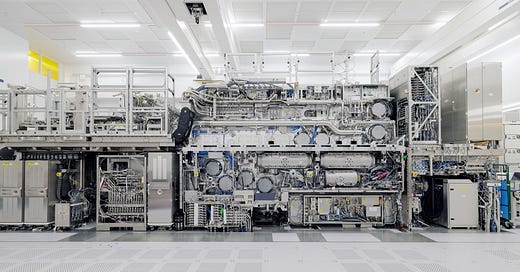

ASML Holding N.V. develops, produces, markets, sells, and services advanced semiconductor equipment systems consisting of lithography, metrology, and inspection-related systems for memory and logic chipmakers. The company provides extreme ultraviolet and deep ultraviolet lithography systems comprising immersion and dry lithography solutions to manufacture various semiconductor nodes and technologies. It also offers metrology and inspection systems, including YieldStar optical metrology solutions to measure the quality of patterns on the wafers and HMI e-beam solutions to locate and analyze individual chip defects. In addition, the company provides computational lithography and software solutions to create applications that enhance the setup of the lithography system and mature products and services that refurbish used lithography equipment and offer associated services. It operates in Japan, South Korea, Singapore, Taiwan, China, the Netherlands, Europe, the United States, and the rest of Asia. The company was formerly known as ASM Lithography Holding N.V. and changed its name to ASML Holding N.V. in 2001. ASML Holding N.V. was founded in 1984 and is headquartered in Veldhoven, the Netherlands.

ASML One-pager

My Thesis on ASML

ASML holds a near-monopoly in the extreme ultraviolet (EUV) lithography market, essential for producing advanced semiconductor chips. The company is the sole provider of EUV lithography systems, a crucial component in miniaturizing semiconductor designs that follow Moore’s Law. This exclusive access to cutting-edge EUV technology gives ASML an unparalleled competitive advantage in a highly specialized and lucrative industry.

EUV Lithography: ASML’s EUV systems are essential for producing smaller, more powerful, and energy-efficient chips. As the demand for advanced chips grows with emerging technologies like 5G, AI, and autonomous vehicles, chipmakers like TSMC, Intel, and Samsung depend on ASML's machines. EUV lithography allows for the production of chips with feature sizes smaller than 5 nanometers, ensuring continued innovation and growth in the semiconductor industry.

Strong Growth Catalysts

The global semiconductor industry is expanding rapidly, driven by increasing demand for computing power, data storage, and connectivity. ASML is positioned at the heart of this growth, supplying the machines enabling semiconductor manufacturers to meet this demand.

Key End Markets: ASML’s equipment is essential to several high-growth industries, including:

Artificial Intelligence (AI): AI applications require vast computing power, driving demand for high-performance chips produced with EUV technology.

5G and IoT: As the world adopts 5G networks and more IoT devices come online, the demand for faster, smaller, and more energy-efficient semiconductors will grow, boosting ASML’s long-term growth prospects.

Automotive Industry: The automotive industry is becoming more reliant on advanced chips for electric vehicles (EVs), autonomous driving, and vehicle-to-infrastructure communication, further enhancing ASML’s growth trajectory.

Capacity Expansion by Chipmakers: Major semiconductor foundries like TSMC, Samsung, and Intel are making multi-billion-dollar investments to expand their production capacity for advanced nodes. This expansion directly benefits ASML, as these companies must purchase ASML’s EUV and deep ultraviolet (DUV) machines to meet future demand for advanced chips.

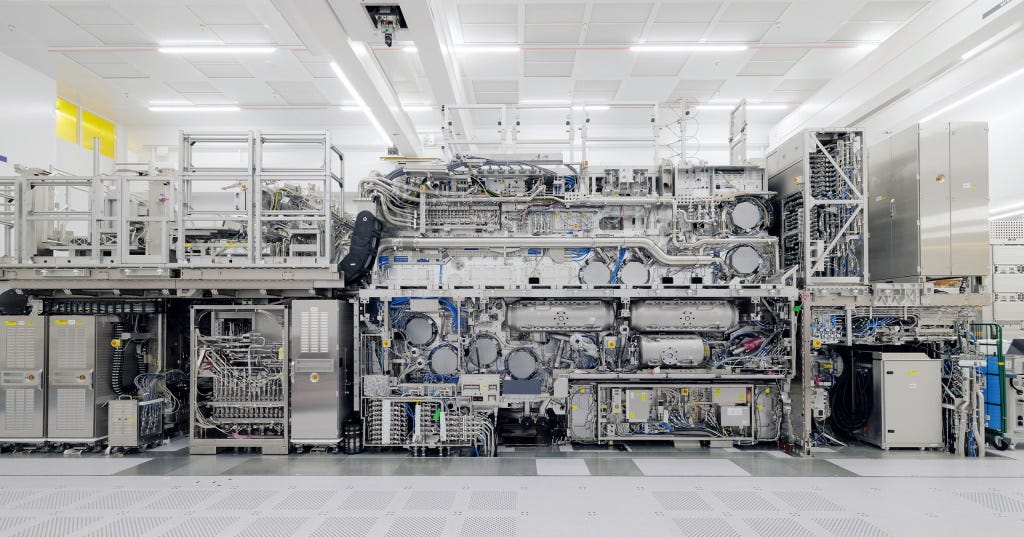

The semiconductor industry has always been extremely competitive and cyclical. There’s a lot of demand for ASML’s products now, but ASML and investors are well aware that, due to its cyclicality, demand could easily die down for a period before picking back up again.

‘‘We also face competition from new competitors with substantial financial resources, as well as from competitors driven by the ambition of self-sufficiency in the geopolitical context. Furthermore, we face competition from alternative technological solutions or semiconductor manufacturing processes.’’

ASML is well aware of its current competitors and how they’re impacting the industry as a whole, further stating:

‘‘We also compete with providers of applications that support or enhance complex patterning solutions, such as Applied Materials Inc. and KLA-Tencor Corporation. These applications effectively compete with our Applications offering, which is a significant part of our business.’’

As shown above, if we examine the previous year more closely, we can see the bottom of the cycle and the potential for upward movement in demand. Of course, cyclicality is unpredictable, and the past does not guarantee future outcomes, but it is something we can hold on to.

Multiple sources, such as ASML, KLA, Canon, and other competitors, have also noticed that we might be experiencing a turnaround. This could indicate that the ‘‘bottom’’ has been reached.

Even though we’re at the bottom of the curve, there's still sufficient demand for ASML's products.

If we could see this turn-around soon, we might also be in for a big one.

Industry Growth Prospects

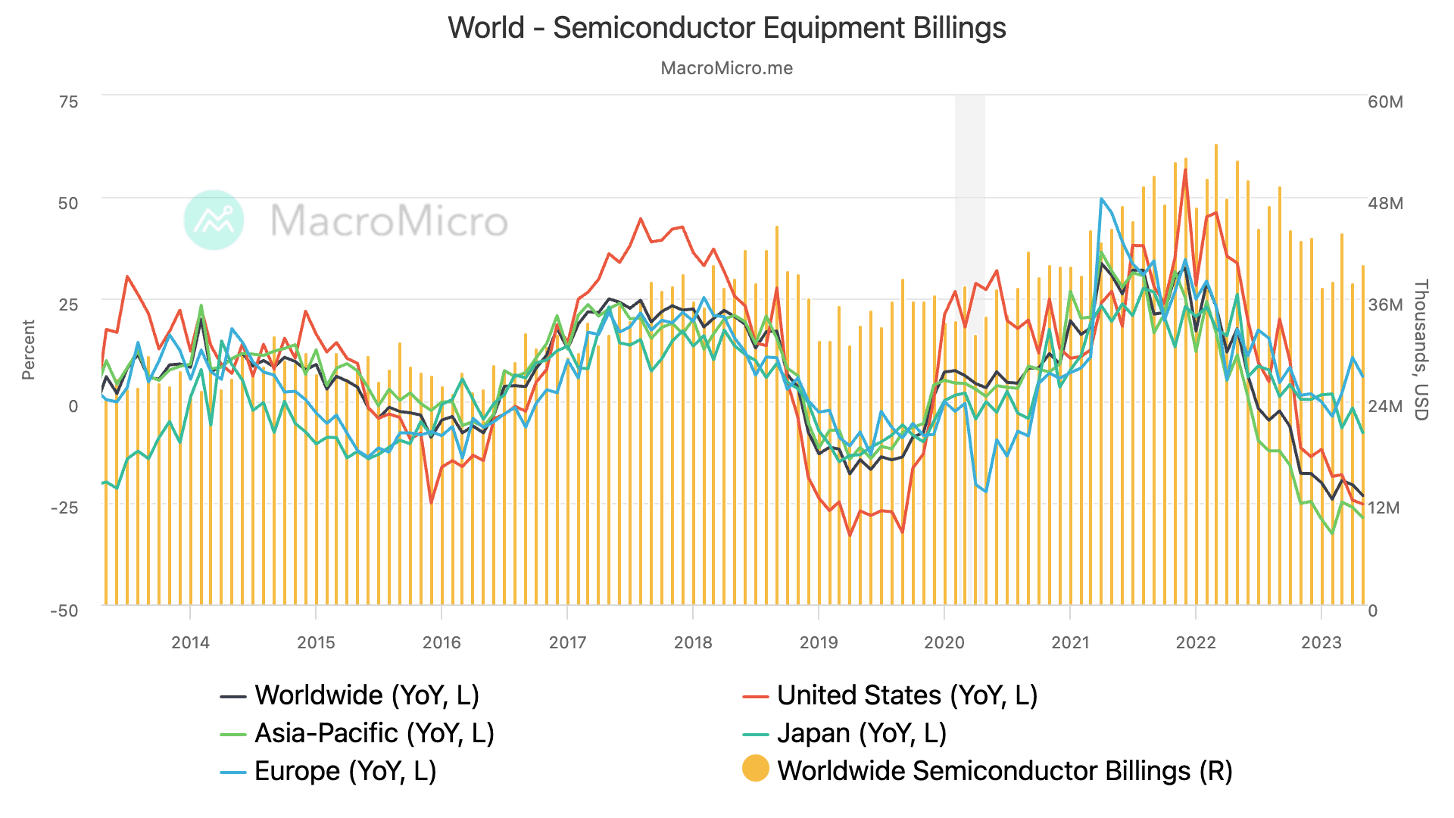

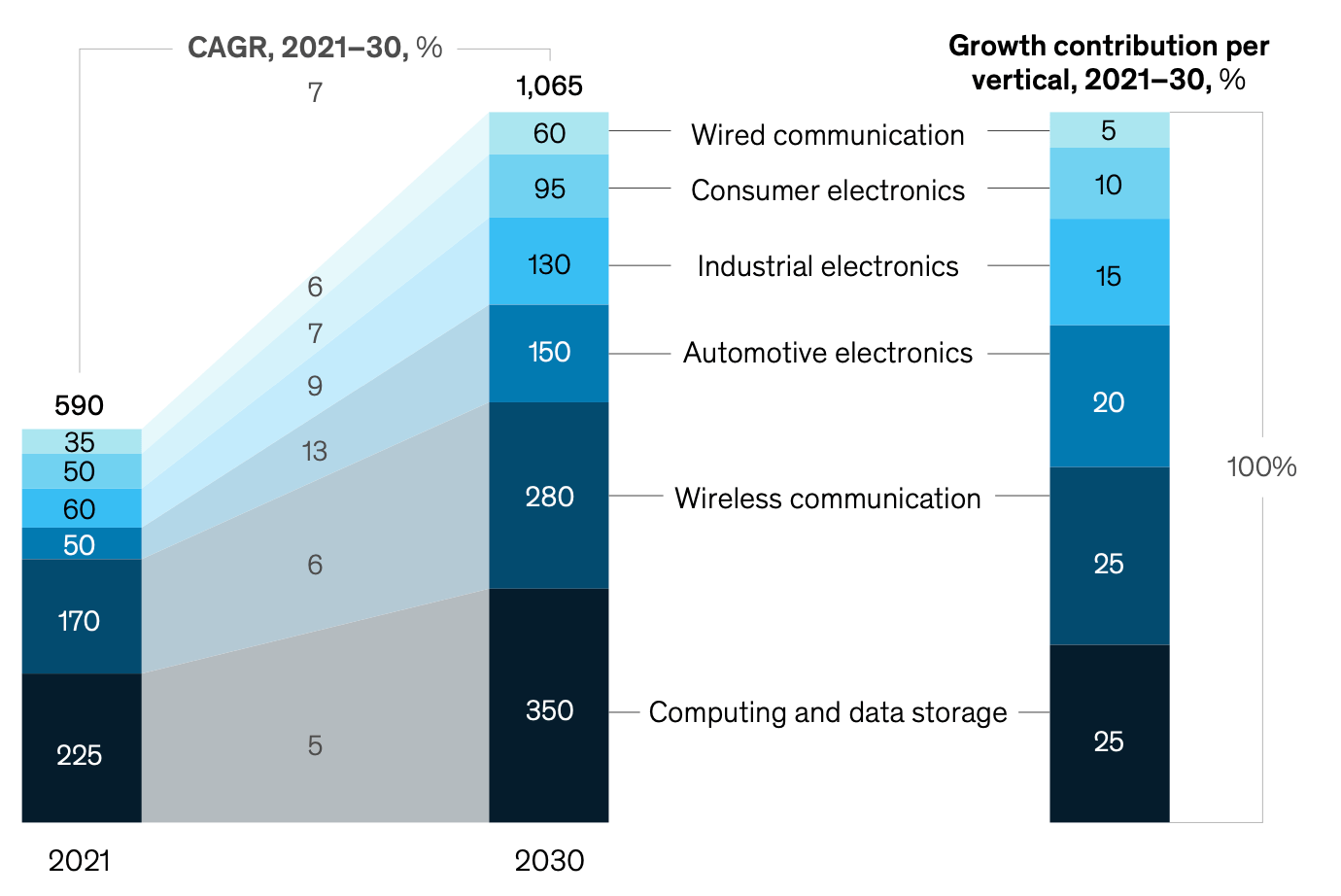

The global semiconductor market is valued at around $611.35B, while the 2022 market size was $590B, a YoY growth of 3.62%. With a possible turn-around around the corner, aiming for a market size of $1.065B doesn’t seem out of the ordinary and is very much possible. Some analysts even argue that the $1T might be hit as soon as 2028, which sounds reasonable. Of course, this might slip a few years due to supply chain constraints and geopolitical forces.

“If you take automotive, for example, we questioned what the car in 2030 looks like,” said Ondrej Burkackey, senior partner at McKinsey & Co. and one of the firm’s Semiconductors and Business Technology practice leaders. “We expect that silicon content per car will double by 2030. Any new functionality, such as driver-assistance features — it doesn’t have to be full autonomy — needs more semiconductors.

The largest chunk comes from computing and data storage. Today, roughly 40% of the industry is in computing and data storage. If this sector grew by a mere 5%, it could contribute around $400B. The second largest segment accounts for roughly 30% of the total: wireless communication, your beloved phone. These segments will grow substantially due to innovation, demand, and consumer needs. Most of this is fueled, of course, by new features.

The semiconductor industry is expected to grow substantially.

Strong Financials and Excellent Margins

ASML has demonstrated impressive financial performance, driven by its strong pricing power and consistent demand for advanced lithography systems. The company’s unique position allows it to command premium prices for its machines, costing up to $150 million each. With a current backlog order of $39 billion, ASML’s revenue visibility and long-term growth prospects are secure.

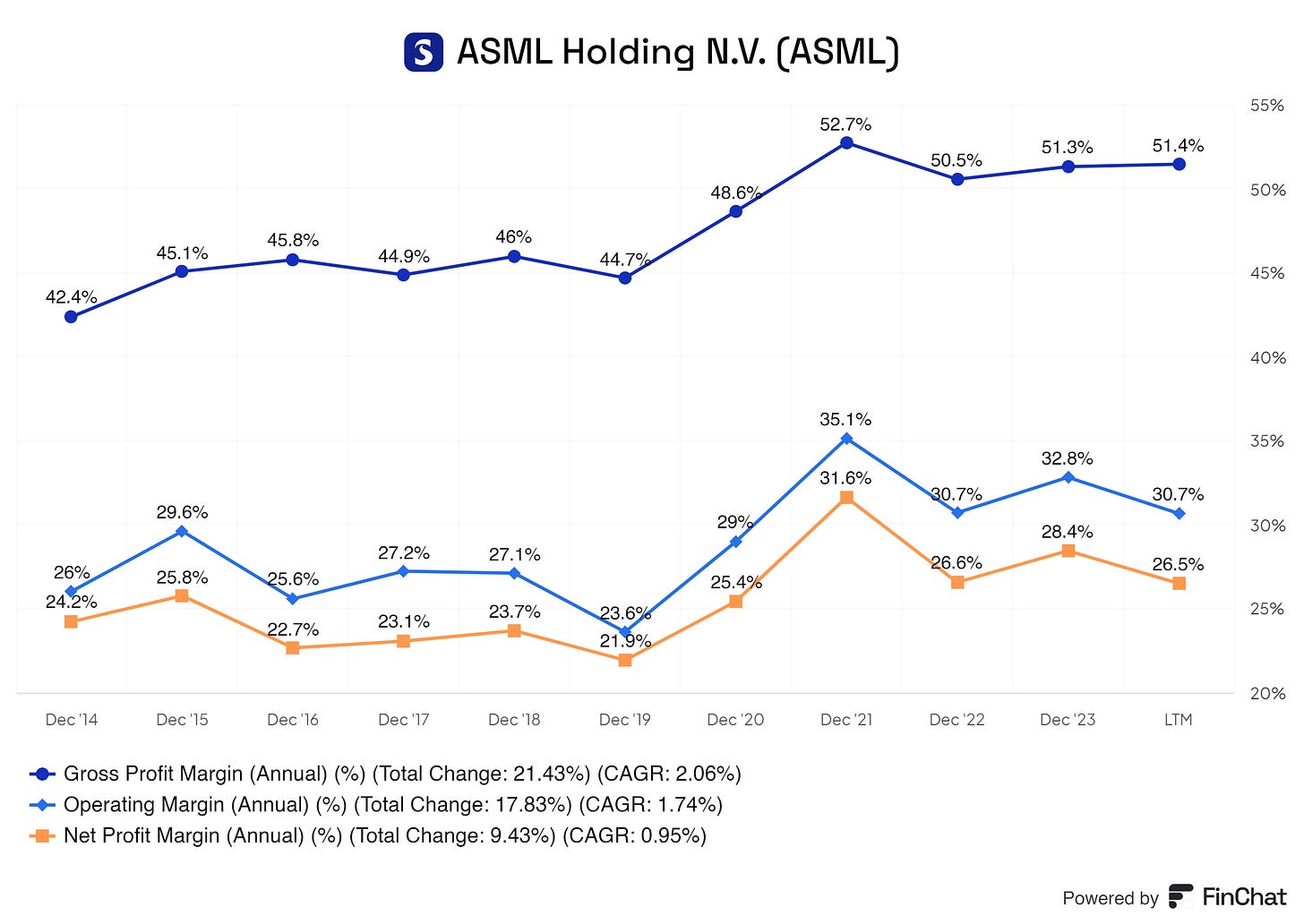

High Margins: Running this monopoly comes with wonderful and sustainable margins for ASML.

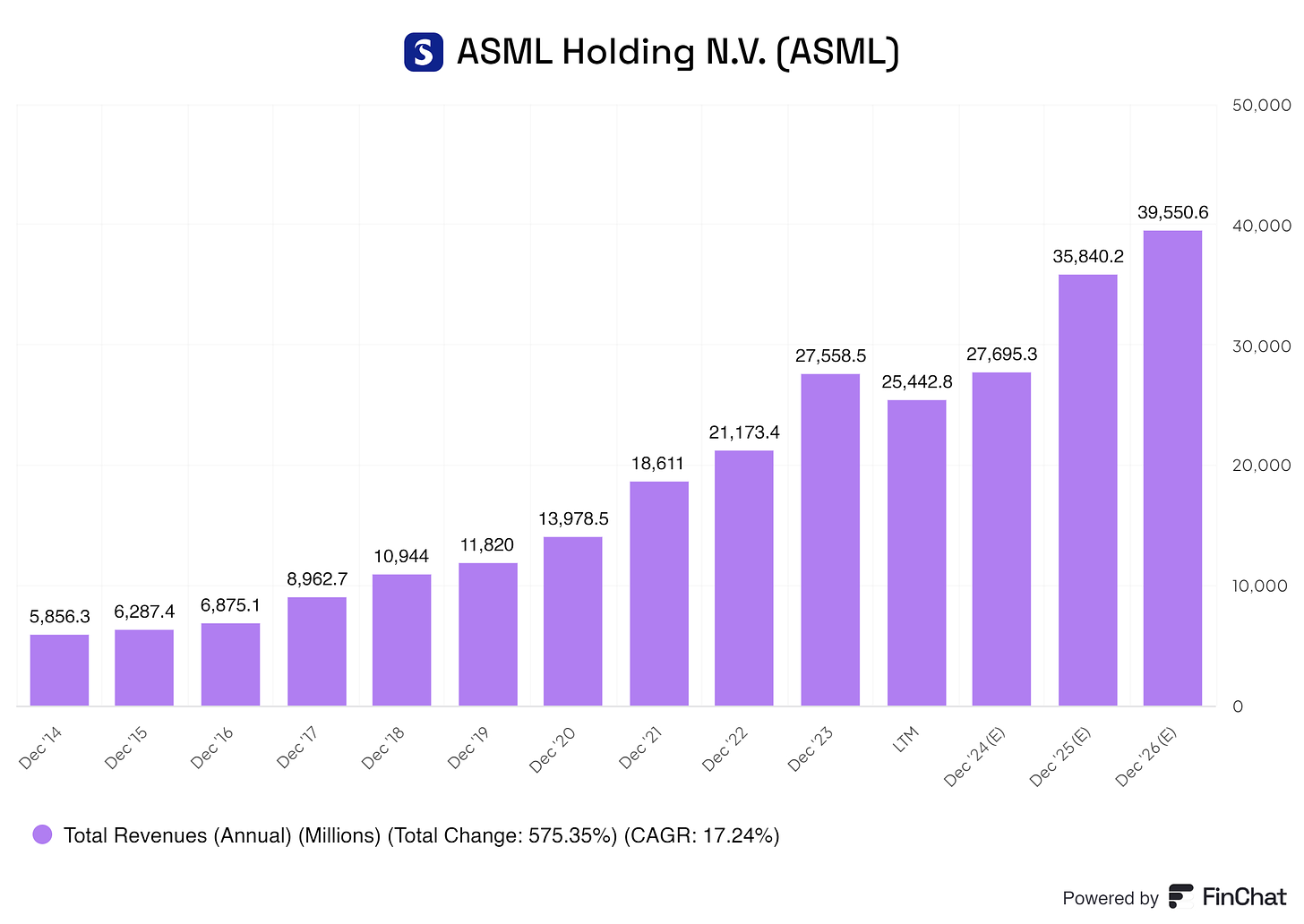

Revenue Growth: ASML’s revenues have grown steadily, driven by strong demand for EUV and DUV machines. In 2023, the company reported total revenues of over €25 billion, and projections indicate continued growth as the semiconductor industry expands.

As illustrated in the graph above, ASML is projected to generate approximately $35,840.2 million in revenue by 2025 and $39,550.6 million by 2026. If these expectations are met, ASML will maintain a strong compound annual growth rate (CAGR) of 17.24%. With the company anticipated to close 2024 at $27,695.3 million, the growth from 2024 to 2025 is expected to be a robust 29.41%, followed by a solid 10.35% growth from 2025 to 2026.

ASML has indicated that it operates at the bottom of the semiconductor cycle. These revenue projections are based on this lower cycle point, meaning ASML could be poised for even more explosive growth once the cycle rebounds. This positions ASML as a significant player in capitalizing on the eventual upswing in the semiconductor industry.

’’The semiconductor industry continues to work through the bottom of the cycle.’’ - - Mr. Christophe D. Fouquet (CEO)

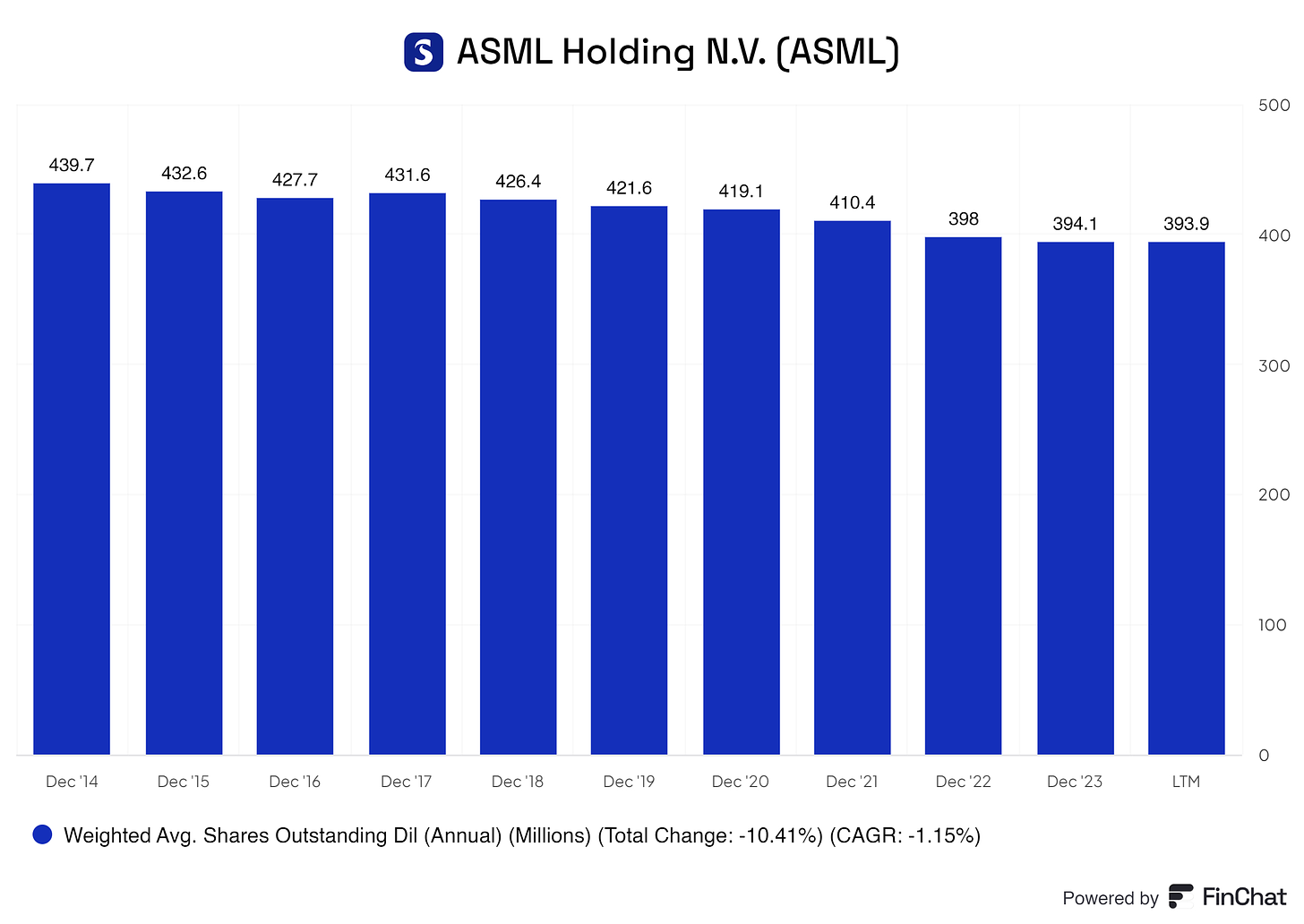

Share buybacks

ASML continues to back its shares, creating more per-share value for its shareholders. Buying back shares with a CAGR of 1.15% is modest, nothing too crazy or unsustainable.

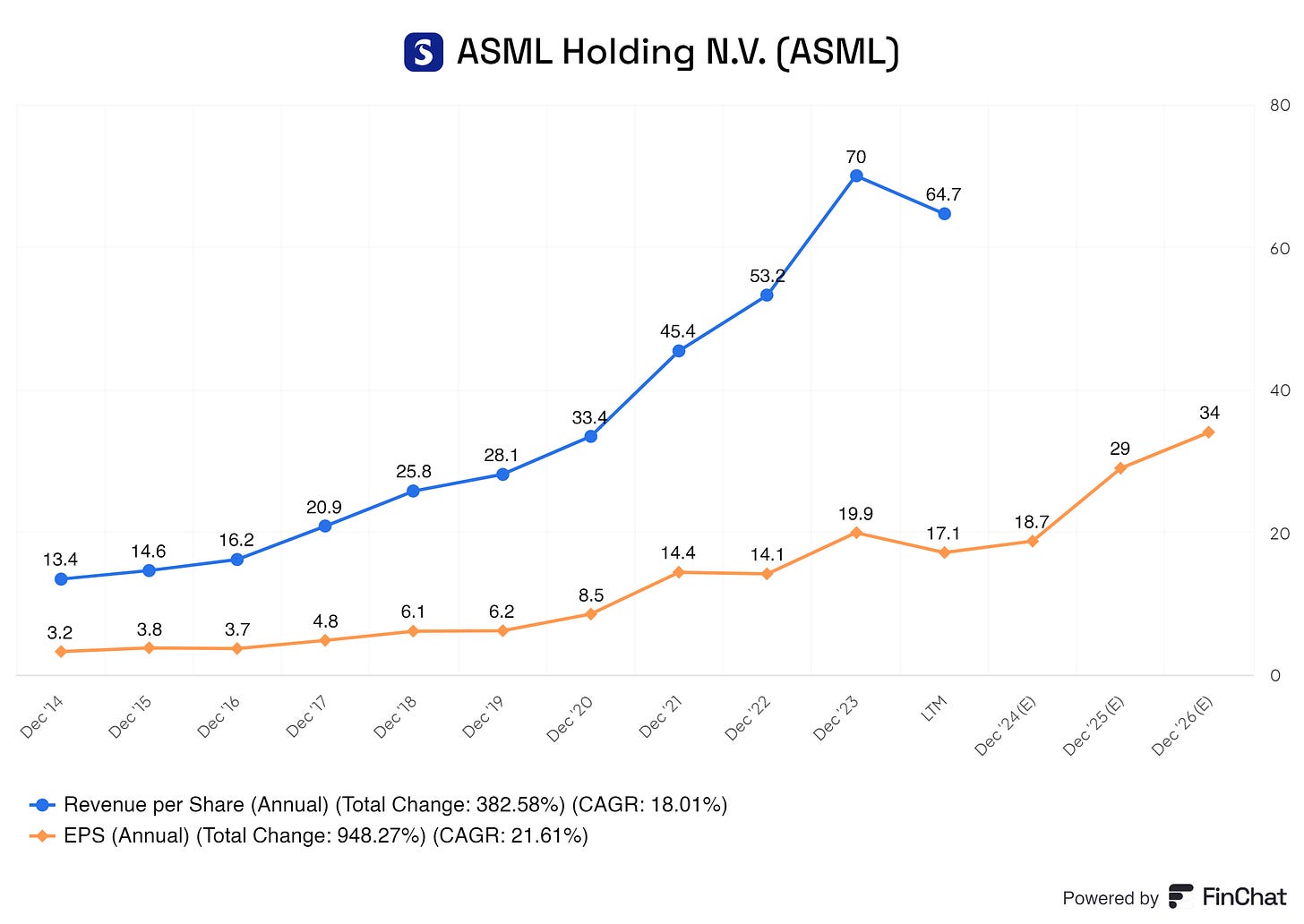

As illustrated above, ASML’s EPS is expected to grow immensely. Of course, revenue per share will climb as long as ASML continues to expand its operations or starts managing its expenses; these are growth drivers for revenue per share. With its current backlog, I think we could see YoY growth in its EPS and revenue per share, two important metrics to me.

Valuation

Multiple valuation: $989,21

Benjamin Graham's valuation: $1,175.62

Discounted Cash Flow valuation (less relevant for this type of business): $1,109.44

Forward EV/OCF for FY2026 is 21.2, and the 10-year median is 26.75. Forward EV/EBITDA is 20.8, and the 10-year median is 22.52. Forward EV/SALES is 8.4 for FY2025 and a 10-year median of 7.24. Lastly, with a forward P/OCF of 25.9 for FY2025 and a 10-year median of 26.76, ASML is looking fairly evaluated and solid as a potential investment. With the projected 20% growth, ASML looks fairly valued and offers solid returns.

End note

Thank you for reading!

Please note that anything I write about on all my platforms should not be considered investment advice. These are my humble opinions, and you should always research before making any decision, especially regarding investments. Please read the full disclaimer below.

Disclaimer

I do not own ASML shares, but I intend to buy shares within the next six months.

By reading my posts, being subscribed, following me, and visiting my Substack, in general, you agree to my disclaimer. You can read the disclaimer here.

677/1175=57.6% under Ben Graham’s fair value for a critical supply company in the most hyped sector?

With recent events my BG valuation comes down to $864,25 per share. (I expect lower growth and AAA bonds are now up of course)