15 High Quality Dividend Stocks

Here's 15 reliable picks for consistent growth and sustainable income

Hey there, partner! 👋

Before we dive in, I need your support to keep these articles FREE.

If you're enjoying this content, here's how you can help:

Like the article

Please share it on your favorite social media channel

Comment on this article to join the conversation

Your engagement means everything. Thanks for being part of the journey! Now, let's get started.

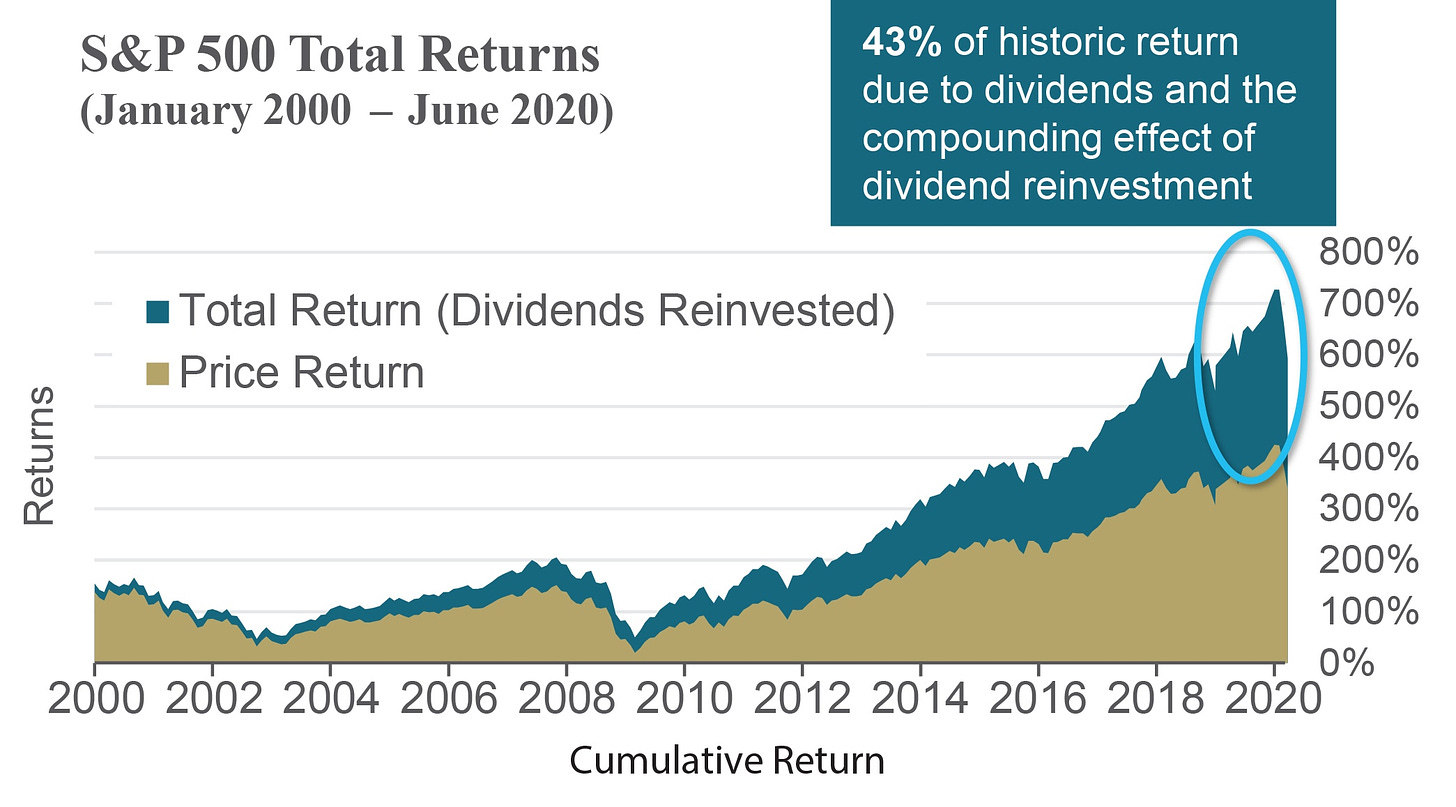

Dividend-paying stocks have long been a cornerstone of successful, balanced portfolios, and for good reason. Dividends provide investors with a steady income stream, even during periods of market volatility. Over the last century, dividends have contributed significantly to total stock market returns. In fact, between 1926 and 2021, dividends accounted for about 40% of the total return of the S&P 500, according to data from Morningstar.

Moreover, companies that regularly pay dividends tend to be financially strong and disciplined, often demonstrating consistent earnings and cash flow growth. Research also shows that dividend-paying stocks outperform non-dividend payers over the long term. A study by Ned Davis Research found that from 1972 to 2020, dividend growers and initiators in the S&P 500 provided an average annual return of 12.9%, compared to just 8.2% for non-dividend payers.

For investors, dividend stocks offer the benefit of compounding income and a buffer against inflation and market downturns. In an era of constant market uncertainties, dividend stocks remain one of the most reliable ways to build wealth and achieve financial independence. In this article, we’ll explore 15 high-quality dividend stocks that stand out for their stability, growth potential, and ability to generate lasting income.

‘‘Do you know the only thing that gives me pleasure? It’s to see my dividends coming in.’’ - John D. Rockefeller

Let the following sink in. This shows us how crucial dividends might be for an investor. From January 2000 to June 2020, the S&P 500 soared by 700% based on total returns (dividend reinvested). This is 43% higher than price returns only. The power of compounding over many years led to a solid 43% excess return.

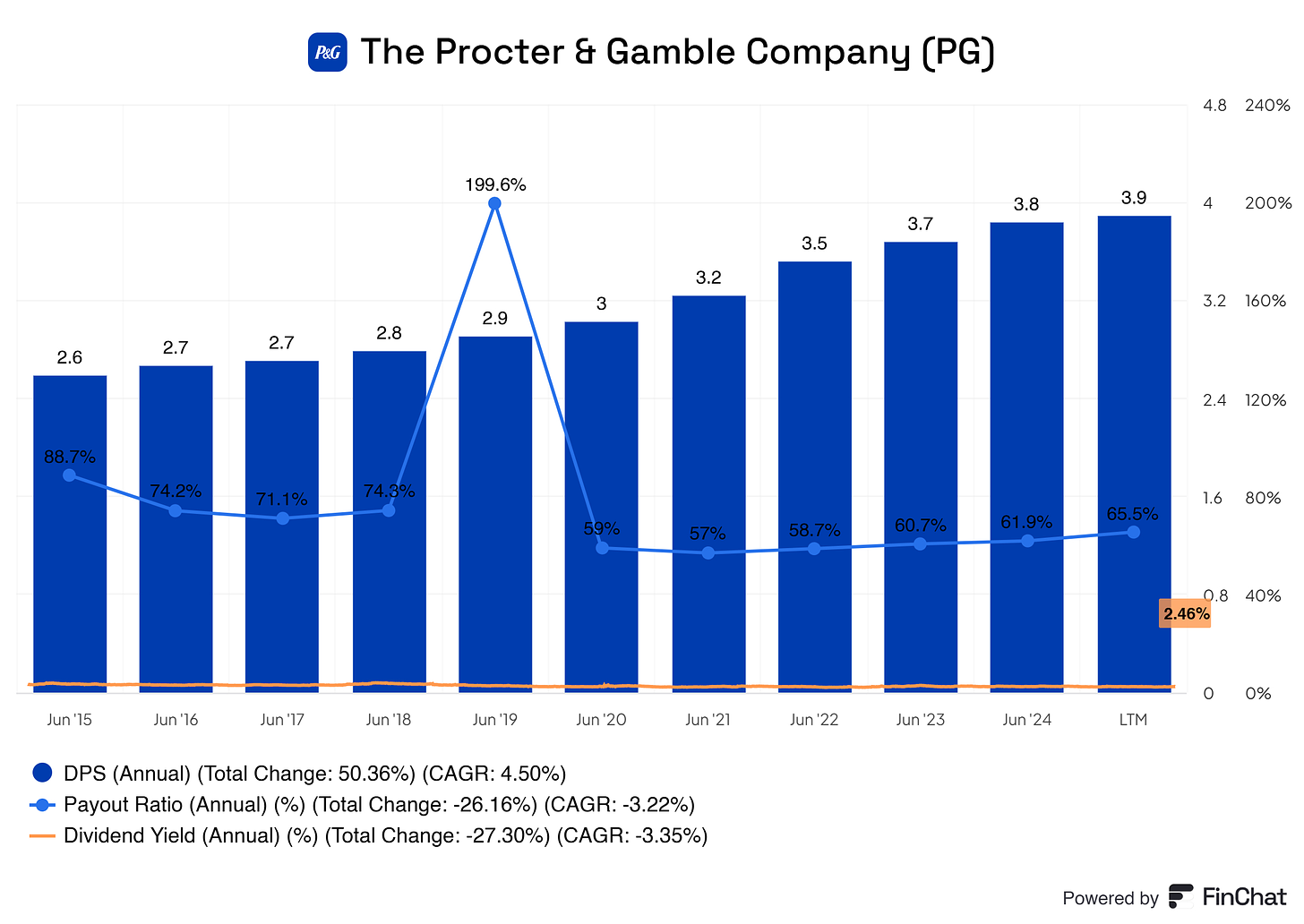

15. Procter & Gamble Co. (PG)

The Procter & Gamble Company provides branded consumer packaged goods worldwide. The company operates through five segments: beauty, grooming, Health Care, fabric and home Care, and Baby, Feminine, and family Care.

Consecutive years of dividend payments: 68 years

Consecutive years of dividend growth: 68 years

Dividend yield: 2.46%

Payout ratio: 65.5%

5-yr growth rate: 6.03%

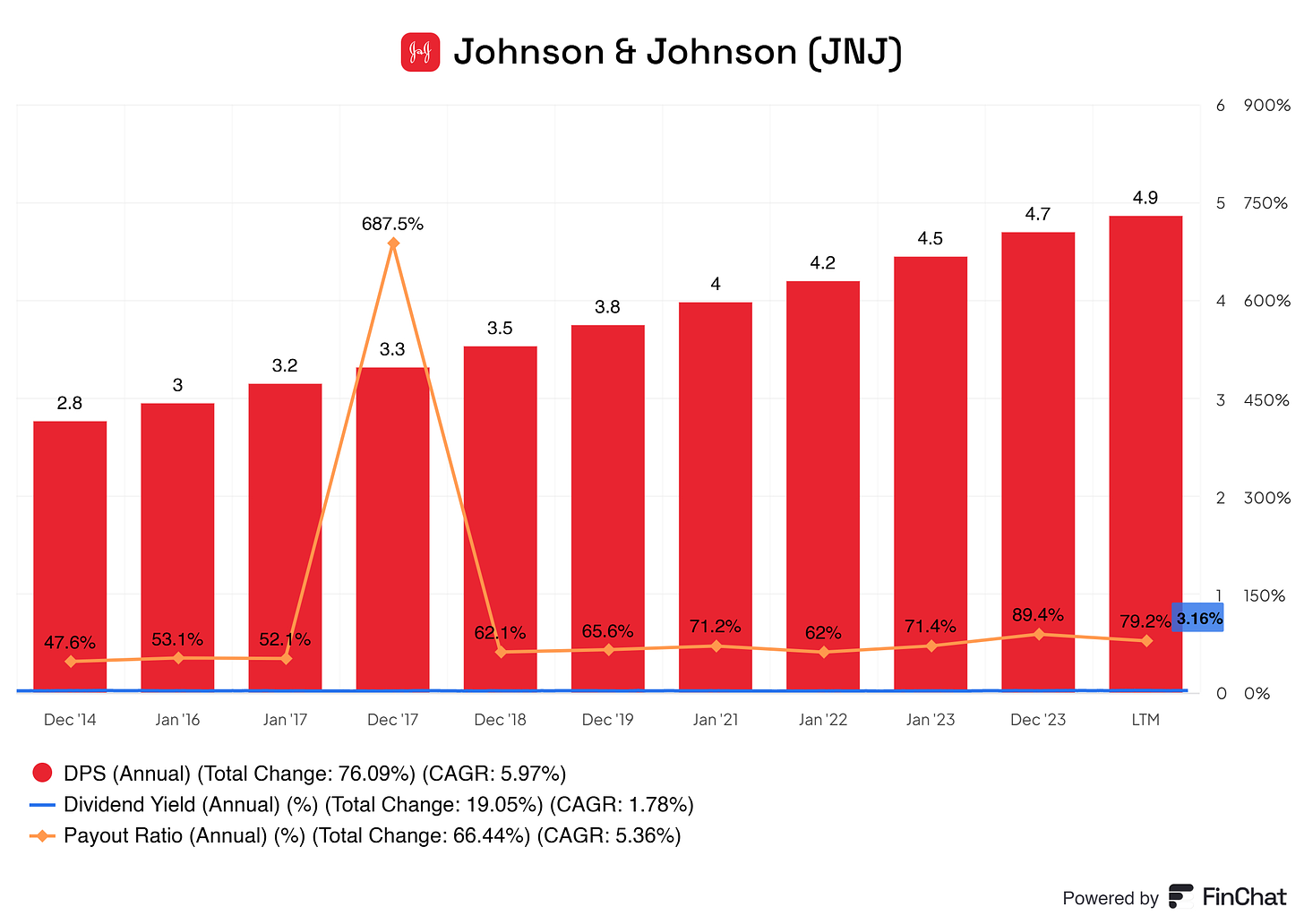

14. Johnson & Johnson (JNJ)

Johnson & Johnson, together with its subsidiaries, researches, develops, manufactures, and sells various products in the healthcare field worldwide. The company’s Innovative Medicine segment offers products for various therapeutic areas, such as immunology, including rheumatoid arthritis, psoriatic arthritis, inflammatory bowel disease, and psoriasis

Consecutive years of dividend payments: 61 years

Consecutive years of dividend growth: 61 years

Dividend yield: 3.16%

Payout ratio: 79.2%

5-yr growth rate: 5.61%

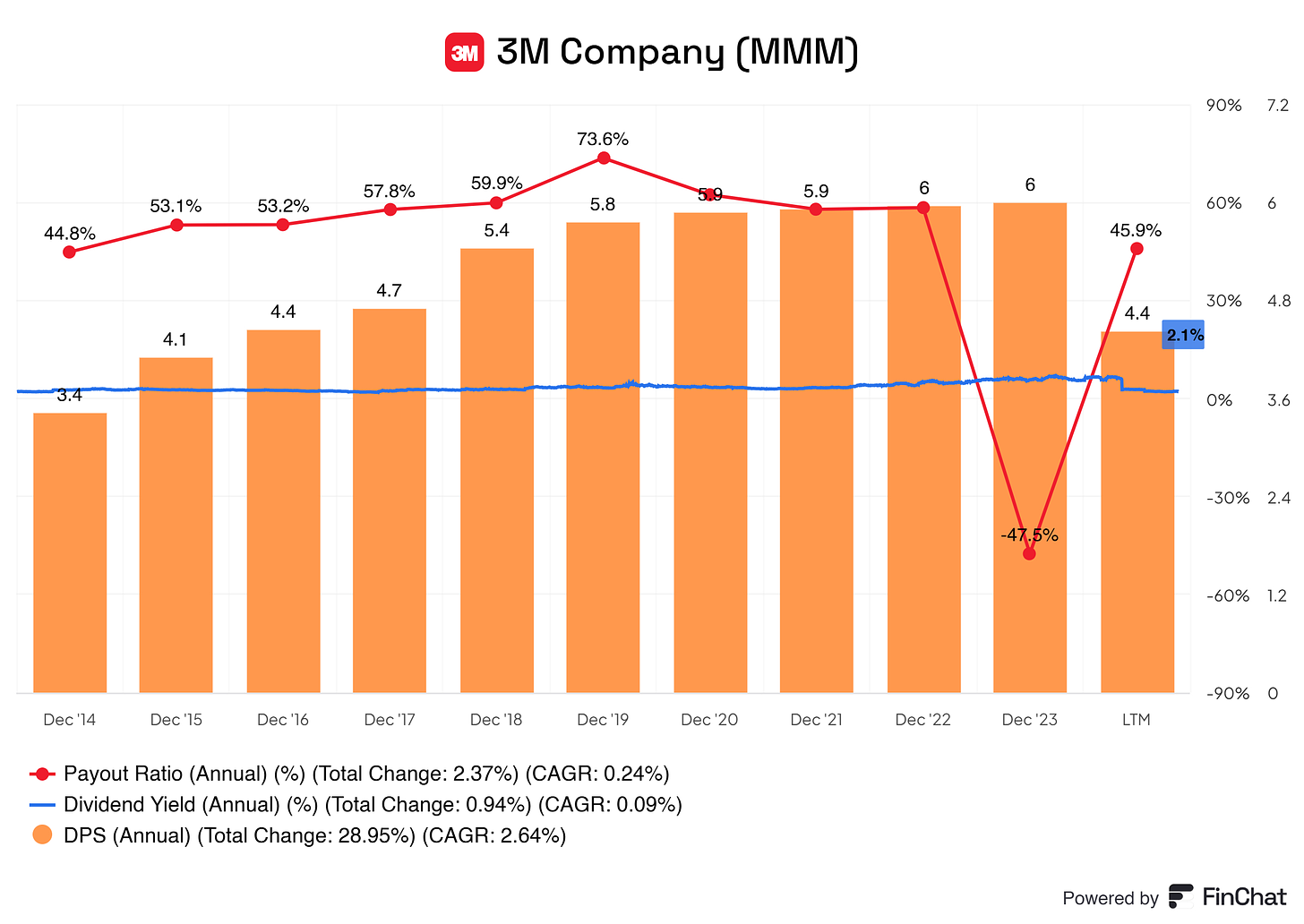

13. 3M Company (MMM)

3M Company provides diversified technology services in the United States and internationally. The company’s Safety and Industrial segment offers industrial abrasives and finishing for metalworking applications; autobody repair solutions; closure systems for personal hygiene products, masking, and packaging materials; electrical products and materials for construction and maintenance, power distribution, and electrical original equipment manufacturers

Consecutive years of dividend payments: 65 years

Consecutive years of dividend growth: 65 years

Dividend yield: 2.1%

Payout ratio: 45.9%

5-yr growth rate: -3.87%

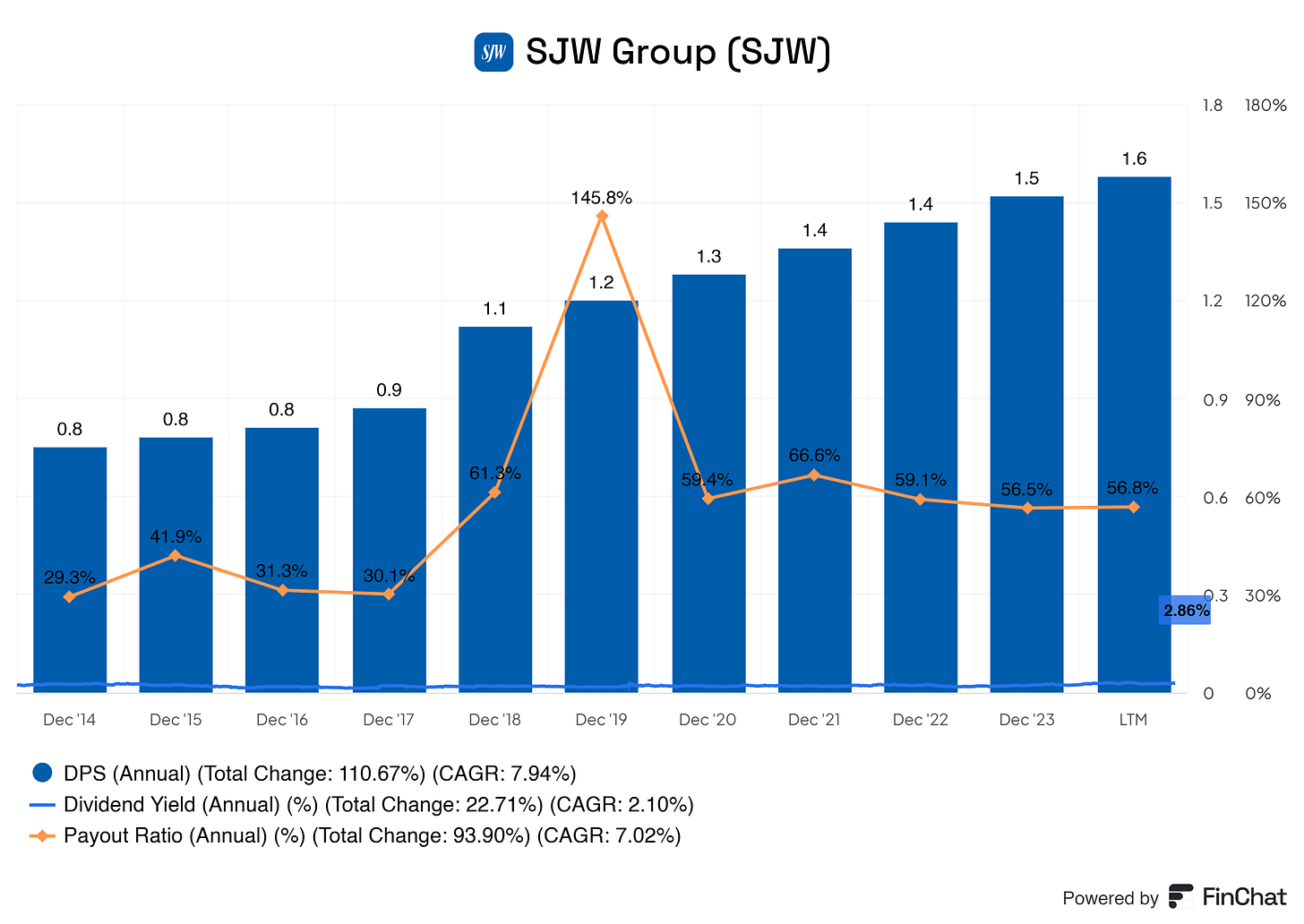

12. SJW Group (SJW)

SJW Group provides water utility and other related services through its subsidiaries in the United States. It operates in Water Utility Services and Real Estate Services segments. The company engages in the production, purchase, storage, purification, distribution, wholesale, and retail sale of water and wastewater services

Consecutive years of dividend payments: 57 years

Consecutive years of dividend growth: 57 years

Dividend yield: 2.86%

Payout ratio: 56.8%

5-yr growth rate: 5.92%

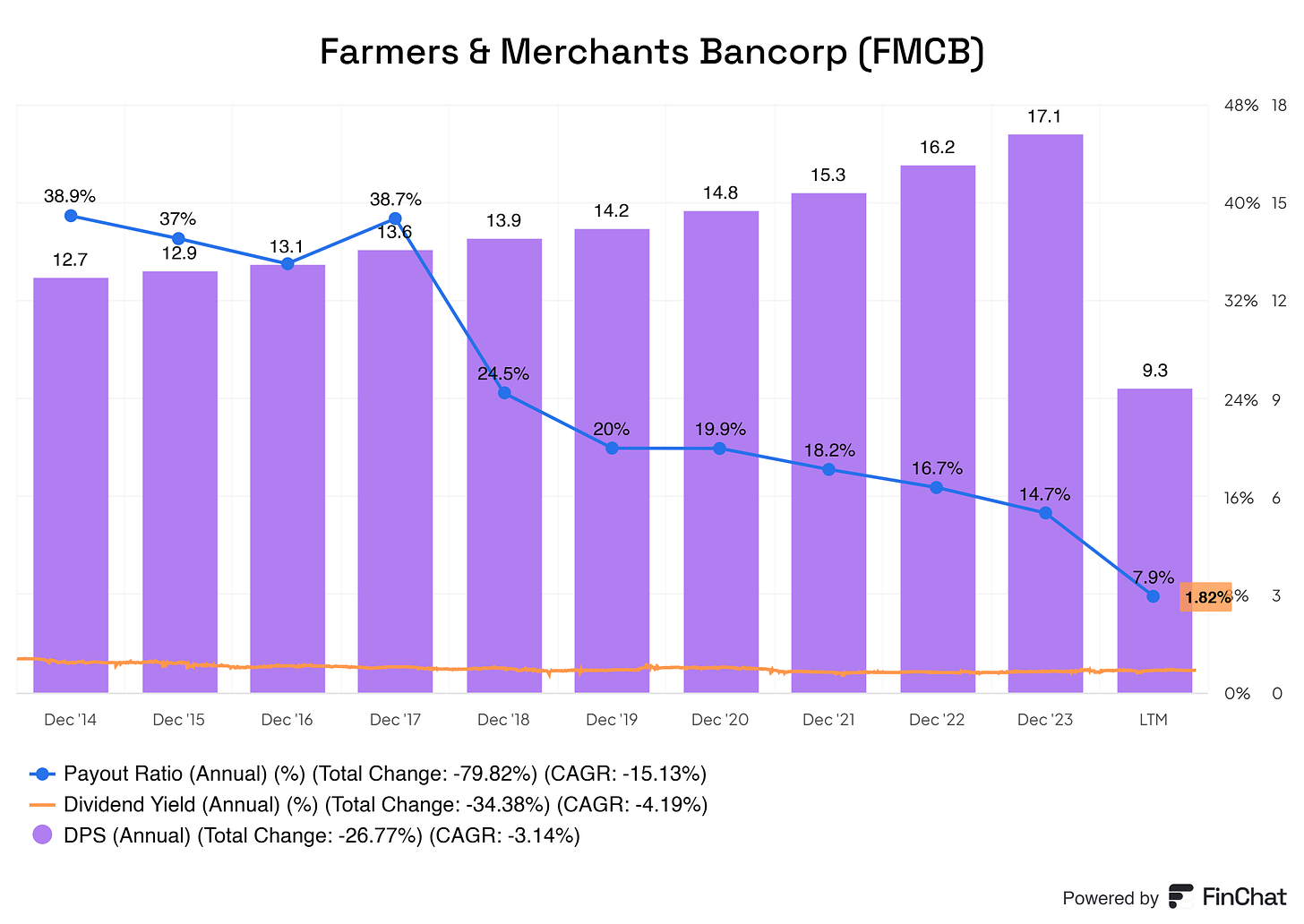

11. Farmers & Merchants Bancorp (FMCB)

Farmers & Merchants Bancorp is the bank holding company for Farmers & Merchants Bank of Central California, which provides various banking services to businesses and individuals. The company accepts various deposit products, including checking, savings, money market, time certificates of deposit, and individual retirement accounts.

Consecutive years of dividend payments: 59 years

Consecutive years of dividend growth: 59 years

Dividend yield: 1.82%

Payout ratio: 7.9%

5-yr growth rate: 4.61%

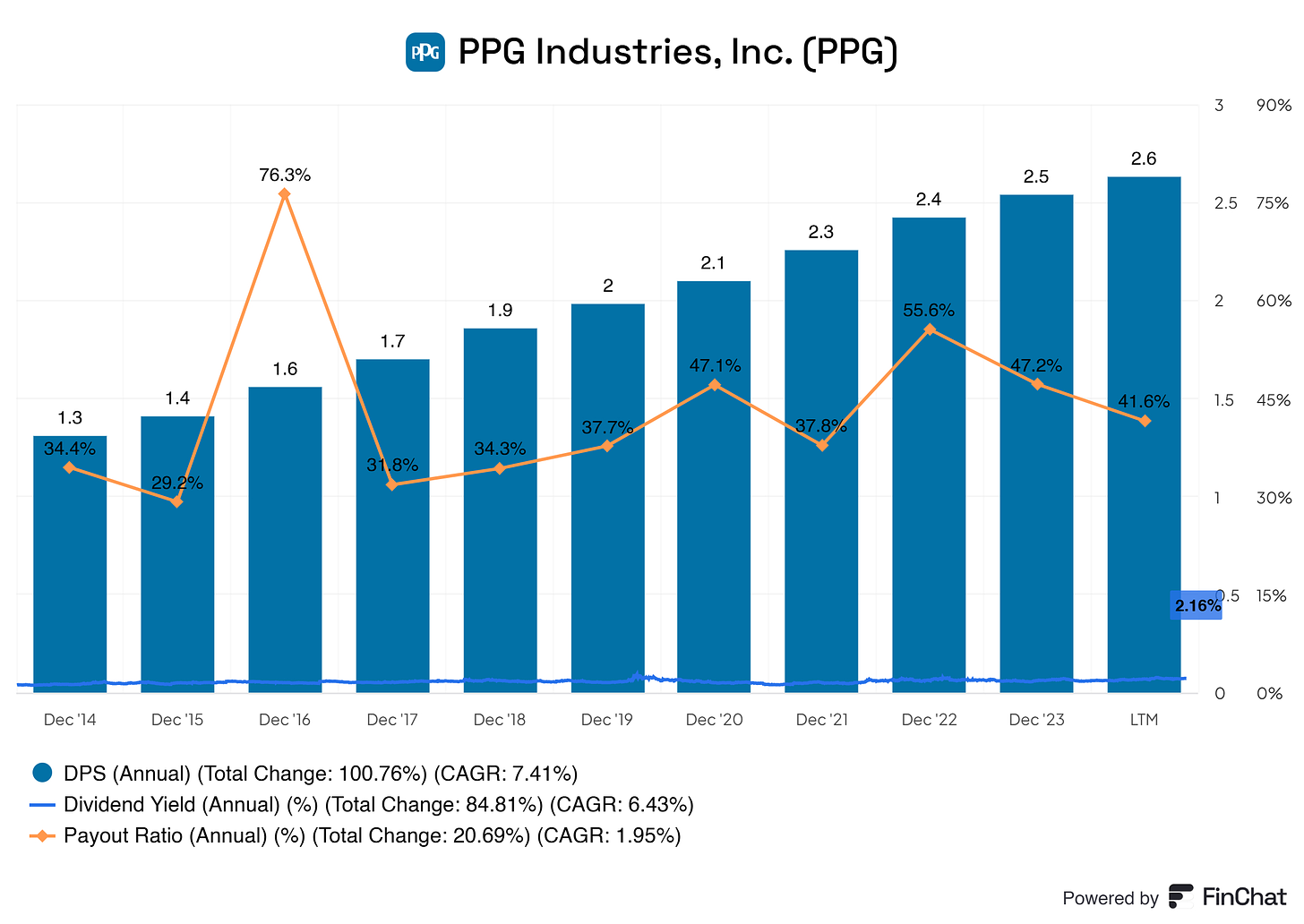

10. PPG Industries, Inc. (PPG)

PPG Industries, Inc. manufactures and distributes paints, coatings, and specialty materials in the United States, Canada, the Asia Pacific, Latin America, Europe, the Middle East, and Africa. It operates through two segments: Performance Coatings and Industrial Coatings.

Consecutive years of dividend payments: 51 years

Consecutive years of dividend growth: 51 years

Dividend yield: 2.16%

Payout ratio: 41.6%

5-yr growth rate: 6.17%

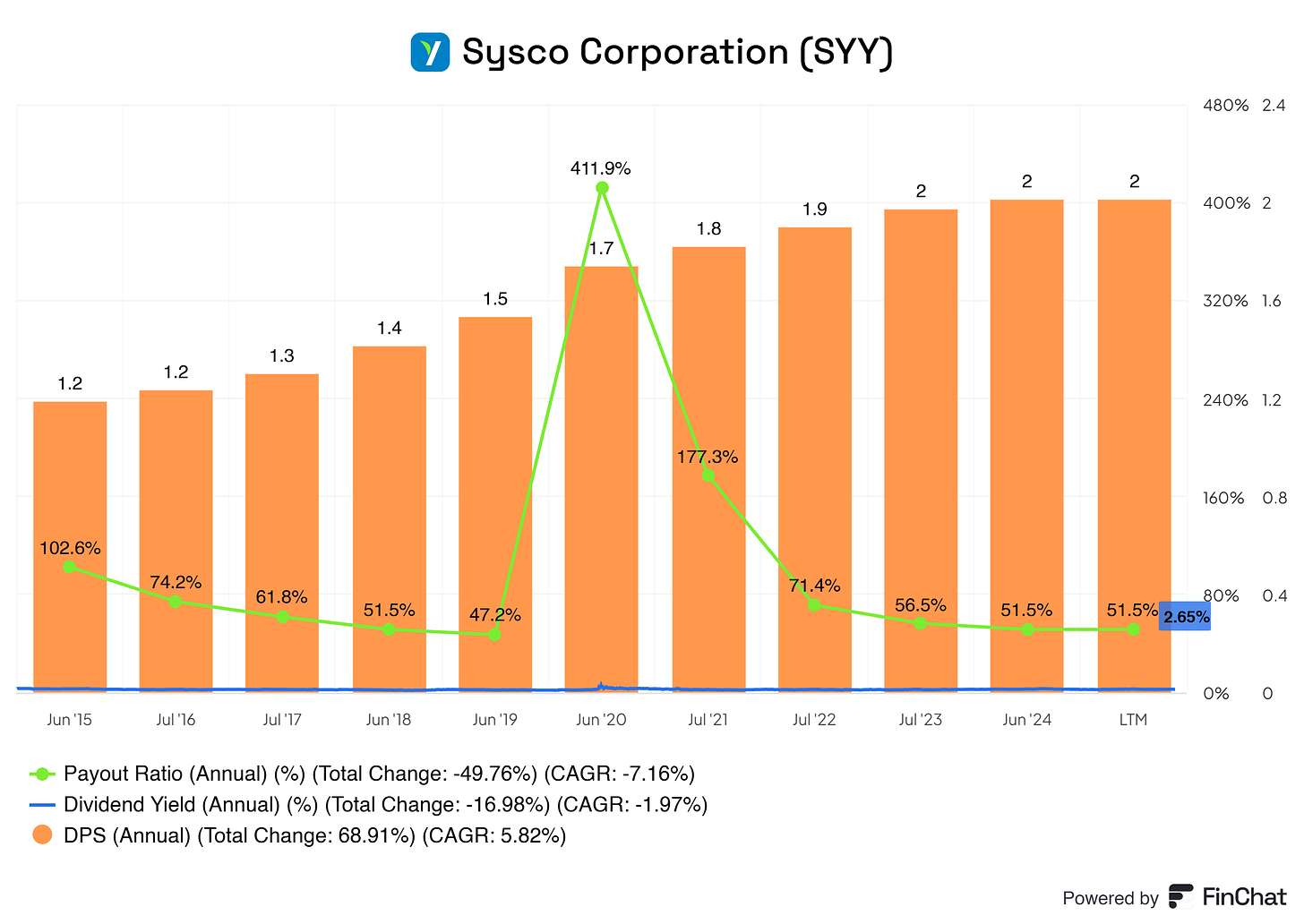

9. Sysco Corporation (SYY)

Through its subsidiaries, Sysco Corporation markets and distributes various food and related products to the food service or food-away-from-home industry in the United States, Canada, the United Kingdom, France, and internationally.

Consecutive years of dividend payments: 9 years

Consecutive years of dividend growth: 54 years

Dividend yield: 2.65%

Payout ratio: 51.5%

5-yr growth rate: 5.30%

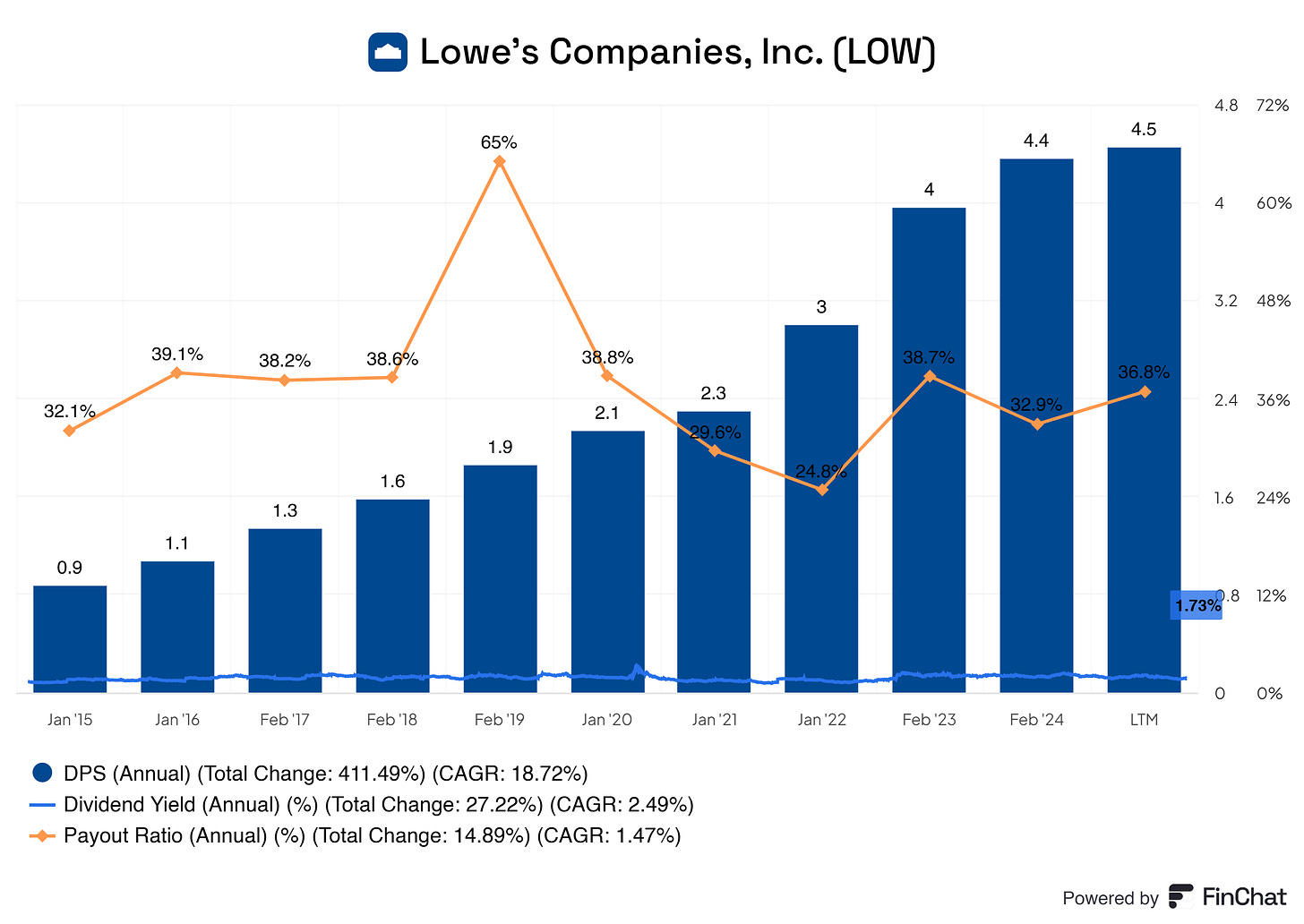

8. Lowe’s Companies, Inc. (LOW)

Lowe's Companies, Inc. and its subsidiaries are home improvement retailers in the United States. The company offers construction, maintenance, repair, remodeling, and decorating products.

Consecutive years of dividend payments: 61 years

Consecutive years of dividend growth: 61 years

Dividend yield: 1.73%

Payout ratio: 36.8%

5-yr growth rate: 16.91%

Before we continue, I’d be grateful if you could share this publication on your favorite social media channels. 😊 It helps spread the word and reach more readers!

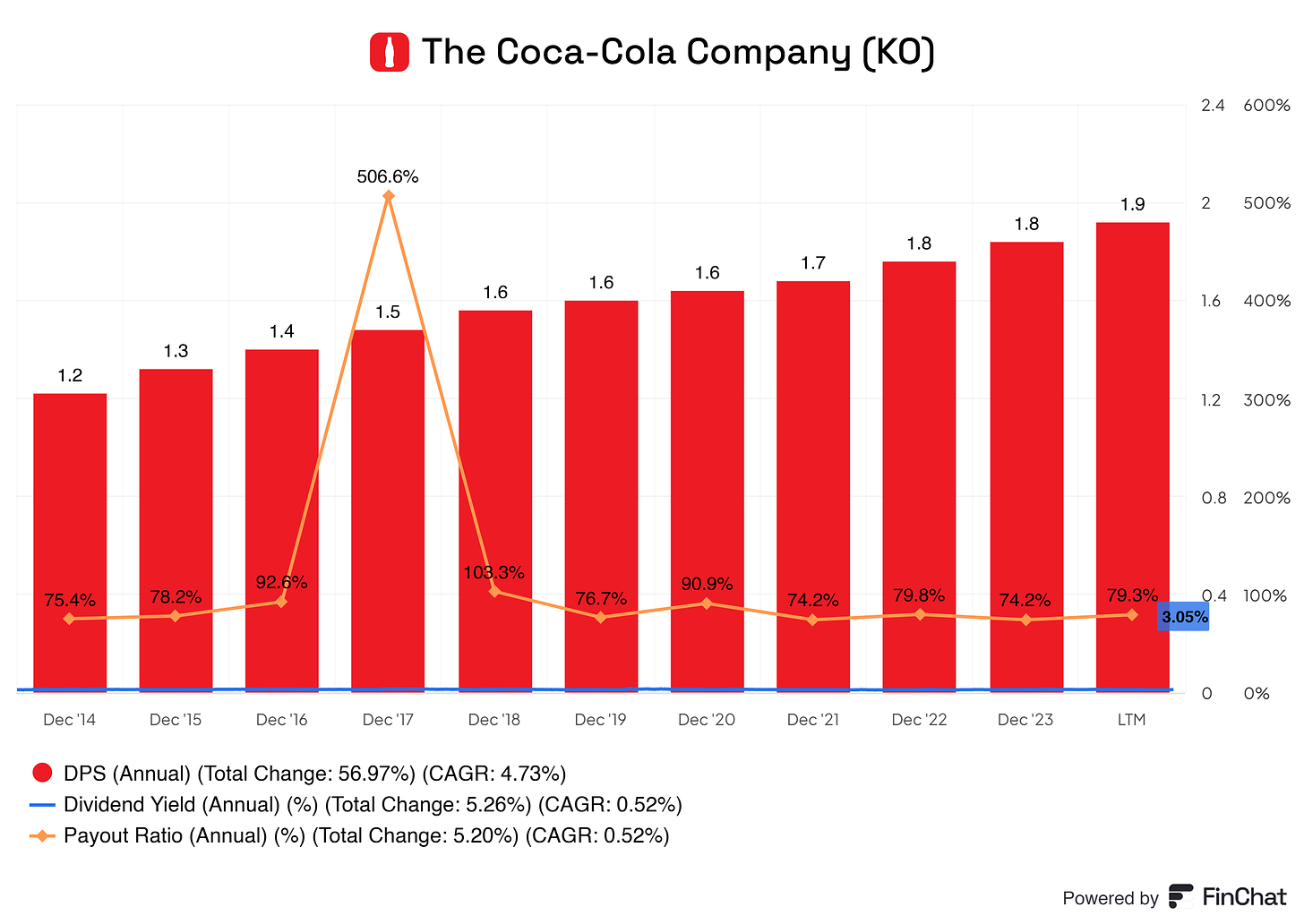

7. Coca-Cola (KO)

The Coca-Cola Company is a beverage company that manufactures, markets, and sells various nonalcoholic beverages worldwide. It provides sparkling soft drinks and sparkling flavors, water, sports, coffee, and tea, juice, value-added dairy, and plant-based beverages, and other beverages.

Consecutive years of dividend payments: 61 years

Consecutive years of dividend growth: 61 years

Dividend yield: 3.05%

Payout ratio: 67.91%

5-yr growth rate: 3.79%

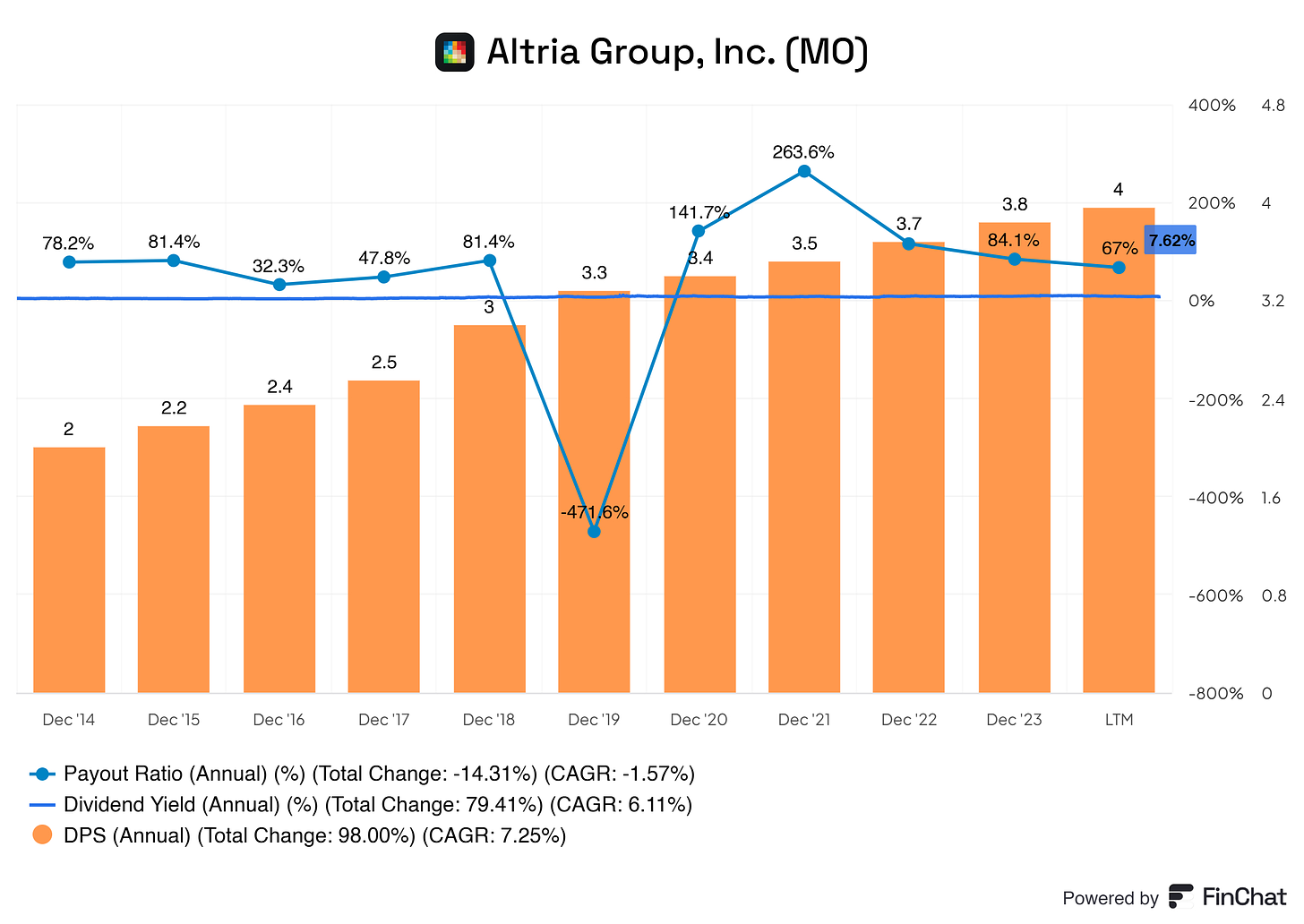

7. Altria Group, Inc. (MO)

Altria Group, Inc., through its subsidiaries, manufactures and sells smokeable and oral tobacco products in the United States. The company offers cigarettes primarily under the Marlboro brand, large cigars and pipe tobacco under the Black & Mild brand, moist smokeless tobacco, and snus products under the Copenhagen, Skoal, Red Seal, and Husky brands.

Consecutive years of dividend payments: 54 years

Consecutive years of dividend growth: 54 years

Dividend yield: 7.62%

Payout ratio: 67%

5-yr growth rate: 4.10%

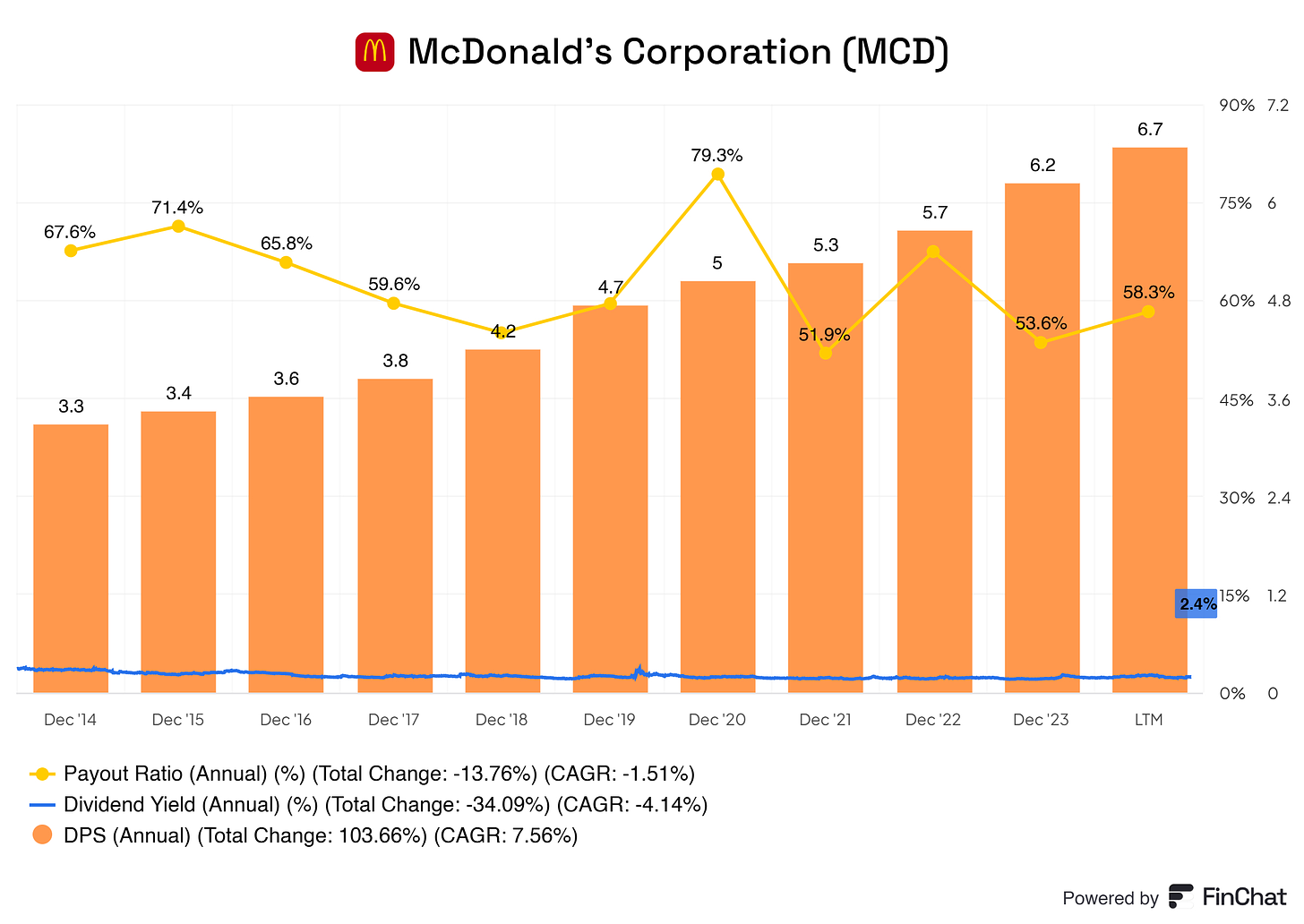

6. McDonald’s Corporation (MCD)

is a leading global fast-food chain, serving over 69 million customers daily across over 40,000 locations in over 100 countries. Founded in 1940, McDonald's offers a diverse menu, including hamburgers, chicken products, salads, and breakfast items. The company operates through a mix of company-owned and franchised restaurants, with approximately 93% of its locations franchised as of 2023. McDonald's is committed to quality, service, cleanliness, and value, continually adapting its menu and services to meet evolving consumer preferences.

Consecutive years of dividend payments: 22 years

Consecutive years of dividend growth: 22 years

Dividend yield: 2.4%

Payout ratio: 58.3%

5-yr growth rate: 7.56%

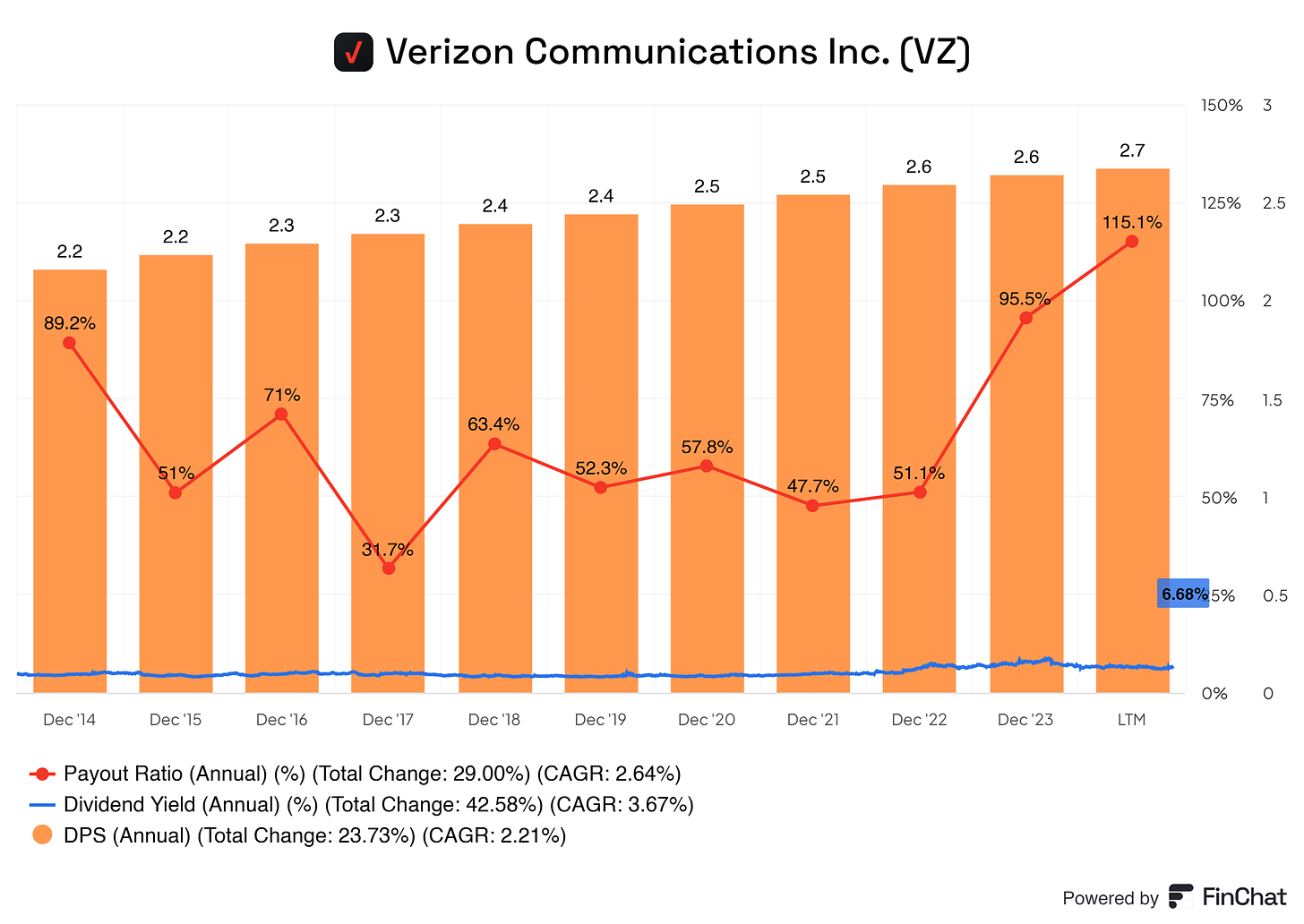

5. Verizon Communications Inc. (VZ)

is a global leader in telecommunications, providing a wide range of services, including wireless communications, broadband, and fiber-optic services, to consumers, businesses, and government entities. Established in 2000, Verizon operates one of the most extensive wireless networks in the United States, serving over 120 million subscribers. The company is at the forefront of technological innovation, investing heavily in 5G technology to enhance connectivity and support the growing demand for high-speed data services.

Consecutive years of dividend payments: 20 years

Consecutive years of dividend growth: 24 years

Dividend yield: 6.68%

Payout ratio: 115.1%

5-yr growth rate: 1.98%

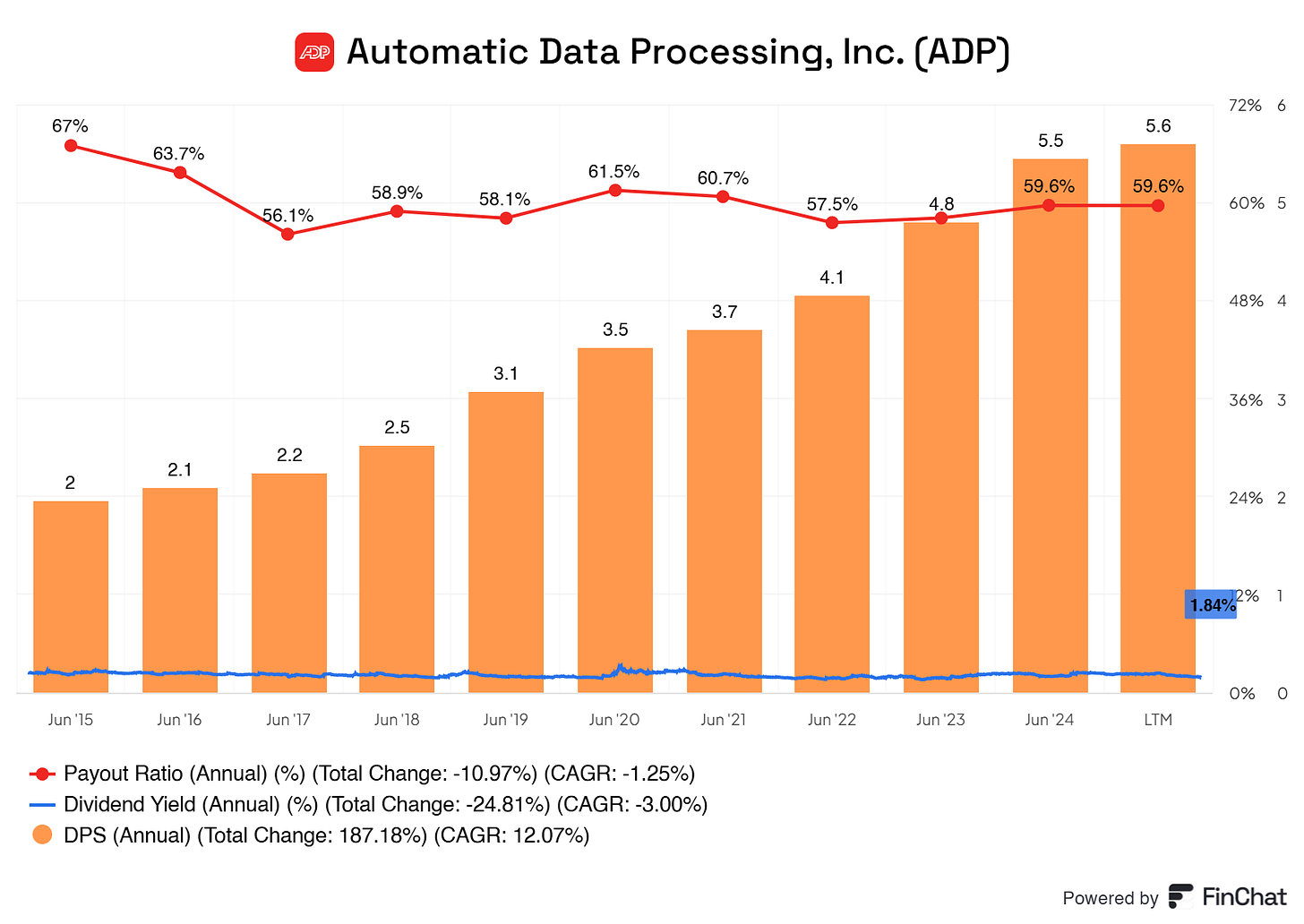

4. Automatic Data Processing (ADP)

is a leading provider of human capital management solutions, offering services such as payroll processing, talent management, and benefits administration to businesses worldwide. Founded in 1949, ADP serves over 990,000 clients across 140 countries, ranging from small businesses to large enterprises. The comprehensive solutions help organizations manage their workforce efficiently, ensuring compliance with regulatory requirements and enhancing overall productivity.

Consecutive years of dividend payments: 25 years

Consecutive years of dividend growth: 48 years

Dividend yield: 1.84%

Payout ratio: 59.6%

5-yr growth rate: 12.12%

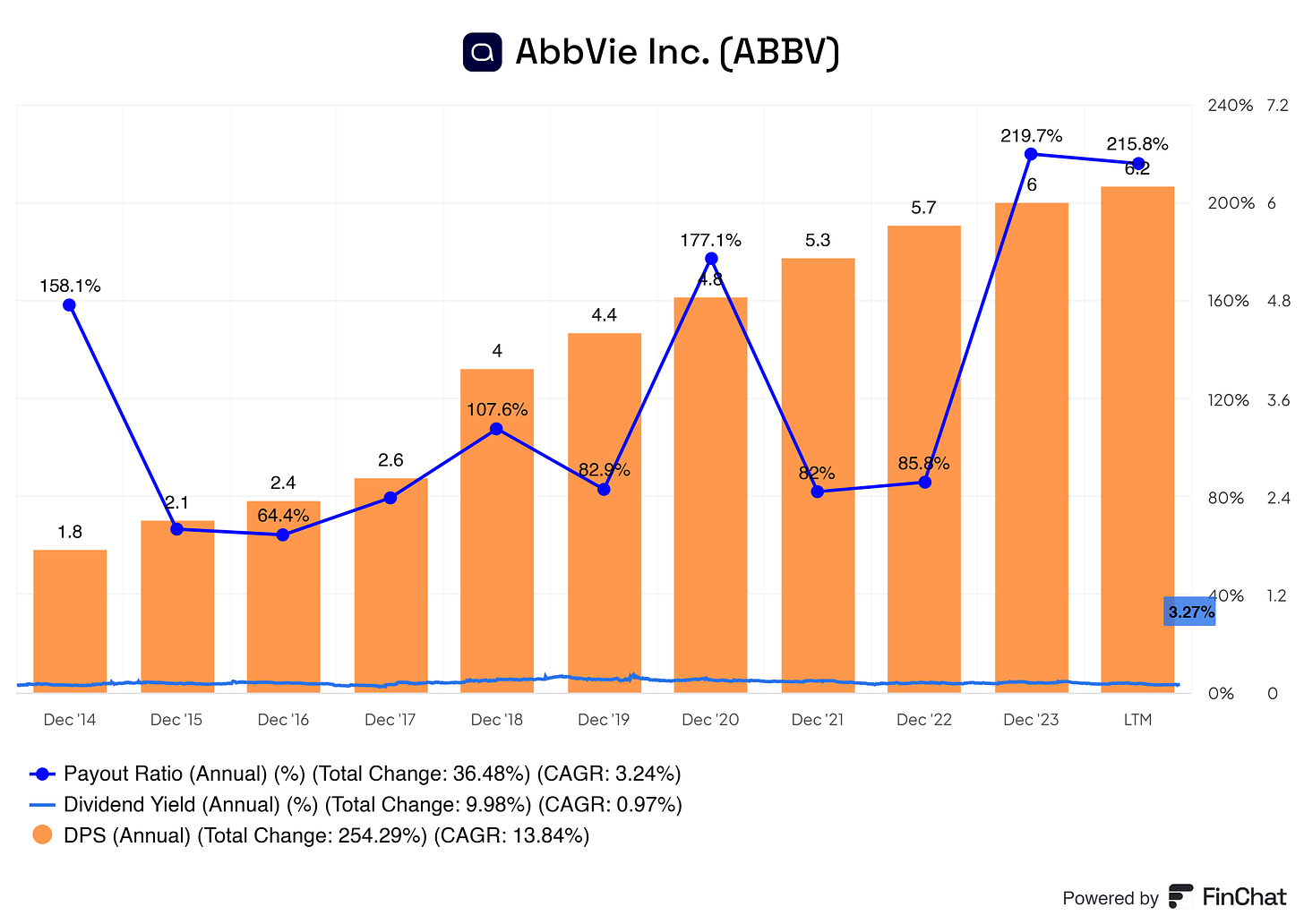

3. AbbVie Inc. (ABBV)

AbbVie Inc. discovers, develops, manufactures, and sells pharmaceuticals worldwide. The company offers Humira, an injection for autoimmune and intestinal Behçet's diseases and pyoderma gangrenosum, and Skyrizi to treat moderate to severe plaque psoriasis, psoriatic disease, and Crohn’s disease.

Consecutive years of dividend payments: 11 years

Consecutive years of dividend growth: 11 years

Dividend yield: 3.27%

Payout ratio: 215.8%

5-yr growth rate: 7.69%

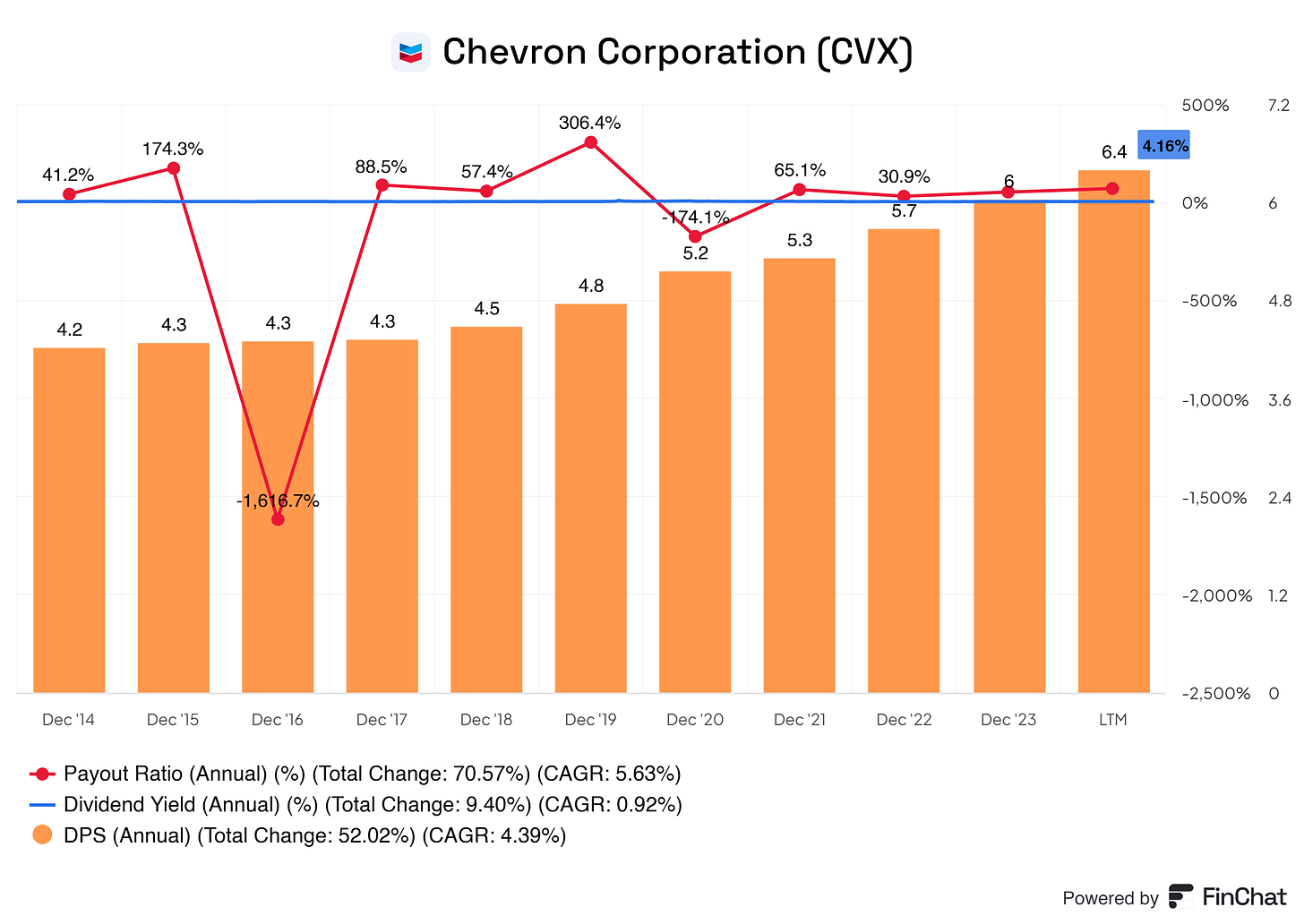

2. Chevron Corporation (CVX)

Through its subsidiaries, Chevron Corporation engages in integrated energy and chemicals operations in the United States and internationally. The company operates in two segments: Upstream and Downstream.

Consecutive years of dividend payments: 36 years

Consecutive years of dividend growth: 36 years

Dividend yield: 4.16%

Payout ratio: 31.9%

5-yr growth rate: 6.41%

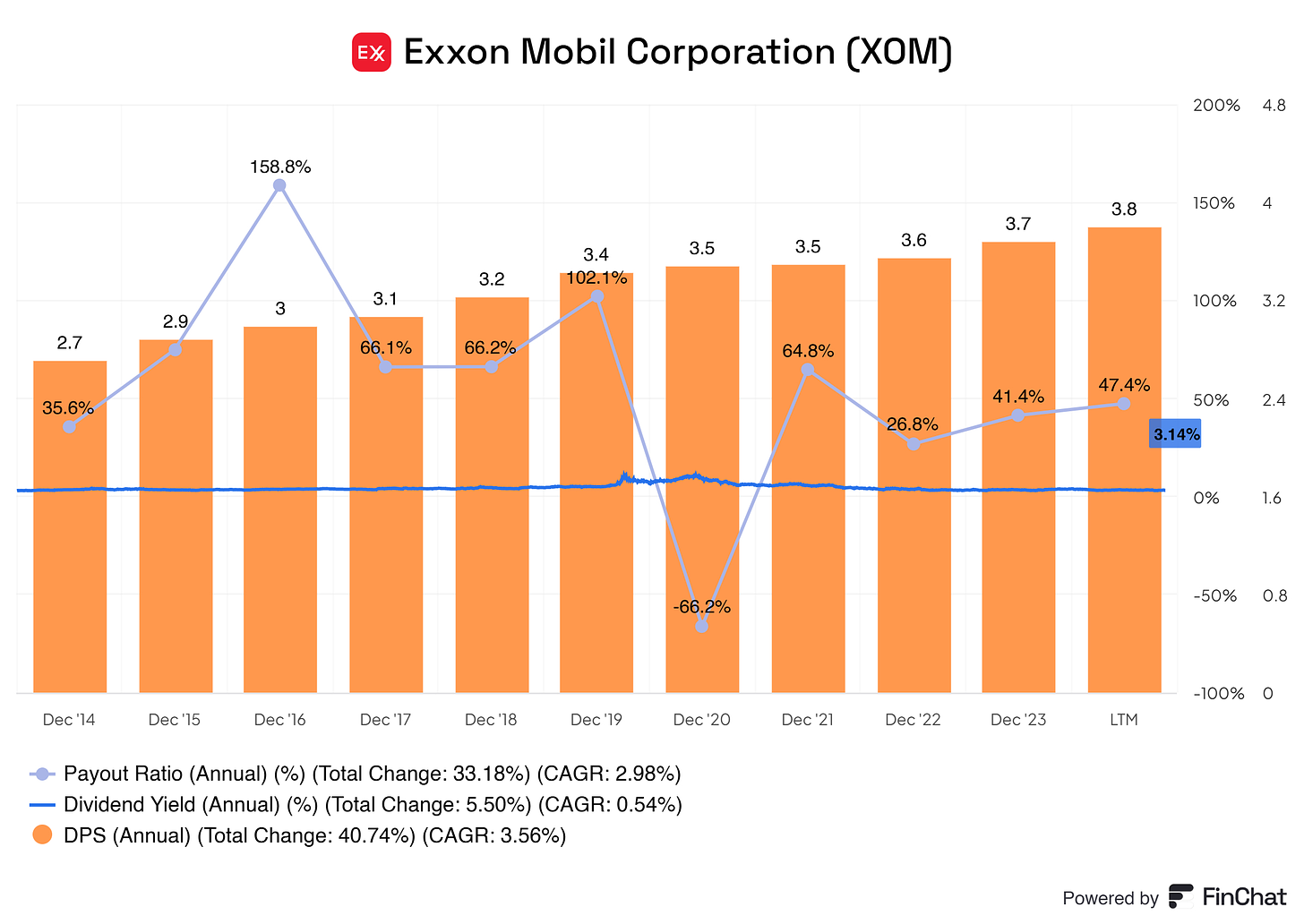

1. Exxon Mobile Corporation (XOM)

Another major player in the energy sector, Exxon Mobil, is known for its consistent dividend growth, driven by its extensive global operations in oil and gas. Its ability to manage costs and maintain profitability during market downturns makes Exxon a solid dividend growth stock.

Consecutive years of dividend payments: 25 years

Consecutive years of dividend growth: 41 years

Dividend yield: 3.14%

Payout ratio: 47.4%

5-yr growth rate: 2.37%

"The beauty of dividends is that they allow investors to realize some portion of their investment returns without being dependent on the market’s mood." - Peter Lynch

That's our top 15 dividend kings for now! Adding these steady, high-quality dividend payers to your portfolio can provide sustainable income and growth over the long term.

Thanks for reading! In the comments, please let me know your thoughts on this list and share your favorite dividend stocks!

Disclaimer

By reading my posts, subscribing, following me, and visiting my Substack in general, you agree to my disclaimer. You can read the disclaimer here.